1 Put the letters in the right order to make words. 0 edb bed 1 syto.. 2 voniteelis 3 olcck 4 retpso 5 Icsteho 6 irugta 7 eokaobcs 8 tpe sifh 9 pucmtroe 10 radbo gema пж ответьте надо на сегодня срочно!!!

|

Федеральное государственное бюджетное образовательное учреждение |

|

высшего образования |

|

РОССИЙСКАЯ АКАДЕМИЯ |

|

НАРОДНОГО ХОЗЯЙСТВА и ГОСУДАРСТВЕННОЙ СЛУЖБЫ |

|

при ПРЕЗИДЕНТЕ РОССИЙСКОЙ ФЕДЕРАЦИИ |

|

ОМСКИЙ ФИЛИАЛ |

Рабочая тетрадь

по дисциплине

«Иностранный язык в профессиональной деятельности»

Центральные банки и банковские системы Российской Федерации, Великобритании и Соединённых Штатов Америки

Составитель: Власенко И.Г.

Омск, 2021

Пояснительная записка

Рабочая тетрадь предназначена для студентов II курса, обучающихся на базе среднего общего образования.

Рабочая тетрадь «Центральные банки и банковские системы Российской Федерации, Великобритании и Соединённых Штатов Америки» содержит комплекс тренировочных упражнений, направленных на формирование у студентов навыков самостоятельной работы над тематической лексикой.

Рабочая тетрадь состоит из четырех тематических разделов, в каждом разделе представлены десять практических заданий на множественный выбор, подбор соответствий, выбор верного/неверного ответа, заполнение пропусков, построение слов/предложений, решение кроссвордов. Цель работы с предложенными заданиями – формирование у студентов лексической компетенции.

Рабочая тетрадь подготовлена на основе рабочей программы по дисциплине «Иностранный язык в профессиональной деятельности» в соответствии с государственными требованиями к содержанию и уровню подготовки по специальности 38.02.07 «Банковское дело» и может быть использована как для аудиторной, так и внеаудиторной самостоятельной работы при изучении тем «Банковская система Российской Федерации», «Банковская система Великобритании», «Федеральная Резервная система США».

СОДЕРЖАНИЕ

Рекомендации по использованию рабочей тетради …………………………………………..4

Central banks

Центральные банки………………………………………………………………………………5

The Bank of Russia

Банк России………………………………………………………………………………………8

The Bank of England

Банк Англии ……………………………………………………………………………………12

The Federal Reserve System

Федеральная Резервная Система ………………………………………………………………16

Key

Ответы…………………………………………………………………………………………..20

Рекомендации по использованию рабочей тетради

В рабочей тетради представлены практические задания, предназначенные для организации самостоятельной работы студентов. Задания сгруппированы по тематическому принципу, каждая тема состоит из десяти заданий. Задания обладают различной степенью сложности. Это позволяет преподавателю осуществлять индивидуальный подход в обучении, ориентируя студентов на выполнение заданий, соответствующих уровню их языковой подготовки, при необходимости определять последовательность, количество заданий и время их выполнения. В случае возникновения затруднений при выполнении заданий студенты могут воспользоваться изученными учебными материалами, двуязычными словарями и ресурсами сети Интернет. Для успешного выполнения заданий рекомендуется осуществлять работу после изучения соответствующей тематики на аудиторных занятиях.

В результате проделанной работы обучающийся должен

знать:

-

тематическую лексику,

-

структуру и функции центральных банков России, Великобритании и США,

-

название и номинал национальной валюты;

уметь:

-

составлять словосочетания и предложения в соответствии с грамматикой английского языка,

-

осуществлять поиск необходимой информации,

-

отделять объективную информацию от субъективной,

-

самостоятельно пополнять словарный запас.

Unit 1. CENTRAL BANKS

Activity 1.1 Type the name of the central bank below the pictures.

|

the Bank of Russia |

the Bank of England |

||||||||

|

the Federal Reserve System |

|||||||||

|

|

|

|

|

1____________________ |

2 _______________________ |

3 _______________________ |

Activity 1.2 Choose the correct phrase from the brackets. Type it into the gap.

A central (issuing) bank – a central link of the 1_______ (credit system/payment system/monetary system), the leading bank of the country with the right of an exclusive issue of 2_______ (securities/ banknotes/bank guarantees). The central bank should provide 3____________ (credit and debit/ buying and selling/ monetary and financial) stability of the country. It also regulates the money 4___________ (circulation/ issue/ usage). Each central bank serves as 5_________ (financial institution/ bank/ investment company) both to the country’s government and to its banking system.

Activity 1.3 Fill in the blanks with the words given in the box.

