Last Update: Jan 03, 2023

This is a question our experts keep getting from time to time. Now, we have got the complete detailed explanation and answer for everyone, who is interested!

Asked by: Prof. Hattie Crooks II

Score: 5/5

(33 votes)

The first thing I want to toss out is the word and term cash flow itself. … Mostly I´ll stick with cash flow. The two spellings of cash flow are of interest because it´s the tip of the iceberg of confusion and disagreement over what cash flow is and isn´t.

Is cash flow long term or short term?

Now that you have the basics of cash flow, look at your finances on a more granular level: short-term cash flow. This is the amount of money coming in and being spent on a daily, weekly, or monthly basis. It’s the day-to-day finances that keep your business running.

What exactly is cash flow?

Cash flow refers to the net balance of cash moving into and out of a business at a specific point in time. … Positive cash flow indicates that a company has more money moving into it than out of it. Negative cash flow indicates that a company has more money moving out of it than into it.

What is another word for cashflow?

In this page you can discover 12 synonyms, antonyms, idiomatic expressions, and related words for cash flow, like: pecuniary resources, available means, profitability, working capital, capital, stock-in-trade, available funds, available resources, cashflows, cashflow and liquidity.

What is the difference between cash and flow?

Profit is defined as revenue less expenses. It may also be referred to as net income. Cash flow refers to the inflows and outflows of cash for a particular business. Positive cash flow occurs when there’s more money coming in at any given time, while negative cash flow means there’s more money out.

27 related questions found

What is a good cash flow?

A ratio less than 1 indicates short-term cash flow problems; a ratio greater than 1 indicates good financial health, as it indicates cash flow more than sufficient to meet short-term financial obligations.

What is cash flow formula?

Cash flow formula:

Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure. Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital. Cash Flow Forecast = Beginning Cash + Projected Inflows – Projected Outflows = Ending Cash.

What is the opposite of cash flow?

Outbound cash flow is any money a company or individual must pay out when conducting a transaction with another party. Outbound cash flow is the opposite of inbound cash flow, which refers to all payments or money that is received.

What is cash float in accounting?

Cash Float Defined

In general, cash float refers to the difference between the cash balance recorded in your accounting system’s cash account and the amount of cash showing in your company’s bank account balances, according to Lumen Learning.

Why is cash flow so important?

Having a positive cash flow means that more money is coming into the business than going out. It’s just as important as profit when it comes to determining your business’ performance. … Fast growing businesses tend to require more cash to buy stock, hire employees, etc. so it’s vital to keep an eye on cash and cash flow.

What are the 3 types of cash flows?

Transactions must be segregated into the three types of activities presented on the statement of cash flows: operating, investing, and financing.

How do you get cash flow?

10 Ways to Improve Cash Flow

- Lease, Don’t Buy.

- Offer Discounts for Early Payment.

- Conduct Customer Credit Checks.

- Form a Buying Cooperative.

- Improve Your Inventory.

- Send Invoices Out Immediately.

- Use Electronic Payments.

- Pay Suppliers Less.

Can cash flow negative?

It’s entirely possible and not uncommon for a growing company to have a negative cash flow from investing activities. For example, if a growing company decides to invest in long-term fixed assets, it will appear as a decrease in cash within that company’s cash flow from investing activities.

What is short term cash flow?

A short-term cash flow forecast is a forecast of the cash you have, the cash you expect to receive and the cash you expect to pay out of your business over a certain period, typically 13 weeks. Fundamentally, it’s about having good enough information to give you time and money to make the right business decisions.

What goes into operating cash flow?

Operating cash flow includes all cash generated by a company’s main business activities. Investing cash flow includes all purchases of capital assets and investments in other business ventures. Financing cash flow includes all proceeds gained from issuing debt and equity as well as payments made by the company.

Whats the opposite of influx?

Antonyms: effluence, efflux, outflow. the process of flowing out. types: inpour, inpouring, inrush.

Are not welcomed synonym?

In this page you can discover 38 synonyms, antonyms, idiomatic expressions, and related words for unwelcome, like: repellent, unwanted, uninvited, unwished-for, non grata, unacceptable, unsought, unwelcomeness, unpopular, unasked and de trop.

Which is the closest antonym for the word foreign?

- Synonyms for foreign. accidental, adventitious, alien, external, extraneous, extrinsic, …

- Words Related to foreign. exterior, outside. immaterial, inapplicable, insignificant, irrelevant. …

- Near Antonyms for foreign. congenital, deep-seated, inborn, inbred. inside, interior, …

- Antonyms for foreign. inherent, innate, intrinsic.

What is tight cash flow?

First off, what is tight cash flow? Here’s my simple definition: when there’s not enough cash generated by the practice to pay the practice bills, service loan debts, and pay the owner an acceptable income. Here are three primary causes of tight cash flow: 1) Low revenue / low net income.

How is the net cash flow calculated?

What is net cash flow? Net cash flow is a profitability metric that represents the amount of money produced or lost by a business during a given period. Usually, you can calculate net cash flow by working out the difference between your business’s cash inflows and cash outflows.

What is liquidity synonym?

In this page you can discover 14 synonyms, antonyms, idiomatic expressions, and related words for liquidity, like: fluidity, equity, fluidness, runniness, liquid, liquidness, liquid state, foreign exchange, volatility, working capital and cash flow.

What is the main purpose of cash flow?

The purpose of the cash flow statement is to show where an entities cash is being generated (cash inflows), and where its cash is being spent (cash outflows), over a specific period of time (usually quarterly and annually). It is important for analyzing the liquidity and long term solvency of a company.

What is a good free cash flow?

Free Cash Flow Yield determines if the stock price provides good value for the amount of free cash flow being generated. In general, especially when researching dividend stocks, yields above 4% would be acceptable for further research. Yields above 7% would be considered of high rank.

Is cash flow the same as profit?

Cash flow is the money that flows in and out of your business throughout a given period, while profit is whatever remains from your revenue after costs are deducted.

This is an issue that I recently came across when writing up the finances for a report. I was in charge of discounted cash flows so I needed to figure out whether it was «cash flow» or «cashflow». There appeared to be no simple definitive answer so I decided to write one. My conclusion is:

Although both are used cash flow is much more commonly used and so should be used.

Tellingly performing a Google search for «cashflow» gives results that all use «cash flow» with the exception of brand names.

| Results obtained from searching «cashflow». I’m logged into two Google accounts which is why I have to use incognito (before you start accusing me of anything)

Furthermore when I took a look at the annual reports of a few companies such as Drax Plc, Lancashire Holdings Ltd and Standard Chartered Plc they all use cash flow. Hence I would say that if you use cash flow you are in good company. I guess this is a matter of prescriptive (how it should be) vs descriptive grammar (how it is actually understood). If we take a descriptive approach its clear that cash flow is the one that is best used. If you stick with «cash flow» in your reports you should be fine. If you are challenged on it just quote some of the references I’ve given you. |

Cash flow или денежный поток компании относится к разряду важнейших показателей, которое показывает перспективы развития компании. В этой статье мы подробно рассмотрим кэш флоу, поговорим о том, как он рассчитывается и какой бывает.

Кеш флоу (от англ. «Cash flow» — «денежный поток») — это совокупность денежных средств в компании, куда включены все притоки (прибыль) и оттоки (затраты). Составляется по утверждённой форме №4 (код формы по ОКУД 0710004).

Для определения результативности работы компании кэш флоу может дать множество полезных данных для инвесторов. Наиболее часто используется такой простой показатель, как «чистый денежный поток»:

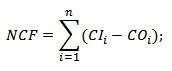

Чистый денежный поток (от англ. «Net Cash Flow», NCF) — это разница между поступлениями и расходами в отдельно взятый период. Это значение может быть как положительным, так и отрицательным.

Формула чистого денежного потока:

NCF = ∑CFi+ — ∑CFj—

Где:

- CFi+ — поступления на счет фирмы;

- CFj— — списания со счета фирмы;

Положительное значение NCF означает, что дела компании идут неплохо: есть свободные деньги, а значит бизнес работает в плюс.

Известный инвестор Уоррен Баффет считает показатель Cash Flow одним из ключевых при оценке акций компании.

- Свободный денежный поток (Free Cash Flow) — что это такое;

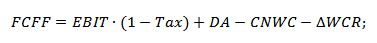

2. Показатель FCFF (Free Cash Flow to the Firm)

Показатель «Free Cash Flow to the Firm» (FCFF) дословно переводится «свободный денежный поток фирмы» — это денежный поток за вычетом налогов и чистых инвестиций в основной и оборотный капитал.

