Present value (PV) is the current value of an expected future stream of cash flow. Present value can be calculated relatively quickly using Microsoft Excel.

The formula for calculating PV in Excel is =PV(rate, nper, pmt, [fv], [type]).

Key Takeaways

- Present value (PV) is the current value of a stream of cash flows.

- PV analysis is used to value a range of assets from stocks and bonds to real estate and annuities.

- PV can be calculated in Excel with the formula =PV(rate, nper, pmt, [fv], [type]).

- If FV is omitted, PMT must be included, or vice versa, but both can also be included.

- NPV is different from PV, as it takes into account the initial investment amount.

Formula for PV in Excel

Again, the formula for calculating PV in Excel is

=PV(rate, nper, pmt, [fv], [type]).

The inputs for the present value (PV) formula in excel includes the following:

- RATE = Interest rate per period

- NPER = Number of payment periods

- PMT = Amount paid each period (if omitted—it’s assumed to be 0 and FV must be included)

- [FV] = Future value of the investment (if omitted—it’s assumed to be 0 and PMT must be included)

- [TYPE] = When payments are made (0, or if omitted—assumed to be at the end of the period, or 1—assumed to be at the beginning of the period)

Some keys to remember for PV formulas is that any money paid out (outflows) should be a negative number. Money in (inflows) are positive numbers.

NPV vs. PV Formula in Excel

While you can calculate PV in Excel, you can also calculate net present value (NPV). Present value is discounted future cash flows. Net present value is the difference between PV of cash flows and PV of cash outflows.

The big difference between PV and NPV is that NPV takes into account the initial investment. The NPV formula for Excel uses the discount rate and series of cash outflows and inflows.

Key differences between NPV and PV:

- The PV formula in Excel can only be used with constant cash flows that don’t change.

- NPV can be used with variable cash flows.

- PV can be used for regular annuities (payments at the end of the period) and annuities due (payments at the beginning of the period).

- NPVs can only be used for payments or cash flows at the end of the period.

Example of PV Formula in Excel

If you expect to have $50,000 in your banking account 10 years from now, with the interest rate at 5%, you can figure out the amount that would be invested today to achieve this.

You can label cell A1 in Excel «Years.» Besides that, in cell B1, enter the number of years (in this case 10). Label cell A2 «Interest Rate» and enter 5% in cell B2 (0.05). Now in cell A3, label it “Future Value” and put $50,000 into cell B3.

The built-in function PV can easily calculate the present value with the given information. Enter «Present Value» into cell A4, and then enter the PV formula in B4, =PV(rate, nper, pmt, [fv], [type], which, in our example, is «=PV(B2,B1,0,B3).»

Since there are no intervening payments, 0 is used for the «PMT» argument. The present value is calculated to be ($30,695.66), since you would need to put this amount into your account; it is considered to be a cash outflow, and so shows as a negative. If the future value was shown as an outflow, then Excel will show the present value as an inflow.

PV in Excel.

Special Considerations

For the PV formula in Excel, if the interest rate and payment amount are based on different periods, adjustments must be made. A popular change that’s needed to make the PV formula in Excel work is changing the annual interest rate to a period rate. That’s done by dividing the annual rate by the number of periods per year.

For example, if your payment for the PV formula is made monthly then you’ll need to convert your annual interest rate to monthly by dividing by 12. As well, for NPER, which is the number of periods, if you’re collecting an annuity payment monthly for four years, the NPER is 12 times 4, or 48.

What Is the Difference Between Present Value (PV) and Future Value (FV)?

Present value uses the time value of money to discount future amounts of money or cash flows to what they are worth today. This is because money today tends to have greater purchasing power than the same amount of money in the future. Taking the same logic in the other direction, future value (FV) takes the value of money today and projects what its buying power would be at some point in the future.

Why Is Present Value Important?

Present value is important in order to price assets or investments today that will be sold in the future, or which have returns or cash flows that will be paid in the future. Because transactions take place in the present, those future cash flows or returns must be considered but using the value of today’s money.

When Might You Need to Calculate Present Value?

