Costs are mandatory expenses which are made in order for the smooth running of a business. Every part of the business is associated with different types of business costs right from production up till marketing and even sales. The cost of labor for instance which is used to produce goods or render services is measured in terms of benefits or raises or even salaries.

Fixed asset cost which is used in production is measured in terms of depreciation and the cost of capital which is used for purchasing fixed assets is measured in interest expense which is associated with raising the capital. Every business is interested in measuring the costs they incur during the process. While many costs may be quantifiable because they are easily observable, other costs must be estimated or specifically allocated.

In the earlier case, the category of the direct relationship between the cost and the quantity is easily observable while in latter cases it may not be directly quantifiable or even observable. Costs are various kinds of relationships with the output and are used in different business applications such as cost accounting, financial accounting, capital budgeting, valuation, mergers, and acquisitions etc.

Hence there are multiple ways of differentiating costs based on their relationship to output as well as in their context in which they are used. Following are different types of business courses that are included in businesses:

1) Direct costs

As the name suggests these are the costs that are related to producing goods or rendering services. This cost includes the labor expenses, materials and distribution and other costs which are associated with producing or manufacturing a product. These are the types of business costs which can be easily traced to a product. Direct costs can also be traced back to departments are individual projects.

For example, Apple manufactures iPhone and a worker spends about 6 hours building the phone. The direct costs that are associated with the phone are the wages to be paid to the worker manufacturing the phone along with the parts that are used to build the phone.

2) Indirect Costs

On the other hand indirect, the types of business expenses which are not related to producing a good or rendering a service. This also cannot be traced back to a particular product, activity, department or even a project. Example in case of Apple the direct costs the cost of glass screen and other parts however the electricity which is used to provide power in the manufacturing plant is considered as an indirect cost since electricity is used for all of the phones that are manufactured in the plant and no one particular product can be traced back to the electricity bill.

3) Fixed Costs

These are the types of business costs which do not vary with the number of goods or services produced by the company. In other words, these are not dependent on the output. This also termed as overhead costs and are incurred irrespective of the fact that for manufacturers one product or thousand products. The fixed cost includes rent, salaries of supervisors, depreciation etc.

Fixed cost may also be included while preparing a budget and include manufacturing overheads such as taxes and insurances. Example if the company is Jesus a machine for the purpose of production for a period of 3 years the company has to pay about $2000 per month for the recovery of the cost of the lease. Lease payment is considered as a fixed cost since it remains fixed for the period of time irrespective of their output.

4) Variable cost

As the name suggests these are unlike fixed costs and fluctuate on the level of production. These types of business costs change upon the quantity of the products are the services that the company renders. Variable costs increase as the production volume increases and as the production volume decrease variable costs go down. For example in a manufacturing facility certain quantity of materials is produced after a certain time by the services provided by a certain number of labors but if the quantities to be increased output has to be increased and so the number of labors and associated costs will increase. Traditionally variable costs are always associated with labor and materials.

However in case of service industry labors are usually salaried people and they do not fluctuate with the production or the services rendered. Therefore, in the case of the service industry, these are fixed cost and not variable costs for these companies. Although the differentiation is clear sometimes there is no hard and fast rule about which category of expenses are fixed and variable.

Example the cost of office paper for one company may be a fixed cost because the paper is used in case of administrative tasks but for the other organization, the same office paper cost will be a variable cost because the business is to provide printing as a service to other businesses. Each business should be able to determine based on its own uses and industry whether a particular expense is fixed or variable.

5) Operating Costs

These are the types of business costs which are associated with everyday transactions and business activities but cannot be traced back to one specific product. Operating costs can also be classified into fixed or variable depending on the nature of the business and the nature of activities conducted every day. Operating costs, for example, include rent utilities for a manufacturing plant. Investors calculate the operating cost ratio for a company which shows how efficiently an organization is generating sales by utilizing their costs.

6) Product and period costs

These costs are considered similar to direct and indirect costs. Period costs are seen as expenses of the current period. On the other hand, product costs are those which the firm’s accounting system relates to the output and are used to value inventory. Period costs are not seen as a cost of the products which are manufactured under direct costing which is why they are not associated with the value in the inventory. In case if a firm uses a full cost accounting system, then all of the costs related to manufacturing including fixed overhead costs and variable cost are classified under product costs.

7) Opportunity cost

This is the benefit given up when one decision is made up over the other. Opportunity costs represent an alternative which is left out when making a decision. This opportunity cost, therefore, is considered as most relevant for two events which are mutually exclusive. In terms of investing opportunity cost is the difference between chosen investment and the one that has come up.

Opportunity costs do not show up for companies in their financial statements. For example, if a company decides to invest in a piece of manufacturing equipment rather than lease it, then the opportunity cost would be the difference between the cost of cash outlay for that equipment and the improved productivity versus the amount that could have been saved had the money bill used to pay the debt.

Out of Pocket and Sunk Costs

Out of Pocket and Sunk Costs

These are the types of business costs which are historical in nature and have already been incurred and will not make any difference based on the current decisions by the management. Out of pocket costs are the ones that require the use of current resources which is more often than not, cash. Sometimes managers have to take into account sunk costs which are associated with types of machinery as well as out of pocket costs which are associated with adding more labor and material. Sunk costs are the costs which company has committed to and unavoidable in nature.

These are also excluded from the decisions of future business since these will be the same regardless of the outcome of a decision.

9) Incremental cost

Incremental costs are the ones that are associated with changing from one activity to other or from one course of action to another. Incremental cost also represents the difference between two alternatives. Unlike opportunity costs, which represent the sacrifice that is made when the productions are used for one task rather than other, incremental costs represent only the difference in both the options available.

10) Controllable and Non-Controllable costs

These are the types of business costs which cannot be changed by an individual or a department or even a business. On the other hand controllable cost other ones that can be controlled regulated by the manager of the head responsible for it. Direct labor materials certain factory overheads can be controlled by the production manager and hence is classified under controlled cost.

Liked this post? Check out these detailed articles on Topic of Business

Alternatively, check out the Marketing91 Academy, which provides you access to 10+ marketing courses and 100s of Case studies.

