Revised on: 2015-11-20

A family of risk standards

ISO 73 is part of ISO 31000, a whole family of standards relating to risk management codified by the International Organization for Standardization. The reason why ISO 73 is particularly useful is because it is intended to provide the risk-related definitions that other standards are meant to use. Obviously, the terms are generic and must be adapted for the specific domain in which is supposed to be used, and that is exactly why the terms and definitions are useful for supply chain risk researchers.

Overview of definitions

I like ISO 73 because it puts things in perspective and arranges the terms related to risk in relationship to each other:

- Risk Management

- Risk Assessment

- Risk Analysis

- Source Identification

- Risk Estimation

- Risk Evaluation

- Risk Analysis

- Risk Treatment

- Risk Avoidance

- Risk Transfer

- Risk Reduction

- Risk Mitigation

- Risk Retention

- Risk Optimization

- Residual risk

- Risk Acceptance

- Risk Financing

- Risk Control

- Risk Communication

- Risk Perception

- Stakeholder

- Interested party

- Risk Assessment

While risk assessment, risk treatment and risk acceptance (of the risk that can not or is chose not to be treated) are perhaps not so surprising elements of risk management, I do find it interesting that risk communication is included. On second thought though, risk communication is essential to raising the awareness about risk and how it should be treated by the organization and how it should be viewed by the stakeholders. For practical advice I recommend this book on risk modelling, assessment and management.

Definitions

Let’s take a closer look at some of the definitions.

Risk management – coordinated activities to direct and control an organization with regard to risk. Risk management generally includes risk assessment, risk treatment, risk acceptance and risk communication.

Note: The focus is on directing and controlling the organization, not the risk, perhaps contrary to what what you would expect?

Risk assessment – overall process of risk analysis and risk evaluation

Risk analysis – systematic use of information to identify sources and to estimate the risk. Risk analysis forms the basis for risk evaluation, risk treatment and risk acceptance. Information can include historical data, theoretical analysis, informed opinions and the concerns of stakeholders.

Note: Risk is not only a technical or factual matter, it can also be what the stakeholders consider important. The risk definition follows the traditional perspective, though:

Risk – the combination of the probability of an event and its consequence.

(Risk) Source – item or activity having a potential for a consequence.

So, a source in itself is not a risk. However, in ISO 51 Safety aspects, a source is referred to as a hazard. In other words, a source might result in a concrete risk, but not necessarily so.

Risk evaluation – process of comparing the estimated risk, against given risk criteria to determine the significance of the risk.

Risk criteria – terms of reference by which the significance of risk is assessed. Risk criteria can include associated costs and benefits, legal and statutory requirements, socio-economic and environmental aspects, the concerns of stakeholders, priorities and other inputs to the assessment.

As as risk treatment is concerned, besides Avoid, Transfer, Reduce and Retain as the classic four ways of dealing with risk, ISO 73 also lists Optimize and Mitigate. Note the difference between Risk Reduction and Risk Mitigation:

Risk avoidance – decision not to become involved in, or action to withdraw from, a risk situation.

Risk transfer – sharing with another party the burden of loss or benefit or gain, for a risk. Legal, mandatory or statutory rights can limit, prohibit or mandate the transfer of certain risk. Risk transfer can be carried out through insurance or other agreements. Risk transfer can create new risks or modify existing risk. Relocation of the source of risk is not risk transfer.

Risk reduction – actions taken to lessen the probability, negative consequence, or both, associated with a risk.

Risk mitigation – limitation of any negative consequence of a particular event.

In other words, risk reduction is proactive, whereas risk mitigation is reactive? Not necessarily. The mitigation can be a preparatory action in the anticipation of the potential consequence of an event. A contingency plan is an example of risk mitigation. Playing the devil’s advocate here, installing fire fighting equipment in a building would be risk mitigation, the actual fire fighting itself is perhaps not. Personally, I prefer to distinguish between mitigative and contingent risk management actions.

Risk retention – the acceptance of the burden of loss or benefit or gain, for a risk.

Risk optimization – process, related to risk, to minimize the negative and maximize the positive consequences and their respective probabilities.

This is an interesting concept. Optimization acknowledges that risk may pose both upside opportunities as well as downside losses. Albeit not said explicitly, risk optimization may also be seen as a cost-benefit assessment of the risks. Finally, risk that cannot be treated or that is decided not to treat has to be accepted.

Risk acceptance – decision to accept a risk

Risk acceptance and risk retention are not the same. Risk retention is a consequence of risk acceptance of a certain risk.

Risk financing – provision of funds to meet the cost of implementing risk treatment and related costs.

Risk control – actions implementing risk management

This is a bit confusing. I don’t really see why there is a need for risk control and risk management, since risk risk management already contains an element of control…unless risk management is see as something abstract, while risk control is something concrete.

Risk communication – exchange or sharing of information about risk between the decision-maker and other stakeholders.

Risk perception – way in which a stakeholder views a risk, based on a set of values or concerns

Stakeholder – any individual, group or organization that can affect, be affected by, or perceive itself to be affected by, a risk. The term stakeholder includes but has a broader meaning than interested party.

Interested party – person or group having an interest in the performance or success of an organization.

I do see the necessity to include risk communication as an integral part of risk management. This also brings in the notion of stakeholders and what risk perception these stakeholders have. Risk perception is particularly important in managing reputation risk.

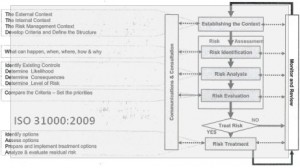

Risk Management Process

According to ISO 31000, and again repeated in ISO 28o02, which I reviewed in my post on supply chain security and resilience, the risk management process can be illustrated graphically as below.

I find this an excellent figure that clearly shows the content of the individual steps of the risk management process, how they are related to each other and how risk management is a never-ending cycle of activities.

Conclusion

As you can see, there is a whole battery of terms related to risk and risk management. I am not sure I am less confused now, but the differences in meaning are beginning to sink in, at least in my mind. As I said in the opening chapter, not many, if any, papers on supply chain risk refer to ISO 73 or ISO 31000 for that matter, but this post I hope that more researchers will make use of the terminology that already exists.

Links

- ISO 31000: Principles and Guidelines on Implementation

- IEC 31010: Risk Management – Risk Assessment Techniques

- ISO 73: Risk Management – Vocabulary

Smartsheet Contributor

Andy Marker

August 2, 2017

Risks are not inherently bad — sometimes taking a risk can lead to big rewards. However, risks do represent uncertainty, and if you’re managing an organization or project, having a clear understanding of potential risks can help you move forward and make decisions with confidence. Risk management is the process of identifying risks, analyzing them to assess their likelihood and potential impact on a program, and developing and implementing methods for responding to each risk. To support your risk management planning, this page offers multiple templates that are free to download. Choose from simple matrix templates or more comprehensive risk management plan templates for Excel, Word, and PDF, all of which are fully customizable to meet the needs of your specific enterprise or project.

Risk Management Planning Templates for Excel

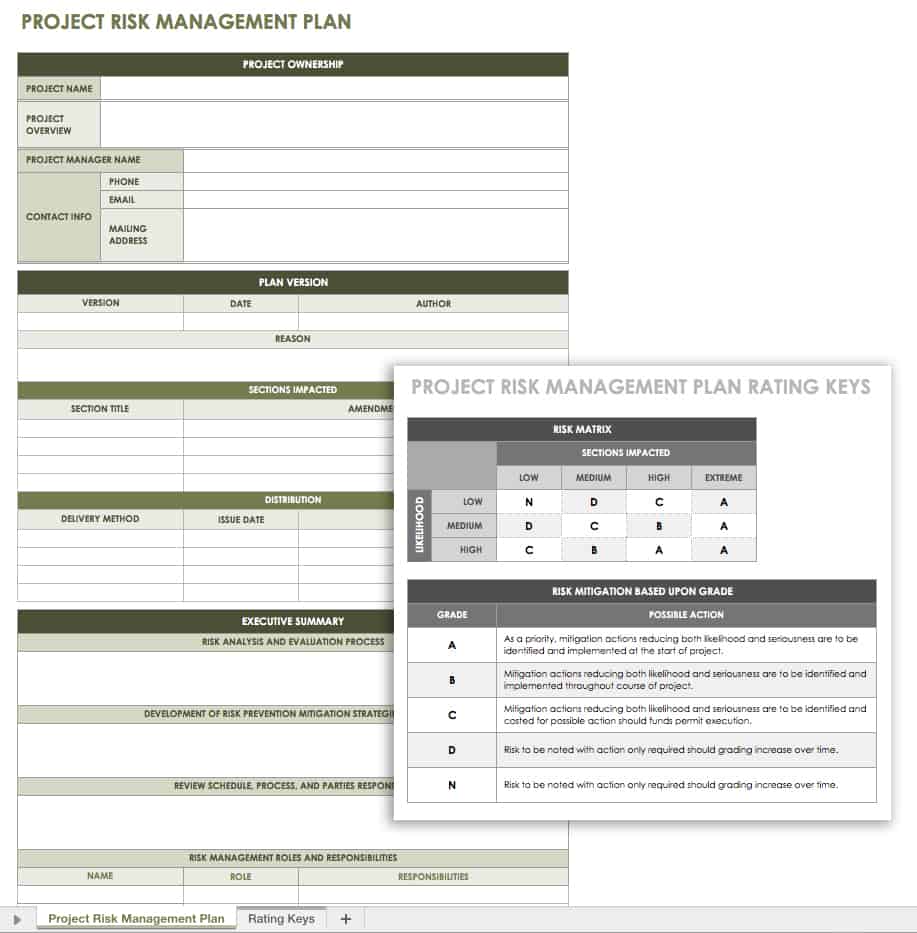

Project Risk Management Plan Template

This template allows you to create a project risk management plan for Excel, which may be helpful for adding any numerical data or calculations. You include typical sections in the template, such as risk identification, analysis and monitoring, roles and responsibilities, and a risk register. Add or remove sections to create a customized template for your project.