Формула свободного денежного потока фирмы:

FCFF = EBITDA × (1-Tax) + DA — CNWC — CAPEX

Где:

- Tax — ставка налога на прибыль;

- EBITDA — прибыль до уплаты процентов и налога;

- DA — амортизация материальных и нематериальных активов (Depreciation & Amortization);

- CNWC — изменение в чистом оборотном капитале (Change in Net Working Capital);

- CAPEX — капитальные расходы (Capital Expenditure);

Денежный поток можно рассчитывать по следующим видам цен:

- Текущие;

- Прогнозные (учитывают инфляцию и прогноз уровня добычи и других факторов);

- Дефлированные (с учетом инфляции по текущим ценам);

Дисконтирование Cash flow

Поскольку деньги обесцениваются каждый год, то и денежный поток сегодня не такой платёжеспособный как завтра. Чтобы внести поправки в будущую стоимость денег применяют коэффициент дисконтирования кэш флоу:

CF = 1/(1 + DS) × Time

Где:

- DS – дисконтная ставка;

- Time – период времени;

Рекомендую ознакомиться:

- Ставка дисконтирования — формула;

3. Кэш флоу операционной, инвестиционной и финансовой деятельности

Прямой и косвенный отчеты:

- Прямой отчёт содержит информацию о денежном потоке по статьям;

- Косвенный отчёт содержит лишь конечные данные без уточнения;

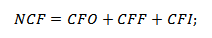

Отчёт о движении денежных средств (Cash Flow Statement) делится на три составляющие:

- Операционная деятельность (operating cash flow, CFO);

- Инвестиционной деятельности (cash flow from investing, CFI);

- Финансовой деятельности (cash flow from financing activities, CFF);

На основании этого можно переписать формула чистого денежного потока в следующем виде:

ЧКФ = ЧКФО + ЧКФИ + ЧКФФ

Где:

- ЧКФО – суммарный поток от операционной деятельности;

- ЧКФИ – суммарный поток от инвестиций;

- ЧКФФ – суммарный поток от финансовых операций;

1 Операционная — это поток прибыли и расходов от ключевого направления фирмы.

Формула для расчета:

[Операционный денежный поток] = [Чистый доход] – [Амортизация] — [Проценты по займам] – [Налог на прибыль]

Что входит в операционные деятельность:

- Получение выручки от продажи товаров и предоставления услуг;

- Оплата счётов;

- Расчёты с бюджетом;

- Выплата заработной платы;

- Получение краткосрочных кредитов и займов;

- Погашение (получение) процентов по кредитам;

- Выплаты налога на прибыль;

Риски операционной деятельности:

- Коммерческий;

- Налоговый;

- Инфляционный;

- Валютный;

- Снижение финансовой устойчивости;

- Неплатежеспособность;

- Показатель OIBDA;

2 Инвестиционная — это деньги, полученные от ценных бумаг, а также затраты на инвестиции.

Что входит в поступления:

- Продажа основных средств, нематериальных активов и прочих внеоборотных активов;

- Продажа акций других компаний;

- Погашение займов;

Что входит в отток:

- Приобретение основных средств, нематериальных активов и прочих внеоборотных активов;

- Покупка акций и долговых инструментов;

- Кредитование;

Риски инвестиционной деятельности:

- Инфляционный;

- Снижения финансовой устойчивости;

- Неплатёжеспособности;

3 Финансовая — это все крупные денежные операции (кредиты, дивиденды, выкуп акций). Можно классифицировать на основе следующих параметров:

- Направленности;

- Масштабам;

- Времени проведении операций;

- Методу определения;

- Уровню достаточности;

В поступление входит прибыль от эмиссии акций или иных выпусков ценных бумаг (облигаций, векселей, закладных, займов).

Риски финансовой деятельности:

- Кредитный;

- Процентный;

- Депозитный;

- Инфляционный;

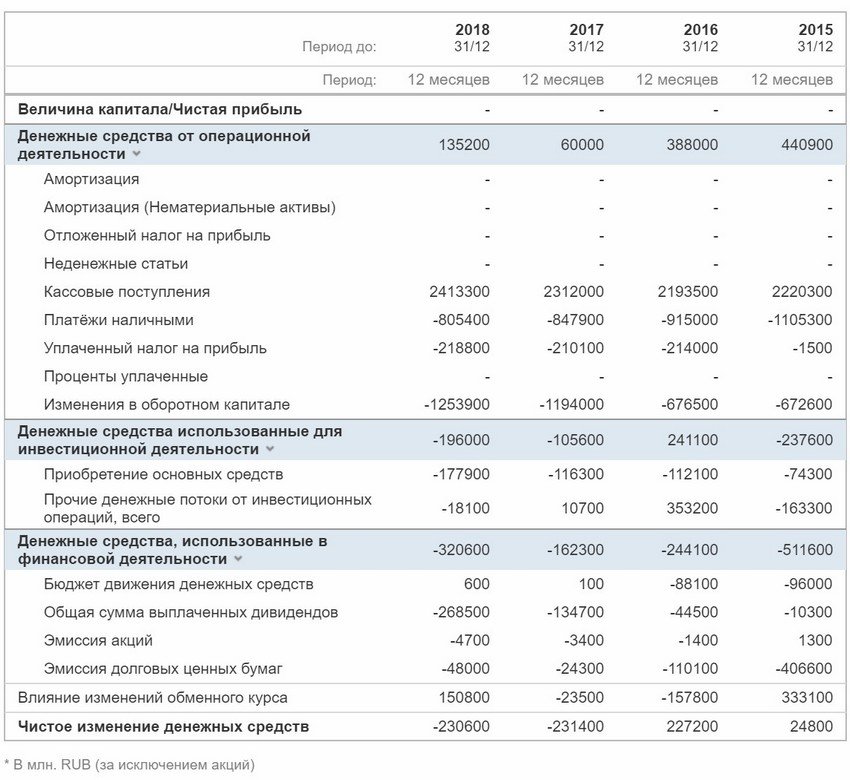

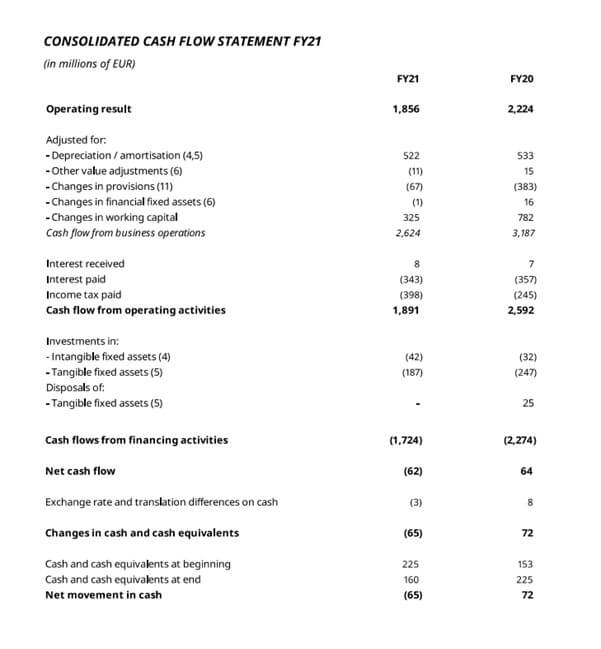

Пример отчёта Cash Flow Сбербанка по годам:

4. Что оказывает влияние на Cash flow

Существует внешние и внутренние факторы, которые оказывают конечное влияние на результаты подсчетов кэш флоу.

Внешние факторы:

- Конъюнктура товарного и фондового рынка;

- Налогообложение;

- Практика кредитования поставщиков и покупателей продукции;

- Осуществления расчётных операций хозяйствующих субъектов;

- Доступность финансового кредита;

- Возможность привлечения средств безвозмездного целевого финансирования;

Внутренние факторы:

- Жизненный цикл;

- Продолжительность операционного цикла;

- Сезонность;

- Инвестиционные программ;

- Амортизация;

- Коэффициент операционного левериджа;

- Корпоративное управление;

5. Недостатки или критика показателя Cash Flow

Cash Flow является очень хорошим показателем для оценки эффективности бизнеса. Но есть и недостатки.

Например, если у компании есть большой чистый положительный денежный поток, то это говорит о том, что она просто не знает как эффективно распорядиться этими деньгами. Раздавать их в качестве дивидендов с одной стороны хорошо для акционеров, но плохо для дальнейшего развития. Ведь эти деньги можно направить на какие-то улучшения. Например, тот же выкуп акций с биржи может повысить курс.

