Excel for Microsoft 365 Excel for Microsoft 365 for Mac Excel for the web Excel 2021 Excel 2021 for Mac Excel 2019 Excel 2019 for Mac Excel 2016 Excel 2016 for Mac Excel 2013 Excel 2010 Excel 2007 Excel for Mac 2011 Excel Starter 2010 More…Less

PMT, one of the financial functions, calculates the payment for a loan based on constant payments and a constant interest rate.

Use the Excel Formula Coach to figure out a monthly loan payment. At the same time, you’ll learn how to use the PMT function in a formula.

Syntax

PMT(rate, nper, pv, [fv], [type])

Note: For a more complete description of the arguments in PMT, see the PV function.

The PMT function syntax has the following arguments:

-

Rate Required. The interest rate for the loan.

-

Nper Required. The total number of payments for the loan.

-

Pv Required. The present value, or the total amount that a series of future payments is worth now; also known as the principal.

-

Fv Optional. The future value, or a cash balance you want to attain after the last payment is made. If fv is omitted, it is assumed to be 0 (zero), that is, the future value of a loan is 0.

-

Type Optional. The number 0 (zero) or 1 and indicates when payments are due.

|

Set type equal to |

If payments are due |

|---|---|

|

0 or omitted |

At the end of the period |

|

1 |

At the beginning of the period |

Remarks

-

The payment returned by PMT includes principal and interest but no taxes, reserve payments, or fees sometimes associated with loans.

-

Make sure that you are consistent about the units you use for specifying rate and nper. If you make monthly payments on a four-year loan at an annual interest rate of 12 percent, use 12%/12 for rate and 4*12 for nper. If you make annual payments on the same loan, use 12 percent for rate and 4 for nper.

Tip To find the total amount paid over the duration of the loan, multiply the returned PMT value by nper.

Example

Copy the example data in the following table, and paste it in cell A1 of a new Excel worksheet. For formulas to show results, select them, press F2, and then press Enter. If you need to, you can adjust the column widths to see all the data.

|

Data |

Description |

|

|---|---|---|

|

8% |

Annual interest rate |

|

|

10 |

Number of months of payments |

|

|

$10,000 |

Amount of loan |

|

|

Formula |

Description |

Result |

|

=PMT(A2/12,A3,A4) |

Monthly payment for a loan with terms specified as arguments in A2:A4. |

($1,037.03) |

|

=PMT(A2/12,A3,A4,,1) |

Monthly payment for a loan with with terms specified as arguments in A2:A4, except payments are due at the beginning of the period. |

($1,030.16) |

|

Data |

Description |

|

|

6% |

Annual interest rate |

|

|

18 |

Number of months of payments |

|

|

$50,000 |

Amount of loan |

|

|

Formula |

Description |

Live Result |

|

PMT(A9/12,A10*12, 0,A11) |

Amount to save each month to have $50,000 at the end of 18 years. |

($129.08) |

Need more help?

В Функция PMT в Excel — это финансовая функция, используемая для расчета выплаты ссуды на основе платежей и процентных ставок. Формула функции PMT: PMT (ставка; кпер; пв;[fv], [type]).

Синтаксис функции PMT

- Ставка: Процентная ставка по кредиту (обязательно).

- Nper: Общее количество платежей по кредиту (обязательно).

- Pv: Приведенная стоимость или общая сумма, которой сейчас стоит серия будущих платежей (обязательно).

- FV: Баланс, которого вы хотите достичь после последнего оплаченного платежа или будущих платежей (необязательно).

- Тип: Цифра ноль или единица указывает срок выплаты.

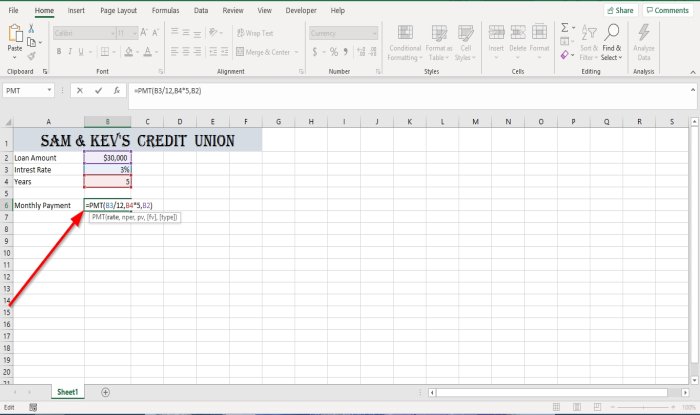

В этом уроке мы хотим найти ежемесячный платеж.