Download Project Risk Management Plan Template

Excel | Smartsheet

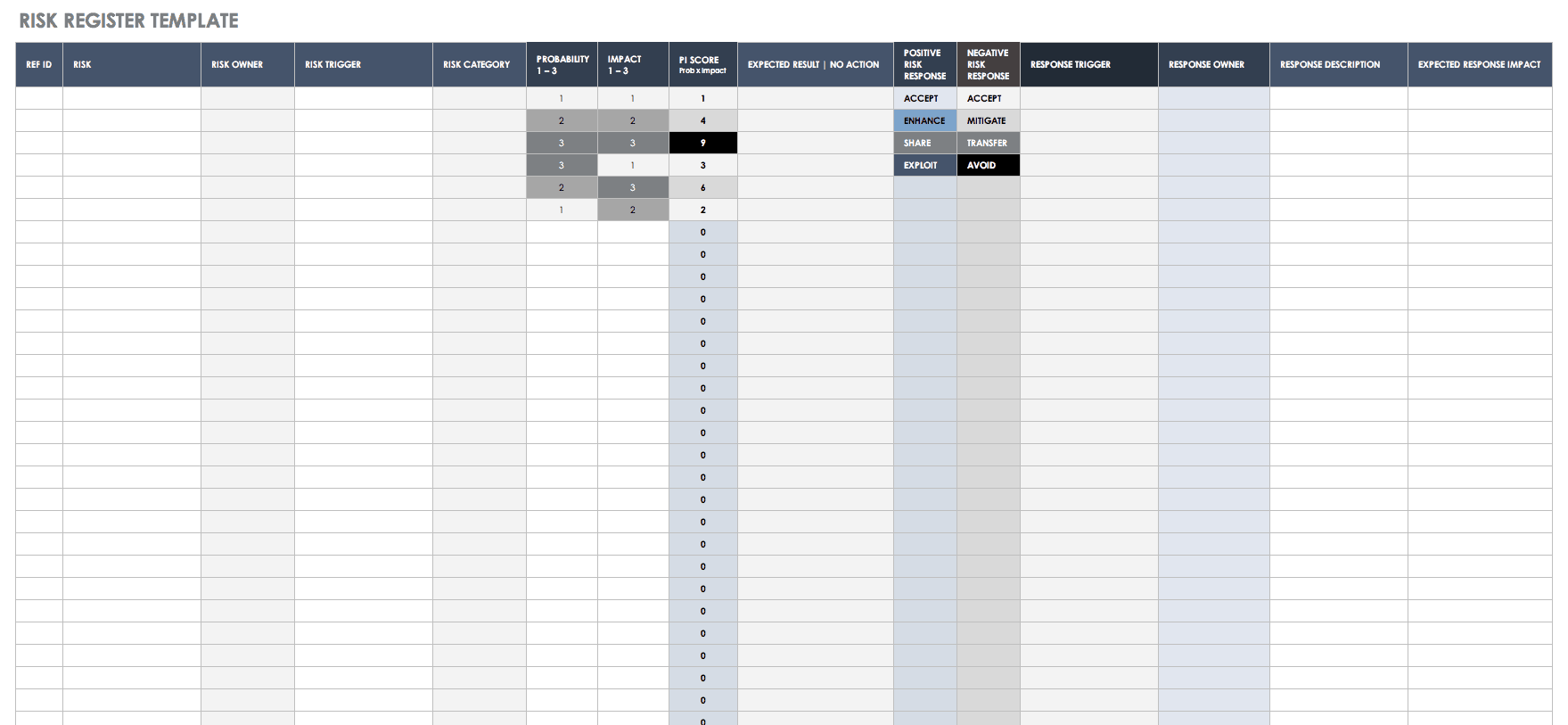

Risk Register Template

On this risk register template, you include project details at the top and list risks below with assigned tracking numbers. The register provides a detailed log of who owns a risk, the level of impact and probability, planned actions, and the response status. This is a spreadsheet template that can be easily edited to include additional columns if needed.

Download Risk Register Template

Excel | Smartsheet

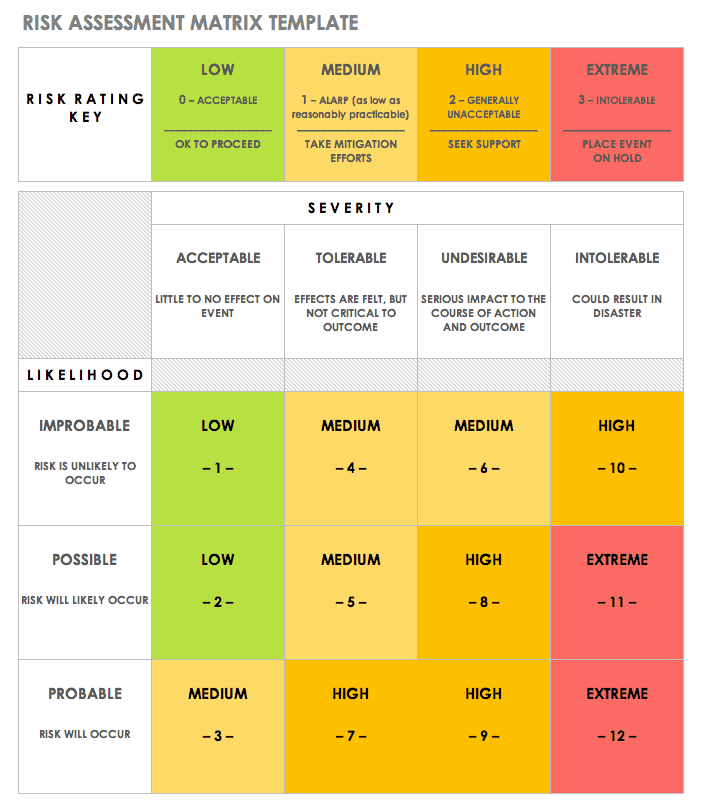

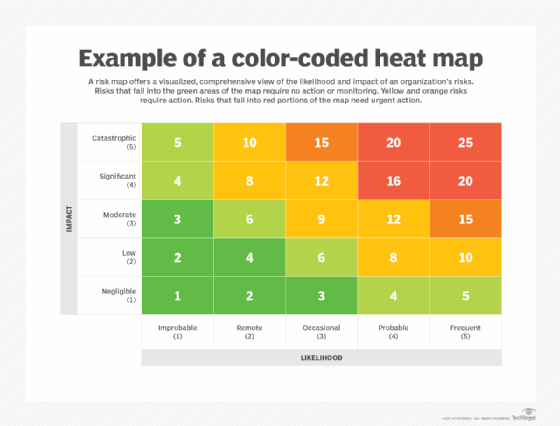

Risk Assessment Matrix

This simple matrix template is designed to aid the assessment process, providing a quick view of the relationship between the likelihood of occurrence and the severity of impact, as well as the number of risks that fall into each category. The color scheme makes it easy to distinguish among the different ratings, so you can get an overview of the levels of risk that need to be addressed.

Download Risk Assessment Matrix

Excel | Word | PDF | Smartsheet

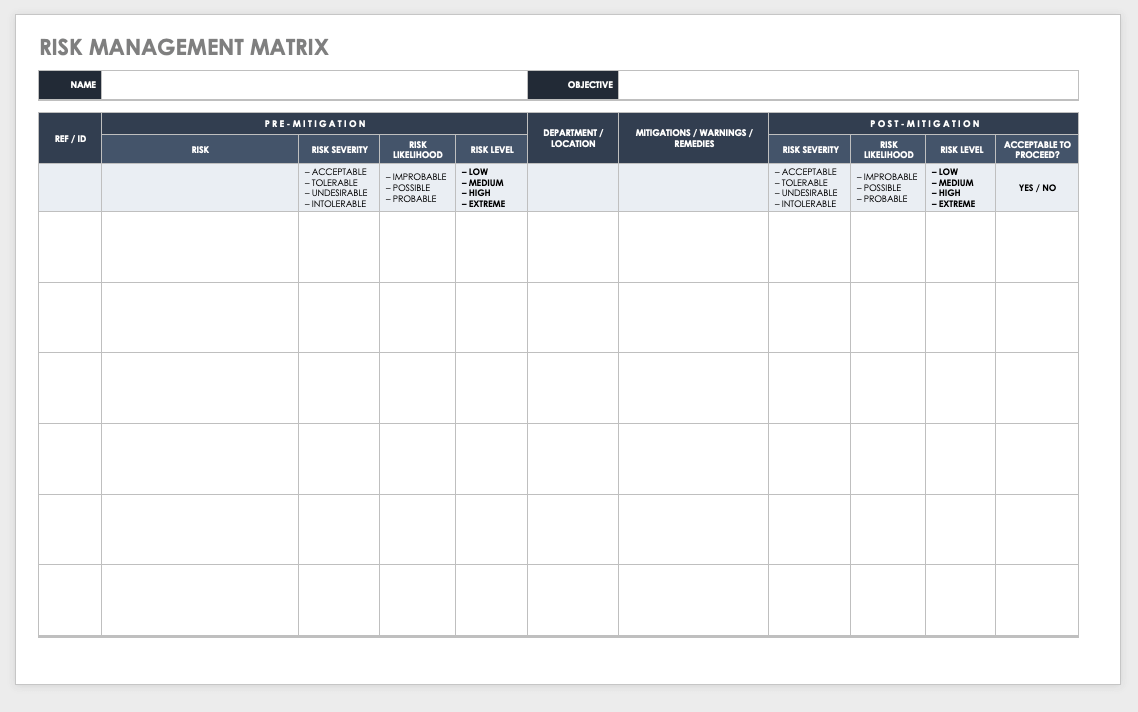

Risk Management Matrix

For some smaller projects, you may only need to use a risk management matrix (rather than create a lengthy management plan). You can also use this matrix template, in addition to a detailed plan, to organize vital information in a single spreadsheet. The template includes a risk assessment matrix for getting an overview of risk ratings, plus a management matrix for identifying and assessing risks, describing mitigation strategies, and monitoring control efforts.

