Excel for Microsoft 365 Excel for Microsoft 365 for Mac Excel for the web Excel 2021 Excel 2021 for Mac Excel 2019 Excel 2019 for Mac Excel 2016 Excel 2016 for Mac Excel 2013 Excel 2010 Excel 2007 Excel for Mac 2011 Excel Starter 2010 More…Less

This article describes the formula syntax and usage of the YIELD function in Microsoft Excel.

Description

Returns the yield on a security that pays periodic interest. Use YIELD to calculate bond yield.

Syntax

YIELD(settlement, maturity, rate, pr, redemption, frequency, [basis])

Important: Dates should be entered by using the DATE function, or as results of other formulas or functions. For example, use DATE(2008,5,23) for the 23rd day of May, 2008. Problems can occur if dates are entered as text.

The YIELD function syntax has the following arguments:

-

Settlement Required. The security’s settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer.

-

Maturity Required. The security’s maturity date. The maturity date is the date when the security expires.

-

Rate Required. The security’s annual coupon rate.

-

Pr Required. The security’s price per $100 face value.

-

Redemption Required. The security’s redemption value per $100 face value.

-

Frequency Required. The number of coupon payments per year. For annual payments, frequency = 1; for semiannual, frequency = 2; for quarterly, frequency = 4.

-

Basis Optional. The type of day count basis to use.

|

Basis |

Day count basis |

|

0 or omitted |

US (NASD) 30/360 |

|

1 |

Actual/actual |

|

2 |

Actual/360 |

|

3 |

Actual/365 |

|

4 |

European 30/360 |

Remarks

-

Microsoft Excel stores dates as sequential serial numbers so they can be used in calculations. By default, January 1, 1900 is serial number 1, and January 1, 2008 is serial number 39448 because it is 39,448 days after January 1, 1900.

-

The settlement date is the date a buyer purchases a coupon, such as a bond. The maturity date is the date when a coupon expires. For example, suppose a 30-year bond is issued on January 1, 2008, and is purchased by a buyer six months later. The issue date would be January 1, 2008, the settlement date would be July 1, 2008, and the maturity date would be January 1, 2038, which is 30 years after the January 1, 2008, issue date.

-

Settlement, maturity, frequency, and basis are truncated to integers.

-

If settlement or maturity is not a valid date, YIELD returns the #VALUE! error value.

-

If rate < 0, YIELD returns the #NUM! error value.

-

If pr ≤ 0 or if redemption ≤ 0, YIELD returns the #NUM! error value.

-

If frequency is any number other than 1, 2, or 4, YIELD returns the #NUM! error value.

-

If basis < 0 or if basis > 4, YIELD returns the #NUM! error value.

-

If settlement ≥ maturity, YIELD returns the #NUM! error value.

-

If there is one coupon period or less until redemption, YIELD is calculated as follows:

where:

-

A = number of days from the beginning of the coupon period to the settlement date (accrued days).

-

DSR = number of days from the settlement date to the redemption date.

-

E = number of days in the coupon period.

-

-

If there is more than one coupon period until redemption, YIELD is calculated through a hundred iterations. The resolution uses the Newton method, based on the formula used for the function PRICE. The yield is changed until the estimated price given the yield is close to price.

Example

Copy the example data in the following table, and paste it in cell A1 of a new Excel worksheet. For formulas to show results, select them, press F2, and then press Enter. If you need to, you can adjust the column widths to see all the data.

|

Data |

Description |

|

|

15-Feb-08 |

Settlement date |

|

|

15-Nov-16 |

Maturity date |

|

|

5.75% |

Percent coupon |

|

|

95.04287 |

Price |

|

|

$100 |

Redemption value |

|

|

2 |

Frequency is semiannual (see above) |

|

|

0 |

30/360 basis (see above) |

|

|

Formula |

Description (Result) |

Result |

|

=YIELD(A2,A3,A4,A5,A6,A7,A8) |

The yield, for the bond with the terms above (0.065 or 6.5%) |

6.5% |

Need more help?

Want more options?

Explore subscription benefits, browse training courses, learn how to secure your device, and more.

Communities help you ask and answer questions, give feedback, and hear from experts with rich knowledge.

YTM means yield to maturity. It is also known as the internal rate of return. If you are dealing with finances, this is one of the values you have to calculate when dealing with compound interest. For you to calculate YTM using Excel formulas, there are some values you need to have. These include the initial principal amount invested, the interest rate to be paid yearly, the time duration the principal amount has been invested, and the rate of daily, monthly or quarterly payments. With all these values available, Excel will calculate for you the YTM value using the RATE function.

This article gives you step-by-step instructions on calculating YTM in Excel workbooks using the bond yield calculator.

Steps to follow when calculating YTM in Excel using =RATE ()

Let us use these values for this example. You can replace them with your values. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values.

