This article is talking about solutions of calculating the price of zero coupon bond, the price of an annual coupon bond, and the price of a semi-annual coupon bond in Excel.

- Calculate price of a zero coupon bond in Excel

- Calculate price of an annual coupon bond in Excel

- Calculate price of a semi-annual coupon bond in Excel

Calculate price of a zero coupon bond in Excel

For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. You can calculate the price of this zero coupon bond as follows:

Select the cell you will place the calculated result at, type the formula =PV(B4,B3,0,B2) into it, and press the Enter key. See screenshot:

Note: In above formula, B4 is the interest rate, B3 is the maturity year, 0 means no coupon, B2 is the face value, and you can change them as you need.

Calculate price of an annual coupon bond in Excel

Let’s say there is a annul coupon bond, by which bondholders can get a coupon every year as below screenshot shown. You can calculate the price of this annual coupon bond as follows:

Select the cell you will place the calculated result at, type the formula =PV(B11,B12,(B10*B13),B10), and press the Enter key. See screenshot:

Note: In above formula, B11 is the interest rate, B12 is the maturity year, B10 is the face value, B10*B13 is the coupon you will get every year, and you can change them as you need.

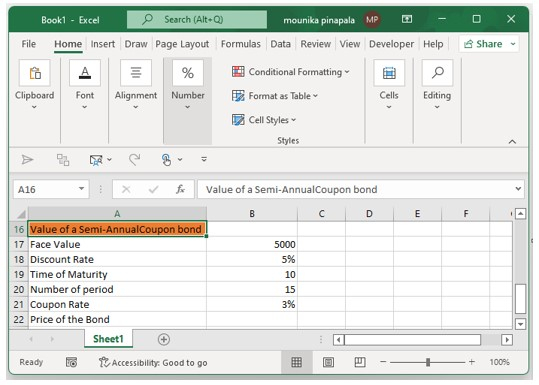

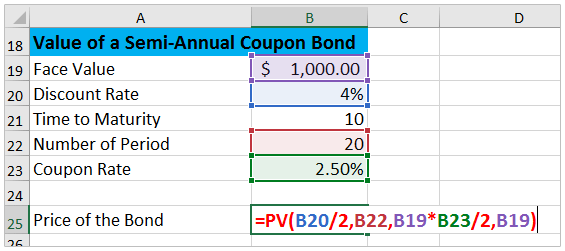

Calculate price of a semi-annual coupon bond in Excel

Sometimes, bondholders can get coupons twice in a year from a bond. In this condition, you can calculate the price of the semi-annual coupon bond as follows:

Select the cell you will place the calculated price at, type the formula =PV(B20/2,B22,B19*B23/2,B19), and press the Enter key.

Note: In above formula, B20 is the annual interest rate, B22 is the number of actual periods, B19*B23/2 gets the coupon, B19 is the face value, and you can change them as you need.

Related articles:

The Best Office Productivity Tools

Kutools for Excel Solves Most of Your Problems, and Increases Your Productivity by 80%

- Reuse: Quickly insert complex formulas, charts and anything that you have used before; Encrypt Cells with password; Create Mailing List and send emails…

- Super Formula Bar (easily edit multiple lines of text and formula); Reading Layout (easily read and edit large numbers of cells); Paste to Filtered Range…

- Merge Cells/Rows/Columns without losing Data; Split Cells Content; Combine Duplicate Rows/Columns… Prevent Duplicate Cells; Compare Ranges…

- Select Duplicate or Unique Rows; Select Blank Rows (all cells are empty); Super Find and Fuzzy Find in Many Workbooks; Random Select…

- Exact Copy Multiple Cells without changing formula reference; Auto Create References to Multiple Sheets; Insert Bullets, Check Boxes and more…

- Extract Text, Add Text, Remove by Position, Remove Space; Create and Print Paging Subtotals; Convert Between Cells Content and Comments…

- Super Filter (save and apply filter schemes to other sheets); Advanced Sort by month/week/day, frequency and more; Special Filter by bold, italic…

- Combine Workbooks and WorkSheets; Merge Tables based on key columns; Split Data into Multiple Sheets; Batch Convert xls, xlsx and PDF…

- More than 300 powerful features. Supports Office / Excel 2007-2021 and 365. Supports all languages. Easy deploying in your enterprise or organization. Full features 30-day free trial. 60-day money back guarantee.

