Whether you’re a Certified Public Accountant feeling the tax-time crunch or just trying to balance your family budget, rely on the software in the Microsoft Office suite to aid in accounting. Even the basic version of the Office suite contains a variety of applications to help run the numbers, providing ways to calculate, track and plan accounts. Before hauling out the calculator and graph pads, “account” on the Microsoft Office suite.

Step 1.

Track spending in the Microsoft Office Excel spreadsheet software. Excel may be the most useful Office Suite product for accounting, as it not only provides a way to create worksheets, budgets and ledgers, but it offers automated summing and chart creation. Keep track of accounts payable for a month and with one click, have Excel add everything together. If you add payments, Excel will recalculate. Use a single Excel spreadsheet as a template and streamline the accounting process.

Step 2.

Produce visuals of accounting information for shareholders or executives using PowerPoint, the Office suite’s presentation component. A PowerPoint slideshow is an ideal way to share accounting information. You can display graphics such as pie charts and slides with information on where money went for the year. PowerPoint presentations are built slide-by-slide. However, the software comes complete with preset template designs so you can just drop in accounting information and be good to go.

Step 3.

Distribute accounting information in report format with Microsoft Word, Office’s word processing program. Take advantage of Word’s included templates such as reports, newsletters and proposals to jump-start accounting reporting or start from scratch and create an annual report, budget agenda or sponsor list. Another Office suite option, Microsoft Publisher, comes with the Office Professional 2010 version and includes templates for newsletters, reports and other publications ideal for accounting.

Step 4.

Store important client information, records and notes in Access, Office’s database component. You don’t need long-term database programming experience; much of Access’ menus, toolbars and features will be familiar to someone who has used other Office products for accounting information.

Accountancy : Computerised Accounting

Microsoft Office — MS Word Practical

MS-Word

i) Creation of a word file : Start – All Programs – Microsoft

Office – Microsoft Word –

File Save As – File name – Save

ii) Opening of a word file :

File – Open – File name – Open

iii) Saving an existing file :

File Save (Short cut key: Control+S)

iv) For closing a file :

File Close

v) Table creation: Insert – Table

– Choose number of rows and columns

vi) Formatting the text : To

bold : Control+B;

To italicise :

Control+I

To underline :

Control+U

vii) Paragraph alignment :

To align text left :

Control+L

To align text right : Control+R

To align text centre :

Control+E

To align text justify : Control+J

viii) Line spacing : Single line

spacing : Control+1

Double line spacing :Control+2

1.5 line spacing : Control+5

ix) Page lay out : Margin

(normal, narrow, wide, etc.)

Orientation (Portrait, Landscape)

Size (A4, A5, etc)

Columns (1,2,3, etc.)

x) Page number : Insert Page Number (top of the page,

bottom of the page,

etc.)

MS Word Practical

Illustration 1

Type the given below passage in

MS-Word and format as directed.

Fra Luca Bartolomeo de Pacioli

was an Italian mathematician (1447 – 1517). He is referred to as The Father of

Accounting and Book keeping in Europe and he was the first person to publish a

work on the double-entry system of book keeping.

Solution

Procedure

i.

Select and bold the name Fra Luca Bartolomeo de

Pacioli.

ii.

Add single quote before The Father and after Book

keeping.

‘The Father of Accounting and Bookkeeping’

iii.

Select and italicise the word Europe. Europe

iv.

Select and underline the word double-entry. double-entry

v.

Select the full text and change the font style to

Arial and font size to 10

Output:

Fra Luca Bartolomeo de

Pacioli was an Italian mathematician (1447 – 1517). He is referred to as ‘The Father of Accounting and Book

keeping’ in Europe and he was the

first person to publish a work on the double-entry system of book

keeping.

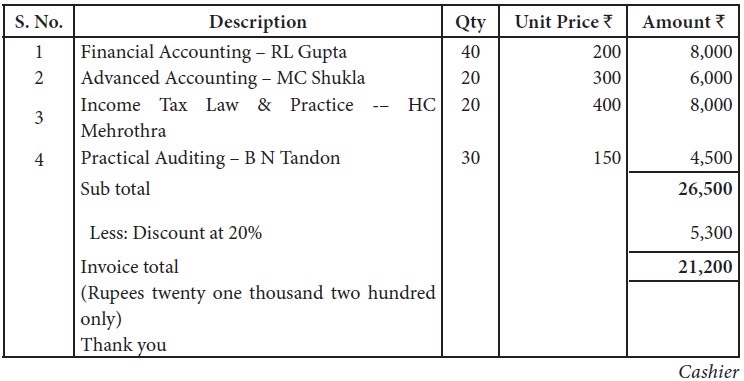

Illustration 2

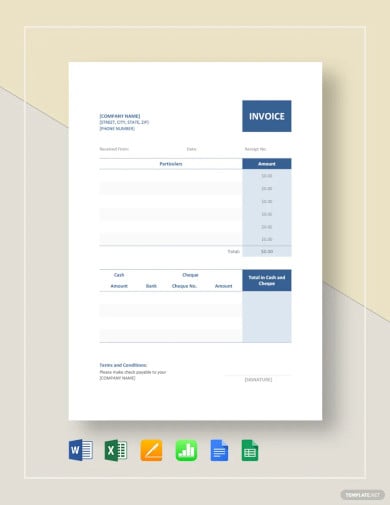

Prepare invoice for the following

items.

