Tax

11+ Sample Profit and Loss Statements to Calculate your Business Expenses

It is always wise to account for the revenues and expenses in a business. This way, the business is able to know how much is going where. At the same time, accounting helps the business how much profit it is earning back from the business. Profit and loss statement forms are therefore a necessity, as they make tracking revenues and expenses over a given time period clear and easy.

Profit and loss statement templates can be of great help to the accounts department especially so that it gets easier for them to make the right statements for the organization. Whether it is a single person or a team, profit and loss statements help accountants make sense of the revenues and expenses incurred by a company in a stipulated year or any given time-frame.

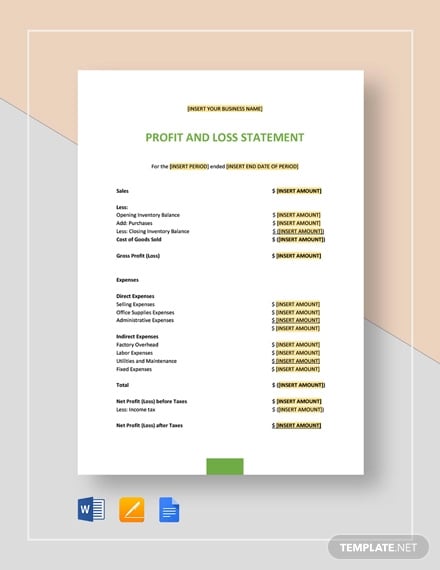

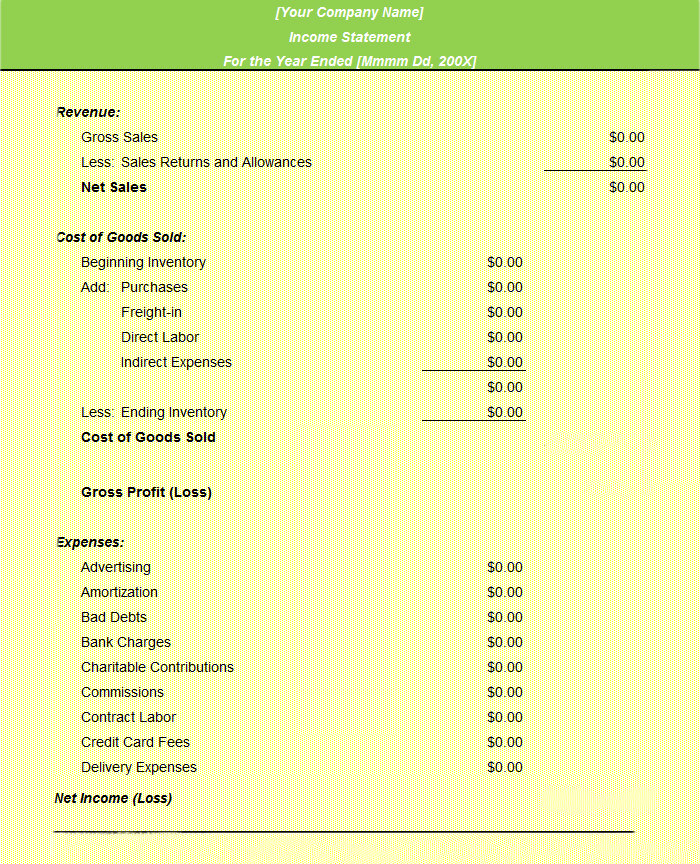

Profit and Loss Statement Template

Details

File Format

- Google Docs

- MS Word

- Pages

Size: A4, US

Download

A company’s destiny is often decided by its ability to generate profit and loss. You can do so with the help of the above template, which will definitely be of great use to you. Produce a summary of your revenues, costs, and expenses in a specific period to assess your company’s profit or loss generation. Help managers decide whether to reduce costs or increase operating income to generate the target profit. Properly gauge the performance of your business using this financial statement. Get a solid reference document that you can use for tax and planning purposes. Try it out now!

Simple Profit & Loss Statement Template

Details

File Format

- Google Docs

- Google Sheets

- MS Excel

- MS Word

- Numbers

- Pages

Size: A4, US

Download

Get a summary of your revenues, costs, and expenses made in a chosen time duration through the use of the above business profit and loss statement template which comes in Word and Excel file format. Have an idea on how to manage your expenses through results from our template. Increase revenue or profits by analyzing how and where sales are generated from. Have a record of your revenues and expenses when assessing taxes on profits earned that you are required to submit to the revenue service.

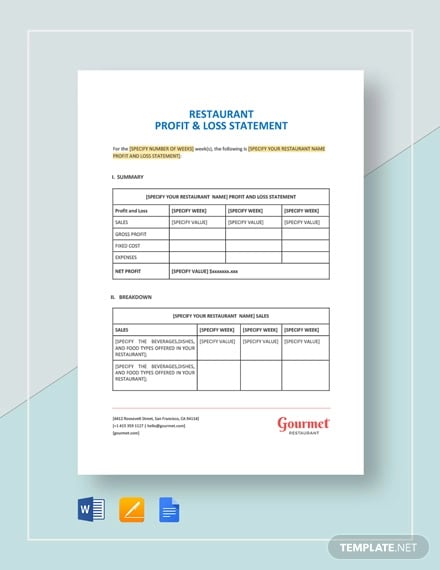

Restaurant Profit and Loss Statement Template

Details

File Format

- Google Docs

- MS Word

- Pages

Size: A4, US

Download

Do you wish to create a tool that will enhance your ability to analyze and understand what is going on in your restaurant and how it’s affecting your profitability and success? If you are, then we got you here. Check profit and loss statements in Excel as well. This file is perfect for helping restaurant owners keep track of their restaurant’s progress and to reflect on its revenue and costs during a specified period of time. It is very easily editable and can be customized to suit your preferences easily. Download now!