1. Launch the Microsoft Excel program on your computer.

2. Write the following words from cells A2 –A5. Future Value, Annual Coupon rate, Years to maturity, and Bond Price

3. Format the column width in the excel sheet so that it is wide enough to accommodate all characters.

4. Let us enter the corresponding values of our example in Column B. You can replace these values with your own.

5. Write YTM in cell A6.

6. Now, this is the crucial part. In the corresponding cell, B6 type the following formula =RATE(B4,B3*B2,-B5,B2) Press enter and the answer is the Yield to Maturity rate in %.

Using the Excel IRR Function

This function’s syntax is as follows

IRR (values, [guess])

It is broken down as follows;

IRR is the internal rate of return for a certain period. For instance, if it is calculated semi-annually, you can double the result to give you the annual bond returns.

Values represent the future bond cash flows. Values must be denoted with a negative and positive value. For instance, say the bond payment was $1000. This shall be written as -$1000 at the start of the payment period. At bond maturity, we shall be able to then calculate the period’s payment coupon and cash flow for future bonds.

Guess this value represents an arbitrary value (a guess value) of what your internal rate of return can be. Using this value is optional. for more lessons on how to calculate the internal rate of returns, click to read How to Calculate irr in Excel.

I inputted random numbers in the above template and you can see the values are tabulated at the end. Therefore, with company information, you can easily calculate yields to maturity by inputting values in a template like the one above in excel.

Uses of YTM

It is important to understand YTM as it is used to assess expected performance. The golden principle here is that the expected bond return rate changes depending on the market price despite the constant coupon rate. It is used to reflect how favorable the market is for the bond. Hence it is vital for people to manage a bond investment portfolio.

The formula for pricing a bond

You can price a bond by using the following formula

PV = Payment / (1+r)+ Payment / (1+r)+ ..+ Payment + Principle / (1+r)

Syntax derivatives

Pv = Price of the bond

Payment =Also referred to as the coupon payment. This is the coupon rate * par value ÷ number of payments per year

r stands for the required rate of return. It’s actually the required rate of return divided by the number of payments per year.

N= Years until maturity

Principal= face value of the bond/par value

As you can see from the above formula the price of the bond depends on the difference between the coupon rate and inferred required rate and

Conclusion

The steps above are the manual way of calculating YTM in an Excel worksheet. It is a straightforward and easy process to accomplish once you know your values and the formula to apply.

In case you find it a challenge using the above method, you can calculate YTM using the RATE and IRR functions in Excel.

Understanding a bond’s yield to maturity (YTM) is an essential task for fixed-income investors. But to fully grasp YTM, we must first discuss how to price bonds in general. The price of a traditional bond is determined by combining the present value of all future interest payments (cash flows), with the repayment of principal (the face value or par value) of the bond at maturity.

The rate used to discount these cash flows and principal is called the «required rate of return,» which is the rate of return required by investors who are weighing the risks associated with the investment.

Key Takeaways

- To calculate a bond’s maturity (YTM), it’s vital to understand how bonds are priced and evaluated.

- It combines the present value of all future interest payments (cash flows) with the repayment of the principal (the face value or par value) of the bond at maturity.

- The pricing of a bond largely depends on the difference between the coupon rate, which is a known figure, and the required rate, which is inferred.

- Coupon rates and required returns frequently do not match in the subsequent months and years following an issuance because market events impact the interest rate environment.

How to Price a Bond

The formula to price a traditional bond is:

PV

=

P

(

1

+

r

)

1

+

P

(

1

+

r

)

2

+

⋯

+

P

+

Principal

(

1

+

r

)

n

where:

PV

=

present value of the bond

P

=

payment, or coupon rate

×

par value

÷

number of

payments per year

r

=

required rate of return

÷

number of payments

per year

Principal

=

par (face) value of the bond

n

=

number of years until maturity

begin{aligned} &text{PV} = frac { text{P} }{ ( 1 + r ) ^ 1 } + frac { text{P} }{ ( 1 + r ) ^ 2 } + cdots + text{P} + frac { text{Principal} }{ ( 1 + r ) ^ n } \ &textbf{where:} \ &text{PV} = text{present value of the bond} \ &text{P} = text{payment, or coupon rate} times text{par value} div text{number of} \ &text{payments per year} \ &r = text{required rate of return} div text{number of payments} \ &text{per year} \ &text{Principal} = text{par (face) value of the bond} \ &n = text{number of years until maturity} \ end{aligned}

PV=(1+r)1P+(1+r)2P+⋯+P+(1+r)nPrincipalwhere:PV=present value of the bondP=payment, or coupon rate×par value÷number ofpayments per yearr=required rate of return÷number of paymentsper yearPrincipal=par (face) value of the bondn=number of years until maturity

The pricing of a bond is therefore critically dependent on the difference between the coupon rate, which is a known figure, and the required rate, which is inferred.

Suppose the coupon rate on a $100 bond is 5%, meaning the bond pays $5 per year, and the required rate—given the risk of the bond—is 5%. Because these two figures are identical, the bond will be priced at par, or $100.

