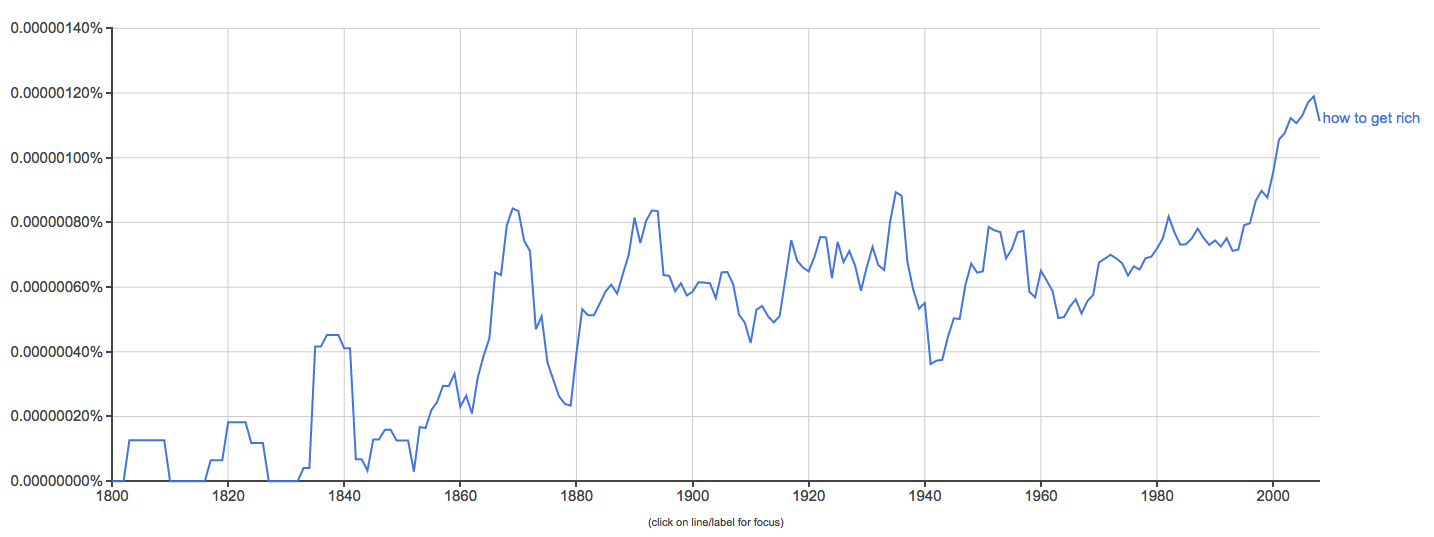

Have you ever asked yourself, “how can I become rich?” Everyone has dreams about winning the lottery and how to become rich overnight. People want to get rich. Just do a search on Google Books and you can see that it’s been a rising trend since the 90s.

Many people are looking for ways to get their first 100K, or ways to invest for a better retirement. Some are trying to succeed as entrepreneurs. People want to have enough money to buy beautiful homes, powerful cars, and great vacations. But not many know how to become rich. How do you become rich?

Being rich is more than about the dollar amount.

Being rich is a state of mind. In a sense, you could be rich but still poor, and vice versa.

You can define “rich” in different ways. There are a lot of people who simply consider it as having a lot of money. For them, rich is equivalent to a being a millionaire.

But rich can also be psychological richness. It is an achievement of being able to live without the worry of money. You don’t necessarily need to own a castle to be considered rich. Everyone can be rich as long as we are able to do what we desire freely and to have the fulfilment in life. The key of it is to live with or even less than what you have. To be “normal” even when you are financially capable to do a lot more.

You might have your own preference on which definition suits you better, but here are some ways on how to get rich. It may help you achieve either (or both) of them.

⌄ Scroll down to continue reading article ⌄

⌄ Scroll down to continue reading article ⌄

If you want to become really really rich, make bold moves.

It’s an ambitious goal to become wealthy, and if you’re aiming for that, here are simple ways to get rich.

1. Exploit your skill as a self-employed expert and invest in it.

Make it your goal to do one thing better than anyone: Work on it, train it, learn it, practice, evaluate and refine it. You may find most sports-players or entertainers are millionaires, and that is because they are utilizing their skills fully. If there’s something you’re good at, it is likely you can reap considerable rewards out of it.

It is the same concept of being the top of a particular field. When you are the best at something, you find that opportunities come to you. To become an expert of something, it is crucial to never stop improving. Successful people invest time, energy, and money in improving themselves, and it might just be the most rewarding investment you can ever make.

To get started, figure out what skill you want to cultivate. Make a list of the world’s ten best people at that one thing, and use this list to define criteria and track your own progress toward becoming the best.

If you’re a writer, for example, you might consult the New York Times Bestseller list, and identify the ten successful authors that you admire the most. Learn more about these writers, what they did to be successful, and read some of their work. Invest the time and energy in improving your own craft, by looking at successful past models.

2. Hit $100K, then invest the rest.

Everyone wants to get rich fast. But a goal like this isn’t something you can easily achieve in a short period of time. Instead of thinking of how to get rich fast, aim at saving $100K first.

The small amounts you save daily are powerful. You might only be able to put away $5 or $10 at a time, but each of these investments are your financial foundation.

⌄ Scroll down to continue reading article ⌄

⌄ Scroll down to continue reading article ⌄

3. Be an inventor and consider it as an opportunity to serve.

Stop thinking about getting rich fast and start thinking about serving a lot of people. If you think about what people need, or things that could improve society, your insights will have more impact. Not only that, you could be the first to produce a trending product in the future.

When you start to serve a lot of people, the effect of word of mouth is magnified – not to mention, you’ll have much more helpful feedback to improve what you do.

Having the patent of a popular invention could be the fast-lane ticket to prosper. Just look at Snapchat.

It would definitely be challenging, but consider it to be a way of serving, to benefit those who actually need your invention. No business is successful without the support of the public. Rather than squeezing every single dollar out of your customers, show them you are actually working to make them better.

4. Join a start-up and get stock.

Using the same potential consideration of start-up in the above points, owning stocks of one or more start-up companies could be a valuable investment if the company thrives and either floats or is sold to a larger enterprise.

Only a small minority of start-ups succeed in realizing large capital gains, so the odds are not good. However, you can use your judgment to see which business idea and which management team are likely to succeed. Early employees in Apple, Google, and Microsoft became millionaires on this basis.

⌄ Scroll down to continue reading article ⌄

⌄ Scroll down to continue reading article ⌄

5. Develop property.

Buying, developing and selling property has always been a major way for people to accumulate capital.

Borrowing could be a key element in this method. Say you borrow $200,000 and put in $50,000 of your own to buy a property for $250,000. Then you develop the property and sell it for $400,000. The property has increased in value by 60% but your $50,000 has now grown fourfold to $200,000. You have to select the right properties in the right areas and develop them wisely.

You are at risk from booms and busts in the property market. However, in the long term this remains a proven way to accumulate wealth.

6. Build a portfolio of stocks and shares.

If you can make steady investments in stocks over a long period, choose wisely and reinvest the dividends then you can build a large store of wealth. Of course stocks can go either way and many small investors lose heart when their portfolio plunges.