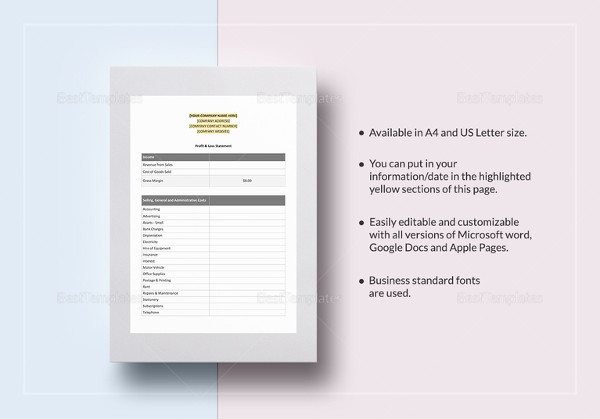

Profit and Loss Statement

Details

File Format

- MS Excel

- MS Word

- Pages

- Numbers

Size: US, A4

Download

Get a clear view of your business finances with the help of this profit and loss statement template mentioned above. All you have to do is download the template, edit and customize it the way you like and suits your preferences. It is not just limited to a computer, but you can download it on any electronic device. Simple profit and loss statements available online will be of great use to help you create the perfect financial statements for your company. It is also available in various file formats. Customize it according to your business standards.

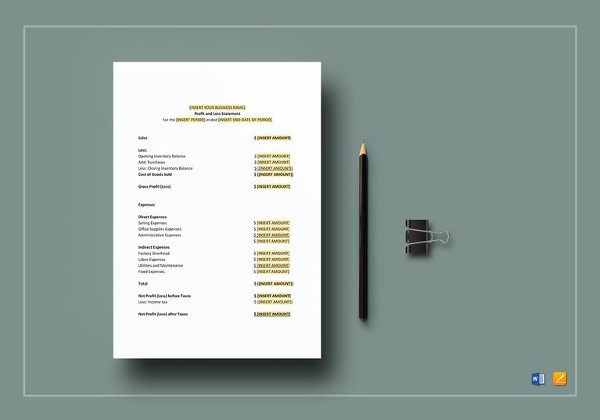

Simple Profit and Loss Statement

Details

File Format

- Word

- Pages

Size: A4, US

Download

Properly record your revenue and losses with the help of the above profit and loss statement template. All you have to do is download the template, edit and customize it to suit your preferences as needed. There are many statement templates in Google Docs that can be of great help to you while creating the statements you need to make of any kind, no matter which industry you work in.

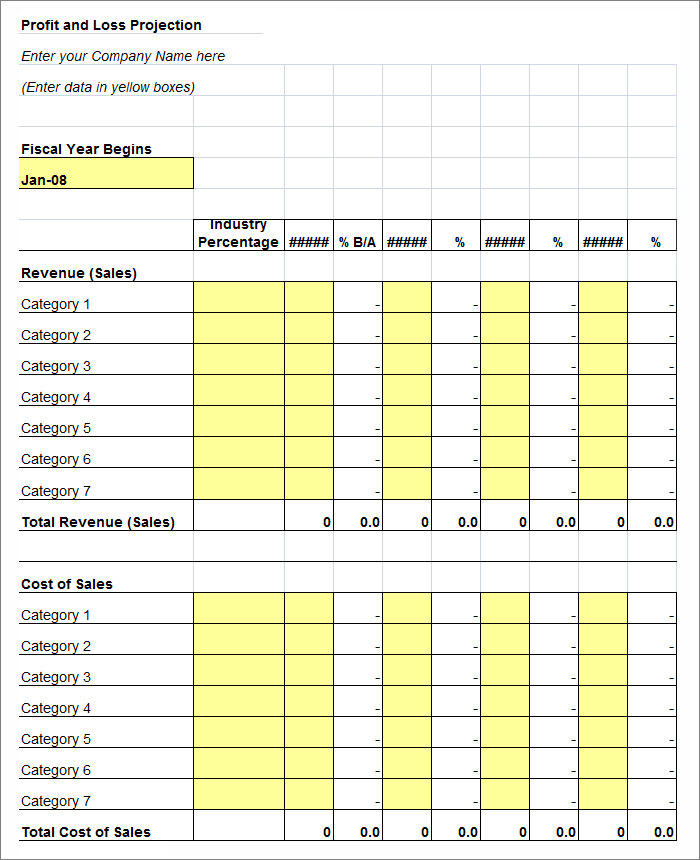

Profit and Loss Statement Template in Excel

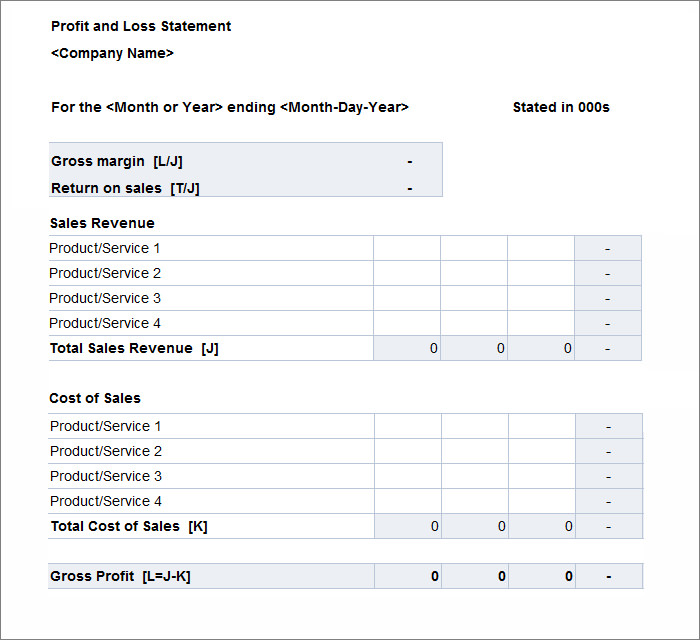

Creating a Profit and Loss Statement:

Step 1: Choose a Template

The first thing for you to do would be to choose the right template to create your statement. There are many statement templates in Word that will help you create the best statement for the organization you work for. You can either make spreadsheets or make a word document statement. Enter the values, subtract expenses from the revenue that you get. This way you can make the right statement you need to be made.