Download Risk Management Matrix

Excel | Word | PDF | Smartsheet

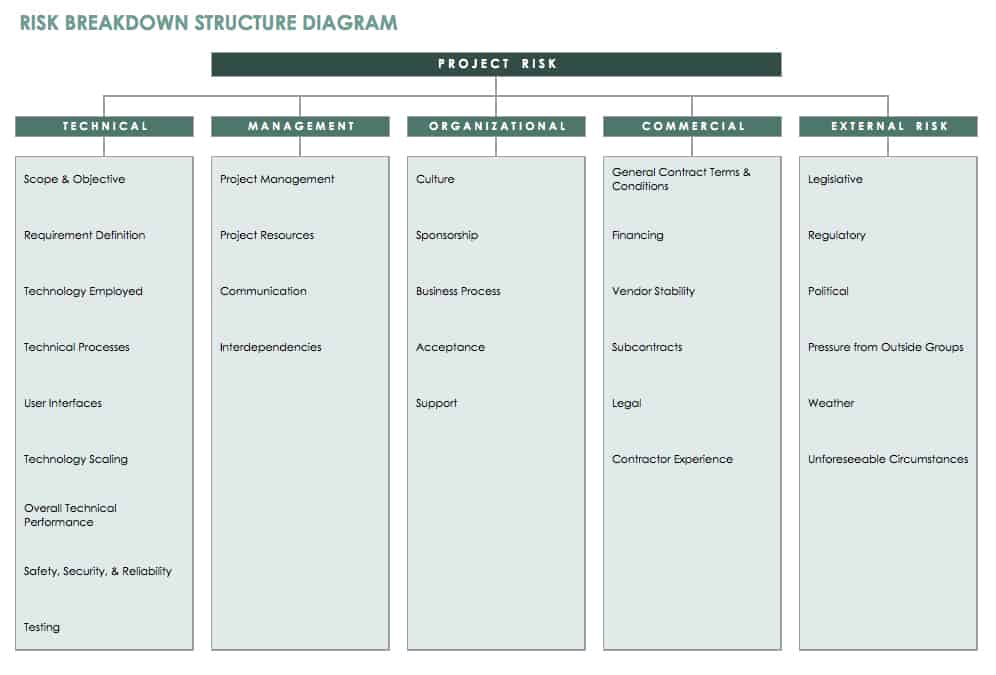

Risk Breakdown Structure Diagram

You can use this template to create an RBS diagram based on the risks involved at the different stages of a project’s work breakdown structure. You can also use the RBS template to organize risks by category by breaking down internal risks into subcategories, such as technical or organizational, and distinguishing them from external risks. This is a helpful tool for organizing risks visually and listing them in the risk register.

Download Risk Breakdown Structure Diagram

Excel | Smartsheet

Other Risk Management Templates

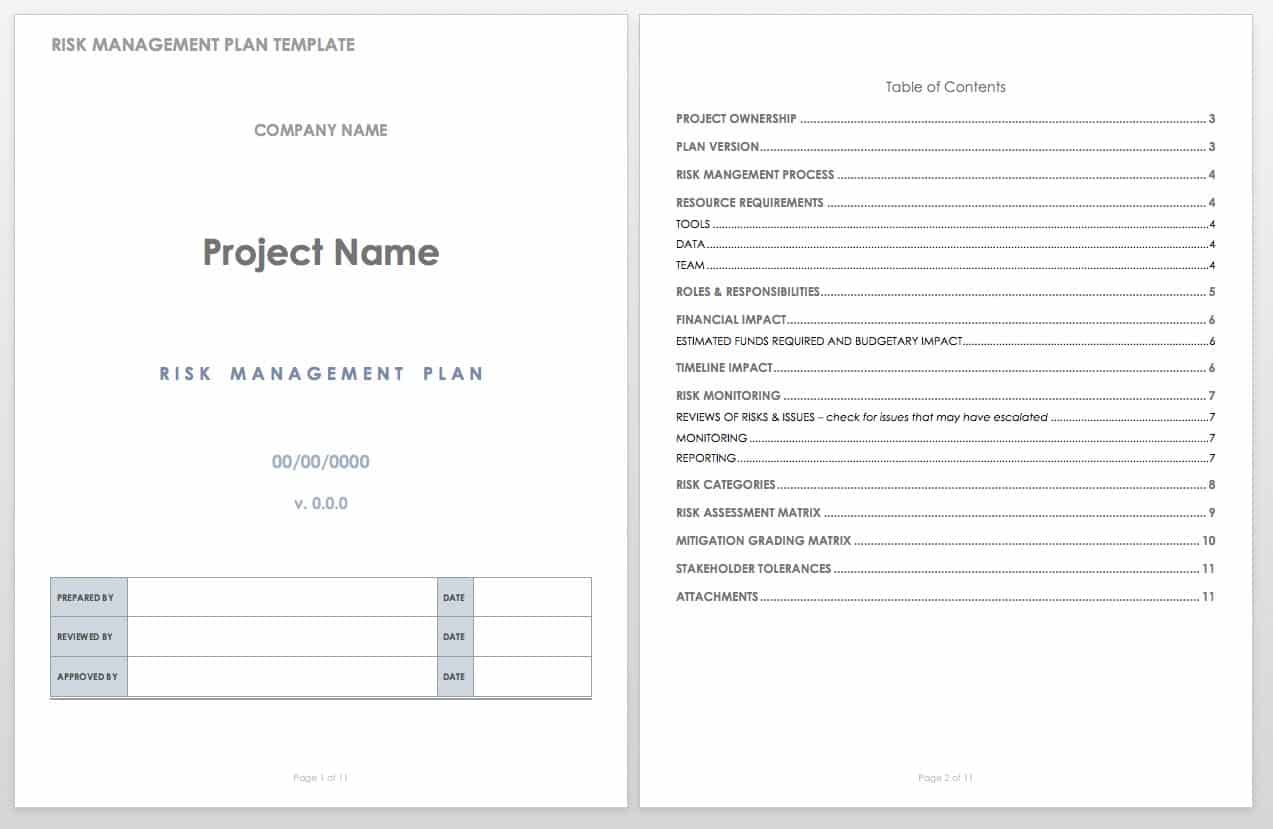

Risk Management Plan Template — Word

This risk management plan sample offers a basic layout that you can develop into a comprehensive plan for project or enterprise risk management. It includes a matrix for viewing probability and impact as well as sections for describing a risk management approach, budgeting, scheduling and reporting protocols, and more.

Download Risk Management Plan Template

Word | Smartsheet

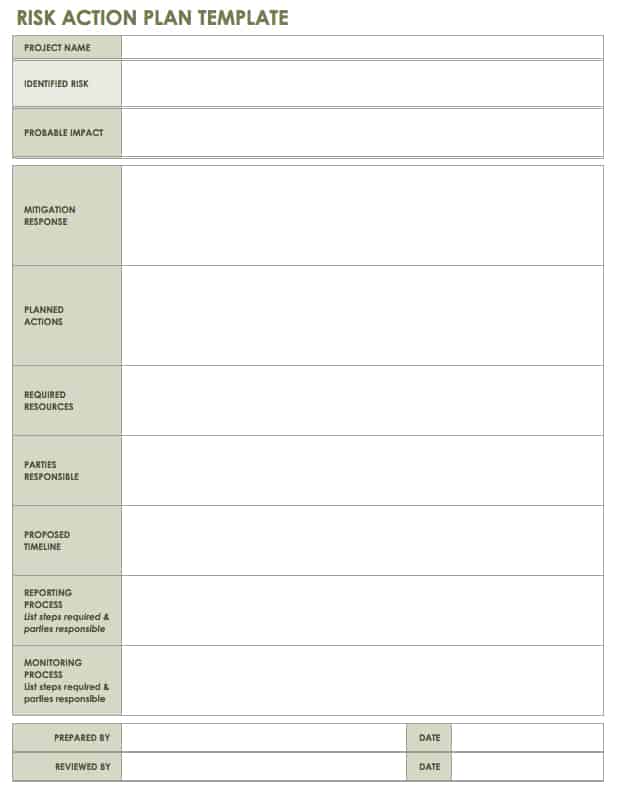

Risk Action Plan Template

An action plan template allows you to go into detail about proposed actions for a specific risk. This PDF template offers a simple layout with sections for describing the risk and recommended response, defining an action plan, listing required resources, assigning responsibility, and setting a timeline for completion.

Download Risk Action Plan Template

Excel | Word | PDF

Project Risk Management

The Project Management Body of Knowledge (PMBOK® Guide, 5th Edition) defines project risk as “an uncertain event or condition that, if it occurs, has a positive or negative effect on one or more project objectives, such as scope, schedule, cost, or quality.” Notice that these risks can be considered positive or negative depending on their effects. Project risk management seeks to maximize positive risks while avoiding or mitigating negative risks. A risk management plan is typically included as part of a larger project plan, and is initiated early in the project lifecycle; the risk plan then evolves as the project progresses. It is generally the project manager’s role to maintain the plan and update it periodically to ensure ongoing clarity and effectiveness.