But over the long-term, equities are as good an investment as property and much more liquid. Stock market crashes represent great buying opportunities for those with cash and strong nerves.

7. Start your own business and eventually sell it

More and more startup have seen success with great return in recent years. If you can find a new approach towards a specific corner of the market and build a business that addresses that need, then you have a potential of success in it.

It literally can be anything: a cleaning business, a food delivery service, or a blog. It will probably take years of very hard work to build up the enterprise. All entrepreneurs will have to endure great risk and stress. But if you can pull it off, the potential rewards are huge. This is how many of the seriously wealthy people did it.

⌄ Scroll down to continue reading article ⌄

⌄ Scroll down to continue reading article ⌄

If you want to become wealthier and live a better life, build simple habits.

If you’re aiming for a stable life with enough money to support a living, start with the everyday things you can do.

8. Find a job in the right vehicle.

Choose a job of your interest – do what you love and love what you do. No one succeeds in doing what they hate.

You might have to start at the bottom and work your way up. But chances are, if you love what you do, it’s easier to make that happen. You’ll actually enjoy the process of getting to the top.

Earn the experience through different levels of work and when you feel like you have gained all that you can from it, consider moving on in other companies would widen your horizon on different business cultures. Putting more experiences in various positions would make you a more valuable asset for companies and making you a better option for higher rank duties.

Consider how the rich are able to get in with the right companies, where there are plenty of opportunities for growth. Seek places where you can grow your skill and and are able to multiply your monthly income many times over

⌄ Scroll down to continue reading article ⌄

⌄ Scroll down to continue reading article ⌄

9. Cut your expenses.

The biggest problem in some people’s path of getting rich is that they always spend more than what they earn. Living below your means will be the easiest to get rich.

Consistently track your progress on how much you’re spending. Use an app or simply an Excel spreadsheet to make sure you always know how much money you have what where it’s going. This gives you a proper place to review and refine what does and doesn’t make sense in terms of your spending.

Start cutting the unnecessary spendings in your life. Do what you can to reduce your bills: make sure you turn off the lights, plan meals to save at the grocery store, and be disciplined about eating in. Focus your life with only the necessities and in no time you will be saving a lot more than what you previously did.

10. Save it in your bank.

Set savings goals and routines to support those goals. Figure out ways that work for you in saving money, and refine what doesn’t.

Many banks have the option of creating separate savings accounts, as well as automatic withdrawals. By setting up these automatic transfers, you save passively and have to make an effort not to save.

Another thing you can try is to increase the amount of savings by 1% in every interval you wish. At first, it will be an insignificant change, but as time passes, you will notice a big difference.

⌄ Scroll down to continue reading article ⌄

⌄ Scroll down to continue reading article ⌄

Give yourself a reason and motivation to save as well. It is always important to plan for the future and saving for retirement could be a great point to persuade yourself to stay away from excessive spending.

11. Make investments wisely

Investment is much more than pure luck. One investment mistake could tear away a large chunk of your assets. So make sure whenever you are making decisions on investments, whether on properties or stock, think twice. It will be better for you to consider opinions from professionals and experts.

To give you some ideas, legendary investor Warren Buffett suggested to put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund, so that if the market crash, you will still be fine by cashing the 10% rather than selling the stock with a bad price.

Getting Rich the Wise Way

There are a lot more important things in life than accumulating wealth. Who wants to end up rich, unloved, lonely, and in poor health? However, if you can enjoy a balanced life and at the same time become rich, why not do so?

Taking combinations from the above suggestions may not guarantee you a prosperous future, but it will surely eliminate a lot of financial troubles in your life. With one step at a time, maybe you will also become the one you dreamed of.

Featured photo credit: Sharon McCutcheon via unsplash.com

Filters

Filter synonyms by Letter

A B C D E F G H I L M N O P R S T U

Filter by Part of speech

verb

phrase

phrasal verb

noun

Suggest

If you know synonyms for Get rich, then you can share it or put your rating in listed similar words.

Suggest synonym

Menu

Get rich Thesaurus

Get rich Antonyms

External Links

Other usefull source with synonyms of this word:

Synonym.tech

Thesaurus.com

Photo search results for Get rich

Image search results for Get rich

Cite this Source

- APA

- MLA

- CMS

Synonyms for Get rich. (2016). Retrieved 2023, April 13, from https://thesaurus.plus/synonyms/get_rich

Synonyms for Get rich. N.p., 2016. Web. 13 Apr. 2023. <https://thesaurus.plus/synonyms/get_rich>.

Synonyms for Get rich. 2016. Accessed April 13, 2023. https://thesaurus.plus/synonyms/get_rich.

-

by

Fiona Smith -

Updated January 7, 2023

Disclosure: This post may receive compensation from partners listed through affiliate partnerships, at no cost to you. This doesn’t influence our ratings, and the opinions are our own. Learn more here.

If you analyzed every self-made millionaire and studied their strategies on how to get rich from nothing…

…you’d find your way to this blog post!

Let’s dive in.

In this article

Getting Rich Starts with Your Mindset

You may have asked yourself in the past, “how can I get rich with no money?”

And truth be told, getting rich starts with your mindset and not so much with your wallet.

Pro Tip:

You can always be financially rich but poor in every other area of your life (no friends, no love, no family, etc.). Remember to pick and choose your battles wisely.

My suggestion is that you should also work toward getting rich mentally and not just financially.

For example, it’s important to show gratitude and appreciate the things – and the people – that you do have in life.

Money is just a tool to help you accomplish your goals (like spending more time with family).

While money is an essential part of life, your focus should not be dedicated to money.

How to Get Rich From Nothing

Are you ready to learn the 12 strategies on how to get rich both mentally and financially?

Then let’s get started!

1. Adopt a Growth Mindset

There are 2 types of mindsets in this world:

- Growth mindset

- Fixed mindset

Growth Mindset Definition:

A growth mindset is when you believe you can develop your talents and skills through hard work, excellent mentorship, and constructive feedback.

A growth mindset will help you:

- Build wealth

- Learn new skills

- Build relationships

Those who adopt a growth mindset typically achieve more than those with a fixed mindset.

Fixed Mindset Definition:

A fixed mindset is when you believe your intelligence, talent and skills are fixed and cannot develop for the better. You strongly dislike constructive feedback and you believe your failures validate your lack of skill or knowledge.

Remember that perception is reality.

To change your reality, start by changing your mentality.

So the next time you hear yourself say:

- I can’t do this

- I’m going to fail

- This will take me forever

Tell yourself “STOP!”

Don’t allow yourself to think these negative thoughts.

If you keep repeating negative thoughts to yourself, soon enough, you’ll start to believe them.

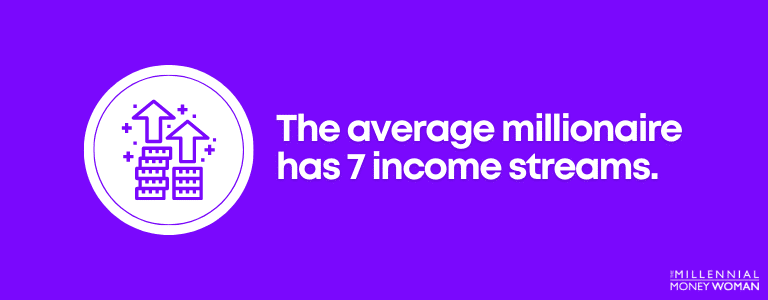

2. Build Multiple Income Streams

Millionaires get rich not so much because of their commitment to 1 job and 1 income stream.