Office Tab Brings Tabbed interface to Office, and Make Your Work Much Easier

- Enable tabbed editing and reading in Word, Excel, PowerPoint, Publisher, Access, Visio and Project.

- Open and create multiple documents in new tabs of the same window, rather than in new windows.

- Increases your productivity by 50%, and reduces hundreds of mouse clicks for you every day!

Comments (0)

No ratings yet. Be the first to rate!

The clean price of a bond is the price excluding accrued interest. To calculate the clean price of a bond in Excel, you will need to know the face value, coupon rate, and market rate.

1. Enter the face value of the bond into cell A1.

2. Enter the coupon rate into cell A2.

3. Enter the market rate into cell A3.

4. In cell A4, enter the formula =A1/(1+A3)^(1/A2). This will give you the clean price of the bond.

How do I calculate the price of a bond in Excel?

There are a few different ways to calculate the price of a bond in Excel. One way is to use the PRICE function. This function takes the settlement date, maturity date, rate, yld, redemption, and frequency as inputs and returns the price of the bond.

Another way to calculate the price of a bond is to use the PV function. This function takes the rate, nper (number of payments), pmt (payment), fv (future value), and type as inputs and returns the present value of those cash flows. The present value of a bond’s cash flows is its price.

You can also use other functions like CUMIPMT or CUMPRINC to calculate bond prices. These functions will give you the interest or principal portions of each payment made on a bond over time. You can then sum these amounts to get the total price of the bond.

How do you calculate dirty bond price in Excel?

There is no one definitive way to calculate dirty bond price in Excel. However, there are a few methods that are commonly used. One approach is to use the PV function, which stands for Present Value. To do this, you need to input the bond’s face value, its coupon rate, the number of years until maturity, and the current market interest rate. Another popular method is to use the YIELD function. This approach requires you to input the bond’s face value, its coupon rate, the number of years until maturity, its purchase date, and its redemption value.

How do I calculate the future value of a bond in Excel?

To calculate the future value of a bond in Excel, you will need to use the FV function. This function takes as inputs the interest rate, number of periods, and payment amount. For example, if you have a bond with an interest rate of 5%, and you want to know what it will be worth in 10 years, you would use the following formula:

FV(5%,10,-100)

This would give you a future value of $146.28.

What is clean price bond with example?

A clean price bond is a debt security that is traded without its accrued interest. The term «clean» refers to the fact that the price quoted for the bond excludes the interest that has accumulated since the most recent coupon payment. For example, let’s say you purchase a $1,000 face value bond with a 6% coupon rate and semi-annual payments. The clean price of this bond would be $917.33, which excludes the $30 in interest that has accrued since the last coupon payment was made six months ago.

Is clean price the same as face value?

No, the clean price is not the same as face value. The face value is the original price of the security, while the clean price takes into account any interest that has accrued since the security was issued.

How do I create a price cell in Excel?

There are a few different ways to create a price cell in Excel. One way is to use the TEXT function. For example, if you wanted to display the number 123456 as $123,456, you would use the following formula: =TEXT(123456,»$#,##0″). Another way is to format the cells as currency. To do this, select the cells you want to format and then click on the «Currency» button on the toolbar.

What is the formula for value of bond?

The formula for the value of a bond is V=P(1+r/n)^nt, where P is the par value of the bond, r is the annual interest rate, n is the number of times per year that interest is paid, and t is the number of years until maturity.

How do you calculate clean price and dirty price?

The clean price of a bond is the market price of the bond excluding accrued interest, while the dirty price of a bond is the market price of the bond including accrued interest. To calculate the clean price, simply subtract the amount of accrued interest from the current market price. To calculate the dirty price, add the amount of accrued interest to the current market price.

What is NPV formula in Excel?