Present value calculations are quite common. Any asset that pays interest, such as a bond, annuity, lease, or real estate, will be priced using its net present value. Stocks are also often priced based on the present value of their future profits or dividend streams using discounted cash flow (DCF) analysis.

Present value (PV) is the current value of a stream of cash flows. PV can be calculated in excel with the formula =PV(rate, nper, pmt, [fv], [type]). If FV is omitted, PMT must be included, or vice versa, but both can also be included. NPV is different from PV, as it takes into account the initial investment amount.

Contents

- 1 How do I calculate present value of cash flows in Excel?

- 2 What is the formula for present value?

- 3 How do you use present value?

- 4 What is an example of present value?

- 5 How do you calculate present value of cash flows?

- 6 What is PV in Excel?

- 7 Why is PV negative in Excel?

- 8 What is YP in valuation?

- 9 Is present value the same as principal?

- 10 Are NPV and IRR the same?

- 11 What is the difference between NPV and PV?

- 12 What is a present value table and how is it used?

- 13 Why present value is negative?

- 14 What is the difference between FV and PV?

- 15 What is the formula for years purchase?

- 16 What is year’s purchase?

- 17 What does NPV give?

How do I calculate present value of cash flows in Excel?

How to Use the NPV Formula in Excel

- =NPV(discount rate, series of cash flow)

- Step 1: Set a discount rate in a cell.

- Step 2: Establish a series of cash flows (must be in consecutive cells).

- Step 3: Type “=NPV(“ and select the discount rate “,” then select the cash flow cells and “)”.

What is the formula for present value?

Present Value Formula and Calculator

The present value formula is PV=FV/(1+i)n, where you divide the future value FV by a factor of 1 + i for each period between present and future dates.

Example of Present Value

- Using the present value formula, the calculation is $2,200 / (1 +.

- PV = $2,135.92, or the minimum amount that you would need to be paid today to have $2,200 one year from now.

- Alternatively, you could calculate the future value of the $2,000 today in a year’s time: 2,000 x 1.03 = $2,060.

What is an example of present value?

Present value is the value right now of some amount of money in the future. For example, if you are promised $110 in one year, the present value is the current value of that $110 today.

How do you calculate present value of cash flows?

The Present Value Formula

Present value equals FV/(1+r )n, where FV is the future value, r is the rate of return and n is the number of periods. Using the example, the formula is $3,300/(1+. 10)1, where $3,300 is the amount you expect to receive, the interest rate is 10 percent and the term is one year.

What is PV in Excel?

PV, one of the financial functions, calculates the present value of a loan or an investment, based on a constant interest rate.Use the Excel Formula Coach to find the present value (loan amount) you can afford, based on a set monthly payment.

Why is PV negative in Excel?

Pmt is the payment made each period and cannot change over the life of the annuity.Pv is the present value that the future payment is worth now. Pv must be entered as a negative amount. Fv is the future value, or a cash balance you want to attain after the last payment is made.

What is YP in valuation?

Years Purchase (YP), single rate or the Present Value (PV) of £1 per annum receivable at the end of each year after accounting for a sinking fund to accumulate at the same rate of interest as that which is required on the invested capital and ignoring the effect of income tax on that part of the income used to provide

Is present value the same as principal?

Compound Interest = total amount of principal and interest in future (or future value) less the principal amount at present, called present value (PV). PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return.

Are NPV and IRR the same?

Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. By contrast, the internal rate of return (IRR) is a calculation used to estimate the profitability of potential investments.

What is the difference between NPV and PV?

Present value (PV) is the current value of a future sum of money or stream of cash flow given a specified rate of return. Meanwhile, net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

What is a present value table and how is it used?

Definition: A present value table is a tool that helps analysts calculate the PV of an amount of money by multiplying it by a coefficient found on the table.

Why present value is negative?

A negative net present value means this may not be a great investment opportunity because you might not make a return. Essentially, a negative net present value is telling you that, based on the projected cash flows, the asset may cause you to lose money.

What is the difference between FV and PV?

