Excel for Microsoft 365 Excel 2021 Excel 2019 Excel 2016 Excel 2013 Excel 2010 Excel 2007 More…Less

This article was adapted from Microsoft Excel Data Analysis and Business Modeling by Wayne L. Winston.

-

Who uses Monte Carlo simulation?

-

What happens when you type =RAND() in a cell?

-

How can you simulate values of a discrete random variable?

-

How can you simulate values of a normal random variable?

-

How can a greeting card company determine how many cards to produce?

We would like to accurately estimate the probabilities of uncertain events. For example, what is the probability that a new product’s cash flows will have a positive net present value (NPV)? What is the risk factor of our investment portfolio? Monte Carlo simulation enables us to model situations that present uncertainty and then play them out on a computer thousands of times.

Note: The name Monte Carlo simulation comes from the computer simulations performed during the 1930s and 1940s to estimate the probability that the chain reaction needed for an atom bomb to detonate would work successfully. The physicists involved in this work were big fans of gambling, so they gave the simulations the code name Monte Carlo.

In the next five chapters, you will see examples of how you can use Excel to perform Monte Carlo simulations.

Many companies use Monte Carlo simulation as an important part of their decision-making process. Here are some examples.

-

General Motors, Proctor and Gamble, Pfizer, Bristol-Myers Squibb, and Eli Lilly use simulation to estimate both the average return and the risk factor of new products. At GM, this information is used by the CEO to determine which products come to market.

-

GM uses simulation for activities such as forecasting net income for the corporation, predicting structural and purchasing costs, and determining its susceptibility to different kinds of risk (such as interest rate changes and exchange rate fluctuations).

-

Lilly uses simulation to determine the optimal plant capacity for each drug.

-

Proctor and Gamble uses simulation to model and optimally hedge foreign exchange risk.

-

Sears uses simulation to determine how many units of each product line should be ordered from suppliers—for example, the number of pairs of Dockers trousers that should be ordered this year.

-

Oil and drug companies use simulation to value «real options,» such as the value of an option to expand, contract, or postpone a project.

-

Financial planners use Monte Carlo simulation to determine optimal investment strategies for their clients’ retirement.

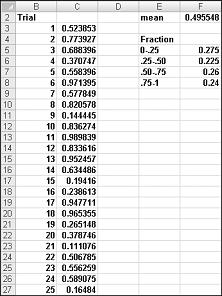

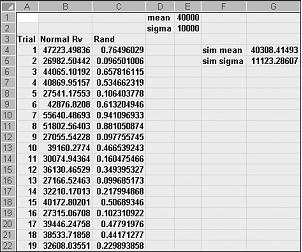

When you type the formula =RAND() in a cell, you get a number that is equally likely to assume any value between 0 and 1. Thus, around 25 percent of the time, you should get a number less than or equal to 0.25; around 10 percent of the time you should get a number that is at least 0.90, and so on. To demonstrate how the RAND function works, take a look at the file Randdemo.xlsx, shown in Figure 60-1.

Note: When you open the file Randdemo.xlsx, you will not see the same random numbers shown in Figure 60-1. The RAND function always automatically recalculates the numbers it generates when a worksheet is opened or when new information is entered into the worksheet.

First, copy from cell C3 to C4:C402 the formula =RAND(). Then you name the range C3:C402 Data. Then, in column F, you can track the average of the 400 random numbers (cell F2) and use the COUNTIF function to determine the fractions that are between 0 and 0.25, 0.25 and 0.50, 0.50 and 0.75, and 0.75 and 1. When you press the F9 key, the random numbers are recalculated. Notice that the average of the 400 numbers is always approximately 0.5, and that around 25 percent of the results are in intervals of 0.25. These results are consistent with the definition of a random number. Also note that the values generated by RAND in different cells are independent. For example, if the random number generated in cell C3 is a large number (for example, 0.99), it tells us nothing about the values of the other random numbers generated.

Suppose the demand for a calendar is governed by the following discrete random variable:

|

Demand |

Probability |

|

10,000 |

0.10 |

|

20,000 |

0.35 |

|

40,000 |

0.3 |

|

60,000 |

0.25 |

How can we have Excel play out, or simulate, this demand for calendars many times? The trick is to associate each possible value of the RAND function with a possible demand for calendars. The following assignment ensures that a demand of 10,000 will occur 10 percent of the time, and so on.

|

Demand |

Random number assigned |

|

10,000 |

Less than 0.10 |

|

20,000 |

Greater than or equal to 0.10, and less than 0.45 |

|

40,000 |

Greater than or equal to 0.45, and less than 0.75 |

|

60,000 |

Greater than or equal to 0.75 |

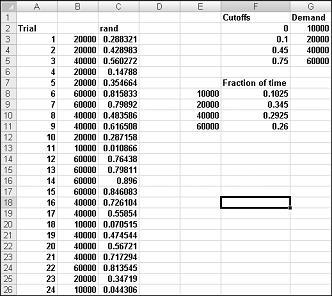

To demonstrate the simulation of demand, look at the file Discretesim.xlsx, shown in Figure 60-2 on the next page.

The key to our simulation is to use a random number to initiate a lookup from the table range F2:G5 (named lookup). Random numbers greater than or equal to 0 and less than 0.10 will yield a demand of 10,000; random numbers greater than or equal to 0.10 and less than 0.45 will yield a demand of 20,000; random numbers greater than or equal to 0.45 and less than 0.75 will yield a demand of 40,000; and random numbers greater than or equal to 0.75 will yield a demand of 60,000. You generate 400 random numbers by copying from C3 to C4:C402 the formula RAND(). You then generate 400 trials, or iterations, of calendar demand by copying from B3 to B4:B402 the formula VLOOKUP(C3,lookup,2). This formula ensures that any random number less than 0.10 generates a demand of 10,000, any random number between 0.10 and 0.45 generates a demand of 20,000, and so on. In the cell range F8:F11, use the COUNTIF function to determine the fraction of our 400 iterations yielding each demand. When we press F9 to recalculate the random numbers, the simulated probabilities are close to our assumed demand probabilities.

If you type in any cell the formula NORMINV(rand(),mu,sigma), you will generate a simulated value of a normal random variable having a mean mu and standard deviation sigma. This procedure is illustrated in the file Normalsim.xlsx, shown in Figure 60-3.

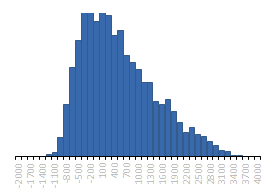

Let’s suppose we want to simulate 400 trials, or iterations, for a normal random variable with a mean of 40,000 and a standard deviation of 10,000. (You can type these values in cells E1 and E2, and name these cells mean and sigma, respectively.) Copying the formula =RAND() from C4 to C5:C403 generates 400 different random numbers. Copying from B4 to B5:B403 the formula NORMINV(C4,mean,sigma) generates 400 different trial values from a normal random variable with a mean of 40,000 and a standard deviation of 10,000. When we press the F9 key to recalculate the random numbers, the mean remains close to 40,000 and the standard deviation close to 10,000.

Essentially, for a random number x, the formula NORMINV(p,mu,sigma) generates the pth percentile of a normal random variable with a mean mu and a standard deviation sigma. For example, the random number 0.77 in cell C4 (see Figure 60-3) generates in cell B4 approximately the 77th percentile of a normal random variable with a mean of 40,000 and a standard deviation of 10,000.

In this section, you will see how Monte Carlo simulation can be used as a decision-making tool. Suppose that the demand for a Valentine’s Day card is governed by the following discrete random variable:

|

Demand |

Probability |

|

10,000 |

0.10 |

|

20,000 |

0.35 |

|

40,000 |

0.3 |

|

60,000 |

0.25 |

The greeting card sells for $4.00, and the variable cost of producing each card is $1.50. Leftover cards must be disposed of at a cost of $0.20 per card. How many cards should be printed?

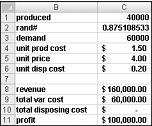

Basically, we simulate each possible production quantity (10,000, 20,000, 40,000, or 60,000) many times (for example, 1000 iterations). Then we determine which order quantity yields the maximum average profit over the 1000 iterations. You can find the data for this section in the file Valentine.xlsx, shown in Figure 60-4. You assign the range names in cells B1:B11 to cells C1:C11. The cell range G3:H6 is assigned the name lookup. Our sales price and cost parameters are entered in cells C4:C6.

You can enter a trial production quantity (40,000 in this example) in cell C1. Next, create a random number in cell C2 with the formula =RAND(). As previously described, you simulate demand for the card in cell C3 with the formula VLOOKUP(rand,lookup,2). (In the VLOOKUP formula, rand is the cell name assigned to cell C3, not the RAND function.)

The number of units sold is the smaller of our production quantity and demand. In cell C8, you compute our revenue with the formula MIN(produced,demand)*unit_price. In cell C9, you compute total production cost with the formula produced*unit_prod_cost.

If we produce more cards than are in demand, the number of units left over equals production minus demand; otherwise no units are left over. We compute our disposal cost in cell C10 with the formula unit_disp_cost*IF(produced>demand,produced–demand,0). Finally, in cell C11, we compute our profit as revenue– total_var_cost-total_disposing_cost.