The NPV formula in Excel is =NPV(rate,value1,value2,…). This formula calculates the present value of a series of cash flows at regular intervals. The rate is the discount rate, and the value1, value2,… are the cash flows.

What does Nper () function do?

The Nper () function returns the number of payment periods for an investment based on periodic, constant payments and a constant interest rate.

What is clean price example?

The clean price of a bond is the quoted price, minus any accrued interest. For example, if a bond has a face value of $1,000 and a quoted price of $1,100, the clean price is $1,000. The extra $100 represents one year’s worth of interest payments (known as «accrued interest«), which the buyer must pay to the seller when they purchase the bond.

How do you calculate dirty price from clean price?

To calculate the dirty price from the clean price, you need to add the accrued interest to the clean price.

How do you clean bond?

Bond is a type of financial instrument that represents an agreement between two parties. The most common types of bonds are corporate bonds, government bonds, and municipal bonds. Bonds are typically issued in denominations of $1,000 or more.

To clean bond, you will need:

-A mild detergent

-A soft cloth or sponge

-Warm water

-A toothbrush (optional)

Instructions:

1) Combine the mild detergent with warm water in a bowl or bucket.

2) Dip the soft cloth or sponge into the mixture and wring it out so that it’s damp but not dripping wet.

3) Gently wipe down the surface of the bond with the damp cloth or sponge.

4) If there are any stubborn stains, use the toothbrush to lightly scrub them away.

5a) Once you’re satisfied with the results, rinse the bond off with clean water to remove any lingering soap residue. 5b) For extra shine, buff dry with a soft microfiber cloth.

Содержание

- Bond Pricing Formula

- Formula to Calculate Bond Price

- Bond Pricing Calculation (Step by Step)

- Practical Examples (with Excel Template)

- Example #1

- Example #2

- Example #3

- Use and Relevance

- Bond Pricing Formula Video

- Recommended Articles

- How to Calculate PV of a Different Bond Type With Excel

- Specific Calculations

- Excel PRICE Function

- Syntax

- Example

- Bond price formula – Excelchat

- Calculate bond price

- Syntax of PV function

- Price of zero coupon bond

- Price of annual coupon bond

- Instant Connection to an Excel Expert

Bond Pricing Formula

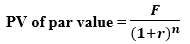

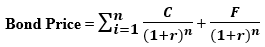

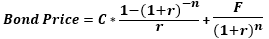

Formula to Calculate Bond Price

The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is the calculation of the present value of the probable future cash flows, which comprises the coupon payments and the par value, which is the redemption amount on maturity. The rate of interest used to discount the future cash flows is known as the yield to maturity (YTM.)

You are free to use this image on your website, templates etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: Bond Pricing Formula (wallstreetmojo.com)

where C = Periodic coupon payment,

- F = Face / Par value of bond,

- r = Yield to maturity (YTM) and

- n = No. of periods till maturity

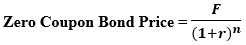

Zero-Coupon Bond Price = (as the name suggests, there are no coupon payments)

Table of contents

Bond Pricing Calculation (Step by Step)

The formula for Bond Pricing calculation by using the following steps:

- Firstly, the face value or par value of the bond issuance is determined as per the company’s funding requirement. The par value is denoted by F.

Now, the coupon rate, which is analogous to the interest rate of the bond and the frequency of the coupon payment, is determined. The coupon payment during a period is calculated by multiplying the coupon rate and the par value and then dividing the result by the frequency of the coupon payments in a year. The coupon payment is denoted by C.

C = Coupon rate * F / No. of coupon payments in a year

The total number of periods till maturity is computed by multiplying the years till maturity and the frequency of the coupon payments in a year. The number of periods till maturity is denoted by n.

n = No. of years till maturity * No. of coupon payments in a year

The YTM is the discounting factor, which is determined based on the current market return from an investment with a similar risk profile. The YTM is denoted by r.

