Every month we all have got income (e.g. salary, dividends) and fixed expenses (e.g. rent, transport). I am a programmer and in this domain these two entities are the same, except the income is a positive value while the expenses are negative ones.

My question is: what word can be used to characterize both concepts of income and fixed expenses? For example the word animal might mean a dog and a cat as well. And what single word does connote both income and fixed expense?

In other words, what do you call the income and fixed expenses you have got monthly in a single word?

asked May 16, 2018 at 15:45

IvanIvan

2251 silver badge7 bronze badges

Income and expenses are both «accounts».

I’m not sure if that works for you because other things are «accounts» also, like liabilities and capital. If you need a word that INCLUDES both income and expenses, than «accounts» is the most likely word. If you mean a word that includes income and fixed expenses and nothing else … I don’t think there’s a generally-accepted term for that.

It’s like your «animal» example: dogs and cats are both «animals», but there are other kinds of animals too.

answered May 16, 2018 at 15:57

JayJay

59.5k1 gold badge63 silver badges128 bronze badges

1

A little late here, but «cashflow» would fit nicely here and is a term commonly used in business/personal finance.

Cashflow refers to the movement of value (or «flow of cash»), with positive and negative cashflow referring to the value coming into or going out of an account. This includes both literal cash (e.g. coins/notes flowing in and out of a till) and digital cash (e.g. bank transfers and investments).

Note that cashflow is distinct from the currently accepted «account» answer, since cashflow refers specifically to the movement of wealth into/out of/between accounts (accounts being the place that cash is stored). .

answered Jun 18, 2018 at 23:57

kwahkwah

6934 silver badges6 bronze badges

Household economy = family finance : State of income and expense of one house.

I must do a part time job to help family finance.

answered May 16, 2018 at 15:54

HK LeeHK Lee

2551 silver badge14 bronze badges

6

You must log in to answer this question.

Not the answer you’re looking for? Browse other questions tagged

.

Not the answer you’re looking for? Browse other questions tagged

.

I often capitalize three specific words when talking about personal finance: Income, Bills, and Expenses.

I’ve defined these ideas in different posts throughout the history of this site, but I’ve found that I haven’t actually devoted a place to just those definitions. And since I’ve learned that I define these terms slightly differently than other places out there, this post will be a reference that you and I can return to, to understand why.

If you want to bookmark a post, this would be one to bookmark!

Income

Income refers to all money that you receive.

This most obviously refers to things like wages and pay checks, but can include other payments as well. Here are some other ideas:

- Tax refunds or other reimbursements

- Proceeds from selling things (such as on eBay or Craigslist)

- Money that someone is paying you back

If it’s liquid assets (as in, not property or other tangible things), then it goes in this category.

Bills

Bills refer to every regular or semi-regular payment made.

A regular payment is one that is the same amount at the same time each month. The canonical example for this is rent/mortgage payment. Also, the phone is a good one. And car insurance. If you give money to a charity, that goes here too.

Then there are the payments that happen at the same time each month, but differ in amount. This would be things like utility payments, or credit card payments.

I would also consider putting money away in savings/retirement a Bill, under the heading of that venerable mantra “paying yourself first“.

Bills can happen more than once per month too, or even once every other month. (For example, property tax that goes out once per quarter is still a Bill.) In all cases they still are mostly regular and scheduled. These are the payments that are easiest to automate.

Expenses

Expenses refer to every non-regular purchase made.

This is the stuff that you do every day (or at least often) throughout the month. Things like groceries, restaurants, home supplies, pet food, gasoline, and clothing. And of course, all those little things that don’t quite fit into any category.

While I see the difference between Bills and Expenses being very important, I don’t usually see people splitting them up as intently as I do. Because of this, it may sometimes be difficult to know whether something counts as a Bill or an Expense.

So here’s a trick that I’d use: If you would use the word “payment” to describe it, it’s a Bill, while if you would use the term “purchase” to describe it, it’s an Expense.

For example, you would purchase gas, but you would make a payment on you car insurance. You wouldn’t make a payment to the restaurant; you would purchase food. But you wouldn’t purchase rent; you would make a rent payment. See how it works?

Add it up

The equation to remember is:

Income = Bills + Expenses

What this means is that, for everything that comes in (Income), you must make sure it’s equal to the sum of all your Bills and Expenses. Everything must add up, and you must figure out how to do this.

If you can make this equivalence work for you, month in and month out, you are positioned for success. And success, in this case, means control over financial situation, understanding and focus to your habits, and eventual wealth. Not bad.

Did I miss anything in these categories? Let me know and I’ll update this post.

- income and expenses

-

Общая лексика: доходы и расходы

Универсальный англо-русский словарь.

.

2011.

Смотреть что такое «income and expenses» в других словарях:

-

Measures of national income and output — A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), gross national product (GNP), and net national income (NNI). All are… … Wikipedia

-

Income statement — Accountancy Key concepts Accountant · Accounting period · Bookkeeping · Cash and accrual basis · Cash flow management · Chart of accounts … Wikipedia

-

income statement — an accounting of income and expenses that indicates a firm s net profit or loss over a certain period of time, usually one year. * * * In accounting, the activity oriented financial statement issued by businesses. Covering a specified time, such… … Universalium

-

income statement — noun a financial statement that gives operating results for a specific period • Syn: ↑earnings report, ↑operating statement, ↑profit and loss statement • Hypernyms: ↑statement, ↑financial statement * * * noun see … Useful english dictionary

-

Income taxes in Canada — constitute the majority of the annual revenues of the Government of Canada, and of the governments of the Provinces of Canada. In the last fiscal year, the government collected roughly three times more personal income taxes than it did corporate… … Wikipedia

-

income tax — n: a tax on the net income of an individual or a business compare excise, property tax Merriam Webster’s Dictionary of Law. Merriam Webster. 1996 … Law dictionary

-

income statement — n. A statement of financial gains and losses over a twelve month period; also called earnings report, operating statement, profit and loss statement. The Essential Law Dictionary. Sphinx Publishing, An imprint of Sourcebooks, Inc. Amy Hackney… … Law dictionary

-

income tax — a tax levied on incomes, esp. an annual government tax on personal incomes. [1790 1800] * * * Levy imposed by public authority on the incomes of persons or corporations within its jurisdiction. In nations with an advanced system of private… … Universalium

-

income — The return in money from one s business, labor, or capital invested; gains, profits, salary, wages, etc. The gain derived from capital, from labor or effort, or both combined, including profit or gain through sale or conversion of capital. Income … Black’s law dictionary

-

income — The return in money from one s business, labor, or capital invested; gains, profits, salary, wages, etc. The gain derived from capital, from labor or effort, or both combined, including profit or gain through sale or conversion of capital. Income … Black’s law dictionary

-

Income tax in India — The Indian Income Tax department is governed by the Central Board for Direct Taxes (CBDT) and is part of the Department of Revenue under the Ministry of Finance.The government of India imposes an income tax on taxable income of individuals, Hindu … Wikipedia

Recognition of

income and expenses

Interest income and expense are recognised on an accrual basis calculated

using the effective interest method.

Отражение

доходов и расходов

Процентные доходы и расходы отражаются по методу наращивания с использованием метода

эффективной ставки процента.

recognition Interest income and expense items are recognized on an accrual basis

using the effective interest rate method.

Признание

доходов и расходов

Процентные доходы и расходы отражаются по методу начисления,

используя метод эффективной процентой ставки.

are recognised in profit or loss using the effective interest method.

отражаются в составе прибыли или убытка с использованием метода эффективной процентной ставки.

In general, income and expense are recognized according to accruals concept,

that is

incomes and expenses

are recognized at the time of operation

and

not on receipt.

В основном доходы и расходы признаются согласно принципу начисления,

то есть

доходы и расходы

признаются на момент осуществления, а не фактического получения.

translated at the exchange rates existing at the dates of the transactions or a rate that approximates the actual exchange rates.

Статьи доходов и расходов за все представленные периоды переводятся по курсу,

действовавшему на момент проведения операции, или по среднему курсу за период.

Contractors should also disclose the amounts of assets, liabilities, income and expense

and

operating and investing cash flows arising from the

exploration for and evaluation of mineral resources.

Контракторы должны также сообщать об объеме активов, обязательств, доходов и расходов, а также о денежных потоках оперативного

и

инвестиционного характера,

связанных с разведкой

и

оценкой минеральных ресурсов.

recognition Interest income and expense are recorded in the statement of

income

for all debt

instruments on an accrual basis using the effective interest method.

Отражение

доходов и расходов

Процентные доходы и расходы отражаются в отчете о прибылях

и

убытках по всем долговым инструментам

по методу начисления

и

рассчитываются по методу эффективной процентной ставки.

Having a written personal budget detailing income and expense is one of the key parameters of financial literacy.

Личный бюджет доходов и расходов в письменном виде- один из основных параметров финансовой грамотности.

in the

income

statement regardless of the date of receipt or payment.

расчете прибыли или убытков независимо от даты получения или оплаты.

Related Party Transactions(Continued) The income and expense items with related parties for the nine-month period

ended 30 September 2018 were as follows.

Операции со связанными сторонами( продолжение)

Ниже указаны статьи доходов и расходов по операциям со связанными сторонами за девять месяцев,

закончившихся 30 сентября 2018 года.

Related Party Transactions(Continued) The income and expense items with related parties for the six-month period

ended 30 June 2016 were as follows.

Операции со связанными сторонами( продолжение)

Ниже указаны статьи доходов и расходов по операциям со связанными сторонами за три месяца,

закончившиеся 30 июня 2016 года.

or loss when the corresponding service is provided.

Прочие комиссии, а также прочие доходы и расходы отражаются в составе прибыли

или убытка на дату предоставления соответствующей услуги.

Income and expense that refer to the accounting period are recognized in the profit

loss regardless of the date of receipt or payment.

Доходы и расходы, относящиеся к отчетному периоду, отражаются в расчете прибыли

или убытков независимо от даты их получения или платежа.

Related Party Transactions(Continued) The income and expense items with related parties for the three-month period

ended 30 September 2015 were as follows.

Операции между связанными сторонами( продолжение)

Ниже указаны статьи доходов и расходов по операциям со связанными сторонами за три месяца,

закончившихся 30 сентября 2015 года.

In order to manage this kind of risk Bank regularly analyses

and

monitories interest income and expense in accordance with corresponding assets

and

liabilities.

В целях управления данным риском Банк регулярно анализирует

и

отслеживает процентные доходы и расходы в соотношении с соответствующими активами

и

обязательствами.

Difference between Income and expense of this part was reported as zero in the Financial

Statements for the year 2013.

Income and expense that refer to the accounting period are recognized in the profit

loss regardless of the date of receipt or payment.

Доход и расходы, которые относятся на отчетный период, признаются в расчете прибыли

убытков, невзирая на дату их получения или выплаты.

After verifying presented reports it was found that reported income and expense match the data provided by banks where

the electoral competitors have their“Electoral Fund” account open.

результате проверки представленных отчетов констатировано, что указанные в отчетах доходы и расходы соответствуют данным, представленным банками,

в

которых электоральные конкуренты открыли счет« Избирательный фонд».

Commission

and

fee income and expense from financial instruments not at fair value through profit

and

loss,

other than amounts included in determining the effective interest rate, can be specified as follows.

Комиссионные

доходы

Комиссионные

расходы

Комиссионные доходы и расходы по операциям с финансовыми инструментами, не переоцениваемыми по справедливой стоимости через

прибыль или убыток, исключая суммы, не учтенные при определении эффективной процентной ставки, могут быть отражены следующим образом.

Looking at quarterly results,

we note a significant variation in the Company’s income and expense articles, which in part could be attributed to the business model

changes in market-based service offerings.

Мы отмечаем, что

при рассмотрении квартальных результатов наблюдается значительная вариация в статьях доходов и расходов Компании, что отчасти можно отнести к модели бизнеса

и

меняющимся

предложениям услуг, основанным на рыночной конъюнктуре.

or premium or other differences between the initial carrying amount of an interest bearing instrument

and

its amount at maturity calculated on an effective interest rate basis.

премии или другие разницы между начальной стоимостью процентного инструмента

и

его стоимостью на момент погашения, расчитаной на основе эффективной процентной ставки.

or premium or other differences between the initial carrying amount of an interest-bearing instrument

and

its amount at maturity calculated on an effective interest rate basis.

или премии или другой разницы между первоначальной балансовой стоимостью приносящего процентный

доход

инструмента

и

суммой выплаты в конце срока, рассчитанную по методу эффективной процентной ставки.

As at 30 June 2016

and

31 December 2015,

the outstanding balances with related parties

and

income and expense items with related parties for 6 months 2016

and 6 months 2015 were as follows.

Остатки по операциям со связанными сторонами по состоянию на 30 июня

2016 года

и

31 декабря 2015 года, а также статьи доходов и расходов по операциям со связанными сторонами за 6 месяцев 2016 года

6 месяцев 2015 года, представлены ниже.

or premium or other differences between the initial carrying amount of an interest-bearing instrument

and

its amount at maturity calculated on an effective interest rate basis.

или премии или другие разности между первоначальной учетной стоимостью приносящего процентный

доход

финансового инструмента

и

суммой его возмещения в конце срока, которую рассчитывают по методу эффективной процентной ставки.

presented separately from the related assets, liabilities, income

and expense

from the related insurance contracts because the reinsurance arrangements do not relieve the Company from its direct obligations to its policyholders.

Активы, обязательства

и

доходы и расходы, возникающие от переданных в перестрахование договоров страхования

представлены отдельно от связанных активов, обязательств,

доходов и расходов

от связанных договоров страхования, поскольку договоры перестрахования не освобождают Компанию от исполнения своих прямых обязательств перед держателями полисов.

Critical accounting estimates

and

judgements The preparation of financial statements in conformity with IFRS requires management to make judgments, estimates

and

assumptions that affect the application of policies

and

the reported amounts of assets

and

Критические допущения

и

оценочные значения Подготовка финансовой отчетности согласно МСФО требует от руководства применения суждений, допущений

и

оценок, которые влияют на применение учетной политики

и

на отражение в финансовой отчетности сумм активов

и

recognition With the exception of financial assets held-fortrading

and

other financial instruments at fair value through profit or loss,

or loss using the effective interest rate method.

Признание

доходов и расходов

За исключением финансовых активов, предназначенных для торговли,

и

прочих финансовых инструментов, оцененных по справедливой стоимости через прибыль или убыток,

убытках с использованием метода эффективной процентной ставки.

SIC-30, assets, liabilities

and

equity items have been translated at the

closing rates existing at dates of presentation; income and expense items have been translated using

exchange rates prevailing at the end of the week in which the

income and expense

items were incurred.

В соответствии с ПКИ- 30, статьи активов, обязательств

и

капитала

были переведены по курсу, действующему на дату представления, статьи доходов и расходов были переведены,

используя курсы, действующие на конец той недели, в которой соответствующие

доходы и расходы

имели место.

Learning Objectives

- Identify and compare the sources and uses of income.

- Define and illustrate the budget balances that result from the uses of income.

- Outline the remedies for budget deficits and surpluses.

- Define opportunity and sunk costs and discuss their effects on financial decision making.

Personal finance is the process of paying for or financing a life and a way of living. Just as a business must be financed—its buildings, equipment, use of labor and materials, and operating costs must be paid for—so must a person’s possessions and living expenses. Just as a business relies on its revenues from selling goods or services to finance its costs, so a person relies on income earned from selling labor or capital to finance costs. You need to understand this financing process and the terms used to describe it. In the next chapter, you’ll look at how to account for it.

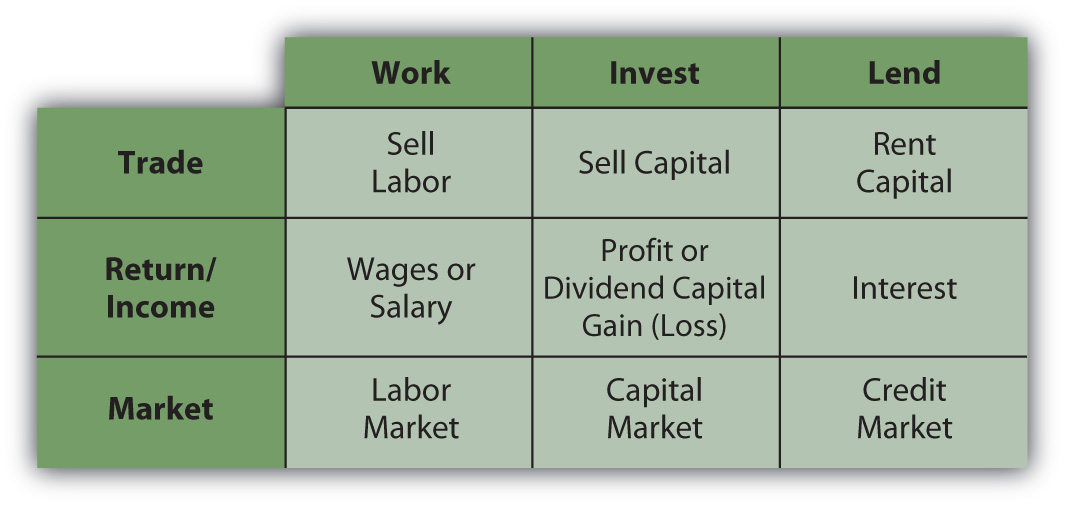

Where Does Income Come From?

IncomeEarnings of a given period. In the case of an indivdual or household, this is generally cash from wages, interest, dividends, or assets (such as rental income from real estate) that can be used for consumption or saved. is what is earned or received in a given period. There are various terms for income because there are various ways of earning income. Income from employment or self-employment is wages or salary. Deposit accounts, like savings accounts, earn interest, which could also come from lending. Owning stock entitles the shareholder to a dividend, if there is one. Owning a piece of a partnership or a privately held corporation entitles one to a draw.

The two fundamental ways of earning income in a market-based economy are by selling labor or selling capital. Selling labor means working, either for someone else or for yourself. Income comes in the form of a paycheck. Total compensation may include other benefits, such as retirement contributions, health insurance, or life insurance. Labor is sold in the labor market.

Selling capital means investing: taking excess cash and selling it or renting it to someone who needs liquidityNearness to cash, or how easily and cheaply—with low transaction costs—an asset can be turned into cash. (access to cash). Lending is renting out capital; the interest is the rent. You can lend privately by direct arrangement with a borrower, or you can lend through a public debt exchange by buying corporate, government, or government agency bonds. Investing in or buying corporate stock is an example of selling capital in exchange for a share of the company’s future value.

You can invest in many other kinds of assets, like antiques, art, coins, land, or commodities such as soybeans, live cattle, platinum, or light crude oil. The principle is the same: investing is renting capital or selling it for an asset that can be resold later, or that can create future income, or both. Capital is sold in the capital market and lent in the credit market—a specific part of the capital market (just like the dairy section is a specific part of the supermarket). Figure 2.2 «Sources of Income» shows the sources of income.

Figure 2.2 Sources of Income

In the labor market, the price of labor is the wage that an employer (buyer of labor) is willing to pay to the employee (seller of labor). For any given job, that price is determined by many factors. The nature of the work defines the education and skills required, and the price may reflect other factors as well, such as the status or desirability of the job.

In turn, the skills needed and the attractiveness of the work determine the supply of labor for that particular job—the number of people who could and would want to do the job. If the supply of labor is greater than the demand, if there are more people to work at a job than are needed, then employers will have more hiring choices. That labor market is a buyers’ market, and the buyers can hire labor at lower prices. If there are fewer people willing and able to do a job than there are jobs, then that labor market is a sellers’ market, and workers can sell their labor at higher prices.

Similarly, the fewer skills required for the job, the more people there will be who are able to do it, creating a buyers’ market. The more skills required for a job, the fewer people there will be to do it, and the more leverage or advantage the seller has in negotiating a price. People pursue education to make themselves more highly skilled and therefore able to compete in a sellers’ labor market.

When you are starting your career, you are usually in a buyers’ market (unless you have some unusual gift or talent), if only because of your lack of experience. As your career progresses, you have more, and perhaps more varied, experience and presumably more skills, and so can sell your labor in more of a sellers’ market. You may change careers or jobs more than once, but you would hope to be doing so to your advantage, that is, always to be gaining bargaining power in the labor market.

Many people love their work for many reasons other than the pay, however, and choose it for those rewards. Labor is more than a source of income; it is also a source of many intellectual, social, and other personal gratifications. Your labor nevertheless is also a tradable commodity and has a market value. The personal rewards of your work may ultimately determine your choices, but you should be aware of the market value of those choices as you make them.

Your ability to sell labor and earn income reflects your situation in your labor market. Earlier in your career, you can expect to earn less than you will as your career progresses. Most people would like to reach a point where they don’t have to sell labor at all. They hope to retire someday and pursue other hobbies or interests. They can retire if they have alternative sources of income—if they can earn income from savings and from selling capital.

Capital markets exist so that buyers can buy capital. Businesses always need capital and have limited ways of raising it. Sellers and lenders (investors), on the other hand, have many more choices of how to invest their excess cash in the capital and credit markets, so those markets are much more like sellers’ markets. The following are examples of ways to invest in the capital and credit markets:

- Buying stocks

- Buying government or corporate bonds

- Lending a mortgage

The market for any particular investment or asset may be a sellers’ or buyers’ market at any particular time, depending on economic conditions. For example, the market for real estate, modern art, sports memorabilia, or vintage cars can be a buyers’ market if there are more sellers than buyers. Typically, however, there is as much or more demand for capital as there is supply. The more capital you have to sell, the more ways you can sell it to more kinds of buyers, and the more those buyers may be willing to pay. At first, however, for most people, selling labor is their only practical source of income.

Where Does Income Go?

ExpensesThe costs of consumption or daily living. are costs for items or resources that are used up or consumed in the course of daily living. Expenses recur (i.e., they happen over and over again) because food, housing, clothing, energy, and so on are used up on a daily basis.

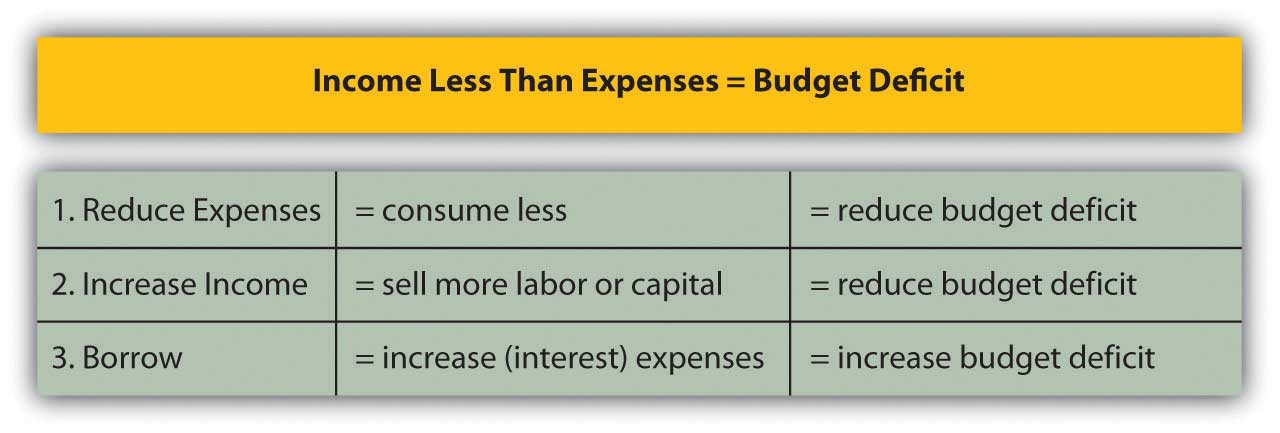

When income is less than expenses, you have a budget deficitA shortfall of available funds created when income is less than the expenses.—too little cash to provide for your wants or needs. A budget deficit is not sustainable; it is not financially viable. The only choices are to eliminate the deficit by (1) increasing income, (2) reducing expenses, or (3) borrowing to make up the difference. Borrowing may seem like the easiest and quickest solution, but borrowing also increases expenses, because it creates an additional expense: interest. Unless income can also be increased, borrowing to cover a deficit will only increase it.

Better, although usually harder, choices are to increase income or decrease expenses. Figure 2.3 «Budget Deficit» shows the choices created by a budget deficit.

Figure 2.3 Budget Deficit

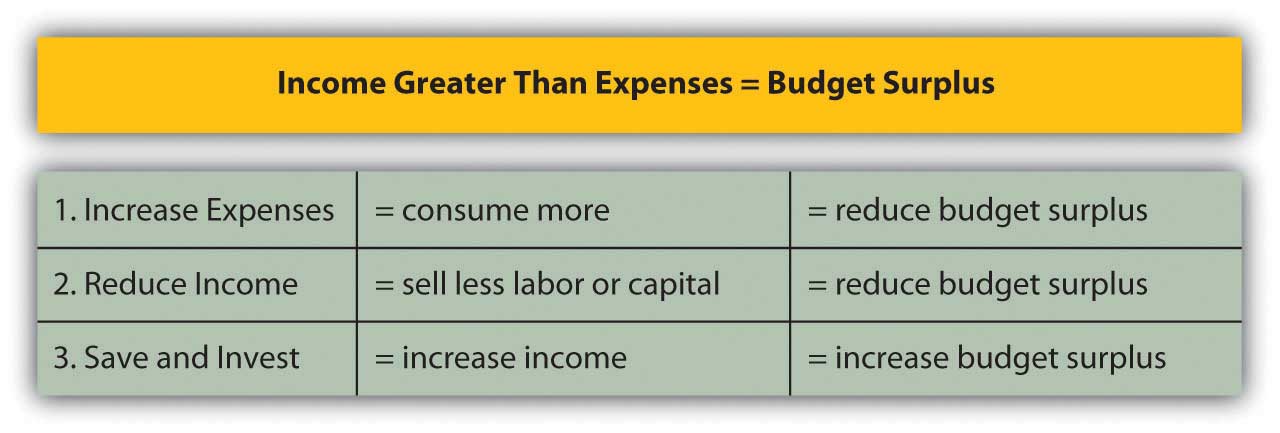

When income for a period is greater than expenses, there is a budget surplusAn excess of available funds created when income is greater than the expenses.. That situation is sustainable and remains financially viable. You could choose to decrease income by, say, working less. More likely, you would use the surplus in one of two ways: consume more or save it. If consumed, the income is gone, although presumably you enjoyed it.

If saved, however, the income can be stored, perhaps in a piggy bank or cookie jar, and used later. A more profitable way to save is to invest it in some way—deposit in a bank account, lend it with interest, or trade it for an asset, such as a stock or a bond or real estate. Those ways of saving are ways of selling your excess capital in the capital markets to increase your wealth. The following are examples of savings:

- Depositing into a statement savings account at a bank

- Contributing to a retirement account

- Purchasing a certificate of deposit (CD)

- Purchasing a government savings bond

- Depositing into a money market account

Figure 2.5 «Budget Surplus» shows the choices created by a budget surplus.

Figure 2.5 Budget Surplus

Opportunity Costs and Sunk Costs

There are two other important kinds of costs aside from expenses that affect your financial life. Suppose you can afford a new jacket or new boots, but not both, because your resources—the income you can use to buy clothing—are limited. If you buy the jacket, you cannot also buy the boots. Not getting the boots is an opportunity costThe cost of sacrificing the next best choice because of the choice made; the value of the next best choice, which is forgone once a choice is made. of buying the jacket; it is cost of sacrificing your next best choice.

In personal finance, there is always an opportunity cost. You always want to make a choice that will create more value than cost, and so you always want the opportunity cost to be less than the benefit from trade. You bought the jacket instead of the boots because you decided that having the jacket would bring more benefit than the cost of not having the boots. You believed your benefit would be greater than your opportunity cost.

In personal finance, opportunity costs affect not only consumption decisions but also financing decisions, such as whether to borrow or to pay cash. Borrowing has obvious costs, whereas paying with your own cash or savings seems costless. Using your cash does have an opportunity cost, however. You lose whatever interest you may have had on your savings, and you lose liquidity—that is, if you need cash for something else, like a better choice or an emergency, you no longer have it and may even have to borrow it at a higher cost.

When buyers and sellers make choices, they weigh opportunity costs, and sometimes regret them, especially when the benefits from trade are disappointing. Regret can color future choices. Sometimes regret can keep us from recognizing sunk costsCosts that have been incurred in past transactions and cannot be recovered..

Sunk costs are costs that have already been spent; that is, whatever resources you traded are gone, and there is no way to recover them. Decisions, by definition, can be made only about the future, not about the past. A trade, when it’s over, is over and done, so recognizing that sunk costs are truly sunk can help you make better decisions.

For example, the money you spent on your jacket is a sunk cost. If it snows next week and you decide you really do need boots, too, that money is gone, and you cannot use it to buy boots. If you really want the boots, you will have to find another way to pay for them.

Unlike a price tag, opportunity cost is not obvious. You tend to focus on what you are getting in the trade, not on what you are not getting. This tendency is a cheerful aspect of human nature, but it can be a weakness in the kind of strategic decision making that is so essential in financial planning. Human nature also may make you focus too much on sunk costs, but all the relish or regret in the world cannot change past decisions. Learning to recognize sunk costs is important in making good financial decisions.

Key Takeaways

- It is important to understand the sources (incomes) and uses (expenses) of funds, and the budget deficit or budget surplus that may result.

- Wages or salary is income from employment or self-employment; interest is earned by lending; a dividend is the income from owning corporate stock; and a draw is income from a partnership.

- Deficits or surpluses need to be addressed, and that means making decisions about what to do with them.

- Increasing income, reducing expenses, and borrowing are three ways to deal with budget deficits.

- Spending more, saving, and investing are three ways to deal with budget surpluses.

- Opportunity costs and sunk costs are hidden expenses that affect financial decision making.

Exercises

- Where does your income come from, and where does it go? Analyze your inflows of income from all sources and outgoes of income through expenditures in a month, quarter, or year. After analyzing your numbers and converting them to percentages, show your results in two figures, using proportions of a dollar bill to show where your income comes from and proportions of another dollar bill to show how you spend your income. How would you like your income to change? How would you like your distribution of expenses to change? Use your investigation to develop a rough personal budget.

- Examine your budget and distinguish between wants and needs. How do you define a financial need? What are your fixed expenses, or costs you must pay regularly each week, month, or year? Which of your budget categories must you provide for first before satisfying others? To what extent is each of your expenses discretionary—under your control in terms of spending more or less for that item or resource? Which of your expenses could you reduce if you had to or wanted to for any reason?

- If you had a budget deficit, what could you do about it? What would be the best solution for the long term? If you had a budget surplus, what could you do about it? What would be your best choice, and why?

- You need a jacket, boots, and gloves, but the jacket you want will use up all the money you have available for outerwear. What is your opportunity cost if you buy the jacket? What is your sunk cost if you buy the jacket? How could you modify your consumption to reduce opportunity cost? If you buy the jacket but find that you need the boots and gloves, how could you modify your budget to compensate for your sunk cost?