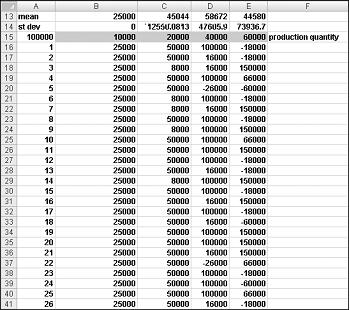

We would like an efficient way to press F9 many times (for example, 1000) for each production quantity and tally our expected profit for each quantity. This situation is one in which a two-way data table comes to our rescue. (See Chapter 15, «Sensitivity Analysis with Data Tables,» for details about data tables.) The data table used in this example is shown in Figure 60-5.

In the cell range A16:A1015, enter the numbers 1–1000 (corresponding to our 1000 trials). One easy way to create these values is to start by entering 1 in cell A16. Select the cell, and then on the Home tab in the Editing group, click Fill, and select Series to display the Series dialog box. In the Series dialog box, shown in Figure 60-6, enter a Step Value of 1 and a Stop Value of 1000. In the Series In area, select the Columns option, and then click OK. The numbers 1–1000 will be entered in column A starting in cell A16.

Next we enter our possible production quantities (10,000, 20,000, 40,000, 60,000) in cells B15:E15. We want to calculate profit for each trial number (1 through 1000) and each production quantity. We refer to the formula for profit (calculated in cell C11) in the upper-left cell of our data table (A15) by entering =C11.

We are now ready to trick Excel into simulating 1000 iterations of demand for each production quantity. Select the table range (A15:E1014), and then in the Data Tools group on the Data tab, click What If Analysis, and then select Data Table. To set up a two-way data table, choose our production quantity (cell C1) as the Row Input Cell and select any blank cell (we chose cell I14) as the Column Input Cell. After clicking OK, Excel simulates 1000 demand values for each order quantity.

To understand why this works, consider the values placed by the data table in the cell range C16:C1015. For each of these cells, Excel will use a value of 20,000 in cell C1. In C16, the column input cell value of 1 is placed in a blank cell and the random number in cell C2 recalculates. The corresponding profit is then recorded in cell C16. Then the column cell input value of 2 is placed in a blank cell, and the random number in C2 again recalculates. The corresponding profit is entered in cell C17.

By copying from cell B13 to C13:E13 the formula AVERAGE(B16:B1015), we compute average simulated profit for each production quantity. By copying from cell B14 to C14:E14 the formula STDEV(B16:B1015), we compute the standard deviation of our simulated profits for each order quantity. Each time we press F9, 1000 iterations of demand are simulated for each order quantity. Producing 40,000 cards always yields the largest expected profit. Therefore, it appears that producing 40,000 cards is the proper decision.

The Impact of Risk on Our Decision If we produced 20,000 instead of 40,000 cards, our expected profit drops approximately 22 percent, but our risk (as measured by the standard deviation of profit) drops almost 73 percent. Therefore, if we are extremely averse to risk, producing 20,000 cards might be the right decision. Incidentally, producing 10,000 cards always has a standard deviation of 0 cards because if we produce 10,000 cards, we will always sell all of them without any leftovers.

Note: In this workbook, the Calculation option is set to Automatic Except For Tables. (Use the Calculation command in the Calculation group on the Formulas tab.) This setting ensures that our data table will not recalculate unless we press F9, which is a good idea because a large data table will slow down your work if it recalculates every time you type something into your worksheet. Note that in this example, whenever you press F9, the mean profit will change. This happens because each time you press F9, a different sequence of 1000 random numbers is used to generate demands for each order quantity.

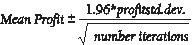

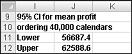

Confidence Interval for Mean Profit A natural question to ask in this situation is, into what interval are we 95 percent sure the true mean profit will fall? This interval is called the 95 percent confidence interval for mean profit. A 95 percent confidence interval for the mean of any simulation output is computed by the following formula:

In cell J11, you compute the lower limit for the 95 percent confidence interval on mean profit when 40,000 calendars are produced with the formula D13–1.96*D14/SQRT(1000). In cell J12, you compute the upper limit for our 95 percent confidence interval with the formula D13+1.96*D14/SQRT(1000). These calculations are shown in Figure 60-7.

We are 95 percent sure that our mean profit when 40,000 calendars are ordered is between $56,687 and $62,589.

-

A GMC dealer believes that demand for 2005 Envoys will be normally distributed with a mean of 200 and standard deviation of 30. His cost of receiving an Envoy is $25,000, and he sells an Envoy for $40,000. Half of all the Envoys not sold at full price can be sold for $30,000. He is considering ordering 200, 220, 240, 260, 280, or 300 Envoys. How many should he order?

-

A small supermarket is trying to determine how many copies of People magazine they should order each week. They believe their demand for People is governed by the following discrete random variable:

Demand

Probability

15

0.10

20

0.20

25

0.30

30

0.25

35

0.15

-

The supermarket pays $1.00 for each copy of People and sells it for $1.95. Each unsold copy can be returned for $0.50. How many copies of People should the store order?

Need more help?

You can always ask an expert in the Excel Tech Community or get support in the Answers community.

Need more help?

A Monte Carlo simulation can be developed using Microsoft Excel and a game of dice. A Monte Carlo simulation is a method for modeling probabilities by using random numbers to approximate and simulate possible outcomes. Today, it is widely used as an analysis tool. It plays a key part in various fields such as finance, physics, chemistry, and economics.

Key Takeaways

- The Monte Carlo method seeks to improve the analysis of data using random data sets and probability calculations.

- A Monte Carlo simulation can be developed using Microsoft Excel and a game of dice.

- A data table can be used to generate the results—a total of5,000 results are needed to prepare the Monte Carlo simulation.

Monte Carlo Simulation

The Monte Carlo method was invented by John von Neumann and Stanislaw Ulam in the 1940s and seeks to solve complex problems using random and probabilistic methods. The term Monte Carlo refers the administrative area of Monaco popularly known as a place where European elites gamble.

The Monte Carlo simulation method computes the probabilities for integrals and solves partial differential equations, thereby introducing a statistical approach to risk in a probabilistic decision. Although many advanced statistical tools exist to create Monte Carlo simulations, it is easier to simulate the normal law and the uniform law using Microsoft Excel and bypass the mathematical underpinnings.

When to Use the Monte Carlo Simulation

We use the Monte Carlo method when a problem is too complex and difficult to do by direct calculation. Using the simulation can help provide solutions for situations that prove uncertain. A large number of iterations allows a simulation of the normal distribution. It can also be used to understand how risk works, and to comprehend the uncertainty in forecasting models.

As noted above, the simulation is often used in many different disciplines including finance, science, engineering, and supply chain management—especially in cases where there are far too many random variables in play. For example, analysts may use Monte Carlo simulations in order to evaluate derivatives including options or to determine risks including the likelihood that a company may default on its debts.

Game of Dice

For the Monte Carlo simulation, we isolate a number of key variables that control and describe the outcome of the experiment, then assign a probability distribution after a large number of random samples is performed. In order to demonstrate, let’s take a game of dice as a model. Here’s how the dice game rolls:

• The player throws three dice that have six sides three times.

• If the total of the three throws is seven or 11, the player wins.

• If the total of the three throws is: three, four, five, 16, 17, or 18, the player loses.

• If the total is any other outcome, the player plays again and re-rolls the dice.

• When the player throws the dice again, the game continues in the same way, except that the player wins when the total is equal to the sum determined in the first round.

It is also recommended to use a data table to generate the results. Moreover, 5,000 results are needed to prepare the Monte Carlo simulation.

To prepare the Monte Carlo simulation, you need 5,000 results.

Step 1: Dice Rolling Events

First, we develop a range of data with the results of each of the three dice for 50 rolls. To do this, it is proposed to use the «RANDBETWEEN(1,6)» function. Thus, each time we click F9, we generate a new set of roll results. The «Outcome» cell is the sum total of the results from the three rolls.

Step 2: Range of Outcomes

Then, we need to develop a range of data to identify the possible outcomes for the first round and subsequent rounds. There is a three-column data range. In the first column, we have the numbers one to 18. These figures represent the possible outcomes following rolling the dice three times: The maximum being 3 x 6 = 18. You will note that for cells one and two, the findings are N/A since it is impossible to get a one or a two using three dice. The minimum is three.

In the second column, the possible conclusions after the first round are included. As stated in the initial statement, either the player wins (Win) or loses (Lose), or they replay (Re-roll), depending on the result (the total of three dice rolls).

In the third column, the possible conclusions to subsequent rounds are registered. We can achieve these results using the «IF» function. This ensures that if the result obtained is equivalent to the result obtained in the first round, we win, otherwise we follow the initial rules of the original play to determine whether we re-roll the dice.

Step 3: Conclusions

In this step, we identify the outcome of the 50 dice rolls. The first conclusion can be obtained with an index function. This function searches the possible results of the first round, the conclusion corresponding to the result obtained. For example, when we roll a six, we play again.