They get rich because they have multiple income streams.

If you’ve heard the saying “never put all your eggs in 1 basket,” then you should know to never rely on 1 income stream.

And millionaires never rely on just 1 income stream.

In fact, the average millionaire has about 7 income streams.

There are so many different strategies to earn multiple sources of income.

Below are some examples of passive income streams you might want to consider building in the near future.

| Income Stream | Source |

|---|---|

|

Dividends & Interest |

Investing: M1 Finance |

|

Rental Income |

Passive Rental Income: RoofStock |

|

REIT Dividends |

Passive Income through REITs: Fundrise |

|

Peer to Peer Lending |

Passive Income through Crowd Funding: Groundfloor |

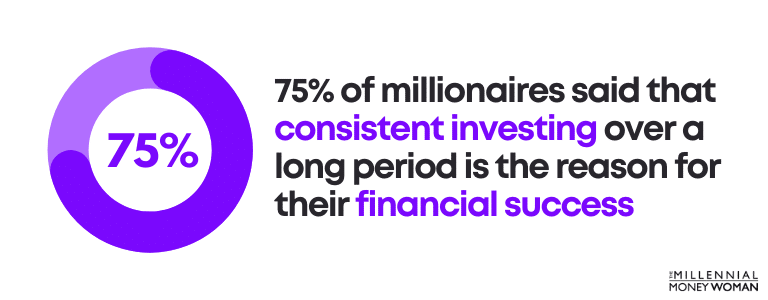

3. Save and Invest

Millionaires don’t just become millionaires because of:

- Blind luck

- A big inheritance

- A winning lottery ticket

Millionaires invest consistently, typically over several decades.

Pro Tip:

The key to much of a millionaire’s financial success is that they started early.

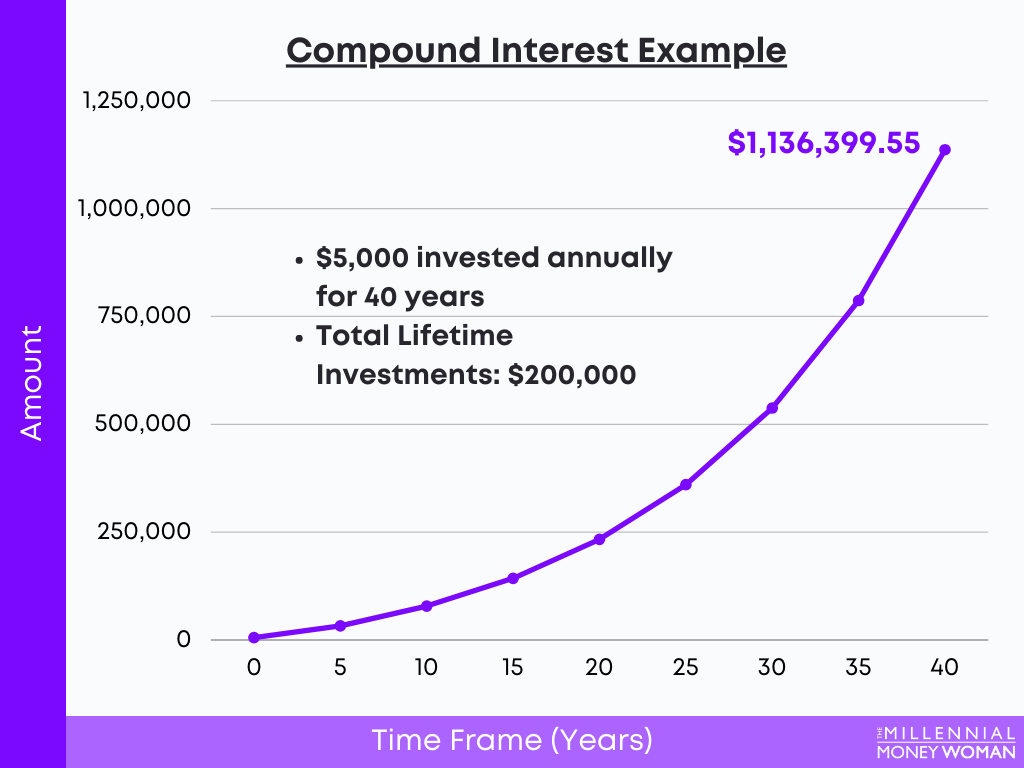

Millionaires use the power of compounding interest to build their wealth.

The earlier you start practicing the habit to save and invest, the earlier you’ll become a millionaire.

Compound Interest Defined:

Compound interest is when you earn interest on your previously earned interest PLUS your original investment.

In plain English, compound interest is when your money makes you more money.

With compound interest, you probably won’t notice a significant change in your net worth over the first few years.

Take a look at this illustration of compound interest (and a $5,000 initial investment), below 👇

If you look 20, 30, even 50 years down the road, compound interest will make a substantial impact on your portfolio.

«Compound interest is the 8th wonder of the world.» — Albert Einstein

Here are a few other things I’ve noticed millionaires do when they invest:

- They typically aren’t day-traders

- They automate their investments

- They tend to invest in index funds

- They typically hire financial advisors

- They choose low-cost investment options

- They typically avoid higher-risk investment strategies

The best way to become rich is to start investing – even if you can only manage a $5 investment – that’s enough to start.

Pro Tip:

There never is the “perfect” time to invest.

If you have several $100 or even $1,000’s of dollars ready to invest, then consider checking out M1 Finance 👇

If you want to get rich, then investing could be a great option.

Just remember to keep a long term mindset.

Start today, your bank accounts will thank me later.

4. Build an Emergency Fund

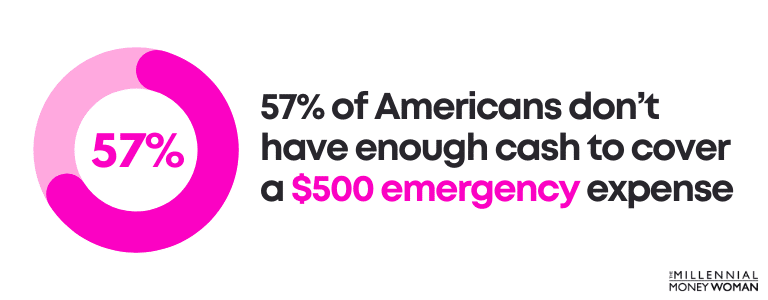

The rich are masters in managing their risk exposure.

What does this mean?

If you want to learn how to get rich, then you must prepare for unexpected expenses, like:

- A roof replacement

- Medical emergencies

- A broken car gearbox

If you’re not prepared for these unexpected expenses, then you might have to use your credit card and build up high-interest debt – which isn’t one of the best ways to get rich fast.

Debt is the No. 1 way to NOT get rich.