The overall goal of a risk management plan is to manage risk in a way that ensures a successful project outcome. The planning process enables managers to clearly identify risks, and then develop and document risk mitigation strategies and contingency plans. The process also includes identifying both the costs and actions necessary for implementing the plan. Once completed, the plan serves as a guide for everyone involved in a project and is particularly important as a tool to communicate with key stakeholders.

Ways to Handle Risk

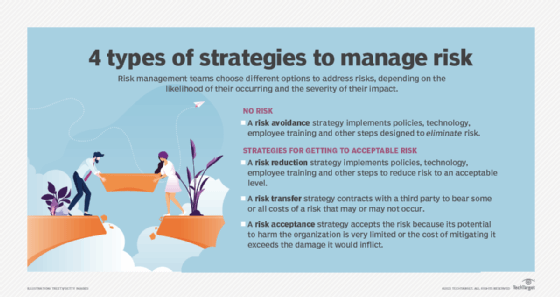

Once you’ve identified and evaluated a risk, there are several potential responses. The response you choose will depend on the probability of the risk occurring and the potential severity of its impact on a project.

- Avoid: Avoiding risks is ideal, and especially important if the risk is high impact and likely to occur. Avoidance tactics may require greater investment (in order to develop alternative strategies), but this additional cost and effort is appropriate for high-impact, high-probability negative risks.

- Transfer: This method refers to transferring risk to another party (for example, the act of purchasing insurance moves the risk to the insurance provider). This response is common for risks that have a high negative impact but a low probability of occurring.

- Mitigate: Mitigation aims to reduce either the likelihood or the level of impact of a risk, and is used for risks that are likely to occur, but also likely to be low-impact.

- Accept: Acceptance is an option when there is no other solution, but would only be used for low-impact risks that have a low probability of occurring.

Risks can be internal or external, and projects may face a combination of both. Internal risks may include issues with technology, staffing, financial security, and other factors that can be controlled within your organization. External risks can be harder to predict and control, and may include factors such as issues with suppliers, changes in the political climate or economy, or even the weather. The process of analyzing risks and measuring them on a scale of probability and severity can provide the initial framework for determining which of the above methods will be the most effective response to a given risk.

Risk Management and HIPAA Compliance in Healthcare Organizations

Healthcare organizations are under strict regulations when it comes to risk and compliance. That’s why the ability to determine where those risks exist and establish a plan to manage them is extremely important for the business, both legally and functionally.

Risk management for healthcare organizations helps to ensure the all businesses are compliant with HIPAA requirements, and outlines potential risks that could occur in a healthcare organization, such as clinical testing errors, hospital facilities issues, security breaches of protected health information PHI, and more. To ensure that all healthcare data is effectively analyzed for security and protection purposes, you need a tool that is able to quickly identify, mitigate, and prevent risks from coming to fruition, while also offering real-time visibility into all potential risks.

Smartsheet is a work execution platform that enables healthcare companies to view and update risks across the company with real-time dashboards, so you can make the best decisions at the right time. Highlight all identified risks and manage how they are addressed, all while ensuring utmost security and protection of PHI. Set sharing settings to ensure that only authorized users have access to confidential information, so your organization remains compliant with HIPAA regulations.

Interested in learning more about how Smartsheet can help you accurately and securely document healthcare processes and maximize your efforts? Discover Smartsheet for Healthcare.

Example of Risk Management Plan Outline

The length and level of detail included in a risk management plan will vary depending on the scope of a project and the needs of an organization. Here is a risk management plan example outline that describes the information you typically include:

- Introduction: The first section in a risk management plan may focus on an executive summary or project description, including the purpose of the project. It may go into detail about the scope of the project, objectives, and important background information, and provide an overview of risk management approach and strategies.

- Risk Management Approach: This may be a brief summary or detailed section providing information on the risk management process, the methodology used, and specific tools and techniques to be utilized.

- Roles and Responsibilities: Here you list the project staff members involved in the risk process, along with each of their roles and responsibilities.

- Risk Identification: This section describes how you will identify risks and/or lists risks that you have already found. Methods for risk identification may include brainstorming, examining the project’s work breakdown structure (WBS) in order to identify risks and create a corresponding risk breakdown structure (RBS), conducting expert interviews, consulting with key stakeholders, or reviewing common risks from similar projects.

- Risk Analysis and Evaluation: You must analyze risks that you identify to determine what effects they might have on a project, such as a delayed timeline or reduced quality. You must also evaluate these risks for probability and impact. This section may describe how probability of occurrence and impact are calculated and combined to create a numeric score for each risk. Here, you can also define the categories and terms you use to describe the different levels of probability and impact. In addition, if you’ve determined top risks, you can list them here.

- Risk Response Planning: You can explain the process for conducting response planning here, including how a project team will develop actions to address both negative and positive risks.

- Risk Mitigation: You can list potential risk mitigation strategies here, connecting possible actions to risks based on the level of seriousness. This section may also consider important risks that you have identified, providing detail on what type of mitigation you’ve proposed, ownership for implementing the action, and cost implications.

- Risk Monitoring and Reporting: This section may describe how you will monitor risks, the frequency of reviews, how you will identify new risks, and the method and schedule you will use for reporting.

- Risk Register: Also called a risk log, the register typically appears at the end of a risk management plan, or as a separate document. The register tracks important details about each risk including probability, impact, overall score, and status. It essentially combines the results from risk analysis and response planning into a spreadsheet or chart for easy reference.

You will need to adjust the content and formatting of this example plan to meet the needs of your business or project. To see how others have handled this process for similar projects, you can search for sample risk management plans online and compare different approaches. Comparing project risk management plan examples may save you time in the long run, especially if you are new to the process. To use the free templates provided below, simply download your chosen file, and make any required edits.

Create a Powerful Risk Management Plan With Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Any articles, templates, or information provided by Smartsheet on the website are for reference only. While we strive to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, articles, templates, or related graphics contained on the website. Any reliance you place on such information is therefore strictly at your own risk.

These templates are provided as samples only. These templates are in no way meant as legal or compliance advice. Users of these templates must determine what information is necessary and needed to accomplish their objectives.

What is another word for Risk Management?

30 synonyms found

Pronunciation:

[ ɹˈɪsk mˈanɪd͡ʒmənt], [ ɹˈɪsk mˈanɪdʒmənt], [ ɹ_ˈɪ_s_k m_ˈa_n_ɪ_dʒ_m_ə_n_t]

Table of Contents

-

n.

• Other relevant words: (noun)

- project management.

-

Other synonyms:

-

•

- adventurism,

- chairmanship,

- administer,

- ADMIN,

- administrative,

- CSR,

- critical-path method,

- administration (of an estate),

- crisis management.

• Other relevant words:

- certificate,

- action plan,

- security department,

- deal,

- dish out,

- deal out,

- shell out,

- security measures,

- lot,

- allot,

- parcel out,

- dispense,

- distribute,

- mete out,

- administrate,

- surety,

- security system,

- protection,

- dole out.

• Other relevant words (noun):

- security.

How to use «Risk management» in context?

Risk Management is the process used to identify, assess, and manage risk associated with an organization’s activities and assets. During the risk assessment process, the risk prober will look at the likelihood and severity of potential risks, as well as the potential impact of those risks on the organization.

Proper risk management can help organizations prevent and minimize the impact of risks while pursue their business objectives. Proper risk management can also ensure that the resources and investments of the organization are effectively deployed.

Risk management begins with a risk assessment.

Risk management is the process of identifying, assessing and controlling threats to an organization’s capital and earnings. These risks stem from a variety of sources, including financial uncertainties, legal liabilities, technology issues, strategic management errors, accidents and natural disasters.

A successful risk management program helps an organization consider the full range of risks it faces. Risk management also examines the relationship between risks and the cascading impact they could have on an organization’s strategic goals.

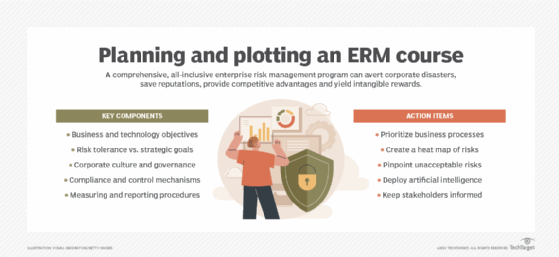

This holistic approach to managing risk is sometimes described as enterprise risk management because of its emphasis on anticipating and understanding risk across an organization. In addition to a focus on internal and external threats, enterprise risk management (ERM) emphasizes the importance of managing positive risk. Positive risks are opportunities that could increase business value or, conversely, damage an organization if not taken. Indeed, the aim of any risk management program is not to eliminate all risk but to preserve and add to enterprise value by making smart risk decisions.

«We don’t manage risks so we can have no risk. We manage risks so we know which risks are worth taking, which ones will get us to our goal, which ones have enough of a payout to even take them,» said Forrester Research senior analyst Alla Valente, a specialist in governance, risk and compliance.

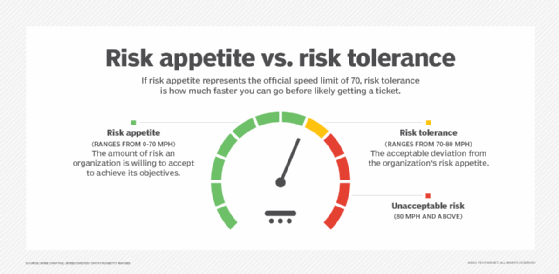

Thus, a risk management program should be intertwined with organizational strategy. To link them, risk management leaders must first define the organization’s risk appetite — i.e., the amount of risk it is willing to accept to realize its objectives.