Открыть Майкрософт Эксель.

Используйте существующую таблицу или создайте таблицу.

В ячейке напротив ежемесячного платежа введите = PMT затем скобка.

Внутри скобки введите B3 потому что это ячейка, содержащая процентную ставку. Затем разделите B3 к двенадцатый (B3 / 12) для преобразования годовой процентной ставки в ежемесячную. Затем поместите запятая.

Тип B4, потому что это ячейка, которая содержит год, который будет способствовать общим платежам по ссуде, но поскольку мы платим ежемесячные платежи, мы должны умножить количество лет на двенадцатую на количество платежей (b4 * 12). потом Запятая.

Теперь мы введем приведенную стоимость ссуды (Pv) — сумма кредита в ячейке Би 2.

Затем закройте скобку и нажмите Enter; вы увидите результаты.

Есть два других варианта использования функции PMT.

Первый вариант — щелкнуть Вставить функцию (FX) в верхней части таблицы.

An Вставить функцию диалоговое окно откроется.

В диалоговом окне «Вставить функцию» выберите Финансовые категория.

Выбирать ГУП в группе Выбор функции и щелкните Ok.

А Аргументы функции появится диалоговое окно.

Внутри диалогового окна, где вы видите Ставка, тип B3 / 12 в поле ввода.

Где ты видишь Nper тип B4 * 12 в поле ввода.

Где ты видишь Pv, тип Би 2и щелкните Ok, вы увидите результаты.

Fv и Тип необязательны; они не нужны.

Вариант два — нажать кнопку Формулы таб.

На Формула вкладку, щелкните значок Финансированиеl кнопка в Библиотека функций группа и выберите ГУП.

An Аргументы Функция появится диалоговое окно.

в Аргументы Функция диалоговое окно сделайте то же самое, что упомянуто выше в первом варианте, чтобы увидеть результаты.

Читать: Как использовать функцию DSUM в Microsoft Excel.

Если у вас есть вопросы, оставьте комментарий ниже.

Summary

The Excel PMT function is a financial function that returns the periodic payment for a loan. You can use the PMT function to figure out payments for a loan, given the loan amount, number of periods, and interest rate.

Purpose

Get the periodic payment for a loan

Return value

Arguments

- rate — The interest rate for the loan.

- nper — The total number of payments for the loan.

- pv — The present value, or total value of all loan payments now.

- fv — [optional] The future value, or a cash balance you want after the last payment is made. Defaults to 0 (zero).

- type — [optional] When payments are due. 0 = end of period. 1 = beginning of period. Default is 0.

Syntax

=PMT(rate, nper, pv, [fv], [type])

Usage notes

The PMT function can be used to figure out the future payments for a loan, assuming constant payments and a constant interest rate. For example, if you are borrowing $10,000 on a 24 month loan with an annual interest rate of 8 percent, PMT can tell you what your monthly payments be and how much principal and interest you are paying each month.

Notes:

- The payment returned by PMT includes principal and interest but will not include any taxes, reserve payments, or fees.

- Be sure you are consistent with the units you supply for rate and nper. If you make monthly payments on a three-year loan at an annual interest rate of 12 percent, use 12%/12 for rate and 3*12 for nper. For annual payments on the same loan, use 12 percent for rate and 3 for nper.

Author

Dave Bruns

Hi — I’m Dave Bruns, and I run Exceljet with my wife, Lisa. Our goal is to help you work faster in Excel. We create short videos, and clear examples of formulas, functions, pivot tables, conditional formatting, and charts.

I just wanted to say thanks for simplifying the learning process for me! Your website is a life saver!

