This article is about financial organisation that provides money upon conditions. For other uses, see Bank (disambiguation).

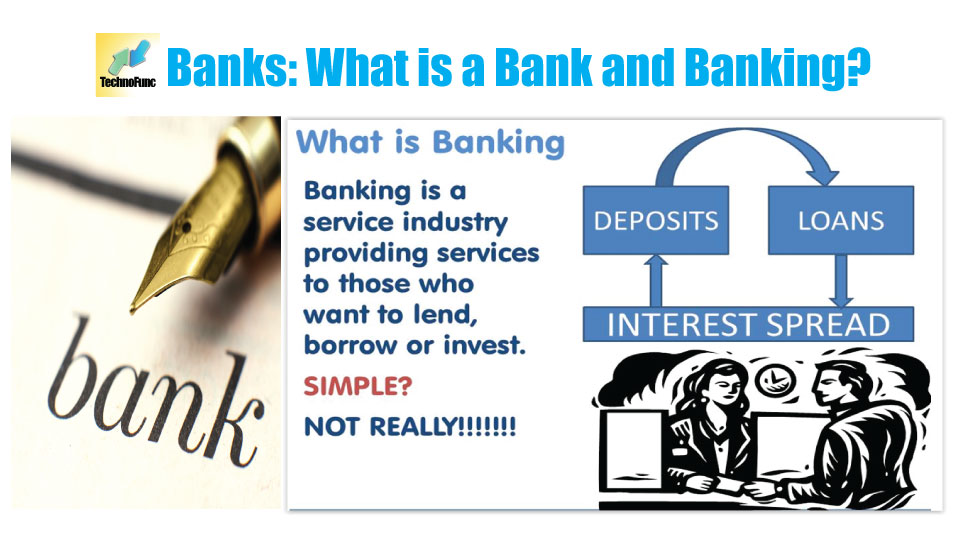

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans.[1] Lending activities can be directly performed by the bank or indirectly through capital markets.

Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords.

Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the ancient world. In the history of banking, a number of banking dynasties – notably, the Medicis, the Fuggers, the Welsers, the Berenbergs, and the Rothschilds – have played a central role over many centuries. The oldest existing retail bank is Banca Monte dei Paschi di Siena (founded in 1472), while the oldest existing merchant bank is Berenberg Bank (founded in 1590).

History[edit]

|

This section needs expansion with: history after the 19th century. You can help by adding to it. (August 2020) |

Ancient[edit]

The concept of banking may have begun in the times of ancient Assyria and Babylonia with merchants offering loans of grain as collateral within a barter system. Lenders in ancient Greece and during the Roman Empire added two important innovations: they accepted deposits and changed money.[citation needed] Archaeology from this period in Iran, ancient China and India also shows evidence of money lending.

Medieval[edit]

The present era of banking can be traced to medieval and early Renaissance Italy, to the rich cities in the centre and north like Florence, Lucca, Siena, Venice and Genoa. The Bardi and Peruzzi families dominated banking in 14th-century Florence, establishing branches in many other parts of Europe.[2] Giovanni di Bicci de’ Medici set up one of the most famous Italian banks, the Medici Bank, in 1397.[3] The Republic of Genoa founded the earliest-known state deposit bank, Banco di San Giorgio (Bank of St. George), in 1407 at Genoa, Italy.[4]

Early modern[edit]

Fractional reserve banking and the issue of banknotes emerged in the 17th and 18th centuries. Merchants started to store their gold with the goldsmiths of London, who possessed private vaults, and who charged a fee for that service. In exchange for each deposit of precious metal, the goldsmiths issued receipts certifying the quantity and purity of the metal they held as a bailee; these receipts could not be assigned, only the original depositor could collect the stored goods.

Gradually the goldsmiths began to lend money out on behalf of the depositor, and promissory notes (which evolved into banknotes) were issued for money deposited as a loan to the goldsmith. Thus by the 19th century we find in ordinary cases of deposits of money with banking corporations, or bankers, the transaction amounts to a mere loan or mutuum, and the bank is to restore, not the same money, but an equivalent sum, whenever it is demanded[5]

and money, when paid into a bank, ceases altogether to be the money of the principal (see Parker v. Marchant, 1 Phillips 360); it is then the money of the banker, who is bound to return an equivalent by paying a similar sum to that deposited with him when he is asked for it.

[6]

The goldsmith paid interest on deposits. Since the promissory notes were payable on demand, and the advances (loans) to the goldsmith’s customers were repayable over a longer time-period, this was an early form of fractional reserve banking. The promissory notes developed into an assignable instrument which could circulate as a safe and convenient form of money[7]

backed by the goldsmith’s promise to pay,[8][need quotation to verify]

allowing goldsmiths to advance loans with little risk of default.[9][need quotation to verify] Thus the goldsmiths of London became the forerunners of banking by creating new money based on credit.

The Bank of England originated the permanent issue of banknotes in 1695.[10] The Royal Bank of Scotland established the first overdraft facility in 1728.[11] By the beginning of the 19th century Lubbock’s Bank had established a bankers’ clearing house in London to allow multiple banks to clear transactions. The Rothschilds pioneered international finance on a large scale,[12][13] financing the purchase of shares in the Suez canal for the British government in 1875.[14][need quotation to verify]

Etymology[edit]

The word bank was taken into Middle English from Middle French banque, from Old Italian banco, meaning «table», from Old High German banc, bank «bench, counter». Benches were used as makeshift desks or exchange counters during the Renaissance by Florentine bankers, who used to make their transactions atop desks covered by green tablecloths.[15][16]

Definition[edit]

The definition of a bank varies from country to country. See the relevant country pages for more information.

Under English common law, a banker is defined as a person who carries on the business of banking by conducting current accounts for their customers, paying cheques drawn on them and also collecting cheques for their customers.[17]

In most common law jurisdictions there is a Bills of Exchange Act that codifies the law in relation to negotiable instruments, including cheques, and this Act contains a statutory definition of the term banker: banker includes a body of persons, whether incorporated or not, who carry on the business of banking’ (Section 2, Interpretation). Although this definition seems circular, it is actually functional, because it ensures that the legal basis for bank transactions such as cheques does not depend on how the bank is structured or regulated.

The business of banking is in many common law countries not defined by statute but by common law, the definition above. In other English common law jurisdictions there are statutory definitions of the business of banking or banking business. When looking at these definitions it is important to keep in mind that they are defining the business of banking for the purposes of the legislation, and not necessarily in general. In particular, most of the definitions are from legislation that has the purpose of regulating and supervising banks rather than regulating the actual business of banking. However, in many cases, the statutory definition closely mirrors the common law one. Examples of statutory definitions:

- «banking business» means the business of receiving money on current or deposit account, paying and collecting cheques drawn by or paid in by customers, the making of advances to customers, and includes such other business as the Authority may prescribe for the purposes of this Act; (Banking Act (Singapore), Section 2, Interpretation).

- «banking business» means the business of either or both of the following:

- receiving from the general public money on current, deposit, savings or other similar account repayable on demand or within less than [3 months] … or with a period of call or notice of less than that period;

- paying or collecting cheques drawn by or paid in by customers.[18]

Since the advent of EFTPOS (Electronic Funds Transfer at Point Of Sale), direct credit, direct debit and internet banking, the cheque has lost its primacy in most banking systems as a payment instrument. This has led legal theorists to suggest that the cheque based definition should be broadened to include financial institutions that conduct current accounts for customers and enable customers to pay and be paid by third parties, even if they do not pay and collect cheques .[19]

Standard business[edit]

Banks act as payment agents by conducting checking or current accounts for customers, paying cheques drawn by customers in the bank, and collecting cheques deposited to customers’ current accounts. Banks also enable customer payments via other payment methods such as Automated Clearing House (ACH), Wire transfers or telegraphic transfer, EFTPOS, and automated teller machines (ATMs).

Banks borrow money by accepting funds deposited on current accounts, by accepting term deposits, and by issuing debt securities such as banknotes and bonds. Banks lend money by making advances to customers on current accounts, by making installment loans, and by investing in marketable debt securities and other forms of money lending.