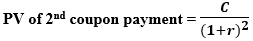

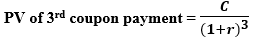

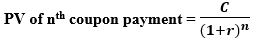

Now, the present value of the first, second, third coupon payment, and so on so forth, along with the present value of the par value to be redeemed after n periods, is derived as,

Finally, adding together the present value of all the coupon payments and the par value gives the bond price as below,

Practical Examples (with Excel Template)

Example #1

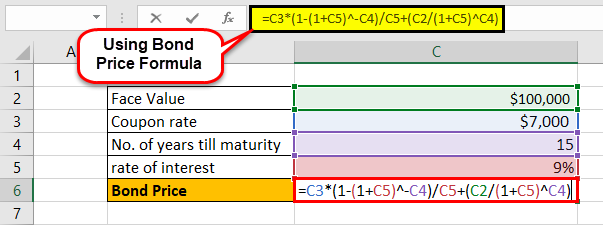

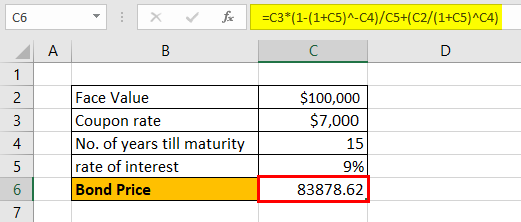

Let us take an example of a bond Example Of A Bond Bonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period. read more with annual coupon payments. Let us assume a company XYZ Ltd has issued a bond having a face value of $100,000, carrying an annual coupon rate of 7% and maturing in 15 years. The prevailing market rate of interest is 9%.

- Given, F = $100,000

- C = 7% * $100,000 = $7,000

- n = 15

- r = 9%

The price of the bond calculation using the above formula as,

- Bond price = $83,878.62

Example #2

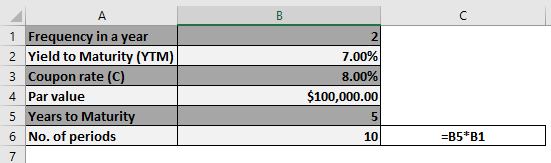

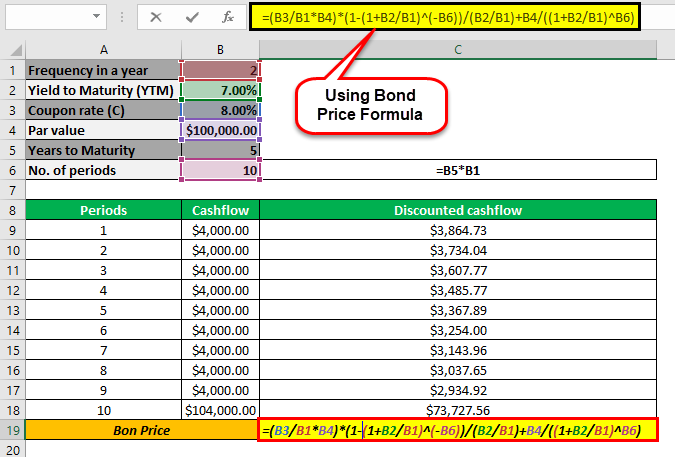

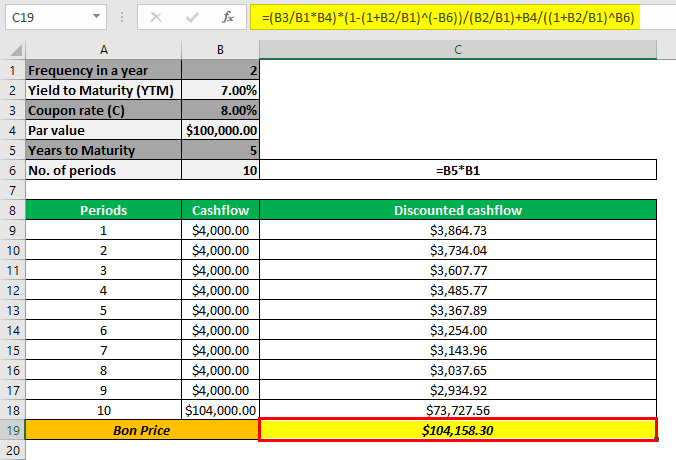

Let us take an example of a bond with semi-annual coupon payments. Let us assume a company ABC Ltd has issued a bond having the face value of $100,000 carrying a coupon rate of 8% to be paid semi-annually and maturing in 5 years. The prevailing market rate of interest is 7%.

