R-squared, often written as r2, is a measure of how well a linear regression model fits a dataset.

In technical terms, it is the proportion of the variance in the response variable that can be explained by the predictor variable.

The value for r2 can range from 0 to 1:

- A value of 0 indicates that the response variable cannot be explained by the predictor variable at all.

- A value of 1 indicates that the response variable can be perfectly explained without error by the predictor variable.

Related: What is a Good R-squared Value?

This tutorial explains how to calculate r2 for two variables in Excel.

Example: Calculating R-Squared in Excel

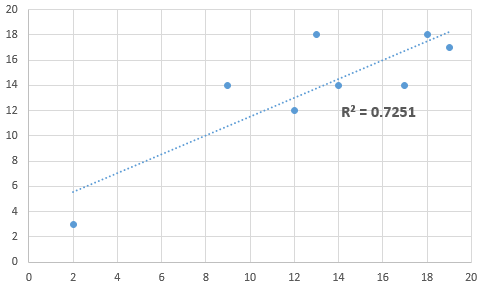

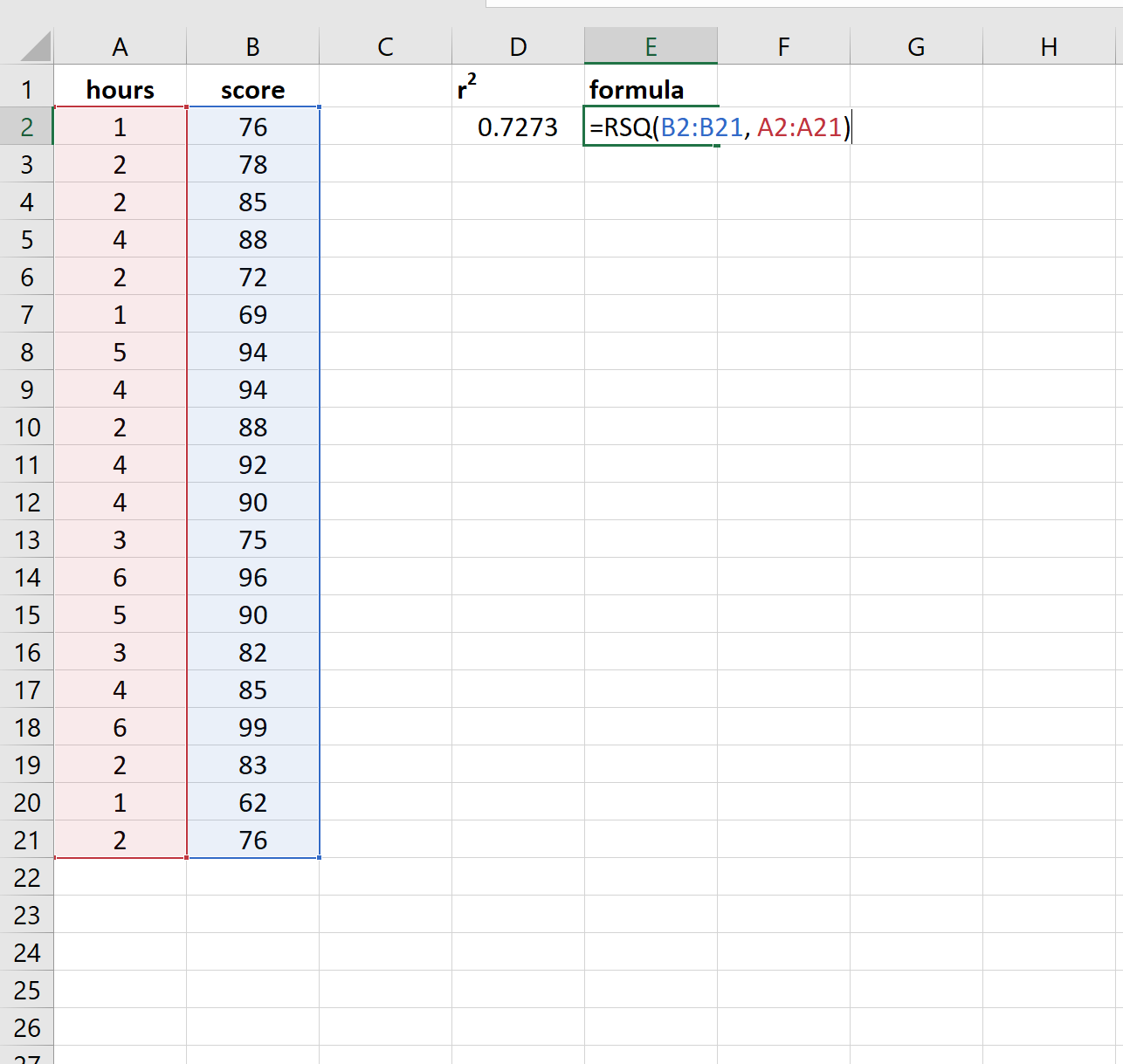

Suppose we have the following data for the number of hours studied and the exam score received for 20 students:

Now suppose we are interested in fitting a simple linear regression model to this data, using “hours” as the predictor variable and “score” as the response variable.

To find the r2 for this data, we can use the RSQ() function in Excel, which uses the following syntax:

=RSQ(known_ys, known_xs)

where:

- known_ys: the values for the response variable

- known_xs: the values for the predictor variable

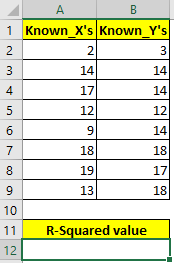

Here’s what that formula looks like in our example:

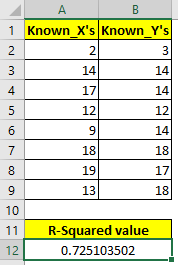

In this example, 72.73% of the variation in the exam scores can be explained by the number of hours studied.

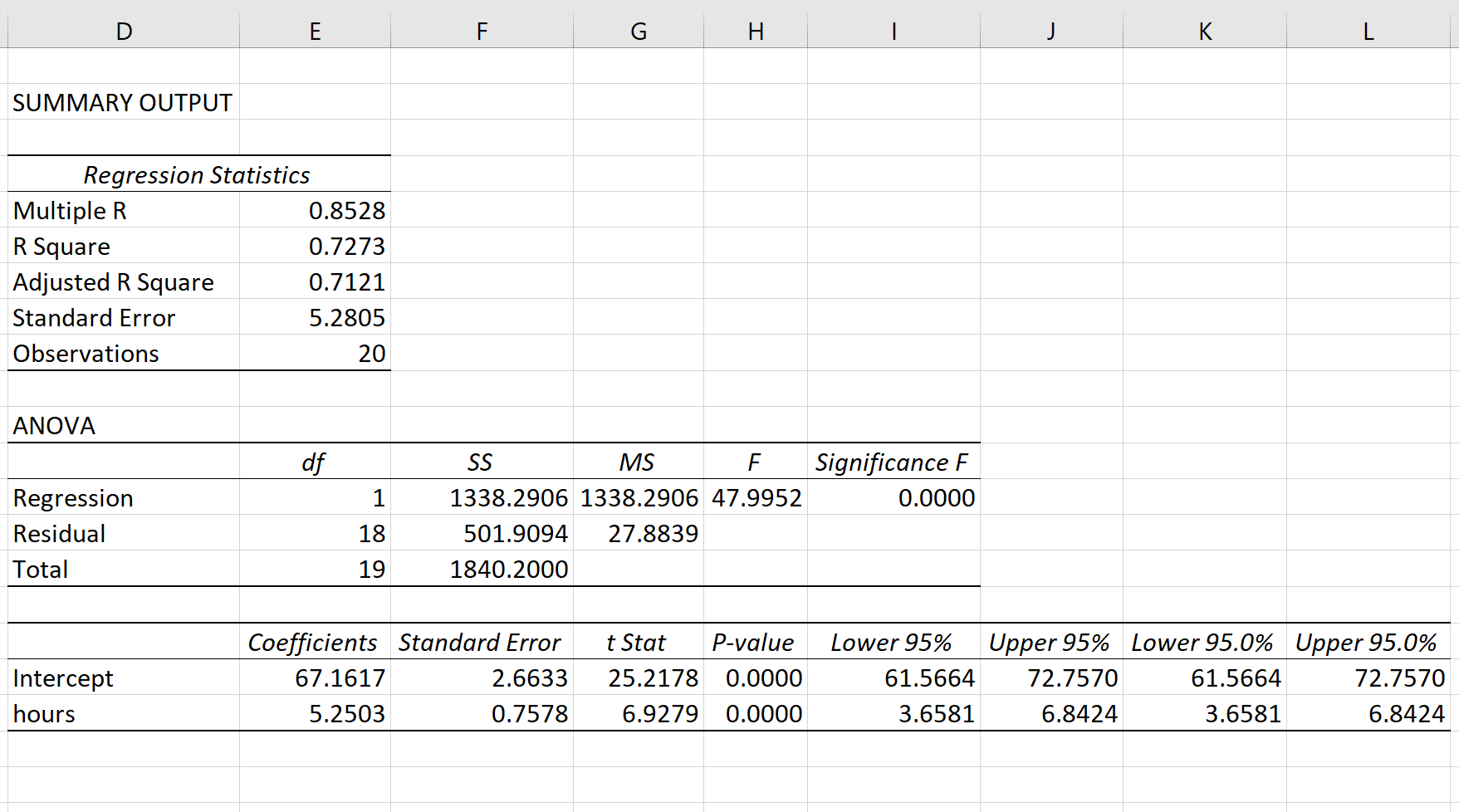

Note that if we fit a simple linear regression model to this data, the output would look like this:

Notice that the R Square value in the first table is 0.7273, which matches the result that we got using the RSQ() function.

Additional Resources

The following tutorials explain how to perform other common tasks in Excel:

How to Calculate Adjusted R-Squared in Excel

How to Calculate SST, SSR, and SSE in Excel

How to Create a Residual Plot in Excel

What Is R-Squared?

In the financial world, R-squared is a statistical measure that represents the percentage of a fund’s or a security’s movements that can be explained by movements in a benchmark index. In this field, R-squared typically ranges from 1% to 100%.

Where correlation explains the strength of the relationship between an independent and dependent variable, R-squared explains to what extent the variance of one variable explains the variance of the second variable.

Continue reading to learn more about R-squared, including how to automate its calculation in Excel.

Key Takeaways

- R-squared, or the coefficient of determination, is a statistical measure that uses the variance of one variable to explain the variance of another.

- Further testing is required to determine if R-squared approaching +/- 1 is statistically significant.

- Variables must be independent and their relationship linear for correlation to exist.

- When calculating a correlation, it is important to normalize data into a common unit.

- To correlate stocks, normalize their data into percent return.

Formula for R-Squared

R

2

=

1

−

R

S

S

T

S

S

where:

R

2

=

Coefficient of determination

R

S

S

=

Sum of squares of residuals

T

S

S

=

Total sum of squares

begin{aligned}&R^2=1-frac{RSS}{TSS}\&textbf{where:}\&R^2=text{Coefficient of determination}\&RSS=text{Sum of squares of residuals}\&TSS=text{Total sum of squares}end{aligned}