Banks provide different payment services, and a bank account is considered indispensable by most businesses and individuals. Non-banks that provide payment services such as remittance companies are normally not considered as an adequate substitute for a bank account.

Banks issue new money when they make loans. In contemporary banking systems, regulators set a minimum level of reserve funds that banks must hold against the deposit liabilities created by the funding of these loans, in order to ensure that the banks can meet demands for payment of such deposits. These reserves can be acquired through the acceptance of new deposits, sale of other assets, or borrowing from other banks including the central bank.[20]

Range of activities[edit]

Activities undertaken by banks include personal banking, corporate banking, investment banking, private banking, transaction banking, insurance, consumer finance, trade finance and other related.

Channels[edit]

An American bank in Maryland.

Banks offer many different channels to access their banking and other services:

- Branch, in-person banking in a retail location

- Automated teller machine banking adjacent to or remote from the bank

- Bank by mail: Most banks accept cheque deposits via mail and use mail to communicate to their customers

- Online banking over the Internet to perform multiple types of transactions

- Mobile banking is using one’s mobile phone to conduct banking transactions

- Telephone banking allows customers to conduct transactions over the telephone with an automated attendant, or when requested, with a telephone operator

- Video banking performs banking transactions or professional banking consultations via a remote video and audio connection. Video banking can be performed via purpose built banking transaction machines (similar to an Automated teller machine) or via a video conference enabled bank branch clarification

- Relationship manager, mostly for private banking or business banking, who visits customers at their homes or businesses

- Direct Selling Agent, who works for the bank based on a contract, whose main job is to increase the customer base for the bank

Business models[edit]

A bank can generate revenue in a variety of different ways including interest, transaction fees and financial advice. Traditionally, the most significant method is via charging interest on the capital it lends out to customers.[21] The bank profits from the difference between the level of interest it pays for deposits and other sources of funds, and the level of interest it charges in its lending activities.

This difference is referred to as the spread between the cost of funds and the loan interest rate. Historically, profitability from lending activities has been cyclical and dependent on the needs and strengths of loan customers and the stage of the economic cycle. Fees and financial advice constitute a more stable revenue stream and banks have therefore placed more emphasis on these revenue lines to smooth their financial performance.

In the past 20 years, American banks have taken many measures to ensure that they remain profitable while responding to increasingly changing market conditions.

- First, this includes the Gramm–Leach–Bliley Act, which allows banks again to merge with investment and insurance houses. Merging banking, investment, and insurance functions allows traditional banks to respond to increasing consumer demands for «one-stop shopping» by enabling cross-selling of products (which, the banks hope, will also increase profitability).

- Second, they have expanded the use of risk-based pricing from business lending to consumer lending, which means charging higher interest rates to those customers that are considered to be a higher credit risk and thus increased chance of default on loans. This helps to offset the losses from bad loans, lowers the price of loans to those who have better credit histories, and offers credit products to high risk customers who would otherwise be denied credit.

- Third, they have sought to increase the methods of payment processing available to the general public and business clients. These products include debit cards, prepaid cards, smart cards, and credit cards. They make it easier for consumers to conveniently make transactions and smooth their consumption over time (in some countries with underdeveloped financial systems, it is still common to deal strictly in cash, including carrying suitcases filled with cash to purchase a home).

- However, with the convenience of easy credit, there is also an increased risk that consumers will mismanage their financial resources and accumulate excessive debt. Banks make money from card products through interest charges and fees charged to cardholders, and transaction fees to retailers[22] who accept the bank’s credit and/or debit cards for payments.

This helps in making a profit and facilitates economic development as a whole.[23]

Recently, as banks have been faced with pressure from fintechs, new and additional business models have been suggested such as freemium, monetisation of data, white-labeling of banking and payment applications, or the cross-selling of complementary products.[24]

Products[edit]

Retail[edit]

- Savings account

- Recurring deposit account

- Fixed deposit account

- Money market account

- Certificate of deposit (CD)

- Individual retirement account (IRA)

- Credit card

- Debit card

- Mortgage

- Mutual fund

- Personal loan (Secured and Unsecured Personal loan)

- Time deposits

- ATM card

- Current accounts

- Cheque books

- Automated teller machine (ATM)

- National Electronic Fund Transfer (NEFT)

- Real-time gross settlement (RTGS)

Business (or commercial/investment) banking[edit]

- Business loan

- Capital raising (equity / debt / hybrids)

- Revolving credit

- Risk management (foreign exchange (FX), interest rates, commodities, derivatives)

- Term loan

- Cash management services (lock box, remote deposit capture, merchant processing)

- Credit services

- Securities Services

Capital and risk[edit]

Banks face a number of risks in order to conduct their business, and how well these risks are managed and understood is a key driver behind profitability, and how much capital a bank is required to hold. Bank capital consists principally of equity, retained earnings and subordinated debt.

Some of the main risks faced by banks include:

- Credit risk: risk of loss arising from a borrower who does not make payments as promised.[25]

- Liquidity risk: risk that a given security or asset cannot be traded quickly enough in the market to prevent a loss (or make the required profit).

- Market risk: risk that the value of a portfolio, either an investment portfolio or a trading portfolio, will decrease due to the change in value of the market risk factors.

- Operational risk: risk arising from the execution of a company’s business functions.

- Reputational risk: a type of risk related to the trustworthiness of the business.

- Macroeconomic risk: risks related to the aggregate economy the bank is operating in.[26]

The capital requirement is a bank regulation, which sets a framework within which a bank or depository institution must manage its balance sheet. The categorisation of assets and capital is highly standardised so that it can be risk weighted.

After the financial crisis of 2007–2008, regulators force banks to issue Contingent convertible bonds (CoCos). These are hybrid capital securities that absorb losses in accordance with their contractual terms when the capital of the issuing bank falls below a certain level. Then debt is reduced and bank capitalisation gets a boost. Owing to their capacity to absorb losses, CoCos have the potential to satisfy regulatory capital requirement.[27][28]

Banks in the economy[edit]

Economic functions[edit]

The economic functions of banks include:

- Issue of money, in the form of banknotes and current accounts subject to cheque or payment at the customer’s order. These claims on banks can act as money because they are negotiable or repayable on demand, and hence valued at par. They are effectively transferable by mere delivery, in the case of banknotes, or by drawing a cheque that the payee may bank or cash.

- Netting and settlement of payments – banks act as both collection and paying agents for customers, participating in interbank clearing and settlement systems to collect, present, be presented with, and pay payment instruments. This enables banks to economise on reserves held for settlement of payments since inward and outward payments offset each other. It also enables the offsetting of payment flows between geographical areas, reducing the cost of settlement between them.

- Credit quality improvement – banks lend money to ordinary commercial and personal borrowers (ordinary credit quality), but are high quality borrowers. The improvement comes from diversification of the bank’s assets and capital which provides a buffer to absorb losses without defaulting on its obligations. However, banknotes and deposits are generally unsecured; if the bank gets into difficulty and pledges assets as security, to raise the funding it needs to continue to operate, this puts the note holders and depositors in an economically subordinated position.

- Asset liability mismatch/Maturity transformation – banks borrow more on demand debt and short term debt, but provide more long-term loans. In other words, they borrow short and lend long. With a stronger credit quality than most other borrowers, banks can do this by aggregating issues (e.g. accepting deposits and issuing banknotes) and redemptions (e.g. withdrawals and redemption of banknotes), maintaining reserves of cash, investing in marketable securities that can be readily converted to cash if needed, and raising replacement funding as needed from various sources (e.g. wholesale cash markets and securities markets).

- Money creation/destruction – whenever a bank gives out a loan in a fractional-reserve banking system, a new sum of money is created and conversely, whenever the principal on that loan is repaid money is destroyed.

Bank crisis[edit]

Banks are susceptible to many forms of risk which have triggered occasional systemic crises.[29] These include liquidity risk (where many depositors may request withdrawals in excess of available funds), credit risk (the chance that those who owe money to the bank will not repay it), and interest rate risk (the possibility that the bank will become unprofitable, if rising interest rates force it to pay relatively more on its deposits than it receives on its loans).