Future value is the dollar amount that will accrue over time when that sum is invested. The present value is the amount you must invest in order to realize the future value.

What is the formula for years purchase?

Year’s purchase is defined as the capital sum required to be invested in order to receive an annuity of Re 1.00 at a certain rate of interest. Sinking Coefficient = Year’s purchase = 1 i + s (Put i and s in decimals)

What is year’s purchase?

1. The amount that is yielded by the annual income of property; – used in expressing the value of a thing in the number of years required for its income to yield its purchase price, in reckoning the amount to be paid for annuities, etc. Webster’s Revised Unabridged Dictionary, published 1913 by G.

What does NPV give?

Net present value, or NPV, is used to calculate the current total value of a future stream of payments. If the NPV of a project or investment is positive, it means that the discounted present value of all future cash flows related to that project or investment will be positive, and therefore attractive.

Microsoft Excel has much more for everyone. Do you have any idea what is PV in Excel?

The PV function is used quite often as a financial function because it helps in finding the present value of a loan or an investment.

With the PV function, you can easily calculate the future values of payment in the present time, so that you can have an idea about how much you need more investment. Apart from that the PV function is helpful in finding the present value of a single future value.

The syntax for PV in Excel:

Below is the formula for PV:

=PV(rate, nper, pmt, [fv], [type])

Let’s have a look at the arguments used in this formula:

RATE: It includes the interest rate per period

NPER: It includes the number of the payment period

PMT: It includes an amount that you have paid per period.

[FV]: It includes the future value of the investment.

[TYPE]: It includes the time of payments done.

Outflow is a term used in PV formulas that you need to add when any payment is done. Remember that outflows should be a negative number whereas inflows must be positive integers.

5 Things to Consider when Using PV Function:

Below are some useful points you must consider while using the Excel PV function to work properly:

- In the formula, when the fv value is zero or skipped, the pmt value must be added and vice versa.

- As already mentioned, outflows must be negative integers and inflows must be positive integers. For instance, when you have made an investment in an insurance allowance, you may use a negative number for pmt.

- The rate argument used in the formula must be supplied as a percentage or decimal integer such as 8% or 0.3.

- If an argument is not numeric, you will encounter #VALUE! error in the PV function.

How to Use the PV Function in Excel?

