YTM means yield to maturity. It is also known as the internal rate of return. If you are dealing with finances, this is one of the values you have to calculate when dealing with compound interest. For you to calculate YTM using Excel formulas, there are some values you need to have. These include the initial principal amount invested, the interest rate to be paid yearly, the time duration the principal amount has been invested, and the rate of daily, monthly or quarterly payments. With all these values available, Excel will calculate for you the YTM value using the RATE function.

This article gives you step-by-step instructions on calculating YTM in Excel workbooks using the bond yield calculator.

Steps to follow when calculating YTM in Excel using =RATE ()

Let us use these values for this example. You can replace them with your values. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values.

1. Launch the Microsoft Excel program on your computer.

2. Write the following words from cells A2 –A5. Future Value, Annual Coupon rate, Years to maturity, and Bond Price

3. Format the column width in the excel sheet so that it is wide enough to accommodate all characters.

4. Let us enter the corresponding values of our example in Column B. You can replace these values with your own.

5. Write YTM in cell A6.

6. Now, this is the crucial part. In the corresponding cell, B6 type the following formula =RATE(B4,B3*B2,-B5,B2) Press enter and the answer is the Yield to Maturity rate in %.

Using the Excel IRR Function

This function’s syntax is as follows

IRR (values, [guess])

It is broken down as follows;

IRR is the internal rate of return for a certain period. For instance, if it is calculated semi-annually, you can double the result to give you the annual bond returns.

Values represent the future bond cash flows. Values must be denoted with a negative and positive value. For instance, say the bond payment was $1000. This shall be written as -$1000 at the start of the payment period. At bond maturity, we shall be able to then calculate the period’s payment coupon and cash flow for future bonds.

Guess this value represents an arbitrary value (a guess value) of what your internal rate of return can be. Using this value is optional. for more lessons on how to calculate the internal rate of returns, click to read How to Calculate irr in Excel.

I inputted random numbers in the above template and you can see the values are tabulated at the end. Therefore, with company information, you can easily calculate yields to maturity by inputting values in a template like the one above in excel.

Uses of YTM

It is important to understand YTM as it is used to assess expected performance. The golden principle here is that the expected bond return rate changes depending on the market price despite the constant coupon rate. It is used to reflect how favorable the market is for the bond. Hence it is vital for people to manage a bond investment portfolio.

The formula for pricing a bond

You can price a bond by using the following formula

PV = Payment / (1+r)+ Payment / (1+r)+ ..+ Payment + Principle / (1+r)

Syntax derivatives

Pv = Price of the bond

Payment =Also referred to as the coupon payment. This is the coupon rate * par value ÷ number of payments per year

r stands for the required rate of return. It’s actually the required rate of return divided by the number of payments per year.

N= Years until maturity

Principal= face value of the bond/par value

As you can see from the above formula the price of the bond depends on the difference between the coupon rate and inferred required rate and

Conclusion

The steps above are the manual way of calculating YTM in an Excel worksheet. It is a straightforward and easy process to accomplish once you know your values and the formula to apply.

In case you find it a challenge using the above method, you can calculate YTM using the RATE and IRR functions in Excel.

Whatever business you are running, every time you will be attracted to buy and selling bonds for financial deals. And for this, you will need to find out the Yield to Maturity YTM of the bonds. In this article, you will get to know how to calculate Yield to Maturity Excel with some Excel formulas.

For this, you will have to show the initial principal amount invested, the time in which the principal amount is invested, the interest rate you need to pay every year, or other monthly and quarterly payments.

Syntax of YTM

=YIELDMAT(settlement, maturity, issue, rate, pr, [basis])

In this formula, the arguments used are explained as:

Settlement: This is a required argument in which you get the settlement date of the security. This date is after the issue date because the security is then given to the buyer.

Maturity: This is also a required argument in which you get the maturity date of the security.

Issue: This is also a required argument in which you get the issuance date of the security.