A central bank is an organization which is officially in charge of managing 1__________ .

Some central banks are owned by 2 ________ (e.g. the Deutsche Bundesbank); some owned by

3 _________ (e.g. Banque de France, the People’s Bank of China); some are 4 ________ (e.g. the Bank of Japan). All central banks are responsible for the 5 _______ stability (i.e. inflation-fighting) and 6 ________ stability (i.e. value compared to other national currencies) of their national currency. They have a variety of means at their disposal to achieve these aims, including 7 ________ (buying or selling national currency in the market in exchange for other national currencies); 8 ________ fixing; or fixing reserve requirements for the private banks.

|

External interest rate mixed private banks intervention a national currency the Government internal |

Activity 1.4 Match the words on the left with the words on the right. Type the letters (a-j).

|

|

banking |

|

rate |

|

|

reserve |

|

bank |

|

|

interest |

|

services |

|

|

central |

|

tender |

|

|

legal |

|

requirements |

|

|

gold |

|

currency |

|

|

monetary |

|

vault |

|

|

foreign |

|

reserves |

|

|

money |

|

policy |

|

|

bullion |

|

circulation |

Activity 1.5 All the words below can be combined with bank or banking. Type the word bank or banking either before or after the given word.

-

_______ account _________

-

_______ balance _________

-

_______ central _________

-

_______ clerk _________

-

_______ commercial _________

-

_______ online _________

-

_______ statement _________

-

_______ system _________

-

_______ savings _________

-

_______ telephone _________

Activity 1.6 Put the letters in order to form a word.

1

|

R |

O |

U |

S |

C |

T |

E |

M |

2

|

N |

A |

L |

F |

I |

O |

N |

I |

T |

3

|

M |

T |

E |

L |

T |

S |

E |

T |

E |

N |

4

|

U |

E |

I |

P |

V |

E |

S |

R |

S |

5

|

N |

O |

M |

E |

N |

D |

A |

O |

I |

N |

I |

T |

Activity 1.7 Choose TRUE if the sentence is correct or FALSE if it is wrong.

-

Banks charge interest for lending.

-

Banks keep people’s money in safe vaults.

-

Bank’s product is money.

-

Banks make money by issuing banknotes.

Activity 1.8 Put the parts in order to form a sentence.

-

can/ money/ people/ with/ save/ the/ bank

-

banks/ the government/ fiscal/ central/ agent/ of/ act as

-

172/ central/ there/ around/ banks/ are/ the world

Activity 1.9 Do the crossword. Type English equivalents of Russian words into the space in accordance with its number.

|

KEYS: |

|||

|

2 |

валюта |

||

|

5 |

клиент |

||

|

6 |

ипотечный кредит |

||

|

1 |

ценная бумага |

||

|

3 |

денежное обращение |

||

|

7 |

ставка (курс) |

||

|

4 |

монета |

||

|

8 |

наличные средства |

||

|

1 |

||||||||||||

|

3 |

8 |

|||||||||||

|

2 |

||||||||||||

|

7 |

||||||||||||

|

4 |

||||||||||||

|

5 |

||||||||||||

|

6 |

||||||||||||

Activity 1.10. Do the crossword

|

Across: |

|||||||

|

1. Can I ___ $5.00? I’ll pay you back tomorrow. |

|||||||

|

3. Who will ___ the hotel bill? |

|||||||

|

7. I don’t have any ___ with me. Can I use my check? |

|||||||

|

8. May I see your ___ card? |

|||||||

|

9. A small round piece of metal money. |

|||||||

|

Down: |

|||||||

|

2. It’s the opposite of deposit. |

|||||||

|

3. After a month’s work, do you get a large ___? |

|||||||

|

4. I’m in the red. I must have miscalculated my __. |

|||||||

|

5. A piece of paper that proves that money or goods have been received. |

|||||||

|

6. Can you lend me a dollar ___? |

|

1 |

2 |

||||||||||

|

3 |

4 |

||||||||||

|

3 |

|||||||||||

|

5 |

6 |

7 |

|||||||||

|

8 |

|||||||||||

|

9 |

|||||||||||

Activity 2.1 Fill in the blanks using the words from the box.

the rouble the Constitution powers “On the Bank of Russia”

stability the exclusive right currency

Article 75 of 1) of the Russian Federation establishes a special legal status of the Bank of Russia, gives it 2) to issue national 3) and protect 4) and ensure its 5) , which is the main function of the Bank of Russia. The status, purposes, functions and 6) of the Bank of Russia are also spelled out in Federal Law 7) .

Activity 2.2 Read the text. Choose TRUE if the sentence given below the text is correct or FALSE if the sentence is wrong.

