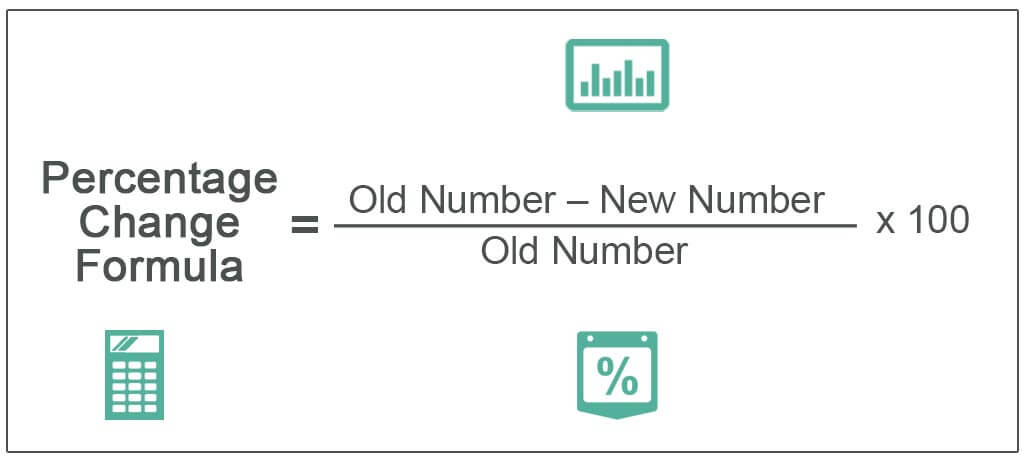

Formula to Calculate Percentage Change

Percentage Change can be defined as a % change in value due to changes in the old number and new number, and the values can either increase or decrease and so the change can be a positive value (+) or a negative value (-).

Table of contents

- Formula to Calculate Percentage Change

- Examples

- Example #1

- Example #2

- Example #3

- Relevance and Use

- Percentage Change Calculator

- Recommended Articles

- Examples

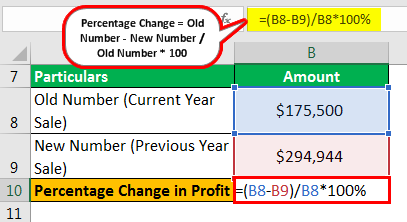

Percentage Change = (Old Number – New Number)/Old Number * 100

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkArticle Link to be Hyperlinked

For eg:

Source: Percentage Change Formula (wallstreetmojo.com)

Looking at the simplicity of this formula, the outcome of this formula must be interpreted correctly. Its outcome can be two types of values:

Positive Value

Even though the positive outcome cannot be interpreted as favorable results, it depends on the input we used in the formula. For example, we used this formula in a cost comparison of two years. If the outcome is positive, then the results are favorable. But on the other hand, if the outcome of a sale comparison is positive, then the result cannot be said favorably.

Negative Value

Prima facie negative values cannot be said unfavorable results every time. If we desire an increase in the value of a particular item, a negative outcome of comparison cannot be said to be unfavorable results.

The formula has to be used carefully. The position of the old value and a new value can be interchanged as follows:

New Number – Old Number/Old Number * 100

But the outcome of this equation has to be interpreted vice-versa to interpretation explained above.

Examples

You can download this Percentage Change Formula Excel Template here – Percentage Change Formula Excel Template

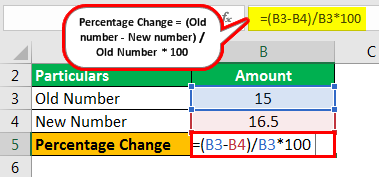

Example #1

Company XYZ, in the first year after its incorporation, made a profit of $ 15 million, and in the next year, its profits increased to 16.5 million. What is the percentage change in its profits?

Solution

Use below given data for the calculation.

- Old Number: 15

- New Number: 16.5

A calculation can be done as follows-

=(15-16.5)/15*100

- = -10%

It can be interpreted as value has increased by 10% from the old number.

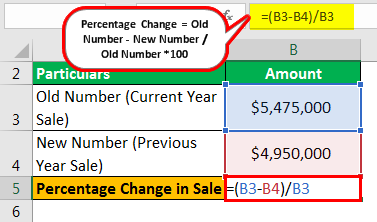

Example #2

Now let us take an example of an organization analyzing its financial statements for the current year and comparing them with the previous year’s figures. Its profit and loss statement for the current year shows a sale of $ 4,950,000, and its profit appears to be $294,944. However, its sale in the previous year was $5,475,000 and a profit of $ 175,500. What is the percentage increase or decrease in organization profit and sales?

Solution

First of all, we will calculate the % change in a sale by applying the formula:

Use the below-given data for the calculation.