Definition: The Business Cost includes all the costs (fixed, variable, direct, indirect) incurred in carrying out the operations of the business. It is similar to the real or actual costs that include all the payments and contractual obligations along with the book cost of depreciation on both the plant and equipment.

The firms compute their business cost to determine the profit and loss and for filing returns for income tax. It is also used in several other legal procedures. There are several types of business costs:

- Variable Cost: The variable cost is the cost which changes with the change in the production. Such as raw material, wages of labor, energy used in production, etc.

- Fixed Cost: The fixed cost is the cost which remains fixed irrespective of the level of output. Such as rent, salaries of employees, advertising, and promotional campaigns, etc.

- Direct Cost: The direct cost is the cost which can be assigned to the production of certain goods and services. Such as labor, material, fuel, power or any other expense related to the production of a product is the direct cost.

- Indirect Cost: The indirect cost is the cost which cannot be directly attributed to the production of goods and services. Depreciation, supervision, security, maintenance and administrative expenses are the cost incurred which cannot be assigned to a specific product or department and hence are classified as an indirect cost.

Thus, the business cost is computed to determine the efficiency with which the firm is carrying out its business operations.

Reader Interactions

Business costs are a critical component in the day-to-day of commerce and trade that all organisations must manage. Even if business is good and you’re amassing a sizeable revenue, a lack of knowledge when it comes to managing costs can lead to a dip in profits. Therefore, understanding the different types of costs that can be incurred can help you to run your own business more effectively.

Although it can be difficult to keep an eye on expenditure as your business grows, it’s important to avoid short-term cost-cutting measures as a means of managing them if they start to mount.

Here, we’ll investigate the various types of costs that SMEs face, how these costs can be classified, and some practical tips for managing them in an effective long-term manner.

Quick navigation

- The different types of business costs

- What are fixed costs?

- What are variable costs?

- What are mixed costs?

- Why is it important to distinguish between fixed costs and variable costs?

- Classifying business costs

- Best practices for reducing and managing costs

The different types of business costs

An integral aspect of business improvement, establishing an accurate costing system serves to identify your most profitable products and services, allowing you to see which revenue streams may be costing your business more than the revenue generated. Therefore, your costing analysis can be used as a means of deciding which products or services to focus on and which to drop.

And though categorising your costs helps to determine accurate costing in order to manage them more effectively, how do the varying types of cost differ from one another? We’ll take a look in the next few sections below.

What are fixed costs?

Fixed costs are the costs associated with your business’ product that must be paid regardless of the volume of sales. So, whatever you sold and whatever you have remaining, you still have to pay your fixed costs. They do not change even if the company’s sales volumes or production levels increase, so there’s no need for any additional calculations.

Examples of fixed costs

Your business overheads are prime examples of fixed costs. These include costs such as rent for your office space, weekly payroll, marketing and advertising and equipment leases.

How to calculate fixed costs: A formula

Your business’ fixed costs can be calculated using the below formula:

Fixed Cost = Total Cost of Production – Variable Cost Per Unit * No. of Units Produced

What are variable costs?

In comparison, variable costs are directly related to sales volume. As sales go up, variable costs increase accordingly, and vice versa.

Examples of variable costs

Consider a business that produces and ships goods. The more goods being produced and shipped, the more it will have to spend on materials, supplies and transportation. Similarly, if a business accepts credit cards or uses payment processors, a small percentage of each sale goes to the bank or processor for facilitating any transactions. Therefore, you’ll incur a variable cost since the amount you pay in merchant fees depends on your sales.

How to calculate variable costs: a formula

Your business’ variable costs can be calculated using the below formula:

Total Variable Cost = Total Quantity of Output x Variable Cost Per Unit of Output

What are mixed costs?

Mixed costs, or semi-variable costs, are those which have an inherent element of both fixed and variable costs. They vary with sales volume, but are not directly proportional to them.

An example of mixed costs

Consider something like a phone bill; the fixed part of this comes in the form of line rental, while the variable component is the call charges that come with frequency of use.

How to calculate mixed costs: a formula

Your business’ mixed costs can be calculated using the formula below:

Total Mixed Cost = Variable Cost + Fixed Cost

Why is it important to distinguish between fixed costs and variable costs?

As a small business owner, tracking and understanding how various costs change in their volume and output levels is vital. The breakdown of these expenses determines the price level of the services and assists in many other aspects of the overall business strategy. Such costs are the main elements that businesses use for various costing methods, including order, process and activity-based costing.

Break-even analysis

Knowledge of fixed and variable expenses is essential for identifying a profitable price level for services. This is done by performing a break-even analysis, which uses the following formula:

Volume needed to break even = fixed costs / (price — variable costs)

This equations illustrates valuable information about pricing but can also be modified to answer other important questions, such as how feasible expansion may be. It’s also useful in showing info for projected profits. If an entrepreneur is considering buying a small business, then the formula helps them calculate what’s needed to make a profit, deciding from there whether these numbers seem credible.

Economies of scale

Fixed and variable expenses also help to identify economies of scale. This cost advantage is established in the fact that as output increases, fixed costs are spread over a larger number of output items.

Classifying business costs

- Direct and indirect costs

In addition to the above, there are direct and indirect costs which affect the classification of business costs. For budgeting and accounting purposes, it’s essential that you classify your costs into these two distinct categories.

Direct costs are traceable to the production of a specific good or service. They can be connected to a ‘cost object’ such as a product, department or project, specifically items such as software, equipment and raw materials. Labour, assuming it is specific to the product, department or project, is also included.

Imagine the following scenario: an employee is hired to work on a project, either exclusively or for an assigned number of hours; the labour of this project constitutes a direct cost. The majority of direct costs are variable, they increase because additional units of a product or service are created. An exception is direct labour costs, which are usually fixed and remain constant throughout the year.

Indirect costs, meanwhile, relate more to the maintenance of the company as a whole, rather than a specific product. After direct costs have been calculated, these are the overhead costs that are leftover. For example, things required by the company to operate on a day-to-day basis constitute examples of indirect costs, such as office equipment rental, phones and desktop computers. They contribute to the company as a whole, rather than being assigned to the creation of any one service.