R2=1−TSSRSSwhere:R2=Coefficient of determinationRSS=Sum of squares of residualsTSS=Total sum of squares

Common Mistakes With R-Squared

The first most common mistake is assuming an R-squared approaching +/- 1 is statistically significant. A reading approaching +/- 1 increases the chances of actual statistical significance, but without further testing, it’s impossible to know based on the result alone.

Statistical testing is not completely straightforward; it can get complicated for several reasons. To touch on this briefly, a critical assumption of correlation (and thus R-squared) is that the variables are independent and that the relationship between them is linear. In theory, you would test these claims to determine if a correlation calculation is appropriate.

Investors often use R-squared with beta to more accurately assess asset managers’ performance.

The second most common mistake is forgetting to normalize the data into a common unit. If you are calculating a correlation (or R-squared) on two betas, then the units are already normalized: The unit is beta.

If you want to correlate stocks, it’s critical you normalize them into percent return and not share price changes. This happens frequently, even among investment professionals.

For stock price correlation (or R-squared), you are essentially asking two questions: What is the return over a certain number of periods, and how does that variance relate to another securities variance over the same period? Two securities might have a high correlation (or R-squared) if the return is daily percent changes over the past 52 weeks but a low correlation if the return is monthly changes over the past 52 weeks.

Which one is «better»? There is no perfect answer, and it depends on the purpose of the test.

How to Calculate R-Squared in Excel

There are several methods for calculating R-squared in Excel.

The simplest way is to get two data sets and use the built-in R-squared formula. The other alternative is to find a correlation and then square it. Both are shown below:

Frequently Asked Questions

How Do I Find R-Squared in Excel?

To find R-squared in Excel, enter the following formula into an empty cell:=RSQ([Data set 1], [Data set 2]). Data sets are ranges of data, most often arranged in a column or row. To select a group or set of data, select a cell and drag the cursor to highlight the other cells.

How Can You Find Adjusted R-Squared in Excel?