This is shown below (note: if tables are hard to read, hover over the graphic and select the magnification icon):

Pricing a Bond After It’s Issued

Bonds trade at par when they are first issued. Frequently, the coupon rate and required return don’t match in the subsequent months and years because events impact the interest rate environment. A failure of these two rates to match causes the price of the bond to appreciate above par (trade at a premium to its face value) or decline below par (trade at a discount to its face value) in order to compensate for the rate difference.

Take the same bond as above (5% coupon, pays out $5 a year on a $100 principal) with five years left until maturity. If the current Federal Reserve rate is 1%, and other similar-risk bonds are at 2.5% (they pay out $2.50 a year on a $100 principal), this bond looks very attractive: offering 5% in interest—double that of comparable debt instruments.

Given this scenario, the market will adjust the price of the bond proportionally, in order to reflect this difference in rates. In this case, the bond would trade at a premium amount of $111.61. The current price of $111.61 is higher than the $100 you will receive at maturity, and that $11.61 represents the difference in the present value of the extra cash flow you receive over the life of the bond (the 5% versus the required return of 2.5%).

In other words, in order to get that 5% interest when all other rates are much lower, you must buy something today for $111.61 that you know in the future will only be worth $100. The rate that normalizes this difference is the yield to maturity.

Calculating the Yield to Maturity in Excel

The above examples break out each cash flow stream by year. This is a sound method for most financial modeling because best practices dictate that the sources and assumptions of all calculations should be easily auditable. However, when it comes to pricing a bond, we can make an exception to this rule because of the following truths:

- Some bonds have many years (decades) to maturity, and a yearly analysis, like that shown above, may not be practical

- Most of the information is known and fixed: We know the par value, we know the coupon, and we know the years to maturity.

For these reasons, we’ll set up the calculator as follows:

In the above example, the scenario is made slightly more realistic by using two coupon payments per year, which is why the YTM is 2.51—slightly above the 2.5% required rate of return in the first examples.

How Can an Investor Realize a Bond’s Yield to Maturity?

For the YTM to be actualized, bondholders must commit to holding the bond until maturity.

Can I Calculate a Bond’s YTM By Hand?

Yes, it is possible; however, it is far easier to use software like Excel or a financial calculator to do so. This is especially true for bonds with longer times to maturity, since you must take into account the present values of reinvented coupon payments at each period, which can quickly become overly complex.

How Is YTM Used by Investors?

YTM is an annualized rate that assumes an investor holds a bond to maturity if it is purchased at its current market price. This provides a standardized yield that can then allow comparisons across different fixed-income investments of various types. Using YTM, one could, for instance, compare the relative attractiveness of bonds from different issuers, among coupon and zero-coupon bonds, and those with different maturity.

Whatever business you are running, every time you will be attracted to buy and selling bonds for financial deals. And for this, you will need to find out the Yield to Maturity YTM of the bonds. In this article, you will get to know how to calculate Yield to Maturity Excel with some Excel formulas.

For this, you will have to show the initial principal amount invested, the time in which the principal amount is invested, the interest rate you need to pay every year, or other monthly and quarterly payments.

Syntax of YTM

=YIELDMAT(settlement, maturity, issue, rate, pr, [basis])

In this formula, the arguments used are explained as:

Settlement: This is a required argument in which you get the settlement date of the security. This date is after the issue date because the security is then given to the buyer.

Maturity: This is also a required argument in which you get the maturity date of the security.

Issue: This is also a required argument in which you get the issuance date of the security.

Rate: This is a required argument in which you get the interest rate of the security at the issuance date.

Pr: This is a required argument as well, in which you get the price per $100 face value of the security.

Basis: This is an optional argument in which you get the count type.

How to Calculate Yield to Maturity Excel with RATE Function?

In the very first method of YTM, you will get to know how the RATE function can help us. Once all the arguments are done, the RATE function gives YTM. All the arguments are then multiplied by the Par Value of the Bond. Below are some easy-to-follow steps:

- Select the C9 cell.

- Enter the following formula in the given bar:

=RATE(C8,C7,-C6,C4)*C5

- Now, press the ENTER key from the keyboard.

- Your wanted outcome will be on the next screen.

How to Calculate Yield to Maturity Excel with Direct Formula?

Here you will see the use of a direct formula to find the YTM of a Bond in Excel. Below is the formula:

YTM=(C+(FV-PV)/n)/(FV+PV/2)

In this formula:

C= It appears as an Annual Coupon Amount.

FV= It appears as a Face Value.

PV= It appears as a Present Value.

N= It appears as a value of Maturity Years.

Considering our dataset, let’s see how this process works:

- Click on the C8 cell.

- Now, enter the formula given below in the selected cell:

=(C6+((C4-C5)/C7))/(C4+C5/2)

- Now, press the ENTER key from the keyboard.

You will see the outcome Yields to Maturity appear on the screen.

How to Calculate Yield to Maturity Excel with YIELD Function?