The banking system in Russia consists of the Bank of Russia, on the one hand, and commercial banks and representatives of foreign banks, on the other hand. By implementing monetary policy the Bank of Russia controls the money supply and combats inflation.

The interest rate policy has become more dynamic last years, because the Bank of Russia has introduced lombard and REPO operations, created a new system of refinancing commercial banks and reduced the share of special-purpose credits. The Bank of Russia is involved in open-market operations; it attracts financial resources to cover the state budget deficit by non-inflationary means.

1. The banking system in Russia is organized as a 2-tier system. TRUE/FALSE

2. The Bank of Russia fights inflation by means of implementing efficient foreign policy. TRUE/FALSE

3. The interest rate policy hasn’t changed for last decades. TRUE/FALSE

4. A lot of innovations were introduced in the Bank of Russia activities to improve the situation in the banking sector. TRUE/FALSE

5. The Bank of Russia uses non-inflationary means to control the state budget. TRUE/FALSE

Activity 2.3 Match the parts to make a phrase. Type the correct letter (a-j)

According to the Federal Law “On the Central Bank of the Russian Federation” the Bank of Russia performs a lot of functions. The main functions of the Bank of Russia are as follows:

|

1. |

To implement |

|

coins |

|

2. |

To issue |

|

the lender of last resort for credit institutions |

|

3. |

To mint |

|

the activities of credit and non-credit financial institutions |

|

4. |

To organize |

|

the rights and legitimate interests of shareholders and investors in the financial markets |

|

5. |

To be |

|

the illegal use of insider information and market manipulation |

|

6. |

To exercise |

|

compensation for household deposits with bankrupt banks |

|

7. |

To supervise |

|

a single state monetary policy |

|

8. |

To pay |

|

banknotes |

|

9. |

To protect |

|

supervision over the national payment system |

|

10. |

To counter |

|

currency circulation and foreign exchange control |

Activity 2.4 Fill in the blanks with the correct preposition.

-

________ (with, under, in) collaboration with the federal government

The lender 2) ______ (in, of, with) last resort

The rules 3) ______ (to, on, for) conducting banking operations

To issue a banking licence 4) ______ (with, to, over) the credit institution

5) _____ (on, with, in) compliance with federal laws

To set an official exchange rates of foreign currencies 6)_____(against, with, on) the rouble

7) ______ (with, under, in) accordance with the insurance legislation

To carry

To present the law 9) _______ (to, with, in) the State Duma

The Law » 10) ______(About, On, Of) the Central Bank» states that …

Activity 2.5 Match English phrases with their Russian equivalents. Type the letters (a-j).

|

|

a single state monetary policy |

|

монопольно осуществлять выпуск наличных средств |

|

|

the sole issuer of cash |

|

юридическое лицо |

|

|

the lender of last resort |

|

курс иностранной валюты |

|

|

foreign exchange regulation |

|

статистические данные |

|

|

a legal entity |

|

единая государственная денежно-кредитная политика |

|

|

a private individual |

|

кредитор последней инстанции |

|

|

the exchange rate of foreign currency |

|

система страхования вкладов |

|

|

statistical data |

|

незаконное использование |

|

|

deposit insurance system |

|

валютное регулирование |

|

|

the illegal use |

|

физическое лицо |

Activity 2.6 Put the parts in order to form a sentence.

-

to protect/ the stability/ the Bank of Russia/ of the rouble/ the primary/has/responsibility

-

to issue/ the exclusive / banknotes and coins/ right / rouble/ has /the Bank of Russia

-

with / performs/ in compliance/ its functions/ the Bank of Russia/ federal laws

Activity 2.7 Choose the correct answer from the box and fill in the blanks in the text.

The national 1) of the Russian Federation is the rouble. The official symbol of the rouble is ₽. The rouble is subdivided into 100 kopeks. 2) legal tender in Russia are banknotes and coins. 3) of the following 4) are in 5) today: 50, 100, 500, 1000 and 5000 roubles. 6 ) of 1, 5, 10, 50 kopeks as well as 1, 2, 5, 10 roubles can be used. The 5 rouble banknote is very rare now. It is now out of print, although it is still 7) . The 10 rouble

-

money/currency 6) coins/banknotes 7) legal tender/money

-

cash/money

banknote/paper

-

coins/banknotes 9) is minted/is printed

-

denominations/money 10) the Bank of Russia/Goznak

-

operation/circulation 11) are printed/are minted

Activity 2.8 Put the letters in order to make a word.

-

a

k

n

o

e

n

t

b

-

e

s

n

i

u

a

r

n

c

-

a

r

l

n

c

i

c

t

i

o

u

|

a |

e |

l |

s |

d |

h |

e |

h |

o |

r |

r |

Activity 2.9 Match the banknote of the correct denomination with its description.

-

A banknote of _______ roubles depicts the monument to Peter the Great and sailing boat in the port of Arkhangelsk.

-

A banknote of _______ roubles has a watermark as a portrait of Prince Yaroslav the Wise.

-

A banknote of _______ roubles depicts the chapel in the city of Krasnoyarsk.

-

A bank note of _______ roubles has a watermark as a portrait of N.N. Muravjov-Amursky.

-

A banknote of _______ roubles depicts the Bolshoy Theatre.

-

A banknote of _______ roubles has the image of Peter and Paul Cathedral in St. Petersburg.

Activity 2.10 Choose the correct answer to complete the sentence.

-

The graphic symbol of the rouble ₽ was approved by the Bank of Russia …

-

on 1 January 2015

-

on 1 December 2014

-

on 11 December 2013

-

The sign ₽ should be used for symbolic representation of the rouble as a national currency …

-

inside Russia

-

inside and outside Russia

-

outside Russia

-

For the first time the Bank of Russia has issued

A) 1 million silver coins for collectors

B) 10 million banknotes of one thousand roubles

C) 100 million nickel-plated steel coins of one rouble

Activity 3.1 Fill in the blanks using the words or phrases from the box.

|

extreme removed currency taken central bank inflation |

The Bank of England has ____1 measures to reduce ____2 . The problem is a result of the _____3 introducing too much ______4 to the money supply. To stop the inflation, the monetary authority has ____5 some of the currency from circulation. Critics of the plan say it is too ____6.

Activity 3.2 Put the words in order to form a sentence.

-

interest/ lowered/ today/ /bank/ United Kingdom/of the/ the central/rates.

-

was/ the bank/ bank/ at first/ a joint-stock/ of /England.

-

the legal/ of the currency/tender/Great/ the pound sterling/in/Britain/is.

Activity 3.3 Match the parts to make a phrase. Type the correct letter (a-f).

The main functions of the Bank of England are as follows:

|

to issue |

|

the money supply |

|

to store |

|

official interest rates |

|

to regulate |

|

banknotes and coins |

|

to set |

|

monetary and financial stability |

|

to supervise |

|

the country’s reserves of gold |

|

to maintain |

|

the work of other banks in the country |

Activity 3.4 Choose TRUE if the sentence is correct or FALSE if the sentence is wrong.

-

The Bank of England stores gold for other countries which don’t have a secure place to keep it.

-

The Bank of England started setting the official interest rate in 1836.

-

The Bank of England will not replace a damaged bank note which was left in a pocket and went through a washing machine.

-

The Bank of England destroys old or damaged banknotes. It turns them into compost and sells it to farmers.

Activity 3.5 Choose the correct answer. Type the letters (a-c).

1.When was the Bank of England founded?

-

1469 b) 1694 c)1964

2. What is the highest denomination banknote ever issued by the Bank of England?

-

£1,000 b) £5,000 c) £10,000

3. Approximately how much is one gold bar worth?

-

£50,000 b) £200,000 c) £1 million

Activity 3.6 Put the letters in order to make a word.

1.

|

C |

X |

N |

E |

G |

E |

H |

A |

2.

|

E |

I |

T |

N |

S |

T |

R |

E |

3.

|

U |

R |

E |

R |

C |

C |

Y |

N |

4.

|

T |

S |

B |

A |

I |

I |

Y |

T |

L |

Activity 3.7 Match English phrases with their Russian equivalents. Type the letters (a-g).

|

|

to set an interest rate |

|

защищать потребителей |

|

|

to keep inflation |

|

обеспечить стабильные цены |

|

|

to improve safety and soundness |

|

повысить кредитование |

|

|

to deliver stable prices |

|

повышать безопасность и устойчивость |

|

|

to increase lending |

|

регулировать денежную массу |

|

|

to adjust the amount of money |

|

сдерживать инфляцию |

|

|

to protect consumers |

|

устанавливать процентную ставку |

Activity 3.8 Match the parts to complete the sentence. Type the letters (a-j).

|

|

Central bank |

|

is a rise in prices in an economy over time and lowering of the value of monetary units |

|

|

Exchange rate |

|

is a public institution that controls a nation’s money supply, regulates interest rates |

|

|

Interest rate |

|

is the role of a central bank when it makes short-term loans to smaller banks to avoid bank runs and insolvency |

|

|

Legal tender |

|

is the specified worth of one currency in terms of another |

|

|

Inflation |

|

is a percentage of the principal amount of a loan, paid by the borrower to the lender |

|

|

Lender of last resort |

|

is an official, legal currency in a given place |

|

|

Money supply |

|

is a situation when prices in an economy change little over time |

|

|

Price stability |

|

is the total amount of money that is available in economy |

|

|

Run |

|

is a person or business giving a loan |

|

|

Lender |

|

is a situation in which a large portion of a bank’s customers withdraw their deposits for fear that the bank will become unable to pay its debts |

Activity 3.9 Match the banknote of the correct denomination with its description. Type the letters (a-d).

