What is Discount Rate?

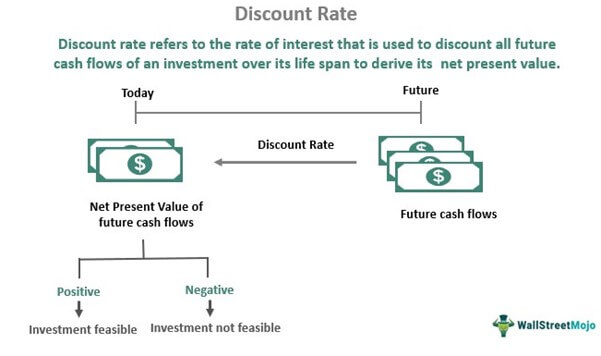

The discount rate refers to the rate of interest that is applied to future cash flows of an investment to calculate its present value. It is the rate of return that companies or investors expect on their investment. An investment’s net present value computed through discounting reveals its viability.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkArticle Link to be Hyperlinked

For eg:

Source: Discount Rate (wallstreetmojo.com)

It is often the expected rate of return from an investment or the Weighted Average Cost of Capital (WACC). Discounting future cash flowsCash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period. It proves to be a prerequisite for analyzing the business’s strength, profitability, & scope for betterment. read more is essential as the future money is less valuable than current money as per the concept of the time value of money. Therefore, discounting helps to understand the real value of future money today.

Table of contents

- Discount Rate Definition

- Discount Rate Explained

- Discount Rate Types

- Formula of Discount Rate

- Calculation & Examples

- Example #1 (Basic)

- Example #2

- Issues

- Frequently Asked Questions (FAQs)

- Recommended Articles

- Discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its Net Present Value (NPV).

- NPV helps to determine an investment or project’s feasibility.

- If NPV is a positive value, the investment is viable; otherwise not.

- WACC, Cost of Equity, Cost of Debt, Hurdle Rate, and Risk-free Rate are the types of discount rates applicable.

Discount Rate Explained

Discount rate is the interest rate used to find the net present valueNet Present Value (NPV) estimates the profitability of a project and is the difference between the present value of cash inflows and the present value of cash outflows over the project’s time period. If the difference is positive, the project is profitable; otherwise, it is not.read more (NPV) of a project’s future cash flows. NPV helps to determine the profitability Profitability refers to a company’s ability to generate revenue and maximize profit above its expenditure and operational costs. It is measured using specific ratios such as gross profit margin, EBITDA, and net profit margin. It aids investors in analyzing the company’s performance.read moreof an investment or project. Therefore, this interest rate determines whether a project is viable or not.

Each company or investor expects certain future cash flows when taking up a project or investmentInvestments are typically assets bought at present with the expectation of higher returns in the future. Its consumption is foregone now for benefits that investors can reap from it later.read more. However, these future cash flows can’t be considered as such to determine the feasibility of the project. This is because the value of money decreases with time. Also, there is uncertainty or risk related to the future, which must be taken into account.

Thus, companies conduct a discounted cash flowDiscounted cash flow analysis is a method of analyzing the present value of a company, investment, or cash flow by adjusting future cash flows to the time value of money. This analysis assesses the present fair value of assets, projects, or companies by taking into account many factors such as inflation, risk, and cost of capital, as well as analyzing the company’s future performance.read more (DCF) analysis. DCF analysis uses discounting to calculate the project’s value today based on its future cash flows. In other words, it lets investors determine the project’s NPV.

A positive NPV indicates that the present valuePresent Value (PV) is the today’s value of money you expect to get from future income. It is computed as the sum of future investment returns discounted at a certain rate of return expectation.read more of cash flows is greater than the initial cost of the investment, i.e., returns exceed the costs. This means that if the NPV is positive, the project is worthwhile; otherwise, it is not. Thus, investing in such scenarios is a wise decision.

Note that NPV and discount rate have an inverse relationship. The higher the rate, the lower the NPV and vice versa. This is because the future cash flows reduce in value if discounted at a higher rate. Therefore, a lower rate is always desirable.

Discount Rate Types

The future value of an investment doesn’t amount to anything for companies. They can judge the utility of the investment only on the basis of its value today. So discount rate comes in handy to compute the present value of any project or investment.

The companies opt for different rates. For instance, some use the rate of return they wish to receive from the investments depending on the risk involved, while others use their weighted average cost of capitalThe weighted average cost of capital (WACC) is the average rate of return a company is expected to pay to all shareholders, including debt holders, equity shareholders, and preferred equity shareholders. WACC Formula = [Cost of Equity * % of Equity] + [Cost of Debt * % of Debt * (1-Tax Rate)]read more (WACC) as a discount rate.

Therefore, different types of rates apply to the investments based on the nature and the purpose for which they are being used.

- WACC: It is the required rate of returnRequired Rate of Return (RRR), also known as Hurdle Rate, is the minimum capital amount or return that an investor expects to receive from an investment. It is determined by, Required Rate of Return = (Expected Dividend Payment/Existing Stock Price) + Dividend Growth Rateread more that a company’s investors expect in return for capital. It comes in handy to compute the equity valueEquity Value, also known as market capitalization, is the sum-total of the values the shareholders have made available for the business and can be calculated by multiplying the market value per share by the total number of shares outstanding.read more of a company.

- Cost of Equity: It is the rate of return that a company pays to its equity shareholders. It is used to compute the equity value of a company.

- Cost of Debt: It is the rate of interest that a company pays to its bondholders. The valuation of fixed-income assets uses it.

- Hurdle Rate: It is the minimum acceptable rate of return for investing in a project. It evaluates investments in internal corporate projects.

- Risk-free Rate: It is the rate of return on an investment with no associated risks. It helps assess the time value of money.

Formula for Discount Rate

To calculate NPV, this is how the discount rate is used:

Where,

- F = projected cash flow of the year

- R = discount rate

- n = number of years of cash flow in future

Calculation & Examples

Suppose a company makes an initial investment of $2,000, which is likely to yield cash inflows of $1000 per year for four years. The total future cash inflow, in this case, would be $4,000. If the rate is 10%, then the present value calculations are as follows:

| Particulars | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 |

|---|---|---|---|---|---|

| Cash flows | ($2000) | $1000 | $1000 | $1000 | $1000 |

| Present value of cash flows | ($2000) | $909 | $826 | $751 | $683 |

Year 1

= $909

Year 2

= $826

Year 3

= $751

Year 4

= $683

Total present value = PV for Year 1 + PV for Year 2 + PV for Year 3 + PV for Year 4

= 909+826+751+683

= $3,169

The initial investment needs to be subtracted from the sum of the present value to determine whether making this investment is profitable or not.

NPV = Total Present Value – Initial Investment

= 3169 – 2000

= 1,169

As the NPV value is positive, the investment is fruitful.

Issues

Though discount rate helps investors find out a project’s NPV and make major investment decisions, there are a few issues that users need to take care of:

- Since future cash flows are uncertain, the NPV calculations using discount rate is, at best, guesswork, which may or may not work.

- The discount rate remains the same throughout the years of activity, while the interest rates, market conditions, and other factors keep changing constantly.

- If the NPV computation works well, it adds to the reputation of the company or shareholder, or investor. On the other hand, if things fail, the reputation gets highly hampered.

Frequently Asked Questions (FAQs)

What is a discount rate?

Discount rate refers to the rate of interest used to discount future cash flows to calculate their present value. In other words, it lets investors compute the net present value of an investment to determine its viability. It is often the expected rate of return, the weighted average cost of capital (WACC), or the hurdle rate.

What are the types of discount rates?

Different types of discount rates used to calculate the net present value (NPV) of an investment are as follows:

• Weighted Average Cost of Capital (WACC)

• Cost of Equity

• Cost of Debt

• Hurdle Rate

• Risk-free Rate

How are NPV and discount rate related?

The discount rate is applied to the future cash flows to compute the net present value (NPV). NPV marks the difference between the current value of cash inflows and the current value of cash outflows over a period.

where, F = projected cash flow of the year, r = discount rate, and n = number of years of cash flow in future

Recommended Articles

This has been a guide to what is Discount Rate & its Definition. Here we explain the formula to calculate NPV using discount rates along with examples. You can learn more from the following articles –

- Discount Rate vs Interest Rate

- Internal Rate of Return (IRR)

- Corporate Finance

A discount rate is the rate of return used to discount future cash flows back to their present value

What is a Discount Rate?

In corporate finance, a discount rate is the rate of return used to discount future cash flows back to their present value. This rate is often a company’s Weighted Average Cost of Capital (WACC), required rate of return, or the hurdle rate that investors expect to earn relative to the risk of the investment.

Other types of discount rates include the central bank’s discount window rate and rates derived from probability-based risk adjustments.

Why is a Discount Rate Used?

A discount rate is used to calculate the Net Present Value (NPV) of a business as part of a Discounted Cash Flow (DCF) analysis. It is also utilized to:

- Account for the time value of money

- Account for the riskiness of an investment

- Represent opportunity cost for a firm

- Act as a hurdle rate for investment decisions

- Make different investments more comparable

Types of Discount Rates

In corporate finance, there are only a few types of discount rates that are used to discount future cash flows back to the present. They include:

- Weighted Average Cost of Capital (WACC) – for calculating the enterprise value of a firm

- Cost of Equity – for calculating the equity value of a firm

- Cost of Debt – for calculating the value of a bond or fixed-income security

- A pre-defined hurdle rate – for investing in internal corporate projects

- Risk-Free Rate – to account for the time value of money

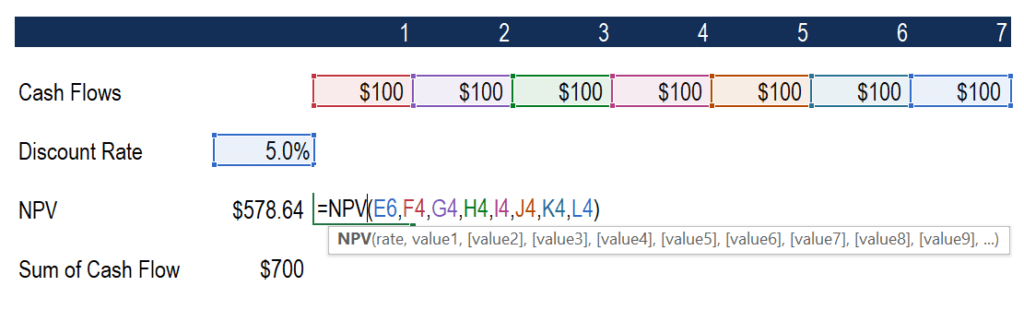

Discount Rate Example (Simple)

Below is a screenshot of a hypothetical investment that pays seven annual cash flows, with each payment equal to $100. In order to calculate the net present value of the investment, an analyst uses a 5% hurdle rate and calculates a value of $578.64. This compares to a non-discounted total cash flow of $700.

Essentially, an investor is saying “I am indifferent between receiving $578.64 all at once today and receiving $100 a year for 7 years.” This statement takes into account the investor’s perceived risk profile of the investment and an opportunity cost that represents what they could earn on a similar investment.

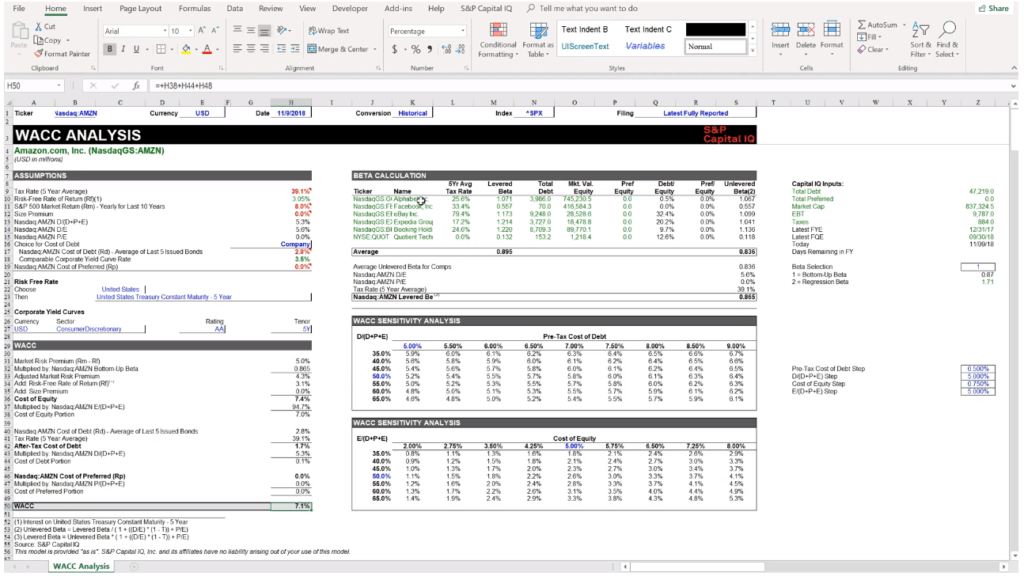

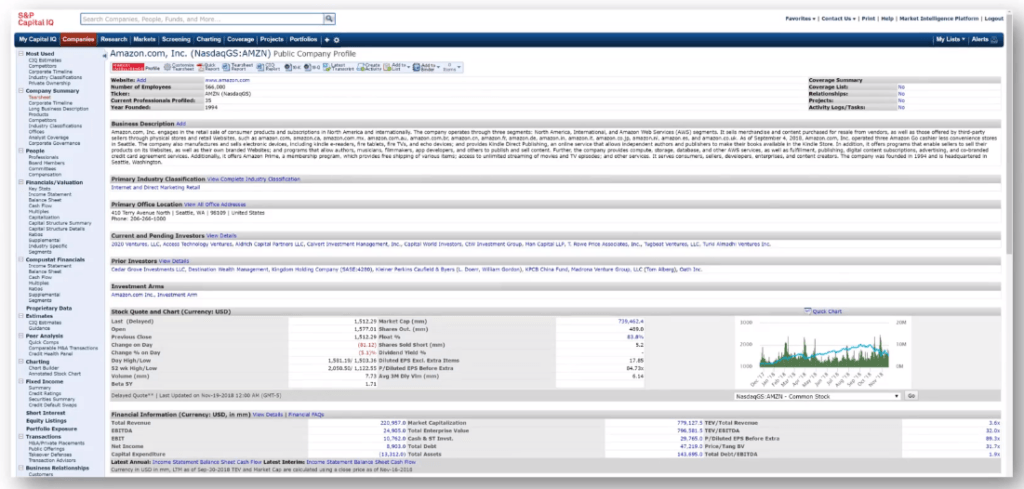

Example (Advanced)

Below is an example from CFI’s financial modeling course on Amazon. As you can see in the screenshot, a financial analyst uses an estimate of Amazon’s WACC to discount its projected future cash flows back to the present.

By using the WACC to discount cash flows, the analyst is taking into account the estimated required rate of return expected by both equity and debt investors in the business.

WACC Example

Below is a screenshot of an S&P Capital IQ template that was used in CFI’s Advanced Financial Modeling Course to estimate Amazon’s WACC.

To learn more, check out CFI’s Advanced Valuation Course on Amazon.

Issues with Discount Rates

While the calculation of discount rates and their use in financial modeling may seem scientific, there are many assumptions that are only a “best guess” about what will happen in the future.

Furthermore, only one discount rate is used at a point in time to value all future cash flows, when, in fact, interest rates and risk profiles are constantly changing in a dramatic way.

When using the WACC as a discount rate, the calculation centers around the use of a company’s beta, which is a measure of the historical volatility of returns for an investment. The historical volatility of returns is not necessarily a good measure of how risky something will be in the future.

Additional Resources

Thank you for reading CFI’s guide to Discount Rate. To keep learning and advancing your career, the following CFI resources will be helpful:

- Coupon Rate

- Internal Rate of Return (IRR)

- Unlevered Beta

- Valuation Methods

- See all valuation resources

What Is a Discount Rate?

The term discount rate refers to the interest rate charged to commercial banks and other financial institutions for short-term loans they take from the Federal Reserve Bank. The discount rate is applied at the Fed’s lending facility, which is called the discount window. A discount rate can also refer to the interest rate used in discounted cash flow (DCF) analysis to determine the present value of future cash flows. In this case, the discount rate can be used by investors and businesses for potential investments.

Key Takeaways

- In banking, the discount rate is the interest rate that the Federal Reserve charges banks for short-term loans.

- Discount lending is a key tool of monetary policy and part of the Fed’s function as the lender-of-last-resort.

- In discounted cash flow analysis, the discount rate is the rate used to discount future cash flows in discounted cash flow analysis.

- The discount rate expresses the time value of money in DCF and can make the difference between whether an investment project is financially viable or not.

- You can calculate the discount rate in DCF as long as you know the future and present values and the total number of years

Fed’s Discount Rate

How the Fed’s Discount Rate Works

Commercial banks in the U.S. have two primary ways to borrow money for their short-term operating needs. They can borrow and loan money to other banks without the need for any collateral using the market-driven interbank rate. They also can borrow money for their short-term operating requirements from the Federal Reserve Bank.

Federal Reserve loans are processed through 12 regional branches of the Fed. The loans are used by financial institutes to cover any cash shortfalls, head off any liquidity problems, or in the worst-case scenario, prevent the bank’s failure. This Fed-offered lending facility is known as the discount window.

The loans are extremely short-term: 24 hours or less. The rate of interest charged is the standard discount rate. This discount rate is set by the boards of the Federal Reserve Bank and is approved by its Board of Governors.

The 3 Tiers of the Fed’s Discount Window Loans

The Fed’s discount window program runs three tiers of loans, each of them using a separate but related rate.

- First Tier: Called the primary credit program, this tier provides capital to financially sound banks that have a good credit record. This primary credit discount rate is usually set above existing market interest rates which may be available from other banks or from other sources of similar short-term debt.

- Second Tier: Called the secondary credit program, it offers similar loans to institutions that do not qualify for the primary rate. It is usually set 50 basis points higher than the primary rate (one percentage point = 100 basis points). Institutions in this tier are smaller and may not be as financially healthy as the ones that use the primary tier.

- Third Tier: Called the seasonal credit program, this one serves smaller financial institutions which experience higher seasonal variations in their cash flows. Many are regional banks that serve the needs of the agriculture and tourism sectors. Their businesses are considered relatively risky, so the interest rates they pay are higher.

All three types of the Federal Reserve’s discount window loans are collateralized. The bank needs to maintain a certain level of security or collateral against the loan.

Use of the Fed’s Discount Rate

Borrowing institutions use this facility sparingly, mostly when they cannot find willing lenders in the marketplace. The Fed-offered discount rates are available at relatively high-interest rates compared to the interbank borrowing rates.

Discount loans are intended to be primarily an emergency option for banks in distress. Borrowing from the Fed discount window can even signal weakness to other market participants and investors. Its use peaks during periods of financial distress.

Example of Fed Discount Rate

The use of the Fed’s discount window soared in late 2007 and in 2008, as financial conditions deteriorated sharply and the central bank took steps to inject liquidity into the financial system. The discount rates for the first two tiers are determined independently by the Fed. The rate for the third tier is based on the prevailing rates in the market.

In August 2007, the Board of Governors cut the primary discount rate from 6.25% to 5.75%, reducing the premium over the Fed funds rate from 1% to 0.5%. In October 2008, the month after Lehman Brothers’ collapse, discount window borrowing peaked at $403.5 billion against the monthly average of $0.7 billion from 1959 to 2006.

Owing to the financial crisis, the board also extended the lending period from overnight to 30 days, and then to 90 days in March 2008. Once the economy regained control, those temporary measures were revoked, and the discount rate was reverted to overnight lending only.

While the Fed maintains its own discount rate under the discount window program in the U.S., other central banks across the globe also use similar measures in different variants. For instance, the European Central Bank (ECB) offers standing facilities that serve as marginal lending facilities. Financial organizations can obtain overnight liquidity from the central bank against the presentation of sufficient eligible assets as collateral.

Most commonly, the Fed’s discount window loans are overnight only, but in periods of extreme economic distress, such as the 2008-2009 credit crisis, the loan period can be extended.

How the Discount Rate Works in Cash Flow Analysis

The same term, discount rate, is used in discounted cash flow analysis. DCF is used to estimate the value of an investment based on its expected future cash flows. Based on the concept of the time value of money, DCF analysis helps assess the viability of a project or investment by calculating the present value of expected future cash flows using a discount rate.

Such an analysis begins with an estimate of the investment that a proposed project will require. Then, the future returns it is expected to generate are considered. Using the discount rate, it is possible to calculate the current value of all such future cash flows. If the net present value (PV) is positive, the project is considered viable. If it is negative, the project isn’t worth the investment.

In this context of DCF analysis, the discount rate refers to the interest rate used to determine the present value. For example, $100 invested today in a savings scheme that offers a 10% interest rate will grow to $110. In other words, $110, which is the future value (FV), when discounted by the rate of 10% is worth $100 (present value) as of today.

If one knows (or can reasonably predict) all such future cash flows (like the future value of $110), then, using a particular discount rate, the present value of such an investment can be obtained.

Discounting With The Discount Rate

What Is the Right Discount Rate to Use?

What is the appropriate discount rate to use for an investment or a business project? While investing in standard assets, like treasury bonds, the risk-free rate of return is often used as the discount rate.

On the other hand, if a business is assessing the viability of a potential project, the weighted average cost of capital (WACC) may be used as a discount rate. This is the average cost the company pays for capital from borrowing or selling equity.

In either case, the net present value of all cash flows should be positive if the investment or project is to get the green light.

Types of Discounted Cash Flow

There are different types of discount rates that apply to various investments of a business. What type required depends on the needs and demands of investors and the company itself. Here are the most common:

- Cost of Debt: Companies must take on debt in order to finance their operations and keep the business running. The interest rate they pay on this debt is known as the cost of debt.

- Cost of Equity: The cost of equity is the rate that corporations use to pay their shareholders. Investors expect (this certain) rate of return in exchange for taking on the risk of investing in a company.

- Hurdle Rate: The minimum rate of return on a certain investment or undertaking, which is known as the hurdle rate, that is required by the business or an investor. This allows them to make important decisions on whether the venture is a good fit.

- Risk-Free Rate: The risk-free rate is the interest rate that comes with an investment or business venture with no risk at all.

- Weighted Average Cost of Capital: This is the rate of return that investors expect for its capita. Investors can include equity shareholders and bondholders.

Formula and Calculation of the Discount Rate

In order to calculate the discount rate, you’ll need a couple of important figures. These include the:

- Future value of cash flow (FV)

- Present value (PV)

- Number of years until the FV

With this information in hand, you can then determine the discount rate using the following formula:

DR = (FV ÷ PV)1/n — 1

Example of the Discount Rate

Here’s an example to show how the discount rate works. Let’s say you want to determine the discount rate on a certain investment using the following variables:

| Future Value | $5,000 |

| Present Value | $3,500 |

| Number of Years | 10 |

Now, let’s use the formula above to figure out the discount rate.

DR = (FV ÷ PV)1/n — 1

DR = ($5,000 ÷ $3,500)1/10 — 1

DR = $1.428571/10 — 1

DR = 1.03631 — 1

DR = 0.03631

So, in this case, the discount rate is 3.631%.

What Effect Does a Higher Discount Rate Have on the Time Value of Money?

Future cash flows are reduced by the discount rate, so the higher the discount rate the lower the present value of the future cash flows. A lower discount rate leads to a higher present value. As this implies, when the discount rate is higher, money in the future will be worth less than it is today. It will have less purchasing power.

How Is Discounted Cash Flow Calculated?

There are three steps to calculating the DCF of an investment:

- Forecast the expected cash flows from the investment.

- Select an appropriate discount rate.

- Discount the forecasted cash flows back to the present day, using a financial calculator, a spreadsheet, or a manual calculation.

How Do You Choose the Appropriate Discount Rate?

The discount rate used depends on the type of analysis undertaken. When considering an investment, the investor should use the opportunity cost of putting their money to work elsewhere as an appropriate discount rate. That is the rate of return that the investor could earn in the marketplace on an investment of comparable size and risk.

A business can choose the most appropriate of several discount rates. This might be an opportunity cost-based discount rate, or its weighted average cost of capital, or the historical average returns of a similar project. In some cases using the risk-free rate may be most appropriate.

What is the Discount Rate?

The Discount Rate represents the minimum return expected to be earned on an investment given its specific risk profile. In practice, the present value (PV) of the future cash flows generated by a company is estimated using an appropriate discount rate that should reflect the risk profile of the underlying company, i.e. the opportunity cost of capital.

How to Calculate Discount Rate (Step-by-Step)

In corporate finance, the discount rate is the minimum rate of return necessary to invest in a particular project or investment opportunity.

The discount rate, often called the “cost of capital”, reflects the necessary return of the investment given the riskiness of its future cash flows.

Conceptually, the discount rate estimates the risk and potential returns of an investment – so a higher rate implies greater risk but also more upside potential.

In part, the estimated discount rate is determined by the “time value of money” – i.e. a dollar today is worth more than a dollar received on a future date – and the return on comparable investments with similar risks.

Interest can be earned over time if the capital is received on the current date. Hence, the discount rate is often called the opportunity cost of capital, i.e. the hurdle rate used to guide decision-making around capital allocation and selecting worthwhile investments.

When considering an investment, the rate of return that an investor should reasonably expect to earn depends on the returns on comparable investments with similar risk profiles.

Calculating the discount rate is a three-step process:

- Step 1 → First, the value of a future cash flow (FV) is divided by the present value (PV)

- Step 2 → Next, the resulting amount from the prior step is raised to the reciprocal of the number of years (n)

- Step 3 → Finally, one is subtracted from the value to calculate the discount rate

Discount Rate Formula

The discount rate formula is as follows.

Discount Rate = (Future Value ÷ Present Value) ^ (1 ÷ n) – 1

For instance, suppose your investment portfolio has grown from $10,000 to $16,000 across a four-year holding period.

- Future Value (FV) = $16,000

- Present Value (PV) = $10,000

- Number of Periods = 4 Years

If we plug those assumptions into the formula from earlier, the discount rate is approximately 12.5%.

- r = ($16,000 / $10,000) ^ (1/4) – 1 = 12.47%

The example we just completed assumes annual compounding, i.e. 1x per year.

However, rather than annual compounding, if we assume that the compounding frequency is semi-annual (2x per year), we would multiply the number of periods by the compounding frequency.

Upon adjusting for the effects of compounding, the discount rate comes out to be 6.05% per 6-month period.

- r = ($16,000 / $10,000) ^ (1/8) – 1 = 6.05%

Discount Rate vs. Net Present Value (NPV)

The net present value (NPV) of a future cash flow equals the cash flow amount discounted to the present date.

With that said, a higher discount rate reduces the present value (PV) of the future cash flows (and vice versa).

Net Present Value (NPV) = Σ Cash Flow ÷ (1 + Discount Rate) ^ n

In the formula above, “n” is the year when the cash flow is received, so the further out the cash flow is received, the greater the reduction.

Moreover, a fundamental concept in valuation is that incremental risk should coincide with greater returns potential.

- Higher Discount Rate → Lower NPV (and Implied Valuation)

- Lower Discount Rate → Higher NPV (and Implied Valuation)

Therefore, the expected return is set higher to compensate the investors for undertaking the risk.

If the expected return is insufficient, it would not be reasonable to invest, as there are other investments elsewhere with a better risk/return trade-off.

On the other hand, a lower discount rate causes the valuation to rise because such cash flows are more certain to be received.

More specifically, the future cash flows are more stable and likely to occur into the foreseeable future – hence, stable, market-leading companies like Amazon and Apple tend to exhibit lower discount rates.

Learn More → Discount Rate by Industry (Damodaran)

How to Determine the Discount Rate

In a discounted cash flow (DCF) model, the intrinsic value of an investment is based on the projected cash flows generated, which are discounted to their present value (PV) using the discount rate.

Once all the cash flows are discounted to the present date, the sum of all the discounted future cash flows represents the implied intrinsic value of an investment, most often a public company.

The discount rate is a critical input in the DCF model – in fact, the discount rate is arguably the most influential factor to the DCF-derived value.

One rule to abide by is that the discount rate and the represented stakeholders must align.

The appropriate discount rate to use is contingent on the represented stakeholders:

- Weighted Average Cost of Capital (WACC) → All Stakeholders (Debt + Equity)

- Cost of Equity (ke) → Common Shareholders

- Cost of Debt (kd) → Debt Lenders

- Cost of Preferred Stock (kp) → Preferred Stock Holders

WACC vs. Cost of Equity: What is the Difference?

- WACC → FCFF: The weighted average cost of capital (WACC) reflects the required rate of return on an investment for all capital providers, i.e. debt and equity holders. Since both debt and equity providers are represented in WACC, the free cash flow to firm (FCFF) – which belongs to both debt and equity capital providers – is discounted using the WACC.

- Cost of Equity → FCFE: In contrast, the cost of equity is the minimum rate of return from the viewpoint of only equity shareholders. The free cash flow to equity (FCFE) belonging to a company should be discounted using the cost of equity, as the represented capital provider in such a case are common shareholders.

Thereby, an unlevered DCF projects a company’s FCFF, which is discounted by WACC – whereas a levered DCF forecasts a company’s FCFE and uses the cost of equity as the discount rate.

The Wharton Online

and Wall Street Prep Private Equity Certificate Program

Level up your career with the world’s most recognized private equity investing program. Enrollment is open for the May 1 — Jun 25 cohort.

Enroll Today

Discount Rate Calculation Guide (WACC)

The weighted average cost of capital (WACC), as mentioned earlier, represents the “opportunity cost” of an investment based on comparable investments of similar risk profiles.

Formulaically, the WACC is calculated by multiplying the equity weight by the cost of equity and adding it to the debt weight multiplied by the tax-affected cost of debt.

WACC = [ke × (E ÷ (D + E))] + [kd × (D ÷ (D + E))]

Where:

- E / (D + E) = Equity Weight (%)

- D / (D + E) = Debt Weight (%)

- ke = Cost of Equity

- kd = After-Tax Cost of Debt

Unlike the cost of equity, the cost of debt must be tax-effected because interest expense is tax-deductible, i.e. the interest “tax shield.”

In order to tax affect the pre-tax cost of debt, the rate must be multiplied by one minus the tax rate.

After-Tax Cost of Debt = Pre-Tax Cost of Debt * (1 – Tax Rate %)

The capital asset pricing model (CAPM) is the standard method used to calculate the cost of equity.

Based on the CAPM, the expected return is a function of a company’s sensitivity to the broader market, typically approximated as the returns of the S&P 500 index.

Cost of Equity (ke) = Risk-Free Rate + Beta × Equity Risk Premium

There are three components in the CAPM formula:

| CAPM Components | Description |

|---|---|

| Risk-Free Rate (rf) |

|

| Equity Risk Premium (ERP) |

|

| Beta (β) |

|

Calculating the cost of debt (kd), unlike the cost of equity, tends to be relatively straightforward because debt issuances like bank loans and corporate bonds have readily observable interest rates via sources such as Bloomberg.

Conceptually, the cost of debt is the minimum return that debt holders demand before bearing the burden of lending debt capital to a specific borrower.

Discount Rate Calculator – Excel Model Template

We’ll now move to a modeling exercise, which you can access by filling out the form below.

Step 1. Cost of Debt Calculation (kd)

Suppose we are calculating the weighted average cost of capital (WACC) for a company.

In the first part of our model, we’ll calculate the cost of debt.

If we assume the company has a pre-tax cost of debt of 6.5% and the tax rate is 20%, the after-tax cost of debt is 5.2%.

- After-Tax Cost of Debt (kd) = 6.5% * 20%

- kd = 5.2%

Step 2. CAPM Cost of Equity Calculation (ke)

The next step is to calculate the cost of equity using the capital asset pricing model (CAPM).

The three assumptions for our three inputs are as follows:

- Risk-Free Rate (rf) = 2.0%

- Beta (β) = 1.10

- Equity Risk Premium (ERP) = 8.0%

If we enter those figures into the CAPM formula, the cost of equity comes out to 10.8%.

- Cost of Equity (ke) = 2.0% + (1.10 * 8.0%)

- ke = 10.8%

Step 3. Capital Structure Analysis (Debt and Equity Weights)

We must now determine the capital structure weights, i.e. the % contribution of each source of capital.

The market value of equity – i.e. the market capitalization (or equity value) – is assumed to be $120 million. On the other hand, the net debt balance of a company is assumed to be $80 million.

- Market Value of Equity = $120 million

- Net Debt = $80 million

While the market value of debt should be used, the book value of debt shown on the balance sheet is usually fairly close to the market value (and can be used as a proxy should the market value of debt not be available).

The intuition behind the usage of net debt is that cash on the balance sheet could hypothetically be used to pay down a portion of the outstanding gross debt balance.

By adding the $120 million in equity value and $80 million in net debt, we calculate that the total capitalization of our company equals $200 million.

From that $200 million, we can determine the relative weights of debt and equity in the company’s capital structure:

- Equity Weight = 60%

- Debt Weight = 40%

Step 4. Discount Rate Calculation (WACC)

We now have the necessary inputs to calculate our company’s discount rate, which is equal to the sum of each capital source cost multiplied by the corresponding capital structure weight.

- Discount Rate (WACC) = (5.2% * 40%) + (10.8% * 60%)

- WACC = 8.6%

In closing, the cost of capital of our hypothetical company comes out to 8.6%, which is the implied rate used to discount its future cash flows.

Step-by-Step Online Course

Everything You Need To Master Financial Modeling

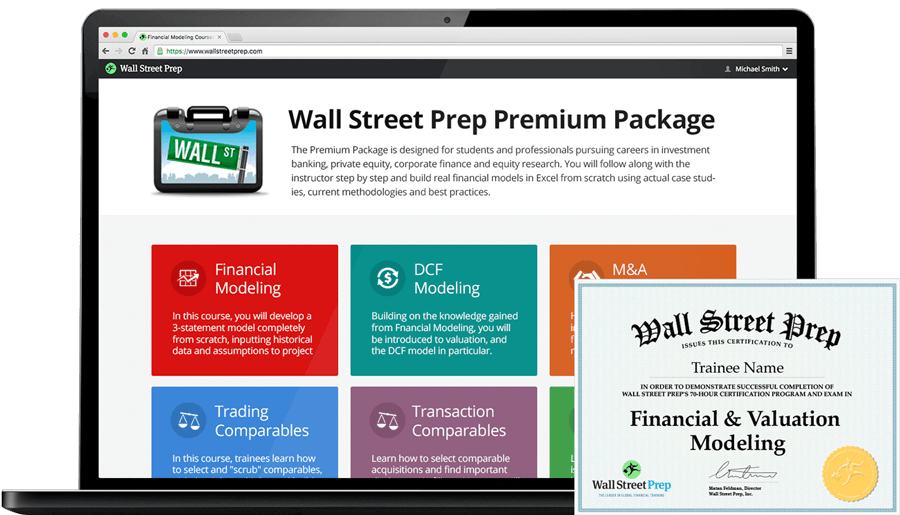

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today

The discount rate is a financial term that can have two meanings. In banking, it is the interest rate the Federal Reserve charges banks for overnight loans. Despite its name, the discount rate is not reduced. In fact, it’s higher than market rates, since these loans are meant to be only backup sources of funding. During major financial crises, though, the Fed may lower the discount rate – and lengthen the loan time. In investing, the discount rate is the rate of return used to figure out what future cash flows are worth today. If you need help understanding this or any other financial concepts, consider working with a financial advisor.

What Is the Discount Rate at the Federal Reserve?

When the discount rate comes up in financial news, it usually refers to the Federal Reserve discount rate. This is the rate the Fed charges commercial banks for short-term loans of 24 hours or less. Sometimes, banks borrow money from the Fed to prevent liquidity issues or cover funding shortfalls. Those loans come from one of 12 regional Federal Reserve banks.

Banks use these loans sparingly since loans from other banks typically come with lower rates and less collateral. Meanwhile, asking the Fed for money may be seen as a sign of weakness, which banks want to avoid. (Since the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Fed must publicly disclose the names of banks that borrow from the discount window and the amount of the loan.)

Banks that borrow from the Fed fall into three discount programs, or “discount windows.”

- Primary credit, which makes overnight loans to banks that are in good financial shape.

- Secondary credit lends at an interest rate higher than the primary rate to banks that don’t qualify for primary credit.

- Seasonal credit, for banks with seasonal needs in places like farming or resort communities.

Who Sets The Discount Rate?

The board of directors of each regional Federal Reserve Bank sets the interest rate for primary credit window loans every 14 days. The Board of Governors of the Federal Reserve System then approves the discount rate, which looks awfully similar in each region.

Since October 31, 2019, the primary rate has been 2.25%, and the secondary rate, which must be 50 basis points higher, has been 2.75%. The seasonal rate is a floating rate based on market conditions and is the average of the federal funds rate and the rate of three-month certificates of deposit (CDs).

Why The Discount Rate is Important

The discount rate helps steer the Fed’s monetary policy. At the beginning of the last recession, the Fed lowered the discount rate to help stressed financial institutions cover costs. In those situations, short-term loans tend to get a bit longer. At the height of the financial crisis in 2008, loans with a discount rate were as long as 90 days.

Discounted Rate of Return For Investments

The second way that a discount rate is used is when cash flow is discounted when analyzing a financial investment. The discounted cash flow (DCF) rises when a particular investment costs more money to buy or ends up generating less of a financial return than expected or more than the cost is valued at. In other words, the DCF analysis helps you decide whether an investment is worth the money it will cost you upfront by analyzing the current cost by the value of future revenue.

Taking into account the time value of money, the discount rate describes the interest percentage that an investment may yield over its lifetime. For example, an investor expects a $1,000 investment to produce a 10% return in a year. In that case, the discount rate for valuing this investment or comparing it to others is 10%.

The discount rate allows investors and others to consider risk in an investment and set a benchmark for future investments. The discount rate is what corporate executives call a “hurdle rate,” which can help determine if a business investment will yield profits.

Businesses considering investments will use the cost of borrowing today to figure out the discount rate. For example, $200 invested against a 15% interest rate will grow to $230. Working backward, $230 of future value discounted by 15% is worth $200 today. This is helpful if you want to invest today but need a certain amount later.

Discount Rate Limits

The discount rate is often a precise figure, but it is still an estimate. It often involves making assumptions about future developments without taking into account all of the variables. For many investments, the discount rate is just an educated guess.

While some investments have predictable returns, future capital costs and returns from other investments vary. That makes comparing those investments to a discount rate even harder. Often, the best the discounted rate of return can do is tilt the odds slightly in favor of investors and businesses.

Bottom Line

The Fed’s discount rate comes up in the news usually during financial crises. It’s the rate the Fed charges banks for overnight loans and doesn’t directly impact individuals. The business sense of the term, though, is relevant to investors. It’s one way of assessing an investment’s value by analyzing whether an investment is worth the initial cost to the investor.

Tips For Investing

- Investing isn’t easy and it can take time to figure out how to properly invest to meet your financial goals. If this sounds like you then you may want to speak to a financial advisor, who can help you sift through the questions you have and set you on the right path for your situation. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Still want to try your hand at stock picking? You can cut down costs by making your trades through an online brokerage account. Brokers such as Charles Schwab, E*Trade and TD Ameritrade offer zero-commission online trades.

Photo credit: ©iStock.com/Xesai, ©iStock.com/manfeiyang, ©iStock.com/ juststock

Mark Henricks

Mark Henricks has reported on personal finance, investing, retirement, entrepreneurship and other topics for more than 30 years. His freelance byline has appeared on CNBC.com and in The Wall Street Journal, The New York Times, The Washington Post, Kiplinger’s Personal Finance and other leading publications. Mark has written books including, “Not Just A Living: The Complete Guide to Creating a Business That Gives You A Life.” His favorite reporting is the kind that helps ordinary people increase their personal wealth and life satisfaction. A graduate of the University of Texas journalism program, he lives in Austin, Texas. In his spare time he enjoys reading, volunteering, performing in an acoustic music duo, whitewater kayaking, wilderness backpacking and competing in triathlons.