Excel has a YIELD function that can easily calculate the Yield to Maturity of a bond in Excel. Let’s start this procedure with a new dataset. In this method, you will notice that the YIELD function extracts every single value from the dataset as arguments and gives the YTM values in the selected cells.

Below are simple steps to follow:

- Choose the C11 cell.

- Add the following formula in the selected cell:

=YIELD(C6,C7,C5,C10,C4,C8)

- Now, press the ENTER key from the keyboard.

- You will find the results in front of you.

A Few Considerations about the YIELDMAT Function

- You may encounter #NUM! error if:

The issuance date is greater than or equal to the date of settlement. Or

The settlement date is greater than or equal to the maturity date. Or

The pr, rate, or basis arguments have invalid numbers, such as rate < 0; pr ≤ 0, or [basis] has numbers other than 0, 1, 2, 3, 4).

- You may encounter #VALUE! error, if:

The issuance, settlement, or maturity dates are not valid Excel dates. Or

The given arguments are non-numeric.

Summary:

In this post, you have learned how to calculate yield to maturity Excel easily by using multiple approaches. Each method is worthy enough to use for this calculation. Try new tricks and continue exploring Excel.

What is the Excel YIELD Function?

The YIELD Function in Excel calculates the return earned on a security that issues periodic interest payments, such as a bond.

How to Use YIELD Function (Step-by-Step)

The Excel “YIELD” function is most often used in practice to determine the yield on a bond or a related debt instrument.

As part of a financing arrangement, the borrower is obligated to pay periodic interest payments to the lender until the date of maturity, in which the remaining balance of the principal must be repaid in full.

Before the terms of the lending agreement are formalized, i.e. prior to the settlement date, the yield earned on a bond by the lender can be estimated. However, there is substantial room for variance between the expected and the actual return.

Therefore, lenders must rely on multiple bond yield metrics, rather than merely one, to measure their potential returns under different scenarios.

Bond Terminology Review

Before delving further into the Excel “YIELD” function, it is necessary to preface the section with a review of common bond terminology to not only understand the calculation itself, but also to reduce the chance for misinterpretations.

| Term | Definition |

|---|---|

| Par Value (or Face Value) |

|

| Market Value |

|

| Maturity |

|

| Par Bond vs. Discount Bond vs. Premium Bond |

|

| Coupon Rate (or Interest Rate) |

|

| Current Yield |

|

| Yield to Maturity (YTM) |

|

| Yield to Call (YTC) |

|

| Yield to Worst (YTW) |

|

| Callable Bond vs. Non-Callable Bond |

|

Excel YIELD Function Formula

The formula for using the YIELD function in Excel is as follows.

= YIELD (settlement, maturity, rate, pr, redemption, frequency, [basis])

Where:

- “settlement” = Settlement Date

- “maturity” = Original Maturity Date or Early Redemption Date

- “rate” = Annual Coupon Rate (%)

- “pr” = Bond Quote (% of Par)

- “redemption” = Par Value or Call Price

- “frequency” = Number of Compounding Periods (e.g. Annual = 1x, Semi-Annual = 2x, Quarterly = 4x)

- “basis” = Day Count Basis

The brackets around the final input, “basis”, denotes that it can be omitted, i.e. left blank.

In order for the implied yield to be accurate, the units of time used in the equation must remain consistent all throughout the calculation.

For instance, if a borrower has taken out a ten-year bond with an annual interest rate of 10% paid on a semi-annual basis, the time-adjusted (i.e. semi-annual) interest rate on the bond is 5.0%.

- Semi-Annual Interest Rate (rate) = 10% ÷ 2 = 5.0%

YIELD Function Excel Syntax

The table below describes the syntax of the Excel YIELD function in more detail.

| Argument | Description | Required? |

|---|---|---|

| “settlement” |

|

|

| “maturity” |

|

|

| “rate” |

|

|

| “pr” |

|

|

| “redemption” |

|

|

| “frequency” |

|

|

| “basis” |

(Source: Microsoft) |

|

YIELD Function Calculator – Excel Model Template

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

Step 1. Bond Yield Calculation Exercise Assumptions

Suppose we’re tasked with calculating the yield on a ten-year semi-annual corporate bond given the following set of assumptions:

- Settlement Date = 12/31/21

- Term to Maturity = 10 Years

- Maturity Date = 12/31/31

The structure of the corporate bond issuance has a stated maturity of ten years and is not callable for the first five years of the borrowing term (i.e. NC/5).

Step 2. Call Provision Assumptions

The first call date is therefore five years from the date of original issuance, with a call premium of 4.0%.

- Call Provision = NC/5

- First Call Date = 12/31/26

- Call Premium (%) = 4%

- Call Price = 104

The bond was issued at par, i.e. “100”, and is trading in the markets at the same price as of the present date.

- Par Value of Bond = $1,000

- Market Value of Bond = $1,000

- Redemption Value (% of Par) = “100”

Step 3. Frequency of Payment and Coupon Rate Assumptions

The final two assumptions left are the frequency of payment and the coupon rate (%).