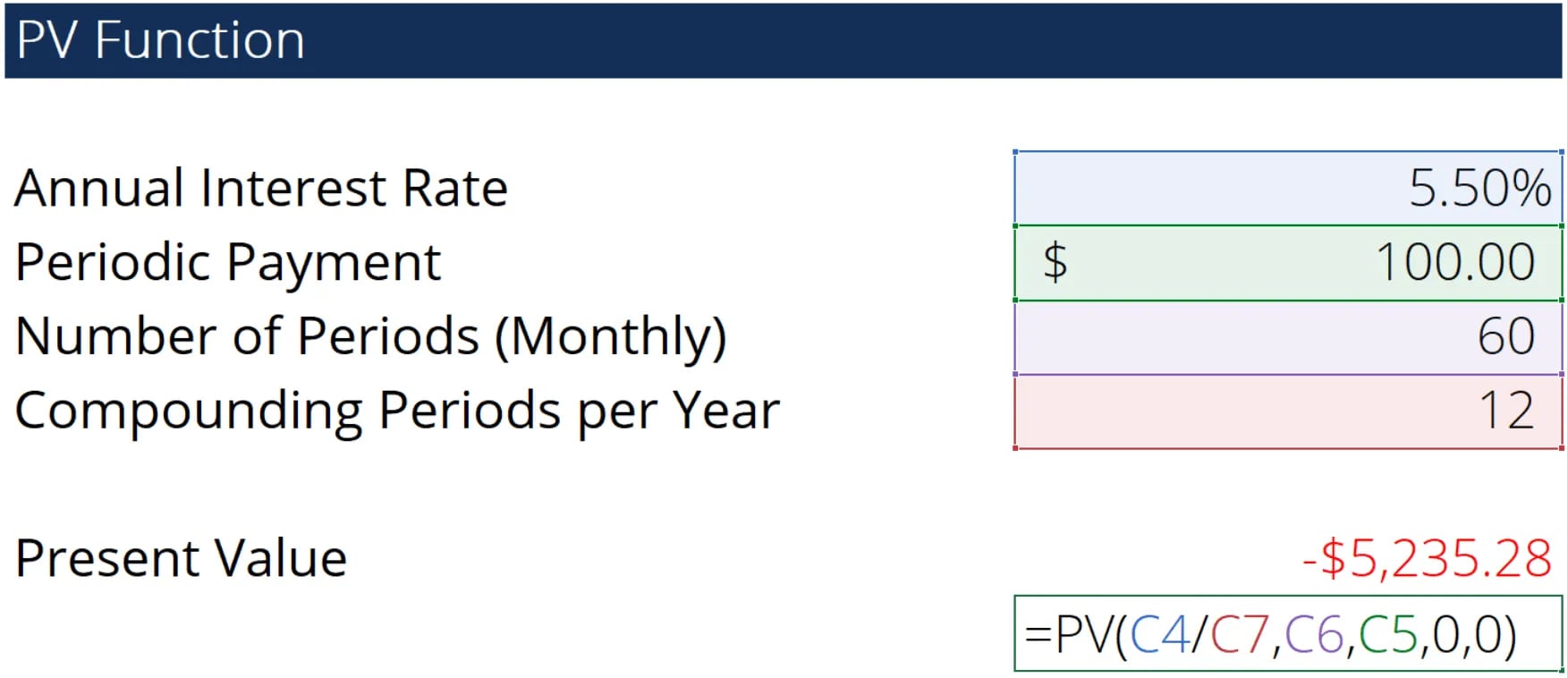

Let’s understand what is PV in Excel with simple examples:

Example 1:

You can see an annuity that pays episodic payments of $100.00 with a 5.5% interest rate annually. Monthly this annuity pays and will continue to do so for the next 5 years. Below is the setup and formula for the PV function:

With the PV function, you can find the fair present value. The annuity worth is $5,235.28 in the recent time period.

Calculate the PV of the Annuity:

Suppose, an annuity is purchased that is paid regularly an amount of $200 to the insurance company monthly for the next 10 years. With a 9% of annual interest rate, the annuity responds back 9%.

You must add data in individual cells to start with:

Monthly payment (B4): -200

Annual interest rate (B2): 9%

Number of periods per year (B6): 12

Annuity type (B5): 1

Number of years: (B3): 10

You can simply notice the rate and pmt both have different periods. To perform the PV function, you need to have a few conversions:

The annual interest rate must be converted into a periodic rate. For this, you need to divide the annual rate by the number of periods per year.

Rate= annual interest rate / no. of periods per year

You can multiply the annuity in years with the number of periods per year to find the net number of periods:

nper = no. of years * no. of periods per year

As you know, here we are using monthly annuity in the example, you can simply divide and multiply it with 12 or cell B6.

Now, the full form of PV would be as:

=PV(B2/B6, B3*B6, B4, , B5)

Likewise, you can find the PV of a week, quarter, or semi-annual annuity. You just need to change the number of periods per year in the relevant cell:

Semiannual: 2

Weekly: 52

Annual: 1

Quarterly: 4

Monthly: 12

To Sum Up:

This post clarifies what is PV in Excel along with its uses and syntax. The arguments used in the formula are super convenient to use when you need to calculate the present value of an investment.

In this post we are going to look at Present Value and how to use the PV function in Excel.

Present Value is what money in the future is worth now. To get the PV of future money, we would work backwards on the Future value calculation. This is called discounting and you would discount all future cash flows back to the present point in time.

Like the future value calculations in Excel, when you are calculating present value to need to ensure that all the time periods are consistent. This means that you will need to divide the annual interest rate by the number of compounding periods in the year.