Emergency Savings Fund Defined:

An emergency savings fund, also known as a rainy day fund, is a liquid and easily accessible savings account. You’ll want to save 3 to 6 months’ worth of your living expenses in cash to be used only for emergencies.

Believe it or not, most people don’t have an emergency savings fund.

Let me fill you in on a trick I know that almost all of the rich I mentor use.

To earn a few extra dollars on the cash you store in your emergency savings account, consider using a high-yield online savings account instead of stashing your cash in a regular savings account.

Typically speaking, high-yield accounts have higher interest rates (around 0.60%) versus regular savings accounts (around 0.01%).

For a small investment, the 0.10% versus 0.60% really doesn’t make a big difference.

But, if we’re talking about several $1,000 dollars in your emergency fund, your interest rate could make a big difference.

This is just one trick to getting rich faster.

Let’s take a look at the numbers behind a regular savings account versus the high-yield savings account idea:

| Regular Savings Account | |

|---|---|

|

Initial Investment |

$100,000 |

|

Investment Time Frame |

20 Years |

|

Interest Rate |

0.10% |

|

Final Value After 20 Years |

$102,019 |

Now, if you had opened up a high yield savings account, your numbers would look a little different over the same time frame:

| High-Yield Savings Account | |

|---|---|

|

Initial Investment |

$100,000 |

|

Investment Time Frame |

20 Years |

|

Interest Rate |

0.60% |

|

Final Value After 20 Years |

$112,709 |

Who wouldn’t want to earn a few extra dollars through a high-yield savings account?

Ok, let me be realistic: Not everyone has a spare $100,000 to dump into a high-yield emergency savings fund.

So what?

Even if it’s “just” $1,000 or “just” $500 – what are you waiting for?

You’re still earning more with a high-yield savings account than if you had just opened a regular savings account.

If you’re ready to open a high-yield savings account, then check out Axos Bank.

It’s time to start your journey to getting rich.

5. Set a Plan of Action

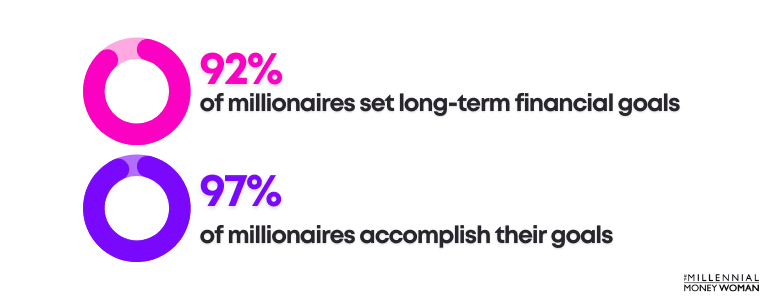

Millionaires get rich and stay rich because they have a plan of action.

They develop a way to assign goals for the:

- Short term (1 to 5 years)

- Mid term (5 to 12 years)

- Long term (12 years and up)

Anyone can set goals.

But not everyone can keep their goals.

Pro Tip:

Millionaires achieve their goals because they monitor their progress daily.

Millionaires revisit their goals every single day, which explains why 97% of millionaires achieve their goals.

So, consider this:

Think about the last time you set your goals.

Now ask yourself when was the last time you reviewed your goals?

Pro Tip:

If you don’t review your goals within 24 to 48 hours, there is a high chance that you will either struggle or you won’t be able to achieve your goals.

That’s why you should aim to develop a plan of action to conquer your goals and find financial freedom.

Develop a clear plan of action to help you conquer your goals:

- Write down your goals

- Create a vision board

- Clarify each goal

Pro Tip:

Vision boards are extremely useful in capturing your goals. Your vision board should be placed in an area you see at least 3x a day (e.g. your bedroom, your office, etc.).

Without my vision board, I would not be where I am today.

Seeing your goals consistently, day-in and day-out gives you that extra boost to motivate you to complete them.

Now the only thing left to do is start.

6. Don’t Procrastinate

Procrastination is why you haven’t accomplished your dreams yet.

And to be very honest, procrastination gets the best of us.

Procrastination Defined:

Procrastination is when you act against your better judgment, doing 1 thing even though you know that you should be doing something else.

In other words, procrastination is a lack of discipline.

I’ll tell you a personal story about procrastination:

For the past 4 years, I’ve wanted to start a personal finance blog.

I procrastinated for 4 years.

I never started because I thought I wasn’t good enough.

Plus, I thought I would fail.

Finally, at the dawn of the COVID-19 pandemic, I stepped up to the plate and started my blog.

Best. Decision. Ever.

The antidote to procrastination is action.

There are many reasons why we procrastinate:

- You’re not patient

- You want immediate rewards

- You haven’t set clear enough goals

- You can’t imagine your future reward

Here’s how I eliminated my procrastination:

I started writing down my goals on a large whiteboard.

Every time I accomplished a task or a goal, I crossed out that goal – and crossing out a task or goal was such a great feeling.

It sounds odd, but it’s true!

Imagine where I could have been if I had started my blog earlier?

Imagine where you could be if you start doing the things you want to do today?

7. Create a Financial Hub

Millionaires are not average people.

That’s because millionaires do what the average person won’t.

The trait that separates the rich from the poor is discipline.

Discipline is when Millionaires practice success-building habits even when they least feel like it.

What is 1 example of millionaires showing ultimate discipline?

They assign a purpose for each and every dollar.

In other words, they don’t blindly spend every cent they earn.

Pro Tip:

Millionaires understand that to get rich, you have to keep a hawk’s eye on your money.

For example, Millionaires allocate their paycheck to the following:

- 529 plans

- Business accounts

- Retirement accounts

- Emergency savings fund

- Joint / Individual accounts

Millionaires have automated their money process.

How can you become like a millionaire and stay on top of your finances?

Budgeting.

One of my top picks for budgeting is YNAB [aka You Need a Budget] 👇

YNAB is especially awesome for people who are visual learners because it helps you recognize areas in your budget where you are:

- Overspending

- Underspending

- Approaching your limit

Pro Tip:

Think of a budget like a road map: If you’re starting a road trip, you probably need a map to help navigate you from Point A to Point B, otherwise you’d be lost. Same thing goes for a budget.

Budgeting helps you get a better idea of what’s happening to your money.

If you’re looking to get rich, and slash costs, then I’d also consider couponing.

In fact, 93% of millionaires use coupons all or some of the time while they are shopping.

Millionaires know that getting rich means they have to save money.

If you are looking to begin your couponing journey, then consider downloading Honey (it’s free).

As you look at purchasing your every day online items, Honey will indicate which items have:

- Promos

- Coupons

- Ongoing discounts

Honey takes seconds to install (it integrates with Google Chrome) and the app could save you $100’s.

By slashing your costs this way, you could be 1 step closer to getting rich.