Banking crises have developed many times throughout history when one or more risks have emerged for the banking sector as a whole. Prominent examples include the bank run that occurred during the Great Depression, the U.S. Savings and Loan crisis in the 1980s and early 1990s, the Japanese banking crisis during the 1990s, and the sub-prime mortgage crisis in the 2000s.

The 2023 global banking crisis is the latest of these crises: In March 2023, liquidity shortages and bank insolvencies led to three bank failures in the United States, and within two weeks, several of the world’s largest banks failed or were shut down by regulators

Size of global banking industry[edit]

Assets of the largest 1,000 banks in the world grew by 6.8% in the 2008–2009 financial year to a record US$96.4 trillion while profits declined by 85% to US$115 billion. Growth in assets in adverse market conditions was largely a result of recapitalisation. EU banks held the largest share of the total, 56% in 2008–2009, down from 61% in the previous year. Asian banks’ share increased from 12% to 14% during the year, while the share of US banks increased from 11% to 13%. Fee revenue generated by global investment in banking totalled US$66.3 billion in 2009, up 12% on the previous year.[30]

The United States has the most banks in the world in terms of institutions (5,330 as of 2015) and possibly branches (81,607 as of 2015).[31] This is an indicator of the geography and regulatory structure of the US, resulting in a large number of small to medium-sized institutions in its banking system. As of November 2009, China’s top four banks have in excess of 67,000 branches (ICBC:18000+, BOC:12000+, CCB:13000+, ABC:24000+) with an additional 140 smaller banks with an undetermined number of branches.

Japan had 129 banks and 12,000 branches. In 2004, Germany, France, and Italy each had more than 30,000 branches – more than double the 15,000 branches in the United Kingdom.[30]

Mergers and acquisitions[edit]

Between 1985 and 2018 banks engaged in around 28,798 mergers or acquisitions, either as the acquirer or the target company. The overall known value of these deals cumulates to around 5,169 bil. USD.[32] In terms of value, there have been two major waves (1999 and 2007) which both peaked at around 460 bil. USD followed by a steep decline (-82% from 2007 until 2018).

Here is a list of the largest deals in history in terms of value with participation from at least one bank:

| Date announced | Acquiror name | Acquiror mid industry | Acquiror nation | Target name | Target mid industry | Target nation | Value of transaction ($mil) |

| 2007-04-25 | RFS Holdings BV | Other financials | Netherlands | ABN-AMRO Holding N.V. | Banks | Netherlands | 98,189.19 |

| 1998-04-06 | Travelers Group Inc | Insurance | United States | Citicorp | Banks | United States | 72,558.18 |

| 2014-09-29 | UBS AG | Banks | Switzerland | UBS AG[clarification needed] | Banks | Switzerland | 65,891.51 |

| 1998-04-13 | NationsBank Corp, Charlotte, North Carolina | Banks | United States | BankAmerica Corp | Banks | United States | 61,633.40 |

| 2004-01-14 | JPMorgan Chase & Co | Banks | United States | Bank One Corp, Chicago, Illinois | Banks | United States | 58,663.15 |

| 2003-10-27 | Bank of America Corp | Banks | United States | FleetBoston Financial Corp, Massachusetts | Banks | United States | 49,260.63 |

| 2008-09-14 | Bank of America Corp | Banks | United States | Merrill Lynch & Co Inc | Brokerage | United States | 48,766.15 |

| 1999-10-13 | Sumitomo Bank Ltd | Banks | Japan | Sakura Bank Ltd | Banks | Japan | 45,494.36 |

| 2009-02-26 | HM Treasury | National agency | United Kingdom | Royal Bank of Scotland Group | Banks | United Kingdom | 41,878.65 |

| 2005-02-18 | Mitsubishi Tokyo Financial Group | Banks | Japan | UFJ Holdings Inc | Banks | Japan | 41,431.03 |

Regulation[edit]

Currently, commercial banks are regulated in most jurisdictions by government entities and require a special bank license to operate.

Usually, the definition of the business of banking for the purposes of regulation is extended to include acceptance of deposits, even if they are not repayable to the customer’s order – although money lending, by itself, is generally not included in the definition.

Unlike most other regulated industries, the regulator is typically also a participant in the market, being either publicly or privately governed central bank. Central banks also typically have a monopoly on the business of issuing banknotes. However, in some countries, this is not the case. In the UK, for example, the Financial Services Authority licenses banks, and some commercial banks (such as the Bank of Scotland) issue their own banknotes in addition to those issued by the Bank of England, the UK government’s central bank.

Banking law is based on a contractual analysis of the relationship between the bank (defined above) and the customer – defined as any entity for which the bank agrees to conduct an account.

The law implies rights and obligations into this relationship as follows:

- The bank account balance is the financial position between the bank and the customer: when the account is in credit, the bank owes the balance to the customer; when the account is overdrawn, the customer owes the balance to the bank.

- The bank agrees to pay the customer’s checks up to the amount standing to the credit of the customer’s account, plus any agreed overdraft limit.

- The bank may not pay from the customer’s account without a mandate from the customer, e.g. a cheque drawn by the customer.

- The bank agrees to promptly collect the cheques deposited to the customer’s account as the customer’s agent and to credit the proceeds to the customer’s account.

- And, the bank has a right to combine the customer’s accounts since each account is just an aspect of the same credit relationship.

- The bank has a lien on cheques deposited to the customer’s account, to the extent that the customer is indebted to the bank.

- The bank must not disclose details of transactions through the customer’s account – unless the customer consents, there is a public duty to disclose, the bank’s interests require it, or the law demands it.

- The bank must not close a customer’s account without reasonable notice, since cheques are outstanding in the ordinary course of business for several days.

These implied contractual terms may be modified by express agreement between the customer and the bank. The statutes and regulations in force within a particular jurisdiction may also modify the above terms and/or create new rights, obligations, or limitations relevant to the bank-customer relationship.

Some types of financial institutions, such as building societies and credit unions, may be partly or wholly exempt from bank license requirements, and therefore regulated under separate rules.

The requirements for the issue of a bank license vary between jurisdictions but typically include:

- Minimum capital

- Minimum capital ratio

- ‘Fit and Proper’ requirements for the bank’s controllers, owners, directors, or senior officers

- Approval of the bank’s business plan as being sufficiently prudent and plausible.

Different types of banking[edit]

An illustration of Northern National Bank as advertised in a 1921 book highlighting the opportunities available in Toledo, Ohio

Banks’ activities can be divided into:

- retail banking, dealing directly with individuals and small businesses;

- business banking, providing services to mid-market business;

- corporate banking, directed at large business entities;

- private banking, providing wealth management services to high-net-worth individuals and families;

- investment banking, relating to activities on the financial markets.

Most banks are profit-making, private enterprises. However, some are owned by the government, or are non-profit organisations.

Types of banks[edit]

- Commercial banks: the term used for a normal bank to distinguish it from an investment bank. After the Great Depression, the U.S. Congress required that banks only engage in banking activities, whereas investment banks were limited to capital market activities. Since the two no longer have to be under separate ownership, some use the term «commercial bank» to refer to a bank or a division of a bank that mostly deals with deposits and loans from corporations or large businesses.

- Community banks: locally operated financial institutions that empower employees to make local decisions to serve their customers and partners.

- Community development banks: regulated banks that provide financial services and credit to under-served markets or populations.

- Land development banks: The special banks providing long-term loans are called land development banks (LDB). The history of LDB is quite old. The first LDB was started at Jhang in Punjab in 1920. The main objective of the LDBs is to promote the development of land, agriculture and increase the agricultural production. The LDBs provide long-term finance to members directly through their branches.[33]

- Credit unions or co-operative banks: not-for-profit cooperatives owned by the depositors and often offering rates more favourable than for-profit banks. Typically, membership is restricted to employees of a particular company, residents of a defined area, members of a certain union or religious organisations, and their immediate families.

- Postal savings banks: savings banks associated with national postal systems.

- Private banks: banks that manage the assets of high-net-worth individuals. Historically a minimum of US$1 million was required to open an account, however, over the last years, many private banks have lowered their entry hurdles to US$350,000 for private investors.[34]

- Offshore banks: banks located in jurisdictions with low taxation and regulation. Many offshore banks are essentially private banks.