Present Value Function Syntax:

The syntax for present value in excel is

=PV(rate, nperiods, pmt,[fv],[type])

Rate is the Period interest rate

Nperiods is the number of compounding periods

PMT is optional and if PMT is omitted, you must include the FV argument. PMT is the actual payment made each period including capital and interest,

FV is in square brackets indicating this value is optional. It refers to the Future value you wish to discount back to. For example you know you need $30,000 for your child’s college in 8 years time. The $30K is the Future Value

Type, also in square brackets indicating this value is optional. 0 or omitted means that payments will be calculated at the end of the period, 1 means that payments are due at the beginning of the period

Let’s now go over to excel in the video below and look at a present value calculation with a simple example:

Present value is one of many Financial functions available in Excel. Financial Functions make complex calculations easy and quick to complete in an Excel Spreadsheet. The Present value calculation also works the same in Google Sheets as do many of the other Financial Functions.

If you want to learn more about Financial Functions in Excel, check out my course – Financial Functions in Excel

Содержание

- Formula to Calculate Net Present Value (NPV) in Excel

- Key Takeaways

- Click Play to Learn the Net Present Value Formula

- How to Use Net Present Value

- 2 Ways to Calculate NPV in Excel

- 1. Using Present Value to Calculate NPV

- 2. Using the NPV Function to Calculate NPV

- excel

- Pros and Cons of the 2 Methods

- Method 1

- Method 2

- What Is Net Present Value?

- How Do I Interpret NPV?

- Can I Calculate NPV Using Excel?

- The Bottom Line

- How to calculate present value of annuity in Excel: formula and calculator

- Present value of annuity

- Present value formula

- How to calculate present value in Excel — formula examples

- Present value formula for a single payment

- Present value formula for annuity

- Present value formula for different annuity types

- How to create present value calculator in Excel

Formula to Calculate Net Present Value (NPV) in Excel

Net present value (NPV) is a core component of corporate budgeting. It is a comprehensive way to calculate whether a proposed project will be financially viable or not.

The calculation of NPV encompasses many financial topics in one formula: cash flows, the time value of money, the discount rate over the duration of the project (usually the weighted average cost of capital (WAAC)), terminal value, and salvage value.

Key Takeaways

- Net present value (NPV) can help companies determine the financial viability of a potential project.

- It’s especially useful when comparing more than one potential project or investment.

- NPV is an essential tool for corporate budgeting.

- You can use Excel to calculate NPV instead of figuring it manually.

- An NPV of zero or higher forecasts profitability for a project or investment; projects with a negative NPV forecast loss.

Click Play to Learn the Net Present Value Formula

How to Use Net Present Value

To understand NPV in the simplest forms, think about how a project or investment works in terms of money inflow and outflow.

Say, you are contemplating setting up a factory that needs initial funds of $100,000 during the first year. Since this is an investment, it is a cash outflow that can be taken as a net negative value. It is also called an initial outlay.

You expect that after the factory is successfully established in the first year with the initial investment, it will start generating the output (products or services) by the second year and onwards. That will result in net cash inflows in the form of revenues from the sale of the factory output.

The factory generates $100,000 during the second year. That amount increases by $50,000 each year over five years. The actual and expected cash flows of the project are as follows:

Year-A represents actual cash flows while Years-P represent projected cash flows over the mentioned years. A negative value indicates cost or investment, while a positive value represents inflow, revenue, or receipt.

Now, how do you decide whether this project is profitable or not? The challenge is that you are making investments during the first year and realizing the cash flows over a course of many future years.

When multi-year ventures need to be assessed, NPV can assist the financial decision-making, provided the investments, estimates, and projections are accurate.

NPV calculations bring all cash flows (present and future) to a fixed point in time in the present. Hence, the term present value. NPV essentially works by figuring what the expected future cash flows are worth at present. Then, it subtracts the initial investment from that present value to arrive at net present value. If this value is positive, the project may be profitable and viable. If this value is negative, the project may not be profitable and should be avoided.

In the simplest terms:

NPV = (Today’s value of expected future cash flows) – (Today’s value of invested cash)

An NPV of greater than $0 indicates that a project has the potential to generate net profits. An NPV of less than $0 indicates a losing proposition. Usually, NPV is just one metric used along with others by a company to decide whether to invest.