One can get the findings of other dice rolls, using an «OR» function and an index function nested in an «IF» function. This function tells Excel, «If the previous result is Win or Lose,» stop rolling the dice because once we have won or lost we are done. Otherwise, we go to the column of the following possible conclusions and we identify the conclusion of the result.

Step 4: Number of Dice Rolls

Now, we determine the number of dice rolls required before losing or winning. To do this, we can use a «COUNTIF» function, which requires Excel to count the results of «Re-roll» and add the number one to it. It adds one because we have one extra round, and we get a final result (win or lose).

Step 5: Simulation

We develop a range to track the results of different simulations. To do this, we will create three columns. In the first column, one of the figures included is 5,000. In the second column, we will look for the result after 50 dice rolls. In the third column, the title of the column, we will look for the number of dice rolls before obtaining the final status (win or lose).

Then, we will create a sensitivity analysis table by using the feature data or Table Data table (this sensitivity will be inserted in the second table and third columns). In this sensitivity analysis, the numbers of events of one to 5,000 must be inserted into cell A1 of the file. In fact, one could choose any empty cell. The idea is simply to force a recalculation each time and thus get new dice rolls (results of new simulations) without damaging the formulas in place.

Step 6: Probability

We can finally calculate the probabilities of winning and losing. We do this using the «COUNTIF» function. The formula counts the number of «win» and «lose» then divides by the total number of events, 5,000, to obtain the respective proportion of one and the other. We finally see that the probability of getting a Win outcome is 73.2% and getting a Lose outcome is therefore 26.8%.

What is Monte Carlo Simulation?

Monte Carlo Simulation is a process of using probability curves to determine the likelihood of an outcome. You may scratch your head here and say… “Hey Rick, a distribution curve has an array of values. So how exactly do I determine the likelihood of an outcome?” And better yet, how do I do that in Microsoft Excel without any special add-ins

Thought you would never ask.

This is done by running the simulation thousands of times and analyzing the distribution of the output. This is particularly important when you are analyzing the output of several distribution curves that feed into one another.

Example:

- # of Units Sold may have a distribution curve

- multiplied by Market price, which may have another distribution curve

- minus variable wages which have another curve

- etc., etc.

Once all these distributions are intermingled, the output can be quite complex. Running thousands of iterations (or simulations) of these curve may give you some insights. This is particularly useful in analyzing potential risk to a decision.

Describe Monte Carlo

When describing Monte Carlo Simulation, I often refer to the 1980’s movie War Games, where a young Mathew Broderick (before Ferris Bueller) is a hacker that uses his dial up modem to hack into the Pentagon computers and start World War 3. Kind of. He then had the Pentagon computers do many simulations of the games Tic Tac Toe to teach the computer that no one will will a nuclear war – and save the world in the process.

Thanks Ferris. You’re a hero.

Here’s a glimpse of the movie to show you big time Monte Carlo in action. I am assuming that you will overlook the politics, the awkward man hugging and of course, Dabney Coleman.

The Monte Carlo Simulation Formula

Distribution Curves

There are various distribution curves you can use to set up your Monte Carlo simulation. And these curves may be interchanged based on the variable. Microsoft doesn’t have a formula called “Do Monte Carlo Simulation” in the menu bar 🙂

Uniform Distribution

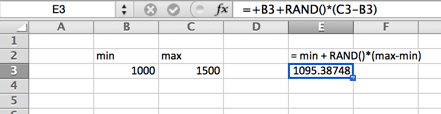

In a uniform distribution, there is equal likelihood anywhere between the minimum and a maximum. A uniform distribution looks like a rectangle.

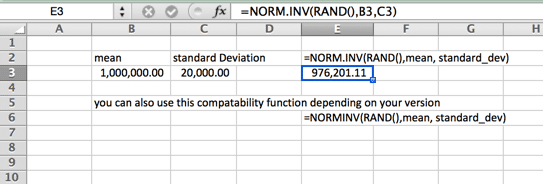

Normal (Gaussian) Distribution

This is also your standard bell shaped curve. This Monte Carlo Simulation Formula is characterized by being evenly distributed on each side (median and mean is the same – and no skewness). The tails of the curve go on to infinity. So this may not be the ideal curve for house prices, where a few top end houses increase the average (mean) well above the median, or in instances where there is a hard minimum or maximum. An example of this may be the minimum wage in your locale. Please note that the name of the function varies depending on your version.

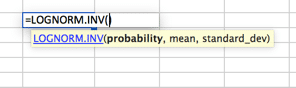

Lognormal Distribution

A distribution where the logarithm is normally distributed with the mean and standard deviation. So the setup is similar to the normal distribution, but please note that the mean and standard_dev variables are meant to represent the logarithm.

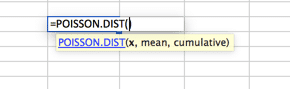

Poisson Distribution

This is likely the most underutilized distribution. By default, many people use a normal distribution curve when Poisson is a better fit for their models. Poisson is best described when there is a large distribution near the very beginning that quickly dissipates to a long tail on one side. An example of this would be a call center, where no calls are answered before second ZERO. Followed by the majority of calls answered in the first 2 intervals (say 30 and 60 seconds) with a quick drop off in volume and a long tail, with very few calls answered in 20 minutes (allegedly).

The purpose here is not to show you every distribution possible in Excel, as that is outside the scope of this article. Rather to ensure that you know that there are many options available for your Monte Carlo Simulation. Do not fall into the trap of assuming that a normal distribution curve is the right fit for all your data modeling. To find more curves, to go the Statistical Functions within your Excel workbook and investigate. If you have questions, pose them in the comments section below.

Building The Model

For this set up we will assume a normal distribution and 1,000 iterations.

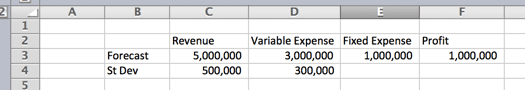

Input Variables

The setup assumes a normal distribution. A normal distribution requires three variables; probability, mean and standard deviation. We will tackle the mean and standard deviation in our first step. I assume a finance forecasting problem that consists of Revenue, Variable and Fixed Expenses. Where Revenue minus Variable Expenses minus Fixed Expenses equals Profit. The Fixed expenses are sunk cost in plant and equipment, so no distribution curve is assumed. Distribution curves are assumed for Revenue and Variable Expenses.

First Simulation

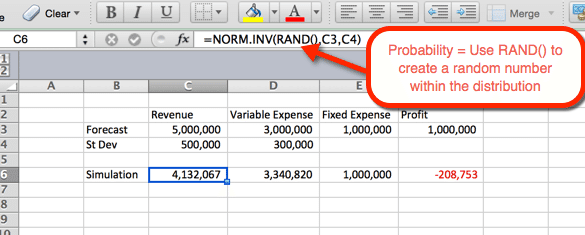

The example below indicates the settings for Revenue. The formula can be copy and pasted to cell D6 for variable expenses. For Revenue and expenses we you the function NORM.INV() where the parameters are:

- Probability = the function RAND() to elicit a random number based on the other criteria within the distribution.

- Mean = The mean used in the Step 1. For Revenue it is C3.

- Standard Deviation = The Standard Deviation used in Step 1. For Revenue it is C4

Since RAND() is used as the probability, a random probability is generated at refresh. We will use this to our advantage in the next step.

1,000 Simulations

There are several ways to do 1,000 or more variations. The simplest option is to take the formula from step #2 and make it absolute. Then copy and paste 1,000 times. That’s simple, but not very fancy. And if Ferris Bueller can save the world by showing a new Tic Tac Toe game to a computer, then we can spice up this analysis as well. Let’s venture into the world of tables.

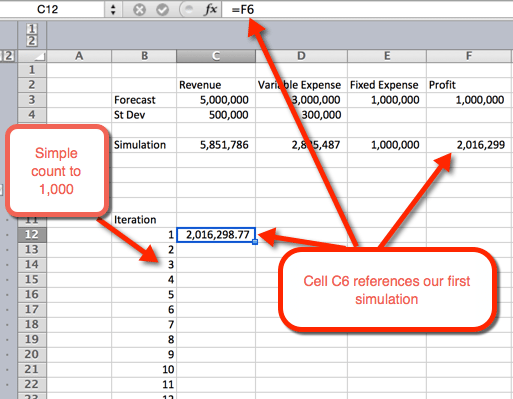

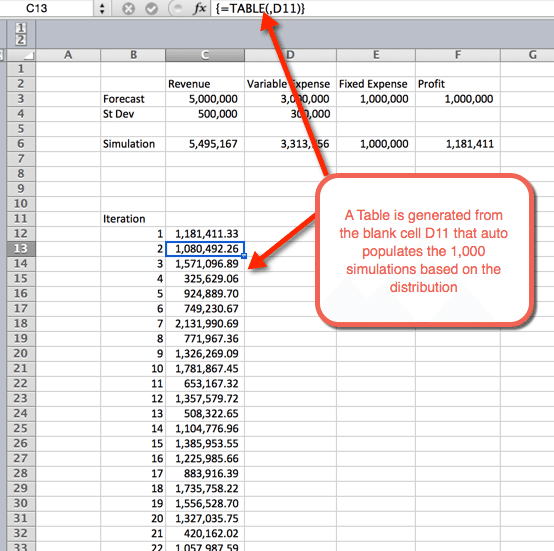

- First we want to create an outline for a table. We do this by listing the numbers 1 to 1,000 in rows. In the example image below, the number list starts in B12.