Hence, the price of the bond calculation using the above formula as,

- Bond price = $104,158.30

Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium

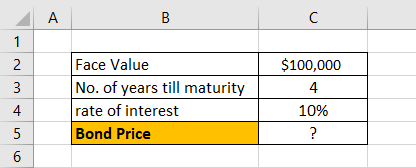

Example #3

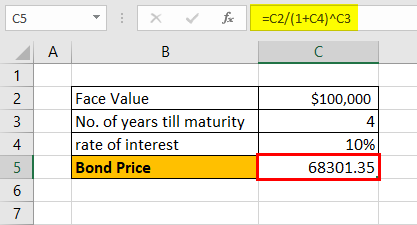

Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. The prevailing market rate of interest is 10%.

Hence, the price of the bond calculation using the above formula as,

$68,301

Use and Relevance

The concept of bond pricing is very important because bonds form an indispensable part of the capital markets. As such, investors and analysts must understand how a bond’s different factors behave to calculate its intrinsic value. Similar to stock valuation, the pricing of a bond helps understand whether it is a suitable investment for a portfolio and consequently forms an integral part of bond investing.

Bond Pricing Formula Video

Recommended Articles

This has been a guide to Bond Pricing Formula. Here we discuss how to perform bond pricing calculations, practical examples, and downloadable excel templates. You may learn more about Fixed Income from the following articles –

Источник

How to Calculate PV of a Different Bond Type With Excel

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

A bond is a type of loan contract between an issuer (the seller of the bond) and a holder (the purchaser of a bond). The issuer is essentially borrowing or incurring a debt that is to be repaid at «par value» entirely at maturity (i.e., when the contract ends). In the meantime, the holder of this debt receives interest payments (coupons) based on cash flow determined by an annuity formula. From the issuer’s point of view, these cash payments are part of the cost of borrowing, while from the holder’s point of view, it’s a benefit that comes with purchasing a bond.

The present value (PV) of a bond represents the sum of all the future cash flow from that contract until it matures with full repayment of the par value. To determine this—in other words, the value of a bond today—for a fixed principal (par value) to be repaid in the future at any predetermined time—we can use a Microsoft Excel spreadsheet.

Specific Calculations

We will discuss the calculation of the present value of a bond for the following:

Источник

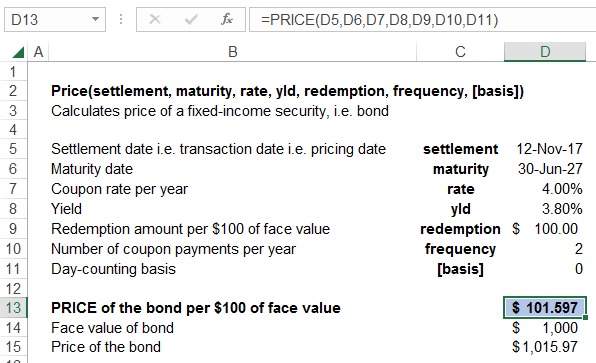

Excel PRICE Function

PRICE is an Excel function that calculates the price of a bond. A bond’s price is determined by discounting the bond’s future cash flows, which comprise of periodic coupon payments and/or redemption value, using the bond’s yield (termed as YLD) over the remaining term of the bond.

The periodic coupon payments are based on the coupon RATE, the annual percentage rate at which the bond pays periodic interest payments and payment FREQUENCY, the number of coupon payments per year.

