Use Excel to perform valuation modeling

What is Valuation Modeling in Excel?

Valuation modeling in Excel may refer to several different types of analysis, including discounted cash flow (DCF) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. The various types of analyses may be built from scratch in Excel or may use an existing template/model. This type of work is commonly performed by a wide range of finance professionals.

Why perform valuation modeling in Excel?

There are many reasons to perform valuation modeling in Excel, and professionals across a wide range of industries spend a significant amount of time doing exactly this kind of work. The reasons include:

- Preparing to raise capital from investors (i.e., determining what price shares should be issued at)

- Selling a business and identifying what range of prices to accept

- Acquiring a company and knowing how much to pay for it

- For issuing shares to employees (an Employee Share Ownership Plan or ESOP)

- Internal budgeting and planning purposes

- Succession planning for the business

- Evaluate investment opportunities and capital projects

- Impairment testing (related to any significant reduction in asset values)

- Legal proceedings, including insolvency

How to perform valuation modeling in Excel?

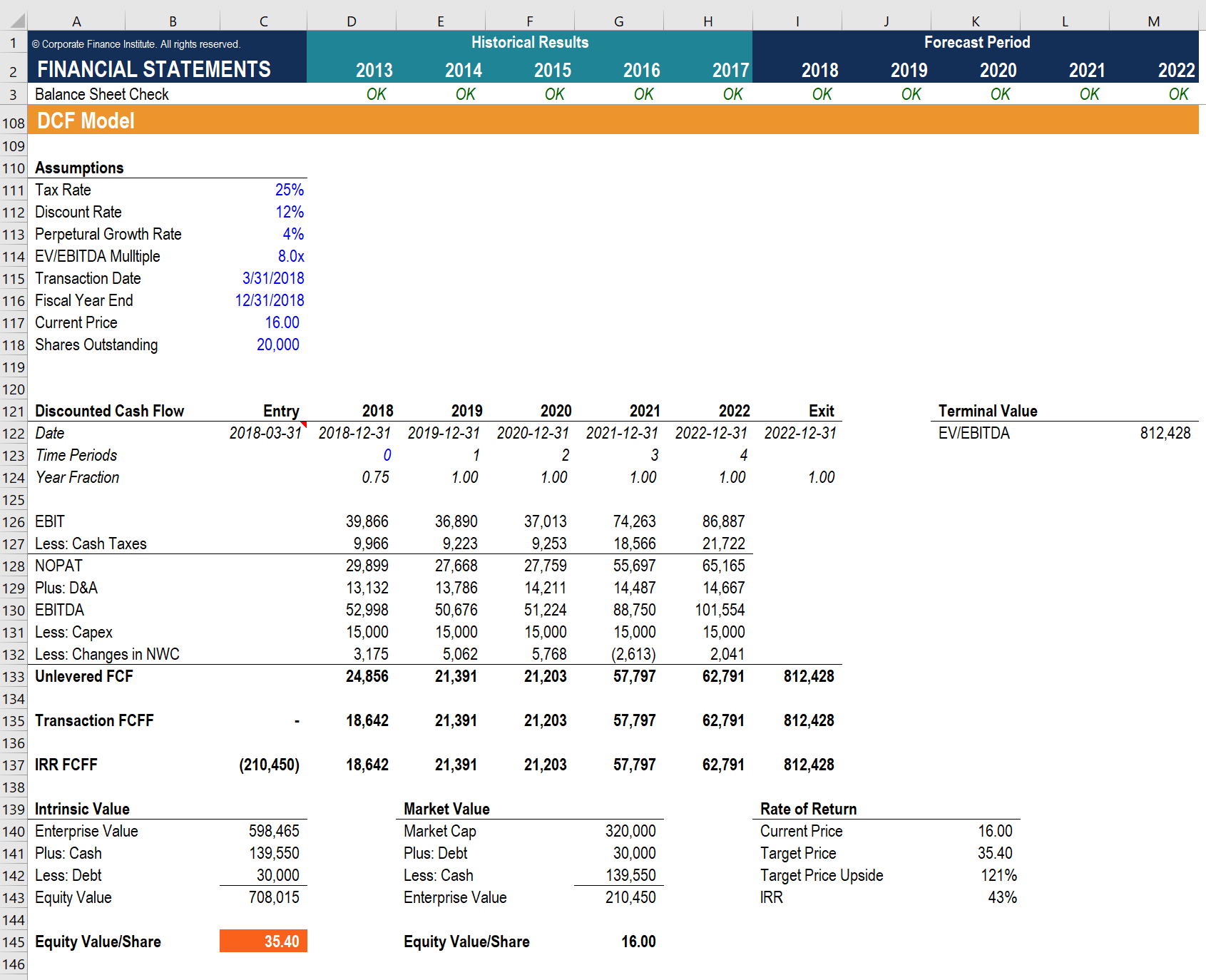

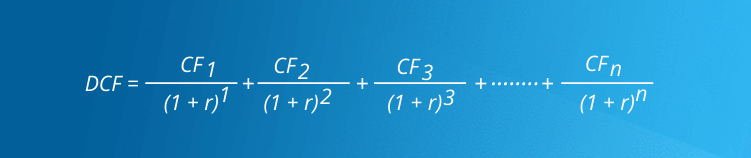

As noted above, there are three primary methods for valuing a company. Discounted cash flow, or DCF, analysis is the most detailed method, and often the most relied upon approach. Below is a description of how to perform each type of modeling.

#1 Discounted cash flow modeling in Excel

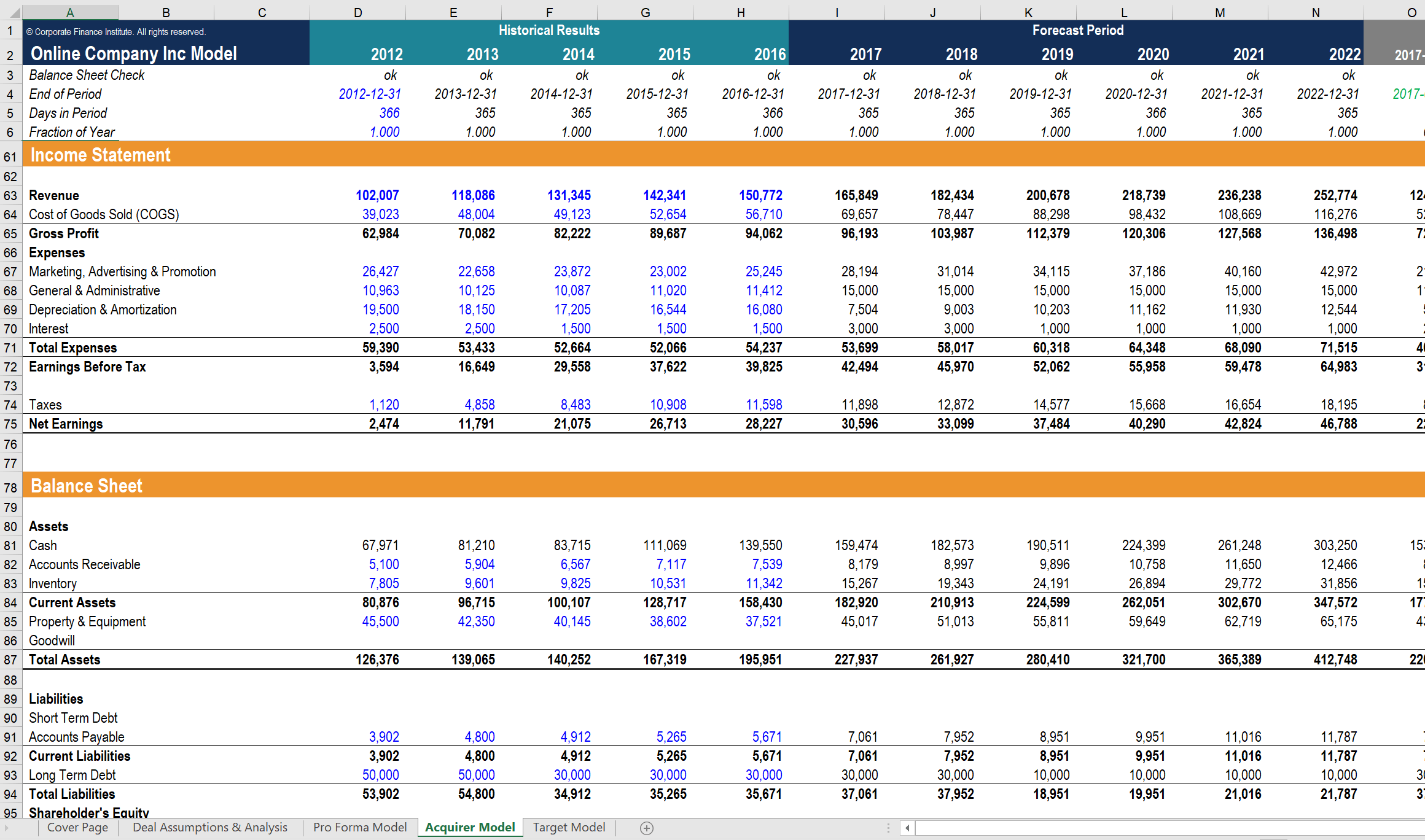

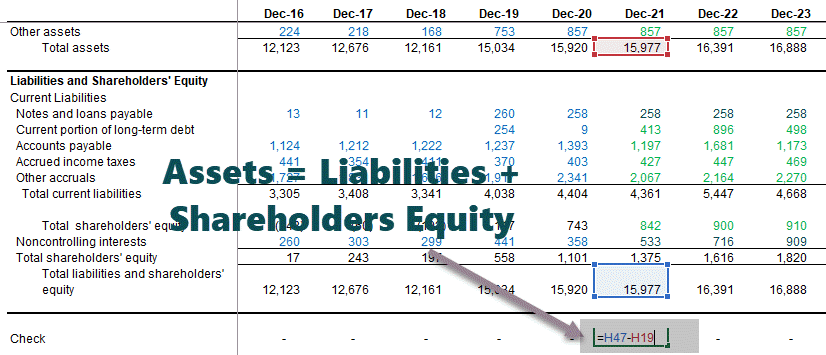

Using the DCF approach, a finance professional takes 3-5 years of historical financial information about a business and puts it into an Excel model. Next, they link the three financial statements together so that they are dynamically connected.

Following that, assumptions are made about how the business will perform in the future, and those assumptions are used in Excel formulas to create a forecast for the future (typically, about five years into the future). Finally, they calculate a terminal value for the business and discount the forecast period and the terminal value back to the present, using the company’s weighted average cost of capital(WACC).

For a more detailed explanation, read this step-by-step guide to DCF modeling.

#2 Comparable trading multiples in Excel

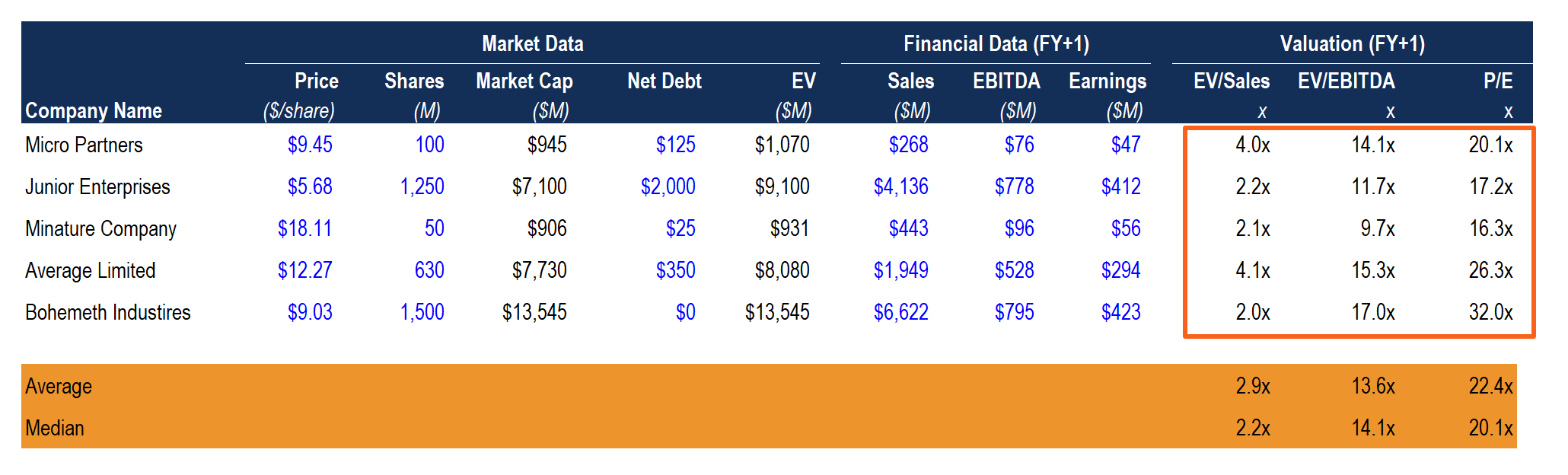

The comparable multiples valuation modeling approach in Excel is very different from that of a DCF model. With this method, instead of determining a company’s intrinsic value (as above), an analyst will look at the valuation multiples of other publicly traded companies and compare them to that of the business(es) they wish to value. Common examples of valuation multiples include EV/Revenue, EV/EBITDA, EV/EBIT, Price/Earnings, and Price/Book.

For a more detailed explanation, read this guide to comparable company analysis.

#3 Precedent transaction modeling in Excel

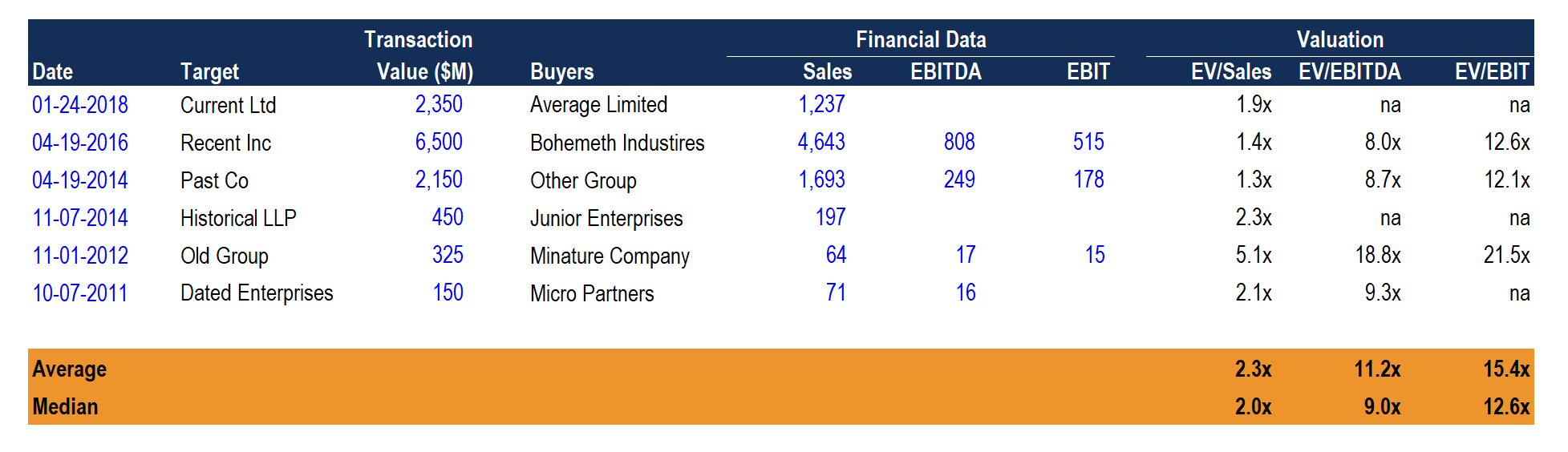

With this third approach to valuation modeling in Excel, an analyst will look at the prices paid for mergers and acquisitions (M&A) of similar businesses that took place in the past. This is also a relative form of valuation, but unlike comparable trading multiples, these transactions include takeover premiums (the value of control) and are based in the past (which can quickly become out of date).

For a more detailed explanation, read this guide to precedent transactions.

Skills for performing valuation modeling in Excel

To perform these types of analyses, financial professionals are required to have many different skills that can often take years of education and experience to master.

The most important skills include:

- Accounting (principles, methods, financial statements)

- Finance (financial math, formulas, ratios, calculations)

- Excel (MS Excel best practices, shortcuts, functions)

- Strategy (competitive advantage, market analysis)

- Valuation (a combination of all of the preceding skills)

CFI’s Financial Analyst Certification covers all of these in one intensive online program, while other designations may not cover all skill areas.

Jobs that perform valuation modeling in Excel

There are many jobs and career paths that require the skills of being able to value a company, a business unit, or an investment opportunity in Excel.

Some of the most common careers that require such skills include the following:

- Investment banking (analyst and associate level)

- Private equity & venture capital (analyst and associate level)

- Corporate development (analyst and manager level)

- Financial planning & analysis (analyst, manager, and director level)

- Public accounting (transaction advisory, impairment testing)

- Equity research (associate and analyst level)

Why use Excel for valuation modeling?

The flexibility of Excel is both a blessing and a curse. While larger organizations may attempt to use software to manage their financial modeling, the reality is they often end up reverting back to Excel.

The main reasons Excel is used include:

- Total flexibility and customization

- Extremely low cost to purchase

- Easy to share externally with other parties

- Ubiquitous and understood by all

- Simple to use and easy to audit (no “black box”)

On the flip side, however, the extreme flexibility of Excel means that models may be prone to errors, inaccurate calculations, and poor practices. Analysts and other finance professionals must ensure that they possess strong Excel modeling skills and a thorough understanding of industry-leading best practices.

Additional Resources

Thank you for reading CFI’s guide to Valuation Modeling in Excel. To help advance your career, see the following CFI resources:

- Valuation Methods

- Analysis of Financial Statements

- Data Sources in Financial Modeling

- Excel Modeling Best Practices

- See all financial modeling resources

- See all Excel resources

Содержание

- Valuation Model Excel Templates 1 comment

- What is valuation?

- Valuation Models

- Valuation models in excel

- Why valuation modeling?

- How to perform valuation modeling in Excel?

- Discounted cash flow (DCF) modeling in Excel

- Everything You Need To Master DCF Modeling

- Comparable trading multiples in Excel

- Precedent transaction modeling in Excel

- Skills for performing valuation modeling in Excel

- Jobs that require valuation modeling in Excel

- Why use Excel for valuation modeling?

What is valuation?

Valuation is the process of calculating the current worth of an asset or liability. Examples of assets are stocks, options, companies, or intangible assets. Concerning liabilities, they can be bonds issued by a company.

Common terms used when discussing the value of an asset or liability are market value, fair value, and intrinsic value.

Put simply, the value to be derived is the present value of all the future benefits (or cashflow) of the given asset or liability. This can calculated in various ways, with the use of financial and valuation tools, to determine the magnitude and risk of such future benefits. Take the example of an analyst determining the value of a company. He will consider the company’s management, the composition of its capital structure, the prospect of future earnings and market value of assets to come to terms with its value.

Valuation Models

There are a range of way to value assets and liabilities, some of which include:

Comparable Company (Comps) Analysis: Also-known-as ‘trading multiples’, ‘peer group analysis’, ‘equity comps’, or ‘public market multiples’, a Comparable Comps Analysis uses information from similar companies, in terms of size and industry, to reach a valuation on the value of a company. This method bases itself on the assumption that comparable organizations will have similar valuation values.

Precedent Transaction Analysis: This method of valuation analysis looks at the price that has been paid for companies similar in size and industry in the past to help value another company. Similar to the comparable comps analysis, due to the fact it is a relative model, the precedent transaction analysis may deliver an outdated valuation depending on when the merger or acquisition has taken place.

Discounted Cash Flow Analysis: A DCF analysis values the company based on the value of current cash flows in the future. This can be a complex method, requiring high levels of detail and intricacy. A DCF analysis is perhaps most accurate, and therefore useful, for companies with steady levels of income.

Other examples of valuation models include the Leverage Buyout Analysis and the Cost Approach (useful for real estate valuations).

It is common for a variety of valuation models used — the outcomes of each, such as the comparable comps, precedent, and DCF valuation models, to be mapped onto a ‘football field chart.’ This shows the variations regarding the different valuation outcomes, and then displays the average price.

All in all, Valuation in finance is key for many reasons. It is needed in investment analysis, capital budgeting and acquisitions transactions, financial reporting, or taxable events.

If you’d like some Valuation Excel Model Templates to facilitate your valuation, you will find the above valuation techniques and many more on the Eloquens catalogue. Also, if you have any questions or would like to discuss matters about a given tool, you can contact our authors whom will happily get back to you.

For more in depth information about Valuation, feel free to have a look through these links:

A more in-depth look at Valuation in general

Источник

Valuation models in excel

Why valuation modeling?

Modeling is a useful tool for finance professionals who are part of various transactions, including mergers and acquisitions (M&As), initial public offerings (IPOs), and venture capital. It is also useful for non-finance professionals like marketing analysts or product development teams to perform market research.

The model can be used independently or in tandem with other models such as sensitivity analysis and scenario analysis. The goal of the model is to estimate the future value of stocks and predict the share price at a certain point in time.

For example, an analyst could use it to figure out how much money they would need to invest in an IPO today to reach their target price when they sell their shares after the IPO.

Modeling in Excel is sometimes the only way to perform valuation analysis if another spreadsheet-based financial application is not accessible or is too expensive. It can also be a more convenient way to perform valuation analysis when spreadsheets are the only tool available for data collection.

It enables one to estimate future financial metrics and use them to calculate ratios, such as price/book value (PBV), price/sales ratio (PSR), price-earnings-growth (PEG), and dividend yield. In addition, it is possible to evaluate changes in the current market value of an asset or company versus its intrinsic value. It can also examine multiples of peers or other companies within the same company.

This article will now cover how to value companies using the three approaches – discounted cash flow (DCF) analysis, precedent comparables, and comparable trading multiples. These models can be built from scratch in Excel or using an existing model or template.

Read on for more!

How to perform valuation modeling in Excel?

Valuation modeling in Excel may be performed by using existing templates or by creating a model from scratch.

DCF analysis is a staple of financial modeling and can be performed with a basic template. It involves estimating future cash flows until the end of the forecast period and is an intrinsic value approach. It is a fundamental approach that provides many options to incorporate various assumptions. Conversely, analyzing trading multiples and precedent comparables are relative value approaches.

In this context, intrinsic value refers to the company’s fair value computed as the sum of its future cash flows and terminal value, discounted at the cost of capital. Other variables being constant, higher future cash flows will translate into a higher intrinsic value in today’s terms.

For example, a person valuing a house using the intrinsic value approach might say, «This house is worth $5 million because if one were to rent this house for many years, they would be paying x amount in annual rent, and the total cash outflow over the years can be discounted to a present value of $5 million.»

Contrary to intrinsic value, relative value derives an asset’s worth by comparing it with the value of similar assets. For example, if a person were valuing a house using the relative value approach, they would say, «A similar house in the neighborhood sold for $4.5 million, but its area was slightly smaller. This house under consideration is fairly similar, so adjusting for its slightly larger area, it must be worth $5 million.»

The video below, taken from our Valuation Modeling Course, walks you through differences in intrinsic and relative valuation methods.

On the other hand, market value is a result of demand and supply. The demand for a stock is reflected in its price. The higher the demand, the higher the price. Therefore, a stock trading at a higher price than its intrinsic value is considered overvalued, and vice versa. However, up and down movements in stock prices are daily occurrences causing stocks to be overvalued and undervalued daily.

Allow us to take you through the steps involved in each of the three approaches to valuing a company.

Discounted cash flow (DCF) modeling in Excel

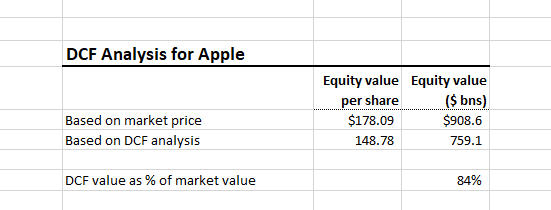

DCF analysis determines the intrinsic value by finding the value of all expected future free cash flows in present terms. It is an intrinsic form of valuation. Due to that, some experts consider it to be the best way to value a company, especially in periods where the market seems to be over or undervaluing assets.

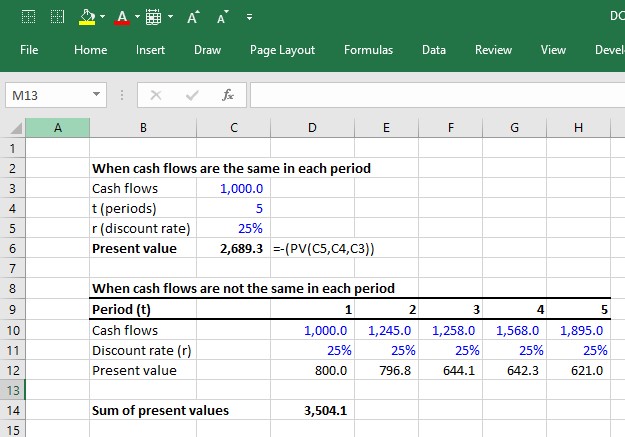

This method accounts for the time value of money. Experts find free cash flows (operating cash flow minus CapEx) to be one of the best proxies for financial performance. Investors use this to evaluate whether the value of the expected cash flows today is greater than their investment or whether the returns are greater than the opportunity cost.

The video below is taken from our DCF Modeling Course. It illustrates the purposes of using the DCF approach and when it is used most.

WSO’s finance experts have crafted a free template specifically for DCF analysis with which you can experiment as you go on reading the steps involved in DCF analysis.

- The UFCF estimate in the first forecasting period can come from the company’s financial statements or somesell-side analyst reports .

- Next, the growth rates can be predicted by creating individual estimates for each year or by applying bulk estimates that apply the same growth rate for different phases. For example, the same growth rate may be applied from years 2 to 6, another growth rate from years 7 to 11, and another to calculate terminal value .

- Then, the discount rate , cash and the liability balances, and the number of shares outstanding need to be input in the separate cells.

- Once this is done, analysts need to decide which rate to use while discounting the UFCF.

- The NPV function is used to calculate the net present value (NPV) of the estimated cash flows and the terminal value by discounting them at the cost of capital .

- The current value of debt and cash can be subtracted from the NPV to determine the intrinsic value of equity.

- The total intrinsic value can be divided by the shares outstanding to find the intrinsic value per share.

Everything You Need To Master DCF Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

Comparable trading multiples in Excel

Comparable analysis (also called trading multiples analysis, comps analysis, or comps) is a relative value approach to valuation in which analysts observe trading multiples of comparable companies and use those ratios to calculate the value of a company. Unlike DCF analysis, comps do not account for the time value of money. Calculating relative valuation through comps is routine for analysts working in investment banking, corporate development, equity research, and private equity.

This method is similar to the precedent transaction method in many ways. The key differences are listed in the next section, which is about the precedent transaction method.

Below is an introductory video on trading comps from our Valuation Course.

Below, we will walk you through the list of steps to build valuation models for trading comps.

- Find similar companies

- Collect information

- Build comps model

- Compute relevant multiples

- Value the company

- Interpret results

Feel free to download this free modeling template on Multiples Analysis which is made with the sole intention of helping you understand this concept better. The above steps to comps analysis are explained below.

This task may not be as easy as it sounds because defining comparable companies can be subjective. Although data mines such as Bloomberg Terminal and CapIQ can be expensive, they are great portals to find all your needed information. They can give you detailed information about publicly traded companies. Analysts can filter companies based on industry, geography, size, growth, etc.

Once we have determined the closest matches to the company we are trying to value, we must gather their historical financial data. Again, data mines like Bloomberg Terminal can help cut down a major chunk of the laborious work. Without access to these databases, the data can still be obtained and entered into the model as it is publicly available, but it can get tedious. Depending on the stage of the company in the business lifecycle, we look at different metrics. Profit-related metrics like EBITDA or net income are considered heavily for a mature company. On the other hand, turnover-based metrics like revenue or gross margin carry more weight in the case of early-stage companies.

We can begin working on the comps valuation model with all the requisite data now at hand. We can start by listing the relevant data about the comparable companies. The most used metrics include share price, market cap, revenue, EBITDA, enterprise value (EV), earnings per share (EPS), and some estimates or assumptions for the future.

The next step is to compute the relevant ratios using the data gathered so far and the future outlook. The most common ratios used in comps analysis are EV/EBITDA, EV/Gross Profit, EV/Revenue, price-to-earnings (P/E), and price-to-book (P/B).

The valuation process is summarized below.

- Compute ratios for each of the comparable companies.

- Take the average of each ratio — for example, the average of the P/E ratios of all the comparables.

- Adjust each of these averages based on future outlook.

- Use the adjusted averages to determine different valuations of the company in question.

- Use the average of the different valuations of the company to arrive at the final valuation.

- Present results:

The best way to communicate quantitative results is by using charts and graphs. The results should be graphed in an easily understandable manner to compare them with the results determined using other methods. A football field chart is one of the commonly used charts in comps analysis and precedent transaction analysis as it allows users to present ranges of valuations.

Comps analysis can ultimately tell us which companies are undervalued or overvalued based on different ratios. However, since the analysis ignores qualitative factors, results need to be interpreted with caution. Understanding why the company is overvalued or undervalued compared to other companies can usually mitigate the ambiguity. Companies may be overvalued or undervalued, or appear to be so, due to differences in growth prospects, Capex, capital structure, etc.

Precedent transaction modeling in Excel

In the precedent transaction approach to valuation, also known as transaction comps analysis, the company in question is compared to comparable companies in the industry which were recently sold or acquired. Since companies are often acquired at a premium, the valuation figures derived using the precedent transaction method also include a premium component. Due to that, it generally gives the highest valuation of a company, followed by comps analysis and then DCF analysis. This method is also a relative value approach to valuation like comps analysis. It also uses metrics and ratios of other companies to derive the value of the company being analyzed. Both the methods rely on comparable companies, which are not easy to pick. That said, the two methods have some key differences, as listed below.

- Data: Comps analysis uses data of publicly traded companies. The precedent transaction method uses transaction data of other recently acquired companies. The data for the latter is harder to gather in comparison with the former.

- Validity of results: Since M&A activity is infrequent, the valuations derived using transaction comps become stale over time. On the other hand, comps analysis can be done daily as the public market data is easily available.

- Acquisition premium: Companies are often acquired at a premium. The precedent transaction method uses companies that are recently acquired. Due to this, a premium component will inflate the valuations of the company being analyzed. Comps analysis does not suffer from this phenomenon.

Transaction comps are particularly useful for valuing companies for mergers and acquisitions (M&A) transactions. However, it is not as prominently used in the valuation business as the other two methods. The steps to value a company using transaction comps are listed below.

- Select relevant transactions

- Shortlist transactions

- Spreading comps

- Value the company

- Present results

These steps involved in precedent transaction analysis are explained below.

Selecting the relevant historical transactions from the universe of all M&A transactions is the first step. Analysts screen for M&A where the target company is comparable to the company being valued. Companies may be considered comparable based on the following criteria–

- Industry

- Company size

- Financial metrics (revenue, EBITDA, etc.)

- Offerings (products and services)

- Geography

- Customer base

Information providers and data aggregators such as CapIQ can make the entire valuation process more efficient, as most of the necessary data, if not all, can be found in a single depository.

No two companies are exactly the same, so it is next to impossible to find perfectly comparable companies. Regardless, we try to find the closest matches in this step of the process. The relevant transactions identified in the previous step can be narrowed down by carefully understanding what the target companies do and discarding those that are not close matches.

«Spreading the comps» is investment banker lingo for creating spreadsheet models to analyze comparable multiples like P/E, P/B, EV/EBITDA, EV/Sales, etc. As part of this step, averages and medians for each ratio are calculated for further use.

The averages and the medians of the multiples calculated in the previous step are applied to the corresponding value drivers of the company being valued. Different ratios should produce different values for the company, thus creating a range for its valuation.

The best way to communicate quantitative results is by using charts and graphs. The results should be graphed in an easily understandable manner to compare them with the results determined using other methods. A football field chart is one of the commonly used charts in comps analysis and precedent transaction analysis as it allows users to present ranges of valuations.

Since precedent transactions analysis ignores qualitative factors, results need to be interpreted with caution. Understanding why a company is overvalued or undervalued compared to other companies can usually mitigate the ambiguity. Reasons for overvaluation or undervaluation could be due to takeover premium or differences in growth prospects, CapEx, capital structure, etc. The video below, taken from WSO’s Valuation Course, gives an overview of breaking down the output from transaction comps analysis.

Skills for performing valuation modeling in Excel

Valuation modeling in Excel is a skill and a practice. Modeling involves a much more comprehensive process than most imagine. It requires the modeler to know more than just Excel. It’s not about formulas or numbers; it’s about understanding the valuation process and how to use the innumerable tools. These skills can sometimes take years of experience to master.

Some skills for performing modeling in Excel include:

- Understanding the benefits of DCF analysis, trading multiples, and precedent transactions

- Being able to build financial models from scratch (or by using existing templates/models)

- Being able to build a three-statement model

- Understanding the significance of ratios

- Being able to prepare data using pivot tables

- Attention to detail

- Forecasting skills

- Presentation skills

- Ability to make reasonable and realistic assumptions

- Ability to simplify complex information

To perform financial modeling in Excel, a finance professional will typically be skilled in Microsoft Excel, Microsoft Access, or both. They should also have the fundamental knowledge of accounting, finance, and strategy. They should also know about financial analysis software like Bloomberg and Reuters. Additionally, a finance professional must be familiar with finance principles and the various types of analysis that can be performed with these tools.

Apart from these skills, financial modelers should also be aware of the current best practices in the industry to build models that are easy to comprehend by all users, meet their objectives effectively, and are robust.

Jobs that require valuation modeling in Excel

Valuation modelers typically work in a variety of fields, including commercial banking, private equity, investment banking, and venture capital. They may also be employed by third-party consulting firms that require them to develop or otherwise use valuation models.

Venture capitalists will often require the valuation models used in their investments to be tailored for their specific businesses. They will then present these valuations in pitch meetings with new business opportunities for potential investments or as part of their due diligence process to evaluate investment opportunities.

Companies selling financial products such as stocks, bonds, and mutual funds may also rely on valuation models created by valuation modelers to determine the value of their assets. These assets are typically valued based on their earnings before interest and taxes (EBIT), market capitalization, and other factors.

Financial modeling in Excel can be used in a variety of different scenarios. Some of the most common jobs that may require this skill are:

Why use Excel for valuation modeling?

Excel is a versatile tool for data analysis, the best perhaps, and valuation modeling is just one of the many ways it can be used. Because it’s so easy to create a spreadsheet in Excel and the software has wide-ranging capabilities, it’s often the best option for this type of work.

An innumerable amount of data is processed on Excel spreadsheets every day. All this data helps decision-makers make informed decisions. Investors are a subset of all decision-makers that use it to analyze data to optimize investment portfolios and evaluate investment opportunities.

Excel allows users to easily manipulate large amounts of data, create models through formulas, and perform advanced statistical calculations. It also enables users to navigate through humongous amounts of data easily. In addition, users can use formatting to differentiate between different data and make numbers look more presentable. Finally, it allows users to present the data visually through charts and graphs.

It offers users an extremely wide range of built-in formulae and functions, which play a huge part in financial modeling and data analysis. Even though most users will not end up using many of its functions, it is comforting to know that they are available at the click of a few buttons.

Besides the wide range of functionality that Excel offers, it also has a large user base. The user base acts as a community that shares resources on Excel. The large community can be an especially helpful source of learning resources. In addition, with such a large user base, any bugs in the software are found and fixed faster, or workarounds are shared rapidly.

Источник

Valuation modeling refers to the forecasting and analysis using several different financial models. It includes discounted cash flow (DCF) analysis, precedent comparables, and comparable trading multiples. These financial models may be developed from the ground up in Excel or developed using existing templates.

Primarily, there are three methods used by practitioners when valuing a company: (1) DCF analysis, (2) comparable company analysis, and (3) precedent transactions. They are commonly used in equity research, investment banking, private equity, mergers & acquisitions (M&A), corporate development, leveraged buyouts (LBO), and many other areas.

Typically, this type of modeling is used to determine the value of an investment, be it an asset or a company’s stock price. For instance, based on its current share price, users can evaluate the value of a company or determine whether it is overvalued or undervalued.

Before we dive deep into the topic, we want you to know that we truly believe that a more hands-on approach always helps gain a much better understanding of a topic. Therefore, we would like you to pick out one of the modeling templates that our finance experts have created for you to explore while reading this page.

Modeling is a useful tool for finance professionals who are part of various transactions, including mergers and acquisitions (M&As), initial public offerings (IPOs), and venture capital. It is also useful for non-finance professionals like marketing analysts or product development teams to perform market research.

The model can be used independently or in tandem with other models such as sensitivity analysis and scenario analysis. The goal of the model is to estimate the future value of stocks and predict the share price at a certain point in time.

For example, an analyst could use it to figure out how much money they would need to invest in an IPO today to reach their target price when they sell their shares after the IPO.

Modeling in Excel is sometimes the only way to perform valuation analysis if another spreadsheet-based financial application is not accessible or is too expensive. It can also be a more convenient way to perform valuation analysis when spreadsheets are the only tool available for data collection.

It enables one to estimate future financial metrics and use them to calculate ratios, such as price/book value (PBV), price/sales ratio (PSR), price-earnings-growth (PEG), and dividend yield. In addition, it is possible to evaluate changes in the current market value of an asset or company versus its intrinsic value. It can also examine multiples of peers or other companies within the same company.

This article will now cover how to value companies using the three approaches – discounted cash flow (DCF) analysis, precedent comparables, and comparable trading multiples. These models can be built from scratch in Excel or using an existing model or template.

Read on for more!

How to perform valuation modeling in Excel?

Valuation modeling in Excel may be performed by using existing templates or by creating a model from scratch.

DCF analysis is a staple of financial modeling and can be performed with a basic template. It involves estimating future cash flows until the end of the forecast period and is an intrinsic value approach. It is a fundamental approach that provides many options to incorporate various assumptions. Conversely, analyzing trading multiples and precedent comparables are relative value approaches.

In this context, intrinsic value refers to the company’s fair value computed as the sum of its future cash flows and terminal value, discounted at the cost of capital. Other variables being constant, higher future cash flows will translate into a higher intrinsic value in today’s terms.

For example, a person valuing a house using the intrinsic value approach might say, «This house is worth $5 million because if one were to rent this house for many years, they would be paying x amount in annual rent, and the total cash outflow over the years can be discounted to a present value of $5 million.»

Contrary to intrinsic value, relative value derives an asset’s worth by comparing it with the value of similar assets. For example, if a person were valuing a house using the relative value approach, they would say, «A similar house in the neighborhood sold for $4.5 million, but its area was slightly smaller. This house under consideration is fairly similar, so adjusting for its slightly larger area, it must be worth $5 million.»

The video below, taken from our Valuation Modeling Course, walks you through differences in intrinsic and relative valuation methods.

On the other hand, market value is a result of demand and supply. The demand for a stock is reflected in its price. The higher the demand, the higher the price. Therefore, a stock trading at a higher price than its intrinsic value is considered overvalued, and vice versa. However, up and down movements in stock prices are daily occurrences causing stocks to be overvalued and undervalued daily.

Allow us to take you through the steps involved in each of the three approaches to valuing a company.

Discounted cash flow (DCF) modeling in Excel

DCF analysis determines the intrinsic value by finding the value of all expected future free cash flows in present terms. It is an intrinsic form of valuation. Due to that, some experts consider it to be the best way to value a company, especially in periods where the market seems to be over or undervaluing assets.

This method accounts for the time value of money. Experts find free cash flows (operating cash flow minus CapEx) to be one of the best proxies for financial performance. Investors use this to evaluate whether the value of the expected cash flows today is greater than their investment or whether the returns are greater than the opportunity cost.

The video below is taken from our DCF Modeling Course. It illustrates the purposes of using the DCF approach and when it is used most.

Comparable trading multiples in Excel

Comparable analysis (also called trading multiples analysis, comps analysis, or comps) is a relative value approach to valuation in which analysts observe trading multiples of comparable companies and use those ratios to calculate the value of a company. Unlike DCF analysis, comps do not account for the time value of money. Calculating relative valuation through comps is routine for analysts working in investment banking, corporate development, equity research, and private equity.

This method is similar to the precedent transaction method in many ways. The key differences are listed in the next section, which is about the precedent transaction method.

Below is an introductory video on trading comps from our Valuation Course.

Below, we will walk you through the list of steps to build valuation models for trading comps.

- Find similar companies

- Collect information

- Build comps model

- Compute relevant multiples

- Value the company

- Interpret results

Feel free to download this free modeling template on Multiples Analysis which is made with the sole intention of helping you understand this concept better. The above steps to comps analysis are explained below.

- Find similar companies:

This task may not be as easy as it sounds because defining comparable companies can be subjective. Although data mines such as Bloomberg Terminal and CapIQ can be expensive, they are great portals to find all your needed information. They can give you detailed information about publicly traded companies. Analysts can filter companies based on industry, geography, size, growth, etc.

- Collect information:

Once we have determined the closest matches to the company we are trying to value, we must gather their historical financial data. Again, data mines like Bloomberg Terminal can help cut down a major chunk of the laborious work. Without access to these databases, the data can still be obtained and entered into the model as it is publicly available, but it can get tedious. Depending on the stage of the company in the business lifecycle, we look at different metrics. Profit-related metrics like EBITDA or net income are considered heavily for a mature company. On the other hand, turnover-based metrics like revenue or gross margin carry more weight in the case of early-stage companies.

- Build comps model:

We can begin working on the comps valuation model with all the requisite data now at hand. We can start by listing the relevant data about the comparable companies. The most used metrics include share price, market cap, revenue, EBITDA, enterprise value (EV), earnings per share (EPS), and some estimates or assumptions for the future.

- Compute relevant multiples:

The next step is to compute the relevant ratios using the data gathered so far and the future outlook. The most common ratios used in comps analysis are EV/EBITDA, EV/Gross Profit, EV/Revenue, price-to-earnings (P/E), and price-to-book (P/B).

- Value the company:

The valuation process is summarized below.

- Compute ratios for each of the comparable companies.

- Take the average of each ratio — for example, the average of the P/E ratios of all the comparables.

- Adjust each of these averages based on future outlook.

- Use the adjusted averages to determine different valuations of the company in question.

- Use the average of the different valuations of the company to arrive at the final valuation.

- Present results:

The best way to communicate quantitative results is by using charts and graphs. The results should be graphed in an easily understandable manner to compare them with the results determined using other methods. A football field chart is one of the commonly used charts in comps analysis and precedent transaction analysis as it allows users to present ranges of valuations.

- Interpret results:

Comps analysis can ultimately tell us which companies are undervalued or overvalued based on different ratios. However, since the analysis ignores qualitative factors, results need to be interpreted with caution. Understanding why the company is overvalued or undervalued compared to other companies can usually mitigate the ambiguity. Companies may be overvalued or undervalued, or appear to be so, due to differences in growth prospects, Capex, capital structure, etc.

Precedent transaction modeling in Excel

In the precedent transaction approach to valuation, also known as transaction comps analysis, the company in question is compared to comparable companies in the industry which were recently sold or acquired. Since companies are often acquired at a premium, the valuation figures derived using the precedent transaction method also include a premium component. Due to that, it generally gives the highest valuation of a company, followed by comps analysis and then DCF analysis. This method is also a relative value approach to valuation like comps analysis. It also uses metrics and ratios of other companies to derive the value of the company being analyzed. Both the methods rely on comparable companies, which are not easy to pick. That said, the two methods have some key differences, as listed below.

- Data: Comps analysis uses data of publicly traded companies. The precedent transaction method uses transaction data of other recently acquired companies. The data for the latter is harder to gather in comparison with the former.

- Validity of results: Since M&A activity is infrequent, the valuations derived using transaction comps become stale over time. On the other hand, comps analysis can be done daily as the public market data is easily available.

- Acquisition premium: Companies are often acquired at a premium. The precedent transaction method uses companies that are recently acquired. Due to this, a premium component will inflate the valuations of the company being analyzed. Comps analysis does not suffer from this phenomenon.

Transaction comps are particularly useful for valuing companies for mergers and acquisitions (M&A) transactions. However, it is not as prominently used in the valuation business as the other two methods. The steps to value a company using transaction comps are listed below.

- Select relevant transactions

- Shortlist transactions

- Spreading comps

- Value the company

- Present results

These steps involved in precedent transaction analysis are explained below.

- Select relevant transactions:

Selecting the relevant historical transactions from the universe of all M&A transactions is the first step. Analysts screen for M&A where the target company is comparable to the company being valued. Companies may be considered comparable based on the following criteria–

- Industry

- Company size

- Financial metrics (revenue, EBITDA, etc.)

- Offerings (products and services)

- Geography

- Customer base

Information providers and data aggregators such as CapIQ can make the entire valuation process more efficient, as most of the necessary data, if not all, can be found in a single depository.

- Shortlist transactions:

No two companies are exactly the same, so it is next to impossible to find perfectly comparable companies. Regardless, we try to find the closest matches in this step of the process. The relevant transactions identified in the previous step can be narrowed down by carefully understanding what the target companies do and discarding those that are not close matches.

- Spreading comps:

«Spreading the comps» is investment banker lingo for creating spreadsheet models to analyze comparable multiples like P/E, P/B, EV/EBITDA, EV/Sales, etc. As part of this step, averages and medians for each ratio are calculated for further use.

- Value the company:

The averages and the medians of the multiples calculated in the previous step are applied to the corresponding value drivers of the company being valued. Different ratios should produce different values for the company, thus creating a range for its valuation.

- Present results:

The best way to communicate quantitative results is by using charts and graphs. The results should be graphed in an easily understandable manner to compare them with the results determined using other methods. A football field chart is one of the commonly used charts in comps analysis and precedent transaction analysis as it allows users to present ranges of valuations.

- Interpret results:

Since precedent transactions analysis ignores qualitative factors, results need to be interpreted with caution. Understanding why a company is overvalued or undervalued compared to other companies can usually mitigate the ambiguity. Reasons for overvaluation or undervaluation could be due to takeover premium or differences in growth prospects, CapEx, capital structure, etc. The video below, taken from WSO’s Valuation Course, gives an overview of breaking down the output from transaction comps analysis.

Skills for performing valuation modeling in Excel

Valuation modeling in Excel is a skill and a practice. Modeling involves a much more comprehensive process than most imagine. It requires the modeler to know more than just Excel. It’s not about formulas or numbers; it’s about understanding the valuation process and how to use the innumerable tools. These skills can sometimes take years of experience to master.

Some skills for performing modeling in Excel include:

- Understanding the benefits of DCF analysis, trading multiples, and precedent transactions

- Being able to build financial models from scratch (or by using existing templates/models)

- Being able to build a three-statement model

- Understanding the significance of ratios

- Being able to prepare data using pivot tables

- Attention to detail

- Forecasting skills

- Presentation skills

- Ability to make reasonable and realistic assumptions

- Ability to simplify complex information

To perform financial modeling in Excel, a finance professional will typically be skilled in Microsoft Excel, Microsoft Access, or both. They should also have the fundamental knowledge of accounting, finance, and strategy. They should also know about financial analysis software like Bloomberg and Reuters. Additionally, a finance professional must be familiar with finance principles and the various types of analysis that can be performed with these tools.

Apart from these skills, financial modelers should also be aware of the current best practices in the industry to build models that are easy to comprehend by all users, meet their objectives effectively, and are robust.

Jobs that require valuation modeling in Excel

Valuation modelers typically work in a variety of fields, including commercial banking, private equity, investment banking, and venture capital. They may also be employed by third-party consulting firms that require them to develop or otherwise use valuation models.

Venture capitalists will often require the valuation models used in their investments to be tailored for their specific businesses. They will then present these valuations in pitch meetings with new business opportunities for potential investments or as part of their due diligence process to evaluate investment opportunities.

Companies selling financial products such as stocks, bonds, and mutual funds may also rely on valuation models created by valuation modelers to determine the value of their assets. These assets are typically valued based on their earnings before interest and taxes (EBIT), market capitalization, and other factors.

Financial modeling in Excel can be used in a variety of different scenarios. Some of the most common jobs that may require this skill are:

- Financial planning and analysis (analysts, managers, and directors)

- CFOs

- Investment bankers (analysts and associates)

- Venture capitalists (analysts and associates)

- Stockbrokers

- Equity researchers (analysts and associates)

- Corporate finance professionals

- Accountants

- Private equity professionals

- Insurance agents

- Business consultants

- Public accounting (impairment testing, transaction advisory)

Why use Excel for valuation modeling?

Excel is a versatile tool for data analysis, the best perhaps, and valuation modeling is just one of the many ways it can be used. Because it’s so easy to create a spreadsheet in Excel and the software has wide-ranging capabilities, it’s often the best option for this type of work.

An innumerable amount of data is processed on Excel spreadsheets every day. All this data helps decision-makers make informed decisions. Investors are a subset of all decision-makers that use it to analyze data to optimize investment portfolios and evaluate investment opportunities.

Excel allows users to easily manipulate large amounts of data, create models through formulas, and perform advanced statistical calculations. It also enables users to navigate through humongous amounts of data easily. In addition, users can use formatting to differentiate between different data and make numbers look more presentable. Finally, it allows users to present the data visually through charts and graphs.

It offers users an extremely wide range of built-in formulae and functions, which play a huge part in financial modeling and data analysis. Even though most users will not end up using many of its functions, it is comforting to know that they are available at the click of a few buttons.

Besides the wide range of functionality that Excel offers, it also has a large user base. The user base acts as a community that shares resources on Excel. The large community can be an especially helpful source of learning resources. In addition, with such a large user base, any bugs in the software are found and fixed faster, or workarounds are shared rapidly.

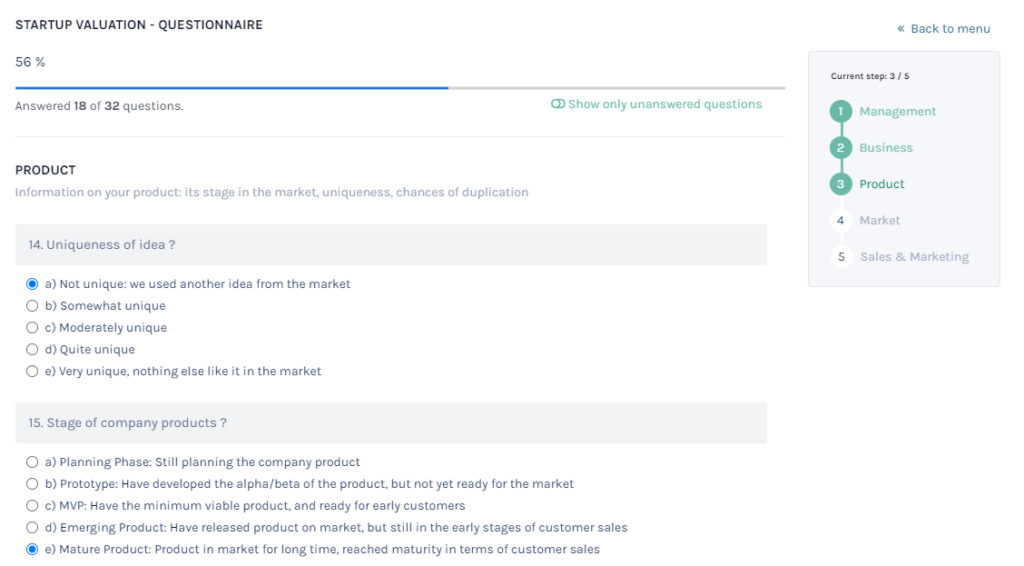

Business valuation is the basis of any future sale or acquisition of a company. Investors and analysts use various startup valuation models to estimate a company’s worth, which can vary drastically based on the figures and assumptions involved.

Valuation models in excel are some of the commonly used formats, and give the company founders and investors a general idea of how much the company is worth. Let’s take a brief look at some of them startup valuation models out there.

Startup Valuation Methods

Startup valuations can be tricky, especially in their pre-revenue stages. Startup valuation models used at this stage have to rely on assumptions. Despite this limitation, the importance of valuation can’t be overlooked. Every startup requires funds to grow and expand their business and a reliable valuation is the only way of estimating the business worth. It is only based on this calculation that investors evaluate funding proposals. In this section, we discuss some of the common valuation methods used for startups.

Market Capitalization

This is one of the simplest startup valuation models. Market capitalization determines the total dollar market value of a company’s outstanding shares. It is a far more dependable measure in comparison to the total asset or revenue figures. Investors use the market cap as a quick measure of the company size and a reliable indicator of possible risks.

Market cap = Price per share x Total number of outstanding shares

Companies are categorized based on their market cap. Here is a suggested range:

- $10 billion or more – Large cap

- $2 billion – $10 billion – Mid cap

- $300 million – $2 billion – Small cap

Let’s take an example of two companies A & B worth $2 billion each. Company A has 20 million shares in the market selling at $100 while Company B has 200,000 shares selling at $10,000 each. From an investor’s point of view Company A is much more stable and functional in the industry.

Market cap is established only after a company goes public through an IPO. Before this stage, a startup must engage a professional valuation firm to get a realistic value of the business using various startup valuation models. Based on this information, the startup determines how many shares to issue and at what value. A $10 million company may want to issue 1 million shares at $10 per share or 2 million shares at $5 per share.

Once a startup goes public, their share prices are determined by market forces. The supply and demand of its products and services impact the price of shares. A higher demand increases share price while a falling demand crashes stock prices. Once a company starts trading in the stock market, the market cap becomes a real-time estimate of the company’s value.

Times Revenue Method

This startup valuation method is used to understand the range of a company’s revenue potential. The idea is to determine the ‘max-value’ or ‘ceiling’ for a particular business. To calculate this, the actual revenue data over a period is considered (for eg. one fiscal year). A ‘multiplier’ is applied to this value. Thus a company valuation using Times Revenue Method can be 1x, 2x, 3x, or less than 1. Multiplier value depends on the industry and its economic growth. A hot industry such as AI may have 3x revenue while a service industry may qualify for 0.5x.

It is important to keep in mind that this startup valuation model may not be completely reliable as it uses a company’s overall revenue for calculations. Revenue is not the same as profits. High revenue does not necessarily mean high profits. But this method provides a starting point for investors to fairly estimate the company’s future growth potential.

Earnings Multiplier

This startup valuation model is used as a comparative study with similar companies. Investors use this method to check if the target company’s stock price is more expensive than it should be relative to its contemporaries in the market. Historical stock price data is also taken into consideration.

In this method, the target company’s current stock price is measured against its earnings per share (EPS). For eg, if a company’s current stock price is $100 and earnings per share are $10, the earnings multiplier will be $100/$10 = 10 years. Put simply, this is expressed as: This Company is trading at 10 times its earnings.

As we see, earnings multiplier methods do not provide an exact valuation. They rather give relative information about companies trading in the stock exchange. Investors use these metrics to invest in the most economical stocks that promise future profit potential.

Discounted Cash Flow (DCF) Method

This startup valuation model is used to estimate the present value of an investment based on the company’s future cash flows. This is one of the more commonly used valuation models used.

This again is a comparative metric and not an absolute one as a lot of its findings are based on assumptions. Analysts apply discount rates to neutralize any risks related to the business and its industry of operation.

Where:

- CF – Cash flow for a given year. Yr1, yr2, yr3…and so on.

- r – Discount rate

If the DCF value is higher than the present investment, it indicates a positive outcome and potential good cash flow in the future years. However be sure to go through the details on how the discount rate was arrived at and what factors of the company were considered.

Book Value

Otherwise known as the ‘net book value’, this startup valuation model simply indicates the carrying value of company assets on its balance sheet. While this method is not the most accurate valuation method for your company, it is quick and easy to calculate and give you a ballpark estimate of the value of your company. It is calculated as follows:

Book value per share = Total common stockholders equity – preferred stock / no. of common shares

Book value serves two purposes:

- It reflects the worth of company assets that shareholders are entitled to in case of company liquidation

- This value when compared to the company’s market value indicates if their stocks are legitimately priced.

Be sure though to identify which assets may be subject to fair market adjustments (fixed assets, intangible assets, etc), and what other assets or liabilities are already at FV (cash and cash equivalents, accounts receivable and accounts payable, etc).

Liquidation Value

This startup valuation model is similar to the book value model but considers only the tangible assets like equipment, inventory, real estate, etc. Intangible assets are not considered in this calculation. Hence in value, liquidation value is always less than the book value but higher than the salvage value.

In the event of liquidation, most assets are sold at a loss. Hence investors use the liquidation value to asset a potential investment so that they have a fair estimation of how much they can expect in returns in case the company falls out of business.

Startup Valuation Model in Excel (DCF Method)

We have created a very simple startup valuation model in excel using the discounted cash flow method, one of the more common methods for company valuations.

As the startup may not have many company assets in the beginning, and being too early to have enough financial figures for comparing to other companies in the market, this income based approach may be the easiest way to determine your startup valuation.

We included a template for a 5 year and 3 year weighted moving average, as some companies may not be able to determine their growth rate just yet. Also we believe a weighted average may be more applicable than a simple average, especially with early stage companies with fluctuating income levels.

Get your 100% reliable startup valuation in minutes with Eqvista!

It’s now easier and more convenient to get a valuation for your startup with Eqvista’s startup valuation software. We incorporate trusted valuation methodologies into the software to calculate the most accurate valuation for your startup. Also, the 30 multiple-choice questions covers 5 areas of your business: team/management, business, product, market, as well as sales and marketing. A summarized report will be made available for you in 20 minutes.

Why should you choose Eqvista for your startup valuation?

There are many startup valuation models and none of them are used standalone. It is best left to the professional evaluators to choose the right mix of these methods to arrive at a justifiable value for the company.

Our team of valuation experts at Eqvista can help you in the valuation of your startup and get an audit ready 409a valuation report. Our online captable also helps you easily manage your company shareholders, equity transactions, valuation reports, and more.

What is valuation?

Valuation is the process of calculating the current worth of an asset or liability. Examples of assets are stocks, options, companies, or intangible assets. Concerning liabilities, they can be bonds issued by a company.

Common terms used when discussing the value of an asset or liability are market value, fair value, and intrinsic value.

Put simply, the value to be derived is the present value of all the future benefits (or cashflow) of the given asset or liability. This can calculated in various ways, with the use of financial and valuation tools, to determine the magnitude and risk of such future benefits. Take the example of an analyst determining the value of a company. He will consider the company’s management, the composition of its capital structure, the prospect of future earnings and market value of assets to come to terms with its value.

Valuation Models

There are a range of way to value assets and liabilities, some of which include:

-

Comparable Company (Comps) Analysis: Also-known-as ‘trading multiples’, ‘peer group analysis’, ‘equity comps’, or ‘public market multiples’, a Comparable Comps Analysis uses information from similar companies, in terms of size and industry, to reach a valuation on the value of a company. This method bases itself on the assumption that comparable organizations will have similar valuation values.

-

Precedent Transaction Analysis: This method of valuation analysis looks at the price that has been paid for companies similar in size and industry in the past to help value another company. Similar to the comparable comps analysis, due to the fact it is a relative model, the precedent transaction analysis may deliver an outdated valuation depending on when the merger or acquisition has taken place.

-

Discounted Cash Flow Analysis: A DCF analysis values the company based on the value of current cash flows in the future. This can be a complex method, requiring high levels of detail and intricacy. A DCF analysis is perhaps most accurate, and therefore useful, for companies with steady levels of income.

Other examples of valuation models include the Leverage Buyout Analysis and the Cost Approach (useful for real estate valuations).

It is common for a variety of valuation models used — the outcomes of each, such as the comparable comps, precedent, and DCF valuation models, to be mapped onto a ‘football field chart.’ This shows the variations regarding the different valuation outcomes, and then displays the average price.

All in all, Valuation in finance is key for many reasons. It is needed in investment analysis, capital budgeting and acquisitions transactions, financial reporting, or taxable events.

If you’d like some Valuation Excel Model Templates to facilitate your valuation, you will find the above valuation techniques and many more on the Eloquens catalogue. Also, if you have any questions or would like to discuss matters about a given tool, you can contact our authors whom will happily get back to you.

For more in depth information about Valuation, feel free to have a look through these links:

-

More on Valuation

-

More on Asset valuation

-

A more in-depth look at Valuation in general

Financial modeling in Excel refers to tools used for preparing the expected financial statements predicting the company’s financial performance in a future period using the assumptions and historical performance information. One may use such financial models in DCF valuations, mergers and acquisitions, private equity, project finance, etc.

Financial modeling in Excel is all around the web. There has been a lot written about learning financial modeling. However, most of the financial modeling pieces of training are the same. It goes beyond the usual gibberish and explores practical financial modeling used by Investment BankersInvestment banking is a specialized banking stream that facilitates the business entities, government and other organizations in generating capital through debts and equity, reorganization, mergers and acquisition, etc.read more and Research Analysts.

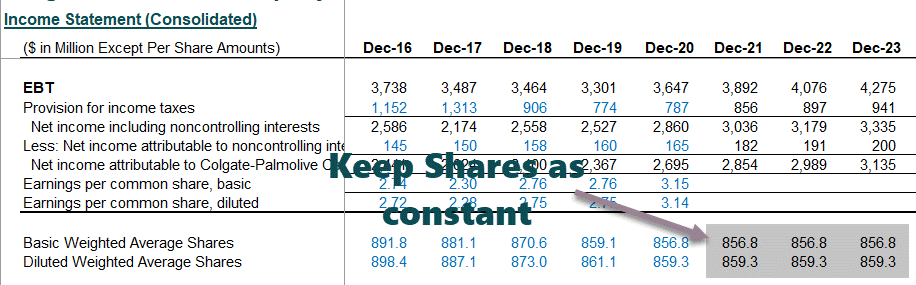

In this free financial modeling Excel guide, we will take the example of Colgate Palmolive (2016 – 2020) and prepare a fully integrated financial model from scratch.

This guide is over 5,000 words and took me three weeks to complete. Therefore, save this page for future reference, and do not forget to share it.

Financial Modeling in Excel Training – Read me First

Step 1 – Download the Colgate Financial Model Template.

You can download this Colgate Financial Modeling Templates (Solved/Unsolved) here – Colgate Financial Modeling Templates (Solved/Unsolved)

Step 2 – Please note you will get two templates – 1) Unsolved Colgate Palmolive Financial Model and 2) Solved Colgate Palmolive Financial Model.

Step 3- You will work on the Unsolved Colgate Palmolive Financial Model Template. Follow the step-by-step instructions to prepare a fully integrated financial model.

Step 4 – Happy Learning!

If you are new to financial modeling, look at this guide on What is Financial Modeling?Financial modeling refers to the use of excel-based models to reflect a company’s projected financial performance. Such models represent the financial situation by taking into account risks and future assumptions, which are critical for making significant decisions in the future, such as raising capital or valuing a business, and interpreting their impact.read more

How to Build a Financial Model in Excel?

Let us look at how one can build a financial model from scratch. This detailed financial modeling guide will provide a step-by-step guide to creating a financial model. The primary approach taken in this financial modeling guide is Modular. The modular system essentially means building core statements like income statements, balance sheets, and cash flows using different modules/sheets. The key focus is to prepare each statement step by step and connect all the supporting programs to the core statements on completion. We understand that this may not be clear now. However, you will realize this is very easy as we move forward.

- Step 1 – Colgate’s Financial Model – Historical

- Step 2 – Ratio Analysis of Colgate Palmolive

- Step 3 – Projecting the Income Statement

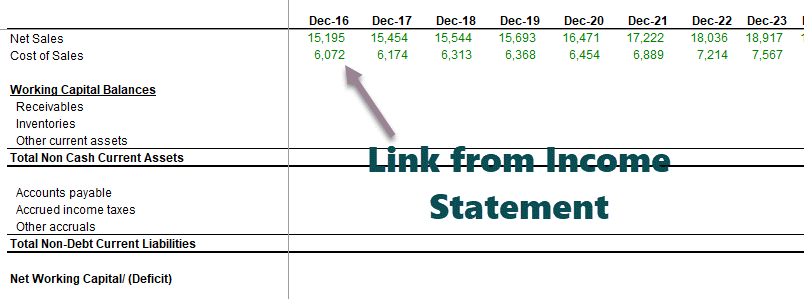

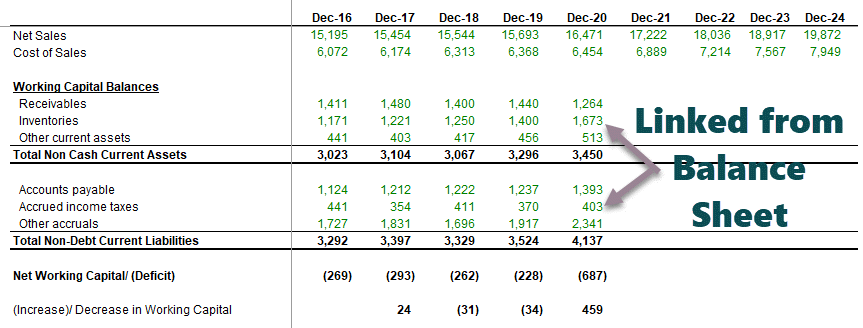

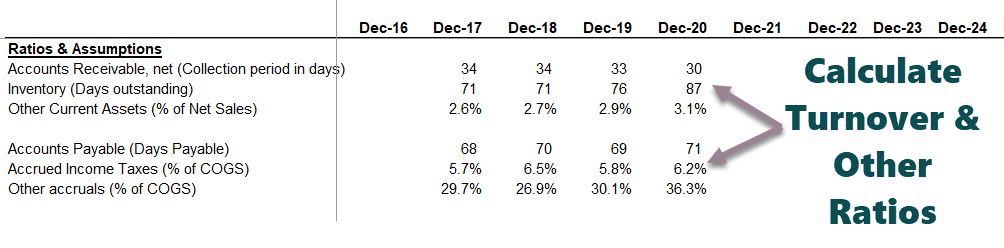

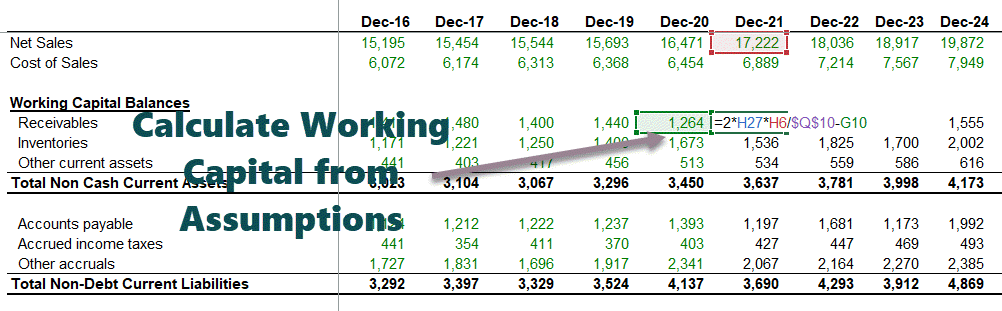

- Step 4- Working Capital Forecast

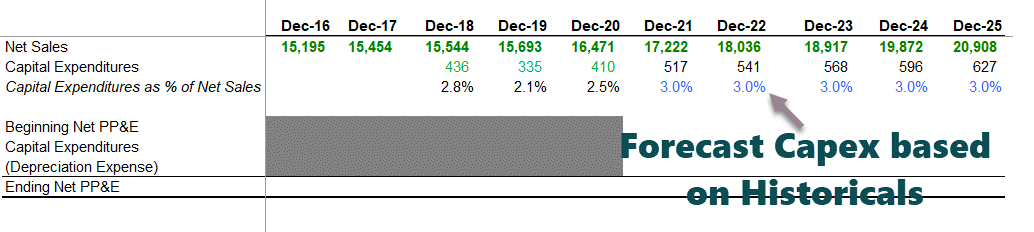

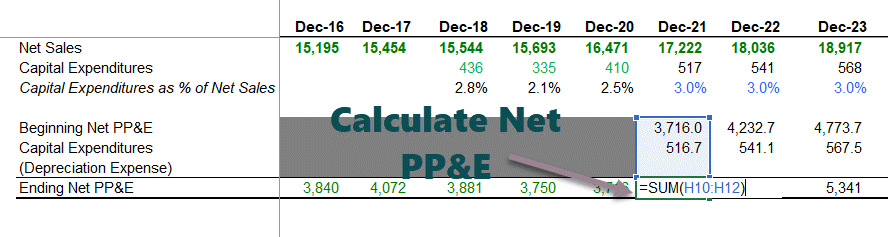

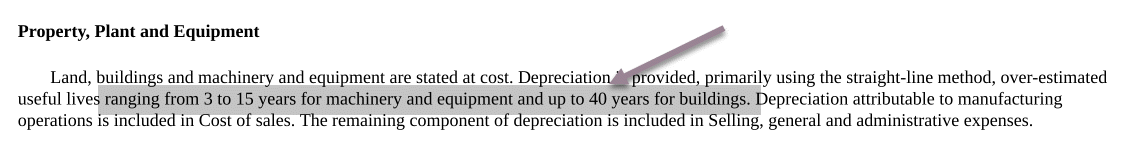

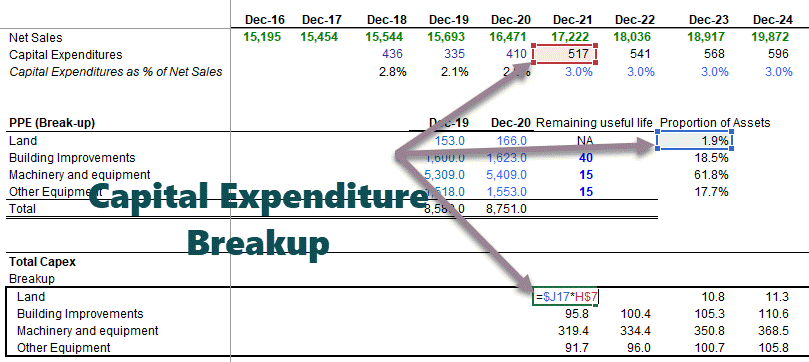

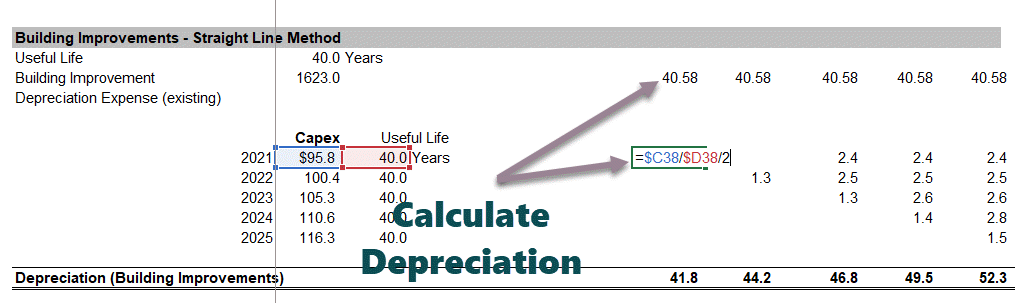

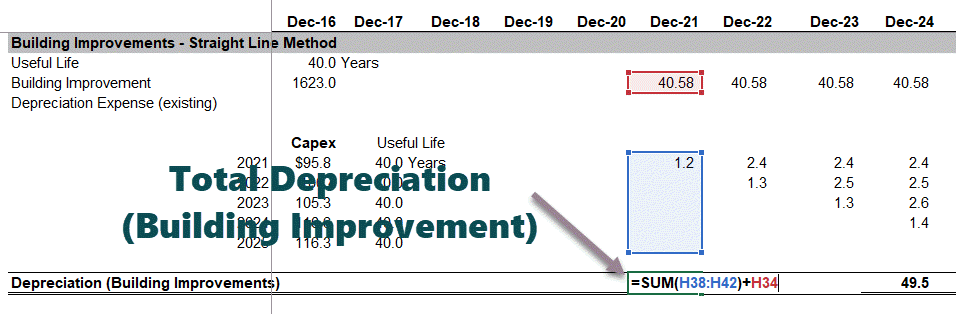

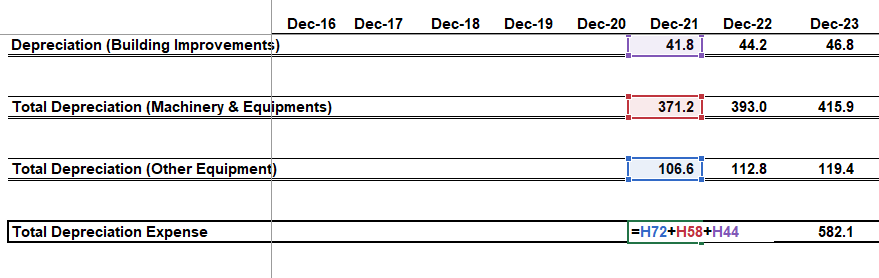

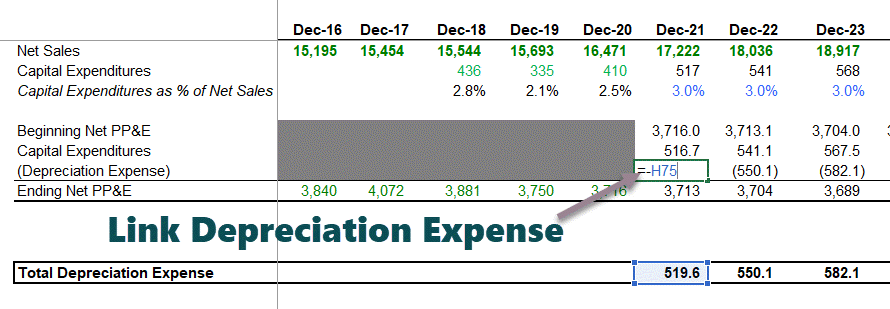

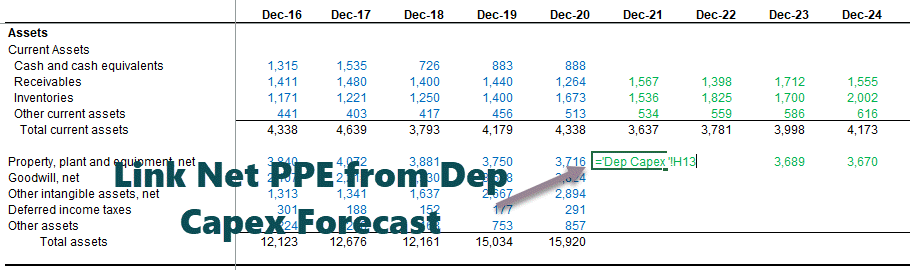

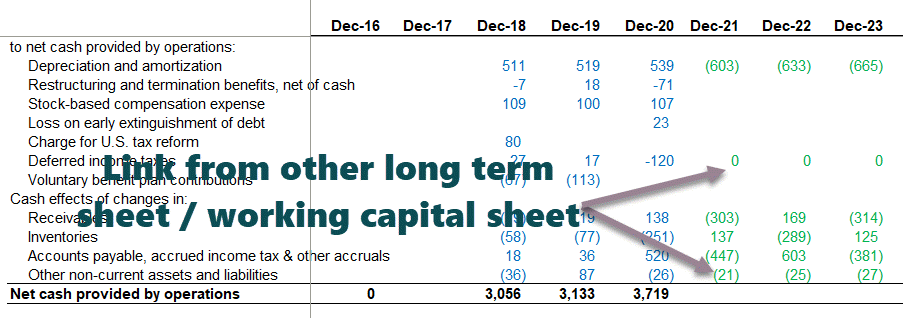

- Step 5 – Depreciation Forecast

- Step 6 – Amortization Forecast

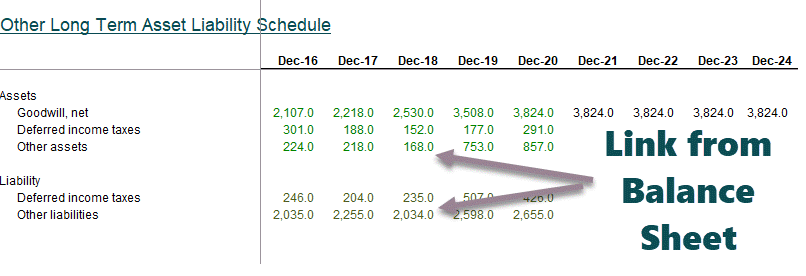

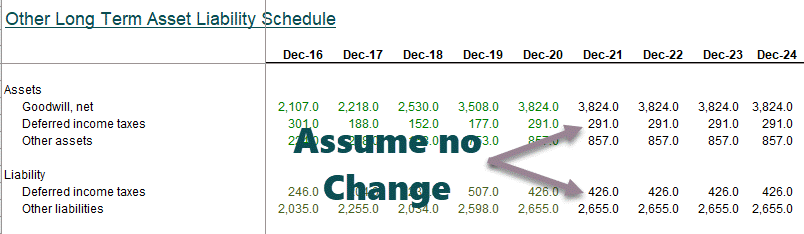

- Step 7 – Other Long Term Forecast

- Step 8 – Completing the Income Statement

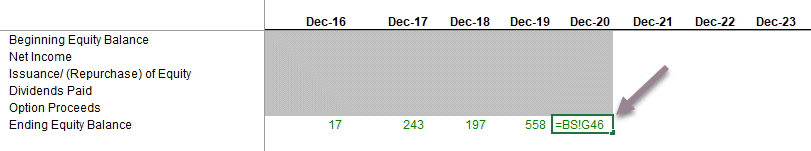

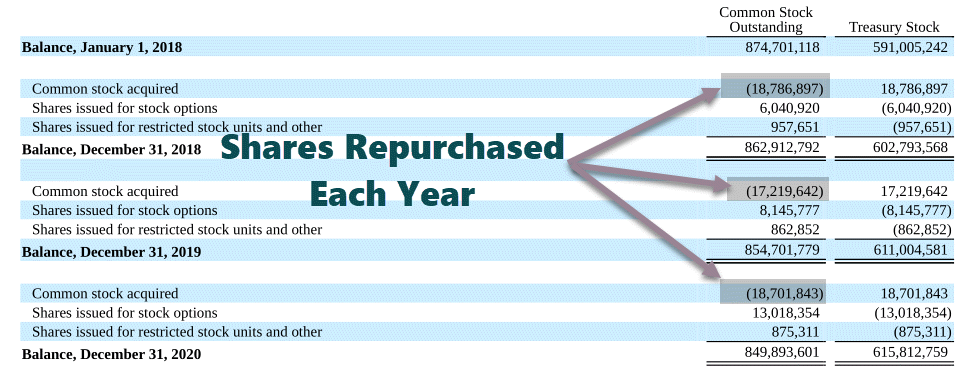

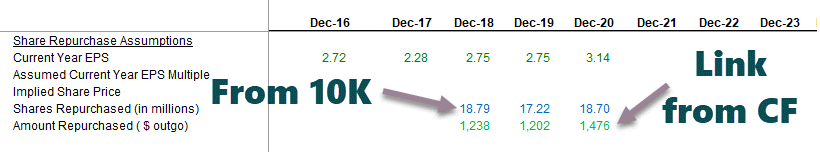

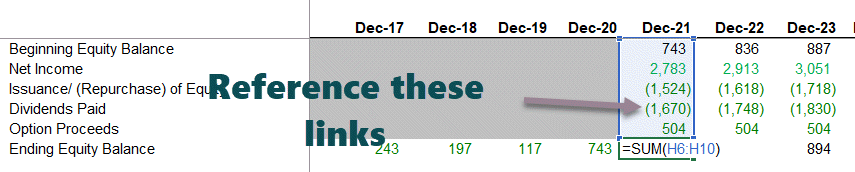

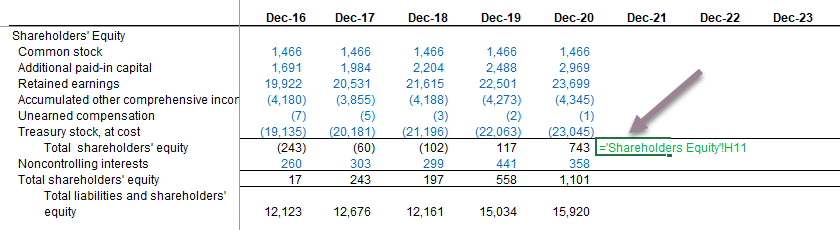

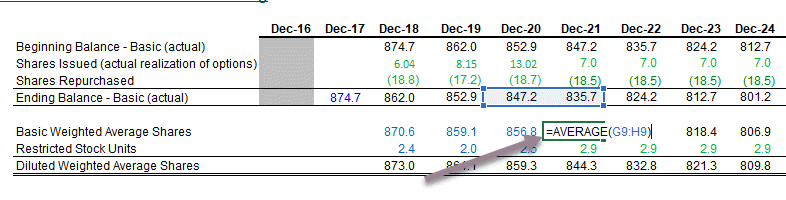

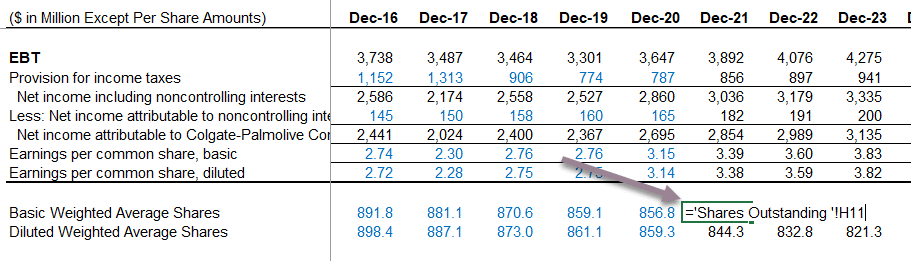

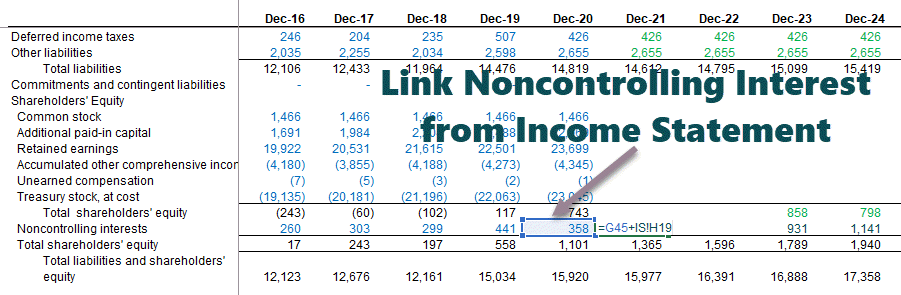

- Step 9 – Shareholder’s Equity Forecast

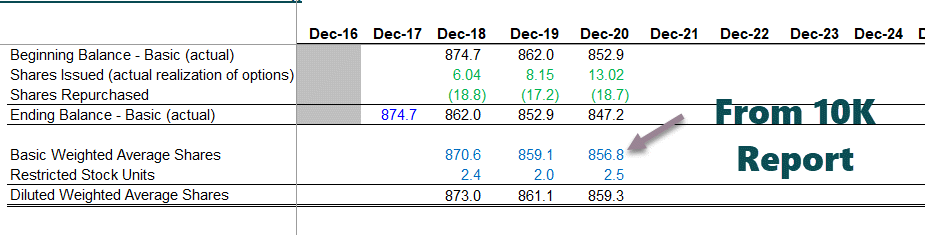

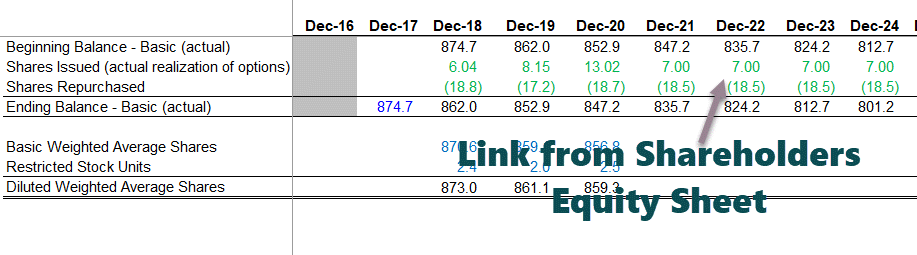

- Step 10 – Shares Outstanding Forecast

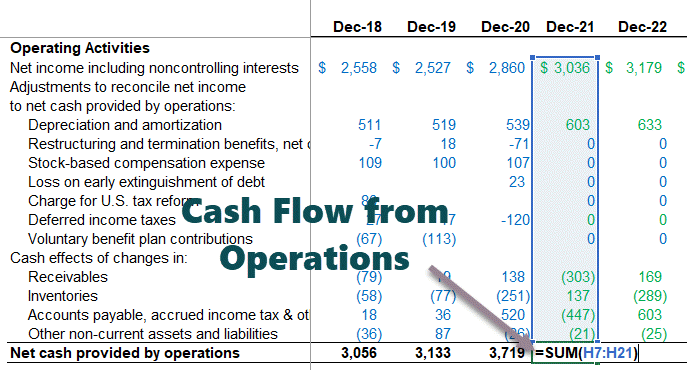

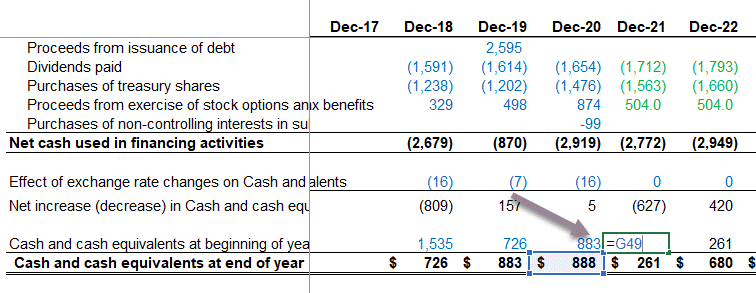

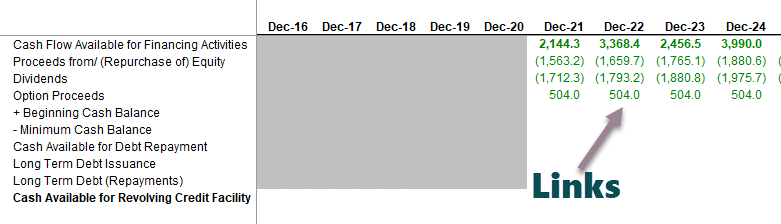

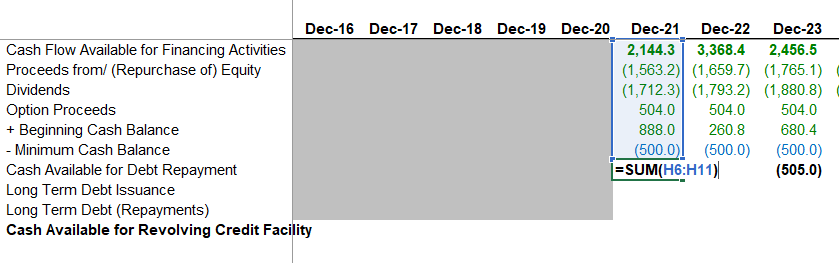

- Step 11 – Completing the Cash Flow Statements

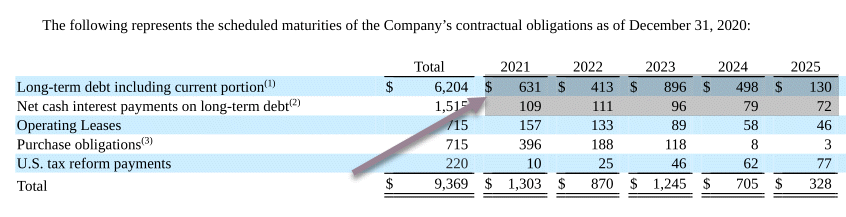

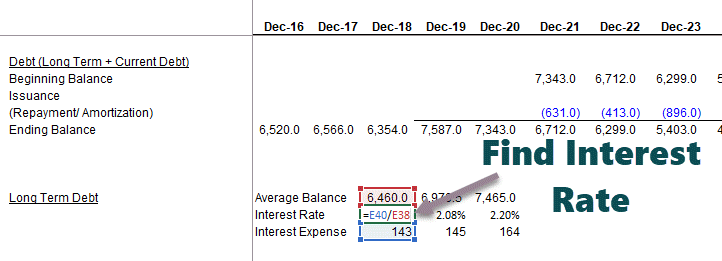

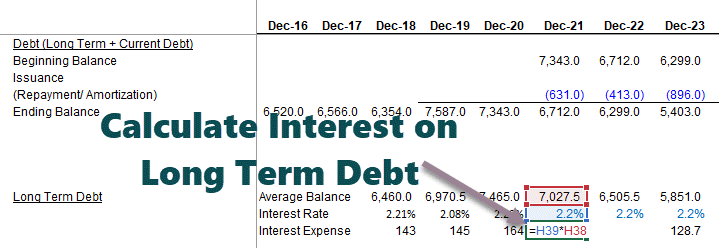

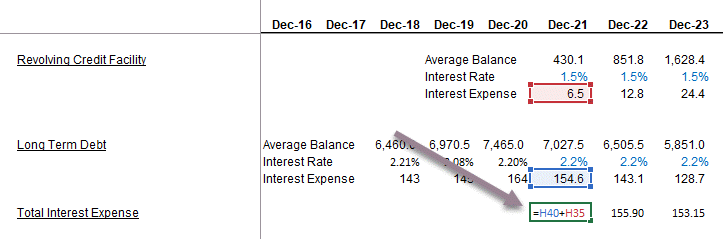

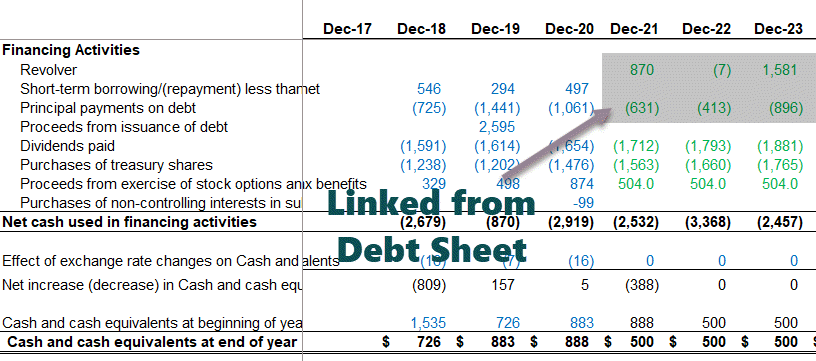

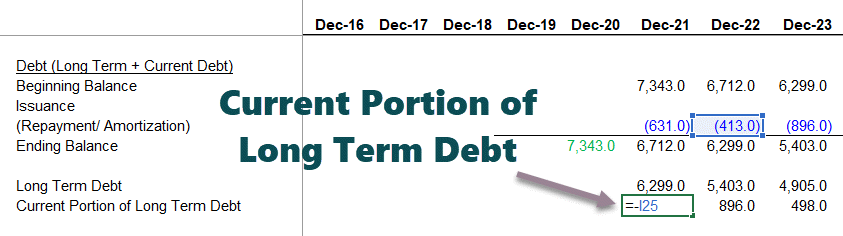

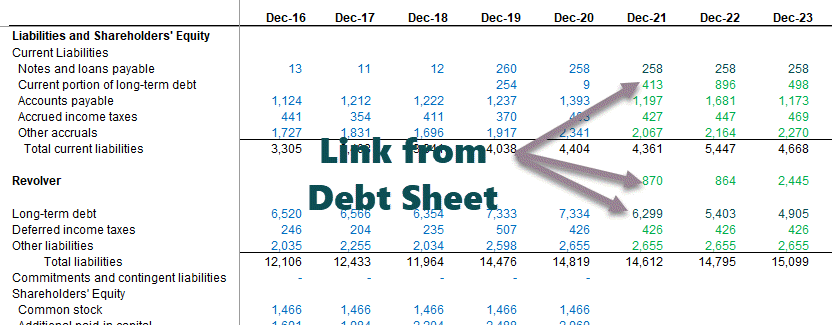

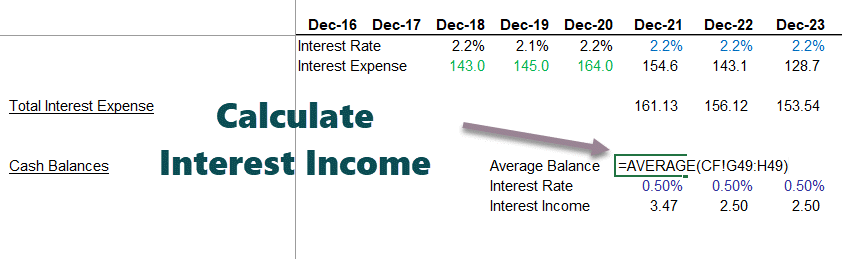

- Step 12- Debt and Interest Forecast

Please note the following –

- The core statements are the Income StatementThe income statement is one of the company’s financial reports that summarizes all of the company’s revenues and expenses over time in order to determine the company’s profit or loss and measure its business activity over time based on user requirements.read more, Balance SheetA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company.read more, and Cash Flows.

- The different sheets are the depreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset’s worth has been utilized. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year.

read more forecast, working capital forecast, intangibles forecast, shareholder’s equityShareholder’s equity is the residual interest of the shareholders in the company and is calculated as the difference between Assets and Liabilities. The Shareholders’ Equity Statement on the balance sheet details the change in the value of shareholder’s equity from the beginning to the end of an accounting period.read more forecast, other long term items forecast, debt forecast scheduleA debt schedule is the list of debts that the business owes, including term loans, debentures, cash credit, etc. Business organizations prepare this schedule to know the exact amount of the company’s liability to others and manage its cash flows to prevent the financial crisis and enable better debt management.read more, etc. - The different schedules are linked to the core statements upon their completion.

- This financial modeling guide will build a step-by-step integrated economic model of Colgate Palmolive from scratch.

Step 1 – Financial Modeling in Excel – Project the Historicals

The first step in the financial modeling guide is to prepare the historicals.

Download Colgate’s 10K Reports

One prepares financial models in Excel. The first steps start with knowing how the industry has been doing recently. Understanding the past can provide valuable insights into the company’s future. Therefore the first step is to download all the company’s financials and populate the same in an Excel sheet. For Colgate Palmolive, you can download the annual reports of Colgate Palmolive from their Investor Relation Section.

Create the Historical Financial Statements Worksheet

- If you download 10K of 2020, you will note that only two years of financial statement data is available. However, for financial modeling in Excel, the recommended dataset is to have the last 5 years of financial statements. Therefore, please download the last 3 years of the annual reportAn annual report is a document that a corporation publishes for its internal and external stakeholders to describe the company’s performance, financial information, and disclosures related to its operations. Over time, these reports have become legal and regulatory requirements.read more and populate the historical.

- Often, these tasks seem too tedious as it may take a lot of time and energy to format and put the excel in the desired format.

- However, one should not forget that this is the work you are required to do only once for each company. Populating the historicals also helps an analyst understand the trends and financial statementsFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period (quarter, six monthly or yearly). These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels.read more.

- So, please do not skip this. Instead, download and populate the data (even if you feel this is the donkey’s work).

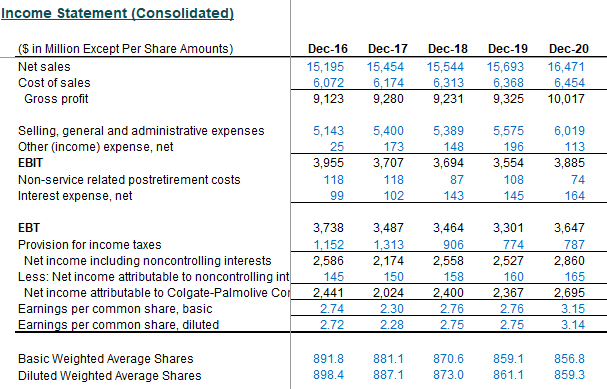

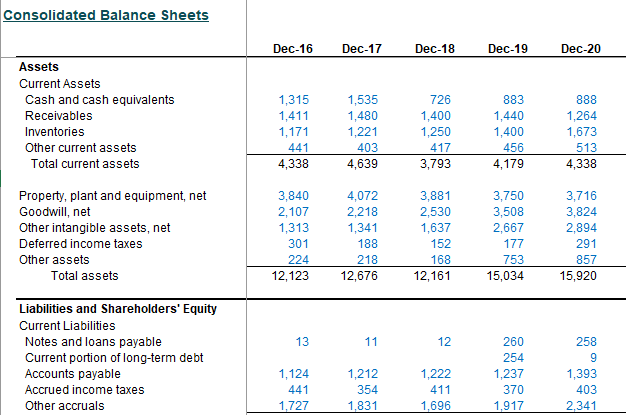

Colgate Income Statement with Historical Populated

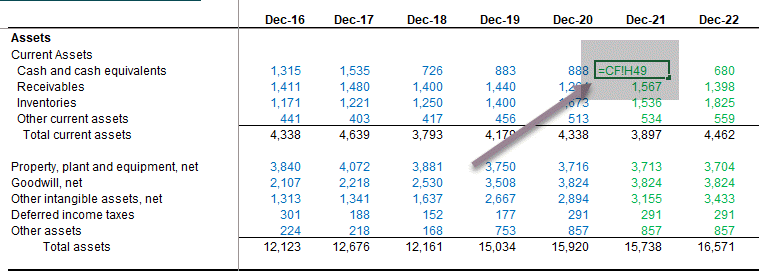

Colgate Balance Sheet Historical Data

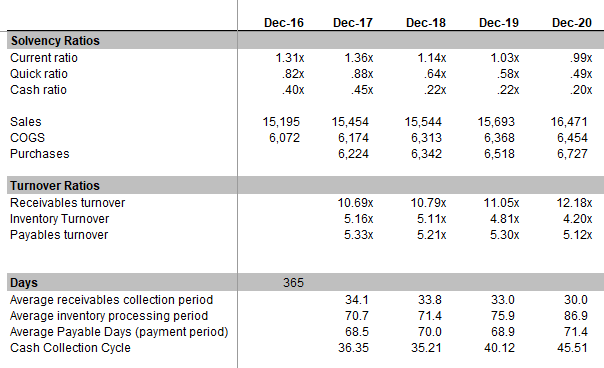

Step 2 – Ratio Analysis

The second step in financial modeling in Excel is to perform ratio analysis. We covered this in detail in part 1 of the series – Ratio AnalysisRatio analysis is the quantitative interpretation of the company’s financial performance. It provides valuable information about the organization’s profitability, solvency, operational efficiency and liquidity positions as represented by the financial statements.read more

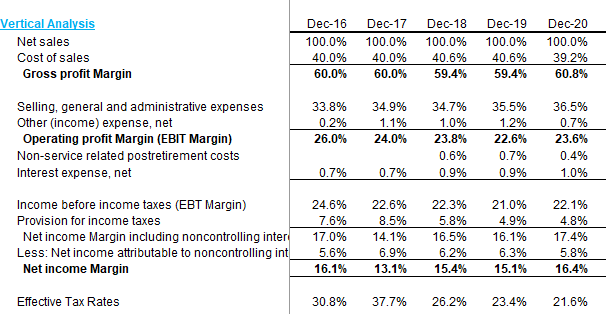

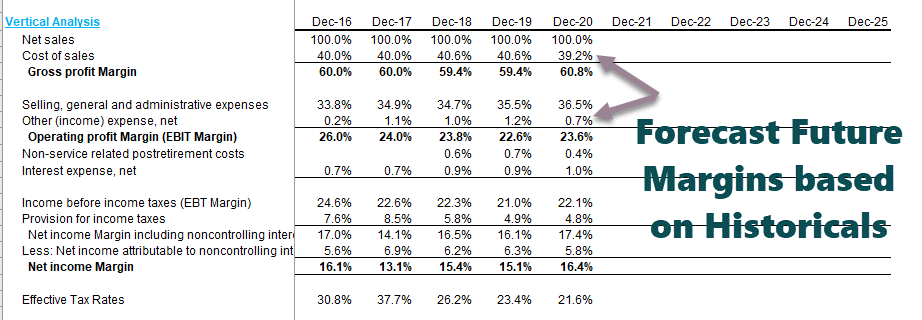

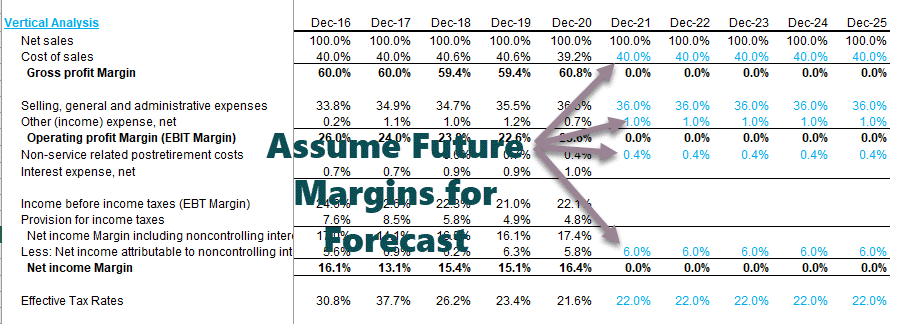

Vertical Analysis of Colgate

On the income statement, the vertical analysis is a universal tool for measuring the firm’s relative performance from year to year in terms of cost and profitability. Therefore, it should always be included as part of any financial analysis. Here, percentages are computed concerning net sales, which is considered 100%. This vertical analysis effort in the income statement is often referred to as margin analysis since it yields different margins concerning sales.

Horizontal Analysis of Colgate

Horizontal analysis is a technique used to evaluate trends over time by calculating percentage increases excelPercentage increase = (New Value — Old Value)/ Old Value. Instead of showing the delta as a Value, percentage increase shows how much the value has changed in terms of percentage increase.read more or decreases relative to a base year. It provides an analytical link between accounts calculated at different dates using the currency with varying purchasing powers. In effect, this analysis indexes the reports and compares these evolved. As with the vertical analysisVertical analysis is a kind of financial statement analysis wherein each item in the financial statement is shown in percentage of the base figure. The formula is: (Statement line item / Total base figure) X 100read more methodology, issues that need to be investigated and complemented with other financial analysis techniques will surface. The focus is to look for symptoms of problems that one can diagnose using additional methods.

Let us look at the horizontal analysis of Colgate.

Liquidity Ratios of Colgate

- Liquidity ratios measure the relationship of the more liquid assetsLiquid Assets are the business assets that can be converted into cash within a short period, such as cash, marketable securities, and money market instruments. They are recorded on the asset side of the company’s balance sheet.read more of an enterprise (the ones most easily convertible to cash) to current liabilities. The most common liquidity ratios are the current ratioThe current ratio is a liquidity ratio that measures how efficiently a company can repay it’ short-term loans within a year. Current ratio = current assets/current liabilities

read more, Acid test (or quick asset) ratio Cash RatiosCash Ratio is calculated by dividing the total cash and the cash equivalents of the company by total current liabilities. It indicates how quickly a business can pay off its short term liabilities using the non-current assets.read more. - Turnover Ratios like Accounts ReceivablesAccounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. They are categorized as current assets on the balance sheet as the payments expected within a year.

read more turnover, inventory turnover, and payables turnover.

Also, have a look at this detailed article on Cash Conversion CycleThe Cash Conversion Cycle (CCC) is a ratio analysis measure to evaluate the number of days or time a company converts its inventory and other inputs into cash. It considers the days inventory outstanding, days sales outstanding and days payable outstanding for computation.read more.

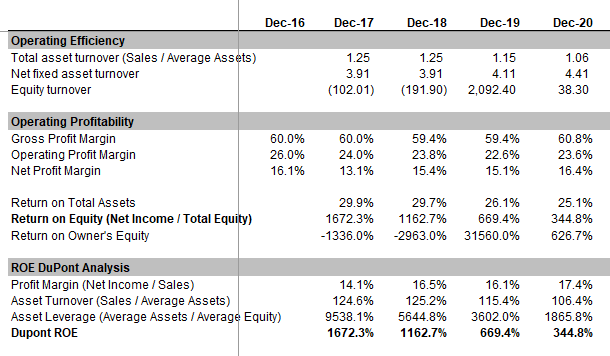

Operating Profitability Ratios of Colgate

Profitability ratiosProfitability ratios help in evaluating the ability of a company to generate income against the expenses. These ratios represent the financial viability of the company in various terms.read more are a company’s ability to generate earnings relative to sales, assets, and equity.

Risk Analysis of Colgate

Through Risk AnalysisRisk analysis refers to the process of identifying, measuring, and mitigating the uncertainties involved in a project, investment, or business. There are two types of risk analysis — quantitative and qualitative risk analysis.read more, we try to gauge whether the companies will be able to pay their short and long-term obligations (debt). We calculate leverage ratiosDebt-to-equity, debt-to-capital, debt-to-assets, and debt-to-EBITDA are examples of leverage ratios that are used to determine how much debt a company has taken out against its assets or equity.read more that focus on the sufficiency of assets or generation from assets. Rates that looks at are:

- Debt to Equity Ratio

- Debt ratio

- Interest Coverage RatioThe interest coverage ratio indicates how many times a company’s current earnings before interest and taxes can be used to pay interest on its outstanding debt. It can be used to determine a company’s liquidity position by evaluating how easily it can pay interest on its outstanding debt.read more

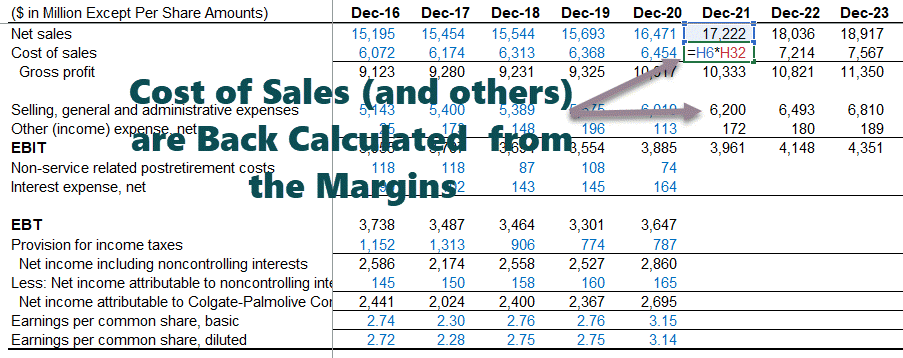

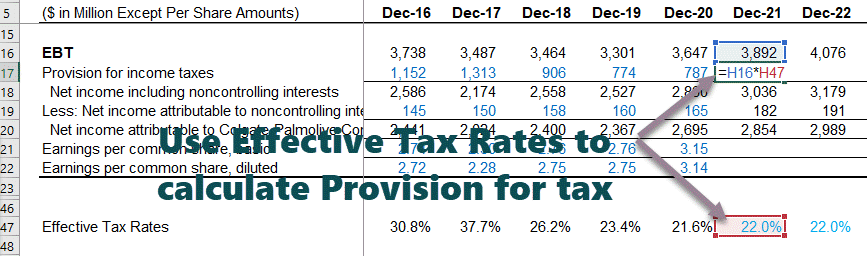

Step 3 – Financial Modeling in Excel – Project the Income Statement

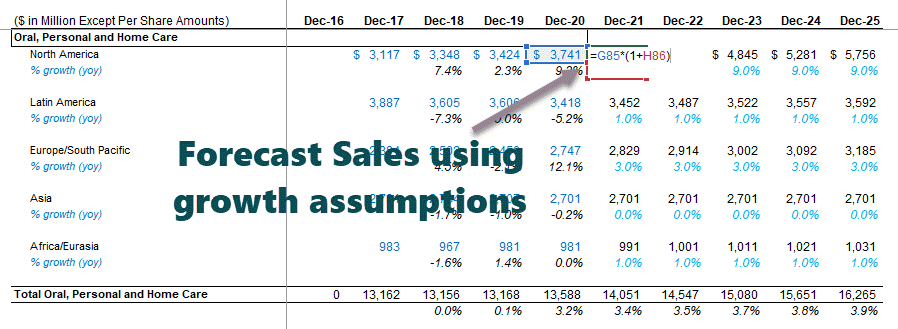

The third step in financial modeling is to forecast the income statement, wherein we will start with modeling the sales or revenue items.

Revenues Projections

For most companies, revenues are a fundamental driver of economic performance. Therefore, a well-designed and logical revenue model reflecting the type and amounts of income flows accurately is extremely important. There are as many ways to create a revenue schedule as there are businesses. Some common types include:

- Sales Growth: Sales growth assumption in each period defines the change from the previous period. It is a simple and commonly used method but offers no insights into the components or dynamics of growth.

- Inflationary and Volume/ Mix effects: Instead of a simple growth assumption, a price inflation factor and a volume factor are used. This useful approach allows the modeling of fixed and variable costs in multi-product companies and considers price vs. volume movements.

- Unit Volume, Change in Volume, Average Price, and Change in Price: This method is appropriate for businesses with a simple product mix. It permits analysis of the impact of several key variables.

- Dollar Market Size and Growth: Market share and change in share – useful for cases where information is available on market dynamicsMarket Dynamics is defined as the forces of market constituents responsible for the shift in the demand and supply curve and are therefore accountable for creating and reducing the demand and supply of a particular product.read more and where these assumptions are likely to be fundamental to a decision. For example, the telecom industry.

- Unit Market Size and Growth: This is more detailed than the preceding case and is useful when pricing in the market is a crucial variable. (For a company with a price-discounting strategy. For example, a best-of-breed premium-priced niche player) e.g., the luxury car market

- Volume Capacity, Capacity Utilization Rate, and Average Price: These assumptions can be important for businesses where production capacity is essential to the decision. (In purchasing additional capacity, for example, or determining whether the expansion would require new investments).

- Product Availability and Pricing

- Revenue was driven by investment in capital, marketing, or R&D

- Revenue-based on installed base (continuing sales of parts, disposables, services, add-ons, etc.). Examples include classic razor-blade businesses and businesses like computers where sales of service, software, and upgrades are essential. Again, modeling the installed base is key (new additions to the floor, attrition in the ground, continuing revenues per customer, etc.).

- Employee based: For example, revenues of professional services firms or sales-based firms such as brokers. Modeling should focus on net staffing and revenue per employeeRevenue Per Employee is the ratio of total revenue over total number of employees in a particular accounting period. It gives an idea about how the business performed.read more (often based on billable hours). More detailed models will include seniority and other factors affecting pricing.

- Store, facility, or Square footage based: Retail companies are often modeled based on stores (old stores plus new stores each year) and revenue per store.

- Occupancy-factor-based: This approach applies to airlines, hotels, movie theatres, and other businesses with low marginal costs.

Projecting Colgate Revenues

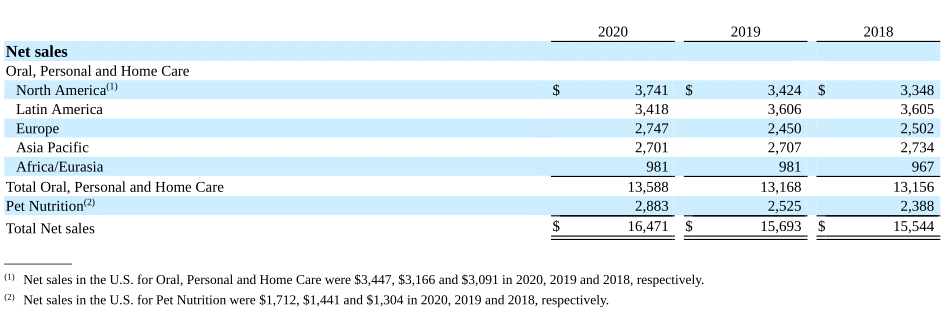

Let us now look at the Colgate 10K 2020 report. First, Colgate has not provided segmental information in the income statement. However, as additional information, Colgate has provided details of each segment.

Source – Colgate 2020 – 10K, Page 119

Since we do not have any further information about the features, we will project the future sales of Colgate based on this available data. We will use the sales growth approach across segments to derive the forecasts. Please see the picture below. We have calculated the year-over-year growth rate for each element.