- in the next column, in cell C12, we will reference the first iteration.

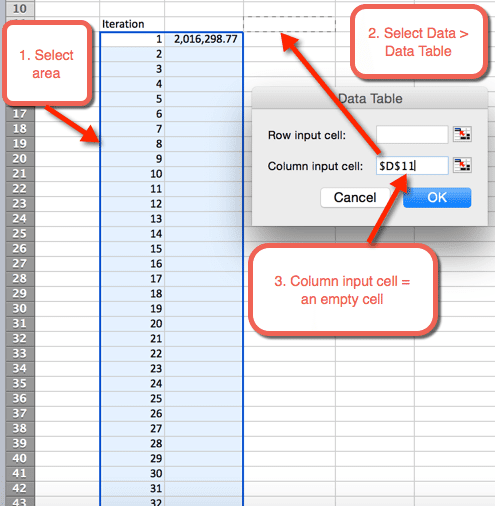

- Next highlight the area where we want to house the 1,000 iterations

- Select Data > Data Tables

- For Column input cell: Select a blank cell. In the download file, cell D11 is selected

- Select OK

- Once OK is selected from the previous step, a table is inserted that autopopulates the 1,000 simulations

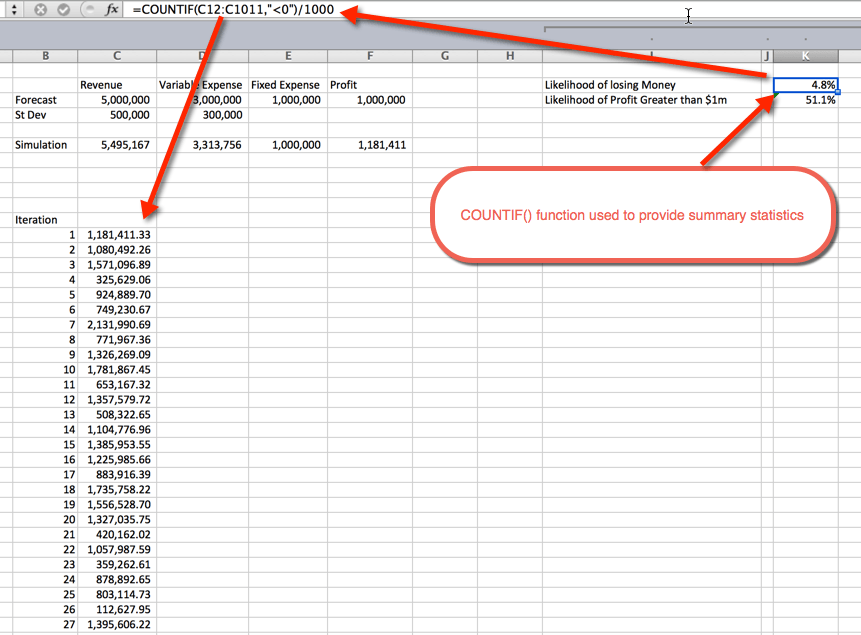

Summary Statistics

Once the simulations are run, it is time to gather summary statistics. This can be done a number of ways. In this example I used the COUNTIF() function to determine the percentage of simulations that are unprofitable, and the likelihood of a profit greater than $1 Million. As expected, the likelihood of greater than $1M hovers around 50%. This is because we used normal distribution curves that are evenly distributed around the mean, which was $1M. The likelihood of losing money is 4.8%. This was gathered by using the COUNTIF() function to count the simulations that were less than zero, and dividing by the 1,000 total iterations.

Get the Download

Now What?

In the video above, Oz asks about the various uses for Monte Carlo Simulation. What have you used it for? Are there any specific examples that you can share with the group? If so, leave a note below in the comments section. Also, feel free to sign up for our newsletter, so that you can stay up to date as new Excel.TV shows are announced. Leave me a message below to stay in contact.

-

All Time Hits, Analytics, Charts and Graphs, Excel Howtos, Featured, Huis, Learn Excel, Posts by Hui, simulation

-

Last updated on June 27, 2013

Chandoo

This is a Guest Post by Hui, an Excel Ninja and One of the Moderators of our Forums. Please note that this post is unusually large by Chandoo.org standards.

============================================================

If anybody asks me what is the best function in excel I am drawn between Sumproduct and Data Tables, Both make handling large amounts of data a breeze, the only thing missing is the Spandex Pants and Red Cape!

How often have you thought of or been asked “I’d like to know what our profit would be for a number of values of an input variable” or “Can I have a graph of Profit vs Cost vs …”

This post is going to detail the use of the Data Table function within Excel, which can help you answer those questions and then so so much more.

- Introduction

- 1 Way Tables

- 2 Way Tables

- Monitor Multiple Variables

- Multiway Tables

- Monte Carlo Analysis

- Iterative Functions and Fractals

- Download Example Workbooks

INTRODUCTION

How often have you thought “I’d like to know what our profit would be for a +/- 10, 20 and 30 % variance in the costs” ?

This post is going to detail the use of the Data Table function within Excel, which can help you answer that question.

The Data Table function is a function that allows a table of what if questions to be posed and answered simply, and is useful in simple what if questions, sensitivity analysis, variance analysis and even Monte Carlo (Stochastic) analysis of real life model within Excel.

The Data Table function should not be confused with the Insert Table function.

DATA TABLE BASICS

The Data Table function is hidden away in different locations within different versions of Excel but apart from the menu location the functionality is the same throughout.

Where is the Data Table Function

Excel 2007/10

In Excel 2007 & 2010 go to the Data Tab, What If Analysis panel and select Data Table

Excel 97-03

In Excel up to 2003 go to the Data Menu and select Table…

Both Excel 97-03 and 2007/10 then bring up the same Data Table dialog box.

… and this simple dialog box is all empowering ?

Yes !

Blue Sky Mine Co

For demonstration of the Data Table function I am going to use a simple profit model of a Gold Mine, “The Blue Sky Mine Co”. This is a fictitious mine but provides a simple model which we can use the data Table function to analyse.

It consists of 6 input variables and a simple cost and revenue model to produce a profit.

In our Blue Sky Gold Mine Co model, we can see that if we mine and treat 1,000,000 t of gold ore containing 1.68 g/t gold, we will make A$ 5.452M profit. But what if the inputs change ?

1 WAY DATA TABLES

Lets make a 1 Way Table with our Blue Sky Gold Mine Co example.

This is shown in the attached Excel Workbook on the “1 Way” Tab or 1 Way Example

In our Blue Sky Gold Mine profit calculation example, we can see that if we mine and treat 1,000,000 t of gold ore containing 1.68 g/t gold, we will make A$ 5.452M profit. But what if the grade is more or less than that value of 1.68 g/t ? After all it is only a geological estimate.

This is what the Data Table function is made for.

Next to the model add a couple of columns as shown in blue

Note: Throughout this post you will see the use of 1E6 in formulas which is simpler to write than 1,000,000.

The first column is a list of values that will be applied to each iteration of the Column Input Cell

The Top Cell of the second Column contains a formula which will retrieve the answer you want to watch, in this case Profit. It will be displayed as M$.

Now select the entire Blue Area and Select Data Table

This is the Data Table input screen.

The tricky/confusing part here is that in our example we are changing the input value to our Gold Mine Profit model using a Column of Numbers, so enter $C$6 in the Column Input Cell, Leave the Row Input Cell blank.

Click Ok

You can now see a Table of Profit Values for each Grade Value.

The variance in the Profit can easily be graphed against the Gold Grade and we can now see that if the Gold Grade is below about 1.55 g/t Au we will not make a profit and conversely if it is above 2.0 g/t Au we will make a large profit.

Before we move onto 2 Way Data Tables it is worth exploring small variations on One Way Tables.

What if my Data is in Rows?

Had our input data been arranged horizontally in Rows, we could have used a Row Input Cell to process the data.

What if I want to vary the inputs by a certain Percentage ?

Another Scenario is often where you want to vary an input by a Fixed Percentage.

This is easily done using Data Tables

Setup the input cells with the percentage variations you want to examine, noting that the values don’t have to be evenly spread.

Setup a Temporary Input Cell, This will hold the Percentage Variance briefly whilst calculations are happening. Set a default value of 0 (zero)

Change your Main Input Cell, Gold Grade in our case, to Multiply the fixed answer by 1+ the temp Input Cell.

Run the Data Table with a Column Input Cell, which will refer to the Temp Input Cell.

2 WAY DATA TABLES

So the Boss comes in and asks, what Happens if the Gold Grade changes as well as the A$/U$ Exchange Rate?

You guessed it, Two Way tables to the rescue.

This is shown in the attached Excel Workbook on the “2 Way” Tab or 2 Way Example

Two way data Tables work the same as One Way Data Tables except that you can vary 2 parameters at once.

With Two Way Data Tables you need to setup a Column of data for one Input and a Row of data for the second Input. The answer is returned at the intersection of the Row and Column.