С другой стороны, отрицательное значение также не всегда говорит, что дела идут плохо. Компания могла инвестировать крупные деньги в расширение и модернизацию своей деятельности. В обозримом будущем эти вложения могут принести крупные прибыли. А ведь это и есть главная цель каждого бизнеса.

Поэтому при оценке кэш флоу нужно смотреть и на саму деятельность компании: какие действия предпринимает текущее руководство, какие прогнозы по прибыли и прочие экономические показатели.

Смотрите также видео «Управленческий учет отчет Cash Flow»:

What is Cash Flow?

Cash flow refers to the inflow and outflow of cash and cash equivalents. Cash-flow is generated by business operations, investments, and financing. It determines a business’s cash position and cash availability.

Analyzing a company’s cash-flow provides critical information about its financial health, business activities, and reported earnings. Based on the analysis, future money flows are projected. Consequently, financial analysts plan short-term goals, long-term goals, working capitalWorking capital is the amount available to a company for day-to-day expenses. It’s a measure of a company’s liquidity, efficiency, and financial health, and it’s calculated using a simple formula: «current assets (accounts receivables, cash, inventories of unfinished goods and raw materials) MINUS current liabilities (accounts payable, debt due in one year)»read more, and the optimum cash level required for business operationsBusiness operations refer to all those activities that the employees undertake within an organizational setup daily to produce goods and services for accomplishing the company’s goals like profit generation.read more.

Table of contents

- What is Cash Flow?

- Cash-Flow Explained

- Types of Cash-Flows

- #1 – Cash-Flow from Operations

- #2 – Cash-Flow from Investing

- #3 – Cash-Flow from Financing

- Analysis

- Cash Flow Formula

- Example

- Profit vs. Cash Flow

- Frequently Asked Questions (FAQs)

- Recommended Articles

- Cash flow is an inward and outward movement of cash and cash equivalents during a specific period.

- The net money-flow is computed as:

Net Cash Flow = Total Cash Inflows – Total Cash Outflows, - A cash flow statement summarizes the transactions for a specified period—cash generating activities and activities requiring cash expenditure.

Cash-Flow Explained

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkArticle Link to be Hyperlinked

For eg:

Source: Cash Flow (wallstreetmojo.com)

Cash flow indicates if a business has enough money for its operation. Any transaction that a company does in cash or cash equivalentCash equivalents are highly liquid investments with a maturity period of three months or less that are available with no restrictions to be used for immediate need or use. These are short-term investments that are easy to sell in the public market..read more is penned down in a cash-flow statement to track the status of business funds and keep an account of the closing cash balance at the end of the accounting periodAccounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared. This might be quarterly, semi-annually, or annually, depending on the period for which you want to create the financial statements to be presented to investors so that they can track and compare the company’s overall performance.read more.

Cash comprises currency, coins, petty cashPetty cash means the small amount that is allocated for the purpose of day to day operations. It is unreasonable to issue a check for such small expenses and for managing the same custodians are appointed by the company.read more, checking accountA checking account is a bank account that allows multiple deposits and withdrawals. Additionally, it provides superior liquidity.read more balance, savings account balance, money orders, and bank draftsA bank draft is a financial instrument purchased from a bank remitted later by a second party to withdraw the amount mentioned on the draft from any bank, guaranteeing that the draft holder shall receive the said amount on presenting the draft. It is also called a banker’s cheque.read more. Cash equivalents refer to securities that can be liquidated within three months. It includes short-term government bondsA government bond is an investment vehicle that allows investors to lend money to the government in return for a steady interest income.read more, marketable securitiesMarketable securities are liquid assets that can be converted into cash quickly and are classified as current assets on a company’s balance sheet. Commercial Paper, Treasury notes, and other money market instruments are included in it.read more, treasury billsTreasury Bills (T-Bills) are investment vehicles that allow investors to lend money to the government.read more, commercial papersCommercial Paper is a money market instrument that is used to obtain short-term funding and is often issued by investment-grade banks and corporations in the form of a promissory note.read more, money market fundsA money market fund is a form of short-term debt security or open-ended mutual fund with a shorter maturity, offering good returns at high liquidity and low credit risk. The instruments it invests in include US Treasury bills, bank debt funds, and corporate commercial papers that could be taxable or free from tax.read more, and other short-term investments.

The net cash-flow can either be positive or negative. A positive cash flow reflects that the company has enough money to meet its future expensesAn expense is a cost incurred in completing any transaction by an organization, leading to either revenue generation creation of the asset, change in liability, or raising capital.read more. However, if the money is surplus, then the firm is not utilizing its liquid funds efficiently. On the contrary, a negative money flow represents a company unable to pay off its liabilities.

Certain payments made by a company do not reflect in the profit and loss accountThe Profit & Loss account, also known as the Income statement, is a financial statement that summarizes an organization’s revenue and costs incurred during the financial period and is indicative of the company’s financial performance by showing whether the company made a profit or incurred losses during that period.read more statement, whereas the same is present in the cash flow statementA Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business.read more. For Example, if a company has a loan and is paying off the principal amount back to the bank, this transaction is not shown in the Profit and loss statement. But it will be mentioned in the money flow statement. Sometimes, such companies show profits but do not have funds to pay off loans and obligations. Such situations can be identified using the money flow statement.

Types

A business entityThe business entity concept declares that a business stands independently from its owner, and hence the two should be treated as separate entities when recording transactions. Therefore, all business transactions (income, expenses, assets, liabilities, and equity) must be kept separate from the owner’s account to ensure accurate accounting records.read more accrues profits via the following activities:

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkArticle Link to be Hyperlinked

For eg:

Source: Cash Flow (wallstreetmojo.com)

#1 Money-Flow from Operations

Operating activitiesOperating activities generate the majority of the company’s cash flows since they are directly linked to the company’s core business activities such as sales, distribution, and production.read more include a company’s regular business operations. Inflows are generated by selling goods or rendering services, including the collection of sundry debtors.

However, money outflows stream through various monetary payments like the purchase of inventory, releasing salaries, taxes, and miscellaneous operating expenses (OpEx)Operating expense (OPEX) is the cost incurred in the normal course of business and does not include expenses directly related to product manufacturing or service delivery. Therefore, they are readily available in the income statement and help to determine the net profit.read more. It also includes the purchase and sale of trading securitiesTrading securities are investments in the form of debt or equity that the company’s management wants to actively purchase and sell to make a profit in the short term with securities they believe will increase in price. These securities can be found on the balance sheet at the fair value on the balance sheet date.read more.

#2 Money-Flow from Investing

Investing activities refer to the funds contributed or acquired from purchasing or selling securities or investments. In such a case, money outflow results from the purchase of property, plant, equipment (PPE), and other investment instruments.

Money inflow is generated by selling the possessed securities. Such exchanges exclude securities held for dealing and trading activities.

#3 Money-Flow from Financing

Financing activitiesThe various transactions that involve the movement of funds between the company and its investors, owners, or creditors in order to achieve long-term growth are referred to as financing activities. Such activities can be analyzed in the financial section of the company’s cash flow statement.read more primarily include any receipts and payments related to capital. The inflow from financing refers to the raising of capital from equityEquity refers to investor’s ownership of a company representing the amount they would receive after liquidating assets and paying off the liabilities and debts. It is the difference between the assets and liabilities shown on a company’s balance sheet.read more or long-term debtsDebt is the practice of borrowing a tangible item, primarily money by an individual, business, or government, from another person, financial institution, or state.read more. It involves cash receipts from issuing common stockCommon stocks are the number of shares of a company and are found in the balance sheet. It is calculated by subtracting retained earnings from total equity.read more, preferred stock, bonds, and various short-term and long-term borrowings. Thus, there are two significant sources of finance—shareholders and creditorsA creditor refers to a party involving an individual, institution, or the government that extends credit or lends goods, property, services, or money to another party known as a debtor. The credit made through a legal contract guarantees repayment within a specified period as mutually agreed upon by both parties.

read more.

In contrast, money outflow comprises repayment of borrowings, the redemption of bondsBonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period.read more, treasury stockTreasury Stock is a stock repurchased by the issuance Company from its current shareholders that remains non-retired. Moreover, it is not considered while calculating the Company’s Earnings Per Share or dividends. read more repurchases, and payment of dividendsDividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the company’s equity.read more. However, indirect borrowing from accounts payableAccounts payable is the amount due by a business to its suppliers or vendors for the purchase of products or services. It is categorized as current liabilities on the balance sheet and must be satisfied within an accounting period.read more is classified as money flow from operating activities and not from financing activities.