Earlier we stated the issuance was a semi-annual bond, so the frequency of payment is 2 times per annum.

The annual coupon rate that we’ll assume is 6.5%, meaning that the annual coupon is $65

- Frequency of Payment = 2x

Annual Interest Rate = 6.5%

The primary factors that determine the yield on bonds are the par value, coupon rate (%), the coupon ($), and the borrowing term.

Furthermore, the price of a bond and the yield are inversely related, wherein if the price of a bond were to rise, its yield would decline (and vice versa).

Step 4. Bond Yield Calculation in Excel

With our assumptions complete, we can now calculate the yield to maturity (YTM) and yield to call (YTC) of the bond.

The inputs entered in our YIELD function formula to compute the yield to maturity (YTM) are as follows.

=YIELD(F4,F7,F15,F12,F8,F14)

The implied yield to maturity (YTM), i.e. the return if held until the date of maturity, is 6.5% on the bond.

In contrast, the formula to calculate the yield to call (YTC) is the following.

=YIELD(F4,F7,F15,F12,F8,F14)

The distinction of YTC from the prior YTM calculation, which has been formatted in italics, is the maturity date and the call price:

- Maturity Date → The bondholder is assumed to have called the bond earlier than anticipated on the first call date and paid a premium.

- Call Price → The call price becomes relevant only for callable bonds, in which a call premium (i.e. fee) is attached to compensate the lender for the loss of the future interest payments and the risk of needing to reinvest the capital.

Using the YIELD function in Excel, we arrived at an implied yield to maturity (YTM) is 6.5%, whereas the yield to call (YTC) was 7.2% in comparison.

The bondholder in our hypothetical scenario—assuming that earning a higher return is the priority—is likely to call the bond early because of the higher yield.

Turbo-charge your time in Excel

Used at top investment banks, Wall Street Prep’s Excel Crash Course will turn you into an advanced Power User and set you apart from your peers.

Learn More

Yield to maturity (YTM) is the total return expected from a bond if the investor holds it until maturity, taking into account the current market price, coupon payments, and the face value of the bond.

YTM is academically defined as market interest rate, but means Yield to Maturity. It actually takes purchase price, the value of redemption, time between payment of interest, and the yield of coupon.

Data preparation

We will calculate the YTM at ease, and you need a data that looks like this:

Important Note: It is extremely important that the frequency is 1 – 4, and the basis is 1 – 3. This would guarantee the calculation of the YTM being successful.

Yield formula creation

Click beside Yield (B11) (1), type =YIELD(B4;B5;B6;B7;B8;B9;B10) (2), and press enter.

Note: You can now format the yield to any format you want.

IRR formula creation

Prepare your data:

- List the cash flows for the bond, including the coupon payments and the face value of the bond.

- Enter the current market price of the bond.

- Select the cell where you want the Yield to Maturity calculation to appear.

Enter the formula:

- The formula for Yield to Maturity in Excel is: =IRR(values, [guess]).

- Values is the range of cells that contains the cash flows for the bond.

- Guess is an optional argument that provides an initial estimate of the Yield to Maturity.

Press Enter:

- The Yield to Maturity calculation will appear in the selected cell.

By using the IRR function in Excel, you can easily calculate the Yield to Maturity for a bond, which is an important metric for evaluating the performance and potential return of a bond investment.

How To Find and Interview Contractors for Your Rehabs – Flipping Junkie – For Those Addicted to House Flipping

House Flipper Mod Apk Unlimited Money + No Ads Download

Cops can’t break these rules if you’re pulled over | finder.com

20 Best Email Verification Services and Tools For 2022

Router Overload – What It Is & How to Fix It — StartupGuys.net

5 Goat Fencing Options And Details To Consider • Insteading

Top 10 scream-worthy haunted houses and corn mazes in Phoenix

Mother-Daughter Quotes: 101 Quotes That Are As Perfect As They Are | Proflowers

How to get rid of cellulite: 15 expert tips from dermatologists and nutritionists

Kidney stones: Causes, symptoms, and treatment

What Do They Eat in Iceland?

How to buy the best garden furniture — Which?

Fact Check: Did the White House ‘change definition of recession’?

What is the best definition of the Cold War quizlet? — society life and development

15 Candles That Will Leave Your House Smelling Fresh All Summer Long

A House for Mr Biswas (HB): Postcolonial and Diasporic Text

How To Start Flipping Houses

12 Best Kitchen Faucet with Sprayer Reviews and Buying Guide of 2023 —

25 Most Beautiful Latin Words and Meanings

16 Popular Chinese Dishes You MUST Try! (w/ pictures)

Why are fighter jets flying over my house today? — ViewHow.com

Nutrition software for nutritionists, personal trainers and gyms

Design Checklist for Commercial Kitchen Exhaust Filtration Systems | Camfil

Find Kitchen Fitters in Boston | MyBuilder

There are a few steps involved in calculating bond yield to maturity in Excel:

1. Enter the bond’s price into a cell.

2. Enter the face value of the bond into a cell.

3. Enter the coupon rate of the bond into a cell.

4. Calculate the number of years until maturity by subtracting the current year from the bond’s maturity year and enter that number into a cell.