Step 2: Create a Basic Structure

You need to write down the details of your company at the top of the document. The basic structure of the statement should be very simple and understandable to all those reading it. The document should have a base headline with subheadings so that it is easier for others to understand the document easily and effortlessly. Remember to keep things simple and precise. Make sure that you add rows and columns for the calculations you need to calculate.

Step 3: Mention Your Revenue Sources

It is very important that you mention the sources of your revenue without fail. This way, you will know where you get your incomes from and how are they spent as well. It helps you keep a check on any debts or loans you have taken from others so that you can pay them back before it gets too late to do so. Do not miss to mention even the smallest source of revenue you could possibly get.

Step 4: Calculate Net Income and Expenses

The next step would be to calculate the net income and expenses you have as an entity. This means that the money that comes into the organization in the forms of funds, revenue, etc. and also, the money that goes out in the form of different expenses, salaries, etc. Tax invoice templates will be of great use as you also need to mention how much tax are you paying, which includes any tax, rent, etc.

Step 5: Calculate Profit and Loss

This step would be to calculate where the money is going and how you would possibly try to manage it. Now that you have the total expenditure and income figures of your organization with you in hand, calculate the difference and figure out whether your company is running a profit or experiencing a loss. This way you will have an idea of where to cut down on expenses. Sample profit and loss statements will help you get a better idea of how to create the right statements.

Sample Profit and Loss Statement in Word

Simple Profit and Loss Statement Template

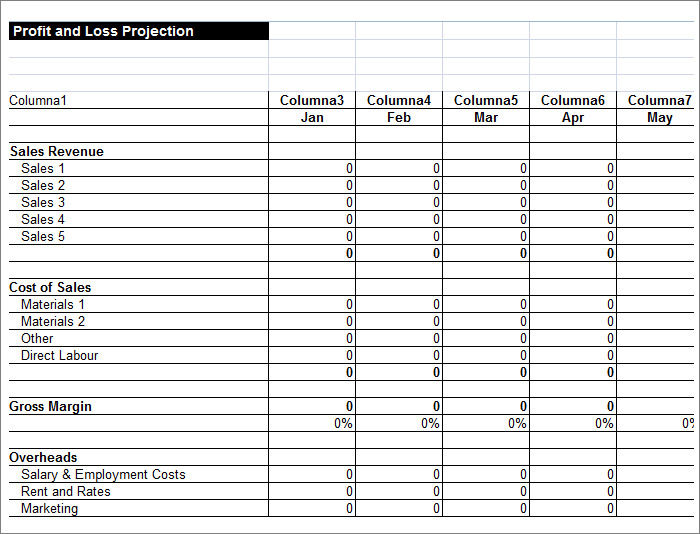

Excel Formatted Business Profit and Loss Statement Template

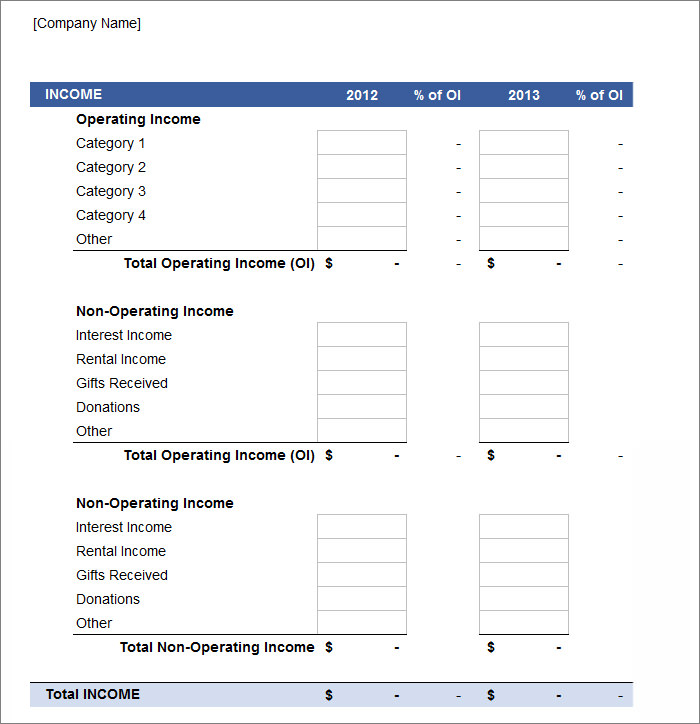

Profit and Loss Statement Template

Profit and Loss Statement Example

Blank Profit and Loss Statement

Using these Templates:

When there are ready-made profit and loss statement templates samples available for use, why should one go through the hassle of making one on their own? The templates are available in multiple variations and different formats. Each one of them is simple, fully editable and you can customize them easily. Check business profit and loss statements, that might be useful for your business to know where you are experiencing profit and where there is a loss.

All you need to do is to replace the same figures with your own because you cannot use the pre-included data as is. You want to make sure that the data available relates to your company but you can be sure that you are just a few clicks away from downloading the best templates that can help you through the accounting process.

More in Tax

A profit and loss (P&L) statement is a report that details a company’s revenue and expenses over a period of time (usually a quarter or fiscal year). The profit & loss statement, also called the income statement, shows whether a company lost money or made a profit during the reporting period.

Let’s explore what a P&L statement means for your business, why you need one, a profit and loss statement example, and three free templates you can use to create yours today in this article from Nav’s experts.

When Your Business Needs a Profit and Loss Statement

As a small business owner, you probably already have a number of responsibilities on your to-do list. Depending on your situation, you may have to manage taxes, apply for business credit cards or small business loans, monitor your business credit scores, and perhaps even oversee daily sales or operations.

It’s understandable that you might feel worried about adding more duties to the ever-growing pile. But once you get used to filling out your income statement template, you’ll get faster at the process over time. Your accounting software may help you complete this task as well.

The good news is you don’t need a business accounting degree to learn how to use these statements. Your accounting software can often help you create a P&L, or your accountant can help as well.