The formidable task is to then determine «which risks fit within the organization’s risk appetite and which require additional controls and actions before they are acceptable,» explained Mike Chapple, Notre Dame University professor of IT, analytics and operations, in his article on risk appetite vs. risk tolerance. Some risks will be accepted with no further action necessary. Others will be mitigated, shared with or transferred to another party, or avoided altogether.

Every organization faces the risk of unexpected, harmful events that can cost it money or cause it to close. Risks untaken can also spell trouble, as the companies disrupted by born-digital powerhouses, such as Amazon and Netflix, will attest. This guide to risk management provides a comprehensive overview of the key concepts, requirements, tools, trends and debates driving this dynamic field. Throughout, hyperlinks connect to other TechTarget articles that deliver in-depth information on the topics covered here, so readers should be sure to click on them to learn more.

Why is risk management important?

Risk management has perhaps never been more important than it is now. The risks modern organizations face have grown more complex, fueled by the rapid pace of globalization. New risks are constantly emerging, often related to and generated by the now-pervasive use of digital technology. Climate change has been dubbed a «threat multiplier» by risk experts.

A recent external risk that manifested itself as a supply chain issue at many companies — the coronavirus pandemic — quickly evolved into an existential threat, affecting the health and safety of their employees, the means of doing business, the ability to interact with customers and corporate reputations.

Businesses made rapid adjustments to the threats posed by the pandemic. But, going forward, they are grappling with novel risks, including how or whether to bring employees back to the office, what should be done to make their supply chains less vulnerable, the threat of a recession and the war in Ukraine.

As the world continues to reckon with these crises, companies and their boards of directors are taking a fresh look at their risk management programs. They are reassessing their risk exposure and examining risk processes. They are reconsidering who should be involved in risk management. Companies that currently take a reactive approach to risk management — guarding against past risks and changing practices after a new risk causes harm — are considering the competitive advantages of a more proactive approach. There is heightened interest in supporting sustainability, resiliency and enterprise agility. Companies are also exploring how artificial intelligence technologies and sophisticated governance, risk and compliance (GRC) platforms can improve risk management.

Financial vs. nonfinancial industries. In discussions of risk management, many experts note that at companies that are heavily regulated and whose business is risk, managing risk is a formal function.

Banks and insurance companies, for example, have long had large risk departments typically headed by a chief risk officer (CRO), a title still relatively uncommon outside of the financial industry. Moreover, the risks that financial services companies face tend to be rooted in numbers and therefore can be quantified and effectively analyzed using known technology and mature methods. Risk scenarios in finance companies can be modeled with some precision.

For other industries, risk tends to be more qualitative and therefore harder to manage, increasing the need for a deliberate, thorough and consistent approach to risk management, said Gartner analyst Matt Shinkman, who leads the firm’s enterprise risk management and audit practices. «Enterprise risk management programs aim to help these companies be as smart as they can be about managing risk.»

Traditional risk management vs. enterprise risk management

Traditional risk management tends to get a bad rap these days compared to enterprise risk management. Both approaches aim to mitigate risks that could harm organizations. Both buy insurance to protect against a range of risks — from losses due to fire and theft to cyber liability. Both adhere to guidance provided by the major standards bodies. But traditional risk management, experts argue, lacks the mindset and mechanisms required to understand risk as an integral part of enterprise strategy and performance.

For many companies, «risk is a dirty four-letter word — and that’s unfortunate,» said Forrester’s Valente. «In ERM, risk is looked at as a strategic enabler versus the cost of doing business.»

«Siloed» vs. holistic is one of the big distinctions between the two approaches, according to Gartner’s Shinkman. In traditional risk management programs, for example, risk has typically been the job of the business leaders in charge of the units where the risk resides. For example, the CIO or CTO is responsible for IT risk, the CFO is responsible for financial risk, the COO for operational risk, etc. The business units might have sophisticated systems in place to manage their various types of risks, Shinkman explained, but the company can still run into trouble by failing to see the relationships among risks or their cumulative impact on operations. Traditional risk management also tends to be reactive rather than proactive.

«The pandemic is a great example of a risk issue that is very easy to ignore if you don’t take a holistic, long-term strategic view of the kinds of risks that could hurt you as a company,» Shinkman said. «A lot of companies will look back and say, ‘You know, we should have known about this, or at least thought about the financial implications of something like this before it happened.'»

In enterprise risk management, managing risk is a collaborative, cross-functional and big-picture effort. An ERM team, which could be as small as five people, works with the business unit leaders and staff to debrief them, help them use the right tools to think through the risks, collate that information and present it to the organization’s executive leadership and board. Having credibility with executives across the enterprise is a must for risk leaders of this ilk, Shinkman said.

These types of experts increasingly come from a consulting background or have a «consulting mindset,» he said, and possess a deep understanding of the mechanics of business. Unlike in traditional risk management, where the head of risk typically reports to the CFO, the heads of enterprise risk management teams — whether they hold the chief risk officer title or some other title — report to their CEOs, an acknowledgement that risk is part and parcel of business strategy.

In defining the chief risk officer role, Forrester Research makes a distinction between the «transactional CROs» typically found in traditional risk management programs and the «transformational CROs» who take an ERM approach. The former work at companies that see risk as a cost center and risk management as an insurance policy, according to Forrester. Transformational CROs, in the Forrester lexicon, are «customer-obsessed,» Valente said. They focus on their companies’ brand reputations, understand the horizontal nature of risk and define ERM as the «proper amount of risk needed to grow.»

Risk averse is another trait of traditional risk management organizations. But as Valente noted, companies that define themselves as risk averse with a low risk appetite are sometimes off the mark in their risk assessment.

«A lot of organizations think they have a low risk appetite, but do they have plans to grow? Are they launching new products? Is innovation important? All of these are growth strategies and not without risk,» Valente said.

To learn about other ways in which the two approaches diverge, check out technology writer Lisa Morgan’s «Traditional risk management vs. enterprise risk management: How do they differ?» In addition, her article on risk management teams provides a detailed rundown of roles and responsibilities.

Risk management process

The risk management discipline has published many bodies of knowledge that document what organizations must do to manage risk. One of the best-known sources is the ISO 31000 standard, Risk management — Guidelines, developed by the International Organization for Standardization, a standards body commonly known as ISO.

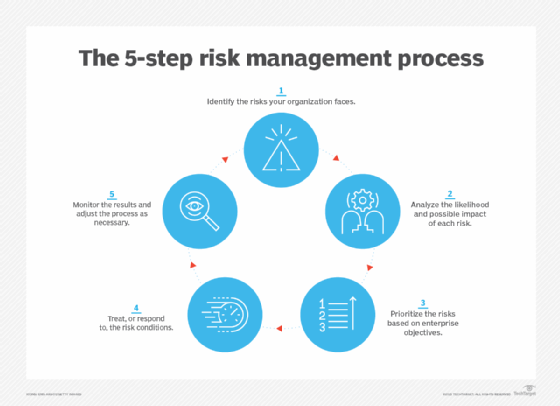

ISO’s five-step risk management process comprises the following and can be used by any type of entity:

- Identify the risks.

- Analyze the likelihood and impact of each one.

- Prioritize risks based on business objectives.

- Treat (or respond to) the risk conditions.

- Monitor results and adjust as necessary.

The steps are straightforward, but risk management committees should not underestimate the work required to complete the process. For starters, it requires a solid understanding of what makes the organization tick. The end goal is to develop the set of processes for identifying the risks the organization faces, the likelihood and impact of these various risks, how each relates to the maximum risk the organization is willing to accept, and what actions should be taken to preserve and enhance organizational value.

«To consider what could go wrong, one needs to begin with what must go right,» said risk expert Greg Witte, a senior security engineer for Huntington Ingalls Industries and an architect of the National Institute of Standards and Technology (NIST) frameworks on cybersecurity, privacy and workforce risks, among others.

When identifying risks, it is important to understand that, by definition, something is only a risk if it has impact, Witte said. For example, the following four factors must be present for a negative risk scenario, according to guidance from the NIST Interagency Report (NISTIR 8286A) on identifying cybersecurity risk in ERM:

- a valuable asset or resources that could be impacted;

- a source of threatening action that would act against that asset;

- a preexisting condition or vulnerability that enables that threat source to act; and

- some harmful impact that occurs from the threat source exploiting that vulnerability.

While the NIST criteria pertains to negative risks, similar processes can be applied to managing positive risks.

Top-down, bottom-up. In identifying risk scenarios that could impede or enhance an organization’s objectives, many risk committees find it useful to take a top-down, bottom-up approach, Witte said. In the top-down exercise, leadership identifies the organization’s mission-critical processes and works with internal and external stakeholders to determine the conditions that could impede them. The bottom-up perspective starts with the threat sources — earthquakes, economic downturns, cyber attacks, etc. — and considers their potential impact on critical assets.

Risk by categories. Organizing risks by categories can also be helpful in getting a handle on risk. The guidance cited by Witte from the Committee of Sponsoring Organizations of the Treadway Commission (COSO) uses the following four categories:

- strategic risk (e.g., reputation, customer relations, technical innovations);

- financial and reporting risk (e.g., market, tax, credit);

- compliance and governance risk (e.g., ethics, regulatory, international trade, privacy); and

- operational risk (e.g., IT security and privacy, supply chain, labor issues, natural disasters).

Another way for businesses to categorize risks, according to compliance expert Paul Kirvan, is to bucket them under the following four basic risk types for businesses: people risks, facility risks, process risks and technology risks.

The final task in the risk identification step is for organizations to record their findings in a risk register. It helps track the risks through the subsequent four steps of the risk management process. An example of such a risk register can be found in the NISTIR 8286A report cited above.

Witte provides an in-depth analysis of the entire process in his article, «Risk management process: What are the 5 steps?»