- Savings banks: in Europe, savings banks took their roots in the 19th or sometimes even in the 18th century. Their original objective was to provide easily accessible savings products to all strata of the population. In some countries, savings banks were created on public initiative; in others, socially committed individuals created foundations to put in place the necessary infrastructure. Nowadays, European savings banks have kept their focus on retail banking: payments, savings products, credits, and insurances for individuals or small and medium-sized enterprises. Apart from this retail focus, they also differ from commercial banks by their broadly decentralised distribution network, providing local and regional outreach – and by their socially responsible approach to business and society.

- Building societies and Landesbanks: institutions that conduct retail banking.

- Ethical banks: banks that prioritize the transparency of all operations and make only what they consider to be socially responsible investments.

- A direct or internet-only bank is a banking operation without any physical bank branches. Transactions are usually accomplished using ATMs and electronic transfers and direct deposits through an online interface.

Types of investment banks[edit]

- Investment banks «underwrite» (guarantee the sale of) stock and bond issues, provide investment management, and advise corporations on capital market activities such as M&A, trade for their own accounts, make markets, provide securities services to institutional clients.

- Merchant banks were traditionally banks which engaged in trade finance. The modern definition, however, refers to banks which provide capital to firms in the form of shares rather than loans. Unlike venture caps, they tend not to invest in new companies.

Combination banks[edit]

- Universal banks, more commonly known as financial services companies, engage in several of these activities. These big banks are very diversified groups that, among other services, also distribute insurance – hence the term bancassurance, a portmanteau word combining «banque or bank» and «assurance», signifying that both banking and insurance are provided by the same corporate entity.

Other types of banks[edit]

- Central banks are normally government-owned and charged with quasi-regulatory responsibilities, such as supervising commercial banks, or controlling the cash interest rate. They generally provide liquidity to the banking system and act as the lender of last resort in event of a crisis.

- Islamic banks adhere to the concepts of Islamic law. This form of banking revolves around several well-established principles based on Islamic laws. All banking activities must avoid interest, a concept that is forbidden in Islam. Instead, the bank earns profit (markup) and fees on the financing facilities that it extends to customers.

Challenges within the banking industry[edit]

United States[edit]

The United States banking industry is one of the most heavily regulated and guarded in the world,[35] with multiple specialised and focused regulators. All banks with FDIC-insured deposits have the Federal Deposit Insurance Corporation (FDIC) as a regulator. However, for soundness examinations (i.e., whether a bank is operating in a sound manner), the Federal Reserve is the primary federal regulator for Fed-member state banks; the Office of the Comptroller of the Currency (OCC) is the primary federal regulator for national banks. State non-member banks are examined by the state agencies as well as the FDIC.[36]: 236 National banks have one primary regulator – the OCC.

Each regulatory agency has its own set of rules and regulations to which banks and thrifts must adhere.

The Federal Financial Institutions Examination Council (FFIEC) was established in 1979 as a formal inter-agency body empowered to prescribe uniform principles, standards, and report forms for the federal examination of financial institutions. Although the FFIEC has resulted in a greater degree of regulatory consistency between the agencies, the rules and regulations are constantly changing.

In addition to changing regulations, changes in the industry have led to consolidations within the Federal Reserve, FDIC, OTS, and OCC. Offices have been closed, supervisory regions have been merged, staff levels have been reduced and budgets have been cut. The remaining regulators face an increased burden with an increased workload and more banks per regulator. While banks struggle to keep up with the changes in the regulatory environment, regulators struggle to manage their workload and effectively regulate their banks. The impact of these changes is that banks are receiving less hands-on assessment by the regulators, less time spent with each institution, and the potential for more problems slipping through the cracks, potentially resulting in an overall increase in bank failures across the United States.

The changing economic environment has a significant impact on banks and thrifts as they struggle to effectively manage their interest rate spread in the face of low rates on loans, rate competition for deposits and the general market changes, industry trends and economic fluctuations. It has been a challenge for banks to effectively set their growth strategies with the recent economic market. A rising interest rate environment may seem to help financial institutions, but the effect of the changes on consumers and businesses is not predictable and the challenge remains for banks to grow and effectively manage the spread to generate a return to their shareholders.

The management of the banks’ asset portfolios also remains a challenge in today’s economic environment. Loans are a bank’s primary asset category and when loan quality becomes suspect, the foundation of a bank is shaken to the core. While always an issue for banks, declining asset quality has become a big problem for financial institutions.

There are several reasons for this, one of which is the lax attitude some banks have adopted because of the years of «good times.» The potential for this is exacerbated by the reduction in the regulatory oversight of banks and in some cases depth of management. Problems are more likely to go undetected, resulting in a significant impact on the bank when they are discovered. In addition, banks, like any business, struggle to cut costs and have consequently eliminated certain expenses, such as adequate employee training programs.

Banks also face a host of other challenges such as ageing ownership groups. Across the country, many banks’ management teams and boards of directors are ageing. Banks also face ongoing pressure from shareholders, both public and private, to achieve earnings and growth projections. Regulators place added pressure on banks to manage the various categories of risk. Banking is also an extremely competitive industry. Competing in the financial services industry has become tougher with the entrance of such players as insurance agencies, credit unions, cheque cashing services, credit card companies, etc.

As a reaction, banks have developed their activities in financial instruments, through financial market operations such as brokerage and have become big players in such activities.

Another major challenge is the ageing infrastructure, also called legacy IT. Backend systems were built decades ago and are incompatible with new applications. Fixing bugs and creating interfaces costs huge sums, as knowledgeable programmers become scarce.[37]

Loan activities of banks[edit]

To be able to provide home buyers and builders with the funds needed, banks must compete for deposits. The phenomenon of disintermediation had to dollars moving from savings accounts and into direct market instruments such as U.S. Department of Treasury obligations, agency securities, and corporate debt. One of the greatest factors in recent years in the movement of deposits was the tremendous growth of money market funds whose higher interest rates attracted consumer deposits.[38]

To compete for deposits, US savings institutions offer many different types of plans:[38]

- Passbook or ordinary deposit accounts – permit any amount to be added to or withdrawn from the account at any time.

- NOW and Super NOW accounts – function like checking accounts but earn interest. A minimum balance may be required on Super NOW accounts.

- Money market accounts – carry a monthly limit of preauthorised transfers to other accounts or persons and may require a minimum or average balance.

- Certificate accounts – subject to loss of some or all interest on withdrawals before maturity.

- Notice accounts – the equivalent of certificate accounts with an indefinite term. Savers agree to notify the institution a specified time before withdrawal.

- Individual retirement accounts (IRAs) and Keogh plans – a form of retirement savings in which the funds deposited and interest earned are exempt from income tax until after withdrawal.

- Checking accounts – offered by some institutions under definite restrictions.

- All withdrawals and deposits are completely the sole decision and responsibility of the account owner unless the parent or guardian is required to do otherwise for legal reasons.

- Club accounts and other savings accounts – designed to help people save regularly to meet certain goals.

Types of accounts[edit]

Bank statements are accounting records produced by banks under the various accounting standards of the world. Under GAAP there are two kinds of accounts: debit and credit. Credit accounts are Revenue, Equity and Liabilities. Debit Accounts are Assets and Expenses. The bank credits a credit account to increase its balance, and debits a credit account to decrease its balance.[39]

The customer debits his or her savings/bank (asset) account in his ledger when making a deposit (and the account is normally in debit), while the customer credits a credit card (liability) account in his ledger every time he spends money (and the account is normally in credit). When the customer reads his bank statement, the statement will show a credit to the account for deposits, and debits for withdrawals of funds. The customer with a positive balance will see this balance reflected as a credit balance on the bank statement. If the customer is overdrawn, he will have a negative balance, reflected as a debit balance on the bank statement.