Here we have setup a Column of Gold Grades ranging from 1.5 to 2.1 g/t Au and a Row of Exchange rates =varying from 0.70 to 1.00 A$/U$

Note at the intersection of the Row and Column there is a Reference to the variable you want to monitor in this case profit.

You can now see the variance in Profit for variations in Gold Grade and Exchange Rate.

What about varying by Percentages?

Once again we can re-arrange the input variables to examine percentage changes in the inputs via a Temporary Input Cell.

MONITORING MULTIPLE VARIABLES

So you have a complex model and want to monitor a number of input and output variables at once. No problems, Data Tables to the rescue.

In this example we are varying one input variable but monitoring 3 Output variables, 2 input variables and then doing a calculation all as part of the Data Table.

This is shown in the attached Excel Workbook on the “Monitor Multi variables” Tab or Monitor Multi Variables Example

The first 3 columns, Total Cost, Revenue and Profit are output variables even though Total Cost doesn’t change, we can still monitor it to make sure our model is working correctly

The next 2 columns, Gold Grade and Gold Price are input variables even though only Gold Grade is being varied.

The last column Cost per Oz is not calculated as part of the model (ok sometimes we forget don’t we), but it can be calculated on the fly as part of the Data Table.

The result is:

MULTIWAY DATA TABLES

But I hear you thinking, “If Data Tables are so good why can I only Change 2 variables at Once? I want to change more! “.

No Problems

Data Tables in fact allow you to Change any Number of input variables at once and monitor any number of input and output variables. It does however require a slight of hand.

This is shown in the attached Excel Workbook on the “Multi Way Tables” Tab or Multiway Table Example

First things first,

Setup a table of what scenarios you want to examine:

Setup the Data Table area to monitor Inputs, Outputs and Calculated Fields

Note that the Input Data Column will be used to select the Scenario No.

Also note that we have setup F2 to retrieve the Scenarios Name.

And in H6 we will put the Scenario name into the Data Table, who said Data Tables were only for Numbers!

Next Link the Model to the scenario

And run the Data Table

Note how the Description Column is populated with the Scenario’s Name (Text values)

So now when your boss asks you what effect the price of … has on the budget, you know where to turn.

MONTE CARLO SIMULATIONS IN EXCEL

Monte Carlo simulation (or analysis) as its name suggests puts an element of gambling into the scenarios, or more correctly allows you to measure the effect of variability on input parameters.

This is done by running scenarios against your model hundreds or thousands of times and changing the inputs each time and then measuring the effects at the end of the runs.

And Data Tables can do that? Absolutely!

First some statistics.

Everything in life has variability, from the size of Zebra’s Strips, The height of people and the Arrival times of trains, the time that people read this post, the time that it takes people to read this post.

Most things are variable around a central or mean (average) value. The spread of variability is commonly known as the distribution.

Distributions can have many names and shapes, but common ones are

- Normal: Bell shaped around a mean

- Uniform: All values have an even chance of selection

- Exponential: Low or High values have a much higher probability that the other values

In life most distributions are Normal in nature indicating that the distribution is Bell shaped around a mean with a known method of describing the variability around this.

Excel has 2 functions that produce Random numbers, Rand() and Randbetween(). These 2 functions both have a Uniform Distribution, that is any value between the minimum and maximum values will have the same probability of being chosen.

We can convert a uniform distribution to a Normal distribution by some simple maths (simple to do, not simple to explain).

=norminv(rand(),mean,standard_dev)

Example =NORMINV(rand(),100,10)

Will generate a distribution of random numbers centred on 100 with a spread having a bell shaped curve with a standard deviation of 10. This means that the function will produce a number with a 99.7% probability of being between 70 and 130 and on average will have a mean of 100.

Monte Carlo simulations

So how can I use this and Data Tables to do Monte Carlo simulations.

Before we go any further the author wants to explicitly state that he is not suggesting that the use of Normal Distributions for the variables modeled below is appropriate, except for the purpose of demonstration of the principles behind Monte Carlo Modelling.

As with all models you need to have a good understanding of the distribution of inputs before you start playing with simulations or of which Monte Carlo is but one type. ie: Rubbish In Rubbish Out.

We can model an input vaiable, in this case Exchange rate with a distribution instead of a fixed value and then run the model a number of times and see what impact the variation has on the output.

This is shown in the attached Excel Workbook on the “Monte Carlo (Simple)” Tab or Monte Carlo (Simple) Example

The formula =NORMINV(RAND(),0.92,0.02), will generate a Random Exchange Rate with a distribution based on a mean on 0.92 A$/U$ and a spread of approximately 6 cents each way ie: there will be a 99.7% probability of the exchange rate being between 0.86 and 0.98 A$/U$.

Copying the formula down from H6 to H1005 will allow our data table to generate 1000 iterations of the model each with a randomly generated Exchange Rate.

In the model above, you can see that for a Base case exchange rate of 0.92 the profit is $M 5.452, however after running 1000 simulations the profit is actually $M 5.7134. More important is that you can now run statistics on the model to tell what is the probability of the profit being greater than 0.00 based on variance in the exchange rate etc.

Note 1: You will note that in the above data table that the Input Column (darker blue) has the formula for calculating a random input grade from a distribution. =NORMINV(RAND(),0.92,0.02)

This is a Volatile Formula , ie: It recalculates every time the worksheet changes.

What this means for the worksheet is that when the Data Table goes to Calculate Row 2 of the Data Table it will recalculate the Input value for Row 1.

On Calculation of Row 2, It doesn’t change the Table Values for Row 1, just the Input Column value.

So after 1,000 calculations of the Data Table, the Input Column values will have no relationship to the data from the original Calculations stored in the Data Table body area.

To make up for this we also add an Input variable to the Data Table.

Doing this allows the Data Table to capture and store both the Input variable and corresponding Output variable in the Data Table’s Body.

Note 2: Always run at least 1000 iterations of Monte Carlo models. This is to ensure that you have a statistical chance of getting sufficient outliers (extreme values) to make the variance analysis meaningful. This is important because as the number of iterations increases the variance of the average output decreases.

Press F9 a few times and watch the average H6:H1005 change.

Try changing the Data table from 1,000 rows to 10, 20 or 100,0000 rows. As the number of iterations increases the variance in the average of the output decreases.

Advanced Monte Carlo Simulations

We can now put our knowledge of Data Tables and Monte Carlo Simulation to the test by varying 4 input variables at the same time.

This is shown in the attached Excel Workbook on the “Monte Carlo (Advanced)” Tab or Monte Carlo (Adv) Example

In the example below we have inserted distributions for 4 input variables.

| Ore Tonnes | Mean 1,000,000 tonnes | Standard Deviation of 100,000 tonnes |

| Gold Grade | Mean 1.68 g/t Au | Standard Deviation of 0.1 g/t Au |

| Gold Price | Mean 1,200 U$/Oz | Standard Deviation of 100 U$/Oz |

| Exchange rate | Mean 0.92 A$/U$ | Standard Deviation of 0.02 A$/U$ |

And setup a data Table for the 4 Input Variables and main output variable, Profit.

Note: When this model is run through the Data Table, note that the Row or Column input cells can be set to anywhere. The Model is not using the value of the Input Cell (Row or Column) and isn’t even using the Run No (Column F) for the model, the data table is simply being used to run lots of iterations of the model, with the variability coming from the Random Numbers in the 4 input cells.

ITERATED FUNCTIONS INCLUDING FRACTALS

At a meeting in early 2005, the company I was working for was looking at an integrated Scheduling & Budgeting system.

The salesman gave a great demo except that the system would take approx. 30 mins to calculate our budget as opposed to a half a second in Excel.

Complaining I mentioned that our current, Excel based, system could do the job in seconds.

And he returned stating that “the system was doing a lot of things Excel couldn’t do”.

I responded “but Excel can do anything”

and he immediately shot back that “Excel can’t do a Mandelbrot”

To which I responded “Yes it can”

And he responded “Not without VB Code”

Without too much thinking I responded that I would accept the Challenge.

The attached file, which is described below is my response.

Excel Mandelbrot

The attached file is an implementation of the classic Mandelbrot implemented in Excel without the use of VBA code.

A Mandelbrot is a graphical display of the simple equation Zn+1 = Zn2 + c, where Z is a complex number (x +iy).

Which is described at http://en.wikipedia.org/wiki/Mandelbrot_set

This can be solved in the real X-Y domain using:

Xnew = Xold2 – Yold2 + X_Orig and

Ynew = 2 * Yold * Xold+ Y_Orig

Study of iterated functions reveals that these functions will either converge on an answer or diverge once a boundary has been breached

In the case of the Mandelbrot, this function diverges after the function Z2 > 4

So to construct a Mandelbrot a program needs simply to

- Loop from Xmin to Xmax in small steps and

- Loop from Ymin to Ymax in small steps and

- For every X, Y Point in the above 2 loops, solve the above equations until the answer is > 4

- Color the screen according to how many iterations it took to diverge or not

Simple…

Except that Excel doesn’t have any looping functions unless you use VBA Code

The calculation of the solution for any X, Y starting point is simple enough using a series of Rows and Columns where each Cells is the starting iteration of the solution for each various X, Y co-ordinate.