Pro forma P&L

The first time your business should create a P&L statement is right at the beginning. You probably won’t have any actual income or expenses to report at that point. Still, you can create a pro forma P&L to project these figures for the future. Pro forma income statements may be helpful when you apply for business loans or other types of financing.

Periodic P&L

All established businesses should prepare a P&L statement from time to time. Ideally, your company should create a new report at least once a quarter. Monthly income statements are even better.

A periodic P&L statement can help you manage your business finances. You can compare your current statement to previous ones and see if your net income is improving or declining. A P&L statement can also help you when it’s time to prepare your business tax return.

Other types of P&L/income statements

Other types of P&L statements include:

- Single-step P&L statements are the simplest format for a P&L statement with subtotals for revenue and expenses.

- Multi-step P&L statements further break down revenues and expenses into operating and non-operating revenues and expenses.

- Comparative income statements compare different periods (such as quarterly or annual reporting periods).

- Common size analysis P&L statements present line items as a percentage of revenue.

- Profit & loss variance statements show the difference between amounts budgeted versus actual income or expenses.

- Contribution margin P&L statements show net profit by first deducting variable expenses from sales to determine the contribution margin, then subtracting fixed expenses.

- Driver-based P&L statements are used to create forecasts, often for executive planning.

Compare Your Financing Options With Confidence

Spend more time crushing goals than crunching numbers. Instantly, compare your best financial options based on your unique business data. Know what business financing you may qualify for before you apply, with Nav.

See My Options

What Information Goes on a P&L Statement?

Before you prepare a statement of profit and loss, you’ll need to gather information about that money that flowed into and out of your business during the time period in question. Make sure your bookkeeping is up to date so you’re working with current information. If you already have a company cash flow statement, it may contain many of the details you need.

In addition to your statement of cash flows, you may also gather information from the following sources:

Your business bank statements

Search your bank statements for all sources of income deposited during the reporting period. Your company’s income categories may include:

- Sales revenue – Total sales earned when your company sells goods or services.

- Affiliate commissions – Commissions received when your business promotes or sells another company’s products or services.

- Rent and lease payments – Income earned from leasing equipment or property to others.

- Royalties – Money earned when you create a product, and someone else sells it on your business’ behalf.

- Non-operating income – May include interest earned on investments or savings.

- Gains – Profits made from the sales of the company’s assets, like equipment, property, etc.

Your accounting software

Next, assemble a list of the funds that flowed out of your business during the time period featured in the report. The transactions list in your accounting software or checkbook ledger should contain these details. Alternatively, you can review your bank statement for the data you need.

Group all expenses incurred into categories, such as:

- Operating costs (or administrative expenses) – Rent, salary, wages, marketing, insurance, legal fees, and other overhead costs.

- Costs of goods sold (COGS, or cost of sales) – Inventory, shipping, storage, raw materials, and other expenses involved in selling products.

- Depreciation and amortization – May apply to equipment, machinery, buildings, or other property your business owns.

- Taxes – Income tax paid.

- Interest paid on debt – Interest expenses incurred on business credit cards, small business loans, lines of credit, and other debt.

Cash receipts

Be sure to include cash transactions in your P&L as well — both income and expenses. Cash deposits should be detailed in your business checking account and your accounting software, if you recorded them previously. It’s also wise to save your receipts to make reporting cash expenses easier.

Simple Profit and Loss Statement Example

The table below shows an example of a simple profit and loss statement.

| Simple P&L Statement Example | |

|---|---|

| Quarterly Income | |

| Sales | $100,000 |

| Royalties | $10,000 |

| Non-Operating Income | $5,000 |

| Total Quarterly Income | $115,000 |

| Quarterly Expenses | |

| Operating Expenses | $25,000 |

| Cost of Goods Sold | $30,000 |

| Taxes | $25,000 |

| Depreciation | $5,000 |

| Total Quarterly Expenses | $85,000 |

| Net Income | $30,000 |

3 Excellent P&L Statement Templates You Can Download for Free

Rather than starting with a blank page, turn to a profit and loss statement template. These templates can provide the backbone of your business’s profit and loss statement. Most templates are in Excel and are fully editable to suit your business needs.

Here are some great options:

- Nav: Get Nav’s profit and loss template here.

- FreshBooks: Download FreshBooks’s free P&L template here.

- Corporate Finance Institute: Get the free template from the Corporate Finance Institute here.

You can also reach out to an accounting professional to get advice on how to complete a profit and loss statement if you have questions.

How to Analyze a Profit and Loss Statement

A profit and loss statement can give you insight into a company’s profitability, but you need to know how to read it first.

A one-step profit and loss statement is relatively straightforward. First, you’ll decide what you want the given period to be, which can be monthly, quarterly, or annually. Then you’ll subtract your total expenses from your business income (any business expenses) to find your net income.

Once you have completed the calculations, a P&L statement can show you where you’re overspending or not grabbing onto opportunities to increase profits. It will allow you to look at changes that happen over time to see if there are up seasons you can plan ahead for, or if you’re growing. You can also compare your business to the competition to see if there’s a way to increase profits. Overall, you can become more efficient and effective at running your business using a P&L statement.

Profit and loss statements can be useful tools, but you need to understand how they work first. Don’t hesitate to contact an accounting professional with any questions.

Why You Need a P&L Statement

We’ve covered when your business needs a P&L statement and some basics about how to create a simple one. But why is a profit and loss statement useful for a business? Below are a few reasons why your business needs an income statement in the first place.

- You can use a P&L statement to improve your bottom line. By periodically taking stock of your company’s income and expenses, you can get a better idea of how it’s performing financially. You may discover how to boost your net income, and ultimately business profits, by increasing revenue, cutting expenses, or some combination of the two.

- Put your business in a better position to borrow. When you apply for business funding, lenders will often review your financial statements, including the P&L statement, as part of the application process. Of course, your business credit scores and reports are often among the key factors considered when you apply for a loan. Yet a P&L statement that shows your company is in the black can be a big plus.