1

2

3

4

-

The … banknote shows Charles Darwin.

-

The … banknote shows Adam Smith.

-

The … banknote shows Elizabeth Fry.

-

The … banknote shows Matthew Boulton and James Watt.

Activity 3.10 Read the information on the organization structure of the Bank of England and match policy committees (1-3) and their functions (a-c).

The affairs of the bank are controlled by a governor, a deputy, and 16 directors.

The major policy committees of the Bank, all of which are chaired by the Governor, are the Monetary Policy Committee (MPC), the Financial Policy Committee (FPC), and the Board of the Prudential Regulation Authority (PRA).

|

1. |

MPC |

|

It works to remove or reduce risks and weaknesses across the financial system. |

|

2. |

FPC |

|

It regulates around 1,700 banks, building societies, credit unions and investment firms. |

|

3. |

PRA |

|

It sets interest rates to hit the Government’s 2% inflation target. |

Activity 4.1. Match the words with their definitions.

|

1. |

reserve bank |

|

is a representation of financial value such as stock or bond |

|

2. |

reserve requirement |

|

is anything of value that is owned. For banks, this includes loans. For the Fed, this includes Treasury securities |

|

3. |

security |

|

is a central bank. It controls a nation’s money supply |

|

4. |

finance |

|

are state-chartered banks. They hold 6 percent of their capital as stock in their Reserve Bank |

|

5. |

to oversee |

|

is a minimum amount of cash that a bank must have available for withdrawals from depositors |

|

6. |

member banks |

|

is an agency located in Washington, D.C. that provides leadership for the Federal Reserve System |

|

7. |

Board of Governors |

|

to supervise |

|

8. |

asset |

|

is the field concerned with managing the flow of money |

Activity 4.2 Fill in the blanks using the words or phrases from the box.

United States has developed financial banking central responsibilities was created private 1913

The Federal Reserve System is the 1) banking system of the 2) . It 3) on December 23, 4) by the Federal Reserve Act largely in response to a series of 5) panics. The Federal Reserve System is a 6) system that is a unity of the government entity with 7) components. Over time, the roles and

Activity 4.3 Read the text and present the structure of the Federal Reserve System as a scheme.

The Federal Reserve System is composed of the presidentially appointed Board of Governors of the Federal Reserve System in Washington, D.C.; the Federal Open Market Committee; twelve regional Federal Reserve Banks located in major cities throughout the nation acting as fiscal agents for the U.S. Treasury, each with its own nine-member board of directors; numerous private U.S. member banks, which subscribe to required amounts of non-transferable stock in their regional Federal Reserve Banks; and various advisory councils. Janet L. Yellen serves as the Chairman of the Board of Governors of the Federal Reserve System.

Activity 4.4 Put the parts in order to make a sentence.

1. oversees/ payment /the nation’s/system/the Board/of/ Governors.

2. Reserve/ supervise/commercial/Banks/regions/in/banks/their.

3. hold/ Reserve/ receive/dividends/ Banks/all/member/in/banks/stock/and

Activity 4.5 Match the parts to make phrases.

The functions of the Federal Reserve System are as follows:

|

1. |

To serve |

|

the stability of the financial system and contain systemic risk in financial markets |

|

2. |

To supervise |

|

the credit rights of consumers |

|

3. |

To protect |

|

to local liquidity needs |

|

4. |

To manage |

|

as the central bank for the United States |

|

5. |

To maintain |

|

U.S. position in the world economy |

|

6. |

To provide |

|

the exchange of payments among regions |

|

7. |

To facilitate |

|

financial services to depository institutions and the U.S. government |

|

8. |

To respond |

|

and regulate banking institutions |

|

9 |

To strengthen |

|

the nation’s money supply through monetary policy |

Activity 4.6 Choose the correct answer. Put it into the gap.

The Board of Governors

Sets 1) money supply/ reserve requirements/ monetary policy

Approves 2) interest rates/ exchange rates/ discount rates as a part of monetary policy

Supervises 3) member banks/ foreign banks/ all American banks

Establishes 4) laws/ protective regulations/ limits in consumer finance

Oversees 5) the world financial market/ New York Stock Exchange/the Federal Reserve System

Activity 4.7 Choose TRUE if the phrase is correct or FALSE if it is wrong

Federal Reserve Banks

-

Propose discount rate. TRUE/FALSE

-

Set reserve requirements for depository institutions. TRUE/FALSE

-

Issue currency. TRUE/ FALSE

-

Transfer funds only for individuals. TRUE/FALSE

-

Handle US government debt and cash balances. TRUE/FALSE

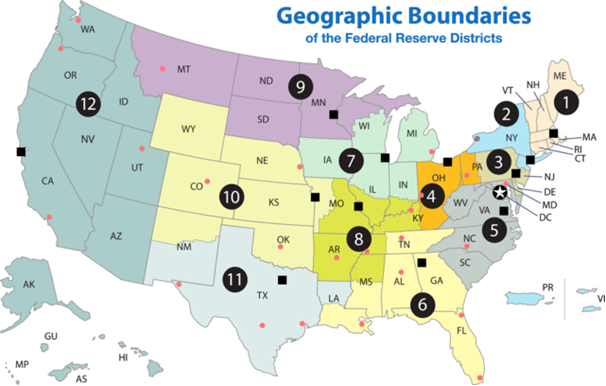

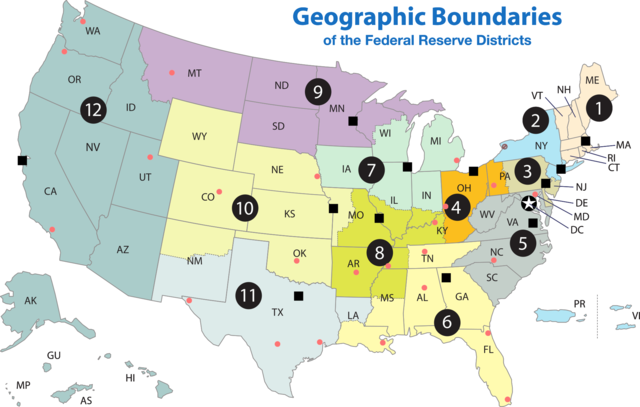

Activity 4.8 Look at the map of the twelve Federal Reserve Districts. Match the names of the Federal Reserve Banks with the numbers on the map.

The twelve Federal Reserve Districts are enumerated in black circles and the twelve Federal Reserve Banks marked as black squares. Branches within each district are marked as red circles. The Washington, D.C. headquarters, is marked with a star enclosed in a black circle.

|

|

Activity 4.9 Look at the map of the twelve Federal Reserve Districts. Match the parts to make a sentence.

The twelve Federal Reserve Districts are enumerated in black circles and the twelve Federal Reserve Banks marked as black squares. Branches within each district are marked as red circles. The Washington, D.C. headquarters, is marked with a star enclosed in a black circle.

|

|

The New York Federal Reserve District is |

|

the largest geographical districts. |

|

|

San Francisco, Kansas City and Minneapolis represent |

|

four branches. |

|

|

The Federal Reserve Bank of Kansas City has |

|

situated in the east of the USA. |

|

|

The Federal Reserve Bank of San Francisco has |

|

three branches. |

Activity 4.10 Examine a new 100-dollar banknote. Fill in the gaps with the words from the box.

The newly designed 100-dollar banknote went into 1) on October 8, 2013. The new banknote has kept the traditional style of U.S. 2) but has included new 3) features to make 4) harder. All 100-dollar banknotes issued before October 8, 2013, remain 5) . The new banknote has two major security features:

3-D Security 6) : The front page of the banknote has a band with 7) that change to the numeral 100 when the banknote is tilted.

Bell in the

ribbon currency images of bells security

inkwell circulation counterfeiting legal tender

KEY

Unit 1. CENTRAL BANKS

1.1

1 the Federal Reserve System 2 the Bank of England 3 the Bank of Russia

1.2

1 monetary system 2 banknotes 3 monetary and financial 4 circulation 5 bank

1.3

1 national currency 2 private banks 3 the Government 4 mixed 5 internal

6 external 7 intervention 8 interest rate

1.4

1 C 2 E 3 A 4 B 5 D 6 H 7 I 8 F 9 J 10 G

1.5

1 bank account 2 bank balance 3 central bank 4 bank clerk

5 commercial bank 6 online banking 7 bank statement 8 banking system

9 savings bank 10 telephone banking

1.6

1 customer 2 inflation 3 settlement 4 supervise 5 denomination

1.7

1 TRUE 2 TRUE 3 TRUE 4 FALSE

1.8

-

People can save money with the bank.

-

Central banks act as fiscal agent of the government.

-

There are 172 central banks around the world.