The same goes for labour that supports the company as a whole, rather than employees that serve something specific. Additionally, costs such as advertising and marketing, communications, and employee benefits, along with accounting and payroll services fall under the umbrella of indirect costs.

They can be both fixed and variable in nature. Fixed indirect costs include the rent for office space, while variable indirect costs can come in the form of fluctuating gas and electricity prices.

Like what you’re reading? There’s even more content on our social media – why not follow us to keep up to date with all things Gazprom Energy?

They can be both fixed and variable in nature. Fixed indirect costs include the rent for office space, while variable indirect costs can come in the form of fluctuating gas and electricity prices.

Best practices for reducing and managing costs

However big a business is, it’s possible that they’re spending money on items that simply do not have an impact on their customers or their business operations. Rather than cost-cutting measures that only work in the short-term, the onus for businesses should be on pro-active and effective cost management that offers positive effects in the long term. Use the following best practices if you’re looking to keep an eye on your spending.

- Look at simple changes first

From the outset, you can make some fairly straightforward changes without risking the quality of your service in a significant way. Check your supplier invoices for any discrepancies, for example. If you’re heating your premises or leaving lights on during downtime, then make sure they’re switched off. Get rid of unnecessary items such as telephones that aren’t being used, and if you post things often, only use first class post when it’s absolutely necessary.

- Review and understand your business’ cost-revenue structure

This one is crucial. If you want to manage your costs, then you must identify where your revenue is coming from. For example, which products and services are producing the most sales, or which customers spend the most on your business,? The company must then work out which specific costs are producing this stream of revenue before identifying overheads and costs that aren’t directly linked to revenue generation.

- Review your vendors regularly

Annual or semi-annual reviews of key vendors should become standard practise if you’re looking to manage costs. If possible, make sure automatically renewing contracts are flagged up for review 60 to 90 days before their renewal.

- Get employees involved in decision making

Employees should be trained up in a way that lets them better control their costs. Getting them involved with decision-making, team-building and problem-solving is a great way of letting them know they’re being invested in. When faced with certain situations, they’ll be able to suggest answers together as a team as a more fiscally-minded workforce.

To this end, you have to practice what you preach, as this can send both a positive and negative message to your employees. Be mindful of the choices you make and actions you take when it comes to spending money.

Gazprom Energy is a leading and award-winning business energy supplier, helping thousands of small businesses manage their gas and electricity contracts. To find out more about what we can offer your business, visit the homepage or call us today on 0161 837 3395.

The views, opinions and positions expressed within this article are those of our third-party content providers alone and do not represent those of Gazprom Energy. The accuracy, completeness and validity of any statements made within this article are not guaranteed. Gazprom Energy accepts no liability for any errors, omissions or representations.

While computing the total cost of production, there are several types of costs that an organisation needs to consider apart from those involved in the procurement of raw material, labour and capital.

Different circumstances give way to different types of costs. For effective decision making, it is essential to distinguish between and interpret the various cost concepts that affect an organisation’s overall profit.

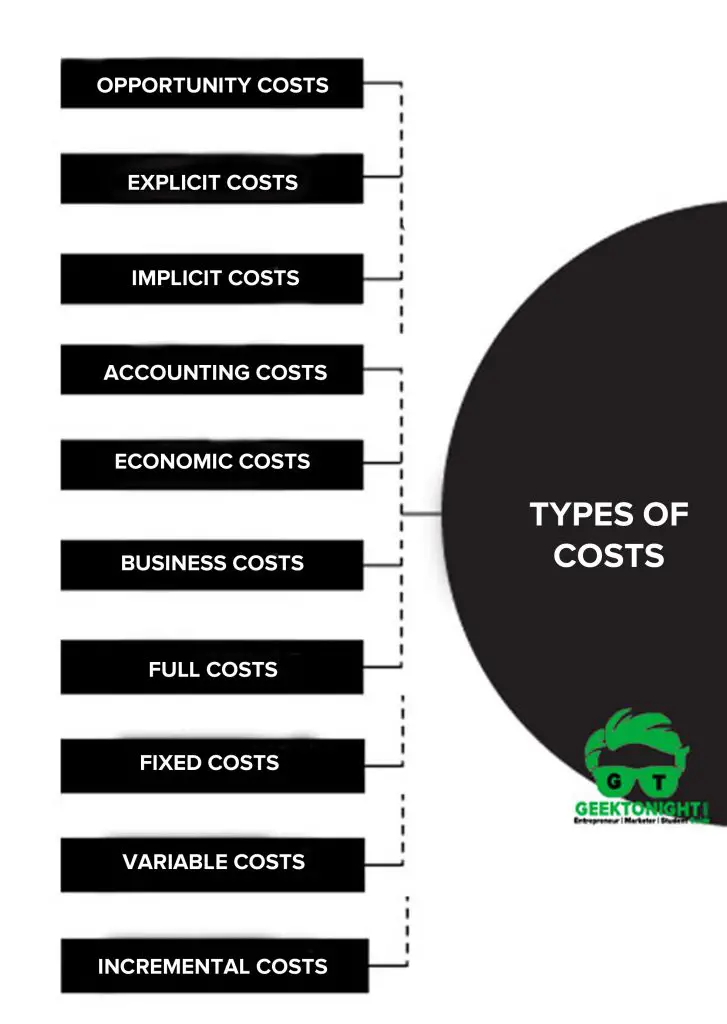

Table of Content

- 1 Types of Costs

- 1.1 Opportunity Costs

- 1.2 Explicit costs

- 1.3 Implicit costs

- 1.4 Accounting costs

- 1.5 Economic costs

- 1.6 Business costs

- 1.7 Full costs

- 1.8 Fixed costs

- 1.9 Variable costs

- 1.10 Incremental costs

- 2 Infographic of Types of Costs

- 3 Business Economics Tutorial

In Economics there are 10 Types of Costs. These are explained below:

- Opportunity costs

- Explicit costs

- Implicit costs

- Accounting costs

- Economic costs

- Business costs

- Full costs

- Fixed costs

- Variable costs

- Incremental costs

Opportunity Costs

Opportunity cost is also referred to as alternative cost. Organisations tend to utilise their limited resources for the most productive alternative and forgo the income expected from the second-best use of these resources.

