Financial modeling in Excel refers to tools used for preparing the expected financial statements predicting the company’s financial performance in a future period using the assumptions and historical performance information. One may use such financial models in DCF valuations, mergers and acquisitions, private equity, project finance, etc.

Financial modeling in Excel is all around the web. There has been a lot written about learning financial modeling. However, most of the financial modeling pieces of training are the same. It goes beyond the usual gibberish and explores practical financial modeling used by Investment BankersInvestment banking is a specialized banking stream that facilitates the business entities, government and other organizations in generating capital through debts and equity, reorganization, mergers and acquisition, etc.read more and Research Analysts.

In this free financial modeling Excel guide, we will take the example of Colgate Palmolive (2016 – 2020) and prepare a fully integrated financial model from scratch.

This guide is over 5,000 words and took me three weeks to complete. Therefore, save this page for future reference, and do not forget to share it.

Financial Modeling in Excel Training – Read me First

Step 1 – Download the Colgate Financial Model Template.

You can download this Colgate Financial Modeling Templates (Solved/Unsolved) here – Colgate Financial Modeling Templates (Solved/Unsolved)

Step 2 – Please note you will get two templates – 1) Unsolved Colgate Palmolive Financial Model and 2) Solved Colgate Palmolive Financial Model.

Step 3- You will work on the Unsolved Colgate Palmolive Financial Model Template. Follow the step-by-step instructions to prepare a fully integrated financial model.

Step 4 – Happy Learning!

If you are new to financial modeling, look at this guide on What is Financial Modeling?Financial modeling refers to the use of excel-based models to reflect a company’s projected financial performance. Such models represent the financial situation by taking into account risks and future assumptions, which are critical for making significant decisions in the future, such as raising capital or valuing a business, and interpreting their impact.read more

How to Build a Financial Model in Excel?

Let us look at how one can build a financial model from scratch. This detailed financial modeling guide will provide a step-by-step guide to creating a financial model. The primary approach taken in this financial modeling guide is Modular. The modular system essentially means building core statements like income statements, balance sheets, and cash flows using different modules/sheets. The key focus is to prepare each statement step by step and connect all the supporting programs to the core statements on completion. We understand that this may not be clear now. However, you will realize this is very easy as we move forward.

- Step 1 – Colgate’s Financial Model – Historical

- Step 2 – Ratio Analysis of Colgate Palmolive

- Step 3 – Projecting the Income Statement

- Step 4- Working Capital Forecast

- Step 5 – Depreciation Forecast

- Step 6 – Amortization Forecast

- Step 7 – Other Long Term Forecast

- Step 8 – Completing the Income Statement

- Step 9 – Shareholder’s Equity Forecast

- Step 10 – Shares Outstanding Forecast

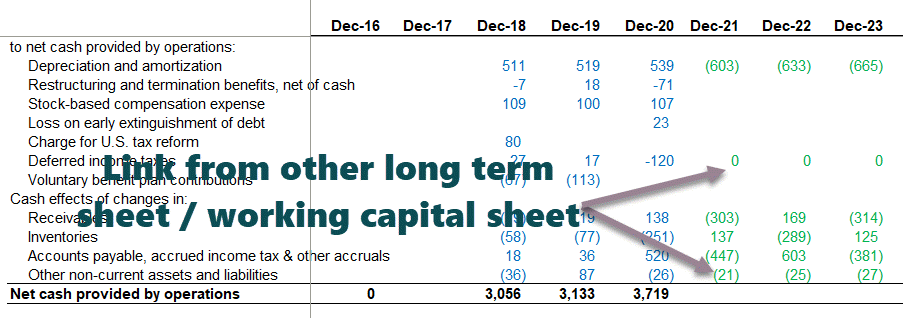

- Step 11 – Completing the Cash Flow Statements

- Step 12- Debt and Interest Forecast

Please note the following –

- The core statements are the Income StatementThe income statement is one of the company’s financial reports that summarizes all of the company’s revenues and expenses over time in order to determine the company’s profit or loss and measure its business activity over time based on user requirements.read more, Balance SheetA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company.read more, and Cash Flows.

- The different sheets are the depreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset’s worth has been utilized. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year.

read more forecast, working capital forecast, intangibles forecast, shareholder’s equityShareholder’s equity is the residual interest of the shareholders in the company and is calculated as the difference between Assets and Liabilities. The Shareholders’ Equity Statement on the balance sheet details the change in the value of shareholder’s equity from the beginning to the end of an accounting period.read more forecast, other long term items forecast, debt forecast scheduleA debt schedule is the list of debts that the business owes, including term loans, debentures, cash credit, etc. Business organizations prepare this schedule to know the exact amount of the company’s liability to others and manage its cash flows to prevent the financial crisis and enable better debt management.read more, etc. - The different schedules are linked to the core statements upon their completion.

- This financial modeling guide will build a step-by-step integrated economic model of Colgate Palmolive from scratch.

Step 1 – Financial Modeling in Excel – Project the Historicals

The first step in the financial modeling guide is to prepare the historicals.

Download Colgate’s 10K Reports

One prepares financial models in Excel. The first steps start with knowing how the industry has been doing recently. Understanding the past can provide valuable insights into the company’s future. Therefore the first step is to download all the company’s financials and populate the same in an Excel sheet. For Colgate Palmolive, you can download the annual reports of Colgate Palmolive from their Investor Relation Section.

Create the Historical Financial Statements Worksheet

- If you download 10K of 2020, you will note that only two years of financial statement data is available. However, for financial modeling in Excel, the recommended dataset is to have the last 5 years of financial statements. Therefore, please download the last 3 years of the annual reportAn annual report is a document that a corporation publishes for its internal and external stakeholders to describe the company’s performance, financial information, and disclosures related to its operations. Over time, these reports have become legal and regulatory requirements.read more and populate the historical.

- Often, these tasks seem too tedious as it may take a lot of time and energy to format and put the excel in the desired format.

- However, one should not forget that this is the work you are required to do only once for each company. Populating the historicals also helps an analyst understand the trends and financial statementsFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period (quarter, six monthly or yearly). These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels.read more.

- So, please do not skip this. Instead, download and populate the data (even if you feel this is the donkey’s work).

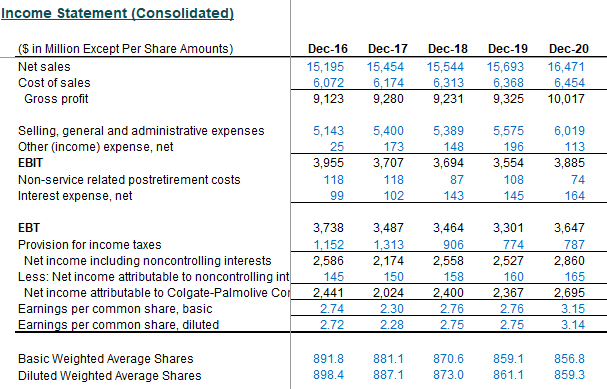

Colgate Income Statement with Historical Populated

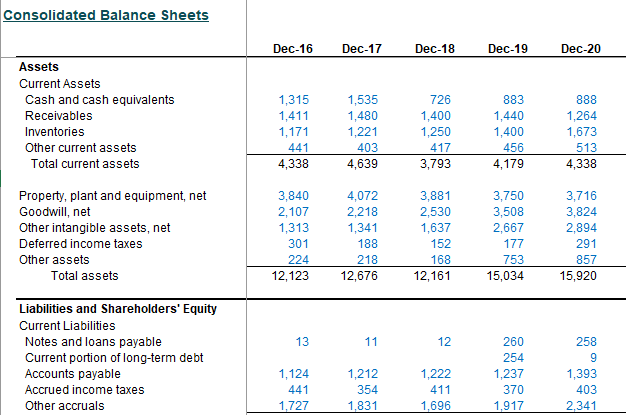

Colgate Balance Sheet Historical Data

Step 2 – Ratio Analysis

The second step in financial modeling in Excel is to perform ratio analysis. We covered this in detail in part 1 of the series – Ratio AnalysisRatio analysis is the quantitative interpretation of the company’s financial performance. It provides valuable information about the organization’s profitability, solvency, operational efficiency and liquidity positions as represented by the financial statements.read more

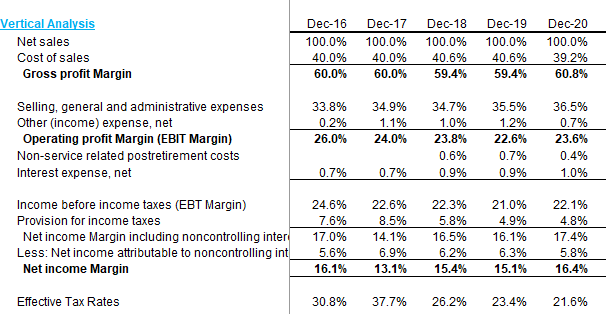

Vertical Analysis of Colgate

On the income statement, the vertical analysis is a universal tool for measuring the firm’s relative performance from year to year in terms of cost and profitability. Therefore, it should always be included as part of any financial analysis. Here, percentages are computed concerning net sales, which is considered 100%. This vertical analysis effort in the income statement is often referred to as margin analysis since it yields different margins concerning sales.

Horizontal Analysis of Colgate

Horizontal analysis is a technique used to evaluate trends over time by calculating percentage increases excelPercentage increase = (New Value — Old Value)/ Old Value. Instead of showing the delta as a Value, percentage increase shows how much the value has changed in terms of percentage increase.read more or decreases relative to a base year. It provides an analytical link between accounts calculated at different dates using the currency with varying purchasing powers. In effect, this analysis indexes the reports and compares these evolved. As with the vertical analysisVertical analysis is a kind of financial statement analysis wherein each item in the financial statement is shown in percentage of the base figure. The formula is: (Statement line item / Total base figure) X 100read more methodology, issues that need to be investigated and complemented with other financial analysis techniques will surface. The focus is to look for symptoms of problems that one can diagnose using additional methods.

Let us look at the horizontal analysis of Colgate.

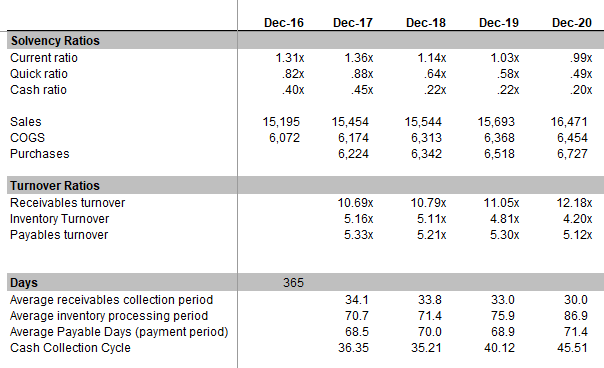

Liquidity Ratios of Colgate

- Liquidity ratios measure the relationship of the more liquid assetsLiquid Assets are the business assets that can be converted into cash within a short period, such as cash, marketable securities, and money market instruments. They are recorded on the asset side of the company’s balance sheet.read more of an enterprise (the ones most easily convertible to cash) to current liabilities. The most common liquidity ratios are the current ratioThe current ratio is a liquidity ratio that measures how efficiently a company can repay it’ short-term loans within a year. Current ratio = current assets/current liabilities

read more, Acid test (or quick asset) ratio Cash RatiosCash Ratio is calculated by dividing the total cash and the cash equivalents of the company by total current liabilities. It indicates how quickly a business can pay off its short term liabilities using the non-current assets.read more. - Turnover Ratios like Accounts ReceivablesAccounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. They are categorized as current assets on the balance sheet as the payments expected within a year.

read more turnover, inventory turnover, and payables turnover.

Also, have a look at this detailed article on Cash Conversion CycleThe Cash Conversion Cycle (CCC) is a ratio analysis measure to evaluate the number of days or time a company converts its inventory and other inputs into cash. It considers the days inventory outstanding, days sales outstanding and days payable outstanding for computation.read more.

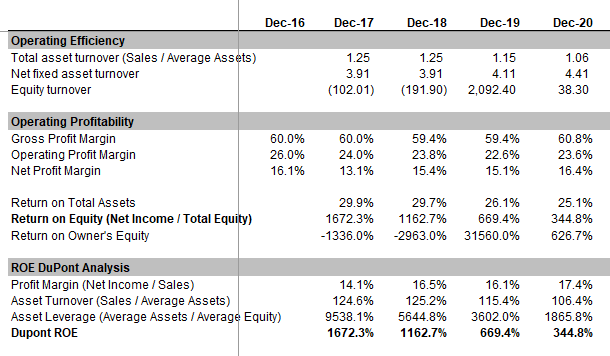

Operating Profitability Ratios of Colgate

Profitability ratiosProfitability ratios help in evaluating the ability of a company to generate income against the expenses. These ratios represent the financial viability of the company in various terms.read more are a company’s ability to generate earnings relative to sales, assets, and equity.

Risk Analysis of Colgate

Through Risk AnalysisRisk analysis refers to the process of identifying, measuring, and mitigating the uncertainties involved in a project, investment, or business. There are two types of risk analysis — quantitative and qualitative risk analysis.read more, we try to gauge whether the companies will be able to pay their short and long-term obligations (debt). We calculate leverage ratiosDebt-to-equity, debt-to-capital, debt-to-assets, and debt-to-EBITDA are examples of leverage ratios that are used to determine how much debt a company has taken out against its assets or equity.read more that focus on the sufficiency of assets or generation from assets. Rates that looks at are:

- Debt to Equity Ratio

- Debt ratio

- Interest Coverage RatioThe interest coverage ratio indicates how many times a company’s current earnings before interest and taxes can be used to pay interest on its outstanding debt. It can be used to determine a company’s liquidity position by evaluating how easily it can pay interest on its outstanding debt.read more

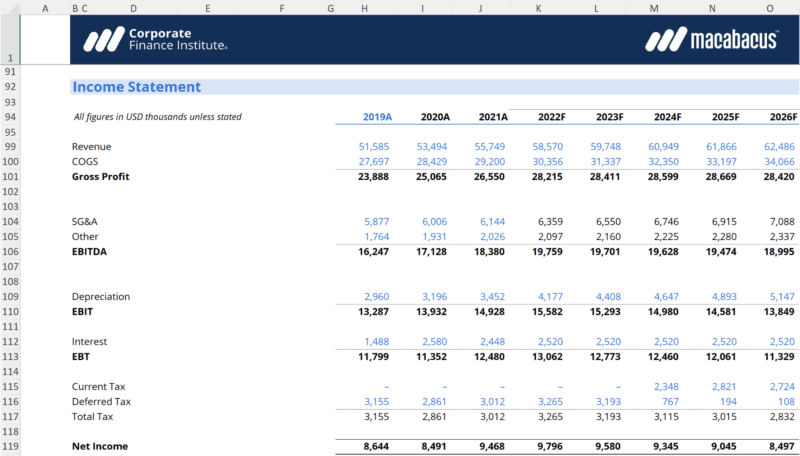

Step 3 – Financial Modeling in Excel – Project the Income Statement

The third step in financial modeling is to forecast the income statement, wherein we will start with modeling the sales or revenue items.

Revenues Projections

For most companies, revenues are a fundamental driver of economic performance. Therefore, a well-designed and logical revenue model reflecting the type and amounts of income flows accurately is extremely important. There are as many ways to create a revenue schedule as there are businesses. Some common types include:

- Sales Growth: Sales growth assumption in each period defines the change from the previous period. It is a simple and commonly used method but offers no insights into the components or dynamics of growth.

- Inflationary and Volume/ Mix effects: Instead of a simple growth assumption, a price inflation factor and a volume factor are used. This useful approach allows the modeling of fixed and variable costs in multi-product companies and considers price vs. volume movements.

- Unit Volume, Change in Volume, Average Price, and Change in Price: This method is appropriate for businesses with a simple product mix. It permits analysis of the impact of several key variables.

- Dollar Market Size and Growth: Market share and change in share – useful for cases where information is available on market dynamicsMarket Dynamics is defined as the forces of market constituents responsible for the shift in the demand and supply curve and are therefore accountable for creating and reducing the demand and supply of a particular product.read more and where these assumptions are likely to be fundamental to a decision. For example, the telecom industry.

