Договор предусматривал оплату аккредитивом в установленный срок.

Оплата остальной части контрактной стоимости должна была производиться с аккредитива.

The payment terms for the agreements, with the exception

of

the contract for the North Jazira

В соответствии

с

условиями контрактов, за исключением контракта в отношении ирригационного проекта в Северной Джезире,

All pledged but still outstanding contributions, including contributions by letter of credit, were not incorporated in the calculation above,

as income resulting from contributions is recorded on a cash basis

of

accounting.

Все объявленные, но еще не выплаченные взносы, включая взносы через аккредитив, в приводимые выше расчеты не включены,

поскольку поступления по линии взносов учитываются на кассовой основе.

The latter reference, to other undertakings, clarifies the independent nature

of

a counter-guaran tee from the guarantee that it relates to and

a confirmation from the stand by letter of credit or independent guarantee that it confirms.

Последняя ссылка на другие обязательства уточняет независимый характер контргарантий от гаран тии, к которой она относится,

а также подтверждения от резервного аккредитива или независимой гарантии, которую оно подтверждает.

Represented the Client in the dispute with a bank(top-10)

regarding compensation

of

losses related to the theft

of

money by letter of credit; Andrey was able to prove

that the bank’s actions aimed at preventing the crime were insufficient and that the

letter of credit

and the underlying contract were legally interconnected;

Представление интересов Клиента в споре

с

банком(

топ- 10) о возмещении убытков, связанных

с

хищением денег с аккредитива, в процессе удалось доказать недостаточность действий банка,

направленных на предотвращение преступления, а также соотносимость условий правоотношений по

аккредитиву

и договора, который им оплачивается;

В целом в финансовой схеме используются аккредитивы открытые.

Furthermore, the deference

of

the Convention

to the specific terms

of

independent guarantees and stand by letters of credit, including any rules

of

practice incorporated therein,

enables the Convention to work in tandem with rules

of

practice such as UCP and URDG.

Кроме того, тот факт, что

в Конвенции непосредственно рассматриваются конкретные условия независимых гарантий и резервного аккредитива, включая любые относящиеся к ним практические правила,

позволяет использовать ее вместе с такими практическими правилами, как УПО и УПГТ.

With respect to shipments

of

goods covered by letters of credit, notice to the banker was essential.

Что касается погрузки груза, на который распространяются аккредитивы, крайне важным является уведомление банкира.

The remaining obligations related to approved and funded contracts earlier concluded

by

the previous Government

of

Iraq and

Сохраняющиеся обязательства относились к утвержденным и профинансированным контрактам, которые были заключены ранее с предыдущим правительством Ирака и

In accordance with paragraph 10

of

resolution 986(1995), until proceeds from the sale

of

petroleum and petroleum products are deposited into the Iraq account, the Committee may approve, on a case-by-case basis,

the exceptional financing

of

the export

of

parts and equipment by letters of credit drawn against future oil sales.

В соответствии с пунктом 10 резолюции 986( 1995) до тех пор, пока средства от продажи нефти и нефтепродуктов не поступят на иракский счет, Комитет может в виде исключения разрешить в

каждом конкретном случае финансирование экспортных поставок запасных частей и оборудования аккредитивами, открытыми в счет будущих продаж нефти.

The form should be accompanied

by

all

relevant supporting documentation required for payment by the letter of credit.

К этой форме должна прилагаться вся

соответствующая подтверждающая документация, необходимая для оплаты по аккредитиву.

Under the contract, the delivery was to have been under f.o.b. stowed conditions at a named port

of

destination,

Согласно договору поставка должны была осуществляться на условиях FOB

stowed конкретный порт

с

оплатой товара с аккредитива, открываемого покупателем.

However, the Advising Bank may accept an undertaking

by

confirming the Letter of Credit.

Однако, Авизующий банк может взять на себя обязательство, подтверждая аккредитив.

Advanced

by

T/T(Telegraphic Transfer)

to our bank account and 70%

by

at sight confirmed Letter of Credit

by

any first class bank.

Выдвинулись T/ T( телеграфным

переходом) к нашему счету в банк и 70% в виде подтверженным кредитным письмом любым банком первого класса.

Payment under the counter-export letter of credit, which is funded

by

the export

letter of credit,

is effected upon presentation

of

the required documents

by

the counter-exporter.

Платеж по встречному экспортному аккредитиву, который финансируется за счет экспортного аккредитива, осуществляется по представлении встречным экспортером необходимых документов.

Cover for the counter-export

letter of credit

is obtained from the proceeds

of

the letter of credit opened

by

the importer for the benefit

of

the exporter export letter of credit.

Покрытие встречного экспортного аккредитива обеспечивается за счет поступлений по аккредитиву, открытому импортером в пользу экспортера экспортному аккредитиву.

The Panel considers that where goods have been shipped to Kuwait and

Группа считает, что в тех случаях,

когда товары были отгружены в Кувейт с оплатой на условиях аккредитива, заявитель имеет потенциальное право требования как по аккредитиву, так и по контракту.

confirming the letter of credit, the seller’s bank undertakes to pay to the seller in addition to the issuing bank’s obligations defined

by

the letter of credit.

Подтверждая аккредитив, банк продавца принимает на себя платежное обязательство перед продавцом, дополнительно к обязательству банка- эмитента по аккредитиву.