Analysis

The analysis helps furnish vital information concerning the company’s business earnings and helps predict future money flows. Following are some of the crucial ratios that help check major sources and uses of cash:

- Free Cash–Flow (FCF): It is the excess money left after paying capital expenditureCapex or Capital Expenditure is the expense of the company’s total purchases of assets during a given period determined by adding the net increase in factory, property, equipment, and depreciation expense during a fiscal year.read more. It defines the business efficacy of making money from the capital employedCapital employed indicates the company’s investment in the business, i.e., the total amount of funds used for expansion or acquisition and the entire value of assets engaged in business operations. «Capital Employed = Total Assets — Current Liabilities» or «Capital Employed = Non-Current Assets + Working Capital.»read more.

- Operating Cash–Flow (OCF): It is money generated by a company’s primary business operation. A higher OCF signifies a good liquidity position of the company.

- Comprehensive Free Money-Flow Coverage: A percentage value is calculated by computing a fraction of FCF and net operating money flow and multiplying it by 100. A positive percentage is better in this case as well.

- Current Liability Coverage Ratio: This ratio is computed as the fraction of cash-flow from operations and current liabilitiesCurrent Liabilities are the payables which are likely to settled within twelve months of reporting. They’re usually salaries payable, expense payable, short term loans etc.read more. It determines the company’s ability to pay off its current liabilities with the cash flow from operationsCash flow from Operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating business in an accounting year. Operating Activities includes cash received from Sales, cash expenses paid for direct costs as well as payment is done for funding working capital.read more. Therefore, a ratio below 1:1 is not acceptable.

- Price to Money-Flow Ratio: To determine this ratio, the operating money flow per share is divided by the stock price. It thus ascertains a company’s worth from the shareholder’s perspective.

- Money-Flow Margin Ratio: It is a ratio of money flow from operations and sales. It, therefore, equates to sales generated per dollar.

- Cash Flow to Net Income Ratio: It is the ratio of a firm’s net cash-flow and net incomeNet income for individuals and businesses refers to the amount of money left after subtracting direct and indirect expenses, taxes, and other deductions from their gross income. The income statement typically mentions it as the last line item, reflecting the profits made by an entity.read more. It represents the amount of cash and cash equivalentsCash and Cash Equivalents are assets that are short-term and highly liquid investments that can be readily converted into cash and have a low risk of price fluctuation. Cash and paper money, US Treasury bills, undeposited receipts, and Money Market funds are its examples. They are normally found as a line item on the top of the balance sheet asset. read more consumed for providing a certain net income. A ratio of 1:1 is considered ideal.

Cash-Flow Formula

Net cash flowNet cash flow refers to the difference in cash inflows and outflows, generated or lost over the period, from all business activities combined. In simple terms, it is the net impact of the organization’s cash inflow and cash outflow for a particular period, say monthly, quarterly, annually, as may be required.read more indicates the increase or decrease in the cash and cash equivalents within an accounting period. The formula is as follows:

Or

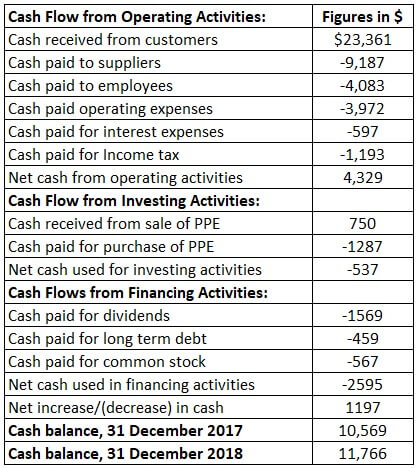

Example

Let us assume that XYZ Ltd. made the following money-flow statement for the year ending December 31, 2018:

Inter Ikea Group

Furniture giant IKEA’s money flow for the financial year 2021 ending on August 31, 2021, is as follows:

Profit vs. Cash-Flow

The business’s profit or net income is the money earned by the company during a specific accounting period—as recorded in the book of accounts. It is the value acquired by deducting all the expenses from the revenueRevenue is the amount of money that a business can earn in its normal course of business by selling its goods and services. In the case of the federal government, it refers to the total amount of income generated from taxes, which remains unfiltered from any deductions.read more. On the contrary, cash-flow is the inward and outward movement of money from the business. It provides the closing cash balance of the firm after deducting all money outflows from money inflows.

Profits give an overview of the business performance in terms of sales; money flowMoney flow (MF) refers to a mathematical function used to analyze changes in the value of a security by multiplying its typical price by daily trading volume.read more represents the efficiency of handling money. These two metrics don’t need to provide similar results. It can be possible for a company with a positive money flow position to have low profitability. Similarly, a company with higher profits can generate a negative money flow.

Moreover, the purposes of these two metrics are significantly different. On the one hand, profits are essential for attaining business goals. Money-flow on the other hand helps smooth operations without capital crunch in the short term—a measure of liquidity.

Frequently Asked Questions (FAQs)

How is cash flow calculated?

The formula used for computing the net money flow of a company is as follows: Net Money–Flow = Total Cash Inflows – Total Cash Outflows,

or,

Net Money–Flow = CFO + CFI + CFF.

What is the purpose of the cash flow statement?

A money flow statement mirrors the company’s efficiency in managing its cash and cash equivalents—pertaining to a particular accounting period. It represents the incoming and outgoing money from the business and the net cash balance at the end of the period.

How to manage money flow?

Following are some of the best cash-flow management practices:

• Prepare a money flow budget;

• Maintain cash reserves;

• Monitor money outflows;

• Reduce expenses.

• Increase sources of money inflows;

• Keep a check over excess inventory; and

• Streamline the process of money flow.

Recommended Articles

This article has been a guide to what is cash flow and its meaning. Here we explain cash flows along with its formula, examples, calculations and its differences from Profit. You can learn more about financing from the following articles –

- Incremental Cash Flow Formula

- Negative Cash Flow

- Cash Flow Per Share Formula

- Overview of Statement of Cash Flow

Понятие денежного потока и его разновидности

Кратко рассмотрим определение денежного потока (cash flow definition). Это перемещение денег по счетам или наличных через кассу в рамках одного проекта или предприятия по разным направлениям.

Процесс, следствием которого становиться увеличение количества денег – это положительный денежный поток (приток, поступление). Процесс обратной направленности – это отток (выплата, расход, затрата).

Из сказанного выше можно сделать вывод, что этот показатель может в итоге иметь как положительное, так и отрицательное значение.

В рамках общей финансовой политики фирмы от руководства требуется мастерство управления денежными потоками (cash flow management) для ее стабильного развития. Cash flow management – это анализ и регулирование финансовых потоков компании с целью оптимизации расходов и максимизации доходов, в частности:

- разработку графиков поступлений и расходов платежных средств в разрезе видов; исследование факторов, влияющих на формирование кэш фло предприятия;

- прогнозирование возможной недостачи денег и источников для ее покрытия;

- определение направлений вложения средств, которые временно высвободились.

Финансисты выделяют у общего денежного потока виды в зависимости от деятельности, которая их производит. В частности, денежный поток проекта состоит из таких потоков:

- от операционной деятельности (operating cash flow, CFO);

- от финансовой деятельности (cash flow from financing activities, CFF);

- от инвестиционной деятельности (cash flow from investing, CFI).

В отдельных начинаниях разделить все перемещения финансов по видам деятельности не удается, в таких случаях их можно объединить все или некоторые из них. Кроме того, кэш фло классифицируется еще по ряду показателей, таких как направленность движения (отрицательный или положительный), уровень достаточности (дефицитный или избыточный), масштаб (по операциям, направлениям деятельности), время (будущий или настоящий) и др.

Разница между поступлениями и выплатами за определенный временной отрезок называется net cash flow (чистый денежный поток, NCF). Данный критерий часто принимается во внимание инвесторами при принятии решения о перспективности вложения в инвестиционный проект. Формула расчета этого показателя выглядит так:

где:

- CO – исходящий (отрицательный) поток;

- CI – входящий (положительный) поток;

- n – количество шагов.

Если принять во внимание виды денежных потоков, то в этом случае формулу можно представить совокупное значение показателей от разных направлений, т.е. суммарное сальдо по разным видам деятельности:

Различают два типа свободных денежных потоков, которые рассчитываются по-разному:

- FCF от активов фирмы (free cash flow to firm). Это передвижение финансов в рамках основной деятельности без учета инвестирования в основной капитал. Фактически, FCFF = FCF, он дает понимание того, сколько финансового ресурса остается у предприятия после капитальных затрат. Критерий чаще используется инвесторами.

- FCF на собственный капитал (free cash flow to equity, FCFE). Это деньги, которые остаются после исключения расходов в части основной деятельности компании, налоговых выплат и банковских процентов. Данный показатель используют для оценки стоимости фирмы акционерами.