1.9

|

KEYS: |

|||

|

2 |

валюта |

||

|

5 |

клиент |

||

|

6 |

ипотечный кредит |

||

|

1 |

ценная бумага |

||

|

3 |

денежное обращение |

||

|

7 |

ставка (курс) |

||

|

4 |

монета |

||

|

8 |

наличные средства |

|

1 |

||||||||||||

|

s |

||||||||||||

|

e |

||||||||||||

|

c |

||||||||||||

|

3 |

u |

8 |

||||||||||

|

2 |

c |

u |

r |

r |

e |

n |

c |

y |

||||

|

i |

i |

a |

||||||||||

|

7 |

r |

t |

s |

|||||||||

|

c |

y |

h |

||||||||||

|

u |

||||||||||||

|

l |

||||||||||||

|

4 |

a |

|||||||||||

|

5 |

c |

u |

s |

t |

o |

m |

e |

r |

||||

|

o |

i |

|||||||||||

|

i |

6 |

m |

o |

r |

t |

g |

a |

g |

e |

|||

|

n |

n |

1.10

|

1 |

2 |

|||||||||

|

b |

o |

r |

r |

o |

w |

|||||

|

3 |

4 |

i |

||||||||

|

3 |

p |

a |

y |

b |

t |

|||||

|

a |

5 |

6 |

7 |

c |

a |

s |

h |

|||

|

y |

r |

b |

l |

d |

||||||

|

8 |

c |

r |

e |

d |

i |

t |

a |

r |

||

|

h |

c |

l |

n |

a |

||||||

|

e |

e |

l |

c |

w |

||||||

|

9 |

c |

o |

i |

n |

e |

a |

||||

|

k |

p |

l |

||||||||

|

t |

Unit 2. THE BANK OF RUSSIA

2.1

-

the Constitution 2 the exclusive right 3 currency 4 the rouble

-

stability 6 powers 7 “On the Bank of Russia”.

2.2

1 TRUE 2 FALSE 3 FALSE 4 TRUE 5 TRUE

2.3

1 G to implement a single state monetary policy

2 H to issue banknotes

3 A to mint coins

4 J to organize currency circulation and foreign exchange control

5 B to be the lender of last resort for credit institutions

6 I to exercise supervision over the national payment system

7 C to supervise the activities of credit and non-credit financial institutions

8 F to pay compensation for household deposits with bankrupt banks

9 D to protect the rights and legitimate interests of shareholders and investors in the f inancial markets

10 E to counter the illegal use of insider information and market manipulation

2.4

1 in 2 of 3 for 4 to 5 in

6 against 7 in 8 out 9 to 10 on

2.5

1E 2 A 3 F 4 I 5 B

6 J 7 C 8 D 9 G 10 H

2.6

1. The Bank of Russia has the primary responsibility to protect the stability of the rouble.

2. The Bank of Russia has the exclusive right to issue rouble banknotes and coins.

3. The Bank of Russia performs its functions in compliance with federal laws.

2.7

1 currency 6 coins

2 cash 7 legal tender

3 banknotes 8 bank note

4 denominations 9 is printed

5 circulation 10 Goznak

11 are minted

2.8

1Banknote 2 insurance 3 circulation 3 shareholder

2.9

1 C 2 F 3 E 4 A 5 B 6 D

2.10

1C 2 B 3 C

Unit 3. THE BANK OF ENGLAND

3.1

1 taken 2 inflation 3 central bank 4 currency 5 removed 6 extreme

3.2

1. The central bank of the United Kingdom lowered interest rates today.

2. At first the Bank of England was a joint-stock bank.

3. The pound sterling is the legal tender of the currency in Great Britain.

3.3

1C 2E 3A 4B 5F 6D

3.4

1 TRUE 2 FALSE (in 1997) 3 FALSE 4 TRUE

3.5

1B 2A 3B

3.6

1 exchange 2 interest 3 currency 4 stability

3.7

1G 2F 3D 4B 5C 6E 7A

3.8

1B 2D 3E 4F 5A 6C 7H 8G 9J 10I

3.9

1C 2A 3B 4D

3.10

1C 2A 3B

Unit 4. THE FEDERAL RESERVE SYSTEM

4.1

1C 2E 3A 4H 5G 6D 7F 8B

4.2

1 central 2 United States 3 was created 4 1913 5 financial

6 banking 7 private 8 responsibilities 9 has developed

4.3

|

The Chairman of the Board of Governors |

|

The Board of Governors |

|

The Federal Open Market Committee |

|

Twelve regional Federal Reserve Banks |

|

Private member banks |

|

Advisory councils |

4.4

-

The Board of Governors oversees the nation’s payment system.

-

Reserve Banks supervise commercial banks in their regions.