This is shown in the Calculations page in the Xnew, Ynew, Xold, Yold, Rsq and Count columns.

The iterations are simply done in the Xnew and Ynew columns

For each iteration we check that the Z2 value hasn’t diverged (not > 4) (Xnew2 + Ynew2)

And keep track of how many iterations it took to diverge, the Count Column

The above 5 lines I refer to below as the Calculator.

The trick to working out how to do this for a X-Y Grid was the use of the Table Function to send the starting positions to the Calculator and return the Count for that location.

This is the large Yellow Area.

The Large yellow area (Data Table Area) is flanked on the Top and Left by the X and Y co-ordinates for a grid encompassing the area which we want to plot.

The Table Function extracts the Top and Left values and puts them in the X Orig and Y Orig positions of the calculator.

The Calculator returns the Count of the Divergence of the Calculator to the H2 position (Top Left corner of the Grid) and that value is stored at the Grid Location.

The Data Table repeats this for each position in the X-Y Grid.

An Excel Surface Chart can then Chart the Large Yellow area in effect creating a Traditional Mandelbrot plot by joining up adjacent areas of equal value (Contouring).

The Chart can also be displayed as a 3D-Surface rather than a Contour Chart for a dramatic effect.

Zooming In can be added by adding code that allows the user to say Right click in the Large Yellow area and the code will then take the Co-ordinates and Zoom in by a fixed factor

Zooming Out can be added by adding code that allows the user to say Double click in the Large Yellow area and the code will then take the Co-ordinates and Zoom out by a fixed factor

DOWNLOAD EXAMPLE WORKBOOKS

Download the complete example workbooks described above and practice data tables on your own.

- Click here to download Gold Mine Monte Carlo Simulations & Data Tables workbook. [XL 2003 version here]

- Click here to download Excel Mandelbrot workbook.

Note: A few people have said the above files either Hang or Freeze there PC’s. This is probably because they have a number of large Data Tables within them.

I have uploaded each Tab as a separate Excel 2007 file, see below:

1. 1 Way.xlsx

2. 2 Way.xlsx

3. Monitor Multi Variables.xlsx

4. Multiway Table.xlsx

5. Monte Carlo Simple (updated)

6. Monte Carlo (Adv).xlsx

In the Example Files some of the Data Tables have been removed and there are instructions on how to re-instate them included in the file.

FINAL THOUGHTS

Speed

If you start adding a number of Data Tables to Complex Models you will rapidly cause even the fastest machines to grind to a halt.

VBA

The best way around the above speed issue is to setup a number of Data Tables for whatever analysis you wish to undertake. Then as you run each analysis copy the Data Table Data Area, The area between the Rows and Columns and paste it as values over itself. Then move onto the next data table and run it.

This allows the Data Tables to be quickly recalculated if required.

This process can be automated via 3 lines of VBA code for each Data Table.

‘Calculate Data Table in F5:H18, using Column Input cell C9

Range(“F5:H18”).Table ColumnInput:=Range(“C9”)

‘Copy Data Area as Values

Range(“G6:H18”).Copy

Range(“G6:H18”).PasteSpecial Paste:=xlPasteValues

‘Repeat Above for each Data Table

‘Deselect Current Range

Application.CutCopyMode = False

Cell Contents

If you look at a cell in a Data Table you will see something like:

- {=TABLE(,E5)}: for a Column Input Cell

- {=TABLE(E4,)}: for a Row Input Cell

- {=TABLE(E4,E5)}: for a Row and Column Input Cell

Although these appear like Array Formula, they cannot be manually set.

So setting up a data table and typing =TABLE(,E5) Ctrl-Shift-Enter, only produces an error message.

Further Reading & References

- http://www.exceluser.com/explore/statsnormal.htm

- http://www.vertex42.com/ExcelArticles/mc/GeneratingRandomInputs.html

- http://www.itl.nist.gov/div898/handbook/eda/section3/eda366.htm

- http://en.wikipedia.org/wiki/Mandelbrot_set

- http://chandoo.org/wp/2011/06/20/analyse-data-like-a-super-hero/

Added by Chandoo

This post is by far one of the most comprehensive posts on Chandoo.org. And each of the 3100+ words in it show the passion and knowledge that Hui has. Thank you so much Hui for sharing this wealth of knowledge with our members.I have learned a lot of interesting and useful things from this article.

If you have enjoyed this article, please say thanks to Hui.

Share this tip with your colleagues

Get FREE Excel + Power BI Tips

Simple, fun and useful emails, once per week.

Learn & be awesome.

-

205 Comments -

Ask a question or say something… -

Tagged under

1way tables, 2way tables, Analytics, data tables, downloads, fractals, guest posts, hui, mandelbrot, Microsoft Excel Formulas, modeling, monte carlo simulations, multiway data tables, scenarios, simulation, spreadsheets, what-if analysis

-

Category:

All Time Hits, Analytics, Charts and Graphs, Excel Howtos, Featured, Huis, Learn Excel, Posts by Hui, simulation

Welcome to Chandoo.org

Thank you so much for visiting. My aim is to make you awesome in Excel & Power BI. I do this by sharing videos, tips, examples and downloads on this website. There are more than 1,000 pages with all things Excel, Power BI, Dashboards & VBA here. Go ahead and spend few minutes to be AWESOME.

Read my story • FREE Excel tips book

Excel School made me great at work.

5/5

From simple to complex, there is a formula for every occasion. Check out the list now.

Calendars, invoices, trackers and much more. All free, fun and fantastic.

Power Query, Data model, DAX, Filters, Slicers, Conditional formats and beautiful charts. It’s all here.

Still on fence about Power BI? In this getting started guide, learn what is Power BI, how to get it and how to create your first report from scratch.

Related Tips

205 Responses to “Data Tables & Monte Carlo Simulations in Excel – A Comprehensive Guide”

-

Hi

Looks like a grate post, I’ll need to give some time over to reading it fully, thanks Hui,

Ross -

oldchippy says:

Hats off to Hui,

Can’t say i’ve ever used that in Excel before, but thanks for the introduction

-

Martin says:

Hui,

definitively, another post to print for the travel back home…Without all your knowledge, I am a convinced that Excel can do everything, but in my case it’s more a question of faith, rather than knowledge…

Thanks for sharing, and thanks Chandoo for giving him the space !

Rgds,

Martin

-

Excellent post describing a powerful yet unknown/underused feature of Excel.

-

Taf says:

1st of all thanks to Hui!

And great bost, maybe the most usefull i’ve seen here so far. I already knew of excels capabilities in this area but often couldn’t find it well described before…

Thanks for the crytal clear explanation!

-

Very thorough use of the tables functions! I wonder though, wouldn’t creating a Pivot table after the fact make rearranging these various scenarios a lot easier?

Also, have you tried using the Analysis ToolPack for the Monte Carlo simulations? I’m curious if it has any similar functionality (it’s disabled for some bizarre reason at my place of work).

-

lhm says:

Nice post, funny — there was a very similar discussion about monte carlo and mandelbrot a few days back, don’t know if that’s just coincidence?

See: http://www.excelhero.com/blog/2010/03/monte-carlo-pi.htmlThe linked workbook is in hi-res so takes a little while, but is worth the wait — maybe someone can help speed it up? (eg using IF(ISNA(…) in the iterations runs about 1/3 quicker)

As mentioned there, to improve performance of Monte Carlo, you need to find ways to reduce the variation. In fact, since convergence is order root n, every additional digit of precision requires 100 times more computations! Lori

-

Hui says:

@ All, Thanx for the words of appreciation.

@ LHM, although the Monte Carlo system is in use in both examples, Excel Hero is using the weight of numbers to zero in on an answer and yes the more iterations you do the more accurate it is, as it is a definaite formula that gets you closer to the answer the more you feed into it.In Monte Carlo analysis of variability you never get the right answer, regardless of how many iterations you do. What you do need to do is do enough iterations that the results are statistically accurate. Generally for a Normal Distribution you need a minimum of 30 points to define a statistical population which will be representative of the real population.

Because you are generally interested on the probability of the results of the simulation being above/below a certain range, you are more interested in the outliers, than the mean. This means that you need enough outliers to be presented to be a representative population of outliers. For a Normal distribution where +/- 3 Standard Deviations is 99.7% of the population if you then want 30 samples in the remainder 0.3% you need 30 x 100/0.3 or about 10,000 iterations to guarantee a sufficient sample of outliers. This is starting to become a large number and most people run in the 1-10,000 iteration range and then check that sufficient outliers have been presented. -

Kanti Chiba says:

Hui & Chandoo,

This was a very instructive post learned a great deal from it.I split out the High and Low in the scenario description and creted a high and low field to hold a percentage and then linked the scenario data to these fileds so that I could change what High and Low meant. If you wanted to test for +10% for high you would put 10% in the High field, or if you wanted to test for a low of 8% you could put -8% in the low field.

The possibilities are endless.

Thanks once again for the post

-

Chris says:

Hui et. al.,

I dont’ really see the advantage of doing this in data tables and not running the iterations in vba? Certainly it isn’t any faster.