Get Training

Quick, clean, and to the point training

Learn Excel with high quality video training. Our videos are quick, clean, and to the point, so you can learn Excel in less time, and easily review key topics when needed. Each video comes with its own practice worksheet.

View Paid Training & Bundles

Help us improve Exceljet

PMT Function in Excel

The PMT function is an advanced Excel formula and one of the financial functionsExcel is known for making complex formulas easy to use and apply. Most needed functions are 1.Future Value 2.FVSchedule 3.Present Value 4.Net Present Value 5.XNPV 6.PMT 7.PPMT 8.Internal Rate of Return 9.Modified Internal Rate of Return 10.XIRR 11.NPER 12.RATE 13.EFFECT 14.NOMINAL 15.SLNread more used to calculate the monthly payment amount against the simple loan amount. You have to provide the function of basic information, including loan amount, interest rate, and payment duration, and the function will calculate the payment as a result. The payment amount calculated by this PMT Excel formula returns the amount without taxes, reserve payments, and fees (sometimes associated with loans).

Table of contents

- PMT Function in Excel

- PMT Function Formula

- Explanation

- Compulsory Parameter:

- Optional Parameter:

- How to Use the PMT Function in Excel? (with Examples)

- Example #1

- Example #2

- Example #3

- Things to Remember

- Recommended Articles

PMT Function Formula

Explanation

Five parameters are used in this PMT Excel function. In which three are compulsory and two are optional.

Compulsory Parameter:

- Rate: Rate represents the interest rate for the loan amount. If you are making a monthly payment in this PMT Excel function, then you should convert the rate at a monthly rate and the nper in a month too.

- Nper: Nper is the total number of installments for the loan amount. For example, considering the 5 years terms means 5*12=60.

- Pv: Pv is the total loan amount or present value.

Optional Parameter:

- [Fv]: It is also called the future value. It is optional in this PMT Excel. If not passed in this function, it will be considered zero.

- [Type]: It can be omitted from PMT fn and used as 1 in case payments are due at the beginning of the period and considered as 0 in case the payments are due at the end of the period.

How to Use the PMT Function in Excel? (with Examples)

This function is very simple. Let us now see how to use this PMT Excel function with the help of some examples.

You can download this PMT Function Excel Template here – PMT Function Excel Template

Example #1

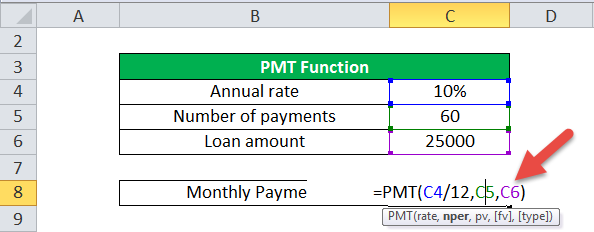

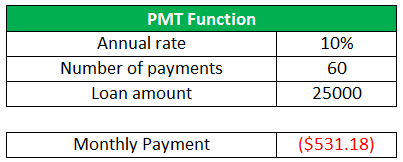

Suppose the loan amount is 25,000, the interest rate is 10% annual, and the period is 5 years.

Here, the number of payments will be =5*12=60 payments in total.

In this PMT Excel, we have considered C4/12 because a 10% rate is annual. By dividing by 12, we get the monthly rate. Here, the future value and type are considered zero.

The output will be:

- It will return the value in a negative amount as this amount will be credited from your bankBank credit is usually referred to as a loan given for business requirements or personal needs to its customers, with or without a guarantee or collateral, with an expectation of earning periodic interest on the loan amount. The principal amount is refunded at the end of loan tenure, duly agreed upon, and mentioned in the loan covenant.read more.

- Use the negative sign before this PMT Excel to convert it into a positive value.

Then the output will be $531.18.

- You can also change the currency type to change the format of the cell.

Select the cell, convert the format, and select the currency type per your requirements.

Example #2

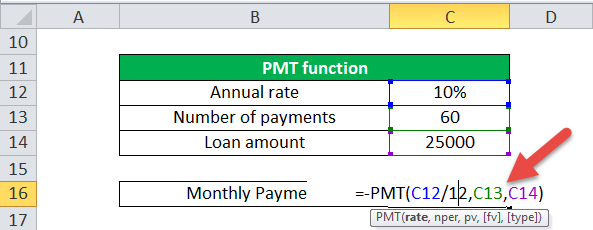

We can use it to calculate the payments on a Canadian mortgage.