Opportunity cost may be defined as the return from the second-best use of the firm’s limited resources, which it forgoes in order to benefit from the best use of these resources.

Example: Let us assume that an organisation has a capital resource of 1,00,000 and two alternative courses to choose from. It can either purchase a printing machine or photo copier, both having a productive life span of 12 years.

The printing machine would yield an income of 30,000 per annum while the photocopier would yield an income of 20, 000 per annum. An organisation that aims to maximise its profit would use the available amount to purchase the printing machine and forgo the income expected from the photo copier. Therefore, the opportunity cost in this case is the income forgone by the organisation, i.e., 20, 000 per annum.

Explicit costs

Explicit costs, also referred to as actual costs, include those payments that the employer makes to purchase or own the factors of production. These costs comprise payments for raw materials, interest paid on loans, rent paid for leased building or machinery and taxes paid to the government.

An explicit cost is one that has occurred and is clearly reported in accounting books as a separate cost.

Example: if an organisation borrows a sum of 70,00,000 at an interest rate of 4% per year, the interest cost of 2,80,000 per year would be an explicit cost for the organisation.

Implicit costs

Unlike explicit costs, there are certain other costs that cannot be reported as cash outlays in accounting books. These costs are referred to as implicit costs. Opportunity costs are examples of implicit cost borne by an organisation.

Example: An employee in an organisation takes a vacation to travel to his relative’s place. In this case, the implicit costs borne by the employee would be the salary that the employee could have earned if he/she had not taken the leave. Implicit costs are added to the explicit cost to establish a true estimate of the cost of production. Implicit costs are also referred to as imputed costs, implied costs or notional costs.

Accounting costs

Accounting costs include the financial expenditure incurred by a firm in acquiring inputs for the production of a commodity. These expenditures include salaries/wages of labour, payment for the purchase of raw materials and machinery, etc.

Accounting costs are recorded in the books of accounts of a firm and appear on the firm’s income statement. Accounting costs include all explicit costs along with certain implicit costs of an organisation.

Example: depreciation expenses (implicit cost) are included in the books of account as a firm’s accounting costs.

Economic costs

Economic costs include the total cost of opting for one alternative over another.

The concept of economic costs is similar that of opportunity costs or implicit costs with the only difference that economic costs include the accounting cost (or explicit cost) as well as the opportunity cost (or implicit cost) incurred to carry out an action over the forgone action.

Example: if the economic cost of the employee in the above example would include his/her week’s pay as well as the expense incurred on the vacation.

Business costs

Business costs include all the expenditures incurred to carry out a business. The concept of business cost is similar to the explicit costs.

Business costs comprise all the payments and contractual obligations made by a business, added to the book cost of depreciation of plant and equipment. These costs are used to calculate the profit or loss made by a business, filing for income tax returns and other legal procedures.

Full costs

The full costs include business costs, opportunity costs, and normal profit. Full costs of an organisation include cost of materials, labour and both variable and fixed manufacturing overheads that are required to produce a commodity.

Fixed costs

Fixed costs refer to the costs borne by a firm that do not change with changes in the output level. Even if the firm does not produce anything, its fixed costs would still remain the same.

Example: depreciation, administrative costs, rent of land and buildings, taxes, etc. are fixed costs of a firm that remain unchanged even though the firm’s output changes. However, if the time period under consideration is long enough to make alterations in the firm’s capacity, the fixed costs may also vary.

Variable costs

Variable costs refer to the costs that are directly dependent on the output level of the firm. In other words, variable costs vary with the changes in the volume or level of output.

Example: if an organisation increases its level of output, it would require more raw materials. Cost of raw material is a variable cost for the firm.

Other examples of variable costs are labour expenses, maintenance costs of fixed assets, routine maintenance expenditure, etc. However, the change in variable costs with changes in output level may not necessarily be in the same proportion.

Incremental costs

Incremental costs involve the additional costs resulting due to a change in the nature of level of business activity.

It characterises the additional cost that would have not been incurred if an additional unit was not produced. As these costs may be avoided by avoiding the possible variation in the production, they are also referred to as avoidable costs or escapable costs.

Example: if a production house has to run for additional two hours, the electricity consumed during the extra hours is an additional cost to the production house. The incremental cost comprises the variable costs.

Infographic of Types of Costs

Also Read: What is Revenue?

Reference

- D N Dwivedi, Managerial Economics, 8th ed, Vikas Publishing House

- Petersen, Lewis & Jain, Managerial Economics, 4e, Pearson Education India

- Brigham, & Pappas, (1972). Managerial economics, 13ed. Hinsdale, Ill.: Dryden Press.

- Dean, J. (1951). Managerial economics (1st ed.). New York: Prentice-Hall.

Business Economics Tutorial

(Click on Topic to Read)

- What is Economics?

- Scope of Economics

- Nature of Economics

- What is Business Economics?

- Micro vs Macro Economics

- Laws of Economics

- Economic Statics and Dynamics

- Gross National Product (GNP)

- What is Business Cycle?

- What is Inflation?

- What is Demand?

- Types of Demand

- Determinants of Demand

- Law of Demand

- What is Demand Schedule?

- What is Demand Curve?

- What is Demand Function?

- Demand Curve Shifts

- What is Supply?

- Determinants of Supply

- Law of Supply

- What is Supply Schedule?

- What is Supply Curve?

- Supply Curve Shifts

- What is Market Equilibrium?

Consumer Demand Analysis | Elasticity of Demand & Supply

Cost & Production Analysis | Cost and Revenue Analysis

Market Structure | Market Failure

Go On, Share article with Friends

Did we miss something in Business Economics Tutorial? Come on! Tell us what you think about our article on Types of Cost | Business Economics in the comments section.

The cost structure is one of the building blocks of a business model. It represents how companies spend most of their resources to keep generating demand for their products and services. The cost structure together with revenue streams, help assess the operational scalability of an organization.

Why it’s important to know how companies spend money

There are two elements to understand about any company:

- How it makes money.

- How it spends money.

While most people focus on how companies make money. A few truly grasp how those same companies spend money.

However, understanding how companies spend money can give you insights into the economics of their business model.