Rate: This is a required argument in which you get the interest rate of the security at the issuance date.

Pr: This is a required argument as well, in which you get the price per $100 face value of the security.

Basis: This is an optional argument in which you get the count type.

How to Calculate Yield to Maturity Excel with RATE Function?

In the very first method of YTM, you will get to know how the RATE function can help us. Once all the arguments are done, the RATE function gives YTM. All the arguments are then multiplied by the Par Value of the Bond. Below are some easy-to-follow steps:

- Select the C9 cell.

- Enter the following formula in the given bar:

=RATE(C8,C7,-C6,C4)*C5

- Now, press the ENTER key from the keyboard.

- Your wanted outcome will be on the next screen.

How to Calculate Yield to Maturity Excel with Direct Formula?

Here you will see the use of a direct formula to find the YTM of a Bond in Excel. Below is the formula:

YTM=(C+(FV-PV)/n)/(FV+PV/2)

In this formula:

C= It appears as an Annual Coupon Amount.

FV= It appears as a Face Value.

PV= It appears as a Present Value.

N= It appears as a value of Maturity Years.

Considering our dataset, let’s see how this process works:

- Click on the C8 cell.

- Now, enter the formula given below in the selected cell:

=(C6+((C4-C5)/C7))/(C4+C5/2)

- Now, press the ENTER key from the keyboard.

You will see the outcome Yields to Maturity appear on the screen.

How to Calculate Yield to Maturity Excel with YIELD Function?

Excel has a YIELD function that can easily calculate the Yield to Maturity of a bond in Excel. Let’s start this procedure with a new dataset. In this method, you will notice that the YIELD function extracts every single value from the dataset as arguments and gives the YTM values in the selected cells.

Below are simple steps to follow:

- Choose the C11 cell.

- Add the following formula in the selected cell:

=YIELD(C6,C7,C5,C10,C4,C8)

- Now, press the ENTER key from the keyboard.

- You will find the results in front of you.

A Few Considerations about the YIELDMAT Function

- You may encounter #NUM! error if:

The issuance date is greater than or equal to the date of settlement. Or

The settlement date is greater than or equal to the maturity date. Or

The pr, rate, or basis arguments have invalid numbers, such as rate < 0; pr ≤ 0, or [basis] has numbers other than 0, 1, 2, 3, 4).

- You may encounter #VALUE! error, if:

The issuance, settlement, or maturity dates are not valid Excel dates. Or

The given arguments are non-numeric.

Summary:

In this post, you have learned how to calculate yield to maturity Excel easily by using multiple approaches. Each method is worthy enough to use for this calculation. Try new tricks and continue exploring Excel.

Understanding a bond’s yield to maturity (YTM) is an essential task for fixed-income investors. But to fully grasp YTM, we must first discuss how to price bonds in general. The price of a traditional bond is determined by combining the present value of all future interest payments (cash flows), with the repayment of principal (the face value or par value) of the bond at maturity.

The rate used to discount these cash flows and principal is called the «required rate of return,» which is the rate of return required by investors who are weighing the risks associated with the investment.

Key Takeaways

- To calculate a bond’s maturity (YTM), it’s vital to understand how bonds are priced and evaluated.

- It combines the present value of all future interest payments (cash flows) with the repayment of the principal (the face value or par value) of the bond at maturity.

- The pricing of a bond largely depends on the difference between the coupon rate, which is a known figure, and the required rate, which is inferred.

- Coupon rates and required returns frequently do not match in the subsequent months and years following an issuance because market events impact the interest rate environment.