When a variable is added, R-squared will increase. However, the adjusted R-squared may increase or decrease depending on the explanatory power of the added variable. To calculate adjusted R-squared in Excel, enter the following formula into an empty cell: = 1 — (1 — R^2)(n-1/n-k-1), where k is the number of variables, and n is the number of data points.

How Can I Add R-Squared Value in Excel?

Adding an R-squared value in Excel can be done by using the formula to find the correlation of variables and then squaring the result, or by using the R-squared formula. The Excel formula for finding the correlation is «= CORREL([Data set 1], [Data set 2]).

To find R-squared, select the cell with the correlation formula and square the result (=[correlation cell] ^2). To find R-squared using a single formula, enter the following in an empty cell: =RSQ([Data set 1],[Data set 2]).

Содержание

- Как вы вычисляете r-квадрат в Excel?

- Как в Excel возвести число в степень (Марш 2023)

- Оглавление:

- Общие ошибки с R-Squared

- Как вычислить R-Squared в Excel

- Как вы вычисляете коэффициент Шарпа в Excel?

- Как вы вычисляете операционный денежный поток в Excel?

- Как вы вычисляете разведенный EPS с помощью Excel?

- Как рассчитать R-квадрат в Excel (с примерами)

- Пример: расчет R-квадрата в Excel

- How Do You Calculate R-Squared in Excel?

- What Is R-Squared?

- Key Takeaways

- Formula for R-Squared

- Common Mistakes With R-Squared

- How to Calculate R-Squared in Excel

- Frequently Asked Questions

- How Do I Find R-Squared in Excel?

- How Can You Find Adjusted R-Squared in Excel?

- How Can I Add R-Squared Value in Excel?

- R squared in Excel – Excelchat

- R squared formula

- What is R squared

- Data for R squared

- How to find the R2 value

- Instant Connection to an Excel Expert

- How to Find R-Squared in Excel? Use (RSQ) Function

Как вы вычисляете r-квадрат в Excel?

Как в Excel возвести число в степень (Марш 2023)

Оглавление:

В финансовом мире R-squared — это статистическая мера, которая представляет собой процент фонда или движений безопасности, которые могут быть объяснены движениями в эталонном индексе. Когда корреляция объясняет силу взаимосвязи между независимой и зависимой переменной, R-квадрат объясняет, в какой степени дисперсия одной переменной объясняет дисперсию второй переменной. Формула для R-квадрата — это просто квадрат корреляции. ( Хотите узнать больше о excel? Посетите Академию Investopedia для наших курсов excel ).

Общие ошибки с R-Squared

Самая распространенная ошибка заключается в том, что R-квадрат приближающегося +/- 1 статистически значим. Считывание, приближающееся +/- 1, безусловно увеличивает шансы на реальную статистическую значимость, но без дальнейшего тестирования невозможно знать только на основе результата. Статистическое тестирование не является простым; он может усложняться по ряду причин. Чтобы коснуться этого кратко, критическое предположение о корреляции (и, следовательно, R-квадрат) состоит в том, что переменные независимы и связь между ними линейна. Теоретически, вы должны проверить эти претензии, чтобы определить, подходит ли расчет корреляции.

Вторая наиболее распространенная ошибка — забыть нормализовать данные в единую единицу. Если вы вычисляете корреляцию (или R-квадрат) на двух бета-версиях, то единицы уже нормализованы: единица является бета-версией. Однако, если вы хотите скорректировать акции, важно, чтобы вы нормализовали их в процентном отношении, а не изменяли цены. Это происходит слишком часто, даже среди профессионалов в области инвестиций.

Для корреляции цен на акции (или R-квадрата) вы по существу задаете два вопроса: каково возвращение за определенное количество периодов и как это отклонение связано с другой дисперсией ценных бумаг над тот же период? У двух ценных бумаг может быть высокая корреляция (или R-квадрат), если доходность ежедневно процентов изменяется за последние 52 недели, но низкая корреляция, если возврат ежемесячно изменяется по за последние 52 недели. Какая из них лучше»? На самом деле нет идеального ответа, и это зависит от цели теста.

Как вычислить R-Squared в Excel

Существует несколько методов вычисления R-квадратов в Excel.

Самый простой способ — получить два набора данных и использовать встроенную формулу R-squared. Другой альтернативой является поиск корреляции, а затем квадрат. Оба показаны ниже:

Как вы вычисляете коэффициент Шарпа в Excel?