Thus, once you grasp those two – seemingly simple – elements you’ll understand a good part of the logic behind the company’s current strategy.

Defining and breaking down the cost structure

In the business model canvas by Alexander Osterwalder, a cost structure is defined as:

What are the most cost in your business? Which key resources/ activities are most expensive?

In other words, the cost structure comprises the key resources a company has to spend to keep generating revenues.

While in accounting terms, the primary costs associated with generating revenues are called COGS (or cost of goods sold).

In business modeling, we want to have a wider view.

In short, all the primary costs that make a business model viable over time are good candidates for that.

Therefore, there is not a single answer.

For instance, if we look at a company like Google, the cost structure will be primarily comprised of traffic acquisition costs, data center costs, R&D costs, and sales and marketing costs.

Why? Because all those costs help Google’s business model keep its competitiveness.

However, if we had to focus on the main cost to keep Google making money we would primarily look at its traffic acquisition costs (you’ll see the example below).

This ingredient is critical as – especially in the tech industry – many people focus too much on the revenue growth of the business.

But they lose sight of the costs involved to run the company and the “price of growth.”

Defined as the money burned to accelerate the rate of growth of a startup.

Too often startups burn all their resources because they’re not able to create a balanced business model, where the cost structure can sustain and generate enough revenues to cover the major expenses and also leave ample profit margins.

Companies like Google have been pretty successful in building up a sustainable business model thanks to their efficient cost structure.

Indeed, from a sustainable cost structure can be built a scalable business model.

Operational scalability

In the Blitzscaling business model canvas, to determine operational scalability, Reid Hoffman asks:

Are your operations sustainable at meeting the demand for your product/service? Are you revenues growing faster than your expenses?

Blitzscaling is a particular process of massive growth under uncertainty that prioritizes speed over efficiency and focuses on market domination to create a first-scaler advantage in a scenario of high uncertainty.

Reid Hoffman uses the term operational scalability as the ability of a company at generating sustainable demand for its products and services while being profitable.

Indeed, lacking the ability to build operational scalability represents a key growth limiter, and the second key element (together with lack of product/market fit).

While most startups’ dream is to grow at staggering rates. Growth isn’t easy to manage either.

As if you grow at a fast rate, but you also burn cash at a more rapid rate, chances are your company or startup might be in jeopardy.

That is why a business model that doesn’t make sense from the operational standpoint is doomed to collapse over time!

Cost structure and unit economics

A cost structure is an important component of any business model, as it helps to assess its sustainability over time.

While a startup’s business models, trying to define a new space might not be able to be profitable right away, it’s important to build long-term unit economics.

Google cost structure case study

I know you might think Google is too big of a target to learn any lessons from it.

However, the reason I’m picking Google is that the company (besides its first 2-3 years of operations) was incredibly profitable.

Many startups stress and get hyped on the concept of growth. However, it exists a universe of startups that instead managed to build a sustainable business model.

Google is an example of a company that came out of the ashes of the dot-com bubble thanks to a hugely profitable business model:

To appreciate Google’s business model strength, it is critical to look at its TAC rate.

TAC stands for traffic acquisition costs, and that is a crucial component to balance Google’s business model sustainability.

More precisely the TAC rate tells us the percentage of how Google spends money to acquire traffic, which gets monetized on its search results pages.

For instance, in 2017 Google recorded a TAC rate on Network Members of 71.9% while the Google Properties TAX Rate was 11.6%.

Over the years, Google managed to keep its cost structure extremely efficient, and that is why Google has managed to scale up!

Part of Google’s cost structure is useful for keeping together the set of processes that help the company generate revenues on its search results pages, comprising:

- Server infrastructure: back in the late 1990s when Google was still in the very initial stage at Stanford, it brought down its internet connection several times, causing several outages. That allowed its founders to understand they needed to build up a robust infrastructure on top of their search tool. Today Google has a massive IT infrastructure made of various data centers around the world.

- Another element to allow Google to stay on top of its game is to keep innovating in the search industry. Maintaining, updating, and innovating Google‘s algorithms isn’t inexpensive. Indeed, in 2021 Google spent billions on R&D.

- The third element is the acquisition of continuous streams of traffic that make Google able to create virtuous cycles and scale up.

How do we judge the ability of Google’s advertising machine?

I envisioned a metric called traffic monetization multiple, which is the ability of the company to monetize its traffic:

As you can notice from the above, this is a purely financial metric, which needs to be balanced out with a qualitative analysis of why the metric increased in the first place.

Indeed, it’s critical to keep into account these questions:

- Has monetization increased thanks to an improved UX? Or is monetization worsening the UX?

- Has monetization improved thanks to an increased customer base? Or has it increased due to higher prices per ad?

- Lastly, how is monetization balanced with legal risks posed by increased tracking?

All these questions are critical to answer, because, financially Google’s advertising machine seems as strong as ever.

There are hidden risks underlying it, which might, all of a sudden threaten its overall business model.

In fact:

- On a positive note, Google has managed to further scale, as a consequence of the pandemic. Thus, bringing its products to hundreds of millions of new users. Yet. this further scale (especially on mobile devices) has created new challenges for the company. Which is finding it harder and harder to properly index a web made of billions and billions of pages, and growing. This poses a threat in the long term, as it might reduce the quality of organic search results.

- To monetize this expanded user base, Google is serving more ads. This might work in the short term to squeeze the advertising machine. But it might make the overall experience bad in the long term. So it’s critical to balance these things out.

- To further expand its revenues, the company has also increased the price per ad. While, in the short-term, the strategy works, in the long-term, this might substantially reduce the customer base.

The points above, are some of the things you want to look at, qualitatively, to really understand what’s going on, with the changing cost structure of the company.

Netflix cost structure case study

When we look at the overall Netflix business model it’s important to understand a couple of things in order to frame its cost structure:

- The Netflix revenue model.

- And the Netflix capital expenditure.

Netflix runs an on-demand streaming platform, on top of a subscription service.

Members pay a fixed subscription monthly or yearly price, in exchange for having access to a library of content that continuously updates.

If Netflix revenues are higher than the cost that it takes to run the platform, then the platform is profitable.