- Unit Market Size and Growth: This is more detailed than the preceding case and is useful when pricing in the market is a crucial variable. (For a company with a price-discounting strategy. For example, a best-of-breed premium-priced niche player) e.g., the luxury car market

- Volume Capacity, Capacity Utilization Rate, and Average Price: These assumptions can be important for businesses where production capacity is essential to the decision. (In purchasing additional capacity, for example, or determining whether the expansion would require new investments).

- Product Availability and Pricing

- Revenue was driven by investment in capital, marketing, or R&D

- Revenue-based on installed base (continuing sales of parts, disposables, services, add-ons, etc.). Examples include classic razor-blade businesses and businesses like computers where sales of service, software, and upgrades are essential. Again, modeling the installed base is key (new additions to the floor, attrition in the ground, continuing revenues per customer, etc.).

- Employee based: For example, revenues of professional services firms or sales-based firms such as brokers. Modeling should focus on net staffing and revenue per employeeRevenue Per Employee is the ratio of total revenue over total number of employees in a particular accounting period. It gives an idea about how the business performed.read more (often based on billable hours). More detailed models will include seniority and other factors affecting pricing.

- Store, facility, or Square footage based: Retail companies are often modeled based on stores (old stores plus new stores each year) and revenue per store.

- Occupancy-factor-based: This approach applies to airlines, hotels, movie theatres, and other businesses with low marginal costs.

Projecting Colgate Revenues

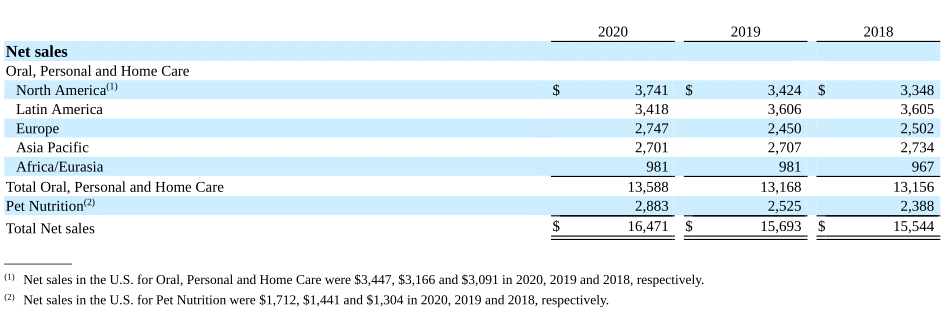

Let us now look at the Colgate 10K 2020 report. First, Colgate has not provided segmental information in the income statement. However, as additional information, Colgate has provided details of each segment.

Source – Colgate 2020 – 10K, Page 119

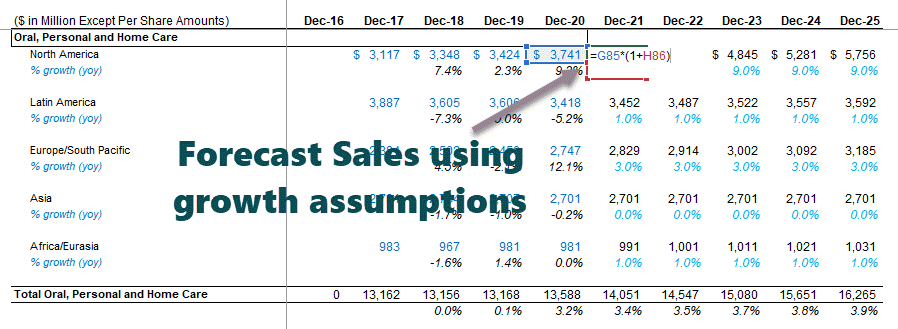

Since we do not have any further information about the features, we will project the future sales of Colgate based on this available data. We will use the sales growth approach across segments to derive the forecasts. Please see the picture below. We have calculated the year-over-year growth rate for each element.

Now, we can assume a sales growth percentage based on the historical trends and project the revenues under each part. Therefore, total net sales are the total of the Oral, Personal & Home Care, and Pet Nutrition Segment.

Costs Projections

- Percentage of Revenues: Simple but offers no insight into any leverage (economy of scale or fixed cost burden.

- Costs other than depreciation as a percent of revenues and depreciation from a different schedule: This approach is the minimum acceptable in most cases and permits only partial analysis of operating leverageOperating Leverage is an accounting metric that helps the analyst in analyzing how a company’s operations are related to the company’s revenues. The ratio gives details about how much of a revenue increase will the company have with a specific percentage of sales increase – which puts the predictability of sales into the forefront.read more.

- Variable costs based on revenue or volume, fixed costs based on historical trends, and depreciation from a different schedule. This approach is the minimum necessary for sensitivity analysisSensitivity analysis is a type of analysis that is based on what-if analysis, which examines how independent factors influence the dependent aspect and predicts the outcome when an analysis is performed under certain conditions.read more of profitability based on multiple revenue scenarios.

Cost Projections for Colgate

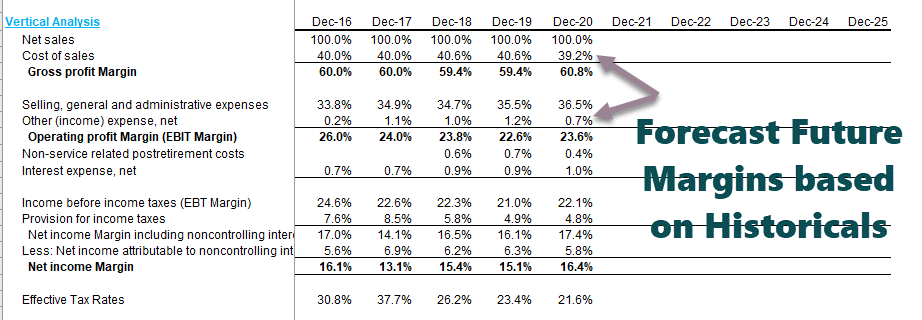

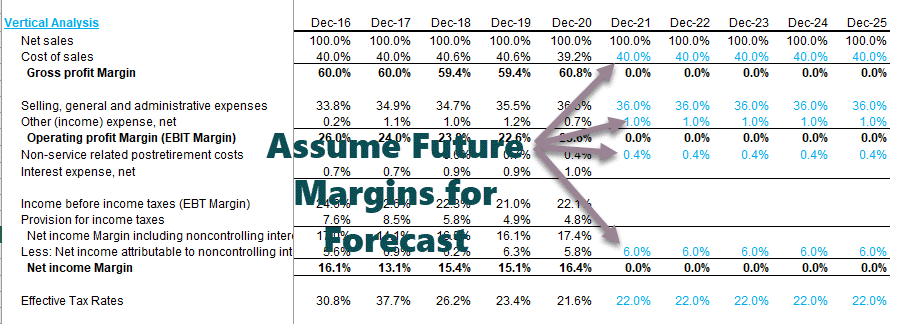

For projecting the cost, the vertical analysis done earlier will be helpful. So, let us have a relook at the vertical analysis:

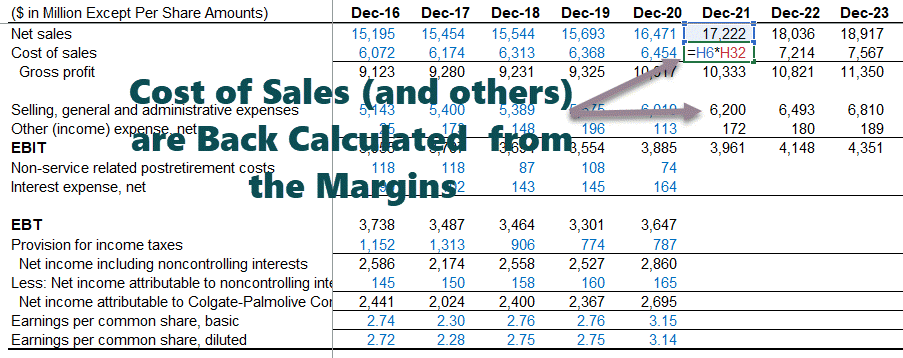

- Since we have already forecasted sales, all the other costs are some margins of these sales.

- The approach is to take the guidelines from the historical cost and expense margins and then forecast the future margin.

- For example, the cost of sales has been in the range of 39.2%-40.6% for the past five years. So we can look at forecasting the margins on this basis.

- Likewise, selling, general, and Administrative ExpensesSelling, general and administrative (SG&A) expense includes all the expenses incurred in the selling of the products of the company whether direct or indirect along with the entire general and the administrative expenses during an accounting period under consideration such as advertisement expenses, sales promotion expenses, marketing salaries, etc.read more have been historically in the range of 33.8%-36.5%. We can assume the future SG&A expense margin on this basis. Likewise, we can go on for another set of expenses.

Using the above margins, we can find the actual values by back calculations.

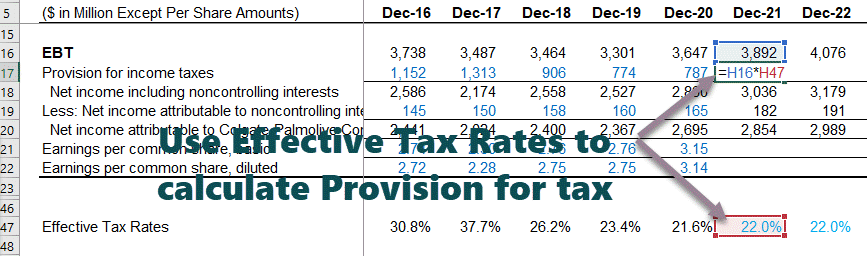

We use the effective tax rate assumption to calculate the provision for taxes.

- Also, note that we do not complete the “Interest Expense (Income)” row as we will look at the income statement later.

- Interest Expense and Interest Income.Interest Income is the amount of revenue generated by interest-yielding investments like certificates of deposit, savings accounts, or other investments & it is reported in the Company’s income statement. read more

- We have also not calculated depreciation and amortization, which we have already included in the cost of sales.

- This completes the income statement (at least for the time being!).

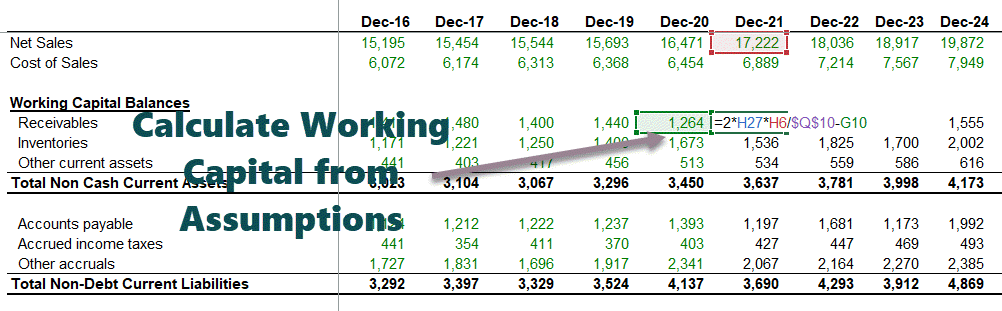

Step 4- Financial Modeling – Working Capital Schedule

Now that we have completed the income statement, the fourth step in financial modeling is to look at the working capital schedule.

Below are the steps that one must follow for a working capital schedule.

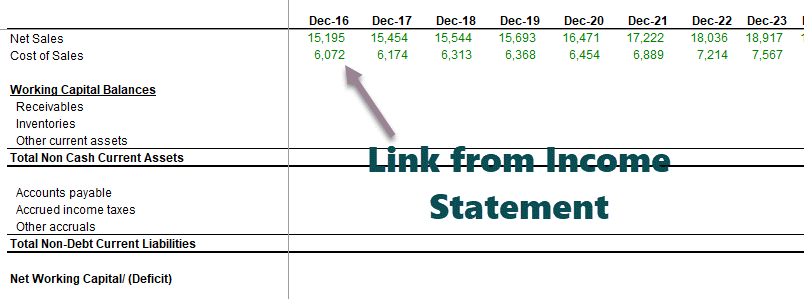

Link the Net Sales and Cost of Sales

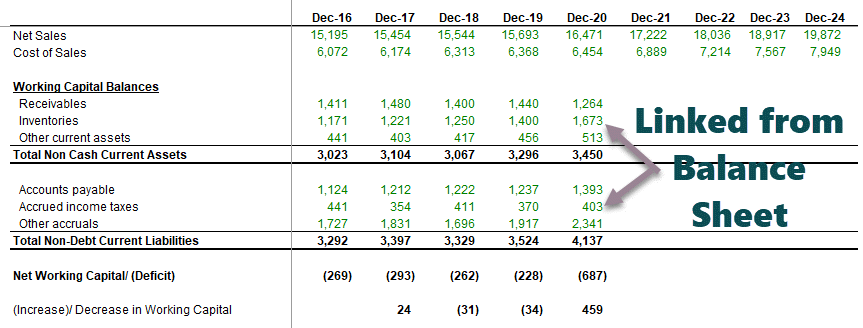

- Reference the past data from the balance sheet.

- Calculate net working capitalThe change in net working capital of a firm from one accounting period to the next is referred to as the change in net working capital. It is calculated to ensure that the firm maintains sufficient working capital in each accounting period so that there is no shortage of funds or that funds do not sit idle in the future.read more

- Arrive at an increase/ decrease in working capital

- Note that we have not included short-term debt and cash and cash equivalents in the working capital. We will deal with debt and cash and cash equivalentsCash and Cash Equivalents are assets that are short-term and highly liquid investments that can be readily converted into cash and have a low risk of price fluctuation. Cash and paper money, US Treasury bills, undeposited receipts, and Money Market funds are its examples. They are normally found as a line item on the top of the balance sheet asset. read more separately.

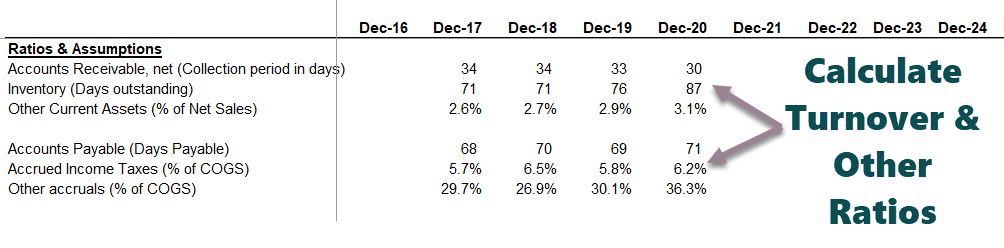

Calculate the Turnover Ratios

- Calculate historical ratios and percentages

- Use the ending or average balance.

- Both are acceptable as long as consistency is maintained.

Populate the assumptions for future working capital items

- Certain items without a prominent driver are assumed usually at constant amounts.

- Ensure assumptions are reasonable and in line with the business.

Project the future working capital balances

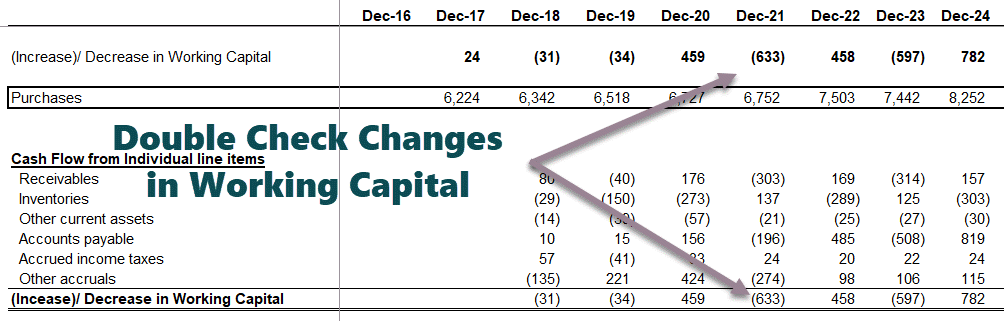

Calculate the changes in Working Capital

- Arrive at cash flows based on individual line items.