FCFF вычисляется по такой формуле:

где:

- EBIT – размер прибыли до отчисления процентов и налогов;

- Tax – налог на прибыль (процентная ставка);

- DA – амортизационные отчисления;

- NCWC – затраты, направленные на обладание новыми активами;

- ∆WCR – расходы капитальные.

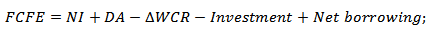

Теперь остановимся на том, как рассчитать FCFE. Здесь актуальна такая формула:

где:

- NI – величина чистой прибыли компании;

- DA – амортизация нематериальных и материальных активов;

- ∆WCR – капитальные расходы;

- Net borrowing – показатель разницы между кредитами взятыми и уже погашенными;

- Investment – сумма инвестиций.

Если показатель FCF на конец шага выше нуля, то это, в общем, свидетельствует о финансовой привлекательности фирмы и повышении ценности ее акций. Отрицательное значение рассчитанного критерия может быть следствием убыточности предприятия или значительных вложений в его развитие.

Как производится расчет

Открыть денежный поток и рассчитывать его можно в различных ценах:

- текущие (базовые), сложившиеся на рынке на настоящий момент, не принимающие во внимание уровень инфляции;

- прогнозные, которые ожидаются в будущем и учитывают темпы инфляции, исчисляются путем умножения базовой цены на индекс инфляции;

- дефлированные (расчетные), это прогнозные цены, приведенные к текущему моменту времени способом деления их на индекс инфляции базисный.

Кеш фло может исчисляться в различных валютах. Правила рекомендуют рассчитывать перемещения средств в тех валютах, в каких проводятся платежи, после чего приводить их все к итоговой единой валюте. В российских статистических отчетах итоговой валютой считается российский рубль, однако если есть потребность, то отдельные расчеты могут быть отражены в итоговой дополнительной валюте.

Потоки денежных средств рассчитывают двумя основными методами – прямым и косвенным.

Прямой метод связан непосредственно с составными частями бухгалтерского учета, такими как журналы-ордера, главная книга, аналитический учет, что более близко российским специалистам. Этим методом удобно рассчитывать контрольные показатели за расходованием и поступлением денег. Здесь приток – это преобладание поступлений над расходами, а отток – превышение выплат над доходами. Исходный элемент – выручка с оборота.

Данные для этой методики берут из Баланса предприятия (форма №1), а также из Отчета о движении денежных средств (форма №4), который анализируют «сверху вниз». В частности, NPV от деятельности финансовой вычисляются исключительно этим методом. Такой анализ дает возможность приблизительно объяснить несовпадение между величиной кеш фло фирмы за отчетный период и полученной за то же время прибылью. В то же время, он не способен раскрыть взаимосвязь между величинами изменения денег и финансовым результатом.

Денежный поток пример расчета прямым методом:

| Наименование показателя | Период 1 | Период 2 | Период 3 | Период 4 |

|---|---|---|---|---|

| 1. Остатки по состоянию на начало рассматриваемого периода | ||||

| 2. Поступления, в т.ч.: | ||||

| авансы и выручка от реализации товара; | ||||

| проценты, дивиденды и иные притоки; | ||||

| займы и кредиты | ||||

| 3. Выплаты, в т.ч.: | ||||

| оплата услуг, работ, товаров, выданные авансы; | ||||

| бюджетные платежи (перечисления налогов и взносов в обязательные фонды); | ||||

| оплата труда персонала; | ||||

| финансовые инвестиции; | ||||

| расходы на основные фонды; | ||||

| погашение взятых кредитов | ||||

| 4. Поток денег (поступление — выплаты) | ||||

| 5. Остатки на окончание периода |

Косвенный метод более подходит для аналитики, он основан на последовательной корректировке зарегистрированной прибыли путем вычитания расходов и прибавления доходов, не относящихся к кеш фло. Этот способ дает понимание взаимосвязи между оборотными средствами и финансовым результатом. В данном случае форма №4 бухгалтерского баланса раскрывается «снизу вверх». К упомянутым корректировкам относятся:

- статьи баланса, носящие не денежный характер (убытки и прибыли предыдущих периодов, амортизационные отчисления, курсовые разницы);

- изменение величины запасов, дебиторской задолженности, краткосрочные финансовые обязательства и вложения (кроме займов и кредитов);

- иные статьи, которые можно причислить к финансовой или инвестиционной деятельности.

Пример расчета потока денежных средств косвенным методом:

| Перемещение денег | Период 1 | Период 2 | Период 3 | Период 4 |

|---|---|---|---|---|

| Деятельность операционная | ||||

| Прирост: | ||||

| прибыль чистая; | ||||

| рост задолженности кредиторской; | ||||

| амортизация | ||||

| Уменьшение: | ||||

| рост затрат и запасов; | ||||

| рост задолженности дебиторской | ||||

| Кэш фло от деятельности операционной | ||||

| Деятельность инвестиционная: | ||||

| реализация средств основных; | ||||

| приобретение средств основных | ||||

| Кэш фло от деятельности инвестиционной | ||||

| Деятельность финансовая: | ||||

| выплата дивидендов; | ||||

| динамика кредитов и займов; | ||||

| динамика векселей | ||||

| Кэш фло от деятельности финансовой | ||||

| Итого поток денежный | ||||

| Финансы на начальную дату периода | ||||

| Финансы на конечную дату периода |

Точность прогноза относительно будущего движения средств зависит, в первую очередь, от точности и корректности расчетов таких показателей:

- объемы затрат капитальных на начальном этапе и в течение цикла жизни проекта;

- расходы на производство и продажу продукции, предусмотренной к выпуску, а также прогноз ожидаемых объемов продаж;

- пошаговая необходимость в сторонних финансах.

Качественное прогнозирование cash flow дает возможность потенциальным инвесторам с высокой долей вероятности предвидеть потенциал и ожидаемую прибыльность рассматриваемой инициативы.

What Is Cash Flow?

The term cash flow refers to the net amount of cash and cash equivalents being transferred in and out of a company. Cash received represents inflows, while money spent represents outflows.

A company’s ability to create value for shareholders is fundamentally determined by its ability to generate positive cash flows or, more specifically, to maximize long-term free cash flow (FCF). FCF is the cash generated by a company from its normal business operations after subtracting any money spent on capital expenditures (CapEx).

Key Takeaways

- Cash flow is the movement of money in and out of a company.

- Cash received signifies inflows, and cash spent signifies outflows.

- The cash flow statement is a financial statement that reports on a company’s sources and usage of cash over some time.

- A company’s cash flow is typically categorized as cash flows from operations, investing, and financing.

- There are several methods used to analyze a company’s cash flow, including the debt service coverage ratio, free cash flow, and unlevered cash flow.

Understanding Cash Flow

Understanding Cash Flow

Cash flow is the amount of cash that comes in and goes out of a company. Businesses take in money from sales as revenues and spend money on expenses. They may also receive income from interest, investments, royalties, and licensing agreements and sell products on credit, expecting to actually receive the cash owed at a late date.

Assessing the amounts, timing, and uncertainty of cash flows, along with where they originate and where they go, is one of the most important objectives of financial reporting. It is essential for assessing a company’s liquidity, flexibility, and overall financial performance.

Positive cash flow indicates that a company’s liquid assets are increasing, enabling it to cover obligations, reinvest in its business, return money to shareholders, pay expenses, and provide a buffer against future financial challenges. Companies with strong financial flexibility can take advantage of profitable investments. They also fare better in downturns, by avoiding the costs of financial distress.

Cash flows can be analyzed using the cash flow statement, a standard financial statement that reports on a company’s sources and usage of cash over a specified time period. Corporate management, analysts, and investors are able to use it to determine how well a company can earn cash to pay its debts and manage its operating expenses. The cash flow statement is one of the most important financial statements issued by a company, along with the balance sheet and income statement.

Cash flow can be negative when outflows are higher than a company’s inflows.

Special Considerations

As noted above, there are three critical parts of a company’s financial statements:

- The balance sheet, which gives a one-time snapshot of a company’s assets and liabilities

- The income statement, which indicates the business’s profitability during a certain period

- The cash flow statement, which acts as a corporate checkbook that reconciles the other two statements. It records the company’s cash transactions (the inflows and outflows) during the given period. It shows whether all of the revenues booked on the income statement have been collected.

But the cash flow does not necessarily show all the company’s expenses. That’s because not all expenses the company accrues are paid right away. Although the company may incur liabilities, any payments toward these liabilities are not recorded as a cash outflow until the transaction occurs.

The first item to note on the cash flow statement is the bottom line item. This is likely to be recorded as the net increase/decrease in cash and cash equivalents (CCE). The bottom line reports the overall change in the company’s cash and its equivalents (the assets that can be immediately converted into cash) over the last period.

If you check under current assets on the balance sheet, that’s where you’ll find CCE. If you take the difference between the current CCE and that of the previous year or the previous quarter, you should have the same number as the number at the bottom of the statement of cash flows.

Types of Cash Flow

Cash Flows From Operations (CFO)

Cash flow from operations (CFO), or operating cash flow, describes money flows involved directly with the production and sale of goods from ordinary operations. CFO indicates whether or not a company has enough funds coming in to pay its bills or operating expenses. In other words, there must be more operating cash inflows than cash outflows for a company to be financially viable in the long term.

Operating cash flow is calculated by taking cash received from sales and subtracting operating expenses that were paid in cash for the period. Operating cash flow is recorded on a company’s cash flow statement, which is reported both on a quarterly and annual basis. Operating cash flow indicates whether a company can generate enough cash flow to maintain and expand operations, but it can also indicate when a company may need external financing for capital expansion.

Note that CFO is useful in segregating sales from cash received. If, for example, a company generated a large sale from a client, it would boost revenue and earnings. However, the additional revenue doesn’t necessarily improve cash flow if there is difficulty collecting the payment from the customer.

Cash Flows From Investing (CFI)

Cash flow from investing (CFI) or investing cash flow reports how much cash has been generated or spent from various investment-related activities in a specific period. Investing activities include purchases of speculative assets, investments in securities, or the sale of securities or assets.

Negative cash flow from investing activities might be due to significant amounts of cash being invested in the long-term health of the company, such as research and development (R&D), and is not always a warning sign.

Cash Flows From Financing (CFF)

Cash flows from financing (CFF), or financing cash flow, shows the net flows of cash that are used to fund the company and its capital. Financing activities include transactions involving issuing debt, equity, and paying dividends. Cash flow from financing activities provide investors with insight into a company’s financial strength and how well a company’s capital structure is managed.

Cash Flow vs. Profit

Contrary to what you may think, cash flow isn’t the same as profit. It isn’t uncommon to have these two terms confused because they seem very similar. Remember that cash flow is the money that goes in and out of a business.

Profit, on the other hand, is specifically used to measure a company’s financial success or how much money it makes overall. This is the amount of money that is left after a company pays off all its obligations. Profit is whatever is left after subtracting a company’s expenses from its revenues.

How to Analyze Cash Flows

Using the cash flow statement in conjunction with other financial statements can help analysts and investors arrive at various metrics and ratios used to make informed decisions and recommendations.

Free Cash Flow (FCF)

Analysts look at free cash flow (FCF) to understand the true cash generation capability of a business. FCF is a really useful measure of financial performance and tells a better story than net income because it shows what money the company has left over to expand the business or return to shareholders, after paying dividends, buying back stock, or paying off debt.

Free Cash Flow = Operating Cash Flow — CapitalEx

Unlevered Free Cash Flow (UFCF)

Use unlevered free cash flow (UFCF) for a measure of the gross FCF generated by a firm. This is a company’s cash flow excluding interest payments, and it shows how much cash is available to the firm before taking financial obligations into account. The difference between levered and unlevered FCF shows if the business is overextended or operating with a healthy amount of debt.

Example of Cash Flow

Below is a reproduction of Walmart’s cash flow statement for the fiscal year ending on Jan. 31, 2019. All amounts are in millions of U.S. dollars.

| Walmart Statement of Cash Flows (2019) | |

|---|---|

| Cash flows from operating activities: | |

| Consolidated net income | 7,179 |

| (Income) loss from discontinued operations, net of income taxes | — |

| Income from continuing operations | 7,179 |

| Adjustments to reconcile consolidated net income to net cash provided by operating activities: | |

| Unrealized (gains) and losses | 3,516 |

| (Gains) and losses for disposal of business operations | 4,850 |

| Depreciation and amortization | 10,678 |

| Deferred income taxes | (499) |

| Other operating activities | 1,734 |

| Changes in certain assets and liabilities: | |

| Receivables, net | (368) |

| Inventories | (1,311) |

| Accounts payable | 1,831 |

| Accrued liabilities | 183 |

| Accrued income taxes | (40) |

| Net cash provided by operating activities | 27,753 |

| Cash flows from investing activities: | |

| Payments for property and equipment | (10,344) |

| Proceeds from the disposal of property and equipment | 519 |

| Proceeds from the disposal of certain operations | 876 |

| Payments for business acquisitions, net of cash acquired | (14,656) |

| Other investing activities | (431) |

| Net cash used in investing activities | (24,036) |

| Cash flows from financing activities: | |

| Net change in short-term borrowings | (53) |

| Proceeds from issuance of long-term debt | 15,872 |

| Payments of long-term debt | (3,784) |

| Dividends paid | (6,102) |

| Purchase of company stock | (7,410) |

| Dividends paid to noncontrolling interest | (431) |

| Other financing activities | (629) |

| Net cash used in financing activities | (2,537) |

| Effect of exchange rates on cash and cash equivalents | (438) |

| Net increase (decrease) in cash and cash equivalents | 742 |

| Cash and cash equivalents at beginning of year | 7,014 |

| Cash and cash equivalents at end of year | 7,756 |

The final line in the cash flow statement, «cash and cash equivalents at end of year,» is the same as «cash and cash equivalents,» the first line under current assets in the balance sheet. The first number in the cash flow statement, «consolidated net income,» is the same as the bottom line, «income from continuing operations» on the income statement.

Because the cash flow statement only counts liquid assets in the form of CCE, it makes adjustments to operating income in order to arrive at the net change in cash. Depreciation and amortization expense appear on the income statement in order to give a realistic picture of the decreasing value of assets over their useful life. Operating cash flows, however, only consider transactions that impact cash, so these adjustments are reversed.

The net change in assets not in cash, such as AR and inventories, are also eliminated from operating income. For example, $368 million in net receivables are deducted from operating income. From that, we can infer that there was a $368 million increase in receivables over the prior year.

This increase would have shown up in operating income as additional revenue, but the cash wasn’t received yet by year-end. Thus, the increase in receivables needed to be reversed out to show the net cash impact of sales during the year. The same elimination occurs for current liabilities in order to arrive at the cash flow from operating activities figure.

Investments in property, plant, and equipment (PP&E) and acquisitions of other businesses are accounted for in the cash flow from the investing activities section. Proceeds from issuing long-term debt, debt repayments, and dividends paid out are accounted for in the cash flow from financing activities section.

The main takeaway is that Walmart’s cash flow was positive (an increase of $742 million). That indicates that it has retained cash in the business and added to its reserves in order to handle short-term liabilities and fluctuations in the future.

How Are Cash Flows Different Than Revenues?

Revenues refer to the income earned from selling goods and services. If an item is sold on credit or via a subscription payment plan, money may not yet be received from those sales and are booked as accounts receivable. But these do not represent actual cash flows into the company at the time. Cash flows also track outflows as well as inflows and categorize them with regard to the source or use.

What Are the 3 Categories of Cash Flows?

The three types of cash flows are operating cash flows, cash flows from investments, and cash flows from financing.

Operating cash flows are generated from the normal operations of a business, including money taken in from sales and money spent on cost of goods sold (COGS), along with other operational expenses such as overhead and salaries.

Cash flows from investments include money spent on purchasing securities to be held as investments such as stocks or bonds in other companies or in Treasuries. Inflows are generated by interest and dividends paid on these holdings.

Cash flows from financing are the costs of raising capital, such as shares or bonds that a company issues or any loans it takes out.

What Is Free Cash Flow and Why Is It Important?

Free cash flow is the cash left over after a company pays for its operating expenses and CapEx. It is the money that remains after paying for items like payroll, rent, and taxes. Companies are free to use FCF as they please.

Knowing how to calculate FCF and analyze it helps a company with its cash management and will provide investors with insight into a company’s financials, helping them make better investment decisions.

FCF is an important measurement since it shows how efficient a company is at generating cash.

Do Companies Need to Report a Cash Flow Statement?

The cash flow statement complements the balance sheet and income statement and is a mandatory part of a public company’s financial reporting requirements since 1987.

Why Is the Price-to-Cash Flows Ratio Used?

The price-to-cash flow (P/CF) ratio is a stock multiple that measures the value of a stock’s price relative to its operating cash flow per share. This ratio uses operating cash flow, which adds back non-cash expenses such as depreciation and amortization to net income.

P/CF is especially useful for valuing stocks that have positive cash flow but are not profitable because of large non-cash charges.

The Bottom Line

Cash flow refers to money that goes in and out. Having a positive cash flow means there’s more money coming in while a negative cash flow indicates a higher degree of spending. The latter isn’t necessarily a bad thing because it may mean that you’re investing your money in growth. But if your spending becomes excessive, you won’t have enough for a rainy day and you won’t be able to pay your suppliers or lenders. Whether you’re running a business or a household, it’s important to keep on top of your cash flow.

Как использовать значения Cash Flow при покупке акций и почему потоки денежных средств могут рассказать больше о компании, чем многие другие показатели.

В число главных индикаторов эффективности бизнес-процессов компании входит показатель Cash Flow (денежный поток). Анализ движения денежных запасов компании отвечает на главные вопросы бизнеса и позволяет сказать:

- Откуда пришли денежные средства на счет компании;

- Какие суммы проходят через счет;

- Куда уходят деньги.

Когда у инвестора Билла Картрайта спросили, как он умудрился просчитать падение акций Fastly Inc. за неделю до краха и сбросить акции, американец ответил просто: «Я изучил их отчет Cash Flow». Умение правильно интерпретировать финансовые показатели спасли инвестору $287 000. Это весомый аргумент для частных инвесторов, чтобы изучить и понять, что такое денежный поток (Cash Flow).

При видимой простоте, оценить денежный поток без специальных знаний сложно. Определимся с понятием и узнаем точно, что такое Cash Flow.

Что такое Cash Flow (простыми словами)

Cash Flow (денежный поток) — это совокупность распределенных во времени притока (поступлений) и оттока (выплат) денежных средств, генерируемых хозяйственной деятельностью компании, независимо от их источников.

Денежный поток простыми словами — это показатель, который описывает реальное движение денег в компании, как наличных, так и размещаемых на счетах. Он показывает, откуда приходят средства, куда уходят, сколько остается. Расчет Cash Flow выполняют как для предприятия в целом, так и для отдельного департамента этого предприятия, сегмента бизнеса, инвестиционного проекта или даже отдельного продукта.

Фундаментальный анализ доказал, что оборот средств оказывает прямое воздействие на эффективность повседневной работы компании. Если оборот находится в пределах нормы, то компания своевременно выполняет обязательства. В противном случае владельцам компании придется заняться поиском выхода из финансового тупика.

Важнейшие показатели, входящие в состав финансового потока:

- инвестиционные расходы;

- налоговые выплаты;

- платежи по кредитам;

- и другие, не относящиеся к категории прибыли показатели.

Частному инвестору следует четко понимать, по каким признакам классифицируется движение финансовых активов компании.

Что принимают в расчет финансовых потоков

Финансовые эксперты изучают следующие показатели денежного потока:

- Переход финансов по операционным категориям деятельности компании. Принимают к учету отчисления средств за товары и услуги, приобретаемые для собственных нужд. К этой категории относят налоговые платежи, оплата трудовых соглашений сотрудников. В доходную часть принимают прямую выручку от продажи товаров и услуг. Дополнительный доход считают от перерасчетов, совершаемых налоговым органом.

- Инвестиционные потоки. К ним относят вложения компании и получаемые доходы в части дивидендов, разницы между покупкой и продажей ценных бумаг, купонный доход от облигаций и другие варианты.

- Кредитные потоки. Учитываются привлеченные заемные средства, выплаты основного долга, процентов.

- Направленность потока (положительный или отрицательный);

- Объем (валовый, чистый);

- Профицитный или дефицитный Cash Flow;

- Непрерывность формирования (регулярный или дискретный).

Помимо вышеперечисленных показателей, экономисты советуют различать денежный поток по стабильности временной оценки:

- Аннуитетный (равномерное поступление финансовых потоков);

- Неравномерный (специальный график поступления средств).

Как применять Cash Flow в решении покупки акций

У каждой индустрии есть свои тонкости, оказывающие влияние на изменение показателей. Например, для Boeing (NYSE: BA) показатель валового объема денежного потока не оказывает ключевого влияния на стоимость активов, в отличие от Tesla Inc (NASDAQ: TSLA).

Важнейшая задача частного инвестора состоит в том, чтобы своевременно выявить состояние бюджета компании. Испытывает ли он нехватку средств или полностью самодостаточен.

Для оценки компании при принятии решения о покупке ее акций обычно используются чистый и свободный денежный поток.

Чистый денежный поток

Чистый денежный поток (Net Cash Flow, NCF) представляет собой сумму всех притоков и оттоков средств от операционной, инвестиционной и финансовой деятельности предприятия за определенный период. Инвесторы используют NCF, чтобы понять, насколько эффективно компания управляет деньгами и есть ли возможность платить дивиденды. Также показатель необходим для расчета свободного денежного потока.

Расчет NCF не требует сложных вычислений, это всего лишь разница между противоположно направленными денежными потоками.

С помощью NCF можно определить:

- насколько привлекательна компания для инвестора;

- насколько удачны ее собственные инвестиции;

- какова финансовая устойчивость компании;

- может ли компания регулировать свою рыночную стоимость.

Свободный денежный поток

Свободный денежный поток (Free Cash Flow, FCF) — это денежные средства, остающиеся в компании от операционной прибыли после всех ее расходов, за исключением платежей по долгам. Эти средства компания может вывести из бизнеса, распределить между инвесторами в виде дивидендов, использовать для выплаты кредитов или даже для поглощения компании-конкурента.

Free Cash Flow часто информативнее данных о прибылях компании, так как он показывает, каким количеством наличных она располагает. Например, если компания в I квартале продала товар на 100 миллионов долларов, но покупатель заплатил в I квартале 50 млн., а остальные деньги переведет во II квартале, то в отчете о прибыли за I квартал будет указано 100 млн., а реальных средств окажется лишь 50 млн. Если компании срочно понадобится больше этой суммы, ей придется брать кредит, так как собственных средств не хватит, несмотря на запись в отчете о прибылях.

FCF — это не стандартный показатель, его не приводят в стандартных отчетах. Его рассчитывают отдельно и применяют для оценки финансового состояния компании.

В отличие от показателя прибыли, Free Cash Flow показывает инвесторам успешность бизнеса в генерации денежного потока, который может пойти на:

- выплату дивидендов;

- выкуп акций на бирже;

- погашение долгов;

- накопление денежных средств.

Поэтому свободный денежный поток (а точнее, его изменения) непосредственно влияет на цену акций компании.

Чаще всего, положительный FCF указывает на то, что компания больше зарабатывает, чем тратит. Отрицательный FCF — напротив, что компания тратит больше, чем зарабатывает. Поэтому, как правило, чем больше денежные потоки (Cash Flow Value), тем выше стоимость акций.

Cash Flow Statement

Для осуществления подобного анализа необходимо изучить отчет о движении денежных средств и ресурсов (Cash Flow Statement). Индикатор охватывает деятельность компании, в том числе инвестиционную.

Текущее состояние индекса характеризует, как реагирует финансовое состояние компании на осуществляемый вид деятельности. Отчет изучает менеджмент компании для понимания ликвидности компании. Он служит базой для принятия решений по увеличению финансирования той или иной профилирующей деятельности компании. Поскольку отчет относится к категории открытых, он доступен всем инвесторам.

- Опытные финансисты рекомендуют изучить Cash Flow Statement компании за два – три года.

Оценка денежных потоков (Cash Flow Statement) включает в себя отчет о трех типах денежных потоков:

- Отчет по текущей деятельности;

- Отчет по инвестиционной деятельности;

- Отчет по финансовой деятельности.

Денежный поток от текущей (или операционной) деятельности компании (Operating Cash Flow)

Представляет собой самый информативный из трех отчетов. В нем подробно раскрываются расчеты по всем операциям, в результате которых на счетах компании образовывается прибыль (operating Cash Flow).

К этой категории относятся расходы на товары и предоставленные услуги сторонних контрагентов, то есть обеспечивающие текущие потребности компании и ее функционирование. Выплаты кредитов, оплата трудовых контрактов и налоговые поступления. В расчет Cash Flow входящего потока принимается операционная выручка от реализации собственных товаров и услуг.

Денежный поток от инвестиционной деятельности (Investing Cash Flow)

Очень важная часть отчета компании. Инвестиции могут быть источником как прибыли, так и расходов компании, как в текущий период времени, так и в долгосрочной перспективе. Компания вкладывает денежные средства могут на покупку ценных бумаг, на кредитование других компаний, на приобретение основных средств, т. е. в то, что в будущем поможет преумножить капитал компании.