Когда используются перекрестные аккредитивы, средства, подлежащие выплате по аккредитиву, открытому импортером в пользу экспортера(» экспортный аккредитив«), блокируются для покрытия аккредитива, открытого встречным импортером в пользу встречного экспортера(» встречный экспортный аккредитив«) пункты 31- 37.

In relation to such contracts financed

by

letters of credit, the Panel required evidence

of

presentation

of

the documents

required under a

letter of credit

in accordance with its terms for the reasons set out in paragraph 61 below.

В связи с такими контрактами, финансировавшимися через аккредитивы, Группа запросила доказательства представления документации,

требуемой по условиям

аккредитива(

по причинам, изложенным в пункте 61 ниже) 7.

The Panel notes that the»E2A» Panel has previously dealt with claims for goods delivered but not paid in relation to

Группа отмечает, что ранее Группа» Е2А» рассматривала претензии по поставленным, но неоплаченным товарам в связи

с

договорами купли- продажи,

заключенными

с

иракскими юридическими лицами, которые финансировались с помощью аккредитивов.

A commercial contract is signed on conditions

of

payment

by

the transferable

letter

of credit.

Заключается контракт на условиях расчетов пререводным аккредитивом.

In relation to such contracts secured

by letters of credit,

the Panel required evidence

of

presentation

of

the documents required under the

letter

of credit in accordance with its terms for the reason set out in paragraph 52 below.

В связи с такими контрактами, обеспечивавшимися с помощью

аккредитивов,

Группа затребовала представить документацию, требуемую по условиям конкретного аккредитива

по

причинам, изложенным в пункте 52 ниже.

The tribunal determined that, under the contract,

payment for goods supplied was effected

by

a

letter

of credit and that the goods had been transferred to the buyer.

Суд установил, что

согласно заключенному сторонами договору расчеты за поставленный товар производились с выставлением ответчиком аккредитива и что товар был передан ответчику.

To avoid the problems caused

by letters

of credit, mechanisms of credit insurance or L/C confirmation can be envisaged.

Чтобы избежать проблем, связанных с использованием аккредитивов, можно предусмотреть механизмы страхования кредитов или подтверждения

аккредитивов.

The mortgage loans granted

by

loan companies to persons

receiving housing subsidy are funded

by letters

of credit giving entitlement to the above-mentioned indirect subsidy and,

according to the amount, to the above-mentioned

credit

guarantee.

Ипотечные кредиты, предоставляемые кредитными учреждениями бенефициарам жилищной субсидии, финансируются кредитными векселями, дающими право на вышеупомянутую косвенную субсидию и, в зависимости от их размера,- на упоминавшуюся также кредитную гарантию.

The contract provided for payment

by letter

of

credit

L/C.

Договор предусматривал оплату по аккредитиву.

На основании Вашего запроса эти примеры могут содержать грубую лексику.

На основании Вашего запроса эти примеры могут содержать разговорную лексику.

посредством аккредитива

по аккредитиву

помощью аккредитива

The buyer was requested to make payment by letter of credit.

Покупателю было предложено произвести платеж аккредитивом.

The B/L is a critical document for payments settled by letter of credit.

B/L является критически важным документом для платежей, оплачиваемых аккредитивом.

Money can also be transferred by letter of credit.

When a client from overseas buys fertiliser at an agreed volume and price, they have to provide proof of funds, normally by letter of credit or make an up-front payment.

Когда клиенты из-за рубежа покупают удобрение в согласованном объеме и по согласованной цене, они должны предоставлять доказательство средств, как правило, посредством аккредитива или осуществления авансового платежа.

The contract provided for payment by Letter of Credit, and shipment by 10 December 1995.

Договор предусматривал оплату товара аккредитивом и доставку груза к 10 декабря 1995 года.

Payment of the balance of the contract value was to be by letter of credit.

Оплата остальной части контрактной стоимости должна была производиться с аккредитива.

Payment was to be made by letter of credit.

Since payment is by letter of credit, all documents required by banks for the issuance or securing of a letter of credit are also taken into account.

Поскольку платеж осуществляется аккредитивом, также принимаются во внимание все документы, требуемые банками для выставления или обеспечения аккредитива.

The payment terms for the agreements, with the exception of the contract for the North Jazira Irrigation Project, were by letter of credit.

В соответствии с условиями контрактов, за исключением контракта в отношении ирригационного проекта в Северной Джезире, платеж должен был осуществляться с помощью аккредитива.

The terms of payment (i.e., by letter of credit) and the deadlines for payment were agreed upon contractually on the evening of 19 December 1990.

Условия (аккредитив) и срок оплаты были так же установлены в договоре вечером 19 декабря 1990г.

(a) All pledged but still outstanding contributions, including contributions by letter of credit, were not incorporated in the calculation above, as income resulting from contributions is recorded on a cash basis of accounting.

а) все объявленные, но еще не выплаченные взносы, включая взносы через аккредитив, в приводимые выше расчеты не включены, поскольку поступления по линии взносов учитываются на кассовой основе.

A letter of credit is opened with the intention of using it, that is, a payment by letter of credit — a phenomenon that occurs in the normal course of events (method of payment).

аккредитив открывается с намерением его использования, т. е. платеж по аккредитиву — явление, имеющее место при нормальном течении обстоятельств (метод платежа).

It should be pointed out that as the interest charged by Letter of Credit programmes is substantially lower than market rates, these programmes provide a not negligible direct subsidy.

В силу того, что процент, взимаемый по программам аккредитивов, значительно ниже рыночных процентов, эти программы превращаются в довольно существенную прямую субсидию.