Price of a bond is expressed by the following algebraic function:

Syntax

PRICE function syntax is:

PRICE(settlement, maturity, rate, redemption, frequency, [basis])

Excel PRICE function works out a bond’s price per $100 face value of a bond given the bond’s

SETTLEMENT is the date on which we intend to work out the price (i.e. the purchase/pricing date), MATURITY (date) is the date on which the bond expires and the principal amount is paid back by the issuer to the bond-holder, (coupon) RATE is the annual interest rate at which coupon payments are made , yield referred to as YLD is the annual market interest rate representative of the risk of the bond, REDEMPTION (value) is the value per $100 of the principal amount that is paid back at the redemption date, FREQUENCY is the number of coupon payments per year and (day-counting) [BASIS].

Example

The following screenshot illustrates how PRICE function can be used to price a bond:

Since the PRICE function works out the price per $100 par value of a bond, we have manually worked out the price per $1,000 of par value by dividing the result of the PRICE function by the $100 par value and multiplying it with the actual par value of $1,000.

by Obaidullah Jan, ACA, CFA and last modified on Jan 27, 2018

Источник

Bond price formula – Excelchat

Bonds essentially refer to a contract between an investor and a borrower. It is a type of loan to be repaid at the end of the maturity period. Some bonds have annual or semi-annual coupons which are basically predetermined interest payments. These coupons are incurred as additional cost of borrowing, and are paid to investors on a regular basis until the bond’s maturity.

This article will show us how to calculate the bond value or bond price for a zero coupon bond, an annual coupon bond and a semi-annual coupon bond.

Calculate bond price

Bond price is the current discounted value of a future cash flow. In simple terms, a bond price is the sum of the present value of the principal payment and the interest payments. In order to calculate the bond price , we can use the PV function.

Syntax of PV function

=PV(rate, nper, pmt, [fv], [type])

- Rate is the interest rate per period

- Nper is the total number of payment periods

- Pmt is the payment made each period and is fixed until bond maturity

- Fv is the future value at bond maturity

- Type is either 0 ((if payment is at the end of the period) or 1 (payment at the beginning of the period)

Price of zero coupon bond

Our example is a ten-year bond with a face value of 10,000 and an interest rate of 5%. In order to calculate the bond price with no coupons, we enter this formula in C8:

=PV(C6,C5,0,C3)

- Interest rate = 5%

- Number of periods = 10

- Payment made each period = 0 (zero coupons)

- Face value = 10,000

The resulting bond price is -6,139.13. In accounting, the negative sign means it is an outgoing cash flow.

Price of annual coupon bond

There are bonds wherein the investors get a coupon each year. In order to calculate the price of an annual coupon bond, we enter this formula in D8:

=PV(D6,D5,D3*D7,D3)

- Discount rate = 4%

- Number of periods = 10

- Payment made each period = 10,000 x 2.5%

- Face value = 10,000

As a result, the bond price is 8783.37.

Price of semi-annual coupon bond

There are also bonds that give out coupons twice in a year. The formula for bond price is:

=PV(E6/2,E5,E3*E7/2,E3)

- Discount rate = 4%/2 = 2%

- Number of periods = 10×2 = 20

- Payment made each period = 10,000 x 2.5%/2

- Face value = 10,000

Note that for semi-annual coupons, we divide the discount rate and coupon rate by 2, and the number of periods is twice the number of years. The resulting bond price is 8773.64.

Instant Connection to an Excel Expert

Most of the time, the problem you will need to solve will be more complex than a simple application of a formula or function. If you want to save hours of research and frustration, try our live Excelchat service! Our Excel Experts are available 24/7 to answer any Excel question you may have. We guarantee a connection within 30 seconds and a customized solution within 20 minutes.

Источник

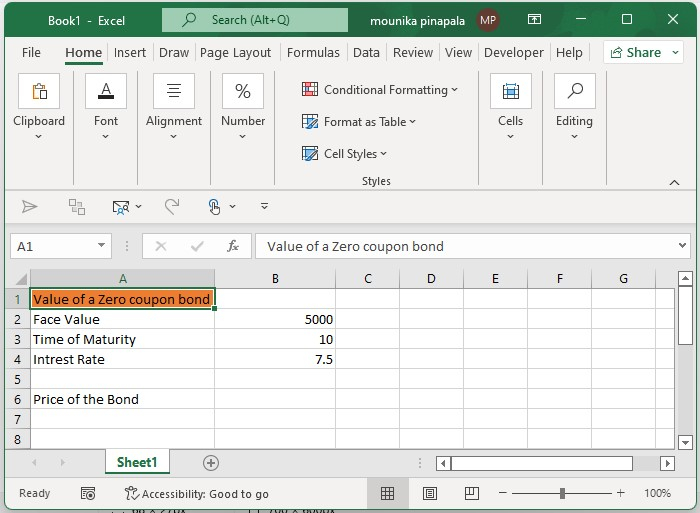

In this tutorial, we will demonstrate how you can calculate the price of a zero coupon bond, the price of an annual coupon bond, and the price of the semi-annual coupon bond in an Excel sheet.

Calculating the Price of a Zero Coupon Bond in Excel

Consider an example, there is a 10 years bond and the value is 5000, and the rate of interest is 7.5 %. Before the maturity date, the bondholder cannot get any coupon. You can calculate the price of the zero bonds using the formula.

Step 1

Open an Excel sheet and enter the data as shown in the below screenshot for your reference.

Step 2

Now you need to enter the below-given formula and press the enter key as shown in the below screenshot for your reference.

=PV(B4,B3,0,B2)

Note − In the above-given formula, B4 – is the rate of interest, B3 – is the maturity year, 0 – means no coupon, and B2 – is the face value, you can change all this as per your need.

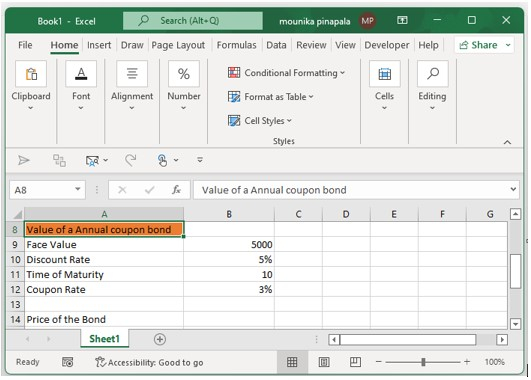

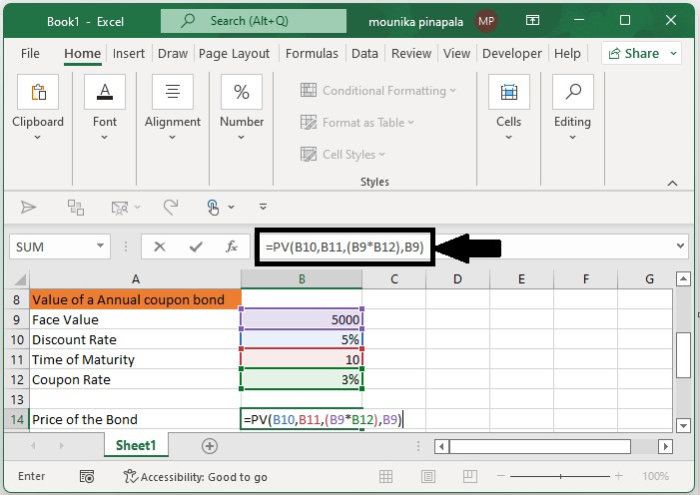

Calculating the Annual Coupon Bond in Excel

Consider there is an annual coupon bond where bondholder can get the coupon every year. You can calculate the price of the annual coupon bond using below.

Step 1

Open an excel sheet and enter the data as shown in the below screenshot for your reference.

Step 2

Now you need to enter the below given formula and press the enter key as shown in the below screenshot for your reference.

=PV(B10,B11,(B9*B12),B9)

Note − In the above formula, B10 is the interest rate, B11 is the maturity year, B9 is the face value, and B9*B12 is the coupon you will get every year. You can change this as per your need.

Calculating the Semi-Annual Coupon Bond in Excel

At times bondholders can get coupons twice a year. To calculate the bond price in this scenario, follow the steps given below −

Step 1

Open an excel sheet and enter the data as shown in the below screenshot for your reference.