1. Financial Accounting – RL Gupta — 40 Nos.

2. Advanced Accounting – MC Shukla — 20 Nos.

3. Income

Tax Law & Practice – HC Mehrothra — 20 Nos.

4. Practical Auditing – B N Tandon — 30 Nos.

Solution

Procedure

i.

Enter name and address of the vendor, number and

date of invoice

ii.

Type

billing address

iii.

To create a table – Select Insert menu -> Click

Table / Insert Table-> Enter number of rows and columns-> Click OK.

iv.

Enter the

data.

Output

SOUTH INDIA Ltd.,

100, Kamarajar Salai, INVOICE

Chennai – 600006.

Invoice # 009876

Invoice date 31-12-2017

Bill To

Prof. A. Rajesh

HSC College,

123, PH Road,

Chennai – 600001.

Tags : Accountancy , 11th Accountancy : Chapter 14 : Computerised Accounting

Study Material, Lecturing Notes, Assignment, Reference, Wiki description explanation, brief detail

11th Accountancy : Chapter 14 : Computerised Accounting : Microsoft Office — MS Word Practical — Computerised Accounting | Accountancy

Are you getting the most out of Microsoft Word? There are probably some capabilities you’re missing.

Microsoft Word is one of the most common forms of communication and document processing in the world. No matter what profession or industry you’re in, businesses tend to use the program in some capacity on a regular basis. Chances are you depend on the tool for various aspects of your accounting, finance or IT role—event if you spend the majority of your day in another Microsoft product, like Excel, or ERP staples like Great Plains or SAP.

With the ease and efficiency of Word, it’s no wonder how much it’s universally recognized as an essential word-processing product. However, there are likely many inner workings of Word you might be unaware of, intimidated by or not using for some reason or another. So, why not start maximizing the program you’re already using on a daily basis?

I bet you’ll even find ways to speed up a number of your tasks and help accomplish more in your role overall.

Recently, I came across an article in CGMA Magazine that discusses this topic and decided to share some of their tips, plus a few of my own, in the 5 Ways for Accounting, Finance and IT Professionals to Maximize Microsoft Word below. Note, most directions below are specific to Word 2013.

1. Remove white space.

To make documents easier to read and more eye-catching, it’s best to hide excessive white space such as blank pages, headers, footers or page breaks. In order to do so, click on the “View” tab and then “Print Layout” option, and position the cursor between two separate pages until the “Double-click to hide white space” option appears. Next, double-click your mouse button. Want to get the white space back? Position your cursor on the break line separating any two pages until the “Double-click to show white space” option appears, and then double-click your mouse button.

2. Automate the table of contents.

When working on an extensive, lengthy document, often times you’ll use a table of contents to organize the information. First, highlight each paragraph heading in the document that you want in the table of contents and from the References tab select Add Text, Level 1 and so on. Once you have done this step for every paragraph, position your cursor where you want the table of contents to appear and from the References ribbon select “Table of Contents,” and then click on the table of contents format. To update your table of contents as the document changes, click the table of contents to select it, and then press the “Update Table” button that appears at the top of your selected table of contents to update the table as you work.

3. View content side-by-side.

Sometimes if you’re working on a lengthy project, it can be beneficial to see many pieces of the information at once. If you want to view two separate parts of your document, click on the “View” tab and select “Split.” In doing this, you can select the desired size of the split. Additionally, if you want to see three or more separate parts of your document, go to the “View” tab and select the “New Window” option (as many times as necessary) to launch copies of the document in separate windows. Next, from the “View” tab, select the “Arrange All” option to display the duplicate Word document windows side-by-side on your monitor.

4. Take a line from newspapers.

We’ve all seen documents that are text heavy and difficult to read. One easy way to remedy that issue is to create a newspaper-style format that organizes your information into columns. To format this style, go to the “Page Layout” tab and select the “Columns” option. Then, select the amount of desired columns. Your document will update to the new format automatically.

5. Insert comments quickly.

When collaborating with colleagues on a single document in Microsoft Word, inserting comments can be a helpful tool. To be efficient you can use a shortcut with hot keys that’ll help save you time. To do so, select the text or position where you want the comment to occur, press Alt+Ctrl+M to launch a blank comment box, and then enter your comment. Be sure to save the document. This time-saving step is one of the easiest ways to collaborate on an accounting, finance or IT project in Word.

These are only a few of the many ways to use Microsoft Word more effectively. Do you have other tips? Comment below and let us know!

When it comes to must-have business tools, Microsoft Office often makes the list for most business owners. In fact, in 2020, the suite was used by over 879,851 companies in the U.S. alone.