Brokered deposits[edit]

One source of deposits for banks is deposit brokers who deposit large sums of money on behalf of investors through trust corporations. This money will generally go to the banks which offer the most favourable terms, often better than those offered local depositors. It is possible for a bank to engage in business with no local deposits at all, all funds being brokered deposits. Accepting a significant quantity of such deposits, or «hot money» as it is sometimes called, puts a bank in a difficult and sometimes risky position, as the funds must be lent or invested in a way that yields a return sufficient to pay the high interest being paid on the brokered deposits. This may result in risky decisions and even in eventual failure of the bank. Banks which failed during 2008 and 2009 in the United States during the global financial crisis had, on average, four times more brokered deposits as a percent of their deposits than the average bank. Such deposits, combined with risky real estate investments, factored into the savings and loan crisis of the 1980s. Regulation of brokered deposits is opposed by banks on the grounds that the practice can be a source of external funding to growing communities with insufficient local deposits.[40] There are different types of accounts: saving, recurring and current accounts.

Custodial accounts[edit]

Custodial accounts are accounts in which assets are held for a third party. For example, businesses that accept custody of funds for clients prior to their conversion, return, or transfer may have a custodial account at a bank for these purposes.

Globalisation in the banking industry[edit]

In modern times there have been huge reductions to the barriers of global competition in the banking industry. Increases in telecommunications and other financial technologies, such as Bloomberg, have allowed banks to extend their reach all over the world since they no longer have to be near customers to manage both their finances and their risk. The growth in cross-border activities has also increased the demand for banks that can provide various services across borders to different nationalities. Despite these reductions in barriers and growth in cross-border activities, the banking industry is nowhere near as globalised as some other industries. In the US, for instance, very few banks even worry about the Riegle–Neal Act, which promotes more efficient interstate banking. In the vast majority of nations around the globe, the market share for foreign owned banks is currently less than a tenth of all market shares for banks in a particular nation. One reason the banking industry has not been fully globalised is that it is more convenient to have local banks provide loans to small businesses and individuals. On the other hand, for large corporations, it is not as important in what nation the bank is in since the corporation’s financial information is available around the globe.[41]

See also[edit]

|

Terms and concepts:

|

Types of institutions:

Crime:

Related lists:

|

Banking by country

|

References[edit]

- ^

Compare: «Bank of England». Rulebook Glossary. 1 January 2014. Retrieved 20 July 2020.bank means:

(1) a firm with a Part 4A Permission to carry on the regulated activity of accepting deposits and is a credit institution, but is not a credit union, friendly society or a building society; or

(2) an EEA bank. - ^ Hoggson, N. F. (1926) Banking Through the Ages, New York, Dodd, Mead & Company.

- ^ Goldthwaite, R. A. (1995) Banks, Places and Entrepreneurs in Renaissance Florence, Aldershot, Hampshire, Great Britain, Variorum

- ^ Macesich, George (30 June 2000). «Central Banking: The Early Years: Other Early Banks». Issues in Money and Banking. Westport, Connecticut: Praeger Publishers (Greenwood Publishing Group). p. 42. ISBN 978-0-275-96777-2. Retrieved 12 March 2009.

The first state deposit bank was the Bank of St. George in Genoa, which was established in 1407.

- ^

Compare:

Story, Joseph (1832). «On Deposits». In Schouler, James (ed.). Commentaries on the Law of Bailments: With Illustrations from the Civil and the Foreign Law (9 ed.). Boston: Little, Brown, and Company (published 1878). p. 87. Retrieved 20 August 2020.In the ordinary cases of deposits of money with banking corporations, or bankers, the transaction amounts to a mere loan or mutuum, or irregular deposit, and the bank is to restore, not the same money, but an equivalent sum, whenever it is demanded.

- ^

Lord Chancellor Cottenham, Foley v Hill (1848) 2 HLC 28. - ^

Richards, Richard D. (1929). «The Goldsmith bankers and the evolution of English paper money». The Early History of Banking in England. Routledge Library Editions: Banking and Finance. Vol. 30 (reprint ed.). London: Routledge (published 2012). p. 40. ISBN 9780203116067. Retrieved 20 August 2020.[…] the promissory note originated as a receipt given by the goldsmith for money, which he took charge of for a customer but was not allowed to use. Such a note was relly a warehouse voucher which could not be assigned. When, however, it became a receipt for a money deposit, which the goldsmith was allowed to use for the purpose of making advances to his customers, it developed into an assignable instrument. Ultimately such notes were issued by the goldsmiths in the form of loans and were not necessarily backed by coin and bullion.

- ^ Richards. The usual denomination was 50 or 100 pounds, so these notes were not an everyday currency for the common people.

- ^ Richards, p. 40

- ^ «A History of British Banknotes». britishnotes.co.uk.

- ^ «A short history of overdrafts». eccount money. Archived from the original on 5 November 2013.

- ^ «The History of Banks | How They’ve Changed through the Years». www.worldbank.org.ro. Retrieved 6 May 2020.

International financing in the 19th Century took hold due to the Rothschilds.

- ^ «HISTORY OF BANKING». History World. Retrieved 20 August 2020.

The Danish loan [1803] is the first of many such transactions on behalf of governments which rapidly establish the Rothschild family as Europe’s most powerful bankers, rising to a pre-eminence comparable to that of the Medici and the Fugger in earlier centuries.

The family is soon represented in all the important centres of the continent. - ^ «A History of Banking». www.localhistories.org. Retrieved 6 May 2020.

- ^ de Albuquerque, Martim (1855). Notes and Queries. in: George Bell. p. 431.

- ^ «bank | Origin and meaning of bank by Online Etymology Dictionary». www.etymonline.com.

- ^ United Dominions Trust Ltd v Kirkwood, 1966, English Court of Appeal, 2 QB 431

- ^ (Banking Ordinance, Section 2, Interpretation, Hong Kong) Note that in this case the definition is extended to include accepting any deposits repayable in less than 3 months, companies that accept deposits of greater than HK$100 000 for periods of greater than 3 months are regulated as deposit taking companies rather than as banks in Hong Kong.

- ^ e.g. Tyree’s Banking Law in New Zealand, A L Tyree, LexisNexis 2003, p. 70.

- ^ McLeay, Michael; Radia, Amar; Thomas, Ryland (8 March 2014). «Money creation in the modern economy». Bank of England Quarterly Bulletin. Retrieved 9 July 2022.

- ^ «How Do Banks Make Money?». GOBankingRates. 27 October 2017.

- ^ «Banking Channels | Bankedge». BANKEDGE | Professional Certification Courses In Banking. 8 February 2016. Retrieved 5 July 2020.

- ^ «How Banks Make Money». The Street. Retrieved 8 September 2011.

- ^ Pejic, Igor (28 March 2019). Blockchain Babel: The Crypto-craze and the Challenge to Business (1st ed.). Kogan Page. ISBN 9780749484163.

- ^ Basel Committee on Banking Supervision (30 November 1999). «Principles for the Management of Credit Risk» (PDF). Bank for International Settlements. p. 1. Retrieved 28 January 2016.

Credit risk is most simply defined as the potential that a bank borrower or counterparty will fail to meet its obligations in accordance with agreed terms.

- ^ Bolt, Wilko; Haan, Leo de; Hoeberichts, Marco; Oordt, Maarten van; Swank, Job (September 2012). «Bank Profitability during Recessions» (PDF). Journal of Banking & Finance. 36 (9): 2552–64. doi:10.1016/j.jbankfin.2012.05.011.

- ^ Raviv, Alon (13 August 2014). «Bank Stability and Market Discipline: Debt-for-Equity Swap versus Subordinated Notes» (PDF). EconPapers. The Hebrew University Business School. p. 59. Archived from the original (PDF) on 13 July 2018. Retrieved 13 July 2018.

- ^ Flannery, Mark J. (November 2002). «No Pain, No Gain? Effecting Market Discipline via «Reverse Convertible Debentures»» (PDF). University of Florida. p. 31. Retrieved 13 July 2018.

- ^ Rustici, Chiara. «Personal Data And The Next Subprime Crisis». Forbes.

- ^ a b «Banking 2010» (PDF). TheCityUK. pp. 3–4. Archived from the original (PDF) on 15 June 2012. Retrieved 20 June 2011.(638 KB) charts 7–8

- ^ «FDIC: HSOB Commercial Banks». www5.fdic.gov. Retrieved 4 September 2016.