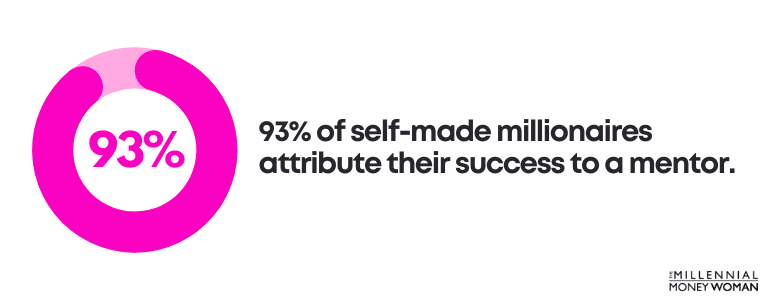

8. Find a Quality Mentor

Millionaires do not become so successful without the help of others:

- Their family

- Their spouses

- Their mentors

I want you to take a second and reflect on the people you know – specifically the people who have seen a certain amount of financial success.

Ask yourself these questions:

- Who are they?

- Where are they going?

- What did they do to achieve their success?

- How are they different from the “average” person?

If you find these successful people and learn from them, chances are, you’ll go where they go.

In fact, over 90% of millionaires attribute their success to a mentor.

It’s my opinion that mentors are the ultimate shortcut to success.

Mentors offer you guidance in:

- Your financial life

- Your personal life

- Your professional life

Finding a good mentor is not difficult, either.

Below are a few examples of the options you might have:

- Close friends

- Family members

- Trusted professors

- A local community leader

- Someone from your office

- Someone from your church

- Someone from your volunteer committee

You just have to open your eyes and create your opportunity.

If you don’t ask, you’ll never know what potential you can reach with your mentor.

If you want to learn how to find a mentor and some of the most valuable lessons I learned from my millionaire mentor, then check out my latest book: How to Get Rich from Nothing.

Mentors help you find shortcuts in life that otherwise you would likely have to wait years to learn.

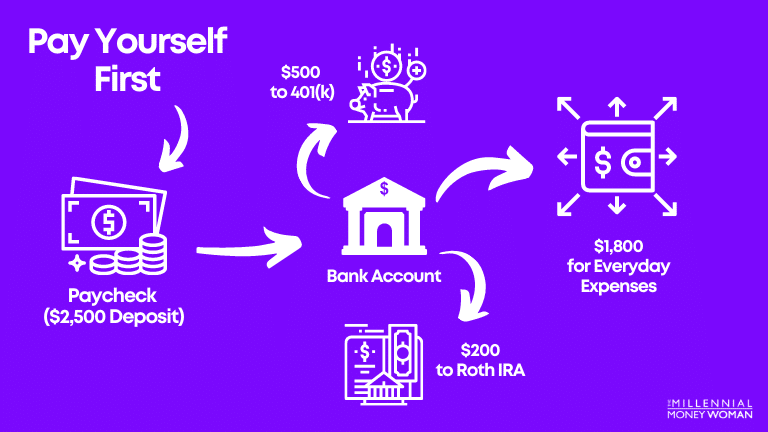

9. Pay Yourself First

The saying “pay yourself first” is hailed as one of the key strategies to getting rich.

Let’s take a peek at what “pay yourself first” actually means.

Pay Yourself First Definition:

Pay yourself first is an expression that describes wealth building habits. Typically, people who “pay themselves first” automatically save and invest a portion of their paychecks before using their paycheck to pay for everyday expenses.

Here’s how this process to getting rich would work:

All you have to do is:

- Determine how much money you want to save and invest

- Determine where it should be saved and invested (e.g. 401k, IRA, etc.)

- Determine how often you want to invest (weekly, semi-weekly, monthly, etc.)

Here’s how I’ve accomplished my automatic investing:

| How to Invest Automatically | |

|---|---|

|

Step #1 |

Set up your outside investment account (Roth IRA, 401k, taxable investment account) |

|

Step #2 |

From your investment account, connect your bank account number & routing number |

|

Step #3 |

Select the frequency, amount and what you want to invest in from your outside investment account |

|

Step #4 |

Sit back, relax and start building wealth! |

Remember, when it’s automatic, it’s out of sight and out of mind.

Pro Tip:

If you aren’t sure how to link your bank account, select the investment frequency, or select the type of investment, try calling the customer service helpline.

They’re typically always very helpful.

Are you ready to start building wealth and getting rich on your own terms?

You can set up your outside investment account with proven investment platforms like M1 Finance.

With M1, you can set up:

- Roth IRA

- Traditional IRA

- Personal investment account

Pro Tip:

Remember that as your paycheck increases, you should also increase how much you are saving/investing.

If you’re wondering how to get rich, one of the first steps is investing today – no matter the amount. Just start.

In fact, by the time you’re in your 60’s, most experts recommend having between 8 to 10 times your annual salary saved.

Personally, I’m trying to have a lot more than “just” 8 to 10 times my salary saved by the time I’m 60.

My goal is to save between 50 to 100 times my salary.

Those folks who don’t have enough money saved for retirement typically spend their paycheck the second it hits their bank account.

What if you find yourself failing to save?

You can change!

That’s the beauty of life – it’s not stagnant.

Start today – and work toward your goal of getting rich and building the life you want.

10. Steer Clear of Debt

Debt can destroy your path to getting rich.

Sadly, debt is pretty common as 80% of Americans are stuck in debt.

There are 2 main types of debt: Bad debt and smart debt.

Smart debt could include:

- Your mortgage

- Your business loan

- Any other low-interest debt

Smart debt is basically any debt that helps you buy or build appreciating assets (like a home or a business).

Bad debt, on the other hand, includes the following:

- Auto debt

- Credit card debt

- Any other high-interest debt

And once you’re in debt, it’s often difficult to pay your way out of it, unless you have a plan.

Getting out of debt doesn’t mean you need an MBA or a degree in finance.

Getting out of debt is about 20% knowledge and 80% a change in habit.

Changing your spending habits to get out of debt – and build your wealth – include:

- Earning more

- Investing more

- Spending less than you earn

Just imagine how your life will look if you don’t owe money to anyone anymore.

Being debt-free means:

- No more stress

- Increased cash flow

- Ability to save more

- Ability to build your wealth and get rich

Now, let’s look at the 2 of the most common types of debt:

- Credit card debt

- Mortgage debt

If you are carrying a credit card balance (or multiple credit card balances) then consider consolidating your debt with Tally.

Tally is an app that:

- Will likely lower your interest rate

- Will help you avoid late payments

- Pays off ALL of your credit card debt

- Gives you 1 consolidated loan in return

Tally is currently offered in 30 states, and it’s expanding rapidly.

The point is this: Start your journey to building wealth today.

11. Use the System in Your Favor

Have you noticed that the majority of millionaires are wealthy because they own their own businesses?

In fact, 66% of millionaires are business owners.

Source: The Millionaire Next Door

After seeing this statistic, it became very clear to me that an answer to the question, “how to get rich?” is becoming a business owner.

Why?

You are your own boss, you reap the rewards, and more likely than not, you’ll probably put in a lot more work into your business than if you were a 9 to 5 worker, building someone else’s dream.

Pro Tip:

One reason why owning your own business is one of the best ways to get rich is because you are building your dream.

And typically, you’ll put a lot more energy and effort toward making your own goals a reality than someone else’s goals.

If you do become a business owner, that’s when it’s a good time to consider establishing:

- S Corporations

- Limited Liability Companies (LLCs)

- Limited Liability Partnerships (LLPs)

These business entities give their business owners massive tax advantages – and liability protection in many instances.