5. Use Excel’s «RATE» function to calculate yield to maturity, using cells for price, face value, coupon rate, and number of years until maturity as inputs for that function.»

How do you calculate a bond’s yield to maturity?

The yield to maturity (YTM) of a bond is the percentage rate of return that would be earned if the bond were held until it matured and its coupon payments were reinvested at that same YTM rate. The formula for calculating a bond’s YTM is as follows:

YTM = C + ((F – P)/n) / ((F + P)/2)

where C is the annual coupon payment, F is the face value of the bond, P is the market price of the bond, and n is the number of years until maturity.

How do you calculate bond yield in Excel?

There are a few different ways to calculate bond yield in Excel. One way is to use the RATE function. The RATE function can be used to calculate the periodic interest rate, based on the number of periods, the amount, and the present value.

Another way to calculate bond yield is to use the YIELD function. The YIELD function calculates the yield on a security that pays periodic interest.

You can also use the PRICE function to calculate bond prices, and then use those prices to calculate yields.

To learn more about how to calculate bond yields in Excel, check out this article: https://www.investopedia.com/articles/bonds/11/how-to-calculate-bond-yields-in-excel.asp

What is bond yield formula?

The bond yield formula is used to calculate the yield of a bond. The formula is:

Yield = (Coupon rate x Par value) / Price of bond

Where:

Coupon rate is the interest rate paid by the issuer

Par value is the face value of the bond

Price of bond is the price at which the bond is currently trading in the market

Is yield to maturity the same as interest rate?

No, yield to maturity is not the same as interest rate. Yield to maturity is the measure of return on a bond if it is held until its maturity date and the investor receives all scheduled interest payments. The interest rate is simply the periodic interest payment divided by the face value of the bond.

Is YTM a percentage?

No, YTM is not a percentage.

What is the formula to calculate yield?

The formula to calculate yield is:

Yield = (Income from Investments – Expenses) / Total Investment Value

To calculate yield, you will need to know your total investment value and your income from investments. Your expenses will include any fees associated with the investment, such as management fees or transaction costs.

What is yield to maturity example?

A yield to maturity example is a bond that has a coupon rate of 5%, and it matures in 10 years. The current market interest rate is 3%. The yield to maturity would be 5.45%.

How do you calculate yield to maturity on a financial calculator?

To calculate yield to maturity on a financial calculator, you will need to input the following information:

-The face value of the bond

-The coupon rate

-The number of years until maturity

-The current market price of the bond

Once you have inputted this information, you can then hit the «Yield to Maturity» button on your calculator. This will give you the yield to maturity for the bond.

How do you calculate time to maturity?

To calculate time to maturity, you’ll need to know the bond’s coupon rate and current market value. Then, you can use this formula:

Time to Maturity = (Coupon Rate / Current Market Value) x Number of Years to Maturity

For example, let’s say you have a $1,000 bond with a 5% coupon rate that matures in 10 years. The current market value of the bond is $950. Using the formula above, we get:

Time to Maturity = (5% / 950) x 10 years = 0.526 years ≈ 6 months

What happens to YTM when interest rates rise?

When interest rates rise, the YTM will also increase. This is because when interest rates are higher, bonds will have a higher coupon rate and thus a higher YTM.

Is YTM the market rate?

No, the yield to maturity (YTM) is not the market rate. The market rate is the interest rate that would be paid on a new investment with similar characteristics to the bond being analyzed. To calculate the YTM, you need to know the coupon rate, current market price, par value, and time to maturity.

The Practical way to Calculate Yield to Maturity

In short:

If you invest in bond’s odds are you’ll hear about yield to maturity. Likely you’ll also hear a bond’s yield to maturity and its price are intricately linked. So, what exactly is yield to maturity, how is it connected to the price of a bond, and how is it calculated?

Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield (or rate of return) they can expect to earn on a bond.

Investors will calculate the YTM by discounting all future payments and the repayment of the face value back to what their present value is. In other words, what would the sum of all those payments be worth if they were received today. This value will be the current price of the bond when discounting by the correct YTM -i.e. this is how YTM and current price are linked.

Key Points

- Yield to Maturity is the expected return of a bond held until maturity.

- Current Price and YTM are directly connected to each other.

- YTM is found when the Present Value of all future cash payments equals the current price of the bond.

How Bonds are Priced

When looking at a bond and trying to figure its yield to maturity, you will have a few variables that you will know. These will include the years left until maturity, the number of times payments are made a year (annual, semiannual, etc.), the actual payment amounts (cash figure or you can calculate the cash figure), the current price of the bond, and the face value.