- Old Number (Current Year Sale): $5,475,000

- New number (Previous Year Sale): $4,950,000

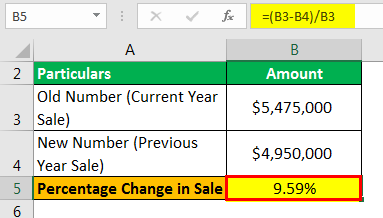

Calculation of change in a sale can be done as follows-

= ($5475000-$4950000)/$5475000

= 9.59 % decrease in sale

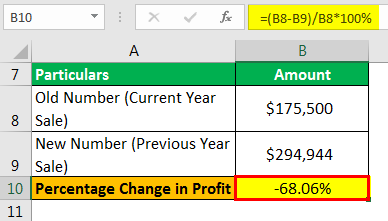

Now we will calculate the % change in profit:

- Old Number (Current Year Sale): $175,500

- New number (Previous Year Sale): $294,944

Calculation of percentage change in a profit can be done as follows-

= ($175,500-$294,944)/ $175,500 *100%

= ($175500-$294944)/$175500

= -68.06% or can be interpreted as a 68.06% increase in profits.

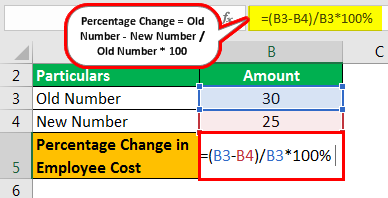

Example #3

A startup firm had 30 employees last year, and its total human resource cost was $ 196,500. The company decided to remove five highly inefficient employees to reduce its employee cost. At the end of the year, while analyzing savings in employee cost, it found the total employee cost is $ 195,500. Find out the % change in employee cost due to no employees.

Solution

Use below given data for calculation

- Old Number: 30

- New Number: 25

Calculation of percentage change in no of employees can be done as follows-

=(30-25)/30*100%

= 16.67% or 16.67% decrease in no. of employees

Use below given data for calculation of the change in the employee cost.

- Old Number: 196500

- New Number: 195500

=(196500-195500)/196500*100%

= 0.5%

= 0.5% increase in employee cost.

Relevance and Use

Percentage change is an important tool to give clarity of thought about the direction. Either change is moving in a favorable direction, or do we need to change our strategies to bring changes per our goals and objectives? As shown in both of the above examples, changes in the first example are favorable but changes in the second example are not favorable in the first example. Even though the strong sales decreased by 9.59%, company profit increased by 68.06%.

It shows that changes adopted by the organization resulted in a favorable outcome. But in the second example, even though the company has removed its five employees still, its employee cost has increased by 0.5%. It gives them clarity of thought that something wrong is happening in the organization.

Percentage Change Calculator

You can use this calculator

| Old Number | |

| New Number | |

| Percentage Change Formula | |

| Percentage Change Formula = |

|

||||||||||

|

Recommended Articles

This has been a guide to the Percentage Change Formula. Here we provide step-by-step calculation of % change, practical examples, and a downloadable excel template. You can learn more about accounting and budgeting from the following articles –

- Net Change FormulaNet Change formula calculates the change in the value of anything from its previous values. It derives the difference in the closing price of the stocks, mutual funds, bonds from its closing price on the previous day. Net Change Formula = Current Period’s Closing Price – Previous Period’s Closing Price

read more - Calculate Percentage Increase in ExcelPercentage increase = (New Value — Old Value)/ Old Value. Instead of showing the delta as a Value, percentage increase shows how much the value has changed in terms of percentage increase.read more

- Decrease Percentage FormulaDecrease Percentage is used to determine the decrease in two values (final value and initial value) in percentage terms and according to the formula the initial value is subtracted from the final value and the resultant is divided by the initial value and multiplied by 100 to derive the decrease percentage.read more

- Calculate Relative ChangeRelative change shows the change of a value of an indicator in the first period and in percentage terms, i.e. Relative change is calculated by subtracting the value of the indicator in the first period from the value of the indicator in the second period which is then divided by the value of the indicator in the first period and the result is taken out in percentage terms.read more

- Extrapolation FormulaLinear exploration is calculated using two endpoints (x1, y1) and (x2, y2). When the value of the point to be extrapolated is «x» in a linear graph, the formula that can be used is y1+ [(xx1) / (x2x1)] *(y2y1).read more

How to explain the impact of Sales Variances on Profitability or Profit Margin of a business? In this article, I am going to explain with the help of an example, how to calculate sales variances, and how to understand the impact of these variances on the profitability of your business. Note that we are calculating the impact of Sales Variances on Profit. This is different from explaining sales variances on Sales $.

Would you like to work with me to get one to one training, or to solve your specific workplace challenges, book your 15 minute consultation here: https://calendly.com/learnaf/discovery-session

Ready to jump to training directly? Book your hour(s) here: https://calendly.com/learnaf/60min

Note: If you would like to learn in detail, how to calculate sales variances and the impact they have on sales $, profit $ and profit margin %, and how to explain performance vs budget and prior periods, click here for a detailed video course (at a special price for readers of this post) showing exactly how this is done. You will also learn how to analyse and present the results of the variances to management and will be able to download solved variance calculation Excel templates.