- A P&L statement might be required. Is your company publicly traded? If so, you’re likely required to file annual reports (and other reports) with the Securities and Exchange Commission (SEC). An income statement is part of the financial information your business must disclose in these reports.

- P&L statements can help you prepare your taxes. Unless you’re an accountant or a big fan of numbers, you likely don’t enjoy preparing your business tax return. Many business owners don’t consider this particular obligation to be much fun. Yet if you prepare regular P&L statements, filling out your tax returns could be less painful. Through your P&L, you’ll already have access to much of the information you need.

P&L Statement vs. Balance Sheet

A balance sheet and a P&L statement are both financial reports, but they provide different information to a business. As mentioned, a profit and loss statement shows a business’s profitability over a certain period of time. It can give insights into how to increase profits by boosting revenue or reducing expenses, or both.

On the other hand, a balance sheet looks at a business’s assets, liabilities, and shareholder equity (if applicable) at a specific time. Assets include accounts receivable, inventory, and cash, while liabilities are debt, overhead, and accounts payable. It shows how well the management is using the business’s resources and how it can be improved. Calculating the rates of return using your balance sheet for different products and services shows what’s giving you the most bang for your buck, and if there is anything you should cut.

Businesses use both of these financial statements in tandem. When used together, they give you an overall view of your business’s efficiency, consistency, changes you should make to your business plan, and the direction you should take as a business as a whole.

The Difference Between a P&L Statement and a Statement of Revenue

A statement of revenue and a P&L are the same financial report. There are actually four different terms used to describe the report that helps you calculate your company’s net income:

- Profit and loss statement

- P&L statement

- Statement of revenue

- Income statement

It can be easy to confuse these terms, but know that they refer to the same report.

Is Profit And Loss Statement and Income Statement the Same?

Yes, you will often see the terms P&L and income statement used interchangeably. They are the same report and perform the same function, but they’re sometimes referred to using two different names.

Final Word: Profit and Loss Statements

Keeping track of your company’s financial performance is critical to its long-term success. That’s why a P&L statement can be such a valuable tool for a business owner to use.

By creating regular profit and loss statements, you can track your company’s financial health over time. This knowledge can provide you with opportunities to either double down on smart business strategies that are working for you or make course corrections when needed.

If the idea of creating regular P&L statements or other financial documents feels overwhelming, you don’t have to create these statements on your own. You can hire a professional accountant to help. Even if you’re comfortable creating your own financial reports, a professional accountant can save you time and free you up to focus on other areas of your business.

Check out Business Boost

Get your full business credit reports & scores, PLUS Nav reports your account payments to the business bureaus as a tradeline.

I’m Ready

This article was originally written on January 8, 2020 and updated on March 7, 2023.

Rate This Article

This article currently has 4 ratings with an average of 5 stars.

The profit and loss statement is one of the most important financial documents of any company. It consists of a summary of revenues, costs, and expenses for a specific business period usually for a fiscal year.

The profit and loss statement template is similar to the income statement template. This type of financial documents is used to analyze the financial stability of a business.

Also, it assesses the ability of a business to generate profit by managing revenue, costs, or both.

This statement sometimes also referred to as earning, income, financial results, expense or profit, and loss statement.

The purpose of the profit and loss statement template is to manage the revenue and cost of a business to generate profit and eliminate the probability of loss for any period of time. You may also like Debt Snowball Spreadsheet Templates.

Table of Contents

- 1 Purpose of Profit and Loss Statement Template

- 2 Frequently Asked Questions (FAQ)

- 3 What is a profit and loss statement?

- 4 What is the Profit and Loss Account?

- 5 How to Create a Profit and Loss Statement?

- 6 How QuickBooks Helps in Generating an Income Statement?

- 7 Why is a Profit and Loss Statement important?

- 8 What is present on the Profit and Loss Statement Template?

- 9 What isn’t shown on a Profit and Loss Statement Template?

Purpose of Profit and Loss Statement Template

The basic purpose of using a profit and loss statement template is to check the profitability and sustainability of the business.

So, a resultant profit in the income statement means the business is revenue more than its expenses. On the other hand, a loss means the expenses are more than the revenue of the business.

Therefore, the profit and loss statement is used to answer a lot of questions such as;

- Is there enough revenue generated by the business to cover the costs?

- How much is the return of investment for the expenses of the business?

- Is the business profitable?

While profit and loss statement template can be used to record the top and lowest-earning revenue and spending. Also, it calculates the gross margin of business by dividing the costs of goods sold by generated revenue.

Moreover, the profit and loss statement template presents the factors impacting the growth and profitability of the business.

Frequently Asked Questions (FAQ)

What is a profit and loss statement?

A Profit and Loss (P&L) statement is a financial statement that provides a summary of the company’s revenues, expenses, profits, and loss over a specified period. This statement is also known as an income statement or statement of operations.

The profit and loss statement is one of the three financial statements issued by the company along with the balance sheet and cash flow statement quarterly and yearly.

P&L statement along with the balance sheet and cash flow statement provides an in-depth look at the company’s financial performance. It is considered to be the most popular financial statement in business plan as it provides quick information about how much profit/loss is generated by a business.

What is the Profit and Loss Account?

A profit and loss account is an account in the books of a company in which incomes and profits are credited and expenses and losses are debited to present the company’s net profit or loss over an available period. This account is necessary for all the running and growing businesses.

How to Create a Profit and Loss Statement?

Here are the steps for creating a profit and loss statement for your business.

- Firstly, you have to calculate all the revenues your company has received. If you are building a monthly P&L statement then you have to include all the revenues that were received in that time frame. From general ledger and current account receivable balances you can get current account balances.

- Then, calculate the costs of goods sold; it is important for any profit and loss statement.

- After that, subtract the costs of goods sold from your calculated revenue to get the gross profit (the profit that a company earned by selling their goods or from their services)

Gross profit= revenue – costs of goods sold - The next thing you have to do is to calculate all your operating expenses.

- Now, for obtaining operating profit/loss subtract the operating expenses from the gross profit.