- Ensure signs are accurate!

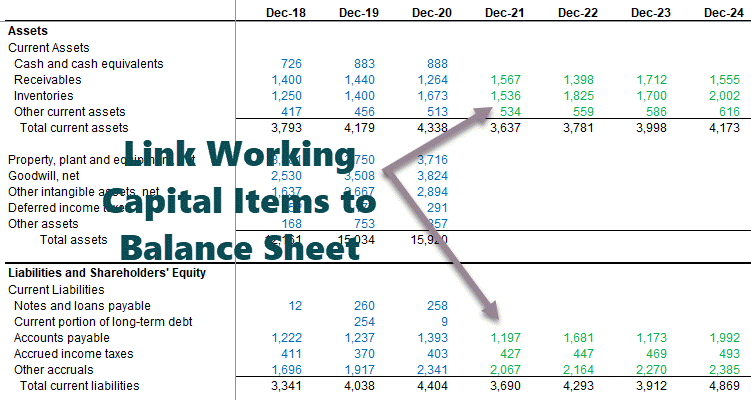

Link up the Working Capital Forecasts to the Balance Sheet

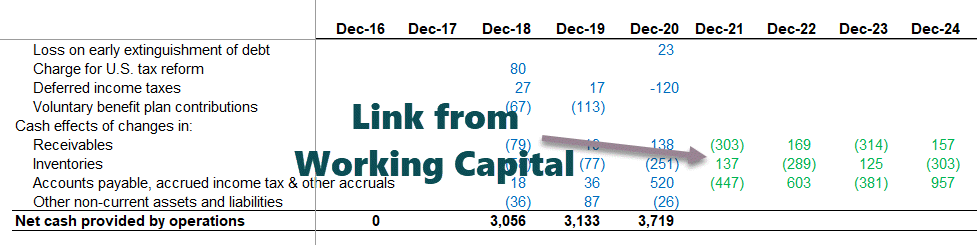

Link Working Capital Items to the Cash Flow Statement

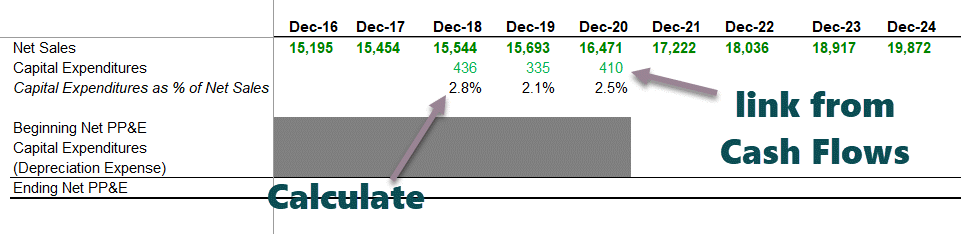

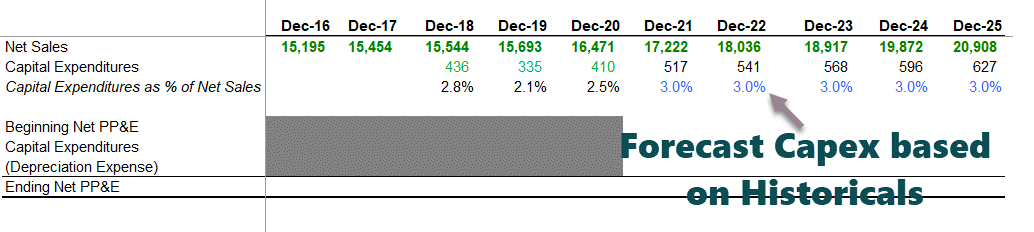

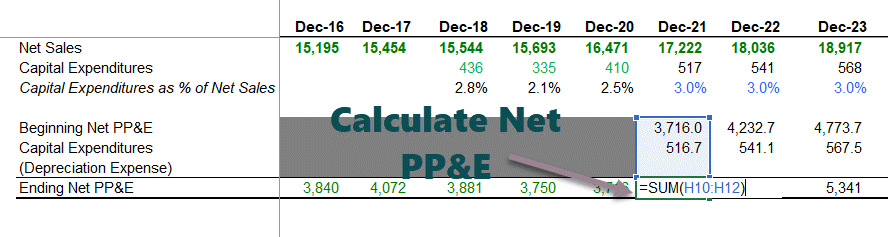

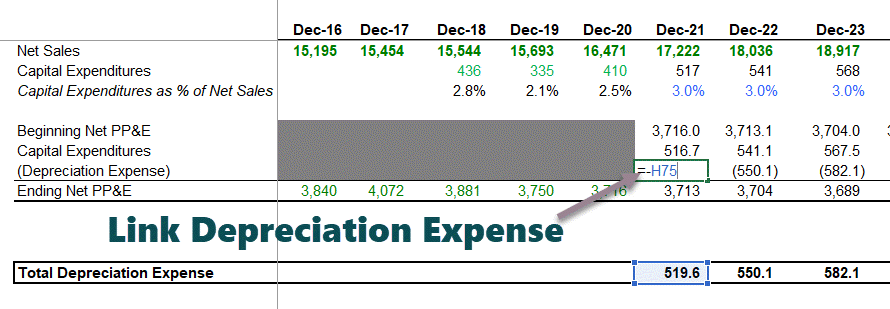

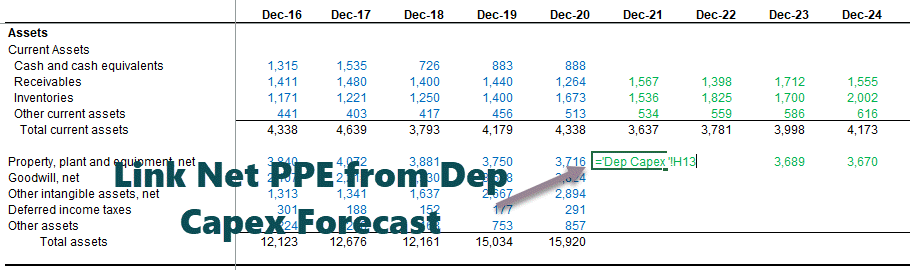

Step 5 – Financial Modeling in Excel – Depreciation Schedule

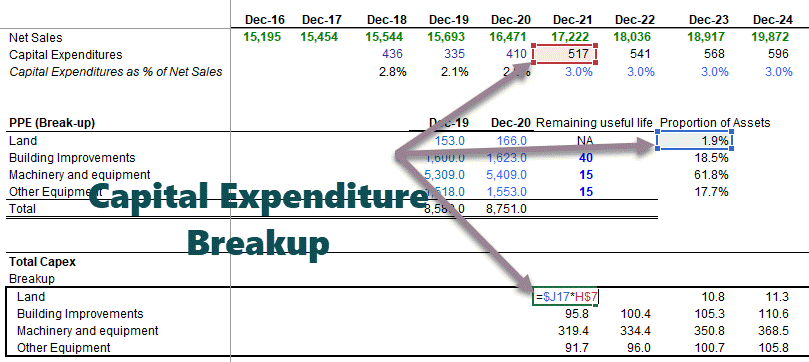

With the completion of the working capital schedule, the next step in this financial modeling is to project the CapexCapex or Capital Expenditure is the expense of the company’s total purchases of assets during a given period determined by adding the net increase in factory, property, equipment, and depreciation expense during a fiscal year.read more of Colgate and the depreciation and assets figures.

source – Colgate 10K 2020 Page – 72

- It has not provided depreciation and amortization as separate line items. However, it is included in the cost of sales.

- In such cases, please look at the cash flow statements, where you will find the depreciation and amortization expense. Also, note that the below figures are 1) Depreciation and 2) amortization. So, what is the depreciation number?

- Ending Balance for PPE = Beginning balance + Capex – Depreciation – Adjustment for Asset Sales (BASE equation).

Link the Net Sales figures in the Depreciation Schedule

- Set up the line items

- Reference net sales

- Input past capital expenditures

- Arrive at Capex as a % of net sales

Forecast the Capital Expenditure Items

- There are various approaches to forecasting capital expenditure. One common practice is to look at the press releases, management projections, and MD&A to understand the company’s view on future capital expenditure.

- If the company has guided future capital expenditure, we can take those numbers directly.

- However, if the Capex numbers are not directly available, we can calculate it crudely using Capex as % of Sales (as done below).

- Use your judgment based on industry knowledge and other reasonable drivers.

Reference Past Information and Calculate Net PP&E

- We will use Ending Balance for PPE = Beginning balance + Capex – Depreciation – Adjustment for Asset Sales (BASE equation)

- It is complicated to reconcile past PP&E due to restatementsA restatement is the revision of already issued financial statements of one or more companies to correct errors with material inaccuracy due to non adhering and complying with the GAAP, accounting mistakes, fraud, or clerical errors affecting part of the entire financial statement requiring a completely new audit.read more, asset sales, etc.

- It is therefore recommended not to reconcile the past PPE as it may lead to some confusion.

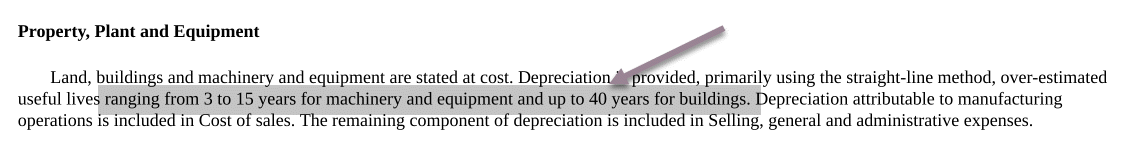

Depreciation Policy of Colgate

- Colgate has not explicitly provided a detailed breakup of the Assets. Instead, they clubbed all assets into the land, building, machinery, and other equipment.

- Also, useful lives for machinery and equipment are provided in range. In this case, we will have to do some guesswork to determine the average useful life left for the assets.

- Also, guidance for useful life is not provided for “Other equipment.” Therefore, we will have to estimate the useful life of other equipment.

Colgate 2020 – 10K, Page 79

Below is the breakup of 2012 and 2013 Property, Plant, and Equipment Details

Colgate 2020 – 10K, Page 125

Estimate the breakup of Property Plant and Equipment (PPE)

- First, find the Asset weights of the Current PPE (2020)

- We will assume that these asset weights of 2020 PPE will continue going forward.

- We use these asset weights to calculate the breakup of estimated capital expenditure.

Estimate the Depreciation of Assets

- Please note that we do not calculate depreciation of LandThe land is a company asset with an infinite useful life. As a result, it is not subject to depreciation, unlike other long-term assets such as buildings and furniture, which have a limited useful life and thus require their costs to be allocated to the accounting period.read more as land is not a depreciable asset.

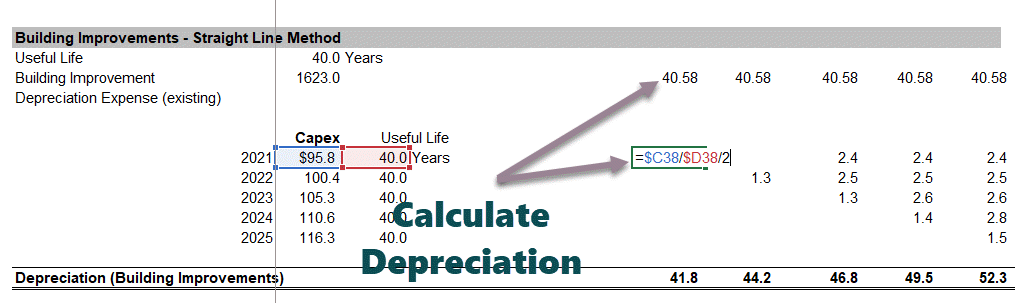

- For estimating depreciation from Building improvements, we first make use of the below structure.

- Depreciation here is divided into two parts: 1)Depreciation from the building improvements asset already listed on the balance sheet, 2) depreciation from the future Building improvements.

- We use the simple Straight Line Method of depreciationStraight Line Depreciation Method is one of the most popular methods of depreciation where the asset uniformly depreciates over its useful life and the cost of the asset is evenly spread over its useful and functional life. read more to calculate the depreciation from building improvements listed on the asset.

- For calculating future depreciation, we first transpose the Capex using the TRANSPOSE Function in ExcelThe TRANSPOSE function in excel helps rotate (switch) the values from rows to columns and vice versa. Being a part of the Excel lookup and reference functions, its purpose is to organize the data in the desired format. To execute the formula, the exact size of the range to be transposed is selected and the CSE key (“Control+Shift+Enter”) is pressed.

read more. - We calculate the depreciation from asset contributions from each year.

- Also, the first-year depreciation is divided by two as we assume the mid-year convention for asset deployment.

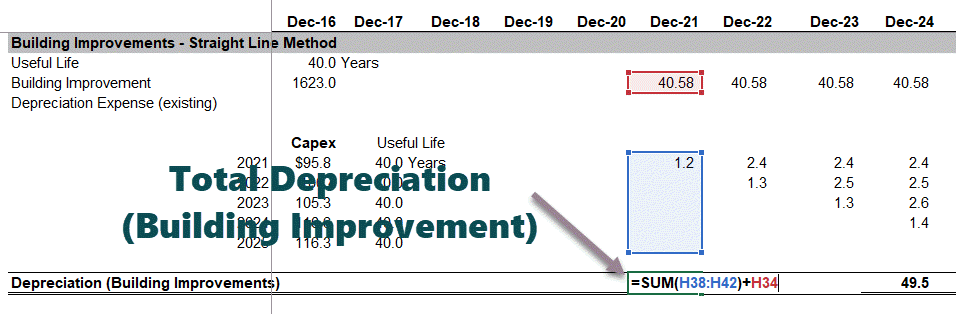

Total Depreciation of BuildingDepreciation of building refers to reducing the recorded cost of a building until the value of the structure either becomes zero or reaches its salvage value. In addition, it helps to map the revenue in the form of lease rental generated during the corresponding expenses.read more improvement = depreciation from the asset already listed on the balance sheet + depreciation from the future building improvements.

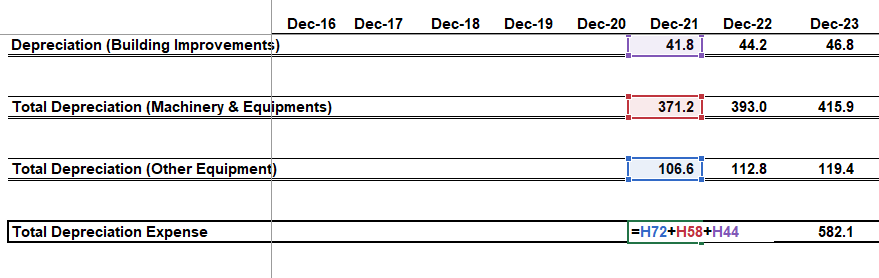

In the above process for estimating depreciation, one may calculate the depreciation of 1) manufacturing equipment & machinery and 2) other equipment, as shown below.

Total Depreciation of Colgate = Depreciation (Building Improvements) + Depreciation (Machinery & Equipment) + Depreciation (additional equipment)

Once we have found the real depreciation figures, we can put that in the BASE equation as shown below.

- With this, we get the ending net PP&E figures for each year.