Let’s take the LLC, for example.

Below are some pros to establishing an LLC:

- Tax deductions

- No double taxation

- Personal liability protection

Because I’m not an accountant, I urge you to talk to your accountant to see what tax benefits you could take to lower your tax liability and build your wealth.

12. Choose Your Friends Carefully

Have you ever heard of the saying: You are the sum of the 5 closest people around you?

This saying is true.

Think about the 5 closest people you hang out with most often.

Soon, you’ll realize that:

- You think the same thoughts

- You have the same goals

- You offer similar advice

There is a very high chance that you’ll become like the people you surround yourself with – whether good or bad, that’s up to you.

And if you aren’t similar yet – then you probably will be, in time.

People inspire you, or they drain you — choose them carefully.

Chances are, the people you are looking for, are also looking for you.

You just haven’t met them yet.

So here’s my challenge for you:

Don’t be afraid to be the least intelligent and least experienced person in the room.

Surround yourself with people who are:

- Smarter than you

- More motivated than you

- More accomplished than you

And figure out how you can shape your life by just 1% to be more like them.

FAQs

How do people get rich?

People get rich mainly because of time, mindset, and discipline. In addition, people get rich by increasing their income, investing in themselves, decreasing their expenses, adopting a growth mindset, saving 30% or more of income, and investing in stocks.

How can I get rich with no money?

It’s possible to get rich with no money. 79% of millionaires did not receive any inheritance and had to figure out how to become rich with no money on their own. If they got rich with no money, you can get rich with no money.

What jobs can make you rich?

The 3 highest-paid jobs in America include lawyers ($144,120), physicians ($180,000), and R&D managers ($142,120). However, the top jobs that create millionaires do not necessarily have to be the highest-paying jobs.

Closing Thoughts

To those of you who are wondering how to get rich and whether you can be the next millionaire in your family – the answer is you absolutely can accomplish these goals.

«Whether you think you can, or you think you can’t – you’re right.» – Henry Ford

Your attitude can literally make or break your future.

Whether you become a millionaire is based on your mindset and whether you believe in yourself.

If you believe you are a winner, you will become a winner.

Pro Tip:

The more you believe in yourself, the more others will believe in you as well.

If you believe in:

- Yourself

- The process

- Your potential

…then you will make it.

How do you crush fear and your doubts?

Confidence and action crush fear.

Never allow someone else’s opinion to become your reality.

It doesn’t matter what others think.

What matters is what you think.

And the bigger you think, the more you’ll accomplish.

Now that you’ve read this article, you can:

- Manage your money better

- Increase your confidence

- Improve your network

- And so much more

As long as you believe in yourself, the world is your taking.

Now go and crush your goals, get rich and pay it forward.

Your bank accounts will thank me later.

Which wealth building strategy will you pursue first? Let me know in the comments below!

Fiona Smith

Fiona Smith is the founder and CEO of The Millennial Money Woman. She has spent 10+ years studying finance, with the last 7 as a wealth and investment advisor. She has worked with clients with a net worth of up to $100M and holds her Master of Science Degree in Personal Financial Planning. She has also co-founded a local non-profit community teaching financial literacy and her work is featured on Forbes, FinCon, and MSN.

22 thoughts on “How to Get Rich From Nothing: 12 Proven Strategies [2023]”

-

Great tips for anyone – no matter whether “rich” is the goal or not. Thank you for sharing your insights!

-

Jim,

It’s my pleasure – thank you so much for your comment! Glad to hear you enjoyed reading the post.

Cheers!Fiona

-

-

02.26.21

Hello Fiona,

Had noticed that you leave comments on ESI’s blog, and always admired how “positive” you have been to all of the interviews (millionaires/six figure income/retirees) presented on ESI’s blog. We are millionaires with a net worth at $2M, and this post hits all of the things that were done to accomplish our level of net worth. I have been coaching my 32 year old millennial twins (boy and girl) on this exact “money stuff” you write about. I will be recommending your web-site to my millennials. You are well beyond your age in wisdom, and wish you the best success in your financial journey!

Stephen-

Hello Stephen,

Thank you so much for your kind words and for reaching out to me. It’s fantastic to hear that the very things listed in this post worked for your situation as well – and clearly, you’ve done well for yourself. I am humbled and honored to hear that you will be recommending my website to millennials. Good luck on your journey as well – and I look forward to staying connected.

Cheers,

Fiona

-

-

There are 3 routes to wealth. Saving and investing, starting a business, or inheritance. It’s fascinating how the advice around saving and investing are all the same across every rich person who became rich that way.

It tells us that there’s a reason why the advice are all centered and look the same. That’s because it works. There’s no secret to becoming wealthy, the information is all out there. It’s all up to the people to actually implement the steps that everyone’s been recommending for all these years and decades.

-

Hi David,

I think you nailed it when you say that most of the advice out there works – it’s really just a matter of how disciplined and how committed one is to pursue their goals. Building and maintaining wealth is really no secret. The information is out there. Now, it’s just up to the individual to determine whether they will take the information to heart and start pursuing their goals with commitment.

Thanks for sharing your thoughts and good luck on your journey!

Cheers,

Fiona

-

-

This was really helpful, HUGE THANK YOU !

-

You’re welcome 🙂 I’m glad you enjoyed it!

-

-

Hi we are just in the process and the middle of getting to grips with our finances and money. And starting to get our shit together. And I mean starting to get all debt paid as we’ve paid a couple of small debt’s and bills off. And can’t wait. Now to see everything that’s totally paid off in full and be totally debt free and I mean totally debt free. And never ever again have any debt again.as we want to build wealth and bye our home. And I want to learn to drive.plus we want to start renovating houses in the future and at the moment we’re selling everything.

-

Hi Diane,

I love reading comments like yours!!

Debt can certainly be detrimental to one’s overall net worth and future financial success… while there certainly is “smart” debt (like a mortgage), most debt (I find) is “bad debt” or high-interest debt like credit card debt, and that’s something I try to eliminate ASAP. Once you pay off your debt, I am positive that you will feel more peace of mind. Keep up the fantastic work – and I hope you continue to share your comments and results with us, readers!Cheers,

Fiona

-

-

Where do you find how much debt your in .

-

Hi Katlyn,

Typically, you’ll want to start out by collecting and reviewing your statements – which include your mortgage statement, car loan statement, student debt, credit card debt, home equity line of credit, etc. If you already have linked your outside accounts to a budgeting tool (like YNAB or Mint), then in theory, all you would have to do is log into your YNAB/Mint account to see your overall debt (and net worth).

Hopefully this helps!

Fiona

-

-

So much value in this blog post.

Thank you so much.

The procrastination point really hit home.

Putting off my writing side hustle for 2 years and it has taken the break down of my marriage to kick me into action.

I’ll have to bookmark this to read over again.

Thanks to you I’ve signed up to Art of Purposes’ course.-

Hi Aaron,

I’m so sorry to hear about your marriage – but am glad that this blog post could make a positive impact on you 🙂

It took me 4 years to jump into gear and start working on my website, too. But – the good news is that we’re in full swing and we’re ready to make a positive difference in our lives with our new found side hustle passion.Keep hustling and good luck!