Seriously speaking MC Valuation need a few thousand iterations, i don’t think you’ll like to do that within the sheet. I’d prefer looping it in VBA for smaller projects, for larger ones you need to switch to oracles crystal ball or sth similar.Never the less, i really liked the application of advanced excel methods.

Thy

-

Hui… says:

@Chris

I ran the Multi Way Tables example with 4 inputs and 5 output variables

with 1,000,000 iterations in the Data Table in about 8 secondsUsing VBA to do 100,000 iterations took about 230 seconds

I Deleted all the other sheets to speed it up in both casesExcel easily handles 100,000+ iterations on modestly complex models with ease

I try and use the native functions of Excel as opposed to VBA as much as possible, they are just so much faster.

The low iteration count in the example models were for demonstration purposes only.

-

Abhishek says:

just one word for this «AWESOME»

-

Lucasini says:

Hui, great post, you and Chandoo really qualify as an =»Excel » & POWER(Ninja,99) — someday I will get there.

I have to say that I agree with your «Excel can do -almost- anything» statement, I prove it everyday in my workplace.

In all my years of working with Excel I´ve learned an important lesson, the very first and ultimate principle that determines the approach to take with an Excel problem: Whatever you can do with the built in Excel functions would run faster and better than if you do the same thing with macros. The problem is that the common mortal doesn´t know what tools he can use, or how to use them.

I have to admit that I dont use the Data Table feature but I like´d your way to do the fractal iterations!

There is another way to make iterations in Excel… you can use one of the most powerful but concealed feature (and often considered only as an error warning): circular references. Of course, you have to make more complex formulas, you have to be careful with the physical placement of your variables and calculations, but you can write really complex models with it!Great work, keep the good posts coming!!!!

P.D.: Sorry about my english, It´s not my native language!

-

[…] He elegantly guides you through the wonderful process of what-if. […]

-

John N says:

Stunning!

-

Gene K says:

Hui, great article with a lot of insight. I will need more time to get everything out of it, but I have learned a great deal already. Thanks.

-

Kwesi says:

All of the inputs in my workbook are on a different sheet. When I try to create a data table I get the error message » Input Cell Reference Is Not Valid «. Is there a workaround?

-

Hui… says:

Kwesi

Setup an input area on the same sheet as where the data Tables will go

Link the real inputs to these values

Run the data tables on these valuesIt is a shame that you can’t use named ranges here to get around this issue, like you can elsewhere where inter-sheet formulas can’t be used.

-

Dilishan says:

Hi..

Montecarlo simulation using excel is amazing. I really appreciate you for sharing the knowledge.

I have this question for you.

Let us say I am trying to figure out the variation in profit for variable A. Using the method suggested I can run the montecarlo simulation. I want to draw a graph at each iteration (X axis- Different units of variable A), (Y axis — Different profit levels which corresponds to different variable units.)

So once the iterations are over a chart will be drawn where this could be used as an efficient frontier.Please let me know whether it will be possible. If this can be done we all have to agree that Excel can do wonders.

Many thanks in advance for your support

-

Hui… says:

Dilishan

You have 2 easy options here:1. Scatter Chart — As you have a table of Input Values and results next to it in the actual Data Table, it is a few clicks to chart the data as a scatter chart. You should see more symbols near the mean value and less as you get towards the outliers.

2. Cummulative Column Chart — The most common method of Charting Distributions is a Column Chart and associated Cummulative Line Chart (like http://i26.tinypic.com/34yo20k.png ) .

This will require you to setup an area where you have a list of result containers, ie: If your results go from 0 to 100, you may want to setup containers every 5, 0-4.99, 5-9.99,10-14.99 etc and then use a sumifs or sumproduct to count how many times these results are in the Solution part of the Data Table. -

Ankit says:

i wanted to knw the procedure of sum the numeric value in one sentance

-

Hui… says:

Ankit

You can do something like:

=Sum(1,2,4,10) which will give you the answer of 17

or

=Sum(A1, A3, A5, A10) which will add up the values in those cells

or

=Sum(A1:A5) will add up all the values in the Range A1:A4

or a combination of the above

=Sum(2,4,A5, A7) which will add 6 (2 + 4 ) to the values in A5 + A7 -

Chris says:

Fantastic article, just helped me save hours of work!

-

Gary says:

Great article. Microsoft should be paying royalties!

Thanks. -

junius says:

Excellent post. You should check out http://tukhi.com. One of the examples in the Mosteller workbook plays the game of craps!

-

james says:

this is pretty cool.

anyone know how to make a data table of a data table?

i.e. i want to run a model for N period where each period is dependent upon the previous period while varying multiple input variables.

then i want an outer loop running the above model for M iterations to find the optimal settings for the input variables based on summary statistics found for each iteration

when i try a data table referencing another data table the referenced data table does not change, so i only get iterations for 1 set of input variables

-

@James

I know it is 7 years late, But I have worked out how to achieve this.

Post a question in the Forums and attach a sample file

Hui…

-

-

Sesky says:

One of the best articles I have ever read on Excel.

Thank you very much Hui. -

Rutgerius says:

Hello, please can I know how you created the Large yellow area (Data Table Area)?

Thanks

Rut -

Bill says:

Is there any way to unsubscribe from comment posts? I think my last comment was a year ago….

-

@Bill.. you can unsubscribe from the email alert you get. There should be a link to managing your profile in that mail.

-

Hui… says:

@Rutgerius

The large yellow area is the Data Table area

You only need to populate the Top Row and Left Column

Then Use the Data Table command to fill it.

Select Cells D2:DE103 and goto Data Table

Select cells for the Row and Column Inputs as described in the text above -

schizophrenia says:

hi,i need some help with the data table.Could please explain how you did the yellow data table for the Mandelbrot set in much details as possible and stepwise..thanks

-

Rutgerius says:

Hi

I tried it.. but it aint working 😐

-

Hui… says:

@Schizophrenia, Rutgerius

.

For a start thanx for taking the interest in this post.

.

1. Download the Mandelbrot Spreadsheet from: http://cid-b663e096d6c08c74.skydrive.live.com/self.aspx/Public/excel-mandelbrot.xls

Don’t click on the icon and open it in the web browser.

It is an .xls file and will work in all versions of Excel.

.

2. Goto the Calculations Page and select I3

3. Press Ctrl Shift Right, Ctrl Shift Down, Delete

This will select and delete the range I3:DE103

4. Go back to H2

5. Press Ctrl Shift Right, Ctrl Shift Down,

This will select the range H2:DE103

6. With your mouse got the Data Tab, What If Button and select Data Table

7. In the Data Table dialog enter

Row input cell: E5

Column input cell: E6

.

Voila -

schizophrenia says:

thank you much..it works!:)..it was of a great help for my project at university..

-

james says:

@hui

any idea for my earlier posted problem?

thanks.

-

Hui… says:

@James

Do you have an example you can email or post for me to see what your trying to do?

-

@hui

couldn’t find your email, trying google docs

https://docs.google.com/leaf?id=0B00vs4RO2HKmN2I0OTRkNGEtMWYxNy00ODIzLWJhMjEtYmMyNTUwZDJjYjZi&hl=en&authkey=CI-XlFQthe top middle portion show 1 iteration with 4 periods, the right data table is 1000 iterations of it

then, as you can see the bottom 2-way data table is referencing the data table on the right, but the different prices and supplies are not being used.

supposing that works, next i want to be able to change the prices from period to period for each iteration, (i.e. 60-45-55-70) [all possible permutations of price-period combinations]

Thanks!

-

Hui… says:

Why not just use the first Table and run for 20 -50,000 iterations

Change

F3: =CHOOSE(RANDBETWEEN(1,6),45,50,55,60,65,70)

C20: =CHOOSE(RANDBETWEEN(1,6),1500,2000,2500,3000,3500,4000)

Add 2 columns to the table

to show Price and Fleet size

and feed results into a pivot tabl

as per: http://rapidshare.com/files/432543642/data_table_referencing_another_data_table_Hui_ver.xls -

james says:

thanks! that’s an interesting approach, never used pivot tables before,

if i’m understanding correctly from the file, this means the number of 45’s vs 50’s vs 55’s prices may differ, so I can’t compare across supplies for averages computed upon the same sample sizes

same goes for the number of iterations that use 1500, or 2000’s — they will differ.

anyway to have a fixed amount of all of them? ( i guess you could have 6 * 6 * 1000 iterations…)

-

Hui… says:

That’s why you do a large number of iterations

You can also do a count in the pivot table to see how many iterations fall into each category -

james says:

say i need exactly 1000 45’s and 1000 50’s and 1000 55’s though?

is the way to private msg on this board without revealing email? -

Rob says:

Great post, I would just comment that the formula you are using to calculate percentage change in the one way table should be =1.68*(1+E2)

-

Dionne says:

Hi Hui

I have a question about using a data table to do scenario analysis on a model I have built. The model has an INPUT tab/worksheet where I have placed my data table. However all the inputs pull onto a second tab (Profit and Loss) to calculate the output value which I want to use in my scenario data table. The data table is not producing the correct values. So my question is: for a data table to work, do all inputs AND calculations need to be on the same tab/worksheet?