-

All member banks hold stock in Reserve Banks and receive dividends

4.5

1 D 2 H 3 B 4 I 5 A

6 G 7 F 8 C 9 E

4.6

-

reserve requirements

-

discount rates

-

member banks

-

protective regulations

-

the Federal Reserve System

4.7

1 TRUE 2 FALSE 3 TRUE 4 FALSE 5 TRUE

4.8

1st District (B) — Federal Reserve Bank of Boston

2nd District (K) — Federal Reserve Bank of New York

3rd District (L) — Federal Reserve Bank of Philadelphia

4th District (G) — Federal Reserve Bank of Cleveland

5th District (F) — Federal Reserve Bank of Richmond

6th District (A) — Federal Reserve Bank of Atlanta

7th District (E) — Federal Reserve Bank of Chicago

8th District (D) — Federal Reserve Bank of St. Louis

9th District (J) — Federal Reserve Bank of Minneapolis

10th District (I) — Federal Reserve Bank of Kansas City

11th District (H) — Federal Reserve Bank of Dallas

12th District (C) — Federal Reserve Bank of San Francisco

4.9

1C 2A 3D 4B

4.10

1 circulation 2 currency 3 security 4 counterfeiting

5 legal tender 6 ribbon 7 images of bells 8 inkwell

28

Instructions: Put the letters in brackets in order to form a word which completes each sentence.

The first letter of each new word is underlined and in bold. Stop playing on your phone and pay _____ (tenoniatt) to what I’m saying! People around the world speak English – it’s an _____ (tiatnelnraino) language. Jeans with holes in them are very _____ (abasholefin) these days. Unfortunately, languages _____ (adispapre) all the time – people simply stop speaking them. The national language here is Spanish, but many _____ (lcaol) people also speak German. At first I didn’t _____ (sreeail) that she was Italian, but then I read an article about her. An _____ (ariscening) number of people are learning languages online each year. Learning a foreign language will _____ (lalwo) you to communicate with more people.

Answer:

Stop playing on your phone and pay attention to what I’m saying! People around the world speak English – it’s an international language. Jeans with holes in them are very fashionable these days. Unfortunately, languages dissapear all the time – people simply stop speaking them. The national language here is Spanish, but many local people also speak German. At first I didn’t realise that she was Italian, but then I read an article about her. An increasing number of people are learning languages online each year. Learning a foreign language will allow you to communicate with more people.

Hope it helps~ヾ(^∇^)

Jawaban:

Attention

International

Fashionable

Disappear

Local

Realise

Increasing

Allow

1. Независимо от того, на каком носителе или компьютере вы работаете, все, что хранится на нем, сохраняется в файле.

2. Компьютеры используются для обучения и обучения.

3. Компьютер можно использовать как инструмент, просто используя его в качестве калькулятора или в сложных программах для анализа данных или отображения данных ясным и интересным способом.

4. Для манипулирования этой матрицей требуется около 80 миллионов отдельных умножений.

5. Очень немногие люди, которые попробовали обработку текстов, рассмотрят возможность возврата к бумажному и карандашом.

6. Вы никогда не должны изменять или удалять конфигурационный файл, особенно тот, который требуется операционной системой компьютера.

7. Программисты начинают решение проблемы путем разработки алгоритма.

8. Системы голосового ввода и управления имеют потенциал для революционизации способа общения с компьютерами.

9. Компьютерная безопасность — это процесс предотвращения и обнаружения несанкционированного использования вашего компьютера.

10. Идеи, лежащие в основе иерархического структурирования программного обеспечения, будут обсуждаться на следующем семинаре.

Переведите предложения на русский язык, определяя форму и синтаксическую функцию герундия и причастия.

1. Информация, помещенная в компьютер для обработки, должна быть закодирована в единицы и нули.

2. Для манипулирования этой матрицей требуется около 80 миллионов отдельных умножений.

3. Значение, позволяющее детям свободно программировать компьютеры, а не использовать образовательные программы, является довольно спорным.

4. Для манипулирования этой матрицей требуется около 80 миллионов отдельных умножений.

5. Fortran стал широко распространенным языком программирования для кодирования математических приложений.

6. Системное программное обеспечение очень зависит от типа используемого прикладного программного обеспечения.

7. На основе той же лазерной технологии, что и компакт-диски, оптические диски предлагают среду, способную хранить чрезвычайно большие объемы данных.

8. Учитель просто не может продолжать повторять урок по-разному, пока не убедится, что все дети понимают концепцию. Но компьютер может.

9. Обработка — это операции с данными, которые включают преобразование их в полезную информацию.

10. Вентиляторы беспроводной сети, желающие подключить компьютеры без беспорядка кабелей, будут видеть новые карты Wi-Fi5, которые обещают большой прирост скорости по сравнению с их предшественниками.