The Stand By Letter of Credit is applied when the customer fails to fulfill his obligations, which are specified in the agreement, and a simple letter of credit is characterized by payment only with a thorough check of all documentation on the shipment and delivery of goods

резервный аккредитив Соединенных Штатах Америки применяется, когда заказчик не выполняет свои обязательства, которые прописываются в договоренности, а простой аккредитив характеризуется платежом лишь при доскональной проверке всей документации по отгрузке и поставке товара

Importer may be able to negotiate more favourable trade terms with the Exporter when payment by Letter of Credit is offered.

Импортер способен выторговать наиболее благоприятные усмловия торговли у экспортера, в случае предложения оплаты при посредстве аккредитива.

It is normally used in situations where a supplier sells through an intermediary or ‘middleman’ to the ultimate Importer and is in a strong enough bargaining position to insist upon payment by Letter of Credit.

Он обычно используется в ситуации, когда поставщик через посредников продает импортеру и находится в достаточно сильной позиции, чтобы на переговорах настаивать на оплате по аккредитиву.

A French buyer entered into a contract with a Chinese seller for the purchase of Lindane providing for payment by Letter of Credit («L/C»).

Покупатель из Франции и продавец из Китая заключили договор на поставку линдана, предусматривавший оплату товара по аккредитиву.

Previously the banks had to apply settlement of accounts by letter of credit only in cases when the amount of a payment exceeds USD 500000,00.

Ранее банки должны были использовать исключительно аккредитивную форму расчетов, если сумма платежа превышала $500 тыс.

It was agreed that the method of payment would be by letter of credit (L/C).

Согласно договоренности, оплату товара надлежало произвести по аккредитиву.

The contracts, concluded through the agent of the seller, concerned the delivery of wool and required payment by letter of credit («L/C») issued by the buyer 180 days from the bill of lading (B/L).

Договоры, заключенные через агента продавца, касались поставки шерсти и предусматривали оплату с помощью аккредитива, который покупатель должен был выставить через 180 дней после получения коносамента.

Результатов: 23. Точных совпадений: 23. Затраченное время: 89 мс

Documents

Корпоративные решения

Спряжение

Синонимы

Корректор

Справка и о нас

Индекс слова: 1-300, 301-600, 601-900

Индекс выражения: 1-400, 401-800, 801-1200

Индекс фразы: 1-400, 401-800, 801-1200

- stand-by letter of credit

-

SLC, SBLC

банк.

резервный [гарантийный, стэнд-бай] аккредитив

See:

* * *

резервный (гарантийный) аккредитив: забалансовое обязательство банка, гарантирующее чужие обязательства или используемое для повышения кредитоспособности клиента; под такие аккредитивы требуется 100-процентное резервирование средств;

1) форма поддержки заимствований, при которой корпорация просит свой банк открыть аккредитив в пользу другого банка, предоставляющего ей резервный кредит, в качестве обеспечения;

2) аккредитив, с помощью которого банк гарантирует выполнение обязательств своего клиента;

= .* * *

резервный аккредитив

Англо-русский экономический словарь.

Смотреть что такое «stand-by letter of credit» в других словарях:

-

Stand-by Letter of Credit — Stand by Akkreditiv. 1. Begriff und Merkmale: Der St.L.o.C. ist seinem Rechtscharakter nach ein ⇡ Akkreditiv und umfasst ein Zahlungsversprechen (Schuldversprechen) der akkreditiveröffnenden Bank. Die Besonderheit von St.L.o.C. liegt darin, dass… … Lexikon der Economics

-

letter of credit — letter of credit: a document issued to a beneficiary at the request of the issuer s customer in which the issuer (as a bank) promises to honor a demand for payment by the beneficiary in order to satisfy or secure the customer s debt compare… … Law dictionary

-

Stand-by letter — Se ha propuesto fusionar este artículo o sección con Boleta bancaria de garantía, pero otros wikipedistas no están de acuerdo. Por favor, lee la página de discusión de ambos artículos y aporta tus razones antes de proceder en uno u otro sentido.… … Wikipedia Español

-

Stand-by-Akkreditiv — ⇡ Stand by Letter of Credit … Lexikon der Economics

-

Stand by Me (film) — Stand by Me Theatrical release poster Directed by Rob Reiner Produced by Br … Wikipedia

-

Social Credit Party of Canada — Parti Crédit social du Canada Former federal party Founded 1935 ( … Wikipedia

-

X-Men: The Last Stand — Theatrical release poster … Wikipedia

-

Collaterals — Assets pledged by a borrower that will be given up if the loan is not paid. Collateral is normally classified in order to simplify risk management and reporting. Collateral categories are groups of logically related collateral. E.g. Pledged… … International financial encyclopaedia

-

Akkreditiv — 1. Charakterisierung: a) Begriff: Der Ausdruck A. bedeutet eine Verpflichtung einer Bank (eröffnende Bank, Akkreditivbank) im Auftrag und nach Weisung eines Kunden (Akkreditivauftraggeber; z.B. ein Importeur) gegen Übergabe vorgeschriebener… … Lexikon der Economics

-

Аккредитив Гарантийный — англ. stand by letter of credit вид аккредитива, обычно используемый для увеличения кредитоспособности клиента, в пользу экспортера и как гарантия контракта в качестве обеспечения платежей. Используется также в качестве дополнительного… … Словарь бизнес-терминов

-

Резервный аккредитив — документарный аккредитив, который может использоваться бенефициаром только в случае неисполнения обязательств по сделке, к которой он относится. Резервные аккредитивы регулируются положениями правил ISP98 (International Standby Practice).… … Финансовый словарь

Oct 23, 2020 — 05:50 PMAuthor — Emerio Banque

Being a global trader, you may have come across the term “Letter of credit” but you wonder what it is, how it works, and why do global traders need it? This Letter of credit guide can help you get your answers.