By the time, you are finished with the article, you will be able to understand clearly how to calculate these variances. I will try to be concise, so I assume you are already aware of terms like Sales, margin, profits and variance etc. If you are not fully aware, click on Commonly used financial terms every new Financial Analyst and Accountant should know! where I explain these and other commonly used terms. Also, start following our blog and YouTube channel LearnAccountingFinance, so that you can stay up to date with practical information and training (knowledge you can use immediately at your work).

What you will learn?

We will start with data in the following example. The example uses data for 2017 and 2018 (current year vs last year) to calculate the variances. However, if you are trying to calculate variances versus budget, simply replace last year (2017) with Budget data and the calculation will work just fine.

In this example, we are selling three products which are 1) Apples, 2) Bananas and 3) Oranges. We have data for Sales, Cost of Sales and Profit margins. We also have the quantity, or number of units sold. See Tables below

As this article is about calculating the impact of Sales variances on Profit margins, we have deliberately kept the cost per unit as same over the two periods to avoid confusion. However, when calculated correctly, it does not matter if cost per unit has changed. As you will see in the calculations, sales variance calculations do not take into account change in costs. The only thing to consider in that case would be that the profit margin change would have an element of variances from costs as well which needs to be calculated separately (cost variances). In our example however, the profit margin increased by $268 and all of it is resulting from Sales related variances. After performing all variance calculations, you will see the split of variances as follows:

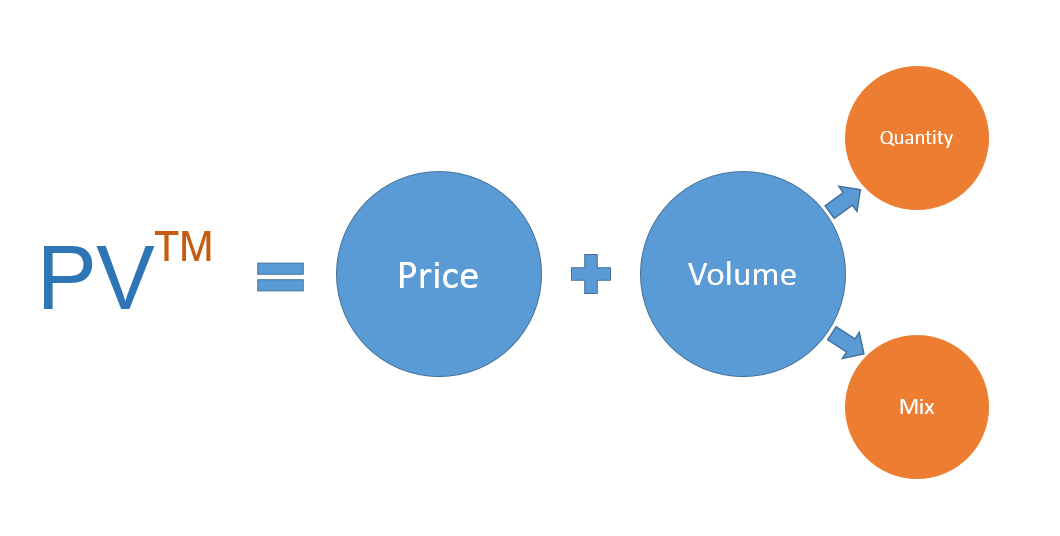

Lets look at types of sales variances quickly. Broadly, there are only two types of Sales variances.

- Price Variance (Change in Selling Price)

- Volume Variance (Change in Volume)

The Volume variance is further sub-divided into Quantity and Mix Variances. Do you like acronyms. Here is a good one to remember. Its PVTM

Accounting Explained in 100 Pages or Less: https://amzn.to/3rCProc

Sales Variance

where ‘P’ is for Price Variance, and ‘V’ is for Volume Variance. ‘T’ for Quantity and ‘M’ is for Mix.

If we calculate our variances correctly, the sum of Price and Volume variances should be equal to the total change in Profit Margin (excluding the impact of cost variances). Similarly the sum of Quantity and Mix variances should equal Volume variance. Its time to calculate each of these variances individually.

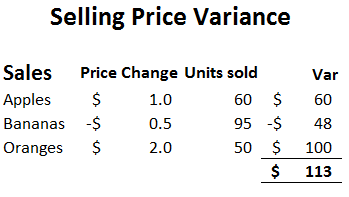

Selling Price Variance

Lets deal with Price variance first. Any change in price directly impacts Profit margin. From the data available, you can easily calculate the selling price per unit of each fruit (Amount of Sales ($) for each fruit sold divided by the number of units sold). So, for example for Apples, the selling price for 2018 is $11 ($660 Sales / 60 units sold). Similarly, the selling price of apples in 2017 was $10. Below is the table of selling prices per unit.

Looking at the table above, we can clearly see that the Selling price for apples and oranges have increased in 2018 compared to previous year, while that of bananas has decreased. This means, if we look at selling prices alone, we should see a favorable impact, or favorable variance from apples and oranges and unfavorable impact from bananas. Now, Selling Price variance will be calculated as follows:

(2018 Selling price – 2017 Selling price) x Units sold in 2018.

For apples, this can be calculated as:

($11 – $10) x 60 units = $60 Fav.