- ^ «M&A by Industries — Institute for Mergers, Acquisitions and Alliances (IMAA)». Institute for Mergers, Acquisitions and Alliances (IMAA). Retrieved 28 February 2018.

- ^ TNAU. «Land Development Bank». TNAU Agritech Portal. Retrieved 8 January 2014.

- ^ «List of Commercial Banks in Nepal». Retrieved 6 June 2019.

- ^ Scott Besley and Eugene F. Brigham, Principles of Finance, 4th ed. (Mason, OH: South-Western Cengage Learning, 2009), 125. This popular university textbook explains: «Generally speaking, U.S. financial institutions have been much more heavily regulated and faced greater limitations … than have their foreign counterparts.»

- ^ Van Loo, Rory (1 February 2018). «Making Innovation More Competitive: The Case of Fintech». UCLA Law Review. 65 (1): 232.

- ^ Irrera, Anna. «Banks scramble to fix old systems as IT ‘cowboys’ ride into sunset». U.S. Retrieved 2 November 2018.

- ^ a b Mishler, Lon; Cole, Robert E. (1995). Consumer and business credit management. Homewood: Irwin. pp. 128–29. ISBN 978-0-256-13948-8.

- ^ Statistics Department (2001). «Source Data for Monetary and Financial Statistics». Monetary and Financial Statistics: Compilation Guide. Washington D.C.: International Monetary Fund. p. 24. ISBN 978-1-58906-584-0. Retrieved 14 March 2009.

- ^ Lipton, Eric; Martin, Andrew (3 July 2009). «For Banks, Wads of Cash and Loads of Trouble». The New York Times. Macon, Ga. Retrieved 13 July 2018.

- ^ Berger, Allen N; Dai, Qinglei; Ongena, Steven; Smith, David C (1 March 2003). «To what extent will the banking industry be globalized? A study of bank nationality and reach in 20 European nations». Journal of Banking & Finance. 27 (3): 383–415. doi:10.1016/S0378-4266(02)00386-2. Retrieved 28 January 2016 – via Google Scholar.

Further reading[edit]

- Born, Karl Erich. International Banking in the 19th and 20th Centuries (St Martin’s, 1983) online

External links[edit]

- Guardian Datablog – World’s Biggest Banks

- Banking, Banks, and Credit Unions from UCB Libraries GovPubs (archived 11January 2012)

- A Guide to the National Banking System (PDF). Office of the Comptroller of the Currency (OCC), Washington, D.C. Provides an overview of the national banking system of the US, its regulation, and the OCC.

Last Update: Jan 03, 2023

This is a question our experts keep getting from time to time. Now, we have got the complete detailed explanation and answer for everyone, who is interested!

Asked by: Arnoldo Witting

Score: 4.7/5

(60 votes)

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

What are the two meanings of bank?

There are several different meanings of the word bank. Besides the ones connected with money — like a savings bank or a piggy bank — a bank is also a slope of grass or earth, such as a river bank.

What is the simple meaning of bank?

A bank is a financial institution where customers can save or borrow money. Banks also invest money to build up their reserve of money. … Banks also can use the money they have from deposit accounts to invest in businesses in order to make more money.

What is the meaning of bank in one word?

bank 1. / (bæŋk) / noun. an institution offering certain financial services, such as the safekeeping of money, conversion of domestic into and from foreign currencies, lending of money at interest, and acceptance of bills of exchange.

What is bank in definition?

A bank is a financial institution licensed to receive deposits and make loans. Banks may also provide financial services such as wealth management, currency exchange, and safe deposit boxes. … In most countries, banks are regulated by the national government or central bank.

23 related questions found

Are bank and bank homonyms?

Bank (a financial establishment) and bank (the slope bordering a river) are homographs that are spelled and sound the same: … Jim and Janet went down to the river bank to admire the swans.

What are the types of bank?

What are some different types of banks?

- Retail banks. Retail banks, also known as consumer banks, are commercial banks that offer consumer and personal banking services to the general public. …

- Commercial banks. …

- Community development banks. …

- Investment banks. …

- Online and neobanks. …

- Credit unions. …

- Savings and loan associations.

What is called bank money?

Bank money, or broad money (M1/M2) is the money created by private banks through the recording of loans as deposits of borrowing clients, with partial support indicated by the cash ratio. Currently, bank money is created as electronic money.

What is the importance of a bank?

Banks provide funds for the business and play an important role in the development of a nation. It acts as an intermediary between people having surplus money and those requiring money for various business activities.

What are the functions of bank?

The function of a Bank is to collect deposits from the public and lend those deposits for the development of Agriculture, Industry, Trade and Commerce. Bank pays interest at lower rates to the depositors and receives interests on loans and advances from them at higher rates.

What are the three main types of bank transactions?

Answer: The three main types of banking are checks, withdrawals, and deposits.

What is the word for putting money in your bank account?

You are making a deposit when you put money into your bank account. In that sentence, deposit is a noun, but you could express the same action using deposit as a verb.

What is the word for taking out money from your bank account?

What Is a Withdrawal? A withdrawal involves removing funds from a bank account, savings plan, pension, or trust.

What are 3 functions of a bank?

— Primary functions include accepting deposits, granting loans, advances, cash, credit, overdraft and discounting of bills. — Secondary functions include issuing letter of credit, undertaking safe custody of valuables, providing consumer finance, educational loans, etc.

How does a bank help us in our life?

Banks are closely linked with our everyday lives and activities. Drawing salaries, paying bills, buying homes, building up savings and taking out loans all involve transactions with banks. Businesses also rely on the banking system for settlement of their transactions and meeting other financial needs.

What is bank explain its function and importance?

A bank is a financial institution which performs the deposit and lending function. A bank allows a person with excess money (Saver) to deposit his money in the bank and earns an interest rate. … Thus, the banks act as an intermediary between the saver and the borrower.

What are examples of bank money?

Bank money consists of the book credit that banks extend to their depositors. Transactions made using checks drawn on deposits held at banks involve the use of bank money.

Is bank a money?

Currency in a bank is not counted as money; only currency held by individuals and businesses in any form is counted money. Credit cards are not money — they are IDs that allow an instant loan. Checks, e-checks, and debit cards are not money — they are instructions to a bank to transfer money from one person to another.

Which kind of money do banks create?

When banks make loans they create money. remember from chapter 12 that money (M1) is currency (coins and bills) AND checkable deposits. When I got a loan for my boat the bank called me up and said that they deposited the loan in my checking account. This new deposit is NEW MONEY created by the bank.

What are the 5 most important banking services?

Different types of business banking services include:

- Business loans.

- Checking accounts.

- Savings accounts.

- Debit and credit cards.

- Merchant services (credit card processing, reconciliation and reporting, check collection)

- Treasury services (payroll services, deposit services, etc.)

What are the basics of banking?

Banking Basics: What Kind Of Bank Accounts Exist In India

- Savings Account. These are deposit accounts meant to help consumers save their money. …

- Current Account. …

- Salary Account. …

- NRI Account. …

- Recurring Deposit (RD) Accounts. …

- Fixed Deposit (FD) Accounts.

How many types of bank accounts are there?

Traditionally, there are four types of bank deposits in India, which are — Current Account, Recurring Deposits, Savings Accounts, and Fixed Deposit Accounts.

What is it called when words sound the same but have different meanings?

The word homophone comes from the Greek word homos (=same) and phone (=voice). Homonyms can be words that sound the same but have different meanings.

bank 1

(băngk)

n.

1. A piled-up mass, as of snow or clouds; a heap: a bank of thunderclouds.

2. A steep natural incline.

3. An artificial embankment.

4. often banks

a. The slope of land adjoining a body of water, especially adjoining a river, lake, or channel.

b. A large elevated area of a sea floor.

5. Games The cushion of a billiard or pool table.

6. The lateral inward tilting, as of a motor vehicle or an aircraft, in turning or negotiating a curve.

v. banked, bank·ing, banks

v.tr.

1. To border or protect with a ridge or embankment.

2. To pile up; amass: banked earth along the wall.

3. To cover (a fire), as with ashes or fresh fuel, to ensure continued low burning.

4. To construct with a slope rising to the outside edge: The turns on the racetrack were steeply banked.

5.

a. To tilt (an aircraft) laterally and inwardly in flight.

b. To tilt (a motor vehicle) laterally and inwardly when negotiating a curve.