How to Price a Bond

The formula to price a traditional bond is:

PV

=

P

(

1

+

r

)

1

+

P

(

1

+

r

)

2

+

⋯

+

P

+

Principal

(

1

+

r

)

n

where:

PV

=

present value of the bond

P

=

payment, or coupon rate

×

par value

÷

number of

payments per year

r

=

required rate of return

÷

number of payments

per year

Principal

=

par (face) value of the bond

n

=

number of years until maturity

begin{aligned} &text{PV} = frac { text{P} }{ ( 1 + r ) ^ 1 } + frac { text{P} }{ ( 1 + r ) ^ 2 } + cdots + text{P} + frac { text{Principal} }{ ( 1 + r ) ^ n } \ &textbf{where:} \ &text{PV} = text{present value of the bond} \ &text{P} = text{payment, or coupon rate} times text{par value} div text{number of} \ &text{payments per year} \ &r = text{required rate of return} div text{number of payments} \ &text{per year} \ &text{Principal} = text{par (face) value of the bond} \ &n = text{number of years until maturity} \ end{aligned}

PV=(1+r)1P+(1+r)2P+⋯+P+(1+r)nPrincipalwhere:PV=present value of the bondP=payment, or coupon rate×par value÷number ofpayments per yearr=required rate of return÷number of paymentsper yearPrincipal=par (face) value of the bondn=number of years until maturity

The pricing of a bond is therefore critically dependent on the difference between the coupon rate, which is a known figure, and the required rate, which is inferred.

Suppose the coupon rate on a $100 bond is 5%, meaning the bond pays $5 per year, and the required rate—given the risk of the bond—is 5%. Because these two figures are identical, the bond will be priced at par, or $100.

This is shown below (note: if tables are hard to read, hover over the graphic and select the magnification icon):

Pricing a Bond After It’s Issued

Bonds trade at par when they are first issued. Frequently, the coupon rate and required return don’t match in the subsequent months and years because events impact the interest rate environment. A failure of these two rates to match causes the price of the bond to appreciate above par (trade at a premium to its face value) or decline below par (trade at a discount to its face value) in order to compensate for the rate difference.

Take the same bond as above (5% coupon, pays out $5 a year on a $100 principal) with five years left until maturity. If the current Federal Reserve rate is 1%, and other similar-risk bonds are at 2.5% (they pay out $2.50 a year on a $100 principal), this bond looks very attractive: offering 5% in interest—double that of comparable debt instruments.

Given this scenario, the market will adjust the price of the bond proportionally, in order to reflect this difference in rates. In this case, the bond would trade at a premium amount of $111.61. The current price of $111.61 is higher than the $100 you will receive at maturity, and that $11.61 represents the difference in the present value of the extra cash flow you receive over the life of the bond (the 5% versus the required return of 2.5%).

In other words, in order to get that 5% interest when all other rates are much lower, you must buy something today for $111.61 that you know in the future will only be worth $100. The rate that normalizes this difference is the yield to maturity.

Calculating the Yield to Maturity in Excel

The above examples break out each cash flow stream by year. This is a sound method for most financial modeling because best practices dictate that the sources and assumptions of all calculations should be easily auditable. However, when it comes to pricing a bond, we can make an exception to this rule because of the following truths:

- Some bonds have many years (decades) to maturity, and a yearly analysis, like that shown above, may not be practical

- Most of the information is known and fixed: We know the par value, we know the coupon, and we know the years to maturity.

For these reasons, we’ll set up the calculator as follows:

In the above example, the scenario is made slightly more realistic by using two coupon payments per year, which is why the YTM is 2.51—slightly above the 2.5% required rate of return in the first examples.

How Can an Investor Realize a Bond’s Yield to Maturity?

For the YTM to be actualized, bondholders must commit to holding the bond until maturity.

Can I Calculate a Bond’s YTM By Hand?

Yes, it is possible; however, it is far easier to use software like Excel or a financial calculator to do so. This is especially true for bonds with longer times to maturity, since you must take into account the present values of reinvented coupon payments at each period, which can quickly become overly complex.

How Is YTM Used by Investors?

YTM is an annualized rate that assumes an investor holds a bond to maturity if it is purchased at its current market price. This provides a standardized yield that can then allow comparisons across different fixed-income investments of various types. Using YTM, one could, for instance, compare the relative attractiveness of bonds from different issuers, among coupon and zero-coupon bonds, and those with different maturity.