Link the Net PP&E to the Balance Sheet

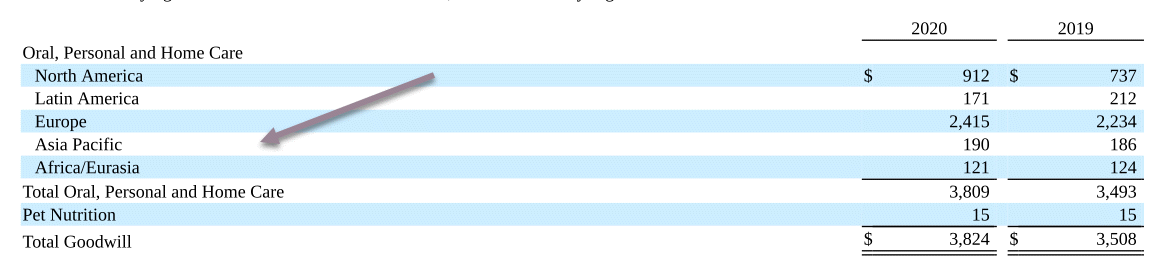

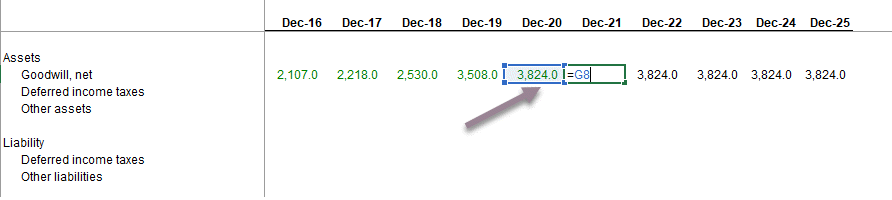

Step 6 – Amortization Schedule

The sixth step in this financial modeling in Excel is to forecast the amortization. Again, we have two broad categories to consider here – 1) GoodwillIn accounting, goodwill is an intangible asset that is generated when one company purchases another company for a price that is greater than the sum of the company’s net identifiable assets at the time of acquisition. It is determined by subtracting the fair value of the company’s net identifiable assets from the total purchase price.read more and 2) Other Intangibles.

Forecasting Goodwill

Colgate 2020 – 10K, Page 88

- Goodwill comes on the balance sheet when a company acquires another company. It usually is complicated to project goodwill for future years.

- However, Goodwill is subject to impairment tests annually, which the company performs. Therefore, analysts are in no position to conduct such tests and prepare estimates of impairments.

- Most analysts do not project goodwill. They just keep this constant, which we will do in our case.

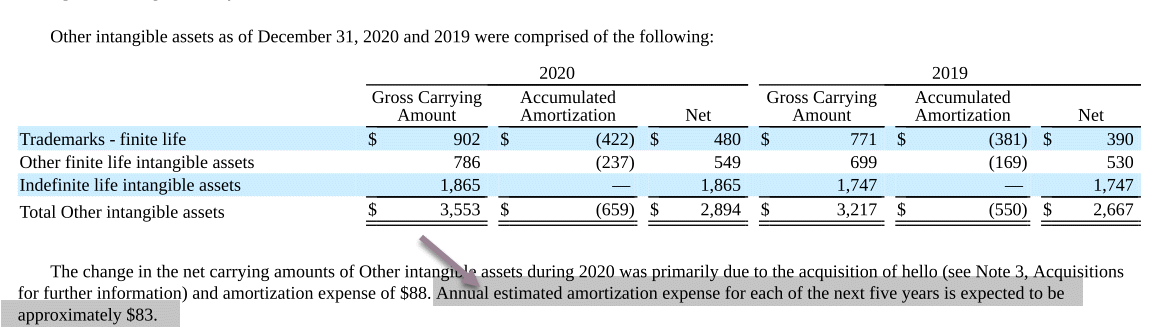

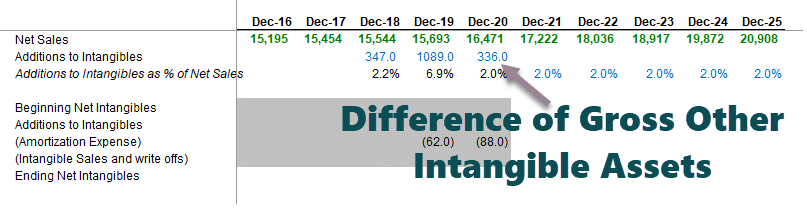

Forecasting Other Intangible Assets

- Colgate’s 10K Report notes that most of the finite life intangible is related to the Sanex acquisition.

- “Additions to Intangibles” are also complicated to project.

- Colgate’s 10K report provides us with the details of the next five years of amortization expenses.

- We will use these estimates in our financial model.

Colgate 2020 – 10K, Page 88

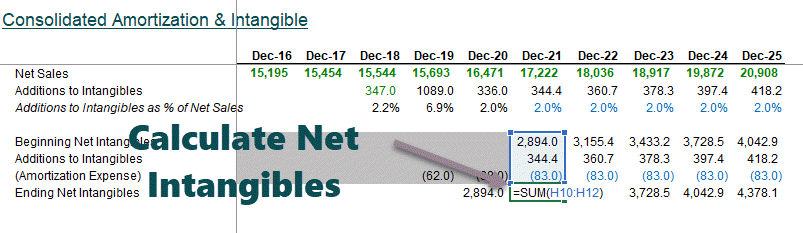

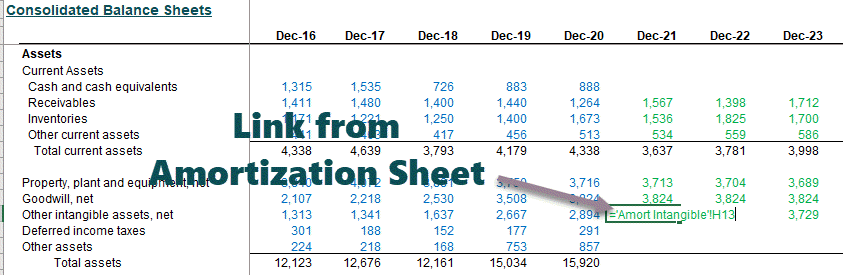

Calculate Ending Net Intangibles

Ending net intangibles are linked to the “Other Intangible Assets.”

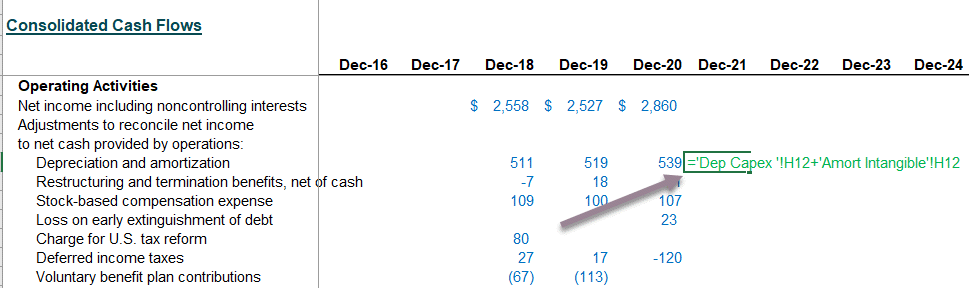

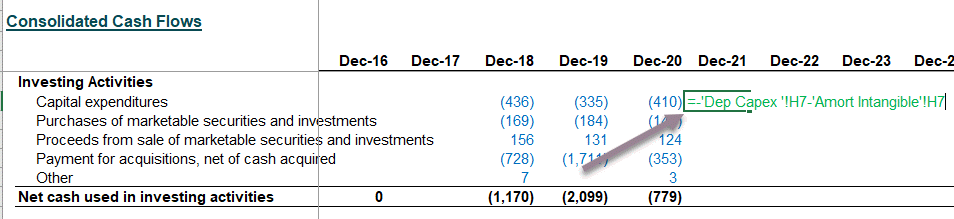

Link Depreciation and Amortization to Cash Flow Statements

Link Capex & Addition to Intangibles to Cash flow statements

Step 7 – Other Long Term Schedule

The next step in this financial modeling is to prepare the other long-term schedule. It is when we prepare for the “leftovers” that do not have specific drivers for forecasting. In the case of Colgate, the other long-term items (leftovers) were Deferred Income TaxesDeferred income tax is a balance sheet item that can be either a liability or an asset since it is a difference in income recognition between the firm’s accounting records and the tax law, resulting in the company’s income tax due being different than the total tax expense reported.read more (liability and assets), other investments, and other liabilities.

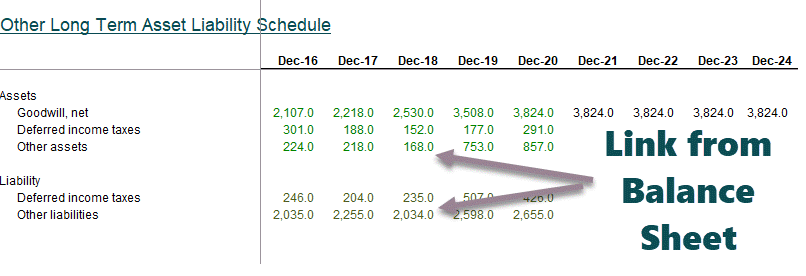

Reference the historical data from the Balance Sheet

Also, calculate the changes in these items.

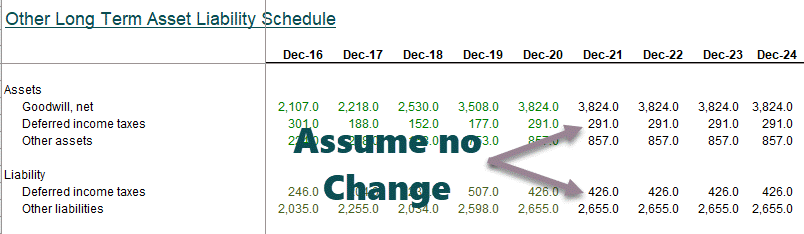

Forecast the Long Term Assets and Liabilities

- Keep the long-term items constant for projected years in case of no visible drivers.

- Link the forecasted long term items to the Balance SheetAssets such as cash, inventories, accounts receivable, investments, prepaid expenses, and fixed assets; liabilities such as long-term debt, short-term debt, Accounts payable, and so on are all included in the balance sheet.read more as shown below.

Reference Other Long Term Items to the Balance Sheet

Link the long term items to the Cash Flow Statement

Please note that if we keep the long-term assets and liabilities constant, the change that flows to the cash flow statement would be zero.

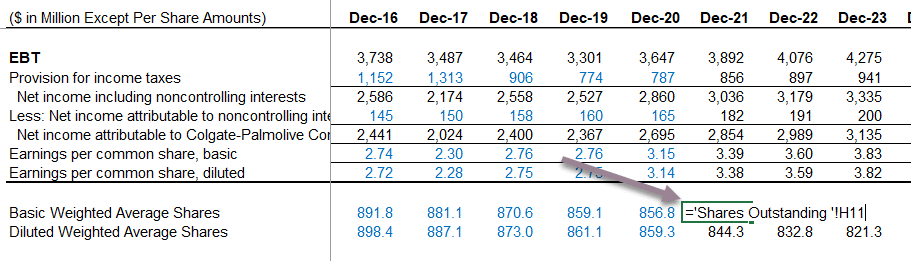

Step 8 – Financial Modeling in Excel – Completing the Income Statement

- Before we move any further in this Excel-based financial modeling, we will review the income statement.

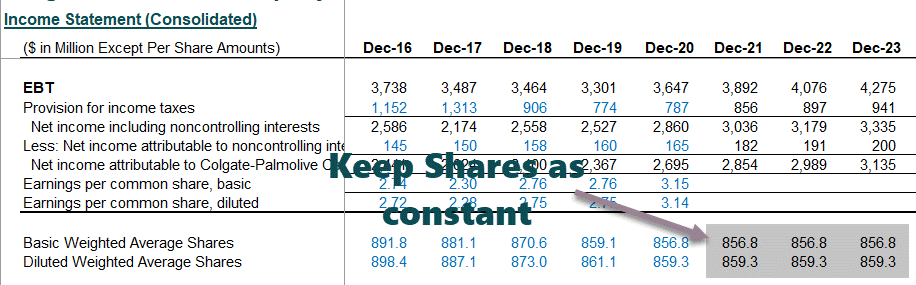

- Populate the historical basic weighted average shares and dilute the weighted average number of shares

- These figures are available in Colgate’s 10K report.

Reference the basic and diluted shares

At this stage, assume that the future number of primary and diluted shares will remain the same as in 2020.

We are ready to move to our next shareholder’s equity schedule.

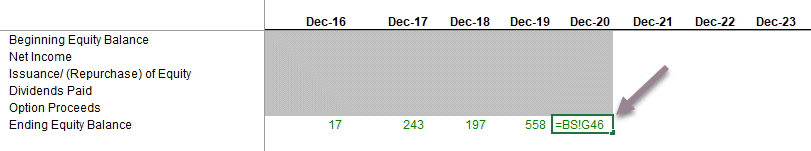

Step 9 – Financial Modelling – Shareholder’s Equity Schedule

The next step in this financial modeling in Excel training is to look at the shareholder’s equity schedule. The primary objective of this schedule is to project equity-related items like shareholder’s equity, dividends, Share buybackShare buyback refers to the repurchase of the company’s own outstanding shares from the open market using the accumulated funds of the company to decrease the outstanding shares in the company’s balance sheet. This is done either to increase the value of the existing shares or to prevent various shareholders from controlling the company.read more, option proceeds, etc.

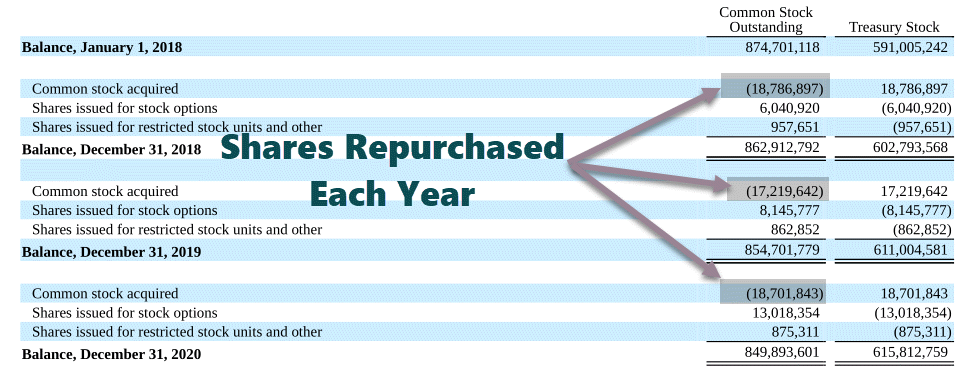

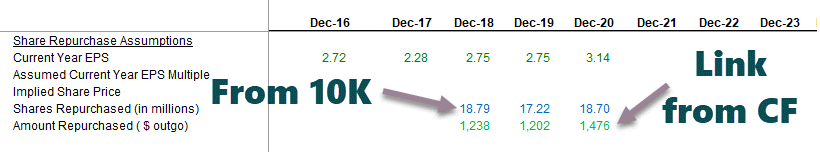

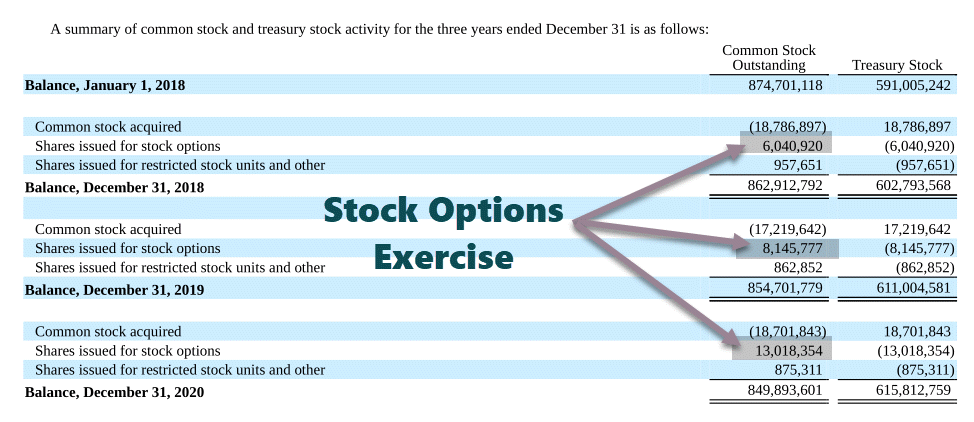

Colgate’s 10K report provides us with the details of common and treasury stock activities in the past years, as shown below.

Colgate 10K 2020 – Page 97

- Historically, Colgate has repurchased shares, as shown in the schedule above.

- Populate Colgate’s shares repurchase (millions) in the Excel sheet.

- Link the historical diluted EPS from the income statement.

- The historical amount repurchased should be referenced from the cash flow statementsA Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business.read more.