Risk management standards and frameworks

As government and industry compliance rules have expanded over the past two decades, regulatory and board-level scrutiny of corporate risk management practices have also increased, making risk analysis, internal audits, risk assessments and other features of risk management a major component of business strategy. How can an organization put this all together?

The rigorously developed — and evolving — frameworks developed by the risk management field will help.

Here is a sampling, starting with brief descriptions of the two most widely recognized frameworks. For more detail on them, readers should consult security expert Michael Cobb’s analysis of ISO 31000 vs. COSO, which delves into their similarities and differences and how to choose between the two:

- COSO ERM Framework. Launched in 2004, the COSO framework was updated in 2017 to address increasing complexity of ERM. It defines key concepts and principles of ERM, suggests a common ERM language and provides clear direction for managing risk. Developed with input from COSO’s five member organizations and external advisors, the framework is a set of 20 principles organized into five interrelated components:

- governance and culture

- strategy and objective-setting

- performance

- review and revision

- information, communication and reporting

As Cobb noted in his comparison article, COSO’s updated version highlights the importance of embedding risk into business strategies and linking risk and operational performance.

- ISO 31000. Released in 2009 and revised in 2018, the ISO standard includes a list of ERM principles, a framework to help organizations apply risk management mechanisms to operations, and a process for identifying, evaluating, prioritizing and mitigating risk. The newer ISO version is a «shorter, clearer and more concise document that is easier to read» than its predecessor, according to Cobb. Developed by ISO’s risk management technical committee with input from ISO national member bodies, the 2018 standard includes more strategic guidance on ERM than the original. The new standard also emphasizes the important role of senior management in risk management and the integration of risk management throughout the organization.

- British Standard (BS) 31100. The current version of this risk management code of practice was issued in 2011, and it provides a process for implementing concepts described in ISO 31000 — including functions like identify, assess, respond, report and review.

- The Risk and Insurance Management Society’s Risk Maturity Model (RMM). The RMM framework was updated in April 2022. The revamped RMM framework helps risk professionals assess their programs in five categories: strategy alignment; culture and accountability; risk management capabilities; risk governance; and analytics

Enterprises might also consider establishing frameworks for specific categories of risks. Carnegie Mellon University’s enterprise risk management framework, for example, examines potential risks and opportunities based upon the following risk categories: reputation, life/health safety, financial, mission, operational and compliance/legal.

What are the benefits and challenges of risk management?

Effectively managing risks that could have a negative or positive impact on capital and earnings brings many benefits. It also presents challenges, even for companies with mature GRC strategies.

Benefits of risk management include the following:

- increased awareness of risk across the organization;

- more confidence in organizational objectives and goals because risk is factored into strategy;

- better and more efficient compliance with regulatory and internal compliance mandates because compliance is coordinated;

- improved operational efficiency through more consistent application of risk processes and control;

- improved workplace safety and security for employees and customers; and

- a competitive differentiator in the marketplace.

The following are some of the challenges risk management teams should expect to encounter:

- Expenditures go up initially, as risk management programs can require expensive software and services.

- The increased emphasis on governance also requires business units to invest time and money to comply.

- Reaching consensus on the severity of risk and how to treat it can be a difficult and contentious exercise and sometimes lead to risk analysis paralysis.

- Demonstrating the value of risk management to executives without being able to give them hard numbers is difficult.

How to build and implement a risk management plan

A risk management plan describes how an organization will manage risk. It lays out elements such as the organization’s risk approach, roles and responsibilities of the risk management teams, resources it will use to manage risk, policies and procedures.

ISO 31000’s seven-step process is a useful guide to follow, according to Witte. Here is a rundown of its components:

- Communication and consultation. Since raising risk awareness is an essential part of risk management, risk leaders must also develop a communication plan to convey the organization’s risk policies and procedures to employees and relevant parties. This step sets the tone for risk decisions at every level. The audience includes anyone who has an interest in how the organization takes advantage of positive risks and minimizes negative risk.

- Establishing the context. This step requires defining the organization’s unique risk appetite and risk tolerance — i.e., the amount to which risk can vary from risk appetite. Factors to consider here include business objectives, company culture, regulatory legislation, political environment, etc.

- Risk identification. This step defines the risk scenarios that could have a positive or negative impact on the organization’s ability to conduct business. As noted above, the resulting list should be recorded in a risk register and kept up to date.

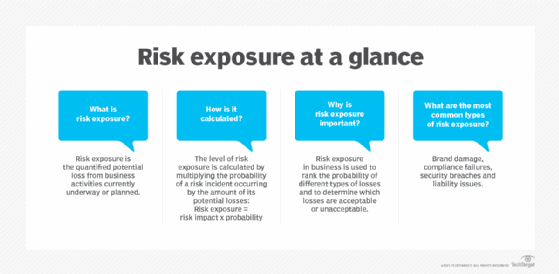

- Risk analysis. The likelihood and impact of each risk is analyzed to help sort risks. Making a risk heat map can be useful here, as it provides a visual representation of the nature and impact of a company’s risks. An employee calling in sick, for example, is a high-probability event that has little or no impact on most companies. An earthquake, depending on location, is an example of a low-probability risk with high impact. The qualitative approach many organizations use to rate the likelihood and impact of risks might benefit from a more quantitative analysis, Witte said. The FAIR Institute, a professional association that promotes the Factor Analysis of Information Risk framework on cybersecurity risks, has examples of the latter approach.

- Risk evaluation. Here is where organizations determine how to respond to the risks they face. Techniques include one or more of the following:

- Risk avoidance: The organization seeks to eliminate, withdraw from or not be involved in the potential risk.

- Risk mitigation: The organization takes actions to limit or optimize a risk.

- Risk sharing or transfer: The organization contracts with a third party (e.g., an insurer) to bear some or all costs of a risk that may or may not occur.

- Risk acceptance: A risk falls within the organization’s risk appetite and tolerance and is accepted without taking action.

- Risk treatment. This step involves applying the agreed-upon controls and processes and confirming they work as planned.

- Monitoring and review. Are the controls working as intended? Can they be improved? Monitoring activities should measure key performance indicators and look for key risk indicators that might trigger a change in strategy.

For more detail on what each step entails, consult Witte’s article on ERM frameworks and their implementation in the enterprise.

Risk management best practices

A good starting point for any organization that aspires to follow risk management best practices is ISO 31000’s 11 principles of risk management. According to ISO, a risk management program should meet the following objectives:

- create value for the organization;

- be an integral part of the overall organizational process;

- factor into the company’s overall decision-making process;

- explicitly address any uncertainty;

- be systematic and structured;

- be based on the best available information;

- be tailored to the project;

- take into account human factors, including potential errors;

- be transparent and all-inclusive;

- be adaptable to change; and

- be continuously monitored and improved upon.

Another best practice for the modern enterprise risk management program is to «digitally reform,» said security consultant Dave Shackleford. This entails using AI and other advanced technologies to automate inefficient and ineffective manual processes.

Risk management limitations and examples of failures

Risk management failures are often chalked up to willful misconduct, gross recklessness or a series of unfortunate events no one could have predicted. But, as technology journalist George Lawton pointed out in his examination of common risk management failures, risk management gone wrong is more often due to avoidable missteps — and run-of-the-mill profit-chasing. Here is a rundown of mistakes to avoid.

Poor governance. The 2020 tangled tale of Citigroup accidentally paying off a $900 million loan, using its own money, to Revlon’s lenders when only a small interest payment was due shows how even the largest bank in the world can mess up risk management — despite having updated policies for pandemic work conditions and multiple controls in place. Human error and clunky software were involved, but ultimately a judge ruled poor governance was the root cause. Citigroup was fined $400 million by U.S. regulators and agreed to overhaul its internal risk management, data governance and compliance controls.

Overemphasis on efficiency vs. resiliency. Greater efficiency can lead to bigger profits when all goes well. Doing things quicker, faster and cheaper by doing them the same way every time, however, can result in a lack of resiliency, as companies found out during the pandemic when supply chains broke down. «When we look at the nature of the world … things change all the time,» said Forrester’s Valente. «So, we have to understand that efficiency is great, but we also have to plan for all of the what-ifs.»

Lack of transparency. The scandal involving the misrepresentation of coronavirus-related deaths at New York nursing homes by the governor’s office is representative of a common failing in risk management. Hiding data, lack of data and siloed data — whether due to acts of commission or omission — can cause transparency issues. As risk expert Josh Tessaro told Lawton, «Many processes and systems were not designed with risk in mind.» Data is disconnected and owned by different leaders. «Risk managers often then settle for the data they have that is easily accessible, ignoring critical processes because the data is hard to get,» Tessaro said.

Limitations of risk analysis techniques. Many risk analysis techniques, such as creating a risk model or simulation, require gathering large amounts of data. Extensive data collection can be expensive and is not guaranteed to be reliable. Furthermore, the use of data in decision-making processes can have poor outcomes if simple indicators are used to reflect complex risk situations. In addition, applying a decision intended for one small aspect of a project to the whole project can lead to inaccurate results.

Lack of risk analysis expertise. Software programs developed to simulate events that might negatively impact a company can be cost-effective, but they also require highly trained personnel to accurately understand the generated results.

Illusion of control. Risk models can give organizations the false belief that they can quantify and regulate every potential risk. This may cause an organization to neglect the possibility of novel or unexpected risks.

Risk management trends: What’s on the horizon?

The spotlight shined on risk management during the COVID-19 pandemic has driven many companies to not only reexamine their risk practices but also to explore new techniques, technologies and processes for managing risk. As Lawton’s reporting on the trends that are reshaping risk management shows, the field is brimming with ideas.