What Is A Letter Of Credit?

Also known as “Payment Guarantee Letter”, “Credit Letter”, or “Documentary Credit Letter”, an international Letter of Credit is issued by a bank or financial institution as a legal document guaranteeing an on-time buyer’s payment to the seller in a global trade deal. In the event, if the buyer defaults ie. is unable to pay or perform the T&C of the contract, the issuing bank will reimburse the full or the remaining amount on behalf of the buyer.

What Is The Need For Applying For A Payment Guarantee Letter?

International trade deals are often influenced by various overseas factors such as distance, countries differing in-laws, and lack of familiarity of parties to the contract, etc., making them a little bit risky for global importers & exporters. The importers are not willing to pay the exporters until the goods are shipped from foreign ports to their destination while the exporters demand payment as the shipment takes place to further avoid their risk of non-performance.

This LC guide will help you know how a letter of credit in international trade works as an appropriate, suitable & reliable payment mechanism for global traders. The issuing bank, on behalf of its customer ie. the buyer/importer, assures sellers/exporters that they will get the payment for their rendered services in international trade.

The buyers are assured that the sellers will be paid after presenting shipment documents while the sellers have peace of mind of getting payment, regardless of the buyer’s capability to pay or perform, as the trade deal is backed by the issuance of a LOC.

Also known as “Payment Credit Letter”, an LC can be used for both import & export business with the main purpose of facilitating legally backed assurance to both the buyer & seller of the fulfillment of contractual obligations in global trade transactions. First, the seller’s obligation to deliver the ordered goods as mentioned in the LC agreement, and secondly, the buyer’s obligation to pay for the delivered goods within the predetermined period.

Features of Letters of Credit:

1. One of the most prominent features of a payment guarantee letter is that the issuing bank is entitled to make the payment solely based on the document presented. They are not responsible for authenticating the shipping of the goods physically.

2. Letters of credit are also known as a documentary credit, and the bank charges a certain fee depending on the type of bank credit letter.

3. The issuing bank can deny the payment of bank credit letters if they observe any type of mistake in the buyer’s name, product name, shipping date, etc.

4. Documentary credit letters are issued against collateral that may include the buyer’s fixed deposit or bank deposit etc.

Importance of Letters of Credit

Letter of Credit plays a vital role in global trade transactions. It ensures beneficiaries that they will be paid on time for their rendered services regardless of the buyer’s capacity. A documentary credit letter allows sellers to mitigate the risk of payment failure for delivered goods as the risk is shifted to the issuing bank.

Seller Protection — If a buyer defaults or shows his inability to pay a seller on time due to any circumstances, the seller can approach the issuing bank. As the bank verifies the seller’s fulfillment of all the requirements mentioned in the agreement, it releases the payment.

Buyer Protection — Documentary credit letters also protect buyers. If the buyer has paid a seller to provide a particular product or service and the seller fails to deliver, the buyer is authorized to get the payment using a Standby LC.