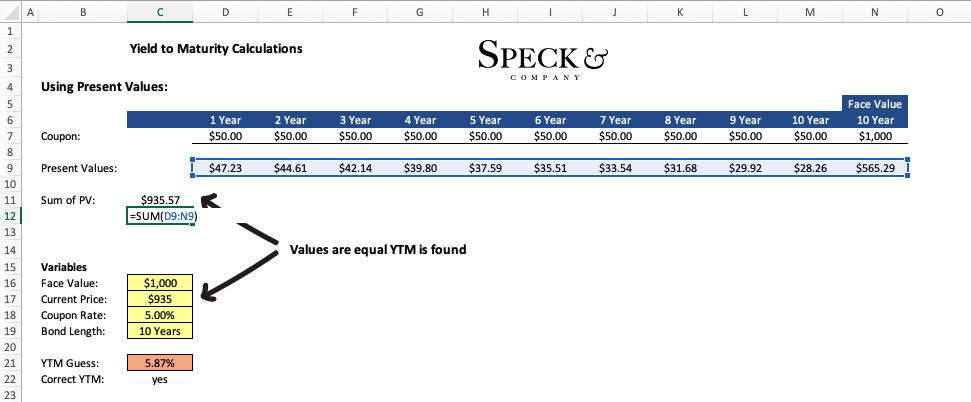

With those known variables you can calculate the yield to maturity by inserting different values for the “Rate” variable in the formula above. You will know you have the correct rate for YTM when the sum of all values on the right is equal to the “Bond Price”.

Calculating Yield to Maturity In Excel – Hard Way & Easy Way

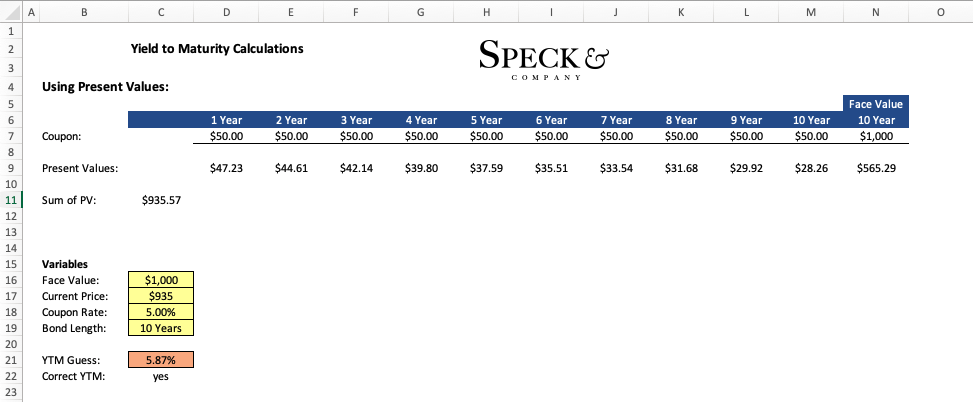

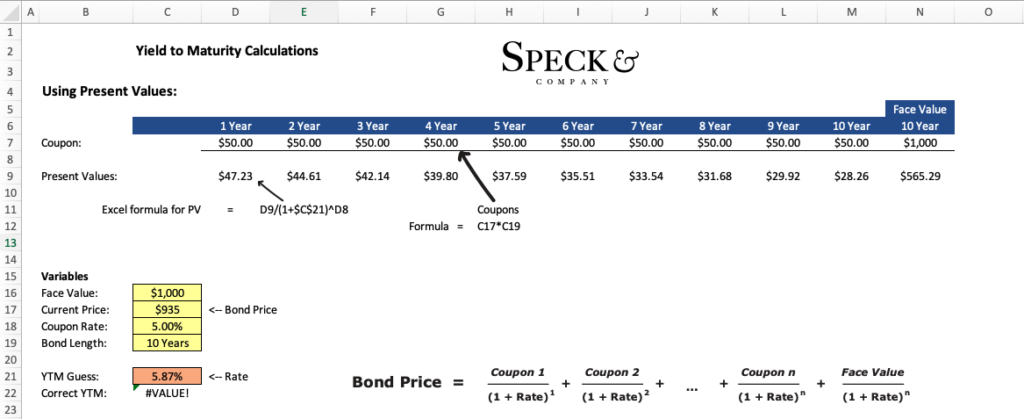

Here’s an example that we’ve set up in excel.

Say we are looking at a bond that is currently trading at $935, has 10 years left until mature, the face value of the bond is $1,000, and pays an annual coupon of $50 -i.e. paid once per year. What is the YTM for this bond?

From this point, we have multiple ways we can find the YTM in excel. Here is one approach which is a little involved but shows how the mechanics of the formula above is working.

You can download this file for free here:

Final Result

Step 1 – Discounting the payments

Step 2 – Sum the discounted values

Calculating Yield to Maturity in Excel – Quick Approach

While the approach we used above is great for an illustrative purpose, likely you will not want to build out a spreadsheet every time you need to calculate the YTM of a bond. Instead, excel has already built-in functions that will calculate this value for us if we insert the values in the right spots.

