- Текст

- Веб-страница

The word ″micro″ means small, and microeconomics means economics in the small. The optimizing behavior of individual units such as households and firms provides the foundation for microeconomics.

Microeconomists may investigate individual markets or even the economy as a whole, but their analyses are derived from the aggregation of the behavior of individual units. Microeconomic theory is used extensively in many areas of applied economics. For example, it is used in industrial organization, labor economics, international trade, cost-benefit analysis, and many other economic subfields. The tools and analyses of microeconomics provide a common ground, and even a language, for economists interested in a wide range of problems.

At one time there was a sharp distinction in both methodology and subject matter between microeconomics and macroeconomics.

The methodological distinction became somewhat blurred during the 1970s as more and more macroeconomic analyses were built upon microeconcmic foundations. Nonetheless, major distinctions remain between the two major branches of economics. For example, the microeconomist is interested in the determination of individual prices and relative prices (i.e., exchange ratios between goods), whereas the macroeconomist is interested more in the general price level and its change over time.

Optimization plays a key role in microeconomics. The consumer is assumed to maximize utility or satisfaction subject to the constraints imposed by income or income earning power. The producer is assumed to maximize profit or minimize cost subject to the technological constraints under which the firm operates. Optimization of social welfare sometimes is the criterion for the determination of public policy.

Opportunity cost is an important concept in microeconomics. Many courses of action are valued in terms of what is sacrificed so that they might be undertaken. For example, the opportunity cost of a public project is the value of the additional goods that the private sector would have produced with the resources used for the public project.

0/5000

Результаты (русский) 1: [копия]

Скопировано!

Слово ″micro″ означает небольшой, а Микроэкономика экономики в малых. Оптимизируя поведение отдельных единиц таких домашних хозяйств и фирм обеспечивает основу для микроэкономики.Microeconomists может расследовать отдельные рынки или даже экономика в целом, но их анализ являются производными от агрегации поведения отдельных единиц. Микроэкономическая теория широко используется во многих областях прикладной экономики. Например он используется в промышленной организации, экономика труда, международной торговли, анализа затрат выгод и многие другие экономические подполей. Инструменты и анализ Микроэкономика обеспечивают общую основу и даже язык, для экономистов интересует широкий спектр проблем.Одно время было резкое различие как методологии, так и предмета между микроэкономики и макроэкономики.Методологические различия стали несколько размыты в 1970-х как более макроэкономического анализа были построены на microeconcmic фундаменте. Тем не менее основные различия остаются между двух основных отраслей экономики. Например microeconomist заинтересована в определении индивидуальных цен и относительных цен (т.е. Обмен соотношение между товарами), тогда как макроэкономиста интересуется более общего уровня цен и его изменения с течением времени.Оптимизация играет ключевую роль в микроэкономике. Предполагается, что потребитель может максимизировать полезность или удовлетворение при условии соблюдения ограничений, налагаемых доход или доход зарабатываются. Предполагается, что производитель максимизации прибыли или минимизации затрат при условии технологические ограничения, при которых действует фирма. Критерием для определения государственной политики является оптимизация социального обеспечения иногда.Издержки является важным понятием в микроэкономике. Многие курсы действий, оцениваются с точки зрения то, что приносится в жертву так, что они могут быть проведены. Например издержки общественного проекта значение дополнительных товаров, которые частный сектор будут произведены с ресурсов, используемых для общественного проекта.

переводится, пожалуйста, подождите..

Результаты (русский) 2:[копия]

Скопировано!

Слово «микро» означает маленький, и микроэкономики означает экономику в мал. Оптимизации поведение отдельных единиц, таких как домашние хозяйства и фирмы обеспечивает основу для микроэкономики. Microeconomists может расследовать отдельных рынков или даже экономики в целом, но и их анализ являются производными от агрегации поведения отдельных подразделений. Микроэкономической теории широко используется во многих областях прикладной экономики. Например, он используется в промышленной организации, экономика труда, международной торговли, анализа затрат и выгод, и многих других экономических подполей. Инструменты и анализ микроэкономики обеспечить общую почву, и даже язык, для экономистов, заинтересованных в широком диапазоне проблем. В свое время было резкое различие в методологии и предмета между микро- и макроэкономики. методологической различие стало несколько размыта в 1970-х, как все больше и больше макроэкономического анализа были построены на microeconcmic фондов. Тем не менее, основные различия остаются между двумя основными отраслей экономики. Например, microeconomist заинтересована в определении индивидуальных цен и относительных цен (например, обмен отношения между товарами), в то время как макроэкономике больше заинтересована в общем уровне цен и его изменение с течением времени. Оптимизация играет ключевую роль в микроэкономике. Предполагается, потребитель максимизирует полезность или удовлетворение при ограничениях, налагаемых на прибыль или доход заработка власти. Предполагается, продюсер, чтобы максимизировать прибыль или минимизировать стоимость, подлежащего технологические ограничения, при которых действует фирма. Оптимизация общественного благосостояния иногда критерий для определения государственной политики. Возможность стоимость важное понятие в микроэкономике. Многие направления деятельности оцениваются с точки зрения того, что приносится в жертву, чтобы они могли быть предприняты. Например, издержки общественного проекта стоимость дополнительных товаров, которые частный сектор произвел бы с ресурсов, используемых для общественного проекта.

переводится, пожалуйста, подождите..

Результаты (русский) 3:[копия]

Скопировано!

Слово «микро» означает малых, и микроэкономики означает экономики в малых. Оптимизации поведения отдельных подразделений, таких, как домашние хозяйства, и фирмы обеспечивает основу для эконометрика.ветровому Microeconomists может расследования отдельных рынков, или даже для экономики в целом, но и их анализ, на основе обобщения поведения отдельных подразделений.Микроэкономическая теория широко используется во многих областях прикладной экономики. Например, она используется в организации промышленности, экономика труда, международной торговли, анализа затрат и выгод, и многих других экономических подполей. Инструменты и анализ эконометрика обеспечивают общую массу, и даже язык, для экономистов заинтересованных в широкий круг проблем.

переводится, пожалуйста, подождите..

Другие языки

- English

- Français

- Deutsch

- 中文(简体)

- 中文(繁体)

- 日本語

- 한국어

- Español

- Português

- Русский

- Italiano

- Nederlands

- Ελληνικά

- العربية

- Polski

- Català

- ภาษาไทย

- Svenska

- Dansk

- Suomi

- Indonesia

- Tiếng Việt

- Melayu

- Norsk

- Čeština

- فارسی

Поддержка инструмент перевода: Клингонский (pIqaD), Определить язык, азербайджанский, албанский, амхарский, английский, арабский, армянский, африкаанс, баскский, белорусский, бенгальский, бирманский, болгарский, боснийский, валлийский, венгерский, вьетнамский, гавайский, галисийский, греческий, грузинский, гуджарати, датский, зулу, иврит, игбо, идиш, индонезийский, ирландский, исландский, испанский, итальянский, йоруба, казахский, каннада, каталанский, киргизский, китайский, китайский традиционный, корейский, корсиканский, креольский (Гаити), курманджи, кхмерский, кхоса, лаосский, латинский, латышский, литовский, люксембургский, македонский, малагасийский, малайский, малаялам, мальтийский, маори, маратхи, монгольский, немецкий, непальский, нидерландский, норвежский, ория, панджаби, персидский, польский, португальский, пушту, руанда, румынский, русский, самоанский, себуанский, сербский, сесото, сингальский, синдхи, словацкий, словенский, сомалийский, суахили, суданский, таджикский, тайский, тамильский, татарский, телугу, турецкий, туркменский, узбекский, уйгурский, украинский, урду, филиппинский, финский, французский, фризский, хауса, хинди, хмонг, хорватский, чева, чешский, шведский, шона, шотландский (гэльский), эсперанто, эстонский, яванский, японский, Язык перевода.

- Как дела, как поиск путевки?

- потому что стирать вещи руками очень дол

- не глубокий

- They skate in the morning?

- Об этом человеке можно сказать самое хор

- что делаешь? пообедал? удачи в делах! об

- They skate in the morning?

- дешевый

- пока

- Как дела? как поиск путевки?

- что делаешь? пообедал? удачи в делах! об

- тихий

- subway station

- Чай англичане пьют со сливками и сахаром

- Как твои дела, как поиск путевки?

- дедушка

- l’ve got a tongue

- I love the sea

- deep

- do it some for me

- Если вы член торгово-промышленной палаты

- do it some for me

- Если вы член торгово-промышленной палаты

- Arrival at Warehouse

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms.[1][2][3] Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as whole, which is studied in macroeconomics.

Microeconomics analyzes the market mechanisms that enable buyers and sellers to establish relative prices among goods and services. Shown is a marketplace in Delhi.

One goal of microeconomics is to analyze the market mechanisms that establish relative prices among goods and services and allocate limited resources among alternative uses[citation needed]. Microeconomics shows conditions under which free markets lead to desirable allocations. It also analyzes market failure, where markets fail to produce efficient results.[citation needed]

While microeconomics focuses on firms and individuals, macroeconomics focuses on the sum total of economic activity, dealing with the issues of growth, inflation, and unemployment and with national policies relating to these issues.[2] Microeconomics also deals with the effects of economic policies (such as changing taxation levels) on microeconomic behavior and thus on the aforementioned aspects of the economy.[4] Particularly in the wake of the Lucas critique, much of modern macroeconomic theories has been built upon microfoundations—i.e. based upon basic assumptions about micro-level behavior.

Assumptions and definitionsEdit

The word microeconomics derives from the Greek word ‘mikros'(small, minor)[citation needed]. Microeconomic study historically has been performed according to general equilibrium theory, developed by Léon Walras in Elements of Pure Economics (1874) and partial equilibrium theory, introduced by Alfred Marshall in Principles of Economics (1890)[citation needed].

Microeconomic theory typically begins with the study of a single rational and utility maximizing individual. To economists, rationality means an individual possesses stable preferences that are both complete and transitive.

The technical assumption that preference relations are continuous is needed to ensure the existence of a utility function. Although microeconomic theory can continue without this assumption, it would make comparative statics impossible since there is no guarantee that the resulting utility function would be differentiable.

Microeconomic theory progresses by defining a competitive budget set which is a subset of the consumption set. It is at this point that economists make the technical assumption that preferences are locally non-satiated. Without the assumption of LNS (local non-satiation) there is no 100% guarantee but there would be a rational rise[citation needed]

in individual utility. With the necessary tools and assumptions in place the utility maximization problem (UMP) is developed.

The utility maximization problem is the heart of consumer theory. The utility maximization problem attempts to explain the action axiom by imposing rationality axioms on consumer preferences and then mathematically modeling and analyzing the consequences.[citation needed] The utility maximization problem serves not only as the mathematical foundation of consumer theory but as a metaphysical explanation of it as well. That is, the utility maximization problem is used by economists to not only explain what or how individuals make choices but why individuals make choices as well.

The utility maximization problem is a constrained optimization problem in which an individual seeks to maximize utility subject to a budget constraint. Economists use the extreme value theorem to guarantee that a solution to the utility maximization problem exists. That is, since the budget constraint is both bounded and closed, a solution to the utility maximization problem exists. Economists call the solution to the utility maximization problem a Walrasian demand function or correspondence.[citation needed]

The utility maximization problem has so far been developed by taking consumer tastes (i.e. consumer utility) as the primitive. However, an alternative way to develop microeconomic theory is by taking consumer choice as the primitive. This model of microeconomic theory is referred to as revealed preference theory.

The supply and demand model describes how prices vary as a result of a balance between product availability at each price (supply) and the desires of those with purchasing power at each price (demand). The graph depicts a right-shift in demand from D1 to D2 along with the consequent increase in price and quantity required to reach a new market-clearing equilibrium point on the supply curve (S).

The theory of supply and demand usually assumes that markets are perfectly competitive. This implies that there are many buyers and sellers in the market and none of them have the capacity to significantly influence prices of goods and services. In many real-life transactions, the assumption fails because some individual buyers or sellers have the ability to influence prices. Quite often, a sophisticated analysis is required to understand the demand-supply equation of a good model. However, the theory works well in situations meeting these assumptions.

Mainstream economics does not assume a priori that markets are preferable to other forms of social organization. In fact, much analysis is devoted to cases where market failures lead to resource allocation that is suboptimal and creates deadweight loss. A classic example of suboptimal resource allocation is that of a public good. In such cases, economists may attempt to find policies that avoid waste, either directly by government control, indirectly by regulation that induces market participants to act in a manner consistent with optimal welfare, or by creating «missing markets» to enable efficient trading where none had previously existed.

This is studied in the field of collective action and public choice theory. «Optimal welfare» usually takes on a Paretian norm, which is a mathematical application of the Kaldor–Hicks method. This can diverge from the Utilitarian goal of maximizing utility because it does not consider the distribution of goods between people. Market failure in positive economics (microeconomics) is limited in implications without mixing the belief of the economist and their theory.

The demand for various commodities by individuals is generally thought of as the outcome of a utility-maximizing process, with each individual trying to maximize their own utility under a budget constraint and a given consumption set.

Allocation of scarce resourcesEdit

Individuals and firms need to allocate limited resources to ensure all agents in the economy are well off. Firms decide which goods and services to produce considering low costs involving labour, materials and capital as well as potential profit margins. Consumers choose the good and services they want that will maximize their happiness taking into account their limited wealth.[5]

The government can make these allocation decisions or they can be independently made by the consumers and firms. For example, in the former Soviet Union, the government played a part in informing car manufacturers which cars to produce and which consumers will gain access to a car.[6]

HistoryEdit

Economists commonly consider themselves microeconomists or macroeconomists. The difference between microeconomics and macroeconomics likely was introduced in 1933 by the Norwegian economist Ragnar Frisch, the co-recipient of the first Nobel Memorial Prize in Economic Sciences in 1969.[7][8] However, Frisch did not actually use the word «microeconomics», instead drawing distinctions between «micro-dynamic» and «macro-dynamic» analysis in a way similar to how the words «microeconomics» and «macroeconomics» are used today.[7][9] The first known use of the term «microeconomics» in a published article was from Pieter de Wolff in 1941, who broadened the term «micro-dynamics» into «microeconomics».[8][10]

Microeconomic theoryEdit

Consumer demand theoryEdit

Consumer demand theory relates preferences for the consumption of both goods and services to the consumption expenditures; ultimately, this relationship between preferences and consumption expenditures is used to relate preferences to consumer demand curves. The link between personal preferences, consumption and the demand curve is one of the most closely studied relations in economics. It is a way of analyzing how consumers may achieve equilibrium between preferences and expenditures by maximizing utility subject to consumer budget constraints.

Production theoryEdit

Production theory is the study of production, or the economic process of converting inputs into outputs.[11] Production uses resources to create a good or service that is suitable for use, gift-giving in a gift economy, or exchange in a market economy. This can include manufacturing, storing, shipping, and packaging. Some economists define production broadly as all economic activity other than consumption. They see every commercial activity other than the final purchase as some form of production.

Cost-of-production theory of valueEdit

The cost-of-production theory of value states that the price of an object or condition is determined by the sum of the cost of the resources that went into making it. The cost can comprise any of the factors of production (including labor, capital, or land) and taxation. Technology can be viewed either as a form of fixed capital (e.g. an industrial plant) or circulating capital (e.g. intermediate goods).

In the mathematical model for the cost of production, the short-run total cost is equal to fixed cost plus total variable cost. The fixed cost refers to the cost that is incurred regardless of how much the firm produces. The variable cost is a function of the quantity of an object being produced. The cost function can be used to characterize production through the duality theory in economics, developed mainly by Ronald Shephard (1953, 1970) and other scholars (Sickles & Zelenyuk, 2019, ch.2).

Fixed and variable costsEdit

- Fixed cost (FC)- This cost does not change with output. It includes business expenses such as rent, salaries and utility bills.

- Variable cost (VC)- This cost changes as output changes. This includes raw materials, delivery costs and production supplies.

Over a short time period (few months), most costs are fixed costs as the firm will have to pay for salaries, contracted shipment and materials used to produce various goods. Over a longer time period (2-3 years), costs can become variable. Firms can decide to reduce output, purchase fewer materials and even sell some machinery. Over 10 years, most costs become variable as workers can be laid off or new machinery can be bought to replace the old machinery [12]

Sunk Costs- This is a fixed cost that has already been incurred and cannot be recovered. An example of this can be in R&D development like in the pharmaceutical industry. Hundreds of millions of dollars are spent to achieve new drug breakthroughs but this is challenging as its increasingly harder to find new breakthroughs and meet tighter regulation standards. Thus many projects are written off leading to losses of millions of dollars [13]

Opportunity costEdit

Opportunity cost is closely related to the idea of time constraints. One can do only one thing at a time, which means that, inevitably, one is always giving up other things. The opportunity cost of any activity is the value of the next-best alternative thing one may have done instead. Opportunity cost depends only on the value of the next-best alternative. It doesn’t matter whether one has five alternatives or 5,000.

Opportunity costs can tell when not to do something as well as when to do something. For example, one may like waffles, but like chocolate even more. If someone offers only waffles, one would take it. But if offered waffles or chocolate, one would take the chocolate. The opportunity cost of eating waffles is sacrificing the chance to eat chocolate. Because the cost of not eating the chocolate is higher than the benefits of eating the waffles, it makes no sense to choose waffles. Of course, if one chooses chocolate, they are still faced with the opportunity cost of giving up having waffles. But one is willing to do that because the waffle’s opportunity cost is lower than the benefits of the chocolate. Opportunity costs are unavoidable constraints on behaviour because one has to decide what’s best and give up the next-best alternative.

Price TheoryEdit

Microeconomics is also known as price theory to highlight the significance of prices in relation to buyer and sellers as these agents determine prices due to their individual actions.[14] Price theory is a field of economics that uses the supply and demand framework to explain and predict human behavior. It is associated with the Chicago School of Economics. Price theory studies competitive equilibrium in markets to yield testable hypotheses that can be rejected.

Price theory is not the same as microeconomics. Strategic behavior, such as the interactions among sellers in a market where they are few, is a significant part of microeconomics but is not emphasized in price theory. Price theorists focus on competition believing it to be a reasonable description of most markets that leaves room to study additional aspects of tastes and technology. As a result, price theory tends to use less game theory than microeconomics does.

Price theory focuses on how agents respond to prices, but its framework can be applied to a wide variety of socioeconomic issues that might not seem to involve prices at first glance. Price theorists have influenced several other fields including developing public choice theory and law and economics. Price theory has been applied to issues previously thought of as outside the purview of economics such as criminal justice, marriage, and addiction.

Microeconomic modelsEdit

Supply and demandEdit

Supply and demand is an economic model of price determination in a perfectly competitive market. It concludes that in a perfectly competitive market with no externalities, per unit taxes, or price controls, the unit price for a particular good is the price at which the quantity demanded by consumers equals the quantity supplied by producers. This price results in a stable economic equilibrium.

The supply and demand model describes how prices vary as a result of a balance between product availability and demand. The graph depicts an increase (that is, right-shift) in demand from D1 to D2 along with the consequent increase in price and quantity required to reach a new equilibrium point on the supply curve (S).

Prices and quantities have been described as the most directly observable attributes of goods produced and exchanged in a market economy.[15] The theory of supply and demand is an organizing principle for explaining how prices coordinate the amounts produced and consumed. In microeconomics, it applies to price and output determination for a market with perfect competition, which includes the condition of no buyers or sellers large enough to have price-setting power.

For a given market of a commodity, demand is the relation of the quantity that all buyers would be prepared to purchase at each unit price of the good. Demand is often represented by a table or a graph showing price and quantity demanded (as in the figure). Demand theory describes individual consumers as rationally choosing the most preferred quantity of each good, given income, prices, tastes, etc. A term for this is «constrained utility maximization» (with income and wealth as the constraints on demand). Here, utility refers to the hypothesized relation of each individual consumer for ranking different commodity bundles as more or less preferred.

The law of demand states that, in general, price and quantity demanded in a given market are inversely related. That is, the higher the price of a product, the less of it people would be prepared to buy (other things unchanged). As the price of a commodity falls, consumers move toward it from relatively more expensive goods (the substitution effect). In addition, purchasing power from the price decline increases ability to buy (the income effect). Other factors can change demand; for example an increase in income will shift the demand curve for a normal good outward relative to the origin, as in the figure. All determinants are predominantly taken as constant factors of demand and supply.

Supply is the relation between the price of a good and the quantity available for sale at that price. It may be represented as a table or graph relating price and quantity supplied. Producers, for example business firms, are hypothesized to be profit maximizers, meaning that they attempt to produce and supply the amount of goods that will bring them the highest profit. Supply is typically represented as a function relating price and quantity, if other factors are unchanged.

That is, the higher the price at which the good can be sold, the more of it producers will supply, as in the figure. The higher price makes it profitable to increase production. Just as on the demand side, the position of the supply can shift, say from a change in the price of a productive input or a technical improvement. The «Law of Supply» states that, in general, a rise in price leads to an expansion in supply and a fall in price leads to a contraction in supply. Here as well, the determinants of supply, such as price of substitutes, cost of production, technology applied and various factors of inputs of production are all taken to be constant for a specific time period of evaluation of supply.

Market equilibrium occurs where quantity supplied equals quantity demanded, the intersection of the supply and demand curves in the figure above. At a price below equilibrium, there is a shortage of quantity supplied compared to quantity demanded. This is posited to bid the price up. At a price above equilibrium, there is a surplus of quantity supplied compared to quantity demanded. This pushes the price down. The model of supply and demand predicts that for given supply and demand curves, price and quantity will stabilize at the price that makes quantity supplied equal to quantity demanded. Similarly, demand-and-supply theory predicts a new price-quantity combination from a shift in demand (as to the figure), or in supply.

For a given quantity of a consumer good, the point on the demand curve indicates the value, or marginal utility, to consumers for that unit. It measures what the consumer would be prepared to pay for that unit.[16] The corresponding point on the supply curve measures marginal cost, the increase in total cost to the supplier for the corresponding unit of the good. The price in equilibrium is determined by supply and demand. In a perfectly competitive market, supply and demand equate marginal cost and marginal utility at equilibrium.[17]

On the supply side of the market, some factors of production are described as (relatively) variable in the short run, which affects the cost of changing output levels. Their usage rates can be changed easily, such as electrical power, raw-material inputs, and over-time and temp work. Other inputs are relatively fixed, such as plant and equipment and key personnel. In the long run, all inputs may be adjusted by management. These distinctions translate to differences in the elasticity (responsiveness) of the supply curve in the short and long runs and corresponding differences in the price-quantity change from a shift on the supply or demand side of the market.

Marginalist theory, such as above, describes the consumers as attempting to reach most-preferred positions, subject to income and wealth constraints while producers attempt to maximize profits subject to their own constraints, including demand for goods produced, technology, and the price of inputs. For the consumer, that point comes where marginal utility of a good, net of price, reaches zero, leaving no net gain from further consumption increases. Analogously, the producer compares marginal revenue (identical to price for the perfect competitor) against the marginal cost of a good, with marginal profit the difference. At the point where marginal profit reaches zero, further increases in production of the good stop. For movement to market equilibrium and for changes in equilibrium, price and quantity also change «at the margin»: more-or-less of something, rather than necessarily all-or-nothing.

Other applications of demand and supply include the distribution of income among the factors of production, including labour and capital, through factor markets. In a competitive labour market for example the quantity of labour employed and the price of labour (the wage rate) depends on the demand for labour (from employers for production) and supply of labour (from potential workers). Labour economics examines the interaction of workers and employers through such markets to explain patterns and changes of wages and other labour income, labour mobility, and (un)employment, productivity through human capital, and related public-policy issues.[18]

Demand-and-supply analysis is used to explain the behaviour of perfectly competitive markets, but as a standard of comparison it can be extended to any type of market. It can also be generalized to explain variables across the economy, for example, total output (estimated as real GDP) and the general price level, as studied in macroeconomics.[19] Tracing the qualitative and quantitative effects of variables that change supply and demand, whether in the short or long run, is a standard exercise in applied economics. Economic theory may also specify conditions such that supply and demand through the market is an efficient mechanism for allocating resources.[20]

Market structureEdit

Market structure refers to features of a market, including the number of firms in the market, the distribution of market shares between them, product uniformity across firms, how easy it is for firms to enter and exit the market, and forms of competition in the market.[21][22] A market structure can have several types of interacting market systems.

Different forms of markets are a feature of capitalism and market socialism, with advocates of state socialism often criticizing markets and aiming to substitute or replace markets with varying degrees of government-directed economic planning.

Competition acts as a regulatory mechanism for market systems, with government providing regulations where the market cannot be expected to regulate itself. Regulations help to mitigate negative externalities of goods and services when the private equilibrium of the market does not match the social equilibrium. One example of this is with regards to building codes, which if absent in a purely competition regulated market system, might result in several horrific injuries or deaths to be required before companies would begin improving structural safety, as consumers may at first not be as concerned or aware of safety issues to begin putting pressure on companies to provide them, and companies would be motivated not to provide proper safety features due to how it would cut into their profits.

The concept of «market type» is different from the concept of «market structure». Nevertheless, it is worth noting here that there are a variety of types of markets.

The different market structures produce cost curves[23] based on the type of structure present. The different curves are developed based on the costs of production, specifically the graph contains marginal cost, average total cost, average variable cost, average fixed cost, and marginal revenue, which is sometimes equal to the demand, average revenue, and price in a price-taking firm.

Perfect competitionEdit

Perfect competition is a situation in which numerous small firms producing identical products compete against each other in a given industry. Perfect competition leads to firms producing the socially optimal output level at the minimum possible cost per unit. Firms in perfect competition are «price takers» (they do not have enough market power to profitably increase the price of their goods or services). A good example would be that of digital marketplaces, such as eBay, on which many different sellers sell similar products to many different buyers. Consumers in a perfect competitive market have perfect knowledge about the products that are being sold in this market.

Imperfect competitionEdit

Imperfect competition is a type of market structure showing some but not all features of competitive markets. In perfect competiton, market power is not achievable due to a high level of producers causing high levels of competition. Therefore, prices are brought down to a marginal cost level. In a monopoly, market power is achieved by one firm leading to prices being higher than the marginal cost level. [24]

Between these two types of markets are firms that are neither perfectly competitive or monopolistic. Firms such as Pepsi and Coke and Sony, Nintendo and Microsoft dominate the cola and video game industry respectively. These firms are in imperfect competition [25]

Monopolistic competitionEdit

Monopolistic competition is a situation in which many firms with slightly different products compete. Production costs are above what may be achieved by perfectly competitive firms, but society benefits from the product differentiation. Examples of industries with market structures similar to monopolistic competition include restaurants, cereal, clothing, shoes, and service industries in large cities.

MonopolyEdit

A monopoly is a market structure in which a market or industry is dominated by a single supplier of a particular good or service. Because monopolies have no competition, they tend to sell goods and services at a higher price and produce below the socially optimal output level. However, not all monopolies are a bad thing, especially in industries where multiple firms would result in more costs than benefits (i.e. natural monopolies).[26][27]

- Natural monopoly: A monopoly in an industry where one producer can produce output at a lower cost than many small producers.

OligopolyEdit

An oligopoly is a market structure in which a market or industry is dominated by a small number of firms (oligopolists). Oligopolies can create the incentive for firms to engage in collusion and form cartels that reduce competition leading to higher prices for consumers and less overall market output.[28] Alternatively, oligopolies can be fiercely competitive and engage in flamboyant advertising campaigns.[29]

- Duopoly: A special case of an oligopoly, with only two firms. Game theory can elucidate behavior in duopolies and oligopolies.[30]

MonopsonyEdit

A monopsony is a market where there is only one buyer and many sellers.

Bilateral monopolyEdit

A bilateral monopoly is a market consisting of both a monopoly (a single seller) and a monopsony (a single buyer).

OligopsonyEdit

An oligopsony is a market where there are a few buyers and many sellers.

Game theoryEdit

Game theory is a major method used in mathematical economics and business for modeling competing behaviors of interacting agents. The term «game» here implies the study of any strategic interaction between people. Applications include a wide array of economic phenomena and approaches, such as auctions, bargaining, mergers & acquisitions pricing, fair division, duopolies, oligopolies, social network formation, agent-based computational economics, general equilibrium, mechanism design, and voting systems, and across such broad areas as experimental economics, behavioral economics, information economics, industrial organization, and political economy.

Information economicsEdit

Information economics is a branch of microeconomic theory that studies how information and information systems affect an economy and economic decisions. Information has special characteristics. It is easy to create but hard to trust. It is easy to spread but hard to control. It influences many decisions. These special characteristics (as compared with other types of goods) complicate many standard economic theories.[31] The economics of information has recently become of great interest to many — possibly due to the rise of information-based companies inside the technology industry.[8] From a game theory approach, the usual constraints that agents have complete information can be loosened to further examine the consequences of having incomplete information. This gives rise to many results which are applicable to real life situations. For example, if one does loosen this assumption, then it is possible to scrutinize the actions of agents in situations of uncertainty. It is also possible to more fully understand the impacts – both positive and negative – of agents seeking out or acquiring information.[8]

AppliedEdit

Applied microeconomics includes a range of specialized areas of study, many of which draw on methods from other fields.

- Economic history examines the evolution of the economy and economic institutions, using methods and techniques from the fields of economics, history, geography, sociology, psychology, and political science.

- Education economics examines the organization of education provision and its implication for efficiency and equity, including the effects of education on productivity.

- Financial economics examines topics such as the structure of optimal portfolios, the rate of return to capital, econometric analysis of security returns, and corporate financial behavior.

- Health economics examines the organization of health care systems, including the role of the health care workforce and health insurance programs.

- Industrial organization examines topics such as the entry and exit of firms, innovation, and the role of trademarks.

- Law and economics applies microeconomic principles to the selection and enforcement of competing legal regimes and their relative efficiencies.

- Political economy examines the role of political institutions in determining policy outcomes.

- Public economics examines the design of government tax and expenditure policies and economic effects of these policies (e.g., social insurance programs).

- Urban economics, which examines the challenges faced by cities, such as sprawl, air and water pollution, traffic congestion, and poverty, draws on the fields of urban geography and sociology.

- Labor economics examines primarily labor markets, but comprises a large range of public policy issues such as immigration, minimum wages, or inequality.

See alsoEdit

- Economics

- Macroeconomics

- Critique of political economy

ReferencesEdit

- ^ Marchant, Mary A.; Snell, William M. «Macroeconomics and International Policy Terms» (PDF). University of Kentucky. Archived (PDF) from the original on 2007-03-18. Retrieved 2007-05-04.

- ^ a b «Economics Glossary». Monroe County Women’s Disability Network. Archived from the original on 2008-02-04. Retrieved 2008-02-22.

- ^ «Social Studies Standards Glossary». New Mexico Public Education Department. Archived from the original on 2007-08-08. Retrieved 2008-02-22.

- ^ «Glossary». ECON100. Archived from the original on 2006-04-11. Retrieved 2008-02-22.

- ^ Perloff, Jeffrey M. (2018). Microeconomics (8th ed.). New York, NY. ISBN 9781292215693.

- ^ Perloff, Jeffrey M. (2018). Microeconomics (8th ed.). New York, NY. ISBN 9781292215693.

- ^ a b Frisch, R. 1933. Propagation problems and impulse problems in dynamic economics. In Economic essays in honour of Gustav Cassel, ed. R. Frisch. London: Allen & Unwin.

- ^ a b c d Varian H.R. (1987) Microeconomics. In: Palgrave Macmillan (eds) The New Palgrave Dictionary of Economics. Palgrave Macmillan, London.

- ^ Varian, Hal R. (1987). «Microeconomics». The New Palgrave Dictionary of Economics. pp. 1–5. doi:10.1057/978-1-349-95121-5_1212-1. ISBN 978-1-349-95121-5.

- ^ De Wolff, Pieter (April 1941). «Income Elasticity of Demand, a Micro-Economic and a Macro-Economic Interpretation». The Economic Journal. 51 (201): 140–145. doi:10.2307/2225666. JSTOR 2225666.

- ^ Sickles, R., & Zelenyuk, V. (2019). Measurement of Productivity and Efficiency: Theory and Practice. Cambridge: Cambridge University Press. doi:10.1017/9781139565981

- ^ «Principles of Microeconomics (Curtis and Irvine)». Social Sci LibreTexts. 5 July 2021.

- ^ Pindyck, Robert S. (2018). Microeconomics (Ninth ed.). Harlow, United Kingdom. ISBN 9781292213378.

- ^ Perloff, Jeffrey M. (2018). Microeconomics (8th ed.). New York, NY. ISBN 9781292215693.

- ^ Brody, A. (1987). «Prices and quantities». In Eatwell, John; Milgate, Murray; Newman, Peter (eds.). The New Palgrave Dictionary of Economics. The New Palgrave: A Dictionary of Economics (first ed.). pp. 1–7. doi:10.1057/9780230226203.3325. ISBN 9780333786765.

- ^ Baumol, William J. (28 April 2016). «Utility and Value». Encyclopædia Britannica.

- ^ Hicks, J.R. (2001) [1939]. Value and Capital: An Inquiry into Some Fundamental Principles of Economic Theory (second ed.). London: Oxford University Press. ISBN 978-0-19-828269-3.

- ^ • Freeman, Richard B. (1987). «Labour economics». In Eatwell, John; Milgate, Murray; Newman, Peter (eds.). The New Palgrave Dictionary of Economics. The New Palgrave: A Dictionary of Economics (first ed.). pp. 1–7. doi:10.1057/9780230226203.2907. ISBN 9780333786765.

• Taber, Christopher; Weinberg, Bruce A. (2008). «Labour economics (new perspectives)». In Durlauf, Steven N.; Blume, Lawrence E. (eds.). The New Palgrave Dictionary of Economics (second ed.). Palgrave Macmillan UK. pp. 787–791. doi:10.1057/9780230226203.0914. ISBN 978-0-333-78676-5.

• Hicks, John R. (1963) [1932]. The Theory of Wages (second ed.). Macmillan. - ^ Blanchard, Olivier (2006). «Chapter 7: Putting All Markets Together: The AS–AD Model». Macroeconomics (4th ed.). Prentice-Hall. ISBN 978-0-1318-6026-1.

- ^ Jordan, J.S. (October 1982). «The Competitive Allocation Process Is Informationally Efficient Uniquely». Journal of Economic Theory. 28 (1): 1–18. doi:10.1016/0022-0531(82)90088-6.

- ^ McEachern, William A. (2006). Economics: A Contemporary Introduction. Thomson South-Western. pp. 166. ISBN 978-0-324-28860-5.

- ^ Hashimzade, Nigar; Myles, Gareth; Black, John (2017). «market structure». A Dictionary of Economics. Oxford University Press. ISBN 978-0-19-875943-0.

- ^ Emerson, Patrick M. (2019-10-28), «Module 8: Cost Curves», Intermediate Microeconomics, Oregon State University, retrieved 2021-05-13

- ^ Goolsbee, Austan (2019). Microeconomics (3rd ed.). New York: Macmillan Learning. ISBN 9781319325435.

- ^ Goolsbee, Austan (2019). Microeconomics (3rd ed.). New York: Macmillan Learning. ISBN 9781319325435.

- ^ «Monopoly — Economics Help». Economics Help. Archived from the original on 2018-03-14. Retrieved 2018-03-14.

- ^ Krylovskiy, Nikolay (20 January 2020). «Natural monopolies». Economics Online. Retrieved 2020-09-03.

- ^ «Competition Counts». ftstatus=live. 11 June 2013. Archived from the original on 4 December 2013.

- ^ Erickson, Gary M. (2009). «Gary M. Erickson (2009). «An Oligopoly Model of Dynamic Advertising Competition». European Journal of Operational Research 197 (2009): 374-388″. European Journal of Operational Research. 197 (1): 374–388. doi:10.1016/j.ejor.2008.06.023.

- ^

«Oligopoly/Duopoly and Game Theory». AP Microeconomics Review. 2017. Archived from the original on 2016-06-25. Retrieved 2017-06-11.Game theory is the main way economists [sic] understands the behavior of firms within this market structure.

- ^ • Beth Allen, 1990. «Information as an Economic Commodity,» American Economic Review, 80(2), pp. 268–273.

• Kenneth J. Arrow, 1999. «Information and the Organization of Industry,» ch. 1, in Graciela Chichilnisky Markets, Information, and Uncertainty. Cambridge University Press, pp. 20–21.

• _____, 1996. «The Economics of Information: An Exposition,» Empirica, 23(2), pp. 119–128.

• _____, 1984. Collected Papers of Kenneth J. Arrow, v. 4, The Economics of Information. Description Archived 2012-03-30 at the Wayback Machine and chapter-preview links.

• Jean-Jacques Laffont, 1989. The Economics of Uncertainty and Information, MIT Press. Description Archived 2012-01-25 at the Wayback Machine and chapter-preview links.

Further readingEdit

*

Bade, Robin; Michael Parkin (2001). Foundations of Microeconomics. Addison Wesley Paperback 1st Edition.

- Editors, biography.com (August 17, 2016). «Adam Smith Biography.com». A&E Television Networks.

- Bouman, John: Principles of Microeconomics – free fully comprehensive Principles of Microeconomics and Macroeconomics texts. Columbia, Maryland, 2011

- Colander, David. Microeconomics. McGraw-Hill Paperback, 7th Edition: 2008.

- Dunne, Timothy; J. Bradford Jensen; Mark J. Roberts (2009). Producer Dynamics: New Evidence from Micro Data. University of Chicago Press. ISBN 978-0-226-17256-9.

- Eaton, B. Curtis; Eaton, Diane F.; and Douglas W. Allen. Microeconomics. Prentice Hall, 5th Edition: 2002.

- Erickson, Gary M. (2009). “An Oligopoly Model of Dynamic Advertising Competition“. European Journal of Operational Research 197 (2009): 374-388. https://econpapers.repec.org/article/eeeejores/v_3a197_3ay_3a2009_3ai_3a1_3ap_3a374-388.htm

- Frank, Robert H.; Microeconomics and Behavior. McGraw-Hill/Irwin, 6th Edition: 2006.

- Friedman, Milton. Price Theory. Aldine Transaction: 1976

- Hagendorf, Klaus: Labour Values and the Theory of the Firm. Part I: The Competitive Firm. Paris: EURODOS; 2009.

- Harnerger, Arnold C. (2008). «Microeconomics». In David R. Henderson (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0-86597-665-8. OCLC 237794267.

- Hicks, John R. Value and Capital. Clarendon Press. [1939] 1946, 2nd ed.

- Hirshleifer, Jack., Glazer, Amihai, and Hirshleifer, David, Price theory and applications: Decisions, markets, and information. Cambridge University Press, 7th Edition: 2005.

- Jaffe, Sonia; Minton, Robert; Mulligan, Casey B.; and Murphy, Kevin M.: Chicago Price Theory. Princeton University Press, 2019

- Jehle, Geoffrey A.; and Philip J. Reny. Advanced Microeconomic Theory. Addison Wesley Paperback, 2nd Edition: 2000.

- Katz, Michael L.; and Harvey S. Rosen. Microeconomics. McGraw-Hill/Irwin, 3rd Edition: 1997.

- Kreps, David M. A Course in Microeconomic Theory. Princeton University Press: 1990

- Landsburg, Steven. Price Theory and Applications. South-Western College Pub, 5th Edition: 2001.

- Mankiw, N. Gregory. Principles of Microeconomics. South-Western Pub, 2nd Edition: 2000.

- Mas-Colell, Andreu; Whinston, Michael D.; and Jerry R. Green. Microeconomic Theory. Oxford University Press, US: 1995.

- McGuigan, James R.; Moyer, R. Charles; and Frederick H. Harris. Managerial Economics: Applications, Strategy and Tactics. South-Western Educational Publishing, 9th Edition: 2001.

- Nicholson, Walter. Microeconomic Theory: Basic Principles and Extensions. South-Western College Pub, 8th Edition: 2001.

- Perloff, Jeffrey M. Microeconomics. Pearson – Addison Wesley, 4th Edition: 2007.

- Perloff, Jeffrey M. Microeconomics: Theory and Applications with Calculus. Pearson – Addison Wesley, 1st Edition: 2007

- Pindyck, Robert S.; and Daniel L. Rubinfeld. Microeconomics. Prentice Hall, 7th Edition: 2008.

- Ruffin, Roy J.; and Paul R. Gregory. Principles of Microeconomics. Addison Wesley, 7th Edition: 2000.

- Sickles, R., & Zelenyuk, V. (2019). Measurement of Productivity and Efficiency: Theory and Practice. Cambridge: Cambridge University Press. https://assets.cambridge.org/97811070/36161/frontmatter/9781107036161_frontmatter.pdf

- Varian, Hal R. (1987). «microeconomics,» The New Palgrave: A Dictionary of Economics, v. 3, pp. 461–63.

- Varian, Hal R. Intermediate Microeconomics: A Modern Approach. W. W. Norton & Company, 8th Edition: 2009.

- Varian, Hal R. Microeconomic Analysis. W. W. Norton & Company, 3rd Edition: 1992.

External linksEdit

- X-Lab: A Collaborative Micro-Economics and Social Sciences Research Laboratory

- Simulations in Microeconomics

- http://media.lanecc.edu/users/martinezp/201/MicroHistory.html – a brief history of microeconomics

Microeconomics and Macroeconomics | Differences

The word ‘micro’ is derived from the Greek word ‘mikros’. Mikros means ‘small’.

Thus, microeconomics means economics in the small. We know that resources are scarce in relation to demand. So choices have to be made.

A country has to make at least three choices:

(a) WHAT goods and services are to be produced?

(b) HOW these goods are to be produced; and

(c) FOR WHOM these goods are to be produced.

These choices are usually called microeconomic choices since these are concerned with the individuals (i.e., small units) that make it up. Thus, microeconomics

is a microscopic view of the economy households, firms, input-owners, etc. Microeconomics takes into account the behaviour of these economic agents. It deals with the operation of a consumer, a firm, involving the determination of prices of a commodity, revenues, costs, employment levels in a firm or industry, and so on.

Microeconomics seeks to explain and predict such things as the prices and outputs of firms and industries, the choices of consumers in buying goods and services, production efficiency and costs, the adjustment of markets to new conditions, etc. The emphasis is on the trees and not the forest.

According to K. E. Boulding; “Microeconomics is the study of particular firms, particular households, individual prices, wages, income of individual industries, particular commodities.”

In microeconomics, we study two things:

(i) How prices of commodities and inputs are determined; and

(ii) How resources are allocated in different sectors of the economy in different branches of production in a free enterprise economy. Microeconomics is the branch of economics concerned with the study of behaviour of consumers and firms and the determination of market prices and quantities bought and sold of goods and inputs.

In addition, microeconomics formulates policies so as to promote social welfare.

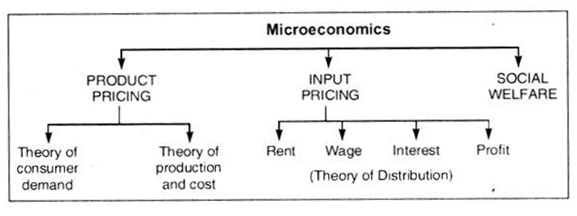

The contents of microeconomics are presented in the following form:

On the other hand, the word ‘macro’ is derived from the Greek word ‘makros’, meaning large. Thus, macroeconomics means economics in the large. It is concerned with the behaviour of the whole economic system in its totality. It is concerned with the large aggregates. Macroeconomics is the study of the nation’s economy as a whole.

Macroeconomic analysis may, thus, be considered as a big-picture exercise with the main concerns being the overall level of economic activities, total employment, national products, aggregate savings and investment, the general price level, international trade balances, government taxes and spending, etc. That is why macroeconomics is called ‘aggregative economics’, while microeconomics is referred to as ‘disaggregative economics’.

Macroeconomics studies the determination of national income or output and employment, the general price level, the balance of payments and policies to tackle macroeconomic problems like inflation, unemployment, recession, etc.

Thus, in macroeconomics, we are concerned with certain broad aggregates or the ‘overall dimensions of economic life’. In the words of K. E. Boulding; “Macroeconomics is the study of nature, relationships and behaviour of aggregates of economic quantities. Macroeconomics deals not with individual quantities as such, but aggregates of these quantities not with individual incomes, but the national income, hot with individual prices, but with price levels, not with individual output, but with the national output.”

Economics is a study of both the trees and the forest i.e., both micro and macroeconomics. One cannot afford to neglect any one. Then only can one get a composite picture, a totality, of what is Economics. P. A. Samuelson remarks: “There is really no opposition between micro and macroeconomics. Both are absolutely vital. And you are half-educated if you understand the one while being ignorant of the other.”

Page load link

Go to Top

-

^Text

2 MICROECONOMICS -

The

word «micro» means small, and microeconomics means economics in

the small. The optimizing behavior of individual units such as

households and firms provides the foundation for microeconomics. -

Microeconomists

may investigate

individual

markets or even the economy as a whole, but their analyses are

derived from the aggregation of the behavior of individual units.

Microeconomic theory is used extensively in many areas of applied

economics. For

example, it is used in industrial organization, labor economics,

international trade, cost-benefit analysis, and many other economic

subfields. The tools and analyses of microeconomics provide a

common ground, and even a

language,

for economists interested in a wide range of

problems. -

At

one time there was a sharp distinction

in

both methodology and subject

matter between

microeconomics and macroeconomics. -

The

methodological distinction became somewhat blurred

during

the 1970s as more and more macro- economic analyses were built upon

microeconomic foundations. Nonetheless, major distinctions remain

between the two major branches of economics. For example, the

microeconomist is interested in the determination of individual

prices and relative prices (i.e., exchange

ratios between

goods), whereas the macroeconomist is interested more in the

general price level and its change over time. -

Optimization

plays

a key role in microeconomics. The consumer is assumed to maximize

utility

or

satisfaction

subject

to the constraints

imposed

by income or income earning power. The producer is assumed to

maximize profit or minimize cost subject to the technological

constraints under which the firm operates. Optimization of social

welfare sometimes is the criterion for the determination of public

policy. -

Opportunity

cost is

an important concept in microeconomics. Many courses of action are

valued in terms of what is sacrificed

so

that they might be undertaken.

For

example, the opportunity cost of a public project is the value of

the additional goods that the private sector would have produced

with the resources used for the public project. -

The

individual consumer or household is assumed to possess a utility

function, which specifies the satisfaction, which is gained from

the consumption of alternative bundles of goods. The consumer’s

income or income- earning power determines which bundles are

available to the consumer. The consumer then selects a bundle that

gives the highest possible level of

utility.

With few exceptions, the consumer is treated as a price taker —

that is, the consumer is free to choose whatever quantities income

allows but

has no influence

over

prevailing market prices. In order to

maximize utility

the consumer purchases goods so that the subjective rate of

substitution for

each

pair of goods as indicated by the consumer’s utility function

equals the objective rate of substitution given by the ratio of

their market prices. This basic utility- maximization analysis has

been modified and expanded in

many

different ways. -

Theory of the Producer

-

The

individual producer or firm is assumed to possess a production

function, which specifies the quantity of- output produced as a

function of the quantities of the inputs used in production. The

producer’s revenue equals the quantity of output produced and

sold times its price, and the cost to the producer equals the sum

of the quantities of inputs purchased and used times their prices.

Profit is the difference between revenue and cost. The producer is

assumed to maximize profits subject to the technology given by the

production function. Profit maximization requires that the producer

use each factor to a point at which its marginal contribution to

revenue equals its marginal contribution to cost. -

Under

pure competition, the producer is a price taker who may sell at the

going market price whatever has been produced. Under monopoly (one

seller) the producer recognizes that price declines as sales are

expanded, and under monopsony (one buyer) the producer recognizes

that the price paid for an input increases as purchases are

increased. -

A

producer’s cost functien gives production cost as a function of

output level on the assumption that the producer combines inputs to

minimize production cost. Profit maximization using revenue and

cost functions requires that the producer equate the decrement in

revenue from producing one less unit (called marginal revenue) to

the corresponding decrement in cost (called marginal cost). Under

pure competition, marginal revenue equals price. Consequently, the

producer equates marginal cost of production to the going market

price. -

Vocabulary

-

behavior

— поведение -

to

investigate — исследовать

applied economics — прикладная

экономика

distinction — отличие -

subject

— предмет, субъект matter

— вопрос, материал to

blur

— затуманивать, размывать -

to

remain

— оставаться exchange

ratio

— ставка (соотношение) обмена

optimization

— оптимизация utility

— полезность -

utility

function

— функция полезности -

satisfaction

— удовлетворение constraints

— ограничение, стеснение -

monopsony

— монопсония (рынок, на котором

выступает лишь один покупатель

товара, услуги или ресурса) -

opportunity

cost

— альтернативные издержки to

sacrifice

— пожертвовать, приносить в жертву to

undertake

— взять на себя -

to

allow

— позволять, разрешать -

to

influence

— влиять to

maximize

— максимально увеличивать -

revenue

— доходы

-

General

understanding:

-

What

is, according to the text, microeconomics? -

What

is meant by «economics in the small»? -

What

economic phenomena are of microeconomists attention? -

Where

is microeconomic theory used? -

What

is «optimization»? -

What

is the concept of the theory of consumer? -

What

is the major difference between the theory of consumer and the

theory of producer?

-

Find

equivalents in Russian:

-

optimizing

behavior of individual units -

industrial

organization -

labor

economics -

international

trade -

cost-benefit

analysis -

sharp

distinction in both methodology and subject matter -

subjective

rate of substitution

-

Translate

into Russian:

-

Microeconomic

theory is used extensively in many areas of applied economics. -

Their

analyses are derived from the aggregation of the behavior of

individual units. -

The

consumer then selects a bundle that gives the highest possible

level of utility. -

The

consumer is free to choose whatever quantities income allows but

has no influence over prevailing market prices. -

The

producer equates marginal cost of production to the going market

price. -

The

producer recognizes that price declines as sales are expanded.

-

Under

pure competition, the producer is a price taker who may sell at the

going market price whatever has been produced.

Соседние файлы в предмете [НЕСОРТИРОВАННОЕ]

- #

- #

- #

- #

- #

- #

- #

- #

- #

- #

- #

Introduction to Microeconomics

Microeconomics is composed of two words – micro and economics. Micro is derived from the Greek word ‘mikros’ which means ‘small’ and economics is the branch of knowledge which studies about the production, consumption, and transfer of wealth incurred during the trade.

The term microeconomics was first coined by Ragner Frich in the year 1993. He was a Norwegian economist and the co-recipient of first ever Nobel Memorial Prize in Economic Science (1969).

“Microeconomics is the study of particular firms, particular households, individual prices, wages, income, individual industries, particular commodities.” -K. E. Boulding

Microeconomics is the branch of Economics which is concerned with the single factors and effects of the individual decision. It studies about the economic actions of the individual unit and small group of the individual unit such as industry and market, in an attempt to understand their decision-making process.

Microeconomics focuses on basic theories of demand and supply. It explains how factor pricing (rent, wage, interest and profit) is affected by the interaction of demand and supply in the market and how the price of a product is determined in accordance.

Assumptions of Microeconomics

There are few assumptions, on the basis of which, theories and principles of microeconomics have been proposed. These assumptions are

- Every individual behaves in a logical or sensible manner.

- Valid information about supply, demand, price, and other market conditions are freely available.

- Efforts of goods and labor are divisible.

- There is always full employment in the market.

- The economic activities between private parties are free from government intervention.

- Microeconomics is based on the assumption ‘ceteris paribus’. It is a Lain phrase which means ‘with other things being equal or held constant.’

Features of Microeconomics

Studies individual unit

Microeconomics is defined as the study of the market behavior of individual consumers and producers. For this purpose, the whole economy is divided into small individual units such as household, firm, commodity, market, etc. To study microeconomics, an economist selects a small unit and conducts a detailed observation of micro variables.

Microscopic approach

Microeconomics is not concerned with the whole or aggregate. It works by slicing a single economy into smaller units. It views economy microscopically by studying the behavior of individual consumer, producer, market, and so on.

Price theory

Microeconomics includes the study of basic theories of demand and supply, including the process of achievement of equilibrium state in the market through the interaction of demand and supply. During the study, microeconomics deals with various forces which explain how prices of factors of production (rent, wage, interest and profit) are determined and how prices of commodities are affected.

Analyzes economic efficiency

Economic efficiency is attained when goods and services are as effectively consumed as it is produced. Every individual tries to attain maximum satisfaction from the goods consumed while every producer works on maximizing their profit. Microeconomics studies in-depth about ways of allocating available or existing resources of the economy to meet the desires of both producers and consumers.

Partial equilibrium

Microeconomics is based on partial equilibrium. It is a condition in which equilibrium is attained by considering only a part of the market. In economy, this phenomenon is commonly known as ‘ceteris paribus’ which means ‘with other things being equal or held constant’.

Economizing

It is by nature that all consumers desire unlimited satisfaction and all producers desire unlimited profit. Microeconomics studies about these economic wants of producers and consumers, analyze individual production and consumption units and define how maximum satisfaction and profit can be achieved by efficient utilization of scarce resources.

Construction of models

Microeconomics comprises various complex phenomena. Such phenomena are expressed in terms of an economic model for understandability. An economic model may be chart, schedule, diagram or economic law, all of which explains the relationship between two or more economic variables.

Limitations of Microeconomics

Not true in case of aggregates

What is true for an individual is not always true at the aggregate level. In other words, any outcome at personal level may be different at societal and national level. For example, saving is good for the individual but if all individuals of an economy begin to save, the entire economy would collapse. This is because, with the rise in aggregate saving starts to fall aggregate demand, investment, employment and income of the nation.

Assumption of full employment

Microeconomics analysis is based on the assumption of full employment. The phenomenon of full employment does not exist in the real market or it is a rare phenomenon in a capitalist economy. Thus, assumptions of microeconomics are unrealistic.

Inadequate data

Microeconomics does not explain the function of the whole economy. It only deals with individual factors of the market. It might not be possible for an economist to get correct information of individual consumers and producers. Thus, results drawn from microeconomic analysis might often be inaccurate.

Unrealistic assumption of ‘ceteris paribus’

Most of the theories and principles of microeconomics are based on the assumption of ceteris paribus. Economic variables might remain constant in the economy which is static in nature but the real economy is always dynamic in nature.