Is Netflix profitable? It is indeed. However, to understand its cost structure we need to have a deeper look at Netflix’s capital expenditure.

In short, in order for Netflix to keep generating revenues in the long-term, it needs to have a library of content that is guaranteed in the coming 5-10 years.

How can the company do that?

It can do that by either licensing or producing content.

Those mechanisms have two different dynamics.

In fact, for most of its life, Netflix has been spending a massive amount of resources to license content and make it available on its platform.

This is the epitome of a platform business model.

Thus, Netflix invested capital to guarantee a continuous flow of content on top of its platform.

This advanced capital would be repaid back, with revenues coming from memberships.

This also means that for most of its history Netflix run at a negative cash flow cost structure.

Meaning that Netflix had to advance the money needed to license the content.

This money would be recouped many times over, in the long run, as the platform kept growing its members’ base.

On the other hand, starting in 2013, Netflix started to invest more and more into produced content.

What we know today as “Netflix Originals” or a library of content exclusive to paying members.

This sort of investment, while similarly, to licensing content, makes Netflix advance the costs of content, which would be recouped over the years.

It also gives the company the ability to freely distribute this content and dispose of this content over the years.

In conclusion, even though the content production investment doesn’t change the Netflix cost structure in the short term, it will change it in the long run.

Thus, we might expect Netflix to move from a cash flow negative cost structure, to a cash flow positive cost structure as it moves from the platform (investing primarily in licensed content) to a media powerhouse (as investments in produced content pass those in licensed content).

Thus, what I like to call “the mediafication” of Netflix, will be a key component of its business model advantage, in the long term.

How do we assess the evolution in this process?

This process of “mediafication” started in 2013. And while today, 66% of the content investments on Netflix are still about licensed content, the company is ramping up its investments in owned content, further.

From a formal standpoint, when new content investments in produced content will pass the license ones, we can officially call Netflix a Media Powerhouse!

And for now, it’s critical for the company to keep “arbitrating content:”

Amazon cost structure case study

When we look at the overall Amazon business model it’s important to understand a couple of things in order to frame its cost structure:

- The Amazon revenue model.

- And Amazon’s capital expenditure.

When it comes to Amazon, in particular, understanding its cost structure is a bit trickier, as the company runs a business model with many moving parts, business units, and cost structures.

In fact, it’s important to look at Amazon’s business model, according to two perspectives:

- Amazon e-commerce platform (everything that runs on top and adjacent to Amazon e-commerce).

- And Amazon Enterprise/B2B platform (Amazon AWS).

When it comes to the Amazon e-commerce platform, its primary mission is to enable variety, low costs, and a great customer experience.

Thus, Amazon runs it (as a choice) with very tight profit margins. However, this doesn’t give us a complete picture of its e-commerce cost structure.

Indeed, while the Amazon e-commerce platform has tight profit margins, it still runs with a widely positive cash flow structure.

How? Through its cash conversion cycle:

In short, Amazon is able to turn its inventories very quickly, get paid quickly by customers, and pay back suppliers with a wider term, thus enabling the company to generate wide cash margins, in the short-term, invested back into the business.

When instead, we look at Amazon’s Enterprise/B2B platform, Amazon AWS, we need to frame this in a different light:

You can see how over the years Amazon AWS profitability has been running at wide margins. As the infrastructure costs are well paid for, from its revenues.

This is true also today (2021), where Amazon AWS contributed to 55.5% of the overall Amazon operating margins.

This means, that if you were to spin off Amazon AWS from Amazon’s operations, you would get a much lower operating profit figure.

Amazon AWS, while also requiring substantial technological investments, for now, it enjoys market dominance (In 2021 Amazon AWS had revenues of over $62 billion, whereas Microsoft Intelligent Cloud, for over $60 billion, and Google Cloud, for over $19 billion) and wide margins, which might last over the next 5 years, as more startups move to AI, as a core paradigm of software companies (Amazon AWS is becoming the leading infrastructure powering up the AI and software industry).

Spotify’s cost structure analysis case study

When we look at Spotify’s cost structure, it’s important to emphasize the difference between the two main revenue streams:

- Ad-supported: free users can get unlimited music for free, but they have limited options and features. For instance, before they can skip listening to new songs or podcasts they will have to listen to the advertising. Thus advertising amortized the cost of Spotify to run the platform for free users.

- Premium: free users are channeled through a self-serving funnel that prompts them to subscribe to the paid service. Thus, enabling Spotify to monetize at wide margins the free platform, once free users become paid subscribers.

When it comes to cost structure, therefore, it’s worth noticing:

- The ad-supported business runs at tight margins, and its cost gets amortized with advertising. However, the free platform is used as a self-serving funnel to prompt free users to become paid members. In fact, chances are – if you are a paid member – you were a free user before. In short, being a free user widely increases the chances of becoming a paid member.

- The premium business, while it has a lower subscriber count, it has much wider margins. Thus, the premium platform widely pays off for the free platform.

In other words, in this specific case, the cost structure analysis helps us frame the importance of the free platform.

As if we were to analyze that from the perspective of revenues along, the free platform would not be justified.

In fact, the free platform has tight margins, and it generates costs the more it widens up.

In fact, the more free users on the platform, the more royalties Spotify has to pay back to creators for the streamed content.

Instead, the free platform needs to be judged beyond revenue generation along. And the cost structure analysis of the premium members helps us assess that.

The free users’ platform is critical to enhancing Spotify’s sales model, thus increasing the chances of free users becoming paid members.

And it plays a key role to enhance the brand and visibility of Spotify, as a consumer platform.

In short, chances are that if to become a premium member, you were a free member first.

The ad-supported business had a 10% gross margin in 2021, compared to 29% of the subscription-based business. That’s because the more the content gets streamed on the platform, the more that increases royalty costs for Spotify. That is also why the company invested in developing its content. Thus, in part transitioning from platform to brand.

Therefore, on the one hand, the ad-supported business is key to amplifying the brand of the company.

On the other hand, the ad-supported business is critical to funneling free users into premium members.

That is why, it’s important to perform bot a revenue model analysis, combined with a cost structure analysis.

To understand the reasons for running certain business segments, that go beyond revenues alone.