More organizations are adopting a risk maturity framework to evaluate their risk processes and better manage the interconnectedness of threats across the enterprise. They are looking anew at GRC platforms to integrate their risk management activities, manage policies, conduct risk assessments, identify gaps in regulatory compliance and automate internal audits, among other tasks. New GRC features under consideration include the following:

- analytics for geopolitical risks, natural disasters and other events;

- social media monitoring to track changes in brand reputation; and

- security systems to assess the potential impact of breaches and cyber attacks.

In addition to using risk management to avoid bad situations, more companies are looking to formalize how to manage positive risks to add business value.

They are also taking a fresh look at risk appetite statements. Traditionally used as a means to communicate with employees, investors and regulators, risk appetite statements are starting to be used more dynamically, replacing «check the box» compliance exercises with a more nuanced approach to risk scenarios. The caveat? A poorly worded risk appetite statement could hem in a company or be misinterpreted by regulators as condoning unacceptable risks.

Finally, while it’s tough to make predictions — especially about the future, as the adage goes — tools for measuring and mitigating risks are getting better. Among the improvements? Internal and external sensing tools that detect trending and emerging risks.

This was last updated in January 2023

Before learning about risk management, first, we should know what the risk is. From the small stores to the large manufacturers, there are common challenges with insurance, claims, and risk in every business. Fire can damage buildings, someone could slip and fall, vehicle accidents often take place, or losses can occur because of defective products.

Risk is integral from return. Every investment contains some risk, which is close to zero with a U.S. T-bill or very high for something such as emerging-market equities or real estate in highly inflationary markets. Risk is significant both in absolute and relative terms. A solid sense of risk in its different forms can help investors to better figure out the opportunities, trade-offs, and costs associated with different investment approaches.

What you are going to learn?

Risk management is the process of identifying, evaluating, and prioritizing risks followed by integrated and economical application of resources to reduce, observe, and control the probability or impact of unfortunate events or to maximize the realization of opportunities.

Importance Of Risk Management

To highlight the importance of risk, here are some reasons all employees should care about risk management.

1. Everyone Should Manage Risk

As most business people know well, sometimes the risk is necessary in order to achieve success. Despite this, we sometimes see risk management as “the department of no” — those who turn down any project plan that seems to have any potential risk. The purpose of risk management is not to wipe out all risks. It is to decrease the negative consequence of risks. By working with risk managers, employees can make smart decisions to prevent risks and improve the chance of being rewarded.

2. Makes Jobs Safer

Health and safety are integral parts of a risk manager’s role. They actively seek problem areas in the organization and look to identify them. They use data analysis to identify damage and injury trends and implement strategies to stop them from occurring again. This benefits employees in physical work environments, such as construction, but can also benefit office employees. A safer workplace is better for everyone and is impacted by risk management dramatically.

3. Enables Project Success

Risk managers help employees from all departments succeed with their projects. Just they have to evaluate risks and implement strategies to maximize organizational success. It can also apply to individual projects. If something goes wrong, there will already be a strategy in place to handle it. This encourages employees to prepare for unexpected risks and maximize project output.

4. Reduces Unexpected Events

Most people don’t like surprises, specifically when it has an organizational impact A risk manager’s goal is to find out all possible risks and then work to prevent them or best manage them. It’s impossible to figure out every risk scenario and address them all, but a risk manager makes unpleasant surprises less likely and serious. The risk management department should first place an employee turns to when it seems like something serious could go wrong and the risk management plan is already there for it.

5. Saves Time and Effort

Employees at all levels submit data to the risk management department when incidents occur. These tasks are often completed in the most inefficient ways. By integrating these tasks, the risk department can ease the burden of tedious data submission from employees, allowing them to direct time and energy towards their correct roles. With a solid process in place, it is easy for employees to agree to high ROI risk management initiatives and facilitate risk managers’ roles and receive the benefits of a formal risk management system.

6. Benefits Culture

An effective risk management culture is better for all parties, including frontline employees, risk managers, executives, and decision-makers. It makes a mindset of prevention and safety that passes through the organization and influences the actions of employees. It predicts possibilities for performance and sends a positive image to the public.

7. Guides Decision-Making

Decision-making is a difficult process, especially when making important choices that will have a large impact on future progress. Risk management data and analytics can guide employees in making wise strategic decisions that will help to fulfil organizational objectives. They can also evaluate the strengths and the weaknesses of a decision and provide recommendations on what risks to maintain and which to avoid.

Risk Management Process

There are five necessary steps that are taken to manage risk; these steps are considered as the risk management process. It begins with identifying risks, evaluates risks, then the risk is prioritized, a solution is implemented, and finally, the risk is controlled.

1. Identify the Risk

The first step of risk management is to identify the risks that the business is discovered to in its operating environment. There are many types of risks, including legal risks, environmental risks, market risks, regulatory risks, and much more. It is important to identify as many of these risk factors as possible. In a manual management environment, these risks are written down manually.

If the organization has employed a risk management solution, all this information is included directly in the system. The advantage of this strategy is that these risks are now transparent to every stakeholder in the organization with access to the system. Rather than this crucial information being locked away in a report which has to be requested via email, anyone who wants to see which risks have been found can access the information in the risk management system.

2. Analyze The Risk

Once your team identifies potential problems, it’s time to go a little deeper. How likely are these risks to take place? And if they take place, what will the consequences be?

During this step, your team will examine the probability and fallout of each risk to choose where to focus first. Factors such as possible financial loss to the organization, time lost, and severity of impact all play a part in precisely analyzing each risk. By placing each risk under the microscope, you’ll also expose any common issues across a project and further improve the risk management process for future projects.

3. Prioritize the Risk

After analyzing the risks, prioritization begins. Rank each risk by factoring in both its possibility of happening and its potential impact on the project.

This step gives you a comprehensive view of the project at hand and pinpoints where the team’s focus should lie. It’ll help you identify useful solutions for each risk. This way, the project itself is not interrupted in ways during the treatment stage.

4. Treat the Risk

After prioritizing the risks, dispatch your treatment plan. While you can’t expect every risk, you should have set up the previous steps for the success of your risk management process. Starting with the highest priority risk first, task your team with either solving or at least reducing the risk so that it’s no longer a risk to the project.

Effectively treating and moderating the risk also means using your team’s resources properly without hindering the project in the meantime. As time goes on and you develop a larger database of past projects and their risk logs, you can expect potential risks for a more proactive rather than reactive approach for more efficient treatment.

5. Monitor the Risk

Transparent communication among your team and stakeholders is crucial for the ongoing monitoring of potential threats. And while it may seem you’re herding cats sometimes, with your risk management process and its corresponding project risk register in place, putting tabs on those moving targets becomes anything but risky business.

Risk Management PDF

Risk Management Approaches

After the company’s exact risks are found and the risk management process has been applied, there are several strategies companies can take regarding different types of risk:

1. Risk Avoidance

While the complete elimination of all risks is hardly possible, a risk prevention strategy is planned to deflect as many threats as possible in order to avoid the costly and disruptive effects of a damaging event.

2. Risk Reduction

Sometimes companies can reduce the amount of damage certain risks can have on company processes. This is done by adjusting particular aspects of an overall project plan or organizational process, or by scaling down its scope.

3. Risk Sharing

Sometimes, the effects of risk are shared or distributed among several of the project’s members or business departments. The risk could also be shared with a third party, such as a dealer or business associate.

4. Risk Retaining

Sometimes, companies decide a risk is worth it from a business point of view, and decide to keep the risk and deal with any possible side effects. Companies will often keep a certain level of risk if a project’s expected profit is greater than the costs of its probable risk.

Types Of Risk Management

Business Risk

Business enterprises take these types of risks themselves in order to increase shareholder values and profits. For example, companies offer high-cost risks in marketing to introduce a new product in order to gain higher sales.

Non- Business Risk

Non-business risks are not under the control of firms. We can term risks that originate out of political and economic imbalances as non-business risks.

Financial Risk

Financial Risk as the term refers to the risk that includes a financial loss to the firms. Financial risk arises because of instability and losses in the financial market caused by movements in stock prices, currencies, interest rates, and more.

Limitations of Risk Management

- Using data in decision-making processes may have poor results if simple indicators are used to reflect the much more complex realities of the situation.

- Adopting a decision throughout the entire project that was intended for one minor aspect can lead to unexpected results.

- Lack of analysis, expertise, and time.

- Computer software programs have been built up to simulate events that might have a negative impact on the company.

- Analyzing past data to identify risks requires highly trained people. These individuals may not always be elected to the project.

- Value-at-risk efforts focus on the past instead of the future. Therefore, the longer things go effortlessly, the better the situation looks. Sadly, it creates a downturn more likely.

- Risk models can provide organizations with the false belief that they can assess and regulate every possible risk. This may cause an organization to ignore the possibility of novel or unpredictable risks.

- An organization’s risk management policies are insufficient and lack the history to make proper evaluations.

Key Takeaways

- Risk management is identifying, evaluating, and prioritizing risks followed by integrated and economical application of resources to reduce, observe, and deal with the probability or impact of unfortunate events or to maximize the realization of opportunities.

- It creates a safe work environment, increases the ability of business operations, decreasing legal liabilities, provides protection from threats, helps establish the organization.

- The risk management process involves 5 steps- Identifying risks, evaluating risks, prioritize the risks, treat the risks, monitor risks.

- Some risk management approaches are -risk avoidance, risk reduction, risk sharing, risk retaining.

- Some Limitations of the risk management process are- the false sense of stability, the illusion of control, failure to see the big picture, immatureness.

Terms Related to Risk Management

Total Quality Management

The term ‘total’ represents the entire organization—all parties, departments, and functions that are involved in quality management. The system refers to the managerial and technological approaches to get quality requirements and business objectives throughout an entire organization. Read more>>>

Change Management

Change management is the systematic technique that deals with the transition or transformation of different organizational objectives, core values, processes, or technologies. Read More>>>

Stakeholders

A stakeholder is a party that has an effect on a company and can either affect or be affected by the organization. The primary stakeholders in a typical company are its investors, employees, consumers, and suppliers. However, with the increasing attention on mutual social responsibility, the perception has been developed to include people, governments, and trade unions. Read more>>>

Resource Management

In the last few decades, resource management has become a very decisive part of modern business structure. This section is mature. An array of novel ideas has been brought in ever since it started growing. Resource management has developed as an independent discipline after organizations became complex with matrix structure and expanded in multiple geographies. Read More>>>

Risks are the unforeseen events that may have positive or negative effects on a project’s goals. These events may originate from various types of resources such as financial errors, poor management, security threats, accidents, and severe climatic conditions. Many people think that risks have always negative effects to a project’s goal. However, during a project’s life, some positive risks which have positive effects on a project may occur. Risk management practices involve identification, assessment, and prioritization of risks throughout a project’s life cycle. This article reviews common Risk Management Terms for conducting an efficient Risk Management Process.

Basic Steps of the Risk Management Process

Risk is a part of every task and delivery within a project. Project management team members usually start establishing a risk management process by analyzing the things that may go wrong. Because problems may inevitably arise from unexpected origins. In order to establish an effective risk management strategy, some basic steps must be followed.

The PMBOK Guide recommends below six processes for an effective risk management

- Planning

- Identification

- Analysis (Qualitative and Quantitative)

- Response Planning

- Monitoring and Controlling

A Short Definition of Risk Management Terms

There are several terms used to describe various steps of risk management. Sometimes professionals may confuse these terms. Below are some of the widely used risk management terms.

- Issue

Issue is a risk that has already happened. In other words, a risk is an event that has the potential to cause loss. On the other hand, issue is a current problem.

- Issue Management

Issue management is the practice of coping with current problems. Problem-solving and decision making are common techniques for issue management. However, risk management strategies (Acceptance, Avoidance, Reduction, Transfer, Sharing) are different than issue management strategies.

- Known Risks

Known risks are the risks that can be identified and analyzed before their occurrence. For example one of your project’s main subcontractor terminated the agreement with you during a critical phase of the project. You analyzed this risk before it’s occurrence and bring another certified subcontractor for the same task quickly.

The contingency reserve is added to the project’s budget to manage known risks.

- Unknown Risks

Unknown risks are the risks that cannot be identified and analyzed before their occurrence. A risk response planning is not possible to manage this kind of risks proactively. For example, you are building a dam project and during the execution of social events occurred. Management reserve is added to the project’s budget to manage unknown risks.

- Negative Risks

Negative Risk is one of the most common risk management terms. Negative risks are threats that have negative impacts on the project’s goals. Negative risks may cause time loss, money loss, stakeholder and customer dissatisfaction. To manage negative risks efficiently removes or minimizes their negative impacts.

For example, a machine malfunction may slow down your productivity. If it happens you cannot complete the tasks on time.

- Positive Risks

Positive risks are the desired events or opportunities that have positive impacts on the project’s objectives. Project manager and stakeholders get satisfied in case of their occurrence. Increasing their probability of occurrence is a good risk response strategy.

For example, your company is conducting a healthcare project. The client will pay a bonus in case of early delivery. If it happens, your planned profit rate for this project will increase.

- Residual Risk

Residual risks are the risks or danger that remain after implementing a risk response plan. It is difficult to remove the risk completely so that the remained risk is deliberately accepted.

For example, a transportation company reduces the risk of an accident by improving maintenance. However, a residual risk remains due to the driver’s fault.

- Risk

Risk is an unforeseen or uncertain event and if it occurs, it will cause positive or negative impacts on the project’s objectives.

- Risk Management

Risk management is a process of understanding and managing project risks in a proactive manner. Risk management involves strategies such as Acceptance, Avoidance, Reduction, Transfer, and Sharing.

- Risk Owner

Risk Owner is one of the most important risk management terms. A risk owner is a person who manages monitors and controls the identified risks within a project. Also, he is responsible for the implementation of risk response strategies.

In small and less complex projects, risk owner and the risk action owner can be the same person. In large and sophisticated projects, risk owner and the risk action owner are usually different.

- Risk Threshold

Risk threshold is the amount of risk which an organization could accept. For example, a company has a policy that if risk increases project’s direct costs not more than 5% is acceptable. However, a percentage of more than 5% is not a value that the company is willing to accept.

- Risk Tolerance

Risk tolerance is the degree of risk that an organization can accept (or absorb).

- Risk Trigger

A risk trigger is something that stimulates a risk to arise. For example, poor maintenance is a risk trigger for machine malfunctions.

- Secondary Risk

A secondary risk is a new risk that is occurred as a result of risk treatments.

Summary

There are various terms used to describe concepts related to risk management.

“The best way to manage risk is to attempt to spot it and plan accordingly before it happens”, according to David Rowland, head of marketing at Engage EHS. This is why risk assessment is now so important to a business. With early and proper risk management, you can make plans, spot potential risks, and then do everything you can to minimize their impact.

Understanding each risk management term helps to improve risk management processes within the organization. Effective risk management practices are helpful to determine a project’s strengths, weaknesses, opportunities, and threats. In order to ensure your project’s success, plan how you will handle potential risks so you can determine and mitigate problems. For successful project management, risk management is critical, because most of the time risks trigger severe losses. In this article, we review common risk management terms , if you want to add or share anything regarding the subject, please use the comments section.

Francois Simosa is the head of training for the Gragados Training Associates, which provides special project management and risk management training programs.

Tags: risk management keywords Risk Management process Risk Management terms

You can use this Risk Management Plan to identify, evaluate and prioritize risks during the software development lifecycle.

Use this template to:

- Identify and understand the risks to which your project is exposed.

- Create an effective plan to prevent losses or reduce impact.

- Prioritize risks and take the appropriate actions to reduce losses.

- Protect the reputation and public image of your organization.

- Reduce legal liability and increase the stability of operations.

Download Now

Risk Managers uses this information to prepare mitigation actions and contingency plans in order to counteract the potential impacts these risk may have on the project’s success.

Here’s are five steps to help you build your Risk Management Plan.

1. Risk Identification – the Risk Manager conducts risk identification meetings and uses the Risk Identification report and questionnaire to assist with initial identification of risks.

2. Risk Analysis – this involves categorizing risks, impact analysis, risk reviews, risk acceptance and updating the Risk Log.

3. Risk Response Planning – next plan mitigation activities, contingency activities, and review the risk action plans.

4. Risk Plan Implementation – once these are established, monitor trigger events, execute the action plan, and update the Risk Log.

5. Risk Tracking, Monitoring & Control – this stages concerns how the risk is progressing, as well as mitigation/contingency strategies that have been executed. When changes to the risk occur, repeat the cycle of identify, analyze, and plan.

Risk Management Plan Template: Blue Theme

This Risk Management plan is updated and expanded throughout the development life-cycle as the project increases in complexity and risks become more defined. The Risk Management Plan is part of the System Concept Development Phase in the Software Development Life Cycle (SDLC).

The following screenshots are of the Red Theme. The contents of this file are the same as the Blue theme.

Download Now for only $9.95

5 Free Excel Risk Management Plan Templates

Risk Management Plan Template: Table of Contents

1 Introduction

1.1 Purpose

1.2 Background

1.3 Scope

1.3.1 Assumptions

1.3.2 Constraints

1.4 Policy

1.5 Risk Management Approach

2 Risk Identification

2.1 Conducting Formal Risk Identification Reviews

2.2 Conducting Informal Risk Identification

2.3 Documenting Risks

2.4 Validating Risks

3 Risks Analysis

3.1 Categorize Risk

3.2 Impact Analysis

3.3 Review Risk v Risk Tolerances

3.4 Review Risk Analysis and Ranking

3.5 Risk Acceptance

3.6 Update Risk Log

4 Risk Response Planning

4.1 Plan Mitigation Activities

4.2 Plan Contingency Activities

4.3 Review Risk Action Plans

4.4 Update Risk Log

5 Risk Plan Implementation

5.1 Monitoring Trigger Events

5.2 Executing Action Plan

5.3 Updating the Risk Log

6 Risk Tracking, Monitoring & Control

6.1 Reporting Risk Status

6.2 Reviewing Changes to Risk Profiles and Action Plans

6.3 Retiring Risks

7 Risk Management Milestones

8 Risk Communications

8.1 Status Meetings

8.2 Lessons Learned

8.3 Escalate Risks

9 Roles and Responsibilities

9.1 Project Office

9.2 Project Sponsor

9.3 Other Participants

10 Contractor’s Role in Risk Management

10.1 Contractor Risk Management Plan

10.2 Contractor Participation in Risk Management

11 Budget

12 Tools, Techniques & Reports

12.1 Risk Management Software

12.2 Risk Management Reports

13 Glossary of Terms

Product Contents & Format

The template pack includes the following documents:

| 2 x Risk Management Plan templates | 24 pages | |

| Risk Assessment Checklist | 1 x worksheet | |

| Risk Assessment Questionnaire | 1 x worksheet | |

| Risk Log | 1 x worksheet | |

| Risk Register | 1 x worksheet | |

| Risk Response Plan | 1 x worksheet |

Download Now

Product Specifications

File Format: The templates are in Microsoft Word (.docx) and Microsoft Excel (.xlsx) format.

Opening the Files: You don’t need any special software to unzip the files. To unzip the files, right click on it, then select Extract, and save it to your computer.

Getting Started: Depending on your MS Office settings, the files may say Read Only when you open them. If this occurs, click File, Save As and save the files. There are no security settings on any of the files.

Images: All of the images in the templates are copyright free.