The familiarity of Microsoft Word and Excel makes these programs an automatic choice for many freelancers and small business owners. But because of this, it’s easy to ignore the signs telling you that using them takes up too much of your time or that it’s the wrong way to manage your business.

We’re here to tell you that there is a better way and that it’s much easier than you think to make a change. Read on for 5 signs telling you it’s time to stop using Word and Excel to manage your business finances—and discover the alternative that saves thousands of business owners time, effort, and stress.

Table of Contents

5 Signs to Stop Using Microsoft Word and Excel for Your Accounting

1. You’ve Sent an Invoice (or Several) With Errors

It’s a cinch, right? You pull up last month’s invoice for your client, hit “save as,” and update the information. It feels like no big deal when you’re doing it. You just save the new copy and send the invoice on its merry way.

But then you get an email from your client (or their accounts payable department). You forgot to update the invoice number. Or change the due date. Or—even worse—your math was wrong. So now you have to get back to your computer to edit the original, check everything, and send it off again.

If you’ve used Word or Excel to create invoices for a while, odds are this has happened to you already. If it hasn’t, well, it will soon enough. In the grand scheme of things, it’s no big deal. But details matter, and when an error does happen, it’s an unnecessary time suck.

And don’t forget: Your client is counting on you to catch the details. While 1 or 2 mistakes may be harmless, making them over and over again paints you as unprofessional and disorganized—even though you’re not.

Avoid this by looking for a solution that automatically updates your invoice numbers, dates, taxes, and even billable hours. Put away the calculator and let good software do the math for you.

2. You’ve Lost a Document in Your Filing System

Because we’re human, even the most immaculate document management systems will see their fair share of mistakes.

Imagine once again you need to fix a mistake on an old invoice of yours. This time, however, the invoice you need to update is nowhere to be found. After checking your filing system—and then your downloaded files—to no avail, you resign yourself to drawing up the invoice from scratch again.

It’s easy to chalk up these mistakes (and the time wasted) to human error. But what most business owners don’t realize is that it’ll probably happen again.

What you need isn’t a better routine but a better tool. We tend to be hard on ourselves when we make mistakes, but instead of taking the blame yourself, take another look at the tools you rely on instead.

If your knife is too dull to cut steak, you don’t blame yourself for what happened. You get a better knife. If your invoicing system fails, you don’t think, “Oh, I’m no good at accounting.” Instead, consider if there’s another solution that fits your needs better.

So if you have trouble keeping all your invoices, receipts, and client expenses organized, you may want to look for an invoicing tool that keeps all these documents in one place. That way, you won’t have to waste time searching your filing system or email inbox to find the information you need.

Related Articles

3. You’ve Discovered Mistakes in Your Reports

Let’s be real: Excel is great. Its creation revolutionized accounting for personal and business finances for millions of people. Still, accounting in Excel is far from perfect. Your spreadsheets have to be built, populated, and updated manually—which inevitably results in mistakes, even for the most formula-savvy of us.

In most cases, Excel is also kept separate from the system you use to manage every invoice, expense receipt, and business transaction. That means lots of manual reconciliations, increasing the possibility of errors even further.

Excel accounting software works at its best when you use it to store data, but issues arise when you manually input data pulled from other sources. A mistake as small as a misplaced decimal point or zero can be costly for your business. And when these errors are folded into your cash flow statement or income statement, it can prevent you from making business decisions with pinpoint accuracy.

4. You Struggle to Get Paid on Time

The feast or famine cycle is one of the biggest roadblocks to financial stability for most freelancers and new business owners. And if you’re using Microsoft Word and Excel (or their Google Sheets and Docs counterparts) to manage your business, the road to financial stability can be more difficult than it needs to be.

The first issue arises when you send an invoice to your client. Even though most people would prefer to pay with a credit card, a lack of infrastructure to support card payments often means you’re forced to use wire transfers, receive paper checks, or set up payment processors just to get paid.

And because Excel and Word weren’t designed for invoicing, you’ll also have to find a way to keep track of accounts receivable and follow up on late payments yourself.

If you’re checking the mailbox daily for paper checks or racking up credit card debt because of overdue invoices, it’s time to level up your payment system. While, to some extent, you’ll always be beholden to your clients’ systems and schedules, more and more business owners are discovering that there’s a better way to get paid.

So if you’re struggling to get paid on time, or you’re limiting yourself to where you can work because of the payment terms, your best bet is to look for a tool that enables online payment with multiple payment options.

Offering several convenient payment methods is one of the easiest ways to get paid faster and improve your cash flow—and with minimal effort on your end. Meanwhile, small business accounting software that offers automated payment reminders ensures you don’t spend more time than you need to follow up on payment for your services. Trust us, your clients and your wallet will thank you.

5. You Waste Hours on Invoicing and Accounting Each Month

Does evening or weekend bookkeeping sound all too familiar? Starting your own business often means taking on a lot of the roles yourself and working outside the typical 9-to-5 work schedule (at least at first).

And as your business grows, so does the amount of time you need to allocate to bookkeeping and accounting, especially if you don’t want to play catch up with your financials during tax season. The problem is: No one wants to spend their leisure time sending out invoices and updating Excel spreadsheets cell by cell.

If you’ve ever found yourself in this situation and thought, “My time would be better spent doing anything else”, you’re right. You could be developing a better product or service, improving your marketing strategy, or just enjoying your weekend—but instead, you’re stuck doing double-entry accounting for hours on end.

When you choose a tool that makes invoicing and expense management a series of small bookkeeping tasks you can manage anytime and anywhere, it becomes so much easier to integrate accounting into your working life. No need to get back to your desk to take on the chore of paperwork. Your tools do most of the heavy lifting for you, while now you’re only responsible for a series of micro-tasks that easily fit into your day.

The right accounting software handles the data entry and other tedious manual tasks for you, so you can dedicate time to the parts of the business that require your unique expertise and light your fire.

Excel and Word vs. Cloud Accounting for Invoicing: Which Is Better for Your Businesses?

If you’re a new business owner, you may be hesitant to spend a little more for accounting software when Microsoft Word and Excel seem to work just fine. But if you found yourself relating to 1 or more of the situations above, it may be time to give dedicated financial software a try.

Not only will invoicing and accounting software save you time and money, but it can also help:

- Ensure you get paid faster

- Catch costly mistakes you’d make otherwise with a manual accounting system

- Run your business more efficiently with tools like automation and software integrations

A recent survey from FlexJobs found that 85% of freelancers take on bookkeeping tasks themselves—a decision that diverts precious time, energy, and resources from activities that bring in revenue or grow the business. In fact, Upwork reported that freelancers spent about 23% of their time on administrative tasks such as invoicing and managing their finances.

On the other hand, separate findings from monday.com show that 54% of workers believe they’d save 5 or more hours of work with automation tools.

These figures show that the right financial software can allow you to do more in less time and with fewer resources, ultimately helping you make meaningful (and profitable) changes in your business.

Ready to transform how you approach your business finances? Download this handy checklist to learn what you should look for in your accounting software. And once you’ve made your decision, find out how to make the switch in this blog post.

FreshBooks: Cloud Accounting Software Designed With Business Owners in Mind

With invoicing, expense tracking, and reporting all rolled up into one platform, plus time tracking and project management to boot, FreshBooks has everything your business needs to streamline your processes, make better decisions, and grow your venture.

Check your dashboard to see how your company is doing at a glance, then review your financial statements for a deeper understanding of the health of your business. FreshBooks pulls in financial information from your business bank accounts, e-commerce store, payroll software, and more to ensure you get the most accurate picture of your business at all times—and then it automatically organizes and packages the financial data, so it’s ready for review whenever you or your accountant need it.

Of course, FreshBooks is far from the only tool on the market, so make sure to do your own due diligence. It’s important to find the tool that fits your business best.

Consider all of your options, and when you’re ready, try some of those options out yourself. FreshBooks offers a free 30-day trial, no credit card required, so you can play with it risk-free. Until then, get your free Microsoft Word invoice template or Excel invoice template here.

This post was updated in December 2022.

Blog

Receipts are important documents used as proof of sale or to transfer ownership from one party to another. Business establishments use receipts to record a sale, while buyers would need their receipts if they need to return or refund an item or a service.

Table of Content

- Build a Receipt Template for Microsoft Word – Step-by-Step Instructions

- Receipt Templates & Examples in Microsoft Word

- Contractor Receipt Template

- Car Rental Receipt Template

- Bakery Receipt Template

- Editable Payment Receipt Template

- Standard Medical Bill Receipt Template

- Confirmation of Receipt of Payment Letter Template

- Sample Cash Receipt Template

- Simple Medical Receipt Template

- Modern Restaurant Receipt Template

- Sample Invoice Receipt Template

- Modern Online Store Receipt Template

- Receipt Acknowledgement Design Letter

- Printable Food Delivery Receipt Template

- Purchase Receipt Creative Template

- Free Simple Receipt Voucher Template

- Kindergarten School Receipt Design

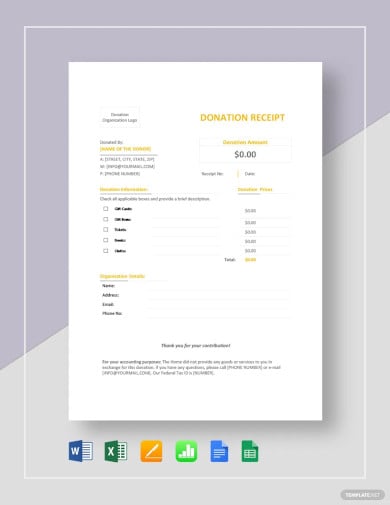

- Donation Receipt Template

- Official Receipt Template

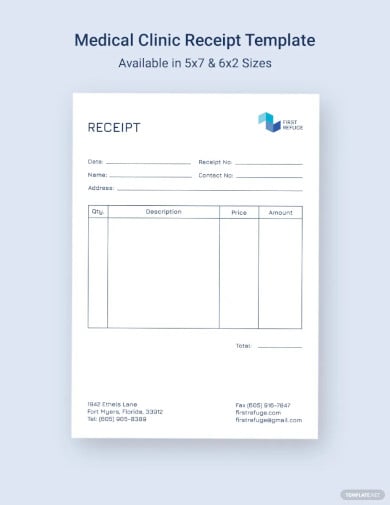

- Medical Clinic Receipt Template

- FAQs

Build a Receipt Template for Microsoft Word – Step-by-Step Instructions

Microsoft Word is an ideal application to create accounting documents such as invoices, purchase orders, and receipts. You can add details, and numbers and get creative by adding a business logo that will fit your financial needs.

Step 1: Open Microsoft Word

To create a receipt, first open a Microsoft Word application found on your desktop, laptop, or digital device.

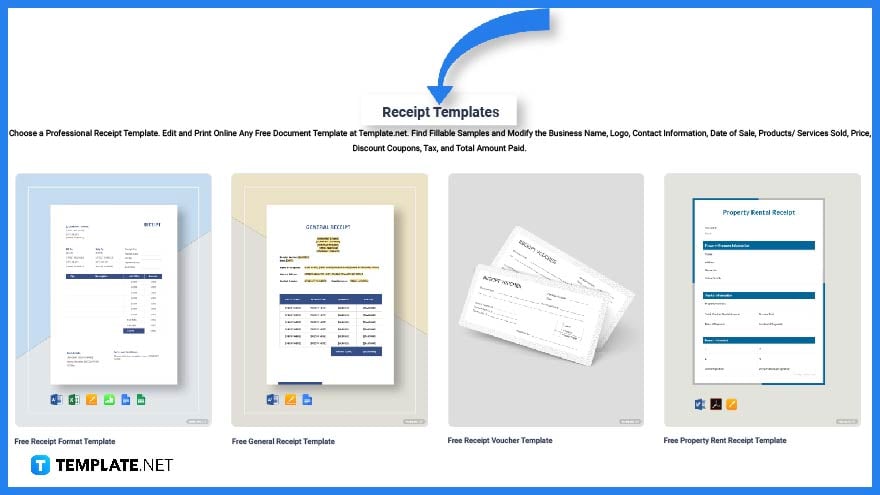

Step 2: Look for a Receipt Template on the Website (Option 1)

To find a suitable receipt template, head over to Template.net. You will find a large selection of templates that may just fit your requirements.

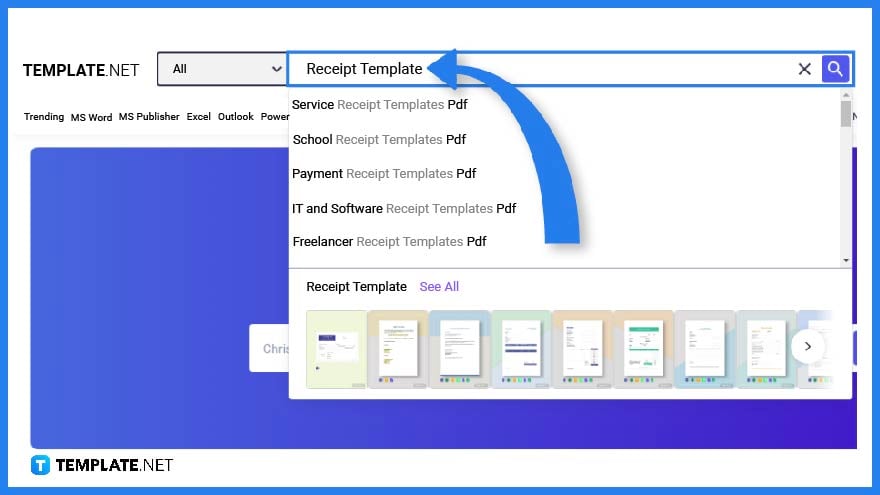

Step 3: Make Use of the Search Text Box to Look for a Template (Option 2)

Another option you can take to search for a specific or general receipt template is to use the search button. Type the keyword on the text box and click enter.

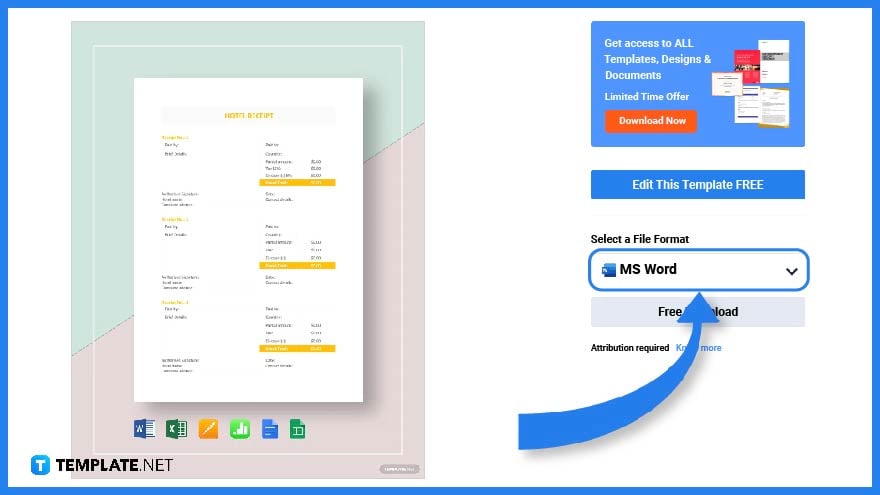

Step 4: Choose a Receipt Template to Edit on Microsoft Word

Choose a specific receipt template that will fit the specifications of your business. Each receipt would depend on what type of business you are running. Once you find one, click on the image to gain better access.

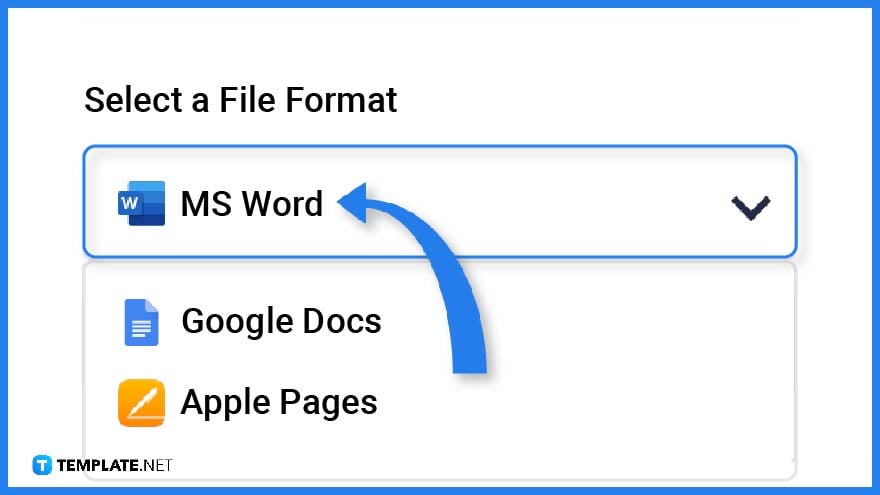

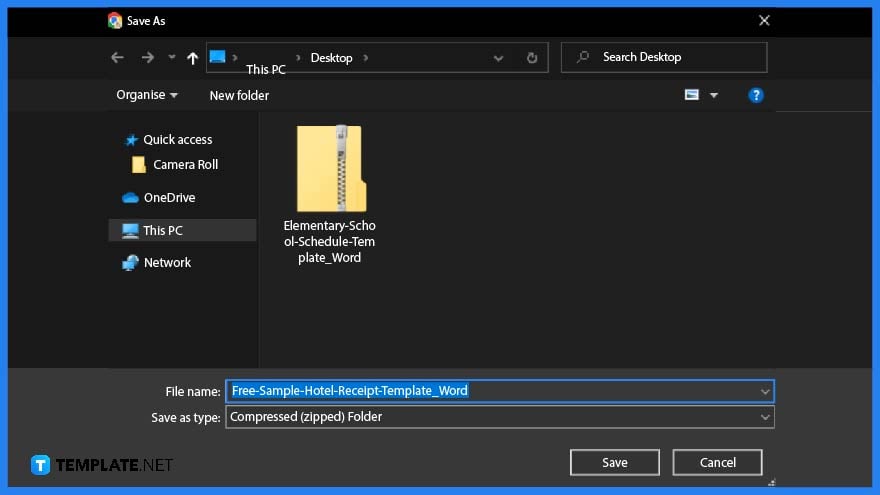

Step 5: Choose a File Format and Download

You will need to download the template in order to customize the document on Microsoft Word. Before doing so, make sure you choose MS Word as its file format.

Step 6: Receipt Template Zip File

The file you will be downloading is a Zip File that you will need to save on your computer or laptop.

Step 7: Add a Business Name and Logo

To start customizing the template, the first thing you need to do is to add the business name. So, on the upper portion of the document, you will need to provide the company/business name and the logo.

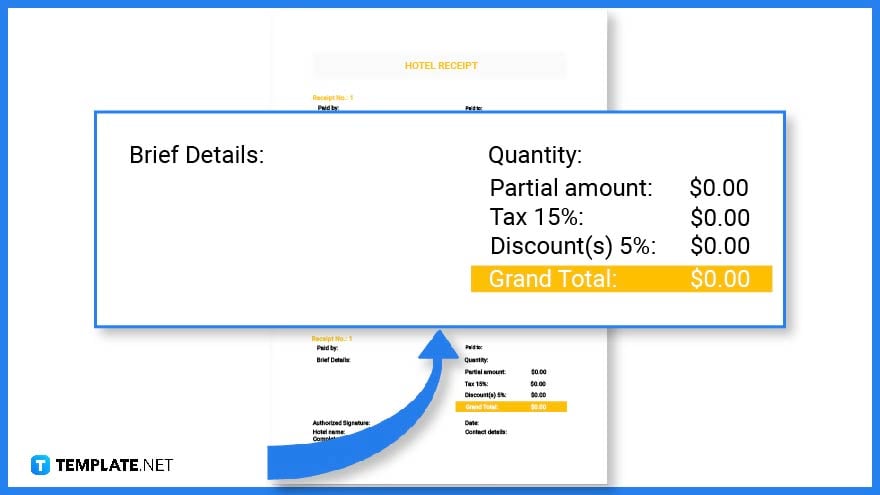

Step 8: Main Content

The main content of a receipt is the accounting or transaction details such as the list of items sold, services rendered, the quantity, the rate/prices, discounts(if applicable), taxes, and the grand total. All these details are essential and are part of the business requirements.

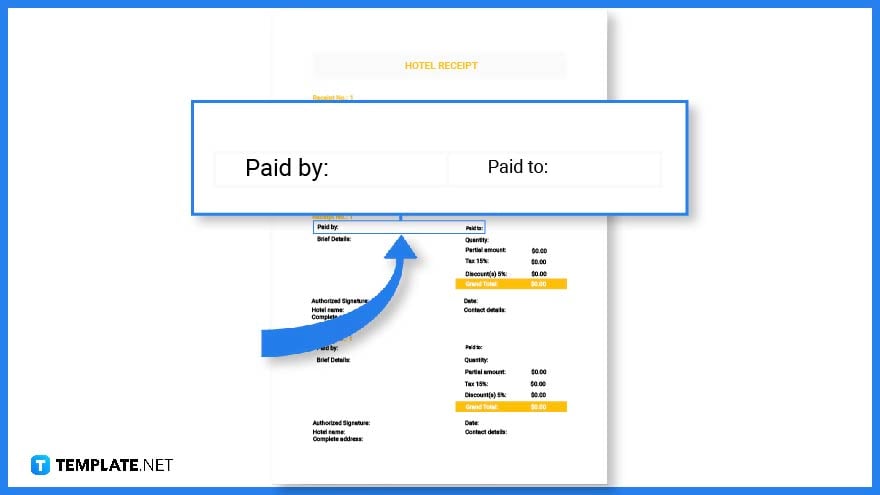

Step 9: Buyer’s Information

Another essential feature of a receipt is the buyer’s information. This should include the name and contact information.

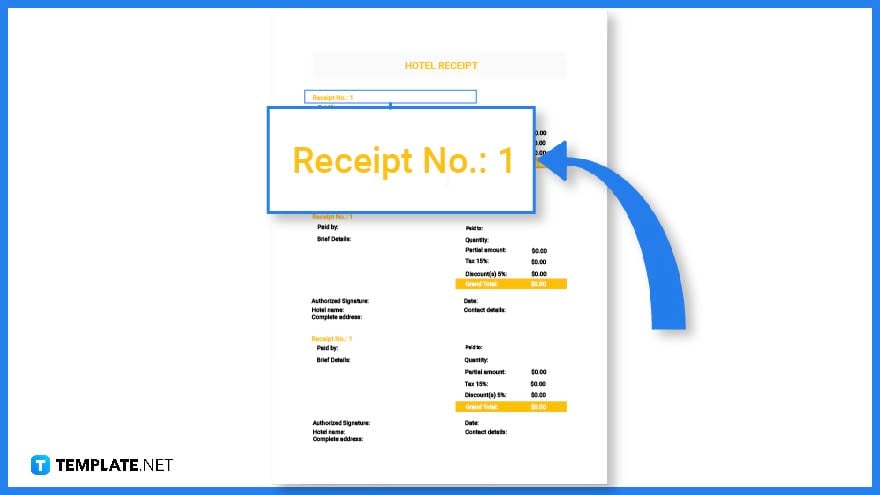

Step 10: Receipt Number

A receipt number is a sequence of numbers based on the date and time of the payment made. This is printed on the upper portion of the receipt.

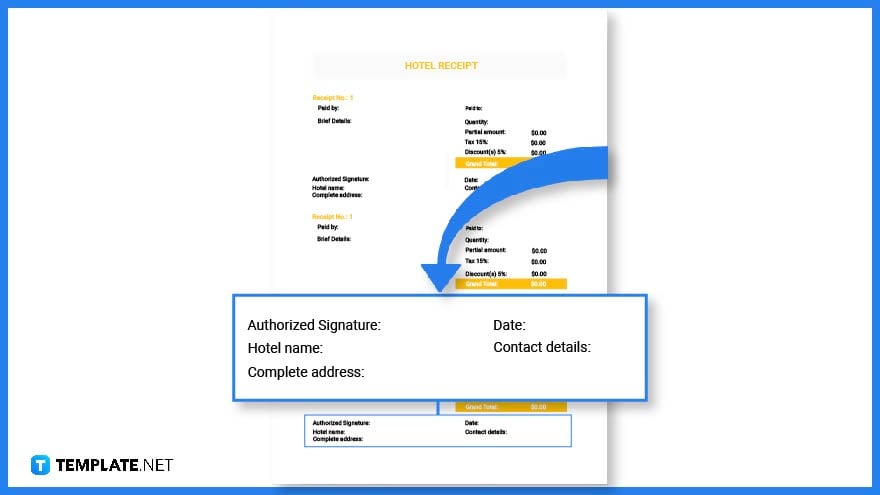

Step 11: Seller’s Information

The seller’s information is located on the top or lower portion of the document, which includes the address, contact numbers, date, authorized signature, and other relevant information.

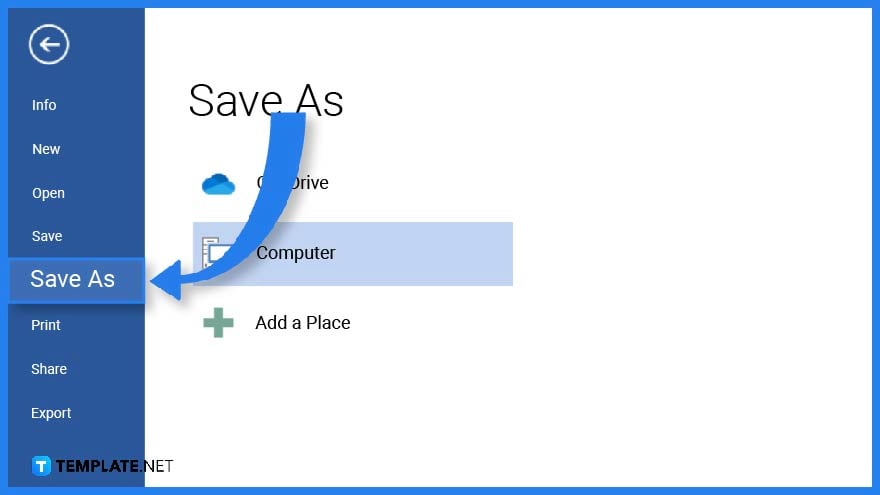

Step 12: Save the Receipt Template

Double-check your work and if all is good it’s time to save the document. Go to the File tab in Microsoft Word and on the drop-down menu click on the save as button to select a location where you want to save the document. You can either save it on your device or on a USB.

Receipt Templates & Examples in Microsoft Word

Receipts are used by various business organizations as valid proof of transaction between two or more parties. That said, there are different kinds of receipt templates you can use to help you edit and customize using Microsoft Word.

Contractor Receipt Template

A contractor receipt is a document used to record transactions between a contractor and their client. It contains valuable information that notes the details of the transaction such as the items or services provided, the rates, and company and client details.

Car Rental Receipt Template

Make use of this car rental receipt template to create and customize receipts for your rental company. You can edit your company logo and choose your own receipt paper size.

Bakery Receipt Template

No matter how small your bakery is, it is important to issue a bakery receipt to your clients. Not only does it records the transaction but this document may help clear any discrepancies in payment and orders.

Editable Payment Receipt Template

Download

Standard Medical Bill Receipt Template

Download

Confirmation of Receipt of Payment Letter Template

Download

Sample Cash Receipt Template

Download

Simple Medical Receipt Template

Download

Modern Restaurant Receipt Template

Download

Sample Invoice Receipt Template

Download

Modern Online Store Receipt Template

Download

Receipt Acknowledgement Design Letter

Download

Printable Food Delivery Receipt Template

Download

Purchase Receipt Creative Template

Download

Free Simple Receipt Voucher Template

Download

Kindergarten School Receipt Design

Download

Donation Receipt Template

Download

Official Receipt Template

Download

Medical Clinic Receipt Template

Download

FAQs

How do I create a receipt on Microsoft Word?

Select a receipt template on Template.net, download the file, and open this on Microsoft Word to customize the document.

What is the format of a receipt?

A receipt basically contains the company details, transaction details, and buyer’s information.

Why is a receipt important?

A receipt is an important financial document that is used by businesses for sales reconciliation and it serves as proof that a sale has been completed.

More in Blog

| 41+ Payment Receipt Templates — DOC, PDF | Cash Receipt Template — 19+ Free Word, Excel PDF Documents Download |

| 18+ Doctor Receipt Templates — Excel, Word, Apple Pages | 127+ Receipt Templates — DOC, Excel, AI, PDF |

| 15+ Rent Receipt Templates — DOC, PDF | 21+ Deposit Receipt Templates — DOC, Excel, PDF |

| 26+ Blank Receipt Templates — DOC, Excel, PDF, Vector EPS | Sample Receipt Template — 18+ Free Word, Excel, PDF Format Download! |

| 28+ Sales Receipt Templates — Word, PDF, Excel, Apple Pages | 14+ Car Sale Receipt Templates — DOC, PDF |

| 16+ Delivery Receipt Templates — DOC, PDF, Excel | 5+ Itemized Receipt Templates -DOC, Excel, PDF |