Apple: how much does an iPhone cost?

Another incredible example, of how a cost structure changes according to a business model, it’s Apple.

Apple has been among the few companies that managed to build one of the most incredible business platforms of the last fifteen years.

Indeed, we can argue, that Apple is the major business platform of the last fifteen years (since on Stage, in 2008, Steve Jobs announced the App Store, after having announced it almost a year before the iPhone).

Of course, when it comes to Apple we can easily argue that its business model depends too much on its iPhone sales and that the company managed to keep its manufacturing costs for the iPhone, by outsourcing most of the manufacture in China, while keeping the design in-house.

And those are all true facts.

Yet, Apple is the only company that managed to build such a massive business, at scale, on a device, which turned into a platform.

This completely affected the company’s cost structure.

First, let me explain what’s the difference between a product and a platform.

A product is simply a physical/digital thing that can be exchanged from the company to the customer.

A platform, instead, is something that goes beyond the physical/digital product itself, and it gains value based on the utility that can grow exponentially, of the underlying product.

This utility comes from the fact, that other people (developers, and entrepreneurs) can extend and expand the capability of the product to design features and a whole set of applications that final users find compelling.

When the iPhone transformed from a product (in 2007) to a platform (in 2008), that was the turning point.

You no longer get a commodifiable good, which over time would depreciate.

Instead, thanks to the fact that the iPhone became de facto the dominating mobile platform of the last fifteen years, it enabled Apple to use a reverse razor strategy.

In other words, other players had to gain market shares by decreasing the price of their products.

Apple could keep growing by increasing the price of the iPhone, as its utility (thanks to the App Store) grew.

This deeply affected Apple’s cost structure.

Where the company managed to keep its cost of making the iPhone low, while keep increasing its prices, as utility grew.

In addition to that, Apple successfully built a service business, on top of the iPhone, thanks to its market strength.

The service business further expanded on top of the iPhone dominance and it’s now become among the most important revenue streams for Apple.

For that, it’s critical to look at the evolution of Apple’s business model.

Today the App Store represents a 30% tax on the mobile web, which Apple is able to keep cashing out on, thanks to the success of hardware + software (Operating System) + Marketplace (App Store) what today we know as a Business Platform!

Key takeaway

You need to understand two key elements to have insights into how companies “think” in the current moment.

The first is how they make money.

The second is how they spend money.

When you combine those two elements, you can understand the following:

- How a company really makes money (where is the cash cow, and how and if a company lowers its margins to generate more cash flow for growth).

- Whether that company is operationally scalable.

- Where the company is headed in the next future and whether it will make sense for it to invest in certain areas rather than others!

In this article, we focused on operational scalability and cost structure, and we saw how Google managed to build an extremely efficient cost structure.

Additional Cost structure examples

Here are some more cost structure examples from a few well-known companies.

Walmart

According to Statista, Walmart has a total of almost 11,000 stores around the world with a sophisticated and optimized supply chain.

The company benefits from a cost-driven structure characterized by economies of scale and scope, but it nevertheless must meet numerous expenses.

One of the main costs Walmart must absorb is labor. This is no surprise since the company at one point was the third largest employer in the world after the United States and Chinese armed forces.

Employee wages are the main component of the labor costs, but the company’s strong anti-union stance means it is frequently embroiled in various legal disputes over worker rights.

The company also spent $107.1 billion on selling, general, and administrative expenses in 2019 (around 20.5% of total revenue).

Cost of sales for the same period was $385.3 billion, which includes the cost of product transportation, warehousing, and import distribution.

Ferrari

As a premium manufacturer of sports cars, Ferrari utilizes a value-driven cost structure.

While it is difficult to compare exact data, manufacturing relatively bespoke vehicles by hand is more expensive than churning out thousands of the same model on a production line.

Nevertheless, estimates suggest Ferrari only makes about $6,000 in profit for each car that sells for an average price of $200,000.

Ferrari’s main costs are incurred from:

- Raw materials and parts.

- Research and development – this was the company’s most significant expense in 2016 because of expenses associated with its Formula 1 racing team.

- Labor – relatively high compared to less prestigious car brands.

- Sales tax.

- Advertising, and

- Other – which includes depreciation, overheads, markups, logistics, etc.

Wizz Air

Wizz-Air is a Hungarian ultra-low-cost airline carrier that unsurprisingly employs a cost-driven structure to provide the most value to travelers.

Like Walmart, Wizz Air can undercut the vast majority of competition by using economies of scale.

In 2020, for example, it was offering two-hour flights for as little as $21 each way.

Wizz Air can offer these extremely low ticket prices because it chooses to collect a smaller profit from more passengers rather than earning a larger profit on fewer passengers.

This means populating each of the company’s Airbus A320s with as many seats as possible and removing business class altogether.

The aircraft themselves are also turned around as quickly as possible to ensure they spend the maximum amount of time in the air.

The company also minimizes costs with the following initiatives:

- A fleet comprised of one type of aircraft. With staff only required to be trained on one model, costs are reduced.

- Continuous leasing. This means Wizz Air has access to only the most reliable and fuel-efficient models.

- Undesirable flight times. Many of Wizz Air’s flights take off early in the morning or very late at night.

- Basic airport services. Scheduled services also operate in satellite or budget terminals that do not contain lounges or other creature comforts.

Alternatives to the Business Model Canvas

FourWeekMBA Squared Triangle Business Model

This framework has been thought for any type of business model, be it digital or not. It’s a framework to start mind mapping the key components of your business or how it might look as it grows. Here, as usual, what matters is not the framework itself (let’s prevent to fall trap of the Maslow’s Hammer), what matters is to have a framework that enables you to hold the key components of your business in your mind, and execute fast to prevent running the business on too many untested assumptions, especially about what customers really want. Any framework that helps us test fast, it’s welcomed in our business strategy.

An effective business model has to focus on two dimensions: the people dimension and the financial dimension. The people dimension will allow you to build a product or service that is 10X better than existing ones and a solid brand. The financial dimension will help you develop proper distribution channels by identifying the people that are willing to pay for your product or service and make it financially sustainable in the long run.