6. Games To strike (a billiard ball) so that it rebounds from the cushion of the table.

7. Sports To play (a ball or puck) in such a way as to make it glance off a surface, such as a backboard or wall.

v.intr.

1. To rise in or take the form of a bank.

2. To tilt an aircraft or a motor vehicle laterally when turning.

[Middle English, of Scandinavian origin.]

bank 2

(băngk)

n.

1.

a. A business establishment in which money is kept for saving or commercial purposes or is invested, supplied for loans, or exchanged.

b. The offices or building in which such an establishment is located.

2. Games

a. The funds of a gambling establishment.

b. The funds held by a dealer or banker in certain games, especially gambling games.

c. The reserve pieces, cards, chips, or play money in some games, such as poker, from which the players may draw.

3.

a. A supply or stock for future or emergency use: a grain bank.

b. Medicine A supply of human fluids or tissues, such as blood, sperm, or skin, that is stored in a facility for future use.

4. A place of safekeeping or storage: a computer’s memory bank.

v. banked, bank·ing, banks

v.tr.

1. To deposit in a bank.

2. To store for future use.

v.intr.

1. To transact business with a bank or maintain a bank account.

2. To operate a bank.

Phrasal Verb:

bank on

To have confidence in; rely on.

[Middle English banke, from French banque, from Old Italian banca, bench, moneychanger’s table, from Old High German banc.]

bank 3

(băngk)

n.

1. A set of similar or matched things arranged in a row, especially:

a. A set of elevators.

b. A row of keys on a keyboard.

2. Nautical

a. A bench for rowers in a galley.

b. A row of oars in a galley.

3. Printing The lines of type under a headline.

tr.v. banked, bank·ing, banks

To arrange or set up in a row: «Every street was banked with purple-blooming trees» (Doris Lessing).

[Middle English, bench, from Old French banc, from Late Latin bancus, of Germanic origin.]

American Heritage® Dictionary of the English Language, Fifth Edition. Copyright © 2016 by Houghton Mifflin Harcourt Publishing Company. Published by Houghton Mifflin Harcourt Publishing Company. All rights reserved.

bank

(bæŋk)

n

1. (Banking & Finance) an institution offering certain financial services, such as the safekeeping of money, conversion of domestic into and from foreign currencies, lending of money at interest, and acceptance of bills of exchange

2. (Banking & Finance) the building used by such an institution

3. a small container used at home for keeping money

4. (Gambling, except Cards) the funds held by a gaming house or a banker or dealer in some gambling games

5. (Card Games) (in various games)

a. the stock, as of money, pieces, tokens, etc, on which players may draw

b. the player holding this stock

6. any supply, store, or reserve, for future use: a data bank; a blood bank.

vb

7. (Banking & Finance) (tr) to deposit (cash, cheques, etc) in a bank

8. (Banking & Finance) (intr) to transact business with a bank

9. (Banking & Finance) (intr) to engage in the business of banking

10. (Gambling, except Cards) (intr) to hold the bank in some gambling games

[C15: probably from Italian banca bench, moneychanger’s table, of Germanic origin; compare Old High German banc bench]

bank

(bæŋk)

n

1. a long raised mass, esp of earth; mound; ridge

2. (Physical Geography) a slope, as of a hill

3. (Physical Geography) the sloping side of any hollow in the ground, esp when bordering a river: the left bank of a river is on a spectator’s left looking downstream.

4. (Physical Geography)

a. an elevated section, rising to near the surface, of the bed of a sea, lake, or river

b. (in combination): sandbank; mudbank.

5. (Mining & Quarrying)

a. the area around the mouth of the shaft of a mine

b. the face of a body of ore

6. (Aeronautics) the lateral inclination of an aircraft about its longitudinal axis during a turn

7. (Civil Engineering) Also called: banking, camber, cant or superelevation a bend on a road or on a railway, athletics, cycling, or other track having the outside built higher than the inside in order to reduce the effects of centrifugal force on vehicles, runners, etc, rounding it at speed and in some cases to facilitate drainage

8. (Billiards & Snooker) the cushion of a billiard table

vb

9. (when: tr, often foll by up) to form into a bank or mound

10. (Civil Engineering) (tr) to border or enclose (a road, etc) with a bank

11. (sometimes foll by: up) to cover (a fire) with ashes, fresh fuel, etc, so that it will burn slowly

12. (Aeronautics) to cause (an aircraft) to tip laterally about its longitudinal axis or (of an aircraft) to tip in this way, esp while turning

13. to travel round a bank, esp at high speed

14. (Billiards & Snooker) (tr) billiards to drive (a ball) into the cushion

[C12: of Scandinavian origin; compare Old Icelandic bakki hill, Old Danish banke, Swedish backe]

bank

(bæŋk)

n

1. an arrangement of objects, esp similar objects, in a row or in tiers: a bank of dials.

2. (Nautical Terms)

a. a tier of oars in a galley

b. a bench for the rowers in a galley

3. (Printing, Lithography & Bookbinding) a grade of lightweight writing and printing paper used for airmail letters, etc

4. (Telecommunications) telephony (in automatic switching) an assembly of fixed electrical contacts forming a rigid unit in a selector or similar device

vb

(tr) to arrange in a bank

[C17: from Old French banc bench, of Germanic origin; see bank1]

Collins English Dictionary – Complete and Unabridged, 12th Edition 2014 © HarperCollins Publishers 1991, 1994, 1998, 2000, 2003, 2006, 2007, 2009, 2011, 2014

bank1

(bæŋk)

n.

1. a long pile or heap; mass: a bank of earth; a bank of clouds.

2. a slope or acclivity.

3. the slope immediately bordering a stream course along which the water normally runs.

4. a broad elevation of the sea floor around which the water is relatively shallow but not a hazard to surface navigation.

5. Also called cant. the inclination of the bed of a banked road or track.

6. the lateral inclination of an aircraft, esp. during a turn.

7. the cushion of a billiard table.

v.t.

8. to border with or like a bank; embank: banking the flooded river with sandbags.

9. to form into a bank or heap: to bank snow along a path.

10. to build (a road or track) with an upward slope from the inner edge to the outer edge at a curve.

11. to tip or incline (an airplane) laterally.

12. (in billiards or pool)

a. to drive (a ball) to the cushion.

b. to pocket (the object ball) by driving it against the bank.

13. to cover (a fire) with ashes or fuel to make it burn long and slowly.

v.i.

14. to build up in or form banks, as clouds or snow.

15. (of an airplane) to tip or incline laterally.

16. (of a road or track) to slope upward from the inner edge to the outer edge at a curve.

[1150–1200; Middle English banke, Old English hōbanca couch, c. Old Norse bakki elevation, hill < Germanic *bank-ōn-; compare bank3, bench]

bank2

(bæŋk)

n.

1. an institution for receiving, lending, and safeguarding money and transacting other financial business.

2. the stock of pieces drawn upon by players in the course of a game, as dominoes.

3. the person or office in a gambling house that holds and distributes cash.

4. a storage place: blood bank; sperm bank.

5. a store or reserve.

v.i.

6. to keep money in or have an account with a bank.

v.t.

7. to deposit in a bank.

8. bank on, to count on; depend on.

[1425–75; late Middle English < Middle French banque < Italian banca table, counter, moneychanger’s table < Germanic; compare Old High German bank bench]

bank3

(bæŋk)

n.

1. an arrangement of objects in a line or in tiers: a bank of lights.

2. a bench for rowers in a galley.

3. the group of rowers occupying one bench or rowing one oar.

4. a number of similar devices connected to act together: a bank of transformers.

v.t.

5. to arrange in a bank.

[1200–50; Middle English bank(e) < Old French banc bench < Germanic; see bank1]

Random House Kernerman Webster’s College Dictionary, © 2010 K Dictionaries Ltd. Copyright 2005, 1997, 1991 by Random House, Inc. All rights reserved.

Bank

a mound, pile, or ridge; a group or series of objects; an amount or stock of money; a batch of paper money. See also balk, bar, heap, mass.

Examples: bank of ants; of books, 1577; of clouds, 1626; of electric lights; of fog, 1848; of hill ants, 1747; of judges [a full court in which the judges are “in bank”]; of mist, 1840; of money, 1878; of mussels, 1861; of oars, 1884; of organ keys, 1884; of oysters, 1861; of rememberances, 1576; of sand; of snow; of swans [on the ground].

Dictionary of Collective Nouns and Group Terms. Copyright 2008 The Gale Group, Inc. All rights reserved.

bank

– bench – seat

1. ‘bank’

The bank of a river or lake is the ground at its edge.

There are new developments along both banks of the Thames.

She left her shoes on the bank and dived into the lake.

A bank is also a place where you can keep your money in an account.

You should ask your bank for a loan.

2. ‘bench’ and ‘seat’

Don’t call a long, narrow seat in a park or garden a ‘bank’. You call it a bench or a seat.

Greg sat on the bench and waited.

She sat on a seat in the park and read her magazine.

Collins COBUILD English Usage © HarperCollins Publishers 1992, 2004, 2011, 2012

bank

Past participle: banked

Gerund: banking

| Imperative |

|---|

| bank |

| bank |

| Present |

|---|

| I bank |

| you bank |

| he/she/it banks |

| we bank |

| you bank |

| they bank |

| Preterite |

|---|

| I banked |

| you banked |

| he/she/it banked |

| we banked |

| you banked |

| they banked |

| Present Continuous |

|---|

| I am banking |

| you are banking |

| he/she/it is banking |

| we are banking |

| you are banking |

| they are banking |

| Present Perfect |

|---|

| I have banked |

| you have banked |

| he/she/it has banked |

| we have banked |

| you have banked |

| they have banked |

| Past Continuous |

|---|

| I was banking |

| you were banking |

| he/she/it was banking |

| we were banking |

| you were banking |

| they were banking |

| Past Perfect |

|---|

| I had banked |

| you had banked |

| he/she/it had banked |

| we had banked |

| you had banked |

| they had banked |

| Future |

|---|

| I will bank |

| you will bank |

| he/she/it will bank |

| we will bank |

| you will bank |

| they will bank |

| Future Perfect |

|---|

| I will have banked |

| you will have banked |

| he/she/it will have banked |

| we will have banked |

| you will have banked |

| they will have banked |

| Future Continuous |

|---|

| I will be banking |

| you will be banking |

| he/she/it will be banking |

| we will be banking |

| you will be banking |

| they will be banking |

| Present Perfect Continuous |

|---|

| I have been banking |

| you have been banking |

| he/she/it has been banking |

| we have been banking |

| you have been banking |

| they have been banking |

| Future Perfect Continuous |

|---|

| I will have been banking |

| you will have been banking |

| he/she/it will have been banking |

| we will have been banking |

| you will have been banking |

| they will have been banking |

| Past Perfect Continuous |

|---|

| I had been banking |

| you had been banking |

| he/she/it had been banking |

| we had been banking |

| you had been banking |

| they had been banking |

| Conditional |

|---|

| I would bank |

| you would bank |

| he/she/it would bank |

| we would bank |

| you would bank |

| they would bank |

| Past Conditional |

|---|

| I would have banked |

| you would have banked |

| he/she/it would have banked |

| we would have banked |

| you would have banked |

| they would have banked |

Collins English Verb Tables © HarperCollins Publishers 2011

ThesaurusAntonymsRelated WordsSynonymsLegend:

| Noun | 1. |  bank — sloping land (especially the slope beside a body of water); «they pulled the canoe up on the bank»; «he sat on the bank of the river and watched the currents» bank — sloping land (especially the slope beside a body of water); «they pulled the canoe up on the bank»; «he sat on the bank of the river and watched the currents»

riverbank, riverside — the bank of a river incline, slope, side — an elevated geological formation; «he climbed the steep slope»; «the house was built on the side of a mountain» waterside — land bordering a body of water |

| 2. |  bank — a financial institution that accepts deposits and channels the money into lending activities; «he cashed a check at the bank»; «that bank holds the mortgage on my home» bank — a financial institution that accepts deposits and channels the money into lending activities; «he cashed a check at the bank»; «that bank holds the mortgage on my home»

banking company, banking concern, depository financial institution financial institution, financial organisation, financial organization — an institution (public or private) that collects funds (from the public or other institutions) and invests them in financial assets banking industry, banking system — banks collectively credit union — a cooperative depository financial institution whose members can obtain loans from their combined savings Federal Reserve Bank, reserve bank — one of 12 regional banks that monitor and act as depositories for banks in their region agent bank — a bank that acts as an agent for a foreign bank commercial bank, full service bank — a financial institution that accepts demand deposits and makes loans and provides other services for the public state bank — a bank chartered by a state rather than by the federal government agent bank, lead bank — a bank named by a lending syndicate of several banks to protect their interests member bank — a bank that is a member of the Federal Reserve System merchant bank, acquirer — a credit card processing bank; merchants receive credit for credit card receipts less a processing fee acquirer — a corporation gaining financial control over another corporation or financial institution through a payment in cash or an exchange of stock thrift institution — a depository financial institution intended to encourage personal savings and home buying Home Loan Bank — one of 11 regional banks that monitor and make short-term credit advances to thrift institutions in their region |

|

| 3. | bank — a long ridge or pile; «a huge bank of earth»

bluff — a high steep bank (usually formed by river erosion) ridge — a long narrow natural elevation or striation sandbank — a submerged bank of sand near a shore or in a river; can be exposed at low tide |

|

| 4. |  bank — an arrangement of similar objects in a row or in tiers; «he operated a bank of switches» bank — an arrangement of similar objects in a row or in tiers; «he operated a bank of switches»

array — an orderly arrangement; «an array of troops in battle order» |

|

| 5. |  bank — a supply or stock held in reserve for future use (especially in emergencies) bank — a supply or stock held in reserve for future use (especially in emergencies)

stockpile, reserve, backlog — something kept back or saved for future use or a special purpose blood bank — a place for storing whole blood or blood plasma; «the Red Cross created a blood bank for emergencies» eye bank — a place for storing and preserving corneas that are obtained from human corpses immediately after death; used for corneal transplantation to patients with corneal defects food bank — a place where food is contributed and made available to those in need; «they set up a food bank for the flood victims» soil bank — land retired from crop cultivation and planted with soil-building crops; government subsidies are paid to farmers for their retired land |

|

| 6. |  bank — the funds held by a gambling house or the dealer in some gambling games; «he tried to break the bank at Monte Carlo» bank — the funds held by a gambling house or the dealer in some gambling games; «he tried to break the bank at Monte Carlo»

cash in hand, finances, funds, monetary resource, pecuniary resource — assets in the form of money |

|

| 7. |  bank — a slope in the turn of a road or track; the outside is higher than the inside in order to reduce the effects of centrifugal force bank — a slope in the turn of a road or track; the outside is higher than the inside in order to reduce the effects of centrifugal force

camber, cant incline, slope, side — an elevated geological formation; «he climbed the steep slope»; «the house was built on the side of a mountain» |

|

| 8. |  bank — a container (usually with a slot in the top) for keeping money at home; «the coin bank was empty» bank — a container (usually with a slot in the top) for keeping money at home; «the coin bank was empty»

coin bank, money box, savings bank container — any object that can be used to hold things (especially a large metal boxlike object of standardized dimensions that can be loaded from one form of transport to another) penny bank, piggy bank — a child’s coin bank (often shaped like a pig) |

|

| 9. |  bank — a building in which the business of banking transacted; «the bank is on the corner of Nassau and Witherspoon» bank — a building in which the business of banking transacted; «the bank is on the corner of Nassau and Witherspoon»

bank building depositary, depository, repository, deposit — a facility where things can be deposited for storage or safekeeping bank vault, vault — a strongroom or compartment (often made of steel) for safekeeping of valuables |

|

| 10. |  bank — a flight maneuver; aircraft tips laterally about its longitudinal axis (especially in turning); «the plane went into a steep bank» bank — a flight maneuver; aircraft tips laterally about its longitudinal axis (especially in turning); «the plane went into a steep bank»