Why did we use 2018 number of units sold, and not 2017 units? The answer is that we are trying to determine the impact of change in Selling price. In other words, we are trying to see if the 60 apples sold in 2018 were sold at 2017 price, how would this compare with 2018 price. Therefore, the variance could also be calculated as follows:

Apples sold at 2018 Price – Apples sold at 2017 Price

which is …

($11 x 60) – ($10 x 60) = $60

Apply the same logic to bananas and oranges

Bananas – Sales Price variance = ($1.5 – $2) x 95 = -$48 Unfav. (numbers are rounded)

Oranges – Sales Price variance = ($10 – $8) x 50 = $100 Fav

Here is the summary of Selling price variances,

So, we can say out of total change in profit margin of $268, Price variance represents $113 (rounded), and we can also see that oranges are the largest contributors to the fav. price variance.

Volume Variance:

This leads to the calculation of our second variance; Sales Volume variance. Sales variances comprise of Price and Volume only. Since we have calculated Price variance already, we can already calculate the total volume variance which would be…

Sales Volume variance = Total Sales Variance – Sales Price Variance

$268 – $113 = $155

However, we need to still calculate it, as well as the two sub Volume variances, which are Quantity and Mix.

Lets start with Volume variance.

Sales Volume Variance =

(2018 Units Sold – 2017 Units Sold) x 2017 Profit Margin per Unit

Yes, I know you have some questions here.

- Why did we use Profit Margin per unit, and not Selling Price?

- OK, even if we use Profit Margin, why 2017 and not 2018.

See .. I can read your mind 🙂

Answer to Question 1. Remember we are trying to explain the impact of Sales variances on profit margin, not total Sales $. If we had taken Selling price instead of Profit margin, we would be explaining Sales $ variance (change in Sales $ from 2017 to 2018), but we are calculating the impact on Profit margin. For each increase or decrease in unit sold vs last year, the profit margin will be impacted only by the amount of profit margin per unit and not the total Sales value. Understanding this is important. Note that in the calculation of two sub Volume variances (Mix and Quantity) as well, we will use profit margin per unit and not Selling price per unit.

If you have understood answer to Q1, then you can also understand that when we calculated price variance, we took into account the change in profit margin per unit in 2018 (change in selling price directly impacts the profit margin). Now we are calculating the impact of change in volume (or number of units) and should exclude the impact of change in Profit margin in 2018. This is why we use 2017 Profit Margin. Think about it for a little while, internalize it and if you still do not understand, leave a comment and I will try to explain further.

Time to do the Math:

At this point, we have understood the impact of Sale price and volume on the $268 change in Profit Margin in 2018 vs 2017.

However, our analysis is not finished, and we need to understand the impact of Mix and Quantity.

Sales Mix Variance:

Sales Mix refers to the share of each product in total Sales, in terms of percentage. If you look at the number of units sold, you will see that in 2017, 50 apples were sold which is 28% of total sales of 180 units (50/180).

Sales Mix variance can be calculated as …

(2018 Mix % – 2017 Mix %) x Total units sold in 2018 x 2017 Profit Margin

So, our Sales Mix variance for each fruit will be as follows:

The share of apples in the overall product mix increased to 29% in 2018 (60/205). This change in mix of 1% multiplied by the total number of units sold in 2018 (205) will give us the number of apples sold that resulted in the increase in Mix %. In this case it is 3 apples (1% x 205 = 3). We know that the total number of apples increased by 10 (50 in 2017 and 60 in 2018). So out of the total Volume change of 10 apples, 3 apples represent Mix change and the remaining 7 represent Quantity change. We can see from the variances above that a drop in mix % of bananas by -9% has impacted the profit margin unfavorably by -$19 but this has been more than compensated by the increase in Mix % of Oranges by 8% (which has a higher Profit margin per Unit compared to bananas).

Calculating Mix variance separately in this way is important because each product has a different profit margin. Assuming the overall volume increased from 180 to 205 (just as in our example) but the mix remained the same as last year, then the change in total profit margin of the business would have been different, although we see the same quantity increase. This calculation of impact of increase in quantity while maintaining the same mix as last year is really our next variance, the Quantity Variance. Calculating Mix variance also helps when trying to explain Profit Margin % changes over the years, or vs budget because Quantity variance has neutral impact on % Profit Margin.

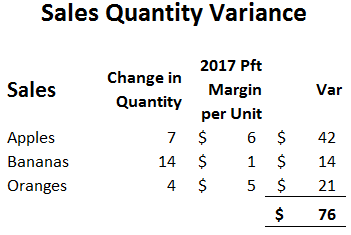

Sales Quantity Variance

As mentioned above, Sales Quantity variance measures the impact of increase in volume, or quantity while maintaining previous year’s mix.