Step 2

Now you need to enter the below given formula and press the enter key as shown in the below screenshot for your reference.

=PV(B18/2,B20,B17*B20/2,B17)

Note − In the above formula, B18 is the annual rate of interest, B20 is the actual period, B17*B21 gets the coupon, and B17 is the face value. You can change this as per your need.

Conclusion

In this tutorial, we used a set of simple examples to show how you can calculate the price of different types of coupon bonds in an Excel sheet.

Download Article

Download Article

A bond value calculator capable of accurately determining the current value of a bond, can be easily assembled in a Microsoft Excel spread sheet. Once created, the desired data will automatically appear in the designated cells when the required input values are entered. This article provides step-by-step instructions on how to create a bond value calculator in an Excel spreadsheet.

-

1

Type the column heading and data labels. Beginning with cell A1, type the following text into cells A1 through A8: Bond Yield Data, Face Value, Annual Coupon Rate, Annual Required Return, Years to Maturity, Years to Call, Call Premium and Payment Frequency. Skipping over cell A9, type «Value of Bond» in cell A10.

-

2

Format the text in column A. Move the mouse pointer over the line separating columns A and B, just above the Bond Yield Data column heading. Click and drag the line to widen column A enough to fit the text in the column.

Advertisement

-

3

Format the column headings. Click and drag to select cells A2 and B2. Hold down the control key on your keyboard. Confirm that both cells are selected, click the «Merge cells» button, and then click the «Center Text» button. With cells A2 and B2 still selected, click the «Borders» button and select «All borders.»

-

4

Set the numerical formatting in column B. Hold down the control key on your keyboard and select cells B2 and B10. With both cells selected, click the «Currency» button ($) on the «Quick format» tool bar. The formatted cell values will display as a dollar amount.

- Hold down the control key and select cells A3, A4 and A7. With all 3 cells selected, click the «Percent» button (%) on the «Quick format» tool bar. The formatted cell values will display as a percentage.

- Hold down the control key and select cells A3, A4 and A7. With all 3 cells selected, click the «Percent» button (%) on the «Quick format» tool bar. The formatted cell values will display as a percentage.

Advertisement

-

1

Enter the bond yield formulas.

- Click in cell B13 and type the formula: =(B3*B2)/B10.

- Click in cell B14 and enter the formula: =RATE(B5*B8,B3/B8*B2,-B10,B2)*B8.

- Click in cell B15 and type the formula: =RATE(B6*B8,B3/B8*B2,-B10,B2*(1+B7))*B8.

- Click in cell B13 and type the formula: =(B3*B2)/B10.

-

1

Enter the following values in the corresponding cells to test the functionality of the bond yield calculator.

- Type 10,000 in cell B2 (Face Value).

- Type .06 in cell B3 (Annual Coupon Rate).

- Type .09 into cell B4 (Annual Required Return).

- Type 3 in cell B5 (Years to Maturity).

- Type 1 in cell B6 (Years to Call).

- Type .04 in cell B7 ( Call Premium).

- Type 2 in cell B8 (Payment Frequency).

- Type 9999.99 into cell B10 (Value of Bond).

- Cross-reference the results of the input values. If the formulas have been entered correctly, the following results will appear in column B, under the Bond Yield Calculations heading. The Current Yield should be 6.0%. The Yield to Maturity should read 6.0%, and the Yield to call should read 9.90%. If the values in the bond yield calculator match the figures listed above, the formulas have been entered correctly. If the values do not match, double check that the formulas have been entered correctly. The bond yield calculator has been tested.

- Type 10,000 in cell B2 (Face Value).

Advertisement

Ask a Question

200 characters left

Include your email address to get a message when this question is answered.

Submit

Advertisement

Video

Thanks for submitting a tip for review!

About This Article

Thanks to all authors for creating a page that has been read 102,314 times.

:max_bytes(150000):strip_icc()/troypic__troy_segal-5bfc2629c9e77c005142f6d9.jpg)

:max_bytes(150000):strip_icc()/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)