Also, have a look at Accelerated Share RepurchaseAccelerated share repurchase (buyback) is a strategy adopted by a publicly-traded company to acquire its outstanding shares in the market from the clients in large blocks via an investment bank.read more.

- Calculate the implied average price at which Colgate has done share repurchases historically. One may calculate the Amount repurchased / Number of shares.

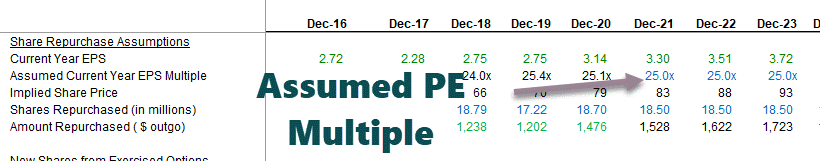

- Calculate the PE multipleThe price to earnings (PE) ratio measures the relative value of the corporate stocks, i.e., whether it is undervalued or overvalued. It is calculated as the proportion of the current price per share to the earnings per share. read more = Implied Share Price / EPS

Colgate has not officially announced how many shares they intend to buy back. The only information that their 10K report shares are that they have authorized a buyback of up to 50 million shares.

Colgate 10K 2020 – Page 97

- We need to assume the share repurchase amount to find the number of shares repurchased. Based on the historical repurchase amount, we have taken this number as $1,500 million for all the future years.

- We need the projected implied share price of the potential buyback to find the number of shares repurchased.

- Actual share price = assumed PE multiplex EPS.

- One can assume future buyback PE multiple based on historical trends. We note that Colgate has repurchased shares at an average PE range of 17x – 25x.

- Below is the snapshot from Reuters that helps us validate the PE range for Colgate.

- In our case, we have assumed that all future buybacks of Colgate will be at a PE multiple of 25x.

- Using the PE of 25x, we can find the implied price = EPS x 25.

- Now that we have found the implied price, we can see the number of shares repurchased = $ amount used for repurchase / implied price.

Stock Options: Populate Historical Data

- The common stock and shareholder’s equity summary shows us the number of options exercises each year.

Colgate 2020 – 10K, Page 97

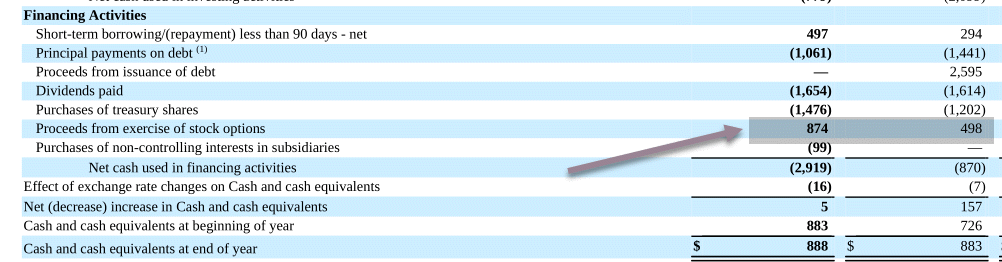

- Besides, we also have the option proceeds from the cash flow statements (approx).

- With this, we should be able to find an effective strike priceExercise price or strike price refers to the price at which the underlying stock is purchased or sold by the persons trading in the options of calls & puts available in the derivative trading. Thus, the exercise price is a term used in the derivative market.read more.

Colgate 2020 – 10K, Page 76

Also, note that the stock optionsStock options are derivative instruments that give the holder the right to buy or sell any stock at a predetermined price regardless of the prevailing market prices. It typically consists of four components: the strike price, the expiry date, the lot size, and the share premium.read more have contractual terms of eight years and vest over three years.

Colgate 2020 – 10K, Page 100

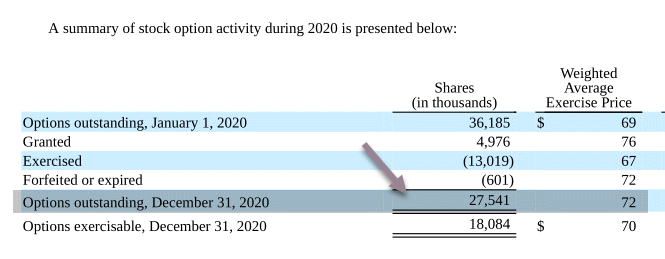

With this data, we fill up the options data as per below. We also note that the weighted average strike price of stock options for 2020 was $72, and the number of options outstanding was 27.541 million.

Colgate 2020 – 10K, Page 100

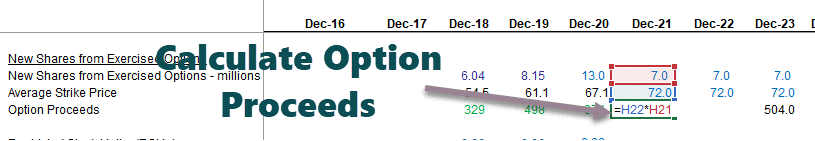

Stock Options: Find the Option Proceeds.

Our options data below shows that the option proceeds were $504 million in 2021. We have assumed that 7 million options exercise each year.

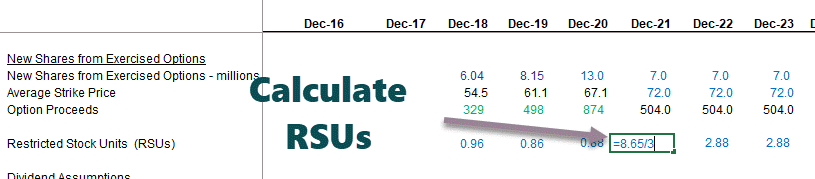

Stock Options: Forecast Restricted Stock Unit Data

In addition to the stock options, there are Restricted Stock UnitsRestricted Stock Units or RSU can be defined as stock-based compensation that is issued as company’s stock to an employee. The company establishes vesting requirements based on the performance of an individual and the length of the employment.read more are given to the employees and awarded and vested at the end of each three-year performance period.

Colgate 2020 – 10K, Page 99

Populating this data in the restricted stock units dataset.

The restricted stock units project to be (8.65/3.0 years), i.e., 2.88 million going forward.

Also, have a look at the Treasury Stock MethodTreasury Stock Method is an accounting approach assuming that the options & stock warrants are exercised at the beginning of the year (or date of issue, if later) & proceeds from the exercise of these options & warrants are used to repurchase shares in the market. read more.

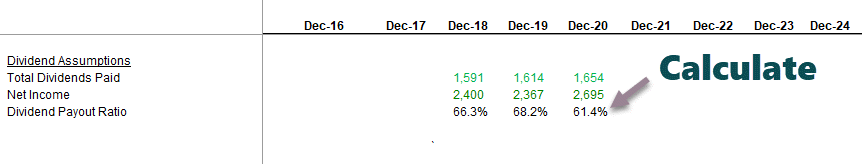

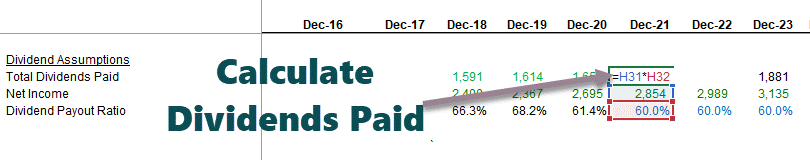

Dividends: Forecast the Dividends

- Forecast estimated dividends using the Dividend Payout Ratio.

- Fixed dividend outgo per-share payout.

- From the 10K reports, we extract all past information on dividends.

- With the information on dividends paid, we can find the Dividend Payout Ratio = Total Dividends Paid / Net Income.

- We have calculated the dividends payout ratio of Colgate as seen below:

We note that the dividends payout ratio has been broadly in the range of 60%-66%. Therefore, let us assume the dividend payout ratio of 60% in the future years.

- We can also link the projected net income from the income statement.

- Using the projected net income and the dividends payout ratio, we can find the total dividends paid.

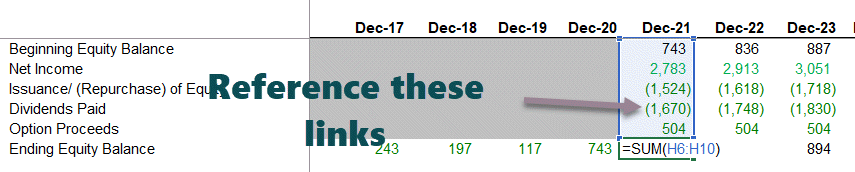

Forecast equity account in its entirety

With the forecast of share repurchase, option proceeds, and dividends, we are ready to complete the shareholder’s equity schedule. Link all these up to find the ending equity balance for each year, as shown below.

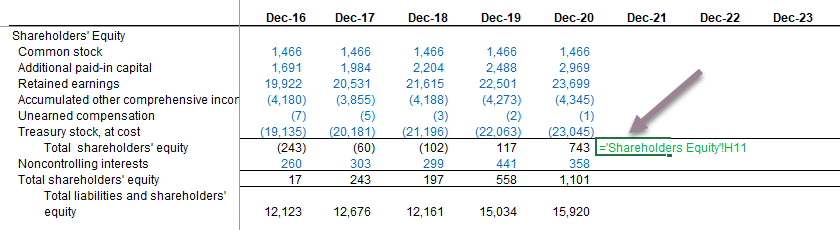

Link Ending Shareholder’s Equity to the Balance Sheet

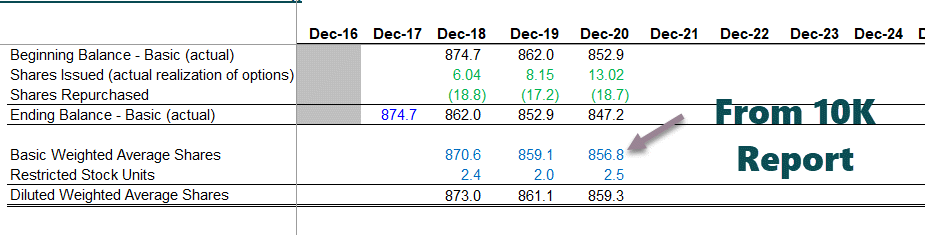

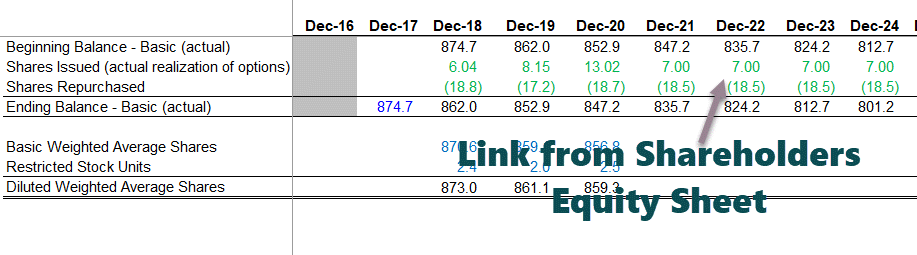

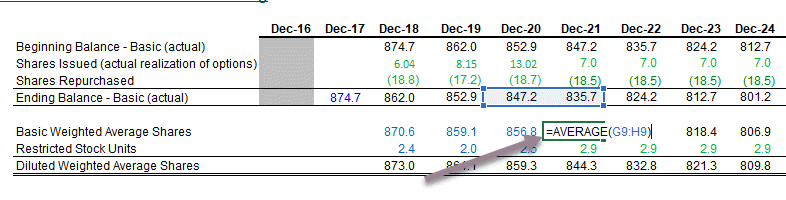

Step 10 – Shares Outstanding Schedule

The next step in this online financial modeling in Excel training is to look at the shares’ outstanding schedule. Summary of shares outstanding schedule:

- Basic Shares – actual and average

- Capture past effects of options and convertibles as appropriate

- Diluted SharesDiluted shares can be defined as the total number of shares that the company has at a particular point that can be converted into the normal share by the holders (convertible bond, convertible preferred stock, employee stock options). It is done by exercising the right to alter such shares into ordinary shares.read more – average

- Reference Shares repurchased and new shares from exercised options

- Calculate forecasted raw percentages (actual)

- Calculate average basic and diluted shares

- Reference projected shares to Income Statement (recall Income Statement Build up!)

- Input historical shares outstandingOutstanding shares are the stocks available with the company’s shareholders at a given point of time after excluding the shares that the entity had repurchased. It is shown as a part of the owner’s equity in the liability side of the company’s balance sheet.read more information

- Note: Commonly, this schedule integrates with the equity schedule.

Input the historical numbers from the 10K report

- Shares issuedShares Issued refers to the number of shares distributed by a company to its shareholders, who range from the general public and insiders to institutional investors. They are recorded as owner’s equity on the Company’s balance sheet.read more (actual realization of options) and shares repurchased can be referenced from the shareholder’s equity schedule.

- The input weighted an average number of sharesWeighted Average Shares Outstanding is a calculation used to estimate the variations in a Company’s outstanding shares during a given period. It is determined by multiplying the outstanding number of shares (consider issuance & buybacks) in a given reporting period with their individual time-weighted portions. read more and the effect of stock options for the historical years.

Basic Shares (Ending) = Basic Shares (Beginning) + Share Issuances – Shares Repurchased.

Find the basic weighted average shares

- We find an average of two years, as shown below.

- Also, add the effect of options and restricted stock units (referenced from the shareholder’s equity schedule) to find the diluted weighted average shares.

Link Basic & diluted weighted shares to Income Statement

- Now that we have calculated the diluted weighted average shares, it is time to update the same in the income statement.

- Link up forecasted diluted weighted average shares outstandingWeighted Average Shares Outstanding is a calculation used to estimate the variations in a Company’s outstanding shares during a given period. It is determined by multiplying the outstanding number of shares (consider issuance & buybacks) in a given reporting period with their individual time-weighted portions. read more to the income statement as shown below

With this, we complete the shares’ outstanding schedule and time to move to our next set of statements.

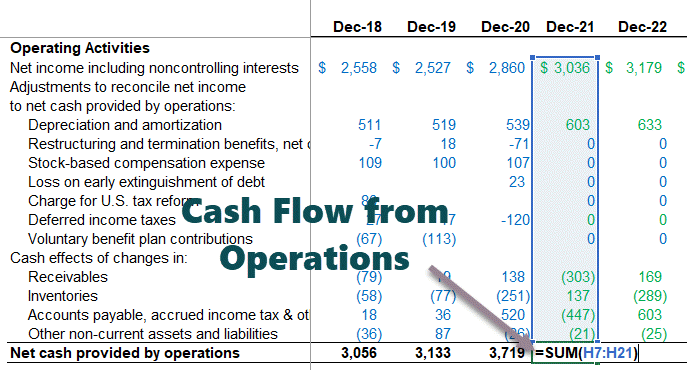

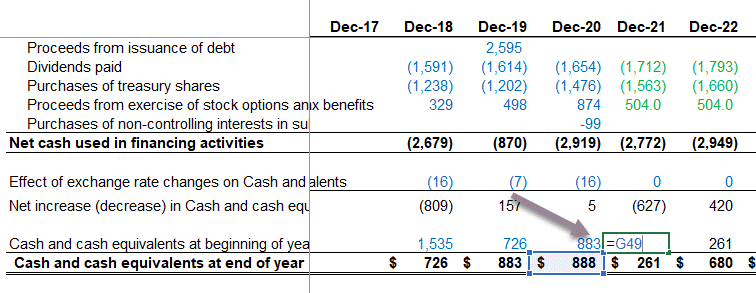

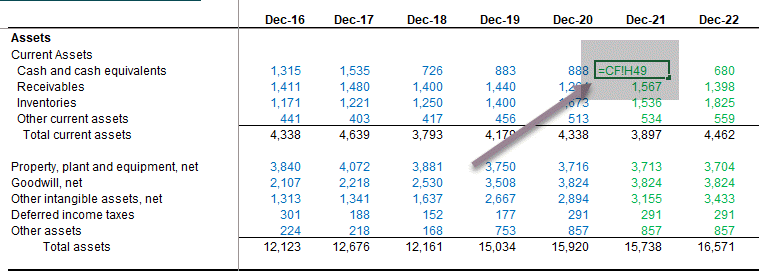

Step 11 – Completing the Cash Flow Statements

We must fully complete the cash flow statements before we move to our next and final schedule in this financial modeling, i.e., the debt schedule. Until this stage, there are only a couple of incomplete things.