2 Ways to Calculate NPV in Excel

There are two methods to calculate net present value in Excel. You can use the basic formula, calculate the present value of each component for each year individually, and then sum all of them up. Or, you can use Excel’s built-in NPV function.

1. Using Present Value to Calculate NPV

Using the figures from the above example, assume that the project will need an initial outlay of $250,000 in year zero. From the second year (year one) onwards, the project starts generating inflows of $100,000. They increase by $50,000 each year till year five when the project is completed.

The WACC is used by the company as the discount rate when budgeting for a new project. For this project, it’s 10%.

The present value formula is applied to each of the cash flows from year zero to year five. For example, the cash flow of -$250,000 results in the same present value during year zero. Year 1’s inflow of $100,000 during the second year results in a present value of $90,909. Year 2’s inflow of $150,000 is worth $123,967, and so on.

Calculating present value for each of the years and then summing those up produces an NPV of $472,169, as shown above.

2. Using the NPV Function to Calculate NPV

The second Excel method uses the built-in NPV function. It requires the discount rate (again, represented by WACC), and the series of cash flows from year 1 to the last year. Be sure that you don’t include the Year zero cash flow (the initial outlay) in the formula.

The result using the NPV function for the example comes to $722,169. Then, to compute the final NPV, subtract the initial outlay from the value obtained by the NPV function. NPV = $722,169 — $250,000, or, $472,169.

This computed value matches that obtained using the first method.

excel

While Excel is a great tool for making rapid calculations with precision, errors can occur. Since a simple mistake can lead to incorrect results, it’s important to take care when inputting data.

Pros and Cons of the 2 Methods

Analysts, investors, and economists can use either of the methods, after assessing their pros and cons.

Method 1

Pro

The present value method is preferred by many for financial modeling because its calculation and figures are transparent and easy to audit.

Con

Unfortunately, it requires multiple manual steps. This takes time and has the potential for input errors.

Method 2

Pro

Method Two’s NPV function method can be simpler and involve less effort than Method One.

What’s more, although it assumes unrealistically that all cash flows are received at the end of the year, cash flows can be discounted at mid-year, as needed (the XNPV function can help here). This presents a better view of after-tax cash flows over the course of the year.

Con

On the downside, the initial cash outlay must be netted out manually, a need that can be overlooked by Excel users.

Also, for financial modeling and audit purposes, it’s harder with Method Two than with Method One to determine the calculations, figures used, what’s hardcoded, and what’s input by users.

What Is Net Present Value?

Net present value is the difference between the present value of cash inflows and the present value of cash outflows over a certain period of time. It’s a metric that helps companies foresee whether a project or investment will be profitable. NPV plays an important role in a company’s budgeting process and investment decision-making.

How Do I Interpret NPV?

A net present value of $0 or higher is a good sign. It indicates that a project will be profitable. A net present value that’s less than $0 means a project isn’t financially feasible and perhaps should be avoided.

Can I Calculate NPV Using Excel?

Yes. While you could calculate NPV by hand, you can use an NPV formula in Excel or use the NPV function to get a value more quickly. There’s also an XNPV function that’s more precise when you have various cash flows occurring at different times.

The Bottom Line

Net present value can be very useful to companies for effective corporate budgeting. Excel can also be useful in helping a business calculate NPV.

Whichever Excel method one uses, the result obtained is only as good as the values inserted in the formulas. Therefore, be sure to be as precise as possible when determining the values to be used for cash flow projections before calculating NPV.

Источник

How to calculate present value of annuity in Excel: formula and calculator

Essentially, this tutorial gives answers to three «what» questions. What is present value of annuity? What is the present value formula? What discount or interest rate to use for present value calculation?

If offered a choice to receive a certain sum of money right now or defer the payment into the future, which would you choose? For most people, taking money now is a natural instinct. In the financial world, this is explained by the time value of money concept.