-

Hui… says:

@Dionne

Yes, All inputs/ouputs have to be on the same sheet as the Data Table

But this can easily be done with an input/output area, which will be linked to other parts of your model as appropriate

Calculations can go across any number of sheets -

Hi Chandoo,

Congratulations for the great work!

I have a couple of questions regarding excel.1) How can I generate auto correlated numbers in excel – Suppose I have fixed the correlation to be 0.7 ( Corr(X,Y) =0.7) then how can I generate random X,Y for it? Is there any way to fix Intra class correlation and generate X,Y for it?

2) How a Monte Carlo simulation can be done to test Krippendorff’s Alpha ( statistical parameter) against Intra class Correlation?

It would be really thankful for your reply!

Thanks!

-

[…] Related Tip: Learn how to work with Data Tables & Monte-carlo Simulations in Excel […]

-

Natalia says:

Thank you sooooo much Hui!

A life changing post for me!

Happy Valentines too 🙂

-

Carlos Santana says:

Thank Hui, your contribution is excellent, and use to calculate the value of the premiums for helth insurance.

-

@ Natalia & Carlos

Thanx for your kind words

Hui… -

Kathleen says:

Hui,

Thank you so much for this valuable information! I have a question regarding the Monte Carlo Simulation (Simple.) You state, «The formula =NORMINV(RAND(),0.92,0.02), will generate a Random Exchange Rate with a distribution based on a mean on 0.92 A$/U$ and a spread of approximately 6 cents each way ie: there will be a 99.7% probability of the exchange rate being between 0.86 and 0.98 A$/U$.» My question is: how did you determine the 0.02? I realize that 3 standard deviations will give us the range between 0.86 and 0.98, but how did you determine the 0.02 in the first place? Why not 0.01 or 0.03 or some other number?

Thanks! -

@Kathleen

The Norminv function accepts 3 Parameters

=NORMINV(probability,mean,standard_dev)

.

The 0.92 and 0.02 are the Mean and Standard Deviation that the distribution I used had.

.

In this case the 2 numbers are made up for Demonstration ourposes only.

Had I used a SD of 0.02 or 0.2 or 0.3 the Ranges Distribution would change, but it will still have a 99.7% probability of being within the Mean +/- 3 SD’s.

.

In reality you will take a number of measurements of your data and then work out what the actual distribution (Mean and Standard Deviation) of the data is. -

[…] One area where Random numbers is used is in Monte Carlo Simulation. This has been discussed at Chandoo.org at Data Tables and Monte-Carlo Simulations in Excel a Comprehensive Guide […]

-

Sam says:

Hi Hui

Very good work. I am just not too sure one one particular point. Why is it that the Exchange rate you generated using «=NORMINV(probability,mean,standard_dev)» be different to what you have in the «Ex Rate» column? Shouldn’t they be the same?

Thanks

Sam

-

Nitin says:

Hi Chandoo,

I downloaded both xls and xlsx versions of the file «gold-mine-monte-carlo-analysis» and attempted to open them twice. On both occasions, MS Excel simply hung up and I had restart it. Is there something wrong with my machine? I think it’s unlikely there can be something wrong with your two files…pls advise. Cheers!

-

@Nitin

Both files are still Ok

.

Click on the link and then select either

1. The Download Link which will open the Download as Dialog

or

2. Click on the large Spreadsheet Icon in the middle of the screen which will open the files in the browser, then File, Save a copy -

Srini says:

good information is presented. Thanks

-

Srini says:

Chandoo, I need a help from you. Could you send the procedure of how to copy the values automatically into other cells using a macros? After completing the data table functions, I need to copy the STDEV of the generated numbers. I want to select the min STDEV. Kindly help me out of this.

-

Nitin says:

Hi Hui,

Thanks for responding. As mentioned earlier, I have complete faith in Chandoo.org. However I regret to state that in spite of following the process you mentioned, I continue to face the same problem — both files simply take too long to load and in the meantime, MS Excel hangs — this in spite of a machine with C2D processor and 2GB RAM. Apologies for bothering you time and again, but could you suggest some other course of action? Thanks!

-

[…] few people have told me that the example files in Data Tables & Monte Carlo Simulations in Excel – A Comprehensive Guide either Hangs or Freezes there […]

-

Dotcomsx says:

All good ,Top stuff

Keep the good work

-

Ambiguous Error says:

Wonderful work Hui & thanks for sharing :o)

I find the Madlebrot set fascinating, although my PC didn’t like the chart.

To get around this I applied xl 07 Graded Colour Scale Conditional formatting to the, once yellow, area. Zooming out this gives a very similar effect & less resource heavy.

Off to see if I can apply different distributions to the Monte Carlo exercise.+ 1e6 Internets

-

Ghazanfar J says:

=kick(«ass»,»everybody’s»)

-

kim says:

anyone know why i am getting the same output for every cell in the table?

-

@Kim

You have probably put the Data Table link in the Row Input Cell instead of the Column Input Cell or vise versa -

[…] Hui and Chandoo have been speaking a lot about the data tables. They are your best friends when it comes to doing the donkey work about changing the variables and noting the scenario results. One post that I love is here. […]

-

Elkhan says:

Hui,

first of all, thanks a lot for this post. it is great and what I have been looking for to understand how data tables work.

I have a question about 1 way (or 2 way) data tables using percentage variation of inputs. you recommend using formula for input cell (e.g. gold grade) as =INPUT*1+Temp.Input.Cell. So, using this logic, -50% as in your spreadsheet, gives -15.5 M$ profit which corresponds to 1.18 (i.e. 1.68-0.5). However, for some people, to me at least, -50% more logically means half of the original value, i.e. 1.68-50%=0.84. In this case the formula for the input cell should be =INPUT*(1+Temp.Input.Cell).

thanks again for the great help -

@Elkhan

I’m glad that you liked the post.

I nearly use Data tables as much as Sumproduct, it is such a powerful function.

.

Great pickup on the formula

You are totally correct that the formula should be

=INPUT*(1+Temp.Input.Cell)

.

I will severely scold the proof reader… -

anup says:

Hui

thank you very much for this wonderful post.Regards

Anup -

Ulrik says:

Excellent article Hui — thanks for unearthing such a beautiful and potent gem from the Excel vault!

-

[…] myself an expert by any measure. There were areas where I was very competent (Sumproduct & Data Tables) and I do consider myself very good at systems analysis, but I was no way an excel […]

-

Andy Holaday says:

In the first 1-Way Table (http://chandoo.org/wp/2010/05/06/data-tables-monte-carlo-simulations-in-excel-a-comprehensive-guide/#1way-tables) I tried using NormInv to vary the Gold Price using formula =NORMINV(RAND(),1.68,0.1). This produces profit results that are completely inconsistent with the input values.

The problem is easy to see if the input value is rounded to produce a few discrete values: =ROUND(NORMINV(RAND(),1.68,0.1),1). Here is a partial sample output from the table using rounded inputs:

5.45

1.70 2.10

1.80 10.48

1.80 6.29

1.70 2.10

1.80 6.29

1.80 10.48

…

How is it that the same input value can produce different outputs? I’m guessing that somehow the call to volatile Rand() causes the Table to evaluate a different value than what is shown. If you look at the output values, they are discrete as well (as expected), but it seems they are mismatched with the inputs.As a test, I tried a different randomizing function for Gold Price =INT(RAND()*3)+168. The same problem occurs: the same input can yield different output in different trials.

I guess the moral of the story is not to use Rand() in the input variable formula. Has anyone else noticed this behavior?

-

@Andy

Thank you for pointing this out

.

There are two things that could be going on here.

.

1. Excel Version

In Excel versions up to XP Norminv returns errors from time to time

Refer: http://support.microsoft.com/kb/827358

.

2. Rand()

Your suggestion as to the Volatile Rand is correct

The Data Table recalculates after every iteration of each cell in the Input Row/Column.

So when the second row calculates, it forces the input cell in the first row to recalculate.

So in the example the Input Column is recalculated 9 times after the first iteration scrambling the input grades.

The Profit figures in that example are still correct as they haven’t been recalculated, its just the input column that is incorrect.

.

Workaround

Luckily there is an easy work around for this:

When setting up the data table at another column that will link to the Input Cell (C10)

in this example

Gold Grade Profit Grade

5.5 1.68

1.70 $6.3 1.70

1.80 $2.1 1.60

1.70 $2.1 1.60

1.70 $10.5 1.80

1.50 $6.3 1.70

1.70 -$2.1 1.50

1.60 $2.1 1.60

1.80 $6.3 1.70

1.60 $10.5 1.80

1.60 -$2.1 1.50

.

You can see above that the Profit is now consistent with the Grade Column, but not the input grade column. -

Andy Holaday says:

@Hui

Great explanation, and the work-around is so simple I couldn’t see it. BTW, this is a great article! I’ve never seen the Excel Data Table function explained so well anywhere else. -

Yun says:

Thank you so much for the information 🙂

-

Premalatha says:

In the first 1-Way Table (http://chandoo.org/wp/2010/05/06/data-tables-monte-carlo-simulations-in-excel-a-comprehensive-guide/#1way-tables),