К прибыли от инвестиций относят возвращенные кредиты с процентами, капитал, полученный с продажи прав на использование собственных уникальных технологий или реализации основных средств. Компания также может проводить дополнительную эмиссию акций, тем самым увеличивая объемы акционерного капитала.

Что входит в приток средств от инвестиционной деятельности:

- эмиссия собственных акций;

- продажа акций других компаний;

- продажа основных средств или нематериальных активов;

- погашение кредитов, которые компания выдала другим лицам.

Что входит в отток средств:

- покупка основных средств или нематериальных активов;

- кредитование других компаний;

- покупка акций, облигаций.

Риски инвестиционной деятельности включают:

- инфляционный риск;

- риск снижения финансовой устойчивости;

- риск неплатежеспособности;

Денежный поток от финансовой деятельности (Financing Cash Flow)

Финансовая деятельность компании — это все крупные денежные операции (выкуп акций, выплата дивидендов, кредиты). Классифицируется на основе следующих показателей:

- масштабам деятельности;

- времени проведении операций;

- направленности;

- уровню достаточности;

- методу определения.

В поступление входит прибыль от эмиссии акций или других ценных бумаг (облигаций, векселей, закладных).

Как понимать значения Cash Flow

Денежный поток имеет отношение только к денежным средствам или эквивалентам текущей деятельности компании и никак не показывает ее прибыльность или убыточность.

Когда компания зарабатывает больше, чем тратит, ее денежный поток положителен. Это хорошо: если компании срочно понадобятся деньги, ей не придется брать кредит. К тому же многие компании выплачивают дивиденды из денежного потока.

Примером успешной, постоянно растущей компании с положительным денежным потоком можно считать Berkshire Hathaway Inc.

Большой денежный поток может быть и плохим знаком для инвестора.

Он может указывать на неэффективное использование компанией своих средств. То есть средства, которые компания могла бы использовать для развития бизнеса, выплачиваются в виде дивидендов или лежат на ее счетах. Раздача дивидендов — это хорошо для инвесторов, но плохо для будущего развития компании.

Кстати, это не касается компаний, не растущих в силу природы своего бизнеса, например, предприятия из сектора электроэнергетики.

Интересное по теме:

- Как использовать показатель EPS (Прибыль на акцию) – Примеры и Особенности

- Что такое EBITDA и как применять показатель при оценке компании

- Торговля на Нон-фарм (что это) – Примеры и стратегии

- Рейтинговые агентства и большая тройка – Как работают РА и их особенности

- Фундаментальный анализ (простыми словами) – Примеры, Этапы и Методы

Отрицательный поток указывает на то, что компания тратит больше, чем зарабатывает. При этом отчеты могут демонстрировать прибыльность бизнеса. Как правило, отрицательный денежный поток указывает на неэффективность бизнеса, ведь он не приносит деньги. Такой бизнес банки кредитуют неохотно, поэтому возможны проблемы с финансированием.

С отрицательным денежным потоком компания не сможет платить дивиденды из заработанных средств, поэтому приходится увеличивать долг или брать деньги из накоплений. Примеры компаний с отрицательными денежными потоками, которые отражаются и на проблемах с ценой: Transocean Inc. (RIG), Southwestern Energy Company (SWN), Chesapeake Energy Corp (CHK).

Однако отрицательный поток — тоже не всегда плохо. Если предприятие тратит больше, чем зарабатывает, возможно, она работает над развитием и перестройкой бизнеса.

Тогда CF со временем восстановится, акции вырастут. Например, отрицательный CF компании Virgin Galactic Holdings (SPCE) не мешали ее акциям расти в 2019–2020 гг.

Преимущества отчета о денежных потоках для анализа компании:

- описывает основные источники притока и оттока средств компании;

- определяет реальный запас денежных средств компании, которого не видно по другим формам отчетности;

- позволяет разделить потоки денежных средств по видам деятельности;

- помогает рассчитывать чистые денежные потоки в распоряжении разных групп пользователей;

- представляет бюджет в понятной для неэкономиста форме.

Основные недостатки анализа денежных потоков:

- не дает достаточно информации для оперативного анализа (т. к. отчеты публикуются в конце отчетного периода);

- не дает возможность учитывать будущие поступления.

Заключение

Положительный CF говорит о том, что бизнес больше зарабатывает, чем тратит. Отрицательный CF означает, что компания тратит больше, чем зарабатывает.

Но это не всегда плохо — возможно, компания вкладывает средства в расширение своей деятельности. Эти вложения в обозримом будущем способны принести большие доходы. А ведь это и есть основная цель для любого бизнеса.

Денежный поток — очень эффективный показатель при анализе компании с точки зрения возможности инвестиций. Он широко применяется в фундаментальном анализе как в краткосрочном трейдинге, так и при покупке акций на долгосрочную перспективу.

Однако при оценке денежных потоков необходимо анализировать и саму деятельность компании: каковы прогнозы по прибыли на будущий год, какие действия предпринимаются текущим руководством и пр.

Загрузка…

Автор: Станислав Горов

Автор статей, трейдер и инвестор. «Трейдинг для меня — это источник вдохновения и приятное времяпровождение. Здесь более 20000 активов, но даже любой один из них может открыть большие горизонты деятельности, знаний и возможностей.»

From Wikipedia, the free encyclopedia

A cash flow is a real or virtual movement of money:

- a cash flow in its narrow sense is a payment (in a currency), especially from one central bank account to another; the term ‘cash flow’ is mostly used to describe payments that are expected to happen in the future, are thus uncertain and therefore need to be forecast with cash flows;

- a cash flow is determined by its time t, nominal amount N, currency CCY and account A; symbolically CF = CF(t,N,CCY,A).

- it is however popular to use cash flow in a less specified sense describing (symbolic) payments into or out of a business, project, or financial product.

Cash flows are narrowly interconnected with the concepts of value, interest rate and liquidity.

A cash flow that shall happen on a future day tN can be transformed into a cash flow of the same value in t0. This transformation process is known as discounting, and it takes into account the time value of money by adjusting the nominal amount of the cash flow based on the prevailing interest rates at the time.

Cash flow analysis[edit]

Cash flows are often transformed into measures that give information e.g. on a company’s value and situation:

- to determine a project’s rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

- to determine problems with a business’s liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

- as an alternative measure of a business’s profits when it is believed that accrual accounting concepts do not represent economic realities. For instance, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

- cash flow can be used to evaluate the ‘quality’ of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

- to evaluate the risks within a financial product, e.g., matching cash requirements, evaluating default risk, re-investment requirements, etc.

Cash flow notion is based loosely on cash flow statement accounting standards. The term is flexible and can refer to time intervals spanning over past-future. It can refer to the total of all flows involved or a subset of those flows.

Within cash flow analysis, 3 types of cash flow are present and used for the cash flow statement:

- [Operating cash flow] — a measure of the cash generated by a company’s regular business operations. Operating cash flow indicates whether a company can produce sufficient cash flow to cover current expenses and pay debts.

- Cash flow from investing activities — the amount of cash generated from investing activities such as purchasing physical assets, investments in securities, or the sale of securities or assets.

- Cash flow from financing activities (CFF) — the net flows of cash that are used to fund the company. This includes transactions involving dividends, equity, and debt.

Business’ financials[edit]

The (total) net cash flow of a company over a period (typically a quarter, half year, or a full year) is equal to the change in cash balance over this period: positive if the cash balance increases (more cash becomes available), negative if the cash balance decreases. The total net cash flow for a project is the sum of cash flows that are classified in three areas:

- Operational cash flows: cash received or expended as a result of the company’s internal business activities. Operating cash flow of a project is determined by:

- OCF = incremental earnings+depreciation=(earning before interest and tax−tax)+depreciation

- OCF = earning before interest and tax*(1−tax rate)+ depreciation

- OCF = (revenue − cost of good sold − operating expense − depreciation)* (1−tax rate)+depreciation

- OCF = (Revenue − cost of good sold − operating expense)* (1−tax rate)+ depreciation* (tax rate)

Depreciation*(tax rate) which locates at the end of the formula is called depreciation shield through which we can see that there is a negative relation between depreciation and cash flow.

- Changing in net working capital: it is the cost or revenue related to the company’s short-term asset like inventory.

- Capital spending: this is the cost or gain related to the company’s fix asset such as the cash used to buy a new equipment or the cash which is gained from selling an old equipment.

The sum of the three component above will be the cash flow for a project.

And the cash flow for a company also include three parts:

- Operating cash flow: refers to the cash received or loss because of the internal activities of a company such as the cash received from sales revenue or the cash paid to the workers.

- Investment cash flow: refers to the cash flow which related to the company’s fixed assets such as equipment building and so on such as the cash used to buy a new equipment or a building