FourWeekMBA VTDF Framework For Tech Business Models

This framework is well suited for all these cases where technology plays a key role in enhancing the value proposition for the users and customers. In short, when the company you’re building, analyzing, or looking at is a tech or platform business model, the template below is perfect for the job.

A tech business model is made of four main components: value model (value propositions, mission, vision), technological model (R&D management), distribution model (sales and marketing organizational structure), and financial model (revenue modeling, cost structure, profitability and cash generation/management). Those elements coming together can serve as the basis to build a solid tech business model.

Download The VTDF Framework Template Here

FourWeekMBA Business Toolbox

Business Engineering

Asymmetric Business Models

Business Competition

Technological Modeling

Transitional Business Models

Minimum Viable Audience

Business Scaling

Market Expansion Theory

Speed-Reversibility

Asymmetric Betting

Growth Matrix

Revenue Streams Matrix

Revenue Modeling

Pricing Strategies

Additional Resources:

- Successful Types of Business Models You Need to Know

- Business Strategy: Definition, Examples, And Case Studies

- What Is a Business Model Canvas? Business Model Canvas Explained

- Blitzscaling Business Model Innovation Canvas In A Nutshell

- What Is a Value Proposition? Value Proposition Canvas Explained

- What Is a Lean Startup Canvas? Lean Startup Canvas Explained

- What Is Market Segmentation? the Ultimate Guide to Market Segmentation

- Marketing Strategy: Definition, Types, And Examples

- What Is Product-Market Fit? Product-Market Fit In A Nutshell

Cost in a business firm is an expense that the business takes on in an effort to sell a product or service. These costs include things like rent for a retail space, investments in replenishing inventory, and wages paid to employees.

Consider these details to give you a better idea of what cost is, in terms of a business firm, and why it differs from price.

What Is Cost in a Business Firm?

In managerial accounting, and in a real-world business firm, one of the most important concepts is that of cost. Cost in a business firm can be thought of as an investment in the business, but it’s a specific kind of investment that goes toward efforts to sell a product or service.

Note

If a retail clothing business uses some of its profits to invest in stocks, that isn’t considered a cost, because the business isn’t trying to sell those stocks as a part of its primary business model. On the other hand, investing in a billboard ad would be considered a cost, since it’s attempting to drive customer traffic to the store.

Since there are many different ways that a company may try to sell its unique goods or services, concepts of cost are similarly varied. There are many types of costs, such as direct and indirect costs, that a manager must understand to effectively manage a business.

How Does Cost in a Business Firm Work?

Managers have to be able to determine the costs of the products or services they offer for sale. They also have to be able to determine the cost of a customer. Costs affect profit, and they’re used to make decisions for both small and large businesses.

Here are some examples of common costs that affect a business firm.

Product or Manufacturing Costs

Only the costs in the production department are relevant to product costing. They consist of the direct and indirect costs of producing a product in a manufacturing firm or preparing a product for sale in a merchandising firm. Products are inventoried, and costs are recorded in an inventory account until the units are sold. Upon sale, the costs to produce those units get transferred to the cost of goods sold account.

Product costs consist of direct materials, direct labor, and manufacturing overhead. The total product cost is the sum of those three costs. Indirect materials and indirect labor are included in overhead.

For example, imagine that XYZ Corporation manufactures widgets at the rate of 30,000 per week. Last week, direct materials were $50,000, direct labor was $40,000, and overhead was $80,000. Using this information, you can calculate the total product cost and the per-unit cost:

- Direct materials: $50,000

- Direct labor: $40,000

- Overhead: $80,000

- Total product cost: $170,000

- Per-unit cost: $170,000 total cost / 30,000 units = $5.67 per unit

Prime Costs and Conversion Costs

Product costs are often grouped into two groups: prime costs and conversion costs. Prime costs include direct materials plus direct labor. Conversion costs include direct labor costs and manufacturing overhead costs. In other words, conversion costs are the costs of converting the raw materials into the final product.

Period Costs

All the other costs of running a company aside from product costs are called period costs. Super Bowl ads, for example, are period costs. Other examples include salaries and wages, and the costs of office supplies. Period costs do not appear as inventory on the balance sheet. They appear as expenses on the income statement.

If a period cost is expected to generate an economic benefit beyond one year, then it can be capitalized, or recorded as an asset on the company’s balance sheet. Assets on the balance sheet can be written off with depreciation over a few years, rather than being expensed all in one year. Examples would be purchases of company vehicles and expensive electronic equipment. Period costs can be significant and can be further subdivided into selling costs and administrative costs.

Cost Object

The term cost object refers to a product, service, customer, or project to which cost is assigned. For example, if you’re a college student, each course is a cost object. The cost itself is that of tuition and books for that course. The cost of foregone alternatives, like working instead of going to school, is the opportunity cost.

Cost vs. Price

| Cost vs. Price | |

|---|---|

| Cost | Price |

| Amount of an investment into a good or service | Amount charged to customer for a good or service |

| Paid to a vendor or service provider | Paid by a customer |

There’s a tendency to confuse cost with price, and they’re often used interchangeably in informal conversations, but they aren’t the same.

The amount that a business charges customers per unit of the product or service it sells is called the price. The amount it takes for a company to produce the product or service it sells is called the cost.

Note

It is important to understand the difference between price and cost so that you can turn a profit. The difference between price, the amount charged to the customer, and cost, the expense to produce the item, is called the profit, net income, or margin.

Price and cost are both relative terms. To understand whether an amount being paid is a price or a cost, you have to define who you’re talking about. For instance, a t-shirt manufacturer sets a price for a wholesale t-shirt. That price is paid by a retailer, but to the retailer, that price is actually a cost—it’s the cost of acquiring inventory for the retail store. After acquiring the t-shirt, the retailer will put it out on the sales floor. A customer who wants to buy it will pay the price charged by the retailer, which is usually the retailer’s cost plus an extra amount to bolster the retailer’s profits.

Key Takeaways

- Cost in a business firm is any cost that’s incurred in pursuit of profits.

- A cost can be thought of as a form of investment, but it’s a specific kind of investment—one intended to help sell a product or service.

- Cost and price are similar but distinct concepts.

Out of Pocket and Sunk Costs

Out of Pocket and Sunk Costs