Suppose the loan amount is 25000, the annual interest rate is 10%, compounded semiannually, and the period is 5 years.

Here, the annual rate/2+1 is the semiannual interest in the annual rate, and the rate is 10/2=5% every 6 months. The rate is a power of (1/6) for monthly and semiannual payments.

Example #3

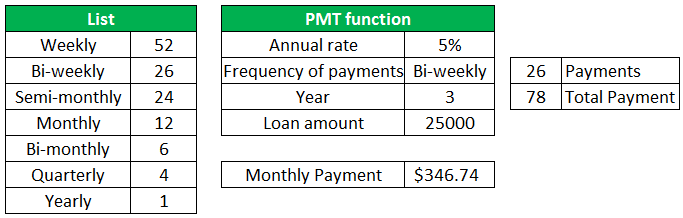

The PMT formula in Excel can be used as an automatic loan calculator.

In the previous example, we calculated the monthly payment by providing the loan amount, interest rate, and number of payments. In an automatic loan calculator, we are using the annual rate, time, and frequency of payments.

Before understanding the automatic loan calculator, create a list for calculating the number of payments.

Using the list, we can calculate the numbers of payments within a year by using a simple VLOOKUP from the list, which is 26 bi-weekly.

For the total number of payments, multiple it from the total number of years,=3*26=78.

Here, we again took the annual rate of 5% and the loan amount as 25000.

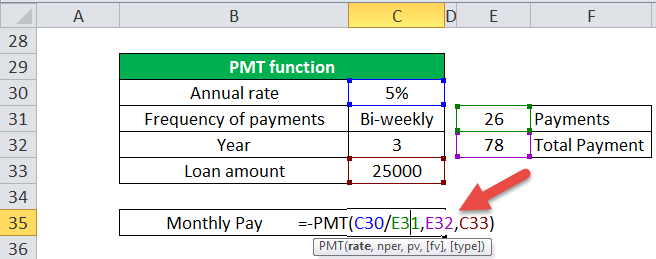

Then the PMT function in Excel looks like: =-PMT(C30/E31,E32,C33) and output will be $346.74.

Things to Remember

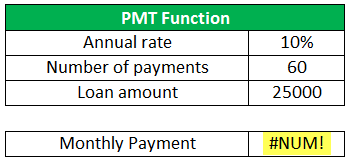

Below are the few error details that can come in the PMT formula in Excel if the wrong argument is passed in the functions.

#1 – Error handling #NUM!: If the Nper value is 0, it will throw a #NUM! Error.

#2 – Error handling #VALUE!: The result will be a #VALUE! Error when any non-numeric value has been passed in the PMT function formula.

In this function, a monthly amount and rate should be considered in a month.

- It would help if you converted the monthly or quarterly rate per your requirement.

- The payment amount calculated by this PMT Excel function returns the amount without taxes, reserve payments, and fees (sometimes associated with loans).

Recommended Articles

This article is a guide to PMT Function in Excel. Here, we discuss the PMT formula and how to use the PMT function, along with practical examples and downloadable Excel templates.

- Excel PPMT FunctionThe PPMT function in Excel is a financial function that calculates the payment for a given principal and returns an integer result. This function can be used to calculate the principal amount of an installment for any period.read more

- IPMT Function in ExcelThe IPMT function calculates the interest to be paid on a given loan with constant interest and periodic payments. It is a financial function that computes the interest portion of a payment for a given period.read more

- Excel NPER FunctionNPER, commonly known as the number of payment periods for a loan, is a financial term and an inbuilt financial function in Excel that can be used to calculate NPER for any loan. This formula takes rate, payment made, present value and future value as input from a user.read more

- User-Defined FunctionUser Defined Function in VBA is a group of customized commands created to give out a certain result. It is a flexibility given to a user to design functions similar to those already provided in Excel.read more

Calculates the payment for a loan or investment with constant payments and a fixed interest rate

What is the PMT Function?