- Income Statement – interest expense/ income are incomplete at this stage

- Balance Sheet – cash and debt items are incomplete at this stage

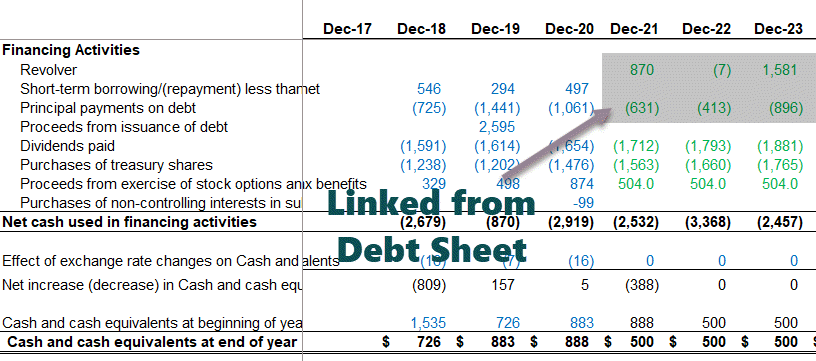

Calculate Cash Flow for Financing Activities

Also, check out Cash Flow from FinancingCash flow from financing activities refers to inflow and the outflow of cash from the financing activities like change in capital from securities like equity or preference shares, issuing debt, debentures or repayment of a debt, payment of dividend or interest on securities.read more

Find net increase (decrease) in Cash & Cash Equivalents

Complete the cash flow statements

Find the year-end cash and cash equivalents at the end of the year.

Link the cash & cash equivalents to the Balance Sheet.

Now we are ready to take care of our last and final schedule, i.e., Debt and Interest Schedule

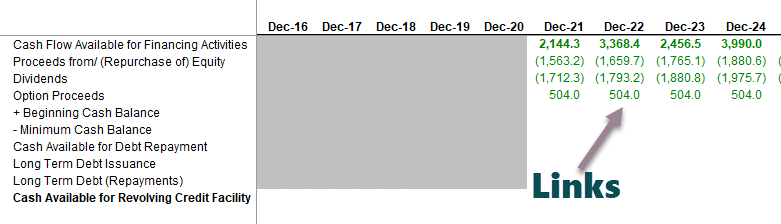

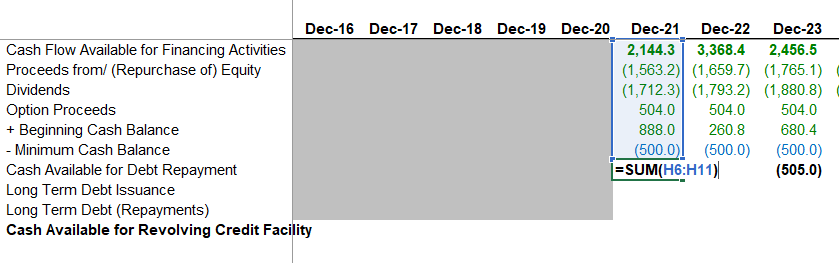

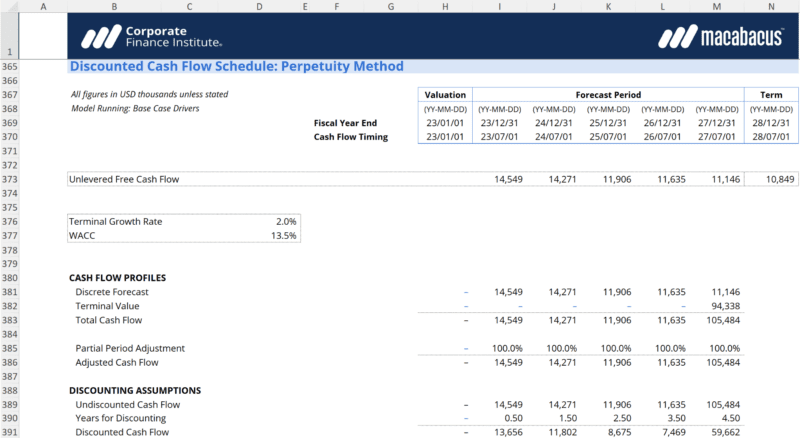

Step 12 – Financial Modeling in Excel – Debt and Interest Schedule

The next step in this online financial modeling is to complete the debt and interest schedule. Summary of the Debt and Interest – Schedule.

Set up a Debt Schedule

- Reference the cash flow available for financing

- Reference all equity sources and uses of cash

Calculate Cash Flow from Debt Repayment

- Reference the beginning cash balance from the balance sheet.

- Deduct a minimum cash balance. We have assumed that Colgate would like to keep a minimum of $500 million yearly.

Skip long-term debt issuance/ repayments, cash available for revolving credit facility, and revolver section.

Colgate’s 10K report notes the available details on the revolved credit facility.

Colgate 2020 – 10K, Page 49

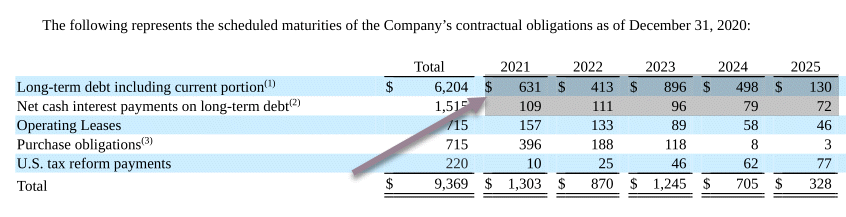

Also provided in additional information on debt is the committed long-term debt repayments.

Colgate 2020 – 10K, Page 50

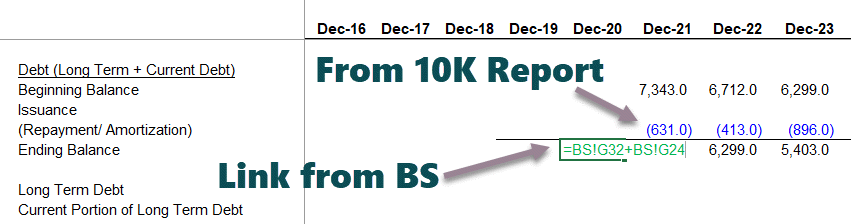

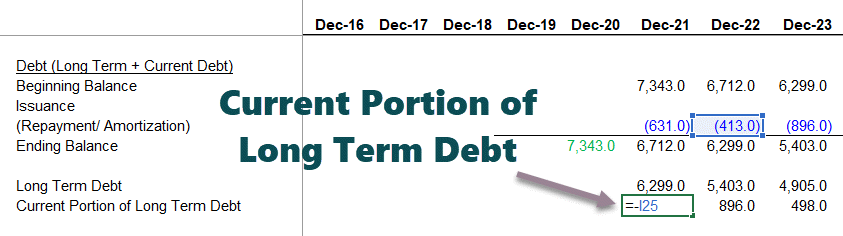

Calculate the Ending Long Term Debt.

We use the long-term debt repayment schedule provided above and calculate the ending balance of long-term debt repayments.

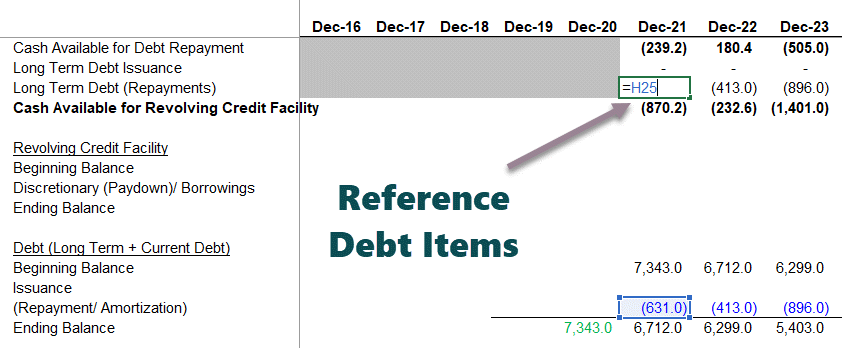

Link the long term debt repayments

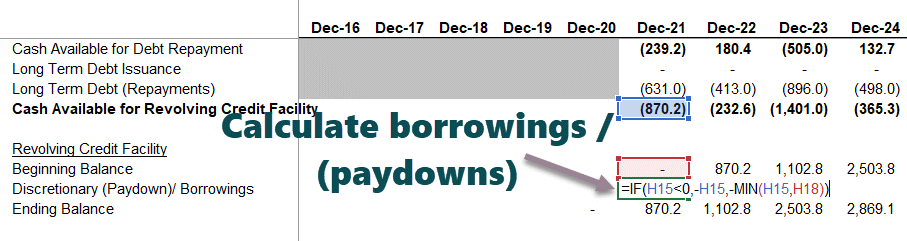

Calculate the discretionary borrowings/paydowns.

Using the cash sweep formula, as shown below, calculate the discretionary borrowings/paydown.

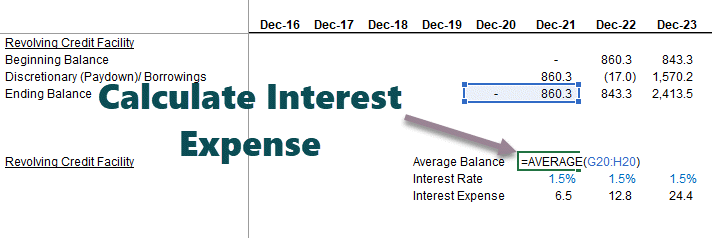

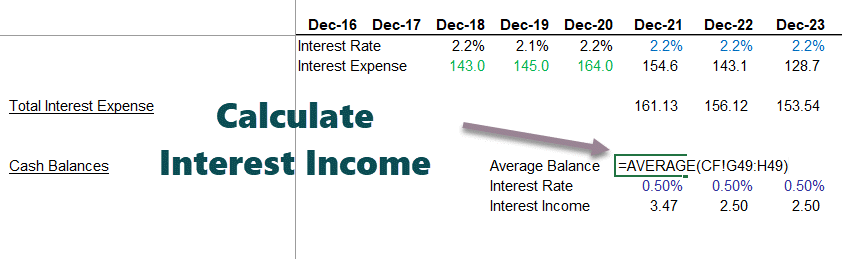

Calculate Interest Expense from Revolving Credit Facility

- Make a reasonable assumption for an interest rate based on the information provided in the 10K report.

- Find the average balance of the revolving credit facility and multiply it with the assumed interest rate.

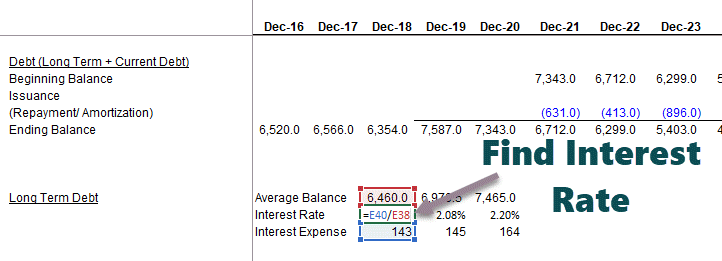

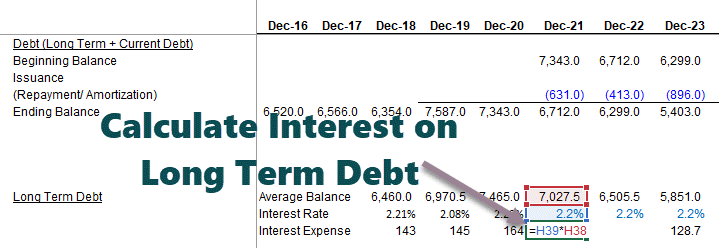

Calculate the Interest Expense from the Long Term Debt

Link the historical average balances and interest expenses. Find the implied interest rate for historical years.

Assume the interest rate on Long term debt based on the implied interest rate. Then, multiply the average long-term debt by the assumed interest rate.

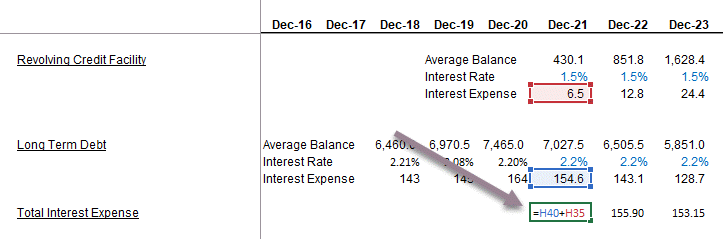

Calculate Total Interest Expense = average balance of debt x interest rate

Find the Total Interest Expense = Interest (Revolving Credit Facility) + Interest (Long Term Debt)

Link debt & Revolver drawdowns to Cash Flows

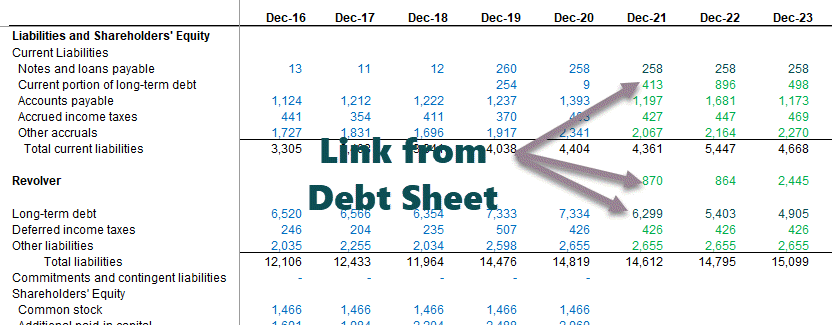

Reference Current and Long Term to Balance Sheet

- Demarcate the Current Portion of Long Term DebtCurrent Portion of Long-Term Debt (CPLTD) is payable within the next year from the date of the balance sheet, and are separated from the long-term debt as they are to be paid within next year using the company’s cash flows or by utilizing its current assets.read more and long-term debt as shown below.

- Link the revolving credit facility, long-term debt, and current portion of long-term debt to the balance sheet.

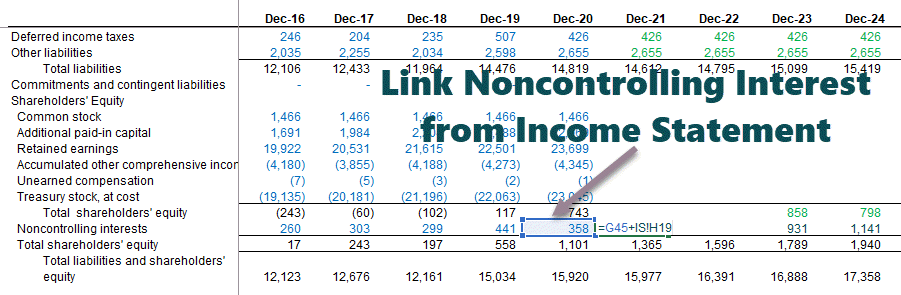

Link Noncontrolling Interest from Income Statement

Calculate the Interest Income using the average cash balance

Link Interest Expense and Interest Income to Income Statement

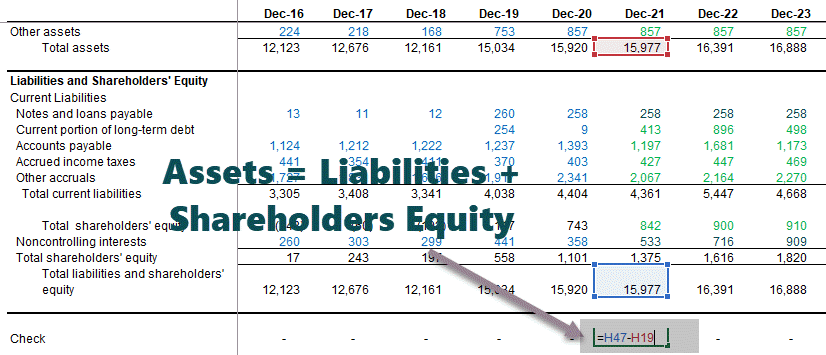

Perform the Balance Sheet check: Total Assets = Liabilities + Shareholder’s Equity

Audit the Balance Sheet

We need to audit the model and check for linkage errors if there is any discrepancy.

Recommended Articles

- Alibaba Financial Model

- Box IPO Financial Model

- Financial Modeling Templates

- Coursera Financial Model

What next?

If you learned something new or enjoyed this Excel-based financial modeling, please leave a comment below. Let me know what you think. Many thanks, and take care. Happy Learning!

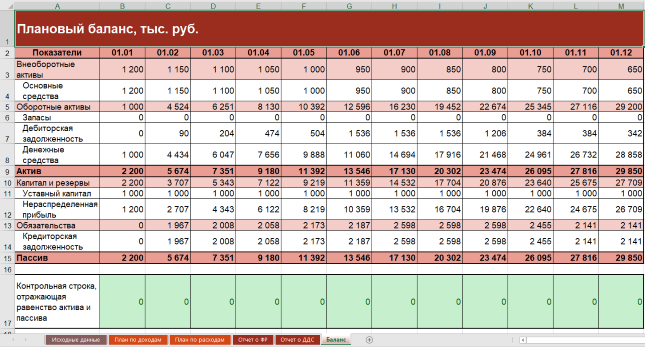

Содержание

- Basics of Financial Modeling in Excel

- 4 Building Blocks of a Financial Model in Excel

- Inputs of a Financial Model

- Financial Modeling in Excel is Driven by Data

- Calculations is the Engine of Financial Modeling in Excel

- Outputs of your Financial Model

- What is Financial Modeling?

- What is Financial Modeling?

- Key Highlights

- What is a Financial Model Used For?

- What Software is Best for Financial Modeling?

- Who Builds Financial Models?

- How Can You Learn Financial Modeling?

- How Much Accounting Knowledge is Required for Financial Modeling?

- Финансовое моделирование в Excel

- Финансовая модель бизнеса: что это

- Финансовое моделирование проекта: что надо знать

- Финансовая модель (ФМ) в Excel: считаем доходы

- Построение финансовых моделей: пример планирования расходов

- Составляем плановый отчет о финансовых результатах

- Формируем плановый отчет о движении денежных средств

- Сводим плановый баланс

Basics of Financial Modeling in Excel

by Ugur | Jan 30, 2019 | Blog

Wikipedia defines financial modeling as “the task of building an abstract representation (a model) of a real world financial situation.” Many of these financial models are built in Excel. In this article, I will outline the basic principles of financial modeling in Excel. Following these principles will ensure that your financial model is easier to maintain and will ultimately reduce the potential for errors.

4 Building Blocks of a Financial Model in Excel

There are four primary building blocks of any financial model in Excel:

- Inputs

- Data

- Calculations

- Outputs (cells, charts, pivot tables)

Inputs of a Financial Model

Inputs are the point of engagement for end users. They define and enter data that powers your financial model. You may be interested in capturing user entry such as historical financial data of a company, cost estimates of an investment property, or cost estimates of a budget model. Some models may only require a few input fields, while others may require thousands of data points to run.

It is always good practice to decouple inputs from the other building blocks of your model. Keep them in a different worksheet solely dedicated to inputs. While it may be easier to achieve this in simpler models, more complex models may require displaying inputs and outputs together for review purposes (see the screenshot below). The yellow cells are inputs and the other cells constitute outputs of the financial model.

Financial Modeling in Excel is Driven by Data

This section refers to the underlying data that is used to analyze inputs. This data is typically updated periodically by the administrator of the financial model. For example, mortality tables are used in actuarial models and are updated rather very infrequently. Another example is mutual fund performance data that can be used in an investment model. This type of data is typically updated quarterly to provide the most accurate results.

It is important to decouple this type of data from the rest of the model in a separate worksheet (or set of worksheets). This will allow the administrator to update the data without impacting any other part of the model.

It is also recommended that each data table has a named range. Always reference the data in your formulas using its named range instead of its cell reference. It is easier to maintain a formula that references a mortality table such as =VLOOKUP(Age,MortalityTable,2,FALSE), rather than a formula like =VLOOKUP(Age,Sheet2!A1:D100,2,FALSE).

While updating your data, always make sure to check the definition of the named range, especially if you are uploading data with more rows or columns than the existing one. If you don’t adjust the named ranges, the copied data that falls outside of the original data may never be used in your calculations.

Calculations is the Engine of Financial Modeling in Excel

This is the most important part of your financial model, where you combine inputs and data to calculate your results.

It is important to keep the calculation section decoupled from the rest of your model. This will make it easier to maintain your model. You can keep your calculations in one worksheet or expand them over multiple worksheets.

Outputs of your Financial Model

This defines the set of results from your financial model. In most cases, this is what you want your end user to see. The output can be a calculated cell, a table, a chart, or a pivot table. You may have a simple model that calculates the cost of a product in a single cell that is dependent upon various user inputs. A more complex model may output a full table of values, such as balance sheet (see screenshot below).

Some models may output results in a more visual format like charts:

The outputs of your model will be coming from the calculations section. Regardless of how simple or complex your outputs are, always bring them into a separate worksheet for display purposes, even if it means some duplication. This will make it is easier to maintain your financial model.

Источник

What is Financial Modeling?

The process of combining historical and projected financial information to make business decisions

What is Financial Modeling?

Financial modeling is one of the most highly valued, but thinly understood, skills in financial analysis. The objective of financial modeling is to combine accounting, finance, and business metrics to create a forecast of a company’s future results.

A financial model is simply a spreadsheet which is usually built in Microsoft Excel, that forecasts a business’s financial performance into the future. The forecast is typically based on the company’s historical performance and assumptions about the future, and requires preparing an income statement, balance sheet, cash flow statement, and supporting schedules (known as a three-statement model ). From there, more advanced types of models can be built such as discounted cash flow analysis ( DCF model ), leveraged buyout ( LBO ), mergers and acquisitions ( M&A ), and sensitivity analysis. Below is an example of financial modeling in Excel:

Key Highlights

- Financial modeling combines accounting, finance, and business metrics to create a forecast of a company’s future results.

- The main goal of financial modeling is to accurately project a company’s future financial performance.

- Modeling can be useful for valuing companies, determining whether a company should raise capital or grow the business organically or through acquisitions.

What is a Financial Model Used For?

There are many types of financial models with a wide range of uses. The output of a financial model is used for decision-making and performing financial analysis, whether inside or outside of the company. Financial models are used to make decisions about:

- Raising capital (debt and/or equity)

- Making acquisitions (businesses and/or assets)

- Growing the business organically (e.g., opening new stores, entering new markets, etc.)

- Selling or divesting assets and business units

- Budgeting and forecasting (planning for the years ahead)

- Capital allocation (priority of which projects to invest in)

- Valuing a business

- Financial statement analysis/ratio analysis

- Management accounting

What Software is Best for Financial Modeling?

Forecasting a company’s operations into the future can be very complex. Each business is unique and requires a very specific set of assumptions and calculations. Excel is used because it is the most flexible and customizable spreadsheet tool available. Other software programs may be too rigid and specialized, whereas Excel knowledge is generally more universal.

Who Builds Financial Models?

There are many different types of professionals who build financial models. The most common types of career tracks are investment banking, equity research, corporate development, FP&A, and accounting (due diligence, transaction advisory, valuations, etc).

How Can You Learn Financial Modeling?

The best way to learn financial modeling is to practice. It takes years of experience to become an expert at building financial models , and you really have to learn by doing. Reading equity research reports can be helpful, as they give you something to compare your results to. One of the best ways to practice is to take a mature company’s historical financials, build a model into the future, calculate the net present value per share, and compare your projections to current share prices or the target prices in equity research reports.

Taking a professional financial modeling training course also offers a solid base understanding of the relevant concepts and skills. In the meantime, you may be interested in exploring CFI’s free Financial Modeling Guidelines or having a go at building your own financial models.

How Much Accounting Knowledge is Required for Financial Modeling?

In order to build a financial model, you need a solid understanding of accounting fundamentals. You have to know what all the various accounts mean, how to calculate them, and how they’re connected. We recommend having at least a few accounting courses under your belt.

Источник

Финансовое моделирование в Excel

Финансовое моделирование в Excel

Кандидат экономических наук, доцент. Автор двух монографий, шести учебных пособий и нескольких десятков статей по вопросам бухгалтерского учета, финансового менеджмента и анализа. Лауреат премии губернатора в сфере науки, техники и инновационной деятельности за 2012 г. За плечами — опыт работы главбухом бюджетного учреждения и преподавателем государственного вуза.

Финансовая модель бизнеса: что это

Финансовая модель предприятия – это плановые показатели его деятельности по:

- доходам;

- расходам;

- прибыли;

- денежным потокам;

- активам;

- обязательствам.

Этим она похожа на систему бюджетов. Отличается от них бóльшими упрощениями и вариативными параметрами. Последнее объясняется целью создания: быстрая оценка изменений финансовых результатов и имущественного положения под влиянием разных факторов. Например, в результате смены условий расчетов с контрагентами, покупки нового оборудования, повышения зарплаты персоналу и т.п.

Обычно финансовая модель строится в Excel или Google-таблицах. Часть исходных данных вносится вручную (план по объему продаж, месячный фонд оплаты труда, нормы потребления материалов на единицу изделия и т.д.). Зависимые от них показатели задаются с помощью формул. Они обеспечивают моментальный пересчет итоговых значений выручки, операционной прибыли, дебиторки, денежных притоков и т.д.

Итоговый результат финансового моделирования – три формы отчетности:

- баланс;

- отчет о финансовых результатах (ОФР);

- отчет о движении денежных средств (ОДДС).

Финансовое моделирование проекта: что надо знать

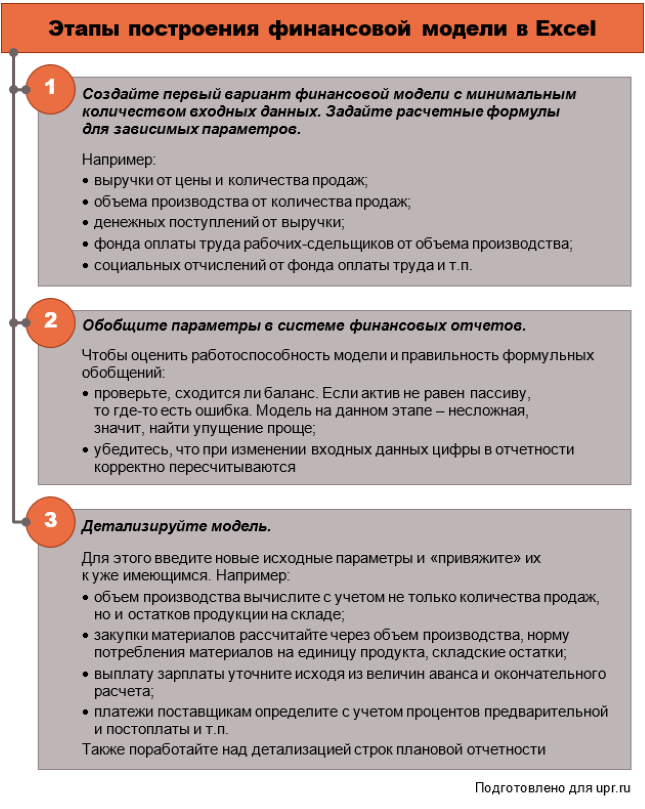

Если вы решили самостоятельно построить финансовую модель в Excel, то идите от простого к сложному и от общих моментов к деталям. Так проще не запутаться в большом количестве формул и ссылок.

Вот пошаговый план реализации.

Рисунок 1. Построение финансовой модели: рекомендуемые этапы

Опробуем данный подход на практике. Рассмотрим пример для организации, которая занимается розничной торговлей. Такой выбор не случайный. Любое производство сложнее торговли, так как в нем предполагаются:

- материальные затраты;

- амортизация оборудования;

- возможно, незавершенный производственный процесс на конец месяца, поэтому необходимость разделения затрат и расходов;

- разнородные складские запасы в виде материалов и продукции.

Кроме того, продажи в розницу исключают вариант формирования дебиторской задолженности покупателей, если исходить из того, что отсрочки и рассрочки не предоставляются.

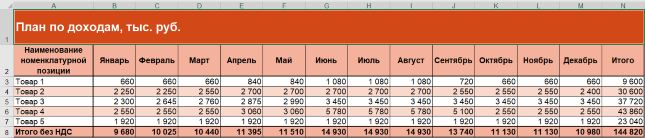

Финансовая модель (ФМ) в Excel: считаем доходы

Отправная точка на данном этапе – объем продаж. Можно пойти простым путем и внести только денежное значение выручки. Позже детализировать его как произведение цены и количества в разрезе номенклатурных позиций.

Мы сразу поступим вторым способом. Это даст количественный параметр, который необходим для корректного подсчета расходов на приобретение товаров.

Основная сложность этапа: откуда взять данные по плану продаж? Все зависит от вашей цели:

- если она пока в том, чтобы построить и «обкатать» работоспособность ФМ, то берите любые данные. Например, за прошлый год или произвольные;

- если вам одновременно нужны и модель, и качественные результаты расчета по ней, то займитесь планированием отдельно.

Мы ратуем за то, чтобы на данном этапе не уходить в детали. Но разумно уже сейчас подумать: чем будете усложнять и этим приближаться к реальности?

Первый. Покажите отдельно НДС, который «сидит» в цене реализации. Он приходит в поступлениях от покупателей, но это не доход вашей организации. Добавив его в таблицу, вы посчитаете выручку-нетто или чистый доход. Заодно определите будущие платежи в бюджет по данному налогу*.

Примечание: в бюджет платится разница между НДС, который начислен к уплате, и тем, который предъявляется к возмещению по собственным закупкам.

Второй. Введите аналитику по продажам. Самое простое – это номенклатурные позиции. Дополнительно к ним:

- процент возврата товаров;

- категория клиента (физическое лицо или организация);

- номер магазина или наименование региона, если есть несколько точек продаж.

Помним: пока излишняя детализация лишь запутает. Поэтому получаем в Excel простой план по доходам.

Рисунок 2. Упрощенный план по доходам в Excel

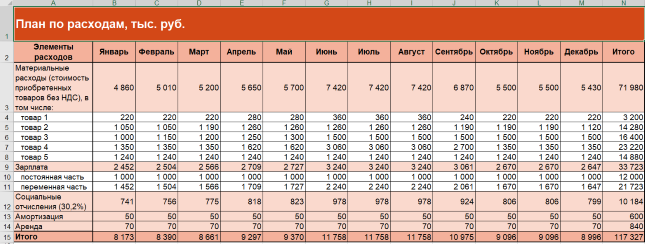

Построение финансовых моделей: пример планирования расходов

Определимся с расходами также пока в первом приближении. Обобщим полный перечень трат компании в разрезе элементов. Это будут:

- материальные траты. В упрощенном варианте предположим, что к ним относятся только траты на покупку товара без НДС и что организация продает в течение месяца столько, сколько закупает. Значит, величину определим как произведение цены приобретения и объема продаж;

- зарплата работников. Ограничимся единой суммой фонда оплаты труда за месяц без разбивки по составляющим;

- социальные отчисления. Для них составим формульную зависимость. Обычно это 30% плюс процент взносов «на травматизм» в Фонд социального страхования от начисленной оплаты труда. Данный процент зависит от класса профессионального риска по организации. Мы взяли минимальное значение 0,2%;

- амортизация. Вводим строку в ФМ, если в собственности предприятия есть основные средства и нематериальные активы. Указываем единую сумму для каждого месяца на основе средних фактических или предполагаемых значений;

- прочие расходы. Это отчасти уход в детализацию. Однако если в компании есть постоянные легко планируемые траты, то зафиксируйте их. К ним относятся: арендные платежи, траты на рекламу, на командировки и т.п.

Для упрощенной ФМ такого списка достаточно. А это четыре совета на будущее о том, чем усложнить.