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone’s favorite digital spreadsheet guru, YouTube’s ExcelIsFun, the 49th installment in his «Excel Finance Class» series of free video lessons, you’ll learn how to calculate YTM & effective annual yield from bond cash flows.

Want to master Microsoft Excel and take your work-from-home job prospects to the next level? Jump-start your career with our Premium A-to-Z Microsoft Excel Training Bundle from the new Gadget Hacks Shop and get lifetime access to more than 40 hours of Basic to Advanced instruction on functions, formula, tools, and more.

Buy Now (97% off) >

Other worthwhile deals to check out:

- 97% off The Ultimate 2021 White Hat Hacker Certification Bundle

- 98% off The 2021 Accounting Mastery Bootcamp Bundle

- 99% off The 2021 All-in-One Data Scientist Mega Bundle

- 59% off XSplit VCam: Lifetime Subscription (Windows)

- 98% off The 2021 Premium Learn To Code Certification Bundle

- 62% off MindMaster Mind Mapping Software: Perpetual License

- 41% off NetSpot Home Wi-Fi Analyzer: Lifetime Upgrades

What is Yield to Maturity?

Yield to Maturity refers to the expected returns an investor anticipates after keeping the bond intact till the maturity date. Unlike the current yieldThe current yield formula essentially calculates the yield on a bond based on the market price instead of face value. The current yield of bond= Annual coupon payment/current market priceread more, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of its bond term. In other words, a bond’s expected returns after making all the payments on time throughout the life of a bond.

Table of contents

- What is Yield to Maturity?

- Yield to Maturity Formula

- Step by Step Calculation of Yield to Maturity (YTM)

- Examples

- Relevance and Uses

- Recommended Articles

Yield to Maturity Formula

YTM considers the effective yieldEffective yield is a yearly rate of return at a periodic interest rate proclaimed to be one of the effective measures of an equity holder’s return as it takes compounding into its due consideration, unlike the nominal yield method.read more of the bond, which is based on compoundingCompounding is a method of investing in which the income generated by an investment is reinvested, and the new principal amount is increased by the amount of income reinvested. Depending on the time period of deposit, interest is added to the principal amount.read more. The below formula focuses on calculating the approximate yield to maturity, whereas calculating the actual YTM will require trial and error by considering different rates in the current value of the bond until the price matches the actual market price of the bond. Nowadays, computer applications facilitate the easy calculation YTM of the bond.

Yield to Maturity Formula = [C + (F-P)/n] / [(F+P)/2]

Where,

- C is the Coupon.

- F is the Face Value of the bond.

- P is the current market price.

- n will be the years to maturity.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkArticle Link to be Hyperlinked

For eg:

Source: Yield to Maturity (wallstreetmojo.com)

The formula below calculates the bond’s present value. If you have the bond’s present value, you can calculate the yield to maturity (r) in reverse using iterations.

Present Value of Bond = [C / (1+r )] + [C / ( 1+r )^2] . . . . . . [C / ( 1+r )^ t ] + [F / ( 1+r )^ t ]

Step by Step Calculation of Yield to Maturity (YTM)

The steps to calculate Yield to Maturity are as follows.

- Gather information on the bond-like its face value, months remaining to mature, the bond’s current market price, and the bond’s coupon rate.

- Now calculate the annual income available on the bond, which is mostly the coupon, and it could be paid annually, semi-annually, quarterly, monthly, etc. Accordingly, the calculation should be made.

- Also, one needs to amortize the discount or premium, which is a difference between the face value of the bond and the current market price over the bond’s life.

- The numerator of the YTM formula will be the sum of the amount calculated in steps two and step 3.

- The denominator of the YTM formula will be the average price and face value.

- When one divides step 4 by step 5 value, it shall be the approximate yield on maturity.