The PMT Function[1] is categorized under financial Excel functions. The function helps calculate the total payment (principal and interest) required to settle a loan or an investment with a fixed interest rate over a specific time period.

Formula

=PMT(rate, nper, pv, [fv], [type])

The PMT function uses the following arguments:

- Rate (required argument) – The interest rate of the loan.

- Nper (required argument) – Total number of payments for the loan taken.

- Pv (required argument) – The present value or total amount that a series of future payments is worth now. It is also termed as the principal of a loan.

- Fv (optional argument) – This is the future value or a cash balance we want to attain after the last payment is made. If Fv is omitted, it is assumed to be 0 (zero), that is, the future value of a loan is 0.

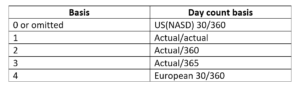

- Type (optional argument) – The type of day count basis to use. The possible values of the basis are:

How to use the PMT Function in Excel?

As a worksheet function, the PMT function can be entered as part of a formula in a cell of a worksheet. To understand the uses of PMT, let us consider an example:

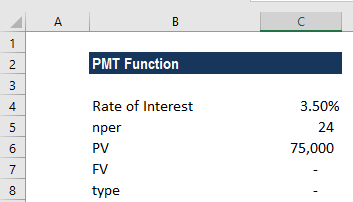

Example 1

Let’s assume that we need to invest in such a manner that, after two years, we’ll receive $75,000. The rate of interest is 3.5% per year and the payment will be made at the start of each month. The details are:

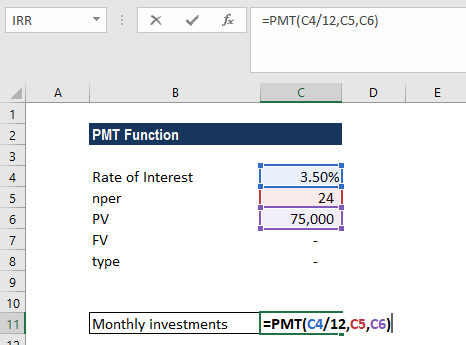

The formula used is:

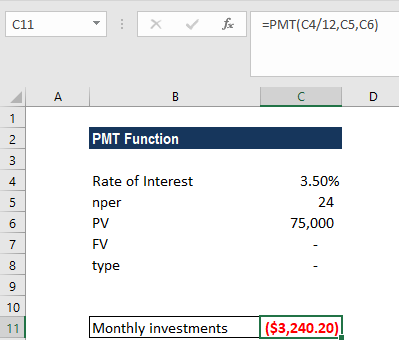

We get the results below:

The above function returns PMT as $3,240.20. This is the monthly cash outflow required to realize $75,000 in two years. In this example:

- The payments into the investment are on a monthly basis. Hence, the annual interest rate is converted to a monthly rate. Also, we converted the years into months: 2*12 = 24.

- The [type] argument is set to 1 to indicate that the payment of the investment will be made at the beginning of each period.

- As per the general cash flow convention, outgoing payments are represented by negative numbers and incoming payments are represented by positive numbers.

- As the value returned is negative, it indicates an outgoing payment is to be made.

- The value $3,240.20 includes the principal and interest but no taxes, reserve payments, or fees.

A few things to remember about the PMT Function:

- #NUM! error – Occurs when:

- The given rate value is less than or equal to -1.

- The given nper value is equal to 0.

- #VALUE! error – Occurs when any of the arguments provided are non-numeric.

- When calculating monthly or quarterly payments, we need to convert annual interest rates or the number of periods to months or quarters.

- If we wish to find out the total amount that was paid for the duration of the loan, we need to multiply the PMT as calculated by nper.

Click here to download the sample Excel file

Additional Resources

Thank you for reading CFI’s guide on the PMT Function. To learn more, check out these additional CFI resources:

- Excel Functions for Finance

- Advanced Excel Formulas Course

- Advanced Excel Formulas You Must Know

- Excel Shortcuts for PC and Mac

- See all Excel resources

Article Sources

- PMT Function