Узнайте, как использовать Microsoft Excel для расчета коэффициента Sharpe, инструмента для инвестиций, полезного для оценки взаимосвязи между риском и возвратом актива.

Как вы вычисляете операционный денежный поток в Excel?

Кредиторы и инвесторы могут прогнозировать успех компании, используя приложение электронной таблицы Excel для расчета свободного денежного потока компаний.

Как вы вычисляете разведенный EPS с помощью Excel?

Узнайте, что такое разведенный EPS, общая формула, используемая для его расчета, и как рассчитать разведенный EPS в Microsoft Excel, используя пример.

Источник

Как рассчитать R-квадрат в Excel (с примерами)

R-квадрат , часто обозначаемый как r 2 , является мерой того, насколько хорошо модель линейной регрессии соответствует набору данных.

С технической точки зрения, это доля дисперсии переменной отклика, которая может быть объяснена предикторной переменной.

Значение для r 2 может варьироваться от 0 до 1:

- Значение 0 указывает, что переменная отклика вообще не может быть объяснена предикторной переменной.

- Значение 1 указывает, что переменная отклика может быть полностью объяснена без ошибок с помощью переменной-предиктора.

В этом руководстве объясняется, как рассчитать r 2 для двух переменных в Excel.

Пример: расчет R-квадрата в Excel

Предположим, у нас есть следующие данные о количестве часов обучения и экзаменационном балле, полученном для 20 студентов:

Теперь предположим, что мы заинтересованы в подгонке к этим данным простой модели линейной регрессии, используя «часы» в качестве переменной-предиктора и «оценку» в качестве переменной-ответа.

Чтобы найти r 2 для этих данных, мы можем использовать функцию RSQ() в Excel, которая использует следующий синтаксис:

=RSQ(известный_ys, известный_xs)

- known_ys: значения для переменной ответа

- known_xs: значения для переменной-предиктора

Вот как эта формула выглядит в нашем примере:

В этом примере 72,73 % различий в баллах за экзамены можно объяснить количеством часов обучения.

Обратите внимание, что если мы подгоним к этим данным простую модель линейной регрессии , результат будет выглядеть следующим образом:

Обратите внимание, что значение R Square в первой таблице равно 0,7273 , что соответствует результату, полученному с помощью функции RSQ().

Источник

How Do You Calculate R-Squared in Excel?

What Is R-Squared?

In the financial world, R-squared is a statistical measure that represents the percentage of a fund’s or a security’s movements that can be explained by movements in a benchmark index. In this field, R-squared typically ranges from 1% to 100%.

Where correlation explains the strength of the relationship between an independent and dependent variable, R-squared explains to what extent the variance of one variable explains the variance of the second variable.

Continue reading to learn more about R-squared, including how to automate its calculation in Excel.

Key Takeaways

- R-squared, or the coefficient of determination, is a statistical measure that uses the variance of one variable to explain the variance of another.

- Further testing is required to determine if R-squared approaching +/- 1 is statistically significant.

- Variables must be independent and their relationship linear for correlation to exist.

- When calculating a correlation, it is important to normalize data into a common unit.

- To correlate stocks, normalize their data into percent return.

Formula for R-Squared

Common Mistakes With R-Squared

The first most common mistake is assuming an R-squared approaching +/- 1 is statistically significant. A reading approaching +/- 1 increases the chances of actual statistical significance, but without further testing, it’s impossible to know based on the result alone.

Statistical testing is not completely straightforward; it can get complicated for several reasons. To touch on this briefly, a critical assumption of correlation (and thus R-squared) is that the variables are independent and that the relationship between them is linear. In theory, you would test these claims to determine if a correlation calculation is appropriate.

Investors often use R-squared with beta to more accurately assess asset managers’ performance.

The second most common mistake is forgetting to normalize the data into a common unit. If you are calculating a correlation (or R-squared) on two betas, then the units are already normalized: The unit is beta.

If you want to correlate stocks, it’s critical you normalize them into percent return and not share price changes. This happens frequently, even among investment professionals.

For stock price correlation (or R-squared), you are essentially asking two questions: What is the return over a certain number of periods, and how does that variance relate to another securities variance over the same period? Two securities might have a high correlation (or R-squared) if the return is daily percent changes over the past 52 weeks but a low correlation if the return is monthly changes over the past 52 weeks.

Which one is «better»? There is no perfect answer, and it depends on the purpose of the test.

How to Calculate R-Squared in Excel

There are several methods for calculating R-squared in Excel.