Examples

You can download this Yield to Maturity (YTM) Formula Excel Template here – Yield to Maturity (YTM) Formula Excel Template

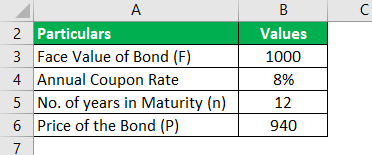

Example #1

Assume that the bond’s price is $940, with the face value of the bond at $1000. The annual coupon rate is 8%, with a maturity of 12 years. Based on this information, you must calculate the approximate yield to maturity.

Solution:

Use the below-given data for the calculation of YTM.

We can use the above formula to calculate approximate yield to maturity.

Coupons on the bondCoupon bonds pay fixed interest at a predetermined frequency from the bond’s issue date to the bond’s maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate.read more will be $1,000 * 8%, which is $80.

Yield to Maturity (Approx) = (80 + (1000 – 94) / 12 ) / ((1000 + 940) / 2)

YTM will be –

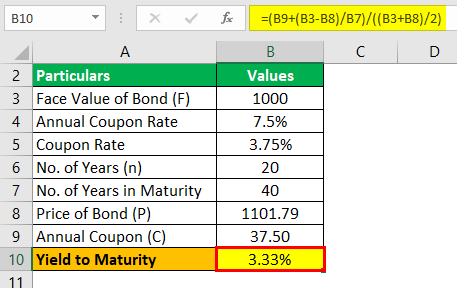

Example #2

FANNIE MAEFannie Mae, i.e., Federal National Mortgage Association is a United States government-sponsored enterprise (GSE) which was founded in the year 1938 by congress to boost the secondary mortgage market during the great depression which involves financing for the mortgage lenders thereby providing access to affordable mortgage financing in all the markets at all times.read more is one of the famous brands trading in the US market. The government of the US now wants to issue a 20 year fixed semi-annually paying bond for their project. The price of the bond is $1,101.79, and the face value of the bond is $1,000. The coupon rate is 7.5% on the bond. Based on this information, you are required to calculate the approximate yield to maturity on the bond.

Solution:

Use the below-given data for the calculation of yield to maturity.

Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually.

Yield to Maturity (Approx) = ( 37.50 + (1000 – 1101.79) / (20 * 2) )/ ((1000 + 1101.79) / 2)

YTM will be –

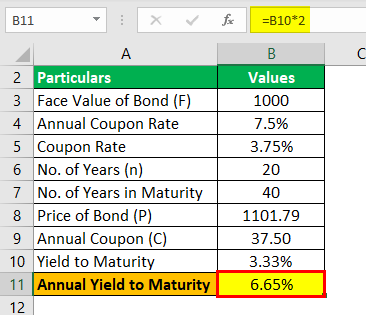

This is an approximate yield on maturity, which shall be 3.33%, which is semiannual.

Annual YTM will be –

Example #3

Mr. Rollins has received the lump sum amount from the lottery. He is a risk-averse person and believes in low risk and high return. He approaches a financial advisor, and the advisor tells him he is the wrong myth of low risk and high returns. Then Mr. Rollins accepts that he doesn’t like risk, and a low-risk investmentLow-risk investments are the financial instruments with minimal uncertainties or chances of loss to the investors. Although such investments are safe, they fail to offer high returns to the investors. read more with a low return will do. The advisor gives him two investment options, and the details of them are below:

You are required to validate the advice made by the advisor.