Первый. Введите дополнительные позиции в материальные расходы. Например, такие:

- отопление, водоснабжение, электроэнергия;

- упаковка;

- ГСМ на автотранспорт, если он есть на балансе;

- канцелярские принадлежности и т.п.

Второй. Отдельной строкой покажите входной НДС. Когда ставка – одна (20%), то его сумма – это произведение 20% на совокупные материальные траты без НДС. Когда примешивается еще 10%, тогда:

- либо упрощайте и считайте налог по максимальной ставке;

- либо усложняйте, применяя средневзвешенное значение ставки исходя из доли в закупках с НДС по 20% и 10% в прошлые периоды.

Третий. Разделите оплату труда на составляющие:

- выделите в зарплате продавцов оклад (постоянную часть) и премию, зависящую от объема продаж (переменную компоненту);

- покажите отдельной строкой зарплату других работников, которая не завязана на количественные показатели и является постоянной.

Четвертый. Учтите изменения амортизации, если в планах организации значатся покупка или продажа основных средств и нематериальных активов.

Рисунок 3. Финансовая модель бизнеса в Excel: план по расходам

То, что мы посчитали, является основой для:

- вычисления прибыли/убытка в ОФР;

- корректировки накопленного финансового результата в балансе;

- построения притоков и оттоков в ОДДС.

Перейдем ко второму этапу – обобщению данных в системе финансовых отчетов. Рассмотрим, как это делается.

Составляем плановый отчет о финансовых результатах

Формирование фактической отчетности начинается с подсчета прибыли/убытка за период. Такое же правило действует для моделей и бюджетов. Ведь чтобы заполнить раздел баланса про собственный капитал, нужна величина финансового результата.

Мы подсчитали плановые доходы и расходы по операционной деятельности. Этого достаточно, чтобы составить упрощенный отчет. Вот его возможный вариант.

Рисунок 4. Упрощенный ОФР в Excel-модели

В нем разница между доходами и расходами показывает прибыль или убыток. Мы рассматриваем только основную деятельность без прочей. Поэтому выходим на операционный финансовый результат.

ОФР тесно связан с балансом и ОДДС. Смотрите в таблице, куда и какую информацию он передает.

Таблица 1. Взаимосвязь плановых ОФР, баланса и ОДДС

| Строка ОФР | Связанная строка баланса | Связанная строка ОДДС |

| Операционная прибыль (убыток) | Нераспределенная прибыль (убыток) – добавляется к значениям предыдущего периода | – |

| Выручка (операционные доходы) | – | Поступления от покупателей и заказчиков – сумма выручки корректируется на авансы полученные и дебиторскую задолженность по формуле: Поступления = Выручка + Авансы полученные – Дебиторская задолженность* |

| Операционные расходы | – | Платежи по текущей деятельности – сумма денежных** расходов корректируется на авансы выданные и кредиторскую задолженность по формуле: Платежи = Денежные расходы + Авансы выданные – Кредиторская задолженность |

| Примечание: * в примере ФМ формируется по организации розничной торговли. Поэтому полагаем: авансов и дебиторки от покупателей нет. Значит, поступления равняются выручке; ** денежные расходы – те, которые приводят к оттоку денег (зарплата, налоги, материальные). Для сравнения: к неденежным относится амортизация |

Чтобы плановый ОФР оказался более информативным, дополним строками:

- рентабельность продаж. Это расчетный показатель, который равняется отношению прибыли (в данном случае – операционной) к выручке;

- точка безубыточности в денежном выражении. Для ее расчета предварительно разделили расходы на постоянные и переменные. Об особенностях классификации затрат по такому принципу читайте в статье «Расчет себестоимости».

Формируем плановый отчет о движении денежных средств

- обобщить денежные притоки и оттоки;

- рассчитать чистый денежный поток как разницу между ними;

- прибавить его значение к остатку денег на начало периода и вычислить остаток денег на конец. Через эту сумму ОДДС связан с балансом.

Для создаваемой ФМ исходим из допущений:

- организация занимается только основной деятельностью. При этом не покупает оборудование и ценные бумаги, не берет и не дает взаймы, не принимает новых учредителей. Значит, формируется один вид денежных операций – текущий. О двух других – инвестиционных и финансовых – читайте в статье «Анализ движения денежных средств компании»;

- товары оплачиваются поставщику двумя платежами: 60% – аванс в месяце, который предшествует поставке, 40% – окончательный расчет сразу после принятия на склад;

- зарплата выплачивается двумя переводами: 50% – аванс в месяце начисления, 50% – перевод остатка в периоде, который следует за отработанным;

- страховые взносы перечисляются в месяце, идущем за их начислением;

- прочая составляющая расходов по обычным видам деятельности представлена арендой. Платежи по ней производятся в месяце начисления арендной платы.

Получаем вариант ОДДС.

Рисунок 5. Упрощенный отчет о движении денежных средств в ФМ

Сводим плановый баланс

Предположим, что у организации:

- нет входящих остатков по запасам, дебиторской и кредиторской задолженности;

- имущество включает одно основное средство и деньги;

- в пассиве – только уставный капитал и нераспределенная прибыль.

Схема заполнения балансовых строк окажется следующей.

Таблица 2. Техника сведения упрощенного баланса

| Показатель на начало месяца | Расчетная формула | Пояснения |

| Основные средства | Основные средства на начало предыдущего месяца (баланс) – Амортизация за месяц (ОФР) | – |

| Запасы | – | Неизменны и равняются нулю из-за допущения: закупаемые товары полностью распродаются в течение месяца |

| Дебиторская задолженность | Дебиторская задолженность на начало предыдущего месяца (баланс) + Платежи поставщикам за товары (ОДДС) – Материальные расходы (ОФР) | В примере нет дебиторки покупателей, так как организация торгует в розницу |

| Денежные средства | Денежные средства на начало предыдущего месяца (баланс) + Чистый денежный поток за месяц (ОДДС) | – |

| Уставный капитал | – | Неизменен и равняется 1000 тыс. руб. из-за допущения: новых учредителей в течение года не было |

| Нераспределенная прибыль | Нераспределенная прибыль на начало предыдущего месяца (баланс) + Прибыль за месяц (ОФР) | – |

| Кредиторская задолженность | Кредиторская задолженность на начало предыдущего месяца + Начисления по зарплате, социальным отчислениям и аренде (ОФР) – Платежи по зарплате, социальным отчислениям и аренде (ОДДС) | – |

Формат баланса будет таким.

Рисунок 6. Упрощенный баланс в финансовой модели в Excel

Детализация финансовой модели в Excel

О возможных вариантах усложнения исходных данных рассказывали выше. Здесь остановимся на детализации строк плановой отчетности. Вот несколько советов:

- используйте разные группировки расходов в ОФР. Мы обобщили их по элементам. Такой подход называется «по характеру расходов». Но он – не единственный. Можно одновременно с ним или вместо него использовать функциональную классификацию с выделением себестоимости продаж, а также расходов на сбыт и управление. Подробнее про такие варианты читайте в статье «БДР: бюджет доходов и расходов»;

- добавьте другие виды прибыли в ОФР. Например, валовую. Она покажет разницу между продажной и закупочной ценами товаров. Если в организации есть прочие операции, то в отчете не обойтись без чистой прибыли. Читайте о видах финансового результата в материале «Анализ финансовых результатов деятельности компании»;

- включите в ОФР строки для прочих доходов и расходов. Растущая организация не сможет обходиться без них. Например, взятие кредита приведет к появлению процентных платежей по нему. Они – это прочий расход;

- расширьте ОДДС за счет инвестиционных и финансовых операций, если собираетесь приобретать оборудование и брать взаймы. Не смешивайте такие денежные потоки с текущими;

- детализируйте сложносоставные строки в балансе. Например, из запасов выделите товары, материалы, готовую продукцию и незавершенное производство (последние два пункта – неактуальны для торговли). Из состава дебиторки: авансы выданные поставщикам и долги покупателей. По аналогии поступите с кредиторкой и покажите в отдельных статьях: авансы полученные, задолженность перед поставщиками, перед персоналом по оплате труда, по налогам и страховым взносам, перед учредителями по дивидендам.

Не забудьте скачать Excel-файл с полученной финансовой моделью из начала статьи.

Финансовое моделирование в Excel помогает понять:

- как планируемые руководством мероприятия отразятся на величине имущества, капитала, обязательств, доходов, расходов и прибыли;

- какие факторы больше других влияют на прибыль, ликвидность и финансовую устойчивость организации.

Важна роль ФМ и в план-фактном анализе. В течение отчетного периода сравнивайте ожидания из нее с тем, как получилось в реальности. Это хороший способ контролировать ситуацию: понимать суть нарождающихся тенденций и того, к чему они приведут бизнес.

Источник

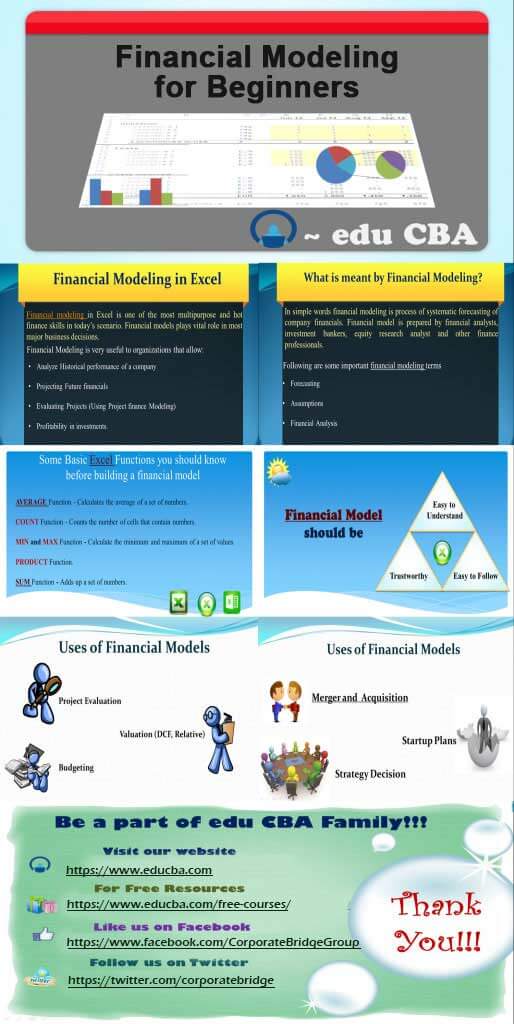

What is Financial Modeling in Excel?

Example of Financial modeling In Excel for dummies is one of today’s most multipurpose and hot finance skills. Financial models play a vital role in most major business decisions. Generally, a company prepares an economic model whenever it plans to expand its business, evaluating a particular project (also called project finance modeling), Merger or acquisition of a specific (target) company, and future forecasting of financials. For startup companies, preparing a financial model is essential for further business planning, and for big organizations plays a vital role in long-term planning, expansion, development, cost planning, etc. Commonly, companies prepare financial models in Excel spreadsheets.

Example Of Financial modeling In Excel – Learning

So, let’s understand what is meant by financial Modeling In Excel. Financial modeling is the process of systematic forecasting of company financials. Financial analysts, investment bankers, equity research analysts, and other finance professionals prepare a financial model.

There is some basic financial modeling In Excel terms that you need to understand.

- Forecasting– Forecasting means the company’s expected financial position in the future.

- Assumptions – To build a financial model, you must make hypothetical assumptions. Now, what does it mean? Assumptions present a condition that is not necessarily expected to occur but is consistent with the purpose of the projection.

- Financial statement Analysis – Financial Analysis means the analysis of financial statements like income statements, Balance sheets, and Cash Flow Statements using various techniques.

- Financial Modeling In Excel – if you are new to accounting, you may want to learn the basics of accounting, without which you will not be able to progress in Financial Modeling In Excel

Example

Generally, companies require financial modeling for a business decision. Beginners prepare a financial model:

- Investment Banker

- Financial Analyst

- Equity Research Analyst

- Credit Research analyst

- Other finance professionals.

Steps to Building a Financial In Excel For Dummies

Generally, financial modeling in Excel starts with collecting and putting essential information into an Excel spreadsheet. The first step towards building an economic model is a collection of data. A financial analyst would collect all historical data from the company’s annual reports, management discussions, transcripts, and research reports.

After that, he will perform a fundamental analysis of financial statements using different methods, such as

- Horizontal and Vertical Analysis

- Ratio Analysis

After doing fundamental analysis, he would prepare various schedules to forecast future financials, for example.

- For forecasting future sales —They prepare Revenue built-up.

- For forecasting future costs — They prepare a cost schedule.

- Forecasting future Depreciation/Amortization—They prepare a Depreciation and amortization schedule, such as a Debt schedule, shareholders equity schedule, Working capital schedule, and so on.

Financial Modeling In Excel – If you are new to Financial Modeling, you can learn more about Financial Modeling and also take our professional Financial Modeling Training

Excel Skills are a Must for Financial Modeling For Dummies

If you are a primary learner of the financial model and need to learn about Microsoft Excel, it’s challenging to prepare the financial model. It’s mandatory to know Excel. If you know Excel, then it would be very beneficial!

Also following are some Basic Excel Functions you must know.

- The AVERAGE Function calculates the average of a set of numbers.

- COUNT Function counts the number of cells that contain numbers

- MIN and MAX Functions calculate the minimum and maximum of a set of values.

- PRODUCT Function multiplies the numbers and returns the product.

- SUM Function adds up a set of numbers.

- The IF function introduces decision-making into a spreadsheet. Depending on whether or not specific criteria are met, you can have the function place different results in one or more cells in the worksheet.

- Excel Chart– A chart often makes understanding the data in a worksheet easier because users can easily pick out patterns and trends.

A Typical Financial Model should be:

- Easy to understand;

- Trustworthy;

- Easy to Follow;

- Emphasis on essential issues.

Some essential vital points one should remember while preparing the financial model. Like a clear understanding of the aims and objectives of your model, build a simple structure; for example, your financial model can divide into various schedules like depreciation schedule, amortization schedule, working capital schedule, etc. Also, try to avoid hard-coated figures.

Note: Become a Financial Modeling In Excel Expert

Learn fundamental financial analysis of companies. Forecast future financials of the business. Perform financial valuation to decide on a buy/sell call on public company shares.

Industry Usages of a Model

- Project Evaluation

- Valuation (DCF, Relative)

- Budgeting

- Startup Plans

- Strategy Decision

- Expansion

- Merger / Acquisition

- Project Evaluation

- Valuation (DCF, Relative)

- Budgeting

- Startup Plans

- Strategy Decision

- Expansion

- Merger and Acquisition

Example Of Financial Modeling In Excel – One can use the financial model in most areas of Finance like Equity Research, Investment Banking, Credit Research, etc. One must try to learn these skills as all core jobs in Finance will require you to understand these skills

Example of Financial Modeling In Excel – Infographics

Recommended Articles

Here are some articles that will help you to get more detail about Financial Modeling In Excel, so go through the link.

- Basic Excel Formulas

- SUMIF Function

- Excel Charts Graphs

- Excel Export to PDF

This is a guest post written by Paramdeep from Pristine. Chandoo.org is partnering with Pristine to bring an excel financial modeling online training program for you.

This is Part 1 of 6 on Financial Modeling using Excel

This is Part 1 of 6 on Financial Modeling using Excel

In this and next 5 posts, we are going to learn how to build a financial model to do project evaluation using Excel. The 6 parts of this tutorial are,

- Introduction to Financial Modeling

- Building a layout for Project Evaluation Model – Best practices

- Building Inputs and Assumptions Sheet

- Building Projections for Project Evaluation

- Modeling the Cash Flow Statement and Projections

- Putting it all together – Final Project Evaluation Model

- Join our Financial Modeling Classes

What is financial modeling?

Financial modeling is creating a complete program/ structure, which helps you in coming to a decision regarding investment in a project/ company. Now this could be on a simple piece of paper or in excel. The advantage with excel is that, even if you have calculation speed and accuracy like me (this is one place where I am like Einstien!), then also you would be able to come to the right conclusion!

Who does Financial Modeling?