The simplest way is to get two data sets and use the built-in R-squared formula. The other alternative is to find a correlation and then square it. Both are shown below:

Frequently Asked Questions

How Do I Find R-Squared in Excel?

To find R-squared in Excel, enter the following formula into an empty cell:=RSQ([Data set 1], [Data set 2]). Data sets are ranges of data, most often arranged in a column or row. To select a group or set of data, select a cell and drag the cursor to highlight the other cells.

How Can You Find Adjusted R-Squared in Excel?

When a variable is added, R-squared will increase. However, the adjusted R-squared may increase or decrease depending on the explanatory power of the added variable. To calculate adjusted R-squared in Excel, enter the following formula into an empty cell: = 1 — (1 — R^2)(n-1/n-k-1), where k is the number of variables, and n is the number of data points.

How Can I Add R-Squared Value in Excel?

Adding an R-squared value in Excel can be done by using the formula to find the correlation of variables and then squaring the result, or by using the R-squared formula. The Excel formula for finding the correlation is «= CORREL([Data set 1], [Data set 2]).

To find R-squared, select the cell with the correlation formula and square the result (=[correlation cell] ^2). To find R-squared using a single formula, enter the following in an empty cell: =RSQ([Data set 1],[Data set 2]).

Источник

R squared in Excel – Excelchat

R squared is an indicator of how well our data fits the model of regression. Also referred to as R-squared, R2, R^2, R 2 , it is the square of the correlation coefficient r.

The correlation coefficient is given by the formula:

R squared formula

Hence, the formula for R squared is given by

In the formula, x and y are two variables for which we want to determine for any linear or non-linear correlation. The value of R squared shall indicate that if there is correlation between the two variables, a change in value of the independent variable will likely result to a change in the dependent variable.

What is R squared

The formula for R squared is quite complicated, and entering the values in a cell is prone to errors in calculation. Fortunately, Excel has built-in functions that allow us to easily calculate the R squared value in regression.

The correlation coefficient, r can be calculated by using the function CORREL . R squared can then be calculated by squaring r , or by simply using the function RSQ . In order to calculate R squared, we need to have two data sets corresponding to two variables.

Data for R squared

Suppose we have below values for x and y and we want to add the R squared value in regression.

How to find the R2 value

There are two methods to find the R squared value:

- Calculate for r using CORREL, then square the value

- Calculate for R squared using RSQ

Enter the following formulas into our worksheets:

- In cell G3, enter the formula =CORREL(B3:B7,C3:C7)

- In cell G4, enter the formula =G3^2

- In cell G5, enter the formula =RSQ(C3:C7,B3:B7)

The results in G4 and G5 show that both methods have the same result for R squared which is 0.100443671. With Excel, adding the R squared value is very easy with the help of the functions CORREL and RSQ.

R squared is relevant in various fields such as in stock market and mutual funds because it is able to find the probability or present the correlation between two variables, and it has the ability to explain how much of the movement of one variable can explain the trend of another variable.

Instant Connection to an Excel Expert

Most of the time, the problem you will need to solve will be more complex than a simple application of a formula or function. If you want to save hours of research and frustration, try our live Excelchat service! Our Excel Experts are available 24/7 to answer any Excel question you may have. We guarantee a connection within 30 seconds and a customized solution within 20 minutes.

Источник

How to Find R-Squared in Excel? Use (RSQ) Function

What is r squared in excel?

The R-Squired of a data set tells how well a data fits the regression line. It is used to tell the goodness of fit of data point on regression line. It is the squared value of correlation coefficient. It is also called co-efficient of determination. This is often used in regression analysis, ANOVA etc. analysis. The squired formula in excel is RSQ function. In this tutorial, we will learn how to calculate r squared in excel using RSQ function.

As I told you, Excel provides RSQ function to easily get the R-squired of the sample data set.

Syntax:

Known_ys: The dependent variables.

Known_xs: The independent variables.

Note: The number of variables of x and y should be the same. Otherwise excel will through #NA error.

Now, let’s have an example of RSQ function so that we can understand it.

Example of R-Square in Excel

Here I have a sample data set. In range A2:A9, I have know_xs and in range B2:B9, I have known_ys.

Now, let us use the RSQ function to find R2 in excel. Write this formula in cell A12.

When you hit the enter button you get the value 0.725103502, which is 72% approx.