Solution:

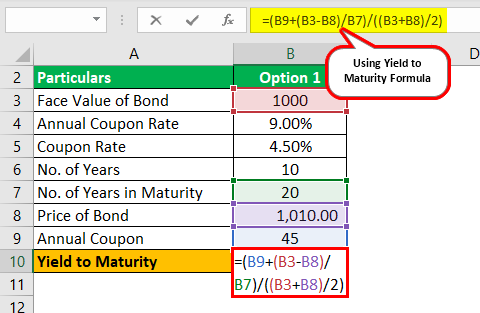

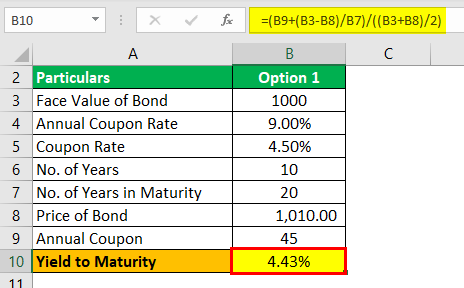

Option 1

Coupon on the bond will be $1,000 * 9% / 2 which is $45, since this pays semi-annually.

Yield to Maturity (Approx) = (45 + (1000 – 1010) / (10 * 2)) / (( 1000 +1010 )/2)

YTM will be –

This is an approximate yield on maturity, which shall be 4.43%, which is semiannual.

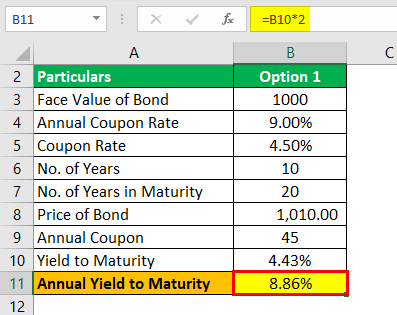

Annual YTM will be –

Therefore, the annual Yield on maturity shall be 4.43% * 2, which shall be 8.86%.

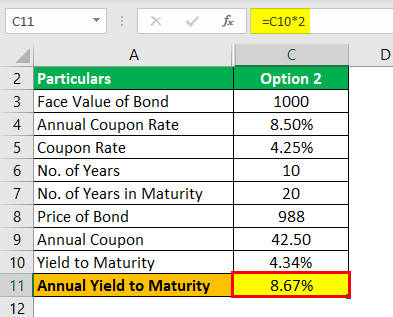

Option 2

Coupon on the bond will be $1,000 * 8.50% / 2 which is $42.5, since this pays semi-annually.

Yield to Maturity (Approx) = (42.50 + (1000 – 988) /(10 * 2))/ (( 1000 +988 )/2)

This is an approximate yield on maturity, which shall be 4.34%, which is semiannual.

Annual Yield to Maturity will be –

Therefore, the annual Yield on maturity shall be 4.34% * 2, which shall be 8.67%.

Since the YTM is higher in option 2; hence the advisor is correct in recommending investing in option 2 for Mr. Rollins.

Relevance and Uses

- Yield to maturity allows an investor to compare the bond’s present value with other investment options in the market.

- TVMThe Time Value of Money (TVM) principle states that money received in the present is of higher worth than money received in the future because money received now can be invested and used to generate cash flows to the enterprise in the future in the form of interest or from future investment appreciation and reinvestment.read more (Time value of money) is taken into consideration while calculating YTM, which helps in better analysis of the investment about a future return.

- It promotes making credible decisions as to whether investing in the bond will fetch good returns compared to the value of the investment at the current state.

Recommended Articles

This has been a guide to Yield to Maturity (YTM). Here we discuss how to calculate the bond yield to maturity using its formula along with practical examples and a downloadable excel template. You can learn more about economics from the following articles –

- Yield to Call CalculationYield to call is the return on investment for a fixed income holder if the underlying security, such as a callable bond is held until the pre-determined call date rather than the maturity date.read more

- Current Yield of a Bond CalculationThe current yield formula essentially calculates the yield on a bond based on the market price instead of face value. The current yield of bond= Annual coupon payment/current market priceread more

- Yield to WorstThe yield to worst (YTW) is the minimum yield that can be received on a bond, assuming the issuer doesn’t default on any of its payments. YTW makes sense for bonds where the issuer exercises its options like calls or prepayments. YTW = risk free rate + credit risk premium

read more - Calculate Yield in ExcelThe Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond’s settlement value, maturity, rate, price, and bond redemption.read more