There are two main terms that measure how much the value of money changes over time: future value (FV) and present value (PV). If you are curious to know the worth of your investment after a certain period, calculate its future value as explained in the FV function tutorial. If you wish to find the current worth of money, then you need to calculate present value, and this tutorial shows how to quickly do this in Excel.

Present value of annuity

When putting deposits to a saving account, paying home mortgage and the like, you usually make the same payments at regular intervals, e.g. weekly, monthly, quarterly, or yearly. Such series of payments (either inflow or outflow) made at equal intervals is called an annuity.

The can be defined as the current value of a series of future cash flows, given a specific discount rate, or rate of return. For this reason, present value is sometimes called present discounted value. The bigger the discount rate, the smaller the present value.

The concept of present value (PV) is based on the idea of the time value of money. In essence, any amount you have now is worth more than the same amount in the future due to its capacity to potentially earn interest. The sooner a certain sum is received, the more it is worth. In simple words, this financial concept is described by the old saying: «A dollar today is worth more than a dollar tomorrow».

In financial analysis, present value is highly important. It lets you clearly understand how much money you need to invest today to reach the target amount in the future. Also, it can help you make an informed decision on whether to accept a specific cash rebate, evaluate projects in the capital budgeting, and more.

In everyday life, the present value comes in useful too. For example, it can help you determine which is more profitable — to take a lump sum right now or receive an annuity over a number of years.

Present value formula

When talking about a single cash flow, i.e. one payment period, the present value formula is as simple as this:

- FV — future value

- r — discount or interest rate

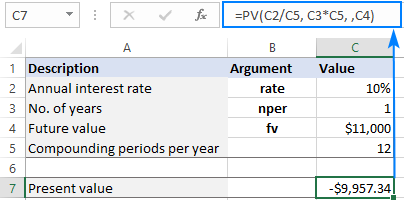

Suppose you want to have $11,000 in your saving account one year from now. How much should you deposit today provided that your bank offers an annual interest rate of 10%?

To find the present value of this investment, do this math:

For a series of cash flows, the present value formula is slightly more complicated:

- r – discount or interest rate

- n – the number of time periods

- i – the cash flow period

For example, to find the present value of a series of three $100 payments made at equal intervals and discounted at 10%, you can perform these calculations:

How to calculate present value in Excel — formula examples

The previous section shows how to calculate the present value of annuity manually. The good news is that Microsoft Excel has a special PV function that does all calculations in the background and outputs the final result in a cell.

If you are not familiar with this function, it’s a good idea to begin with the above linked tutorial that explains the syntax.

Present value formula for a single payment

Suppose you have won a cash prize in a lottery and have two options — to get $10,000 right now or $11,000 in a year. Which is a better deal?

To get your answer, you need to calculate the present value of the amount you will receive in the future ($11,000). For this, you need to know the interest rate that would apply if you invested that money today, let’s assume it’s 7%.

With the above information in mind, set up your worksheet as follows:

- Annual interest rate (C2): 7%

- No. of years (C3): 1

- Future value (C4): 11,000

The formula to calculate the present value of the investment is:

Please pay attention that the 3 rd argument intended for a periodic payment (pmt) is omitted because our PV calculation only includes the future value (fv), which is the 4 th argument.

Also, please note that the returned present value is negative, since it represents a presumed investment, which is an outflow. In other words, if you invested $10,280 at 7% now, you would get $11,000 in a year.

Getting back to the initial question — receiving $11,000 one year from now is a better choice, as its present value ($10,280) is greater than the amount you are offered right now ($10,000).

In the above example, an interest rate is compounded yearly. However, most savings accounts pay monthly compound interest. Will it impact the calculation? Let’s see…

Because the interest is compounded 12 times a year, we divide 7% by 12 to get the correct periodic rate, and multiply 1 by 12 to have the right nper:

As you can see below, with an interest rate compounded monthly, the present value is much smaller, which totally changes the answer to the original question 🙂

Note. These examples assume ordinary annuity when all the payments are made at the end of a period. For annuity due, please see this example.

Present value formula for annuity

When calculating the present value of annuity, i.e. a series of even cash flows, the key point is to be consistent with rate and nper supplied to a PV formula.

To get a correct periodic interest rate (rate), divide an annual interest rate by the number of compounding periods per year:

- Monthly: rate = annual interest rate / 12

- Quarterly: rate = annual interest rate / 4

- Semiannual: rate = annual interest rate / 2

To get the total number of periods (nper), multiply the length of an annuity in years by the number of periods per year:

- Monthly: nper = no. of years * 12

- Quarterly: nper = no. of years * 4

- Semiannual: nper = no. of years * 2

For this example, we will be using a series of $100 payments that we calculated manually in the first part of this tutorial and input the following data in a worksheet:

- Annual interest rate (B2): 10%

- No. of years (B3): 3

- Annual payment (B4): -100

Please notice that the payment is expressed by a negative number because it’s an outflow.

Assuming the payments are made at the end of each year, you can calculate the present value with this formula:

As shown in the image below, the PV formula returns the same result as the manual calculation — $248.69.

If the payments are made monthly, then add one more input cell (B5) for the number of periods per year (12 on our case). To get the correct present value, convert an annual interest rate to a monthly rate (B2/B5) and provide the total number of periods for annuity (B3*B5):

=PV(B2/B5, B3*B5, B4)

Present value formula for different annuity types

The annuity type is controlled by the 5 th (optional) argument of the PV function, named type:

- For ordinary (regular) annuity, where all payments are made at the end of a period, use 0 for type. This is the default value that applies automatically when the argument is omitted.

- For annuity due, where all payments are made at the end of a period, use 1 for type.

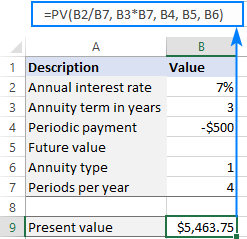

To see the effect of different annuity types, set up your spreadsheet like shown below and enter your data in the corresponding cells:

- Annual interest rate: B2

- No. of years: B3

- Payment amount: B4

- Annuity type: B5

- Periods per year: B6

For regular annuity, type 0 in B5; for annuity due, type 1. To prevent mistakes, it makes sense to create a drop-down list for B5 that only allows 0 and 1 values.

To calculate the present value of a series of payments, we will be using the below formula. Please pay attention that the 4 th argument (fv) is omitted because the future value is not included in the calculation.

=PV(B2/B6, B3*B6, B4, ,B5)

As shown in the screenshot below, the annuity type does make the difference. With the same term, interest rate and payment amount, the present value for annuity due is higher.

How to create present value calculator in Excel

Knowing how to write a PV formula for a specific case, it’s quite easy to tweak it to handle all possible cases. Simply provide input cells for all the arguments of the PV function. If some argument is not used in a particular calculation, the user will leave that cell blank.

In our case, we organize the data as follows:

- Annual interest rate: B2

- Annuity term in years: B3

- Payment amount: B4

- Future value: B5

- Annuity type: B6

- Periods per year: B7

The present value calculator formula in B9 is:

=PV(B2/B7, B3*B7, B4, B5, B6)

Assuming you make a series of $500 payments at the beginning of each quarter for 3 years with a 7% annual interest rate, set up the source data as shown in the image below. And the present value calculator will output the result:

For the PV calculator to work correctly, please follow these usage notes:

- For a lump sum investment that will pay a certain amount in the future, define the future value (B5). For an annuity spread out over a number of years, specify the periodic payment (B4).

- Any money that you pay out should be represented by a negative number; any money that you receive — by a positive number.

- The Periods per year cell (B7) must not be blank or 0 because this will cause a #DIV/0 error. In case of annual cash flows, enter 1 in that cell.

I hope our examples have shed some light on how to how to calculate present value of annuity in Excel. Thank you for reading and hope to see you on our blog next week!

Источник

:max_bytes(150000):strip_icc()/PortraitHeadshot-DavidKindness-DavidKindness-2318e84654364a0584b715e44c99f13a.jpg)

:max_bytes(150000):strip_icc()/SuzannesHeadshot-3dcd99dc3f2e405e8bd37271894491ac.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)