Cheers,

Fiona

-

-

I really learnt a lot here thanks for this Article 🙏

-

Hi Romeo,

Thank you so much for your kind words!

So glad to hear that you had the opportunity to learn something new 🙂Good luck on your journey!

Cheers,

Fiona

-

-

Really enjoyed this post has lots of valuable information.

Thanks.-

Thank you so much for your kind words Lindsay!

I appreciate it 🙂

Fiona

-

-

I’d like to have financial advisor but I don’t know what credentials to look for when selecting one, do you have any suggestions? Thanks-Andrew

-

Hi Andrew,

That’s a great question.

As you’ve noted, not all financial advisors are equal.

That’s why I would make sure to take a look at the following 2 most important credentials (in my opinion): CFP (a Certified Financial Planner; A CFP must go through rigorous training, a 7 hour exam, plus ~3 years of prior experience; A CFP is focused on the financial planning side like retirement planning, social security analysis, tax planning, estate planning, etc.) and CFA (Chartered Financial Analyst – the top tier investment professionals hold these designations, typically it takes 3 years to accomplish the CFA designation and these folks are focused mainly on the investment side).

There are other designations as well that can provide specialization for you like the CDFA (Chartered Divorce Financial Analyst; CDFAs provide help for divorcing individuals), CRPC (Chartered Retirement Plan Counselor; specific to retirement planning), and AIF (Accredited Investment Fiduciary; Mainly focuses on the fiduciary standard of the investment professional…aka by law these professionals MUST make the best decision on your behalf and not just decisions based on what will make them the most money).

Bottom line, I’d definitely focus on the CFP designation and if you are working with an investment manager, I’d also see if they hold a CFA designation.

Also, another tip, make sure you ask if they are fiduciaries (they are required by law to do what is in your best interest).

Good luck!

Fiona

-

-

your the best

-

I really appreciate it 🙂

-

Leave a Comment

Join over 20,000+ others who receive my weekly newsletter, where I share the secrets to building modern wealth 👇

Subjects>Hobbies>Toys & Games

Wiki User

∙ 9y ago

Want this question answered?

Be notified when an answer is posted

Study guides

Add your answer:

Earn +

20

pts

Q: What is a 7 letter word called to get richer?

Write your answer…

Submit

Still have questions?

Related questions

People also asked

You are never going to be rich, and you sure as hell won’t ever be successful. That’s what I would say to myself back in the day.

If You Want to Know How to Be Rich and Successful…Keep Reading

I never said such things out loud, but I was always thinking it.

When I was younger, becoming rich didn’t seem real to me. Becoming rich and successful always seemed like something off in the distance, something always out of reach.

Becoming rich felt like a thing that only a select few were entitled to claim. And for a long time, it seemed as if riches and success were only for the lucky, for the special, for the connected.

And poor ole me always felt like I was unworthy. Growing up without much money will do that to you though.

But, I killed off that silly false belief. And fortunately for me, I was able to do so early.

Unfortunately though, many will never shrug off those superstitions. There will always be people who believe themselves unworthy.

Choose Your Reality

For silly reasons, there will always be a great many people who hold on to false notions about money and what’s possible for them. They’ll even hold on to their pity like it’s good for them.

Now don’t get me wrong, I am not trying to be a jerk. I am just stating a fact.

Sadly, there will always be people who believe they don’t deserve more. People who believe they can’t get rich or succeed, and so they never will.

I take that back, they will succeed at something. But that something will be their own self-fulfilling prophecy.

Poor them. No really, poor them.

But this article is not for those people. No, this article is for you the hopeful.

This article about how to be rich and successful is for the few who choose to see. It is for those who are still excited for all that can still be.

Yes, this article is for you, the eager, the willing, the able. It’s for anyone wanting to learn about bringing riches into their reality.

IF YOU WANT TO BE RICH, WAKE UP

First, I had to wake up. For a long time I was asleep at the wheel of possibility. I was programmed to not want money, to think bad of riches, and to doubt success. Shame on you society!

So, for many years my eyes were closed, they were closed to opportunity.

But, I had a wake-up call, and it was kicked-off just a few months after landing my first corporate J.O.B.

It was within that J.O.B. that I saw the dismal future that was in store for me.

I observed my peers (and my bosses) in those early days. I watched them and their lives very closely. And they all had one thing in common. They were all living uninspired lives, living lives I didn’t want for me.

Their lives showed me the limits of the path I was about to embark upon. A path full of suffocating and meaningless drudgery.

Observing them allowed me to peak into the future. And the prospect of such a future sent chills down my spine.

It was that vision of what would have been, which forced me to question things. The vision forced me to scramble and seek out ways to avoid living my life in a such a way. It pushed me to discover how I could create an inspired life.

It helped me realize what I wanted, and what I wanted was options, what I wanted was to be free.

Believe and You Shall Find

In my search I would learn a great many things.

But the most important thing I learned was this…

In order to get what we want in life, we must first believe we can.

If you do not believe, you will not seek, and if you do not seek, you will not find.

“But what does this have to do with getting rich?”

Everything.

It has everything to do with getting rich. If you don’t believe, you can’t achieve.

Without belief, all the secrets of success and money-getting won’t get you anything.

And if you want to have options, if you want to be free, it’s gonna take a lot of that green stuff called money.

So now you know.

And now that you know, I can share with you the other, sexier secrets to riches and success, so here you go…

Here are the 10 key rules you should follow to help you become richer and even more successful, than you ever thought you could be, behold…

THE 10 RULES FOR BECOMING RICH AND SUCCESSFUL

1. Be Honest

In the beginning of my search, I began reading many books. And one of the first books I read on how to get rich was ‘The Millionaire Mind’ by Thomas J. Stanley.

Much like me, Stanley was also hungry for the secret to wealth and riches. So, he went about interviewing hundreds of millionaires to unravel their secrets to becoming rich. And the answer most millionaires gave for how they became rich and successful was this…

Honesty.

Truly, if you want to get rich, it will be through people. Riches are made through business, and business is always with and through people.

There is popular business maxim that supports this, and it goes like this: “People only do business with those whom they know, like, and trust.”

If you are dishonest, and no one trusts you, getting business, making partnerships, and closing deals will be hard. Maybe even impossible.

So, the first rule to follow to become rich, is to be a person of your word. Be honest.

2. Be Self-Disciplined

Self-discipline has been the success secret that has stood out the most in all the success literature I’ve read. After reading book after book on success, it has faithfully shown itself over and over again.

Robert Kiyosaki once stated, “Self-discipline is the No.1 delineating factor between the rich, the middle class, and the poor.”

And many other self-made men and women have also made the claim, that without self-discipline, their achievements would be trivial.

I believe it, and so should you.

So, strive to become a more self-disciplined version of you, and you’ll be surprised with the money and success that will start flowing to you.

3. Be The Hardest Worker You Know

The best of the best in the worlds of sports, business, and entertainment, have claimed the secret behind much of their success, was a result of their ability to work harder than most people. Hustle was the name of their game.

Study any highly successful person, and you will find this to be true. If you examined Ray Lewis’s work ethic, you would notice it was greater than his peers.

If you had the chance to witness the late Steve Jobs, or Elon Musk, or even Jeff Bezos, you would also notice every single one of them had a knack for being relentless in their pursuits.

You’ve heard the saying… “the harder I worked, the luckier I got.”

The rich and the successful are always doing what others don’t like to do. They work harder than their competition, and so set the stage for their well-deserved success.

4. Be Passionate For What You Do

You hear it all the time, follow your passion, follow your dreams. Most of the time this sentiment is shared as the path to finding happiness. However, a handful of the highly successful have extolled the importance in loving what you do in order to find success.

For example, Warren Buffett once stated that the people who find their passion in life are the luckiest. He believed that when people find their passion, or that thing they love to do, they usually end up doing that thing extremely well.

Meaning, in this competitive world of ours, if you don’t love what you do, you put yourself at a disadvantage against those who do.

The person who loves what he is doing, has a better shot and doing that thing they love better than you.

Steve Jobs also stated once that, “The only way to do great work, is to love what you do.”

He believed in the passion principle too.

These two Titans of success believed in the importance of having a passion for your work, and so should you.

5. Be Adaptive

If what you love doing is making art, but there is little to no interest in your art in your market, then you must be willing to adapt. If you don’t, you won’t make any money. And if you don’t make any money, you can’t become rich.

A good way to do adapt your interests to the market, is to keep to your true interests, but also keep your business or art flexible enough to incorporate the interests of others.

If you love making art, but nobody wants to buy it, then you must consider making art that people are willing to buy. It is a sacrifice that you must pay, but, it is necessary if you wish to stay in business and make money doing what you love.

So, follow your heart, but don’t hesitate to adapt what you’re offering till you hit your mark.

6. Be Willing to Cut Loose Negative Influences

Every successful person has had do it. At one point or another, they’ve had to cut loose the negative influences within their lives.

They’ve had to stop hanging out with their “good friends”, those cool people who always want to hang out, party, or do things that are counterproductive to success.

They’ve had to ignore or cut out completely, the doubters in their lives. The people who always second guess their dreams.

They’ve even had to avoid some of their very own family. Family members that were holding them back, suppressing their ambitions and encouraging them to slack.

It may seem harsh, but it is the truth. No one ever said success and riches come without sacrifice.

Therefore, if you are serious about getting rich or becoming more successful, you will, at some point, need to cut loose those negative influences within your life.

And once you do, you can fill that void with encouraging stories and positive voices, like those found right here on The Strive.

7. Be an Action Taker, Execution Is All That Matters

Ideas are good, and good ideas are great, but execution is the name of the game. Without a doubt, you could have the best ideas in the world, but if you don’t back them up with determined and consistent action, they will remain just that, ideas.

Money, success, achievement, all of it revolves around execution.

If we both happened to discover the cure for some incurable disease at the same time, but I dilly dally on the idea, while you jump in, take action, and work to turn it into a living breathing solution that truly cures people of their disease, who do you think the money will start flowing to?

That’s right, he who executed best. You.

Execution my friend, the goddess of good luck loves action takers, she loves those who execute.

8. Be The Owner, Every Percentage Point Counts

If you ever take the route of entrepreneurship, you may come to a point where you need capital to keep your venture humming about long enough to turn it into your very own cash machine.

And if that happens, it is vital to remember that every time you borrow capital as a way to keep the business moving forward, you slowly give away your business. And with it, your hard earned riches.

As such, the less you own of your business, the less say you’ll have when it takes off and everybody wants what you are selling.

All too often hardworking entrepreneurs sell their company and their rights to run it, just to keep it alive. And then, just like that, without much notice, they are let go from their very own company.

So, hold on to every percentage of the assets you build. You’ll be the richer for it.

9. Be Ready, Know When to Sell

All rides are meant to come to an end, and it’s better to get off while their still fun.

Most riches are made when assets are sold. And most people who have become rich and successful, have either been lucky to sell at just the right time, or smart enough to sell when the time was prime.

You could sell to cut your losses, or you can sell to reap the most from your efforts. In either case, the more attuned you are with the value of your assets, the better chance you’ll have selling them when it benefits your bank account the most.

So pay attention to the value of your assets, the economy, and your end goals, and sell when the getting is good.

10. Buy Low

One of my mentors once uttered the following…

“Be fearful when others are greedy and greedy when others are fearful.” – Warren Buffett

Without a doubt, this is the ultimate rule for getting rich. Make it your mission to buy into either the stock market or the real estate market when everyone else is running away from it. Lean into a falling market.

You see, many investors, especially those who are fearful of losing their principle, will sell off their assets at the worst possible time when the markets decline month over month for an extended period of time. But not you, the faithful, the fearless.

So, if you are serious about becoming rich, you must discipline yourself to dive in while others are bailing out. You have to realize, that the markets throughout history, have trended upwards 75% of the time.

So, heed this sage advice from the Oracle of Omaha, Warren Buffett, and buy when the masses are bailing.

Bonus Rule – Focus on Becoming Rich

If you want to become rich, you have to focus on becoming rich consistently. You have to cultivate a mindset for money and riches. Which is why it is impetrative that you keep your goals top of mind. Like the saying goes, “What you focus on expands.”

So, be sure you stay focused on applying these rules on how to become rich and successful often. If you dilly dally, and only think about becoming wealthy and successful every now and then, your chances of success will dwindle.

So…

Because weak desires bring weak results, and strong desires bring strong results. Therefore, you should not be afraid to obsess over how to increase your net worth and achieve the success you’re after, because in the end, that’s exactly what it takes.

Speaking of being afraid, here’s one last rule. In fact, it’s the ultimate rule of the rich.

The Ultimate Rule – Be Fearless

If you truly want to know how to be rich and successful, then you must pay very close attention.

Here’s the deal, courage and success are co-conspirators. They work together in secret to bring you the riches you deserve.

Risk little, Receive little. Risk much, receive much.

The fearful, the timid, the hesitant lose in the grand scheme of things.

Much like the ancient Olympian Gods and Goddesses, success and riches demand their sacrifices too.

So be willing to sacrifice your comfort, push yourself through uncertainties, and kill your fears.

Do this, and you will become fearless.

Become fearless, and the world becomes your oyster.

Go Get It

There you have it friend.

The key rules to follow if you truly wish to become successful and rich. Here’s a quick recap just to ensure it all sticks.

- Choose to Be Rich and Successful

- Wake Up to the World of Possibility

- Believe You Can Acquire Riches and Success

- Be Honest

- Be Self-Disciplined

- Embrace Hard work

- Follow Your Passion

- Be Adaptive

- Cut Loose Negative Influences

- Take Action and Execute

- Keep Full Ownership

- Sell High

- Buy Low

- Focus on Growth and Results

- Be Fearless

You now have the blueprint for how to be rich and successful. Now, all you have to do is follow these rules, plan your attack, and the world will become yours for the taking.

Take it, it’s yours!

STRIVE

PS – The pathway to riches and success will be made much easier when you follow the rules outlined above combined with reading these books on getting rich. Knowledge is power!

Note: Our content is for informational and entertainment purposes only. The information on our site is not a substitute for professional financial services or advice.