How to Interpret R-Squared

The R-Squared value always falls in the range 0.0-1.0 or we can say 0% to 100%. 0% r-squared value tells that there is no guarantee of falling a data point on the regression line. Where 100% r-squared value tells us that there are 100% chances of falling data point on regression line. (There are other factors and analysis too that are done to assure this.

In our case, there 72% of goodness of fit.

Another method of Calculating R-Squared in Excel

In the beginning of the article, I told you that R-squared value is squared value of correlation coefficient. So if you write this formula, it will return the same result as RSQ function:

= POWER ( CORREL (A2:A9,B2:B9),2)

Here, CORREL function is used to calculate correlation coefficient and then encapsulated it with POWER function to get the square of the correlation coefficient.

I hope it was explanatory enough. To understand r-square more, read regression analysis in excel. For further queries use the comments section below.

Источник

17 авг. 2022 г.

читать 2 мин

R-квадрат , часто обозначаемый как r 2 , является мерой того, насколько хорошо модель линейной регрессии соответствует набору данных.

С технической точки зрения, это доля дисперсии переменной отклика, которая может быть объяснена предикторной переменной.

Значение для r 2 может варьироваться от 0 до 1:

- Значение 0 указывает, что переменная отклика вообще не может быть объяснена предикторной переменной.

- Значение 1 указывает, что переменная отклика может быть полностью объяснена без ошибок с помощью переменной-предиктора.

Связанный: Что такое хорошее значение R-квадрата?

В этом руководстве объясняется, как рассчитать r 2 для двух переменных в Excel.

Пример: расчет R-квадрата в Excel

Предположим, у нас есть следующие данные о количестве часов обучения и экзаменационном балле, полученном для 20 студентов:

Теперь предположим, что мы заинтересованы в подгонке к этим данным простой модели линейной регрессии, используя «часы» в качестве переменной-предиктора и «оценку» в качестве переменной-ответа.

Чтобы найти r 2 для этих данных, мы можем использовать функцию RSQ() в Excel, которая использует следующий синтаксис:

=RSQ(известный_ys, известный_xs)

куда:

- known_ys: значения для переменной ответа

- known_xs: значения для переменной-предиктора

Вот как эта формула выглядит в нашем примере:

В этом примере 72,73 % различий в баллах за экзамены можно объяснить количеством часов обучения.

Обратите внимание, что если мы подгоним к этим данным простую модель линейной регрессии , результат будет выглядеть следующим образом:

Обратите внимание, что значение R Square в первой таблице равно 0,7273 , что соответствует результату, полученному с помощью функции RSQ().

Написано

Замечательно! Вы успешно подписались.

Добро пожаловать обратно! Вы успешно вошли

Вы успешно подписались на кодкамп.

Срок действия вашей ссылки истек.

Ура! Проверьте свою электронную почту на наличие волшебной ссылки для входа.

Успех! Ваша платежная информация обновлена.

Ваша платежная информация не была обновлена.

R squared is an indicator of how well our data fits the model of regression. Also referred to as R-squared, R2, R^2, R2, it is the square of the correlation coefficient r.

Contents

- 1 What r 2 value means?

- 2 How do you find the R 2 value in Excel?

- 3 What does the R 2 value mean in excel?

- 4 What does an R2 value of 0.8 mean?

- 5 How do you calculate r 2?

- 6 What is R vs R2?

- 7 What does an R 2 value of 1 mean?

- 8 What does the R2 value tell you about the trendline?

- 9 What does an R squared value of 0.3 mean?

- 10 How do I improve my R2 score?

- 11 What does an R2 value of 0.99 mean?

- 12 What does a low R2 value mean?

- 13 How do you manually calculate r 2?

- 14 How do you find r 2 on a TI 84?

- 15 How do you find r in stats?

- 16 How do you calculate R2 in Anova table?

- 17 How do you interpret adjusted R2?

- 18 R mean?

- 19 What does an R2 value of 0.5 mean?

What r 2 value means?

R-squared (R2) is a statistical measure that represents the proportion of the variance for a dependent variable that’s explained by an independent variable or variables in a regression model.

How do you find the R 2 value in Excel?

Double-click on the trendline, choose the Options tab in the Format Trendlines dialogue box, and check the Display r-squared value on chart box.

What is r squared in excel? The R-Squired of a data set tells how well a data fits the regression line. It is used to tell the goodness of fit of data point on regression line. It is the squared value of correlation coefficient. It is also called co-efficient of determination.

What does an R2 value of 0.8 mean?

R-squared or R2 explains the degree to which your input variables explain the variation of your output / predicted variable. So, if R-square is 0.8, it means 80% of the variation in the output variable is explained by the input variables.

How do you calculate r 2?

To calculate R2 you need to find the sum of the residuals squared and the total sum of squares. Start off by finding the residuals, which is the distance from regression line to each data point. Work out the predicted y value by plugging in the corresponding x value into the regression line equation.

What is R vs R2?

R: The correlation between the observed values of the response variable and the predicted values of the response variable made by the model. R2: The proportion of the variance in the response variable that can be explained by the predictor variables in the regression model.

What does an R 2 value of 1 mean?

R-squared is a measure of how well a linear regression model fits the data.A value of r close to 1: indicates a positive linear relationship between the 2 variables (when one increases, the other does)

What does the R2 value tell you about the trendline?

R-squared is a statistical measure of how close the data are to the fitted regression line. It is also known as the coefficient of determination, or the coefficient of multiple determination for multiple regression.100% indicates that the model explains all the variability of the response data around its mean.

What does an R squared value of 0.3 mean?

– if R-squared value < 0.3 this value is generally considered a None or Very weak effect size, – if R-squared value 0.3 < r < 0.5 this value is generally considered a weak or low effect size,- if R-squared value r > 0.7 this value is generally considered strong effect size, Ref: Source: Moore, D. S., Notz, W.

How do I improve my R2 score?

When more variables are added, r-squared values typically increase. They can never decrease when adding a variable; and if the fit is not 100% perfect, then adding a variable that represents random data will increase the r-squared value with probability 1.

What does an R2 value of 0.99 mean?

Practically R-square value 0.90-0.93 or 0.99 both are considered very high and fall under the accepted range. However, in multiple regression, number of sample and predictor might unnecessarily increase the R-square value, thus an adjusted R-square is much valuable.

What does a low R2 value mean?

A low R-squared value indicates that your independent variable is not explaining much in the variation of your dependent variable – regardless of the variable significance, this is letting you know that the identified independent variable, even though significant, is not accounting for much of the mean of your

How do you manually calculate r 2?

How to Calculate R-Squared by Hand

- In statistics, R-squared (R2) measures the proportion of the variance in the response variable that can be explained by the predictor variable in a regression model.

- We use the following formula to calculate R-squared:

- R2 = [ (nΣxy – (Σx)(Σy)) / (√nΣx2-(Σx)2 * √nΣy2-(Σy)2) ]2

How do you find r 2 on a TI 84?

TI-84: Correlation Coefficient

- To view the Correlation Coefficient, turn on “DiaGnosticOn” [2nd] “Catalog” (above the ‘0’). Scroll to DiaGnosticOn. [Enter] [Enter] again.

- Now you will be able to see the ‘r’ and ‘r^2’ values. Note: Go to [STAT] “CALC” “8:” [ENTER] to view. Previous Article. Next Article.

How do you find r in stats?

Divide the sum by sx ∗ sy. Divide the result by n – 1, where n is the number of (x, y) pairs. (It’s the same as multiplying by 1 over n – 1.) This gives you the correlation, r.

How do you calculate R2 in Anova table?

- R2 = 1 – SSE / SST. in the usual ANOVA notation.

- R2adj = 1 – MSE / MST. since this emphasizes its natural relationship to the coefficient of determination.

- R-squared = SS(Between Groups)/SS(Total) The Greek symbol “Eta-squared” is sometimes used to denote this quantity.

- R-squared = 1 – SS(Error)/SS(Total)

- Eta-squared =

How do you interpret adjusted R2?

Adjusted R2: Overview

If you add more and more useless variables to a model, adjusted r-squared will decrease. If you add more useful variables, adjusted r-squared will increase. Adjusted R2 will always be less than or equal to R2.

R mean?

To contrast a simple real number with a vector, we refer to the real number as a scalar. Hence, we can refer to f:R2→R as a scalar-valued function of two variables or even just say it is a real-valued function of two variables. Everything works the same for scalar valued functions of three or more variables.

What does an R2 value of 0.5 mean?

Any R2 value less than 1.0 indicates that at least some variability in the data cannot be accounted for by the model (e.g., an R2 of 0.5 indicates that 50% of the variability in the outcome data cannot be explained by the model).

:max_bytes(150000):strip_icc()/excel_for_finance_headshot-5bfc26d546e0fb00265b1279.png)

:max_bytes(150000):strip_icc()/AmyImage-AmyDrury-d6b6143c6d5c49a0add2201e25969457.jpg)