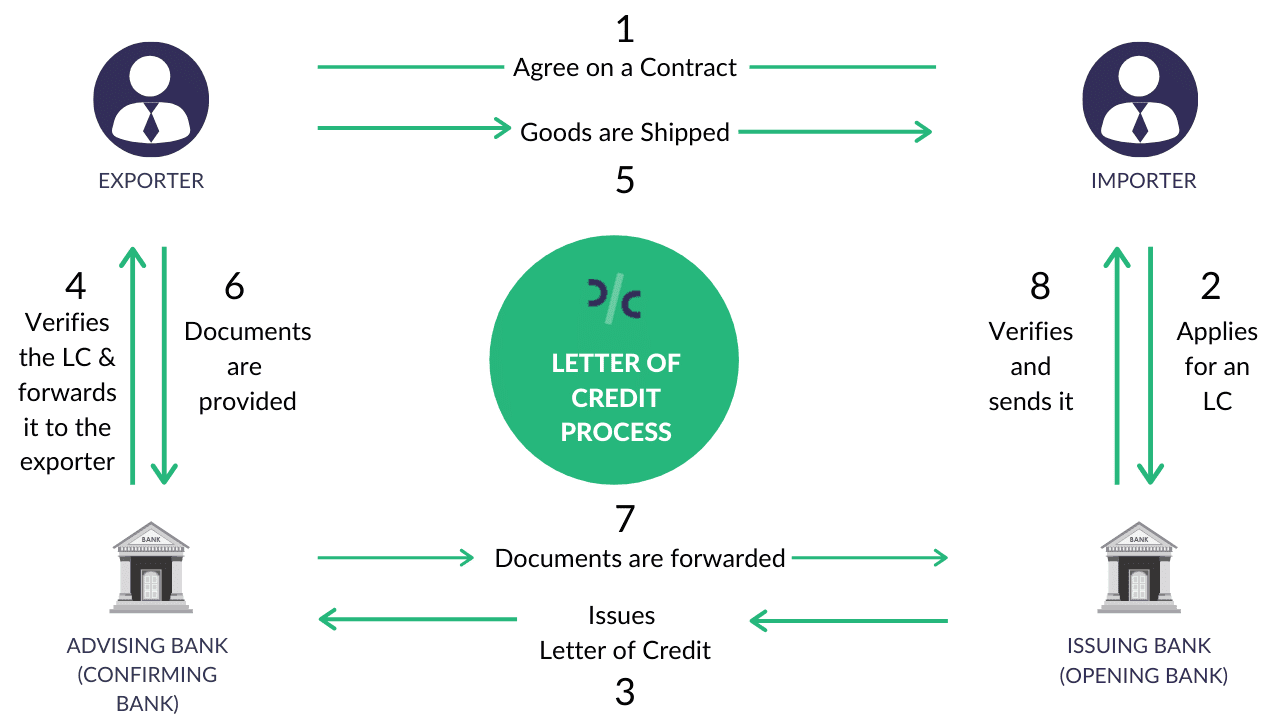

Parties Involved In The Issuance of LC:

Following parties are involved in the issuance of a payment guarantee letter(LOC):

1. Applicant/Importer — Who requests a bank to issue LC.

2. Beneficiary / Exporter — Who gets the payment from the bank in case of the buyer’s default

3. Issuing Bank — Who issues the LC in import finance on behalf of its applicant

4. Advising Bank — An international bank that transfers the documents to the issuing bank on behalf of the exporters. It is usually located in the exporter’s country.

5. Confirming Bank — The bank that provides an additional guarantee to the undertakings of the issuing bank in case the exporter is not satisfied with the issuing bank’s assurance.

Types of Letter of credit

There are several types of LCs that can be used by global traders in international transactions. However, here we have explained some of the major types of LCs.

1. Commercial LOC

2. Standby LC

3. Revocable LC

4. Irrevocable Bank Credit

5. Confirmed Letter of Credit

6. Unconfirmed LC

7. Back-to-Back Bank Credit Letter (LC)

8. Red Clause Payment guarantee letter

9. Transferable LOC

10. Non-transferable Payment guarantee letter

We have also published a separate guide on Different Types of Letters of Credit that will help you understand their use in detail.

How Does a Letter of Credit Work?

Since Credit Letter (LOC) is a negotiable payment instrument, the issuing bank is entitled to pay either the exporter or any other bank recommended by the exporter.

In the case of transferable LC, the exporter is also allowed to transfer his right to another entity but the presentation of the evidential documents to the bank is necessary to get the payment.

Here is a step by step procedure to open an LC:

1. Buyer Applies For The LC — The importer approaches his bank and requests for issuing a bank credit letter in the favor of the exporter if the exporter demands an up-front payment after entering into a trade deal with the importer.

2. Filling LC Application Form — The request by the importer for the documentary credit letter is further followed by filling an application form known as “Letter of Credit Application Form”. The issuing bank verifies the given details in the form and sends it to the exporter for approval.

3. Advising Bank Evaluates LC — Then, the issuing bank shares the documents with the Advising bank (Exporter’s Bank) to thoroughly check the authenticity. After getting assured, the advising bank instructs the exporter to initiate the shipment of the goods.

4. Shipment of Goods & Presentation of Documents — The exporter ships the goods & services and receives the shipment documents. Further, To get the advance payment against the shipment documents, the exporter presents these documents to the confirming bank. After verification, the confirming bank sends them to the issuing bank.

5 Settlement of Payment — The issuing bank verifies the documents with the importer and if it finds everything right, it releases the payment to the exporter.

Find our blog “Letter of Credit Frequently Asked Questions” to understand this trade finance instrument better.

Role of the issuing bank in the process of letter of credit is much similar to Escrow service where the bank regulates & controls the payment between the global importers & exporters and only releases funds when all the mentioned T&C are fulfilled.

Documents Required For LC

Here are a few documents that are required to obtain an LC in global trade transaction::

1. Importer’s financial documents

2. Bills of exchange

3. Certificate of Origin

4. Commercial Invoice

5. Packing, shipping, and transport documents

6. Landing airway bills or cargo receipts etc.

Is There Any Difference Between a Loan and a Letter Of Credit?

Yes, Letters of credit are different from a loan.

A loan is a lump sum amount borrowed from a third party like a bank to purchase any goods. The borrower needs to repay the money within a prescribed period in the form of EMIs. While, on the other hand, a letter of credit is a short-term trade finance instrument issued by a bank or a Financial institution to assure buyer’s on time payment to the seller.

Plus, there is no guarantor in the case of a loan while letters of credit include the bank as a legal guarantor for the borrower.

What Is The Difference Between A Bank Guarantee And A Letter Of Credit?

There is a slight difference between a letter of credit and bank guarantee. In a bank guarantee, the bank ensures the seller on time payment if the debtor defaults while in a credit letter, the bank additionally assures fulfillment of contractual obligations on behalf of the buyer apart from the payment assurance.

It means that the process of LC will continue even if the buyer defaults in payment while in the case of a bank guarantee, the bank reduces only the loss that occurred.

When To Use A Letter Of Credit?

Any business which trades in large volumes either domestically or internationally is advised to use a letter of credit. It not only reduces the risks of fraud due to non-payment from the buyer but also assures the performance of the terms & conditions of the contract and cash flow of a company.

Here are some cases where using an LC is essential:

International Transactions — Import & export letters of credit help the global traders mitigate the associated overseas risks in international transactions. It ensures sellers receive on-time payment for the delivered goods & services in case the buyers are unable to meet the requirements. If the buyer of the goods defaults, the LC takes effect and the issuing bank covers the full or remaining payment.