Operating profit/loss= gross profit- operating expenses - If you didn’t include any additional income such as interest income and dividends from investments in revenue then add them in operating profit to get EBITDA (Earnings before interest, taxes, depreciation, and amortization).

EBITDA= operating profit + additional income - The next step is calculating the interest, taxes, depreciation, and amortization expenses.

- In the end, by subtracting interest, taxes, depreciation, and amortization expenses from EBITDA you finally obtain the net profit/loss.

Net profit/loss= EBITDA – (interest, taxes, depreciation, and amortization)

How QuickBooks Helps in Generating an Income Statement?

QuickBooks creates your income statement just in a few clicks. It gives a pathway and organizes your company’s accounting data, and making it accession easy and review your income statement.

Why is a Profit and Loss Statement important?

A profit and loss statement is important because every company needs it by law or association membership to complete it. It represents the overall probability of a company. It can help you to analyze how efficiently your business enables you to translate your expenses into revenues.

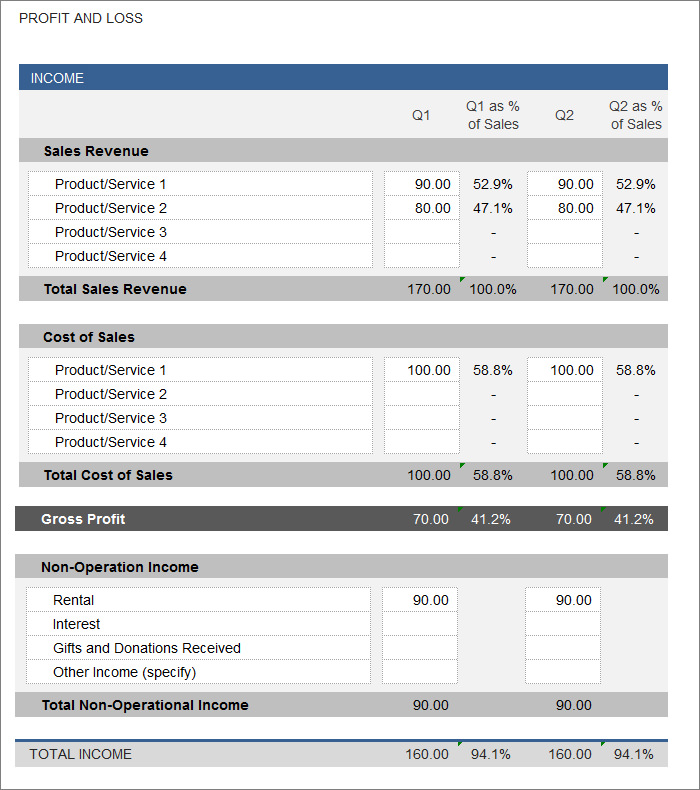

What is present on the Profit and Loss Statement Template?

There is a specific set of information that must be present on the profit and loss statement template. So, to achieve all the benefits mentioned in the above section. The profit and loss statement template has the following major sections. You should also check the Stock Certificate Template.

- Income

- Cost of Goods Sold

- Gross Profit

- Expenses/Costs

- Net Operating Income

- Other Income

- Other Costs/Expenses

- Net Other Income

- Net Income

Each of the above sections is sub-categorized. The income section enlists all the sources that generate revenue for the business.

While the other income sources can be anything that isn’t directly linked to the core competencies of the business but generates some revenue.

Expenses record the list of all costs incurred by a business to produce the products. While other expenses may include anything such as taxes and penalties.

The net income of the business can be calculated by extracting the cost of goods sold, expenses, and other expenses from the sum of income and other income of the business.

What isn’t shown on a Profit and Loss Statement Template?

To differentiate between the profit and loss statement and other financial statements. It is important to keep the information within a specified limit to make it effective. You can also free download Monthly Financial Management Report Template.

The information that must be present on a profit and loss statement template is revenue, costs, and cost of goods sold. While the profit and loss statement should include any information about the assets, liabilities, and equity of the business.

Keeping your finances in check is easy to start-and maintain- when you use an Excel budget planning template in your financial management routine. Customize an Excel template to suit your unique financial management needs, whether you’re balancing the books of a small business or keeping track of your household budget.

Budget your personal and business finances using these templates

Manage your finances using Excel templates. Stay on track for your personal and business goals by evaluating your income and expenses. Use these templates to add in pie charts and bar graphs so that you can visualize how your finances change over time. Create infographics that show what categories are included in your budget and the types of factors that incorporate each category. Download your financial management template so that you can access it and edit it as you need.

Every company and business works on the fundamental concept of profit and loss. It is very important to familiarize yourself with profit and loss, not only to run a business or company but also to keep an account of your own expenditure. Money is actually a tricky concept to explain to kids without giving them an opportunity to get hands-on experience. Parents often take their kids to the supermarket to make them learn about the price marked on every good and the calculation of total price. Later, kids come across the concept of discount on the cost price and the concept of comparing prices before purchasing. Comparing prices is also a form of profit and loss as you learn to save money by buying the same good at a comparatively lesser price.

The term ‘Profit and Loss’ is a concept developed from various applications to real-life problems which take place in our lives almost every day. When a good is re-purchased at a greater price then a profit is incurred. Similarly, if the good is repurchased at a lesser price then there is a loss.

Terms related to Profit and Loss

We have come across the word profit and loss many times. Profit stands for gain, advantage or benefit whereas loss is the opposite of profit that involves expenditure as compared to gain.

Cost Price (CP): It is the amount at which a product is purchased. Sometimes it also includes overhead expenses, transportation cost, etc. For example, you bought a refrigerator at Rs 10,000 and spent Rs 2000 for transportation and Rs 500 for set up. So the total cost price is the sum of all the expenditure done, that is, Rs 12,500.

Selling Price (SP): It is the amount at which a product is sold. It may be more than, equal to or less than the cost price of the product. For example, if a shopkeeper bought a chair at Rs 500 and sold it at Rs 600, then the cost price of the chair is Rs 500 and the selling price of the chair is Rs 600.

Profit (P): If a product is sold at a price more than its cost price then the seller makes a profit. For example, a plot was purchased at Rs 50,000 and three years later it was sold at Rs 1,50,000 then there is a profit of 1 lakh.

Loss (L): If a product is sold at a price less than its cost price then the seller makes a loss.

For example, a phone is bought at Rs 20,000 and a year later it was sold for Rs 12,000 then the seller made a loss of Rs 8000.

Profit Percent (P%): It is the percentage of profit on the cost price.

Loss Percent (L%): It is the percentage of loss on the cost price.

Concept of Profit and Loss

Let us understand the concept in a simpler way by using profit and loss Math. Suppose a shopkeeper buys a pen at Rs 8 from the market and sells it at Rs 10 at his shop.

Amount invested by the shopkeeper or Cost Price = Rs 8

The amount received by the shopkeeper or Selling Price = Rs 10

|

Rule 1 If the cost is less than the Selling price then it’s a profit. CP < SP —— Profit If the cost price is more than Selling Price then it’s a loss. CP > SP —— Loss |

In the above example, the selling price is more than the cost price so that means the shopkeeper made a profit.

|

Rule 2 To find the amount of profit or loss, subtract the smaller value from greater value. In the case of profit, the selling price is always more than the cost price. Profit = Selling Price — Cost Price. Similarly, in the case of loss, the cost price is more than the selling price. Loss = Cost Price — Selling Price. |

Here,

Cost Price = Rs 8

Selling Price = Rs 10

Profit = Selling Price — Cost Price

= Rs 10 — Rs 8

= Rs 2

Therefore, the shopkeeper made a profit of Rs 2 on selling a pen.

Now, let us find what percent of profit was made by the shopkeeper.

|

Rule 3: In order to find the percentage, we divide the term we are finding the percentage of by total amount and then multiply the resultant with 100. Profit % = [frac{{profit}}{{{text{Cost Price}}}} times ] 100 Loss % =[frac{{Loss}}{{{text{Cost price}}}} times ] 100 |

Here,

Profit % =[frac{{profit}}{{operatorname{Cos} t{text{ }}price}} times 100]

= [frac{2}{{10}} times 100]

= 20%

Thus, the shopkeeper made a profit of 20% of the cost price.

Summary of Profit and Loss Formula

Given below are profit and loss formulas and tricks to derive the value of other terms from the basic fundamental formulas:

|

Profit |

Loss |

|

CP < SP Profit = Selling Price — Cost Price Selling Price = Cost Price + Profit Cost Price = Selling price — Profit Profit % =[frac{{profit}}{{operatorname{Cos} t{text{ }}price}}][ times ]100 Cost Price =[frac{{profit}}{{profit{text{ }}% }}][ times ] 100 Profit = [frac{{profit}}{{100}} times ] Cost Price |

CP > SP Loss = Cost Price — Selling Price Cost Price = Selling Price + Loss Selling Price = Cost Price — Loss Loss % =[frac{{Loss}}{{{text{Cost price}}}} times ] 100 Loss = [frac{{Loss% }}{{100}}][ times ] Cost Price Cost Price = [frac{{Loss}}{{{text{Loss }}% }}][ times ] 100 |

Solved Examples:

Given below are the profit and loss examples found in real life:

-

Find the Selling price of a bicycle of Rs 700 if

-

Loss is Rs 50

-

If Profit percentage is 50%

Solution:

-

CP = Rs 700

Loss = Rs 50

Let SP be x.

We know in case of loss, the cost price is more than the selling price.

By using the formula of CP and SP.

Loss = CP — SP

Rs 50 = Rs 700 — x

x = Rs 700 — Rs 50

x = Rs 650

Thus, the selling price is Rs 650.

-

CP = Rs 700

Profit % = 50

Let the profit be x.

Profit % = [frac{{profit}}{{operatorname{Cos} t{text{ }}price}}][ times ] 100

50 = [frac{x}{{700}} times 100]

[50 = frac{x}{7}]

x = 7[ times ]50

x = Rs 350

Profit = Rs 350.

From the profit and loss Mathematics formula,

Profit = SP — CP

Rs 350 = SP — Rs 700

SP = Rs 700 + Rs 350

= Rs 1050

Thus, the selling price is Rs 1050 if the profit is 50% of the cost price.

2) A shopkeeper bought two TV sets at Rs 10,000 each such that he can sell one at a profit of 10% and the other at a loss of 10%. Find his overall profit or loss.

Solution:

The shopkeeper bought two TV sets. He made a profit by selling one and a loss by selling another. So let us divide the solution into two parts:

|

The cost price of TV = Rs 10,000 Profit % = 10 % of cost price According to the formula, Profit % = [frac{{profit}}{{operatorname{Cos} t{text{ }}price}} times 100] [10 = frac{{profit}}{{10,000}} times 100] [10 = frac{{profit}}{{100}}] Therefore, Profit = Rs 1000 If CP = Rs 10,000 and Profit = Rs 1000 Then, SP = 10,000+1000 = Rs 11000 |

The cost price of TV = Rs 10,000 Loss % = 10 % of cost price According to the formula, Loss % = [frac{{Loss}}{{operatorname{Cos} t{text{ }}price}} times 100] [10 = frac{{Loss}}{{10,000}} times 100] [10 = frac{{Loss}}{{100}}] Therefore, Loss = Rs 1000 If CP = Rs 10,000 and Loss = Rs 1000 Then, SP = 10,000-1000 = Rs 9000 |

Total Cost price = Rs 10,000 + Rs 10,000

= Rs 20,000

Total Selling price = Rs 11,000 + Rs 9000

= Rs 20,000

As the cost price is equal to the loss price, there is neither a profit nor a loss.

3) A shopkeeper bought 200 bulbs for Rs 10 each. Out of those, 5 bulbs were fused so he sold the remaining at Rs 12 each. Find the percentage of gain or loss.

Solution:

No of bulbs shopkeeper bought = 200

Cost of 1 bulb = Rs 10

Cost of 200 bulbs = Rs 10 x 200 = Rs 2000.

Therefore, the total cost price of 200 bulbs is Rs 2000

If 5 bulbs are thrown away then the number of bulbs left = 200 — 5 = 195.

Selling price of one bulb = Rs 12

Selling price of 195 bulbs = Rs 195 x 12 = Rs 2340

Therefore, the total selling price of 200 bulbs is Rs 2340

Selling price is more than the cost price, this means that the shopkeeper made a profit.

Profit = SP — CP

= Rs 340

Profit % =[frac{{profit}}{{operatorname{Cos} t{text{ }}price}} times 100]

= [frac{{340}}{{2000}} times 100]

= 17%

Thus, the shopkeeper made a profit of 17% on selling 195 bulbs at Rs 12.

4) Ankit bought a plot at Rs 2,25,000. He wanted an overall profit of 12% but he sold one-third of the plot at a loss of 8% so at what price should he sell the remaining plot of land?

Solution:

The cost price of the entire plot = Rs 2,25,000.

Cost price of 1/3rd of the plot = 1/3 [ times ] 2,25,000 = 75000

Loss % = [frac{{Loss}}{{operatorname{Cos} t{text{ }}price}}][ times ]100

[8% = frac{{loss}}{{75000}}][ times ]100

loss = [frac{{8 times 75000}}{{100}}] = 6000.

Sumit suffered a loss of Rs 6000 on selling 1/3rd of the land

SP for 1/3rd of the land = 75000 — 6000 = 69,000.

To make a profit of 12% of 2,25,000, is

P%= [frac{p}{{cp}} times 100]

[12 times frac{p}{{225000}} times 100]

[frac{{12 times 225000}}{{100}}]=P

Profit = Rs 27,000

Thus, to get a profit of Rs 27,000

SP= 2,25,000 + 27000 = Rs 2,52,000

Sumit has already sold 1/3rd of the land at Rs 69,000 thus he needs to sell the remaining land at Rs(2,52000-69000) i.e, Rs 1,83,000.

Therefore, Sumit needs to sell the remaining plot at Rs 1,83,000.

‘Percentage’ Vs ‘Profit and Loss’

Percentage, increase and decrease is closely related to profit, loss and their percentage in the profit and loss chapter. A percentage is a ratio that represents nothing but a fraction of 100. We use percentage for standardizing different quantities as the denominator is always 100. We not only represent data in percentage but also indicate the increase and decrease of value in percentage. The profit and loss concepts of increase percent relates to profit percent whereas decrease percent relates to loss percent. The only difference in profit and loss problems and percentage is that profit and loss percent deal with only money and play a great role in the financial calculation in all the businesses whereas increase and decrease percent can be used for anything.

Increase Percent

Suppose, the population of a village is 30,000. If the percentage of the population in the next two years is 50% of the actual population then what is the current population of the village?

We know that the actual or initial population of the village is 30,000. If 50% of the population is increased then that means 50% of 30,000 is increased.

50% of 30,000 =[frac{{50}}{{100}}]of 30,000

= [frac{{50}}{{100}} times 30,000]

= 15,000

This means, in two years 15,000 people increased. So the current number of people is 30,000 + 15,000 which equals 45,000. Thus, the current population of the village is 45,000.

The relation between Increase Percent and Profit Percent.

Profit percent is the increased value of the cost price of the product. Suppose the initial value (Cost price) of a house was 6 lakhs after a few years the value of the house increased 50% of the initial value.

Increased value = Increase %=[frac{{increase}}{{Original{text{ }}Value}} times 100]

= 50% of 6lakhs

= [frac{{50}}{{100}}]of 6,00,000

= 3 lakhs

Current Value = 6 lakhs + 3 lakhs = 9 lakhs

If the house is sold at the current value then the selling price will be 9 lakhs.

According to profit and loss basics,

Profit = Selling Price — Cost Price

= 9 lakhs — 6 lakhs

= 3 lakhs

Note:

Increase %=[frac{{increase}}{{Original{text{ }}Value}} times 100] whereas Profit %=[frac{{profit}}{{operatorname{Cos} t{text{ }}price}} times 100]

Therefore, profit is equal to the increase in the value and profit percentage is equal to the increased percentage.

The Difference between Increase Percent and Profit Percent.

|

Increase Percent |

Profit Percent |

|

It is calculated on the basis of the initial value |

It is calculated on the basis of cost price |

|

It is used to calculate the increase in the number of things, population, etc. |

It is used to calculate the increase in the value of the commodity or product. |

|

It may and may not deal with money. |

It deals with money. |

Learn about Profit and Loss with Vedantu

Mathematics is an art and it is the science and study of quality, structure, space, and change of any object. Mathematicians seek out patterns, formulate new conjectures, and establish the truth by rigorous deduction from appropriately chosen axioms and definitions.

It is the science of numbers, quantities, and shapes, how it is measured, and the relations between them. With knowledge of Mathematics, you can actually study the science that revolves around numbers, shapes, and patterns, how things can be counted, how particular things are organized. This subfield of Mathematics with alphabets is usually called algebra and there are lots more in Math.

Definition and Formula

Finding the amount of profit or loss is explained in detail in this chapter. If you subtract the smaller value from the greater value accordingly you can calculate the profit or loss percentage within minutes. In the case of profit, the selling price will always be more than the actual cost price. Profit = Selling Price — Cost Price. Similarly, in the case of loss, the cost price is more than the planned selling price.

The formula to calculate the profit percentage is

Profit % = Profit/Cost Price × 100.

The formula to calculate the loss percentage is

Loss % = Loss/Cost Price × 100.

Calculation

To effectively calculate and produce a profit and loss statement at the end of a financial year, the total of a business’s revenue sources is added and that of the business’s total expenses that are connected to gaining revenue will be subtracted from the profit. The profit and loss statement, also called an income statement of any business, will provide details of a company’s financial performance for any specific period of time. We would like to know the financial condition.