To calculate YTM in excel with a prebuilt function, simply find a cell in excel and type “=RATE”.

We can use the same values from the above example to see how it would work.

The important thing to note is that the current price should be entered as a negative value, and the periods are not necessarily the number of years. For example, if you have a semi-annual payment you would want to take the coupon value and divide it by 2 since you are getting half the coupon in the beginning of the year and half in the end of the year (timing difference –> time value of money).

Applying this to our example, if we had semiannual payments our coupon would be $25 ($50/2) and our periods would be 20 (10*2).

This would have a major impact on the value we get for YTM so make sure you make note of this.

Yield to Maturity in Excel Underlying ideas

What’s going on behind the scene during the calculation?

Truly understanding yield to maturity requires an understanding of a few foundational components of finance. If you can get a sense of these concepts then understanding what is going on with YTM should be more intuitive.

Time Value of Money – what’s happening during the calculation

The time value of money is actually a really simple concept, all it means is that money today is worth more than money tomorrow. But how can this be? Isn’t $1 today still $1 tomorrow? Yes, however, time has passed meaning you could have done something with that money over that one day to earn more money. The simplest thing is an interest-bearing savings account.

Time value of money applies to bonds in that the same coupon an investor receives 15 years after they purchase the bond will be less valuable than the same coupon they are receiving today. Yield to maturity gives investors a way to account for this.

Present Value – what’s happening during the calculation

So how do you account for the time value of money issue on bonds? You calculate out what all the coupon’s value would be if they were all received today, called the present value. The fancy way to say this is that you discount future coupon values back to their present value -which is what YTM is doing.

We can take all the present values and set them equal to the current price of the bond to find equilibrium. When we achieve both sides being the same value we have found the discount/interest rate.

Frequently Asked Questions

Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is held to maturity. There are two formulas to calculate yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / Current Value)(1 / time periods)] -1. The yield to maturity formula for a coupon bond: Bond Price = [ Coupon x (1 – (1 / (1 + YTM)n) / YTM) ] + [ Face Value x (1 / (1 + YTM)n ) ]

Yield to maturity can be calculated in excel with the rate function. To calculate the yield to maturity you will need the current price, the face value, the years periods until maturity, and the coupon payment per period. With those variables, you can type “=RATE” into excel and enter the values as follows RATE(periods, coupon, -current price, face value).

The current yield formula is the bond’s annual coupon divided by its current price. This value reflects the percentage return an investor would receive from buying the bond at the current price and holding the bond for one year.

Summary

The Excel YIELDMAT function returns the annual yield of a security that pays interest at maturity.

Purpose

Get annual yield of security interest at maturity

Return value

Arguments

- sd — Settlement date of the security.

- md — Maturity date of the security.

- id — Issue date of the security.

- rate — Interest rate of security.

- pr — Price per $100 face value.

- basis — [optional] Coupon payments per year (annual = 1, semiannual = 2; quarterly = 4).

Syntax

=YIELDMAT(sd, md, id, rate, pr, [basis])

Usage notes

The YIELDMAT function returns the annual yield of a security that pays interest at maturity. In the example shown, the formula in F5 is:

=YIELDMAT(C9,C7,C8,C6,C5,C10)

with these inputs, the YIELDMAT function returns 0.081 which, or 8.10% when formatted with the percentage number format.

Entering dates

In Excel, dates are serial numbers. Generally, the best way to enter valid dates is to use cell references, as shown in the example. If you want to enter valid dates directly inside a function, the DATE function is the best approach.

Basis

The basis argument controls how days are counted. The PRICE function allows 5 options (0-4) and defaults to zero, which specifies US 30/360 basis. This article on Wikipedia provides a detailed explanation of available conventions.

| Basis | Day count |

|---|---|

| 0 or omitted | US (NASD) 30/360 |

| 1 | Actual/actual |

| 2 | Actual/360 |

| 3 | Actual/365 |

| 4 | European 30/360 |

Notes

- In Excel, dates are serial numbers.

- Settlement, maturity issue, and basis are truncated to integers

- If settlement, maturity, or issue dates are not valid, YIELDMAT returns #VALUE!

- YIELDMAT returns #NUM! if any of the following are true:

- rate < 0

- pr <= 0

- settlement >= maturity

- Basis is not 0-4

Author

Dave Bruns

Hi — I’m Dave Bruns, and I run Exceljet with my wife, Lisa. Our goal is to help you work faster in Excel. We create short videos, and clear examples of formulas, functions, pivot tables, conditional formatting, and charts.

Thank you for a very well put together web page to help with my excel learnings. Best site I have ever been on.

Get Training

Quick, clean, and to the point training

Learn Excel with high quality video training. Our videos are quick, clean, and to the point, so you can learn Excel in less time, and easily review key topics when needed. Each video comes with its own practice worksheet.

View Paid Training & Bundles