Performance Transactions — The exporters or beneficiaries can use a letter of credit and standby letter of credit in cases where the nature of the transaction is expected to take a significant amount of time to perform and requires inspection until it is completed. For example, hiring a contractor for a building project and if it is not completed on time, the exporter can present the non-fulfillment of the obligations to the bank. Then, the bank pays the beneficiary.

Last Resort Payment — A Standby LC can also be used to assure the importer’s creditworthiness to the exporter and make him carry out the end of the bargain without any stress. It serves as a last resort payment for the exporters. In simple words, here the beneficiary can show his part of fulfillment to the bank and is assured that payment would be released subsequently.

Payment for Intermediary’s Transactions — A LC can be essentially used in situations where a transferable LC is issued and the bank is responsible to make the payment to the secondary beneficiary nominated by the original beneficiary.

For Payment Security — It is highly recommended to use an irrevocable LC instead of a revocable LC due to associated high risks for the exporters. The issuing bank can cancel, change, or modify the terms of LC without any prior notice to the beneficiary in case of revocable LC.

Also Read: Difference Between Revocable And Irrevocable Letter Of Credit

Advantages of Letter of Credit in Global Trade Deal

For The Sellers:

1. The sellers are assured of getting paid on time as the buyer’s bank is responsible to pay in case of default made by the importer for the shipped goods.

2. The risk of no payment is transferred from the importer to the issuing bank.

3. Documentary credit letter is one of the most secure methods of payment guarantee for the exporters provided they meet the terms and conditions.

4. The sellers can fulfill their working capital requirements for the period between the shipment of goods and receipt of payment.

5. Sellers have easier access to funds and are capable of transferring all or a part of their LC to another party.

For The Buyers:

1. By using a documentary credit letter or a letter of credit service, the buyers can assure the seller that they will be paid on time.

2. The issuing bank will pay the seller upon the presentation of shipment documents to the bank and verify their authenticity following the terms and conditions of LC.

3. The letter of credit is the legal proof of the buyer’s solvency or creditworthiness.

4. Using bank credit letters, the buyers can avoid or reduce the advance payment to the exporters.

5. The buyers can execute any number of transactions overseas as long as they are backed by a legal institution.

Other Advantages of Letter of Credit

1. Letter of credit services allows parties-to-the-contract to trade with unfamiliar overseas parties and establish new trade opportunities.

2. Both importers and exporters can expand their business quickly in new geographical areas.

3. A letter of credit is a safe, customizable, and flexible type of import trade finance.

4. Both the importers and exporters can put their conditions in the LC agreement as per their convenience and requirements.

Trade finance instruments like an LC can significantly help you reduce foreign trade payment risks and allow you to enter into an international trade deal without any threat of payment failure.

There are several uncertainties that arise when buyers and sellers across the globe engage in maritime trade operations. Some of these uncertainties revolve around delayed payments, slow deliveries, and financing-related issues, among others. The sheer distances involved in international trade, different laws and regulations, and changing political landscape are just some of the reasons for sellers needing a guarantee of payment when they deliver goods through the maritime route to their sellers. Letters of credit were introduced to address this by adding a third party like a financial institution into the transaction to mitigate credit risks for exporters.

What is a Letter of Credit?

A letter of credit or LC is a written document issued by the importer’s bank (opening bank) on importer’s behalf. Through its issuance, the exporter is assured that the issuing bank will make a payment to the exporter for the international trade conducted between both the parties.

The importer is the applicant of the LC, while the exporter is the beneficiary. In an LC, the issuing bank promises to pay the mentioned amount as per the agreed timeline and against specified documents.

A guiding principle of an LC is that the issuing bank will make the payment based solely on the documents presented, and they are not required to physically ensure the shipping of the goods. If the documents presented are in accord with the terms and conditions of the LC, the bank has no reason to deny the payment.

Why is Letter of Credit important?

A letter of credit is beneficial for both the parties as it assures the seller that he will receive his funds upon fulfillment of terms of the trade agreement and the buyer can portray his creditworthiness and negotiate longer payment terms, by having a bank back the trade transaction.

Features / Characteristics of letter of credit

A letter of credit is identified by certain principles. These principles remain the same for all kinds of letters of credit. The main characteristics of letters of credit are as follows:

Negotiability

A letter of credit is a transactional deal, under which the terms can be modified/changed at the parties assent. In order to be negotiable, a letter of credit should include an unconditional promise of payment upon demand or at a particular point in time.

Revocability

A letter of credit can be revocable or irrevocable. Since a revocable letter of credit cannot be confirmed, the duty to pay can be revoked at any point of time. In an irrevocable letter of credit, all the parties hold power, it cannot be changed/modified without the agreed consent of all the people.

Transfer and Assignment

A letter of credit can be transferred, also the beneficiary has the right to transfer/assign the LC. The LC will remain effective no matter how many times the beneficiary assigns/transfers the LC.

Sight & Time Drafts

The beneficiary will only receive the payment upon maturity of letter of credit from the issuing bank when he presents all the drafts & the necessary documents.

Documents required for a Letter of Credit

How does Letter of Credit Work?