Sales Quantity Variance

= (2018 Units sold @ 2017 Mix – 2017 Units Sold) x 2017 Profit Margin per unit

In our example fruit sales increased from 180 to 205. If the sale had increased maintaining the same product mix as 2017, our unit sales for 2018 would be as follows:

And the Sales Quantity Variance can be calculated as follows:

Conclusion:

We have calculated all the variances now. The overall increase of $268 in Profit margin can be clearly explained with Price increase resulting in fav. variance of $113 and Volume increase resulting in fav. variance of $155. The volume increase includes $79 due to change in Product Mix.

Note: If you would like to learn in detail, how to calculate sales variances and the impact they have on sales $, profit $ and profit margin %, and how to explain performance vs budget and prior periods, click here for a detailed video course (at a special price for readers of this post) showing exactly how this is done. You will also learn how to analyse and present the results of the variances to management and will be able to download solved variance calculation Excel templates.

If you are also interested in learning how to calculate purchase price variance and the accounting entries involved in recording purchase price variance, click on the link How to calculate Purchase Price Variance (PPV) and track PPV accounting entries in SAP

Are you an accounting and finance professional looking to improve your financial analysis skills? Make sure you connect with me by subscribing to my email list. I will be sharing practical tips and advice that will help you transform you career this year. Click here to subscribe to my email list.

I have a YouTube channel with helpful accounting and finance, Excel and career related videos. You can find my channel by clicking on the link LearnAccountingFinance. Leave a comment if you found this information helpful or if you have any questions!

Xem thêm từ vựng tiếng Anh theo chủ đề tại: https://hoctuvung.hochay.com/

Cùng HocHay học tiếng Anh Market Leader Intermediate các bạn nhé!

Market Leader Intermediate – Unit 3: Change – Listening

A. Anne Deering is Head of Transformation Practice at international management consultants AT Kearney. listen to the first part of the interview and complete the gaps.

- What are they …………………………… (1), how are they going to ……………………….(2), and how will they know they’ve ………….(3)?

- Make sure people are …………………(4) in the change, that they feel this is something they are doing for ………..(5) and not something which is being done ………………. (6)

Đáp án:

- going to change

- measure that change

- been successful

- fully engaged

- themselves

- to them

B. Listen to the second part. What are the two main problems that businesses face when going through change?

Đáp án:

- change fatigue

- getting leadersengaged and aligned aroundthe change

C. Listen to the final part, where Anne talks about Nokia-Siemens Networks, and answer the questions.

1. What was the main purpose of the merger?

2. What do these numbers refer to?

a) 8,000

b) 72

Đáp án:

1. to create better value I a future for the organisation

2.

a) the number of people involved in the development stage of the project

b) the number of hours over which this ‘conversation’ took place

Ứng dụng học tiếng Anh – App HocHay cho Android & iOS

|

|

|

Vocabulary Market Leader Intermediate – Unit 3: Change– HocHay

- Write the verbs from the box under the correct prefix to make words connected with change. Use a good dictionary to help you. Some of the words can be used with more than one prefix.

assess centralise date develop grade launch locate organise regulate size structure train

Đáp án:

| down- | de- | up- | re- |

|

grade size |

centralise regulate |

date grade |

assess develop launch locate organise structure train |

B. Complete these sentences with the correct form of the verbs from the box in Exercise A_ Use a good dictionary to help you.

- Following the merger, the office layout was ……………. to accommodate the new staff.

- The most successful change in our company was the decision to ………..the company. Now there is more opportunity for promotion.

- It is now so expensive to rent offices in the city centre that many companies are ………… their operations to purpose-built business parks at the city limits.

- The company has recently ………… its workforce. Reducing the number of employees is the best way to stay profitable in the current economic climate.

- To improve efficiency, the company has introduced new working practices. The HR department will …………. all sales staff.

- One of our products hasn’t been selling well recently. The marketing team has decided to take it off the market and ………… it next year with new packaging.

- The IT department report recommended that the company ……….. the computer system as soon as possible.

- The CEO thinks that too many decisions are made at Head Office. She wants to ………….. the decision-making process so that branch managers are more involved at an earlier stage.

- The company has finalised the plans to ………… the disused car-park site. It is going to become a fitness centre for employees.

- The logo and slogan are very old-fashioned. We need to …………….. the whole image of the product and bring it into the 21st century.

- There is a lot of pressure on the government from consumer groups to ……………… the industry and remove controls, so customers can benefit from increased competition.

- Following the report by the legal department and changes in the tax laws, the management decided to ……………. the situation and delay making a decision on the takeover.

Đáp án:

- reorganised

- restructure

- relocating

- downsized

- retrain

- relaunch

- upgrade

- decentralise

- redevelop

- update

- deregulate

- reassess

C. Underline the nouns in Exercise B that make partnerships with the verbs.

Đáp án:

1. the office layout was reorganised

2. restructure the company

3. relocating their operations

4. downsized its workforce

5. retrain all sales staff

6. relaunch (the product)

7. upgrade the computer system

8. decentralise the decision-making process

9. redevelop the disused car-park site

10. update the whole image

11. deregulate the industry

12. reassess the situation

Language Review Market Leader Intermediate – Unit 3: Change– HocHay

Xem thêm ngữ pháp Thì quá khứ đơn trong tiếng Anh tại: https://dethi.hochay.com/thi-qua-khu-don-cd

- Which of the following expressions are used with the past simple and which are used with the present perfect? Which are used with both?

in 2010 this week recently since 2009 yesterday last year yet ever six months ago

Đáp án:

Past simple: in2010, yesterday, last year, six monthsago

Present perfect: since 2009, yet*, ever

Both: this week, recently

*Unless you are teaching an American English class, don’t get bogged down in differences between British English and American English. It’struethatinAmerican English the past simple can be used with yet, as in Did you eat yet?, but only confirm this if a student mentions it.

B. Complete this short business brief about Vietnam using the past simple or the present perfect forms of the verbs in brackets.

Vietnam …………(1) (go) through many changes in its history and …………(2) (experience) many economic changes recently. It is currently experiencing an economic boom. In 1986, the government …………(3) (introduce) economic reforms or doi moi (doi meaning change and moi new). The reforms ………. (4) (permit) the setting up of free market enterprises and …………(5) (abolish) the practice of collective farming. However, agriculture remains the most important part of the economy. Vietnam ……….. (6) (recently/become) the second largest producer of rice in the world after Thailand. The industrial sector ……….. (7) (show) dramatic improvement and expansion as well. In 1993, the World Bank …………(8) (declare) 58% of the population to be living in poverty. By 2005, this figure was less than 20%. Vietnam …………(9) (also/make) great strides on the international stage in the last decade or so. It ………..(10) (become) a full member of ASEAN in 1995, and of the WTO in 2006. The effects of this new-found prosperity can be seen everywhere. Large, glitzy malls …………. (11) (appear) in major cities, while streets once filled with bicycles are now overflowing with locally produced Japanese, Korean and Chinese motorbikes and cars. Business visitors wishing to relax in a more traditional Vietnamese town should visit Hoi An. Hoi An …………(12) (be) a major Asian trading port in the 17th and 18th centuries, and its picturesque architecture and relaxed lifestyle …………(13) (change) little over the years.

Đáp án:

- has been/gone

- has experienced

- introduced

- permitted

- abolished

- has recently become/recentlybecame

- has shown

- declared

- has also made

- became

- have appeared

- was

- have changed

Xem thêm ngữ pháp Thì hiện tại hoàn thành trong tiếng Anh tại: https://dethi.hochay.com/thi-hien-tai-hoan-thanh-cd

HOCHAY.COM – nhận thông báo video mới nhất từ Học Hay: Học Tiếng Anh Dễ Dàng

Subscribe Youtube Channel | Youtube.com/HocHay

Tiếp theo:

- Market Leader Intermediate – Unit 3: Change (Part 2)

Chia sẻ ngay trên các MXH sau để tạo tín hiệu tốt cho bài viết

There

are many factors that affect how much profit a business might make.

Here are some of the most common.

Expenses.

Expenses must be deducted from income to determine profit. The more

the business’s expenses increase, the lower profit will be. It is

important for businesses to keep their expenses as low as possible.

Demand

for the product or service.

If the demand for the business’s products or services remains the

same or increases, profit increases too. And if demand decreases,

profit decreases too.

Economy.

Sometimes, the economy experiences a recession or depression –

wages may be lower or people are out of work. A business’s profit

may be decreased simply because its customers do not have money to

buy as many goods or services as in the past. The profits of

businesses are more likely to increase, since more sales can be

made.

Chance.

Sometimes profits are affected by chance or luck. On occasion, this

is good for the business. On the other hand, the chance of loss is

always possible. And, even though a business is going well one year,

there is no guarantee that factors, many times beyond control, will

not change the profit picture.

Prices.

Why don’t businesses just raise their prices to cover any increase

in the cost of merchandise or any decrease in demand? Actually, it

is difficult for businesses to raise their prices because decreased

sales might result. Customers who don’t like price increases may

show their dissatisfaction by not doing any further business with

the company if they are able to get the same or similar products

from another businesses. Because most of the businesses in the free

enterprise system exist in a competitive environment, it is

important that a business does not charge more than its competitors

unless it gives some additional service to customers.

How

to increase profit?

Profits

are not fixed or guaranteed, there are many ways a business owner

can help to increase profit. Increasing sales is a popular way to

increase profit. Businesses try to increase sales by offering better

quality products or services than competitors, by keeping prices

at/or below the level of competitors, and by using promotional

techniques, such as personal selling, creative displays, special

sales, and advertising.

Profits

can be increased when workers are more efficient. This means that

workers must use scarce resources wisely. These resources include

such things as time and supplies. For example, workers should spend

time on the job working, rather than talking with others or taking

care of personal matters. When workers are efficient, they are able

to produce more for the company. Increased production can result in

more sales and more profit. Many businesses reward employees for

efficient work habits through monetary bonuses and other rewards.

Some of the work habits, which are rewarded, are promptness, regular

attendance, and superior performance. Increasing worker efficiency

is receiving much attention as businesses realize just how much time

and money can be saved.

Another

way of increasing profit is decreasing expenses. Businesses can

decrease expenses in several ways. They might consider eliminating

some free services, such as delivery, gift wrapping, or alterations.

Businesses must be certain that their expenditures in terms of cost

of merchandise are at the best prices. Perhaps a new supplies would

offer better prices or benefits than a current supplier. In

addition, businesses should try to obtain the best rates for such

expenses as advertising, insurance, etc., and should try to keep

payroll expenses as low as possible without sacrificing service to

customers. And, businesses should encourage workers to use resources

wisely. For example, turning off lights and equipment when not being

used and not wasting supplies. Decreasing expenses is the best way

that businesses can help to increase profit.

Comments:

-

To

deduct – вычитать -

Recession

– спад -

In

terms of – в

исчислении -

Rate

– тариф

Divide

the text into logical parts and copy out the topic sentence in each

part that could be useful for composing a plan to the text.

Write

a brief summary of the text. Use the following key-patterns.

1.

As the title implies the first part of the text deals with ….. .

2.

It is spoken in detail ….. .

3.

In the second part of the text much attention is given to ….. .

4.

The text gives the detailed analysis of ….. .

5.The

text is of interest to ….. .

Answer

the questions.

-

What

are the most common factors affecting the profit? -

What

is the relation between expenses and profit? -

How

does demand influence the profit? -

What

do businesses experience during the recession?

-

Are

there any guarantees that business will be successful? -

Why

does not price raising guarantee higher profits? -

What

is a popular way to increase profit? -

What

workers are referred to as “efficient workers”? -

How

do businesses reward their efficient employees? -

How

can expenses be decreased?

Summarize

the information of the text and render its essentials.

Look

through the text and fill in the gaps with the words given below.

Normal

profit

..(1)..

a component of the firm’s opportunity costs. The time that the owner

..(2).. running the firm could be spent on running another firm.

Normal profit is the ..(3).. the entrepreneur can expect to earn or

the profit that a business owner considers ..(4).. to make running

the business. When a firm ..(5).. positive economic profits, we say

returns to entrepreneurial ability are ..(6).. . In the short run, a

firm earning subnormal profits (i.e. an economic loss) can continue

to do ..(7).. as long as revenues cover average variable costs. In a

perfect market, positive economic profits cannot be ..(8).. in the

long run as more firms enter the market and increase competition.

An

..(9).. profit arises when revenue exceeds the opportunity cost of

inputs, noting that these costs ..(10).. the cost of equity capital

that is met by «normal profits.»

All

enterprises can be stated in financial capital of the ..(11).. of

the enterprise. The economic profit may include an element in

recognition of the ..(12)..that an investor takes. It is often

uncertain, because of incomplete information, whether an enterprise

will succeed or ..(13)..

This

extra risk is included in the minimum ..(14).. of return that

providers of financial capital require, and so is treated as still a

cost within economics. The size of that return corresponds to the

riskiness associated ..(15).. each type of investment.

Risks,

business, sustained, is, spends, economic, earns, with, return,

supernormal, owners, include, rate, necessary, not.

Render

the text into English.

Соседние файлы в предмете [НЕСОРТИРОВАННОЕ]

- #

- #

- #

- #

- #

- #

- #

- #

- #

- #

- #

As a company’s sales or revenues increase, some of the company’s expenses will increase and some expenses will not change. For example, if a company sells a few additional products on which it pays a sales commission, the company’s cost of goods sold will increase as will its commissions expense. On the other hand, the salaried employees’ pay and the company’s rent will not increase even a penny with the sale of a few more products. To help improve the profits at a company, it is valuable to know how the expenses behave—will they increase when sales increase or will they stay at the present amount. The goal is to increase sales or revenues by an amount greater than the increase in expenses. Another approach is to decrease expenses by an amount greater than a related decrease in revenues.

Expenses can be classified according to how they react to a change in revenues. Often we see three classifications of expenses:

- Variable

- Fixed

- Mixed

To help explain these three types of expense behavior, we will use the example of Verve Company, a women’s retail clothing store.

1. Variable expenses change in total as volume changes.

A sales commission is considered to be a variable expense. For example, let’s say that instead of a salary, Verve pays its sales staff commissions equal to 10% of sales. When sales are $50,000 Verve has $5,000 of commissions expense; when sales are $70,000 Verve has $7,000 of commission expense.

With a variable expense the amount per unit (or the percent) stays constant—in this case it’s 10%—but the total expense will vary with the sales volume.

You can see this with the cost of goods sold. Let’s say Verve pays $7 for a particular shirt and then sells the same shirt for $10. When sales are $100, the cost of goods sold is $70; when sales are $10,000, the cost of goods sold is $7,000. Other variable expenses could include delivery expenses, wages in the shipping department, and shipping supplies used such as boxes, shrink wrap, etc.

2. Fixed expenses do not change in total as volume changes.

If Verve rents retail space for $2,500 per month, the rent remains at $2,500 whether the sales are at an all-time high or an all-time low. If Verve owns the space, the real estate taxes remain the same whether sales are high or low. Other examples of fixed expenses include such things as salaries, insurance, telephone book advertising, and most depreciation.

If sales were to increase by a huge percentage, some fixed expenses might change. For example, if sales doubled it is likely to cause an increase in rent expense.

3. A mixed expense is a combination of a variable and a fixed expense.

Let’s say Verve employs a sales person who is paid a base salary of $2,000 per month plus a 2% commission on all sales. The base salary is a fixed expense; the 2% commission is a variable expense. Taken together, the salesperson’s compensation is considered a mixed expense.

Some mixed expenses (such as vehicle expenses) do not correlate with sales. If a salesperson uses her car to make sales presentations to customers, expenses such as insurance, licenses, parking, and some depreciation are all fixed expenses—the total amount will be the same within a reasonable range of miles driven regardless of the amount of sales. Some vehicle expenses, such as gasoline, oil changes, tires, and other maintenance will vary (in total) with the number of miles driven. But, will these expenses vary with sales? Maybe or maybe not.

To help determine (1) how much of a mixed expense is fixed and (2) the rate at which the variable portion of a mixed expense will change as some activity changes, accountants use a statistical tool called regression analysis. Consult a statistics textbook to learn more about this valuable tool.

When buying and selling assets for profit, it is important for investors to differentiate between realized profits and gains, and unrealized or so-called «paper profits».

Until an investment is disposed of, any change of value experienced is only unrealized, or «on paper.» Only when the investment is sold is a loss or gain realized. And only then would you be subject to taxation.

Key Takeaways

- An unrealized, or «paper» gain or loss is a theoretical profit or deficit that exists on balance, resulting from an investment that has not yet been sold for cash.

- A realized profit or loss occurs when an investment is actually sold for a higher or lower price than where it was purchased.

- Realized vs. unrealized gains and losses are treated differently for tax purposes.

What Are Unrealized Gains And Losses?

Realized Profits

Simply put, realized profits are gains that have been converted into cash. In other words, for you to realize profits from an investment you’ve made, you must receive cash and not simply witness the market price of your asset increase without selling. For example, if you owned 1,000 common shares of XYZ Corporation, and the firm issued a cash dividend of $0.50 per share, you would realize a profit of $500 from your investment. This is a realized profit because you have received the actual cash, which cannot be lost due to changes in the marketplace.

Similarly, let’s say you purchased your 1,000 XYZ shares at $10 per share, for a total investment of $10,000. If XYZ Corp. were presently trading on the market for $15 per share and you sold all of your 1,000 shares on the open market at $15, you would realize a gain of $5,000 on your investment ($15,000 — $10,000).

Now, suppose that XYZ Corp.’s shares were trading at $15, but you believed they were fairly valued at $20 per share, and therefore, you were not willing to sell at $15. Because you would still be holding on to all of your 1,000 shares, you would have an unrealized, or «paper», profit of $5,000. Of course, if you have not closed out of your position and realized your gain, you could still lose some, or all, of your profits, and your principal as well.

Unrealized (Paper) Profits

On the other hand, because you have not realized your profit, you are not required to claim the gain as income; thus, by holding your shares instead of selling, you can potentially defer taxable income for a year (or many). Of course, the reverse is true for losses: realized losses can usually be claimed by investors as capital losses, offsetting other capital gains, while paper losses can not.

Advisor Insight

Lawrence Sprung, CFP®

Mitlin Financial Inc., Hauppauge, NY

Realized profits, or gains, are what you keep after the sale of a security. The key here is that you have sold, locking in the profit and «realizing» it. For instance, if you purchased a security at $50 per share and subsequently sold it at $100 per share you would have a realized profit of $50. Unrealized gains, or paper profits, are gains that you only have on “paper» because you still hold the investment. These gains could evaporate if the security declines in value or increase if the price of the security rises.

For example, if you purchased a security at $50 per share, still currently own it and it is valued at $100 per share, then you would have an unrealized gain or paper profit of $50 per share. This unrealized gain would become realized only if you sell the security.

How Are Realized Profits Taxed?

In the U.S., only realized profits are subject to taxation. If an investment is held for less than one year, it is considered a short-term capital gains tax, which would be the same as ordinary income. If held for longer than one year, it would instead be subject to the more favorable long-term capital gains tax (which would be either 0%, 15%, or 20% depending on total income and filing status).

Why Are People Reluctant to Realize Paper Losses?

In behavioral finance, the well-known phenomenon of loss aversion predicts that people hold on to losing prospects for too long because the psychological pain of realizing a loss is difficult to bear. In other words, the pain of losing, say $100, is bigger than the pleasure received from finding $100. As they say, «losses loom larger than gains.» In the context of investing, this is known as the disposition effect. As a result, people tend to hold on too long to losing stocks and sell their winners too early.

Why Are Unrealized Gains or Losses Known As «Paper» Gains or Losses?

An unrealized gain or loss has not yet been actualized. This means that the value of an asset you’ve invested in has changed in value, but you have not yet sold it. As a result, these changes in value only appear «on paper,» once in the form of physical brokerage or account statements mailed to clients.