LC is an arrangement whereby the issuing bank can act on the request and instruction of the applicant (importer) or on their own behalf. Under an LC arrangement, the issuing bank can make a payment to (or to the order of) the beneficiary (that is, the exporter). Alternatively, the issuing bank can accept the bills of exchange or draft that are drawn by the exporter. The issuing bank can also authorize advising or nominated banks to pay or accept bills of exchange.

Fee and charges payable for an LC

There are various fees and reimbursements involved when it comes to LC. In most cases, the payment under the letter of credit is managed by all parties. The fees charged by banks may include:

-

Opening charges, including the commitment fees, charged upfront, and the usance fee that is charged for the agreed tenure of the LC.

-

Retirement charges are payable at the end of the LC period. They include an advising fee charged by the advising bank, reimbursements payable by the applicant to the bank against foreign law-related obligations, the confirming bank’s fee, and bank charges payable to the issuing bank.

Parties involved in an LC

Main parties involved:

Applicant

An applicant (buyer) is a person who requests his bank to issue a letter of credit.

Beneficiary

A beneficiary is basically the seller who receives his payment under the process.

Issuing bank

The issuing bank (also called an opening bank) is responsible for issuing the letter of credit at the request of the buyer.

Advising bank

The advising bank is responsible for the transfer of documents to the issuing bank on behalf of the exporter and is generally located in the country of the exporter.

Other parties involved in an LC arrangement:

Confirming bank

The confirming bank provides an additional guarantee to the undertaking of the issuing bank. It comes into the picture when the exporter is not satisfied with the assurance of the issuing bank.

Negotiating bank

The negotiating bank negotiates the documents related to the LC submitted by the exporter. It makes payments to the exporter, subject to the completeness of the documents, and claims reimbursement under the credit.

(Note:- Negotiating bank can either be a separate bank or an advising bank)

Reimbursing bank

The reimbursing bank is where the paying account is set up by the issuing bank. The reimbursing bank honors the claim that settles the negotiation/acceptance/payment coming in through the negotiating bank.

Second Beneficiary

The second beneficiary is one who can represent the original beneficiary in their absence. In such an eventuality, the exporter’s credit gets transferred to the second beneficiary, subject to the terms of the transfer.

Letter of Credit — Process

The process of getting an LC consists of four primary steps, which are enlisted here:

Step 1 — Issuance of LC

After the parties to the trade agree on the contract and the use of LC, the importer applies to the issuing bank to issue an LC in favor of the exporter. The LC is sent by the issuing bank to the advising bank. The latter is generally based in the exporter’s country and may even be the exporter’s bank. The advising bank (confirming bank) verifies the authenticity of the LC and forwards it to the exporter.

Step 2 — Shipping of goods

After receipt of the LC, the exporter is expected to verify the same to their satisfaction and initiate the goods shipping process.

Step 3 — Providing Documents to the confirming bank

After the goods are shipped, the exporter (either on their own or through the freight forwarders) presents the documents to the advising/confirming bank.

Step 4 — Settlement of payment from importer and possession of goods

The bank, in turn, sends them to the issuing bank and the amount is paid, accepted, or negotiated, as the case may be. The issuing bank verifies the documents and obtains payment from the importer. It sends the documents to the importer, who uses them to get possession of the shipped goods.

Letter of Credit with Example

Suppose Mr A (an Indian Exporter) has a contract with Mr B (an importer from the US) for sending a shipment of goods. Both parties being unknown to each other decide to go for an LC arrangement.

The letter of credit assures Mr A that he will receive the payment from the buyer and Mr B that he will have a systematic and documented process along with the evidence of goods having been shipped.

From this point on, this is how a letter of credit transaction would unveil between Mr A & Mr B:-

-

Mr B (buyer) goes to his bank that is the issuing bank (also called an opening bank) and issues a Letter of Credit.

-

The issuing bank further processes the LC to the advising bank (Mr A’s bank).

-

The advising bank checks the authenticity of the LC and sends it to Mr A.

-

Now that Mr A has received the confirmation he will ship the goods and while doing so he will receive a Bill of Lading along with other necessary documents.

-

Further, he will send these documents to the negotiating bank.

-

The negotiating bank will make sure that all necessary requirements are fulfilled and accordingly make the payment to Mr A (the seller).

-

Additionally, the negotiating bank will send all the necessary documents to the issuing bank.

-

Which again the issuing bank will send to Mr B (Buyer) to confirm the authenticity.

-

Once Mr B has confirmed he will make the payment to the issuing bank.

-

And the issuing bank will pass on the funds to the negotiating bank.

To understand the process clearly refer to this image:

Letter of credit Sample Format

Types of Letter of Credit

Following are the most commonly used or known types of letter of credit:-

-

Revocable Letter of Credit

-

Irrevocable Letter of Credit

-

Confirmed Letter of Credit

-

Unconfirmed Letter of Credit

-

LC at Sight

-

Usance LC or Deferred Payment LC

-

Back to Back LC

-

Transferable Letter of Credit

-

Un-transferable Letter of Credit

-

Standby Letter of Credit

-

Freely Negotiable Letter of Credit

-

Revolving Letter of Credit

-

Red Clause LC

-

Green Clause LC

To understand each type in detail read the article, Types of letter of credit used in International Trade.

What is the application process for an LC?

Importers have to follow a specific procedure to follow for the application of LCs. The process is listed here:

- After a sales agreement is created and signed between the importer and the exporter, the importer applies to their bank to draft a letter of credit in favor of the exporter.

- The issuing bank (importer’s bank) creates a letter of credit that matches the terms and conditions of the sales agreement before sending it to the exporter’s bank.

- The exporter and their bank need to evaluate the creditworthiness of the issuing bank. After doing so and verifying the letter of credit, the exporter’s bank approves and sends the document to the importer.

- After that, the exporter manufactures and ships the goods as per the agreed timeline. A shipping line or freight forwarder assists with the delivery of goods.

- Along with the goods, the exporter also submits documents to their bank for compliance with the sales agreement.

- After approval, the exporter’s bank then sends these complying documents to the issuing bank.

- Once the documents are reviewed, the issuing bank releases the payment to the exporter and sends the documents to the importer to collect the shipment.

What are the Benefits of an LC?

A letter of credit is beneficial for both parties as it assures the seller that they will receive their funds upon fulfillment of the terms of the trade agreement, while the buyer can portray his creditworthiness and negotiate longer payment terms by having a bank back the trade transaction.

Letters of credit have several benefits for both the importer and the exporter. The primary benefit for the importer is being able to control their cash flow by avoiding prepayment for goods. Meanwhile, the chief advantage for exporters is a reduction in manufacturing risk and credit risk. Ultimately, since the trade deals are often international, there are factors like location, distance, laws, and regulations of the involved countries that need to be taken into account. The following are advantages of a letter of credit explained in detail.

-

LC reduces the risk of late-paying or non-paying importers

There might be instances when the importer changes or cancels their order while the exporter has already manufactured and shipped the goods. The importers could also refuse payment for the delivered shipments due to a complaint about the goods. In such circumstances, a letter of credit will ensure that the exporter or seller of the goods receives their payment from the issuing bank. This document also safeguards if the importer goes into bankruptcy. -

LC helps importers prove their creditworthiness

Small to midsize businesses do not have vast reserves of capital for managing payments for raw materials, equipment, or any other supplies. When they are in a contract to manufacture a product and send it to their client within a small window, they cannot wait around to free up capital for buying supplies. This is where letters of credit come to their rescue. A letter of credit helps them with important purchases and serves as proof to the exporter that they will fulfill the payment obligations, thus avoiding any transaction and manufacturing delays. -

LCs help exporters with managing their cash flow more efficiently

A letter of credit also ensures that payment is received on time for the exporters or sellers. This is especially important if there is a huge period of time between the delivery of goods and payment for them. Ensuring timely payments through the letter of credit will go a long way in helping the exporters manage their cash flow. Furthermore, sellers can obtain financing between the shipment of goods and receipt of payment, which can provide an additional cash boost in the short term.

Bank guarantee vs letter of credit

A Bank guarantee is a commercial instrument. It is an assurance given by the bank for a non-performing activity. If any activity fails, the bank guarantees to pay the dues. There are 3 parties involved in the bank guarantee process i.e the applicant, the beneficiary and the banker.

Whereas, a Letter of Credit is a commitment document. It is an assurance given by the bank or any other financial institution for a performing activity. It guarantees that the payment will be made by the importer subjected to conditions mentioned in the LC. There are 4 parties involved in the letter of credit i.e the exporter, the importer, issuing bank and the advising bank (confirming bank).

Things to consider before getting an LC

A key point that exporters need to remind themselves of is the need to submit documents in strict compliance with the terms and conditions of the LC. Any sort of non-adherence with the LC can lead to non-payment or delay and disputes in payment.

The issuing bank should be a bank of robust reputation and have the strength and stability to honor the LC when required.

Another point that must be clarified before availing of an LC is to settle the responsibility of cost-bearing. Allotting costs to the exporter will escalate the cost of recovery. The cost of an LC is often more than that of other modes of export payment. So, apart from the allotment of costs, the cost-benefit of an LC compared to other options must also be considered.

FAQs on Letter of Credit

1. Is Letter of Credit safe?

Yes. Letter of Credit is a safe mode of payment widely used for international trade transactions.

2. How much does it cost for a letter of credit?

Letters of credit normally cost 1% of the amount covered in the contract. But the cost may vary from 0.25% to 2% depending on various other factors.

3. Can a letter of credit be cancelled?

In most cases letters of credit are irrevocable and cannot be cancelled without the agreed consent of all parties.

4. Can a letter of credit be discounted?

A letter of credit can be discounted. While getting an LC discounted the supplier or holde of LC should verify whether the issuing bank is on the approved list of banks, with the discounting bank. Once the LC is approved, the discounting bank releases the funds after charging a certain amount as premium.

5. Is a letter of credit a not negotiable instrument?

A letter of credit is said to be a negotiable instrument, as the bank has dealings with the documents and not the goods the transaction can be transferred with the assent of the parties.

6. Are letters of credit contingent liability?

It would totally depend on future circumstances. For instance, if a buyer is not in a condition to make the payment to the bank then the bank has to bear the cost and make the arrangement on behalf of the buyer.

7. A letter of credit is with recourse or without recourse?

A ‘without recourse’ letter of credit to the beneficiary is a confirmed LC. Whereas an unconfirmed or negotiable letter of credit is ‘with recourse’ to the beneficiary.

8. Who is responsible for letters of credit?

The issuing bank takes up the responsibility to complete the payment if the importer fails to do so. If it is a confirmed letter of credit, then the confirming bank has the responsibility to ensure payment if the issuing bank and importers fail to make the payment.

The Uniform Customs and Practice for Documentary Credits (UCP) describes the legal framework for all letters of credit. The current version is UCP600 which stipulates that all letters will be irrevocable until specified.

Also Read: