Excel Form 10E-Salary Arrears Relief calculator AY 2022-23 version 7.22 (FY 2021-22) for claiming rebate under section 89(1) of Income Tax Act 1961-Download

वित्तीय वर्ष 2022-23 (आय गणना वर्ष 2023-24) के लिए नई तथा पुरानी कर व्यवस्था के साथ तुलनात्मक रूप से आयकर गणना प्रपत्र तैयार करें, बस कुछ ही एंट्री के साथ।

🌟 एकदम नया और सबसे हटकर ऐसा एक्सेल प्रोग्राम जिसमें आप चंद एंट्री के साथ बहुत कम मेहनत के साथ आप आयकर गणना रिपोर्ट तैयार कर सकते हैं।

🌟 कंप्यूटर 🖥️ तथा स्मार्ट फोन📱 दोनों में कार्य करें।

🌟 आयकर गणना प्रपत्र के अलावा आप इसमें आपका Form No.16 भी तैयार देखें एवं प्रिंट लें।

🌟 गत वर्षों के बकाया वेतन के एरियर से यदि I-Tax कटौती की गई है तो Form 10E {U/s 89(1)} तैयार कर आयकर गणना में छूट दिखाएं।

🌟 वेतन आहरण अधिकारी द्वारा मांगी जाने वाली गृह किराया रिसिप्ट तैयार मिलेगी जिसका प्रिंट प्राप्त करें।

🌟🌟 किसी कार्मिक के लिए संबंधित बिना किसी त्रुटी के साथ रिपोर्ट तैयार करने हेतु दिए गए लिंक से फ्रेश शीट ही डाउनलोड करें।

✨डीडीओ द्वारा अपने अधीनस्थ समस्त कार्मिकों से प्राप्त आयकर गणना की करें जांच।

✨जांच के साथ-साथ एक ही शीट में उनसे संबंधित कुछ एंट्रीज करके आगामी शेष वेतन में की जाने वाली अपेक्षित आयकर कटौती का निर्धारण कर, तैयार करें समेकित ब्यौरा।

✨नियमानुसार देय HRA में दी जा सकने वाली छूट की भी करें गणना।

✨तैयार करें HRA रिसिप्ट।

आयकर गणना प्रपत्र : वित्तीय वर्ष 2022-23 सामान्य एवं वरिष्ठ नागरिक हेतु (MS Excel) Date : 11-11-2022

आयकर गणना प्रपत्र : वित्तीय वर्ष 2022-23 सामान्य एवं वरिष्ठ नागरिक हेतु (MS Excel) Date : 11-11-2022

Incometax Calculator 2022-23

House Rent Allowance का उठा रहे हैं लाभ तो इन 3 गलतियों से बचें, नहीं तो भारी-भरकम Tax भरना होगा।

सेक्शन 80सी के अलावा इन 5 सेक्शन में बचाएं कम से कम 5 लाख पर टैक्स

आयकर गणना प्रपत्र FY 2022-2023

DOWNLOAD – INCOME TAX CALCULATOR FY 2022-23 EXCEL

Parmanand Meghwal |

Download |

Ummed Tarad |

Download |

Heera Lal Jat |

Download |

Ashwini Kumar Sharma |

Download |

C.P. Kurmi |

Download |

Hans Raj Joshi |

Download |

Vijay Kumar Prajapat |

Download |

Pravesh Kumar Sharma |

Download |

INCOME TAX CALCULATOR 2022-23 EXCEL

Income Tax Calculator for Central Govt. Employee |

DOWNLOAD CLICK HERE

Comparison Of New Tax Regime Vs Old Tax Regime

(नई कर व्यवस्था बनाम पुरानी कर व्यवस्था की तुलना)

एक नई कर व्यवस्था की शुरुआत के साथ, यह भ्रम आता है कि कौन सा आपके लिए उपयुक्त है। करदाता के रूप में, आपको यह पहचानना चुनौतीपूर्ण हो सकता है कि दोनों में से कौन सी व्यवस्था आपकी आय के लिए बेहतर और प्रासंगिक है।

यहां एक और सवाल उठता है कि आपकी आय का स्रोत क्या है? क्या आप एक वेतनभोगी व्यक्ति हैं, अपना व्यवसाय चला रहे हैं या एक उद्यमी या पेशेवर हैं? मौजूदा वर्गों में बदलाव के साथ, आप में से कई लोग पुराने कर बनाम नए कर के बीच अंतर का मूल्यांकन करने की कोशिश कर रहे हैं।

हालांकि सभी करदाताओं के लिए कोई कस्टम-फिट दृष्टिकोण नहीं है, इस लेख के माध्यम से, हम नई कर बनाम पुरानी कर व्यवस्था और आपकी आय संरचना के लिए सबसे उपयुक्त तरीके के बारे में विस्तार से बताते हैं। बजट 2020 के दौरान, सरकार ने करदाताओं को काफी राहत देने और आयकर कानून को कारगर बनाने के लिए एक नई कर व्यवस्था शुरू की। एक अन्य उद्देश्य कर सलाहकारों पर करदाताओं की निर्भरता को दूर करना और स्वतंत्र रूप से अपना रिटर्न दाखिल करना है।

The New Tax Regime –

आइए नई कर व्यवस्था से शुरुआत करें। यह रुपये तक की आय पर कम मौजूदा दरों के साथ छह टैक्स स्लैब प्रदान करता है। 15 लाख। आय स्लैब और विभिन्न कर दरों के कारण, कई छूट और कटौती यहां लागू नहीं होती हैं। नई कर व्यवस्था के अपने फायदे और नुकसान हैं।

गुण: –

वर्तमान कर व्यवस्था अभी भी लागू है, और एक करदाता के रूप में आपके पास अपने लिए सबसे उपयुक्त विकल्प चुनने का विकल्प है, जो या तो पुरानी कर व्यवस्था या नई कर व्यवस्था है। सरकार ने नई कर व्यवस्था पर स्विच करने के लिए बाध्यता लागू नहीं की है।

नई कर व्यवस्था करदाताओं को अपनी पसंद के अनुसार अपना पैसा निवेश करने की सुविधा प्रदान करती है। नई योजना के साथ, कर बचत योजनाओं और बीमा योजनाओं में निवेश करने की कोई अनिवार्य आवश्यकता नहीं है जो उनके वित्तीय लक्ष्यों के अनुरूप नहीं हो सकती हैं।

कई टैक्स स्लैब के साथ, आप करदाता के रूप में टैक्स स्लैब में फिट होंगे जो आपकी वार्षिक आय को सर्वोत्तम रूप से पूरा करता है।

अवगुण: –

धीरे-धीरे, वर्तमान छूटों की समीक्षा की जाएगी और धीरे-धीरे नई कर व्यवस्था से मिटा दी जाएगी।

बिना किसी छूट के, आपकी कुल कर योग्य राशि पुरानी कर व्यवस्था की तुलना में अधिक होगी।

हालांकि छह कर स्लैब हैं, लेकिन यह सभी करदाताओं के लिए फायदेमंद नहीं हो सकता है अगर आयकर अधिकारी पुरानी व्यवस्था को पूरी तरह से खत्म करने का फैसला करते हैं।

The Exemptions & Deductions (छूट और कटौती)- नई कर व्यवस्था के साथ, कई छूट और कटौतियां हटा दी गई हैं। यदि आप वेतनभोगी व्यक्ति या व्यवसाय या पेशेवर की श्रेणी में आते हैं तो नीचे एक विस्तृत सूची दी गई है।

नई प्रणाली में प्रचलित छूटें, जिनका आप दावा कर सकते हैं:-

डाकघर बचत खाते पर धारा 10(15)(i) के तहत प्राप्त ब्याज की अधिकतम राशि रु. 3,500.

नियोक्ता से प्राप्त ग्रेच्युटी अधिकतम रु. 20 लाख।

धारा 10(10डी) के तहत परिपक्वता पर जीवन बीमा पॉलिसी से प्राप्त राशि।

एनपीएस या ईपीएफ में नियोक्ता का योगदान वेतन का 12% तक और ईपीएफ पर ब्याज 9.5% प्रति वर्ष तक।

जीवन बीमा से आय।

कृषि कृषि से आय।

किराए पर मानक कमी।

छंटनी मुआवजा।

सेवानिवृत्ति पर अवकाश नकदीकरण।

वीआरएस पर 5 लाख रुपये तक की आय होती है।

सेवानिवृत्ति सह मृत्यु लाभ।

वीआरएस पर 5 लाख रुपये तक की आय होती है।

सेवानिवृत्ति सह मृत्यु लाभ।

शिक्षा के लिए छात्रवृत्ति के रूप में प्राप्त धन।

पीपीएफ या सुकन्या स्मृति योजना की ब्याज और परिपक्वता राशि।

पेंशन का रूपान्तरण। नई कर व्यवस्था आपको धारा 80CCD(2) (अधिसूचित पेंशन योजना में नियोक्ता का योगदान) और 80JJAA (नए रोजगार के लिए) के तहत कटौती का दावा करने की पेशकश करती है।

Income Tax Calculator 2022-23 Excel

How to Calculate Income Tax on Salary with Example

कई लोगों द्वारा Income Tax को एक आवश्यक बुराई के रूप में देखा जाता है। लगातार बदलते टैक्स कानून और टैक्स छूट, टैक्स सेविंग, टैक्स डिडक्शन, टैक्स रिबेट आदि जैसी शर्तें टैक्स को समझना मुश्किल बना देती हैं। ज्यादातर मामलों में, हमें यह नहीं पता होता है कि हम पर कितने पैसे का कर लगता है और हम कितना पैसा बचा सकते हैं।

इस ब्लॉग में, हम आपको दिखाते हैं कि आप अपने आयकर की गणना कैसे कर सकते हैं और साथ ही सर्वोत्तम कर बचत विकल्प पेश कर सकते हैं – ताकि अगली बार, आप अपना गणित स्वयं कर सकें और जितना संभव हो उतना कर बचाने के लिए पर्याप्त उपाय कर सकें।

जारी रखने से पहले, आइए पहले समझते हैं कि आयकर का अर्थ क्या है और आयकर की गणना के लिए घटक क्या हैं।

What is Income Tax?

आयकर अधिनियम, 1961 के अनुसार, एक आयकर केंद्र सरकार द्वारा व्यक्तियों और/या संगठनों (करदाताओं) पर उनकी आय या लाभ (आमतौर पर कर योग्य आय के रूप में जाना जाता है) के संबंध में लगाया गया कर है।

आम तौर पर, आयकर की गणना कर योग्य आय की राशि से गुणा की गई कर की दर के उत्पाद के रूप में की जाती है। कराधान की दरें करदाता के प्रकार या विशेषताओं और आय के प्रकार से भिन्न हो सकती हैं।

आयकर अधिनियम 1961 के अनुसार, किसी की आय को 5 श्रेणियों में बांटा गया है:-

वेतन से आय

गृह संपत्ति से आय

व्यापार लाभ से आय

निवेश/पूंजीगत संपत्ति से आय

अन्य स्रोतों से आय

Components for Calculating Income Tax

आयकर की गणना करते समय कुछ प्रमुख घटकों को याद रखना चाहिए। यहां इन प्रमुख घटकों की सूची दी गई है:-

वित्तीय वर्ष (वित्त वर्ष) – जिस वर्ष धन अर्जित किया जाता है उसे वित्तीय वर्ष कहा जाता है। यह इस वर्ष की 1 अप्रैल से अगले वर्ष की 31 मार्च तक की समयावधि है। आपको अपने सभी निवेश प्रमाण तैयार करने होंगे और इस पूरे समय में अपने सभी दस्तावेज एकत्र करने होंगे।

उदाहरण के लिए – वित्त वर्ष 2022-23 1 अप्रैल 2022 से 31 मार्च 2023 के बीच की अवधि है।

आकलन वर्ष (AY) – जिस वर्ष में किसी विशेष वित्तीय वर्ष से आपकी आय का आकलन किया जाएगा, उसे आकलन वर्ष कहा जाता है।

उदाहरण के लिए – वर्ष 2022-23 वर्ष 2023 है जब 1 अप्रैल 2022 से 31 मार्च 2023 तक आपकी आय की गणना की जाएगी।

कर कटौती – वे आपको आयकर अधिनियम के अध्याय VI-A के तहत धारा 80 के अनुसार आपकी कुल कर योग्य आय को कम करने की अनुमति देते हैं।

उदाहरण के लिए – अध्याय VIA की धारा 80C के तहत कर प्रावधानों के अनुसार आप जीवन बीमा पॉलिसियों के लिए भुगतान किए गए प्रीमियम, अध्याय VI के तहत निर्धारित अन्य निवेशों पर ₹ 1,50,000 तक की कर कटौती का दावा कर सकते हैं। यह टैक्स बचाने के सबसे बेहतर तरीकों में से एक है।

Tax Exemption- यह एक निर्दिष्ट राशि है जो कर की गणना से पहले सकल आय से काट ली जाती है। ये छूटें धारा 10 और धारा 54 में मिलती हैं। वे इस प्रकार हैं:

वेतन आय छूट, भत्ते और कटौती

धारा 10 के खंड (5) में निहित अवकाश यात्रा रियायत;

धारा 10 के खंड (13ए) में निहित मकान किराया भत्ता;

धारा 10 के खंड (14) में निहित कुछ भत्ते;

मानक कटौती, मनोरंजन भत्ता और धारा 16 में निहित रोजगार/पेशेवर कर की कटौती;

हाउस संपत्ति कटौती से किराये की आय

धारा 24 के तहत होम लोन पर चुकाया गया ब्याज। घर पर ब्याज पर कटौती स्व-अधिकृत या खाली संपत्ति के संबंध में लागू होती है।

किराए के मकान के लिए गृह संपत्ति से होने वाली आय के मद में होने वाली हानि को किसी अन्य शीर्ष के तहत समायोजित करने की अनुमति नहीं दी जाएगी और मौजूदा कानून के अनुसार इसे आगे ले जाने की अनुमति दी जाएगी।

व्यवसाय या व्यवसाय आय से कटौती

ऐसे व्यवसाय या पेशे को चलाने के संबंध में किया गया व्यय

संपत्ति पर मूल्यह्रास, और ऐसी संपत्ति पर अतिरिक्त मूल्यह्रास।

वैज्ञानिक अनुसंधान के लिए दान या व्यय के लिए कटौती

भवन का किराया, दरें, कर, मरम्मत और बीमा

कर्मचारियों को दिया गया कोई बोनस या कमीशन

कर्मचारियों को मान्यता प्राप्त भविष्य निधि या अनुमोदित सेवानिवृत्ति निधि या अनुमोदित ग्रेच्युटी निधि में किया गया योगदान।

टीडीएस – टीडीएस का मतलब स्रोत पर कर कटौती है। आयकर अधिनियम के अनुसार, भुगतान करने वाली किसी भी कंपनी या व्यक्ति को स्रोत पर कर काटने की आवश्यकता होती है यदि भुगतान निश्चित सीमा से अधिक हो। टीडीएस की कटौती कर विभाग द्वारा निर्धारित दरों पर की जानी है।

सैलरी ब्रेकअप – अपने सैलरी ब्रेकअप को समझना आपके वेतन पर इनकम टैक्स की गणना की दिशा में पहला कदम है। वेतन का विवरण वेतन पर्ची या वेतन विवरण पर पाया जा सकता है।

आप पर्ची या बयान का बारीकी से अध्ययन करके अपने मुआवजे के मुख्य घटकों और बुनियादी ढांचे को समझ सकते हैं।

Taxable Income = कुल आय (आपकी सभी कमाई का योग) – योग्य कटौतीअपने वेतन के टूटने के बाद आपको अपनी कर योग्य आय का निर्धारण करना चाहिए। शब्द “कर योग्य आय” आपके वेतन के अलावा आय के किसी भी स्रोत को संदर्भित करता है जिस पर आपको करों का भुगतान करना होगा।

Income Tax Calculator 2022-23 Excel

| Income Source | Description |

|---|---|

| वेतन से आय | आयकर अधिनियम, 1961 के प्रयोजनों के लिए “वेतन” में मौद्रिक भुगतान (जैसे मूल वेतन, बोनस, कमीशन, भत्ते आदि) के साथ-साथ गैर-मौद्रिक सुविधाएं (जैसे आवास आवास, चिकित्सा सुविधा, ब्याज मुक्त ऋण आदि) दोनों शामिल होंगे। ।) धारा 17(1) “वेतन” शब्द को परिभाषित करता है। |

| गृह संपत्ति से आय | घर या जमीन से उत्पन्न आय (किराए पर या स्वयं के कब्जे में)। |

| व्यवसाय/पेशे से आय | करदाता द्वारा सभी अनुमत व्ययों को ध्यान में रखते हुए लाभ और हानि खाते में दिखाई गई कोई आय। आय में सकारात्मक (लाभ) और नकारात्मक आय दोनों शामिल हैं। |

| पूंजीगत लाभ से आय | पिछले वर्ष में प्रभावित पूंजीगत संपत्ति के हस्तांतरण से उत्पन्न होने वाले किसी भी लाभ या लाभ पर ‘पूंजीगत लाभ’ मद के तहत आयकर लगाया जाएगा। इस तरह के पूंजीगत लाभ को पिछले वर्ष की आय माना जाएगा जिसमें स्थानांतरण हुआ था। |

| अन्य स्रोतों से आय | कोई भी आय जो आय के अन्य चार शीर्षों में शामिल नहीं है, अन्य स्रोतों से आय के तहत कर योग्य है, इस वजह से, इसे आय के अवशिष्ट शीर्ष के रूप में जाना जाता है। |

Payable Tax Calculation –

देय कर गणना – देय कर की गणना करने के लिए अंतिम और सबसे महत्वपूर्ण कदम है। सभी लागू कटौतियों और टीडीएस को काटने के बाद आपको जो राशि मिलती है, वह वह राशि है जिसका भुगतान आपको आयकर विभाग को करना होगा। अगर आपकी कुल आय ₹2,50,000 से कम है तो आपको इनकम टैक्स नहीं देना होगा। यदि आप ₹2,50,000 से अधिक कमाते हैं, तो आपको अपनी आय वर्ग के अनुसार आयकर का भुगतान करना होगा।

60 वर्ष से कम आयु के व्यक्तिगत करदाता के लिए, पुरानी कर व्यवस्था और नई कर व्यवस्था के तहत लागू कर दरें/कर स्लैब निम्नलिखित हैं। इन दो कर व्यवस्थाओं में से किसी एक को करदाता द्वारा चुना जा सकता है।

How to Calculate Income Tax under Salary Head?

formula to calculate the Income tax is:-

Basic Salary

+ HRA

+ Special Allowance

+ Transport Allowance

+ Any other allowance

= Gross Income from Salary

– Deductions

– Professional Tax (if any)

Net Income

(Tax calculated according to the income tax slab)

निष्कर्ष-

देय कर की सही गणना करने के लिए निर्धारण वर्ष की शुरुआत में सभी निवेशों का खुलासा करना महत्वपूर्ण है। एक ठोस वित्तीय नींव बनाने के लिए करों, कटौती और रिटर्न का ज्ञान आवश्यक है। गलत कर भुगतान, गलत जानकारी प्रस्तुत करना और झूठ बोलना सभी अवैध हैं। आयकर धोखाधड़ी के उदाहरण निम्नलिखित हैं:

उद्देश्य से, आईटी रिटर्न दाखिल करने से बचना

जानबूझकर कर भुगतान को विफल होने देना

जानबूझकर कुल आय की सूचना नहीं देना

टैक्स रिटर्न जो नकली हैं

झूठा दावा

कर धोखाधड़ी के परिणामस्वरूप गंभीर जुर्माना और जेल जैसे कानूनी दंड हो सकते हैं। हर कोई एक शानदार जीवन जीना चाहता है लेकिन उनका मानना है कि यह मुश्किल है क्योंकि उनके वेतन का एक बड़ा हिस्सा करों पर खर्च किया जाता है। यह जानना कि सही गणना और कटौती कैसे करें, उचित धन निवेश और कर बचत में सहायता करता है, जिससे आप हमेशा से वांछित जीवन जीने की अनुमति देते हैं। यह टैक्स धोखाधड़ी करने से भी रोकता है।

ऑनलाइन इनकम टैक्स भरने के क्या फायदे हैं?

ऑनलाइन फाइल करना त्वरित और आसान है

त्वरित और अधिक कुशल इलेक्ट्रॉनिक टैक्स रिफंड की अनुमति देता है

एक त्वरित पुष्टिकरण रसीद के साथ-साथ रीयल-टाइम स्थिति अपडेट की अनुमति देता है।

यह सुरक्षित और गोपनीय है

त्रुटि रहित है और पेशेवर लागत बचाता है

वीज़ा प्रसंस्करण, बीमा आवेदनों और ऋण आवेदनों में सहायता करता है।

आय प्रमाण और पते के प्रमाण के स्रोत के रूप में कार्य करता है

लेट पेनल्टी से बचना आसान हो जाता है।

आपको नुकसान को आगे ले जाने की अनुमति देता है।

क्या सभी को इनकम टैक्स भरना जरूरी है?

If your gross total income for the financial years exceeds the basic exemption limit, you must file income tax returns. The basic exemption limit under the old regime is as follows:

For residents below age 60 – ₹ 2.5 lakh

For senior citizens (between 60 and 80 years) – ₹ 3 lakhs

For super-senior citizens (80 years and above) – ₹ 5 lakhs

The basic exemption under the new tax regime is 2.5 lakh for all age groups. In addition, if you have the following you must file an ITR:

More than ₹ 1 crore was deposited in a current account(s)

More than ₹ 2 lakh was spent on international travel

Paid more than ₹ 1 lakh on electricity

An account in a foreign country that receives income/ has assets/ has signing authority

Before claiming relevant capital gains exemptions, you must have gross total income that is more than the exemption limit

According to the Union Budget 2021, senior citizens over 75 years of age are excluded from filing Income Tax Returns for the financial year 2021-22 if their only source of income is pension and interest income, both of which are deposited/ earned in the same bank.

If you had a loss during the financial year that you want to carry forward to the next year to offset positive income in the following year(s), you must file a claim of loss by filing your return before the due date.

आयकर दाखिल करने के लिए पात्रता मानदंड क्या है?

Any resident citizen whose total gross income above the basic exemption limit is required to file income tax returns. You can, however, submit a NIL return if your total income is less than the taxable limit.

The following are some of the other entities that submit ITR in India:

Hindu Undivided Family (HUF)

Associations of Persons (AoPs)

Local authorities

Corporate firms

Charitable and/or religious trust

Companies

Artificial juridical persons

Body of Individuals (BOI)

The correct ITR form must be used depending on the taxpayer.

The following are the forms of return prescribed under the Income-tax Law:

Return Form

ITR-1 – Also known as SAHAJ is applicable to an individual having salary or pension income or income from one house property (not a case of brought forward loss) or income from other sources (not being lottery winnings and income from race horses, income taxable under section 115BBDA/ 115BBE

ITR-2 -It is applicable to an individual or an Hindu Undivided Family not having income chargeable to income-tax under the head “Profits or gains of business or profession”

ITR-3 – It is applicable to an individual or a Hindu Undivided Family who has any income chargeable to tax under the head business or profession

ITR-4 – Also known as SUGAM is applicable to individuals or Hindu Undivided Family or partnership firm who have opted for the presumptive taxation scheme of section 44AD/ 44ADA/44AE.

ITR-5, – This Form can be used by a person being a firm, LLP, AOP, BOI, cooperative society and local authority ( Not for trusts, political parties, institutions, colleges)

ITR-6 – It is applicable to a company, other than a company claiming exemption under section 11

ITR-7 – It is applicable to a persons including companies who are required to furnish return under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D) (i.e., trusts, political parties, institutions, colleges)

ITR-V -It is the acknowledgement of filing the return of income.

आयकर रिटर्न ई-फाइलिंग के लिए आवश्यक विवरण क्या हैं?

PAN card

Aadhaar card

Permanent address proof

Bank account details related to the financial year (indicate which account any income tax refund should go to)

Form 16 and proofs of all the “other incomes” ( like commission, interest income, and/or dividend)

Details of tax deduction(s), related to Section 80C, Section 80D, and many such deduction related to investments/expenses and other allowances – as mentioned under Chapter VIA.

Proof of tax paid (TDS, advance tax, and so on.)

Financial statements of the entity/ corporate

Statement of equity trading/ future-options/ mutual funds (for all Demat accounts)

Details of any capital assets sold/ purchased during the year

वेतनभोगी व्यक्तियों के लिए क्या कटौती/छूट उपलब्ध हैं?

The following deductions/exemptions are available for salaried individuals:

Standard deductions (Rs 50,000)

Leave Travel Allowance (for domestic travel)

HRA – House Rent Allowance (partial or total)

Work-related expenses (telephone bills, meal coupons, etc.)

Deduction under different Sections of Chapter VIA of Income Tax Act:80C, 80CCC, 80CCD(1) – Life Insurance premiums, ULIPs, PPF, NPS, tuition fees, etc.

80D – Premiums paid towards health insurance policy

80C, 24B, and 80EE/ 80EEA – Home loan repayment

80E – Education loan interest

80G – Contributions to approved charitable organisations

80TTA – Savings account interest

धारा 80सी के तहत कटौती की सीमा क्या है?

Under Section 80C, taxpayers can claim deductions of up to 1,50,000 per financial year. However, there is an additional deduction of up to Rs 50,000 permitted for deposits made to an NPS account.

The Section 80C deduction applies to investments like life insurance premiums EPF, PPF, ULIPs, home loan repayment, child’s tuition fees, and much more.

The limit of Rs 1,50,000 is inclusive of subsections like 80CCC, 80CCD(1), and 80CCD(2).

होम लोन पर कितनी टैक्स छूट उपलब्ध है?

Eligible taxpayers can claim the following tax rebate when repaying home loan:

Under Section 80C for principal repayment and stamp duty – up to Rs 1,50,000 per year

Under Section 24B for interest payment – up to Rs 2,00,000 per year

As an additional interest deductions under Section 80EE – up to Rs 50,000 annually

Under Section 80EEA – as an additional interest deduction on home loans taken for affordable housing – up to Rs 1,50,000 annually

Note:

You can claim a maximum deduction of Rs 5 lakh per year (Rs 1,50,000 + Rs 2,00,000 + Rs 1,50,000) if you are eligible under Section 80EE or 80EEA.

If co-owners take out a home loan, each of them can claim tax deductions based on their ownership stake.

We are sharing an Excel-based 15-in-one software by CMA Pravesh Sharma. You will find all tax-related calculations in one file. This excel f…

We are sharing an Excel-based 15-in-one software by CMA Pravesh Sharma. You will find all tax-related calculations in one file.

This excel file has mainly 15 types of calculation /charts

- Income Tax comparison for new rates and old rate and which option is beneficial for you

- Generate form 16 for 500 Employees by filling data in excel sheet

- Income Tax calculator for FY 1985-86 Fy 2021-22

- Income Tax Rate for FY 1985-86 Fy 2021-22

- Capital gain Calculation

- Calculation of Deductions

- Calculation of NSC interest

- Calculation of House rent allowance

- Printing of Challan 280

- printing of challan 281

- Section 89(1) relief calculator

- Interest Calculator 234A ,234B ,234C

- TDS rates for Fy 2008-09 to Fy 2021-22

- TCS rates For Fy 2008-09 Fy 2021-22

- RD Interest calculation

Please enable macro in excel to use this calculator (Do not Download in Mobile It is a Big file 5MB)

For error and suggestion for improvement contact

BY Pravesh Kumar Sharma M.Com, ACMA ,B-204, Kanta Khaturiya Colony, Bikaner ,

To download the calculator, share on Facebook or Twitter and click on the shared link to open the Lock or visit page-2 for direct download Link or send mail on raniraj1950 at gmail.com with the subject «15 in One Income Tax calculator FY 2021-22«

15 in One Income Tax calculator FY 2023-24

[lock]

Please enable macro in excel to use this calculator (Please Do not Download in Mobile It is a Big file 5MB)

For error and suggestion for improvement contact

BY Pravesh Kumar Sharma M.Com, ACMA ,B-204, Kanta Khaturiya Colony, Bikaner ,

[/lock]

[next]

Please enable macro in excel to use this calculator (Do not Download in Mobile It is a Big file 10MB)

For error and suggestion for improvement contact

BY Pravesh Kumar Sharma M.Com, ACMA ,B-204, Kanta Khaturiya Colony, Bikaner ,

Every year there are changes in the Income Tax rules of India in the Union Budget. Keeping these changes in mind we come up with our Income Tax Calculator India every year. The latest budget was presented in February 2021 and made the following changes.

Contents

- 1 Income Tax Changes in Union Budget 2021

- 2 Download Income Tax Calculator in Excel

- 3 How to use the Income Tax Calculator India for FY 2021-22 (AY 2022-23)?

- 3.1 Section 1: Basic Details

- 3.2 Section 2: Salary Income

- 3.3 Section 3: Income from other sources

- 3.4 Section 4: Loss from Home Loan Interest

- 3.5 Section 5: Tax Deductions – Chapter VI A

- 3.6 Section 6: More Tax Deductions

- 3.7 Section 7: Income Tax Calculation (Old Tax Slabs)

- 3.8 Section 9: Calculating Income Tax with New Tax Slab under new Regime

- 4 How to Calculate Income Tax in India?

- 4.1 Step 1: Calculate Gross total income from salary:

- 4.2 Step 2: Tax Deductions

- 4.3 Step 3: Other Income

- 4.4 Step 4: Net Taxable Income

- 4.5 Step 5: Calculating using Income Tax Formula

- 5 Income Tax Calculator FY 2020-21 Excel

- 6 Income Tax Calculator FY 2019-20 Excel

- 7 Income Tax Calculator FY 2018-19 Excel

- 8 Income Tax Calculator FY 2017-18 Excel

- 9 Income Tax Calculator FY 2016-17 Excel

- 10 Income Tax Calculator FY 2015-16 Excel

- 11 Income Tax Calculator FY 2014-15 Excel

- 12 Income Tax Calculator FY 2013-14 Excel

- 13 Income Tax Calculator FY 2012-13 Excel

- 14 Income Tax Calculator FY 2011-12 Excel

- 15 Income Tax Calculator India FAQs

- 15.1 ✅ Should I go with New or Old Tax Slab?

- 15.2 ✅ Is Tax Deduction different than Tax Exemption?

- 15.3 ✅ Do NRIs need to pay Income Tax in India?

- 15.4 ✅ What is surcharge on Income Tax?

- 15.5 ✅ What is Cess on Income Tax?

Income Tax Changes in Union Budget 2021

There was No major changes in income tax in Budget 2021. The only change was the interest earned on contribution of more than Rs 2.5 Lakh in a year through EPF or VPF would be added to the income and taxed at marginal tax rate.

Also the biggest change in Budget 2020 regarding income tax was introduction of new tax slabs in case you do not want to take benefit of various tax deductions like standard deduction, Chapter VI A deductions, HRA benefit, LTA, home loan interest for self-occupied homes etc. continues.

From last year you have the option to choose on what you want to follow:

- New Tax Slabs but forgoing all tax deductions

- Continue with old tax slabs with all tax deductions

The income tax calculator India calculates the tax outgo using both the above tax slabs and you can choose what suits you.

Sukanya Samriddhi Account + PPF + SCSS Calculator

Sukanya Samriddhi Account, PPF, Senior Citizens’ Savings Scheme are part of small saving scheme sponsored by Government of India. These schemes are quite popular and rightly so because of the safety, higher interest rate offered among other things. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. Click on the links to get the relevant calculator – PPF Calculator, Sukanya Samriddhi Yojana Calculator, Senior Citizens’ Savings Scheme Calculator, NSC Calculator.

You can download the income tax calculator 2021 (for FY 2021-22) in excel by clicking the button below.

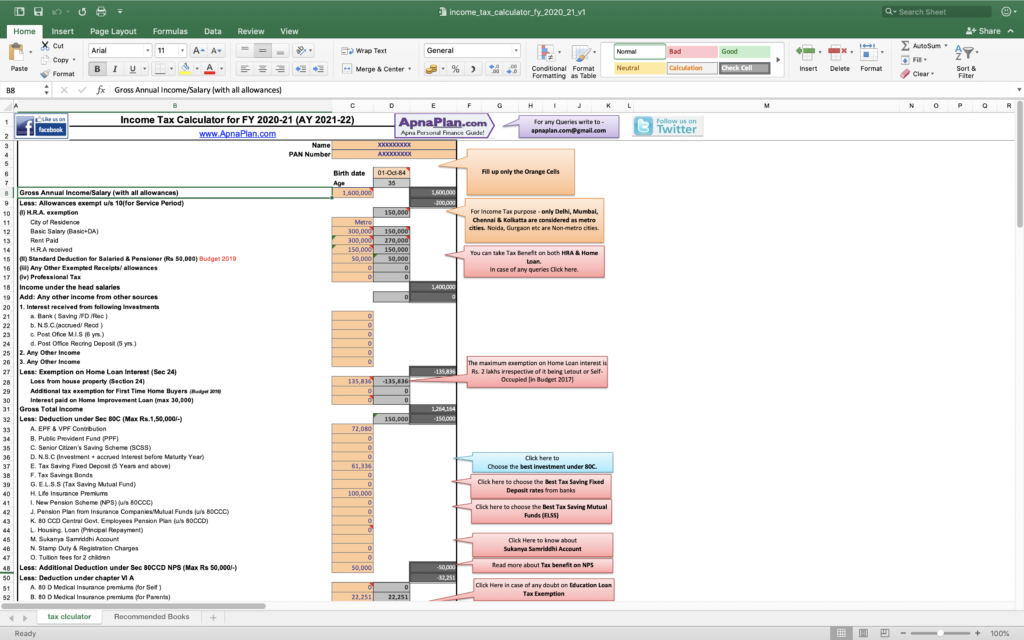

How to use the Income Tax Calculator India for FY 2021-22 (AY 2022-23)?

The picture below shows how the income tax calculator India for FY 2021-22 (AY 2022-23) looks like. You can edit all cells in Orange colour.

Section 1: Basic Details

The top cells ask for your name and PAN Number. It’s optional field and is meant in case you want to use it for multiple people.

Date of Birth is mandatory field as the tax slab is different for people aged below 60, between 60 to 80 years and more than 80 years.

Section 2: Salary Income

The next fields ask information about gross salary income.

- In case you are employed, get HRA and rent out do fill in the details

- Standard Deduction is Rs 50,000 from Budget 2019 onwards and is applicable to salaried and pensioners only.

- Do mention Any Other Exempted Receipts/ allowances like LTA, etc

- In case you have paid Professional Tax as happens in Maharashtra and some other states do mention that. This is tax exempt.

Tax Free Salary Components

There are components in salary which are fully or partially tax exempt. For example HRA is tax exempt if you satisfy certain conditions. You can have the complete list in the post: Must have Tax Free components in Salary.

Section 3: Income from other sources

Input all the other income like Interest income from fixed or recurring deposits. You can also include income from gifts received if its more than Rs 50,000 and from non-relatives.

Section 4: Loss from Home Loan Interest

In case you have home loan, fill up the columns to reflect the same. You get tax benefit on interest under section 24. Budget 2018 onwards there is additional benefit for first time buyers of affordable homes. You can also claim tax benefit on interest paid on home improvement loan.

HRA & Home Loan Benefit at same Time – Possible?

Many employer (& employers) are confused if they can take advantage of both HRA and Home Loan for saving tax. This seems intuitive as how can you pay for home loan and also live on rent. However just for your information its completely legal to take advantage of both HRA & Home Loan as there are multiple situations where you need to live on rent but still pay home loan. You can read more about this our post – Can I claim Tax Benefit on both HRA & Home Loan?

Section 5: Tax Deductions – Chapter VI A

Fill in the tax deductions you want to claim. It covers Section 80C for investments like EPF, VPF, PPF, SCSS, etc.

Additionally, you can claim tax deduction up to Rs 50,000 by investing in NPS u/s 80CCD(1B). this is in addition to Section 80C.

Section 6: More Tax Deductions

There are several cases where you can claim tax deductions like buying medical insurance, etc. Mention the same accordingly.

- Medical Insurance premiums (for Self or parents)

- Interest Paid on Education Loan

- Medical Treatment of handicapped Dependent

- Expenditure on Selected Medical Treatment for self/ dependent

- Donation to approved funds

- For Rent in case of NO HRA Component (Budget 2016)

- For Physically Disable Assesse

- In case your employer contributes to NPS account on your behalf, you can claim up to 10% of your basic salary as tax deductible.

- There is also tax deduction for interest paid on purchase of electric vehicles.

Section 7: Income Tax Calculation (Old Tax Slabs)

This section is auto-computed based on your inputs and displays your final tax outgo. There

Section 9: Calculating Income Tax with New Tax Slab under new Regime

This section computes the Income Tax with Lower Tax Slab under new Regime announced in Budget 2020. This would help you to determine which tax regime suits you.

How to Calculate Income Tax in India?

In case you want to calculate your income tax without using the Income Tax India calculator, it’s not very difficult. You need to follow following steps using the below example.

Amit is salaried employee with following salary structure.

- Basic Salary: Rs 6,00,000

- HRA: Rs 3,00,000

- Special Allowance: Rs 60,000

- LTA: Rs 40,000

- Total CTC: Rs 10,00,000

Step 1: Calculate Gross total income from salary:

The table below shows the calculation for gross taxable income from salary.

| Component | Amount (Rs.) | Exemption/ Deduction | Old regime | New regime |

|---|---|---|---|---|

| Basic Salary | 600,000 | – | 600,000 | 600,000 |

| HRA | 300,000 | 240,000 | 60,000 | 300,000 |

| Special Allowance | 60,000 | – | 60,000 | 60,000 |

| LTA | 40,000 | 40,000 (bills submitted) | 0 | 40,000 |

| Standard Deduction | – | 50,000 | – 50,000 | |

| Gross Total Income from Salary | – | – | 670,000 | 1,000,000 |

Step 2: Tax Deductions

Amit had made the following investments to save tax. These will be deducted from the gross income to arrive at net taxable income.

- EPF deduction from salary – Rs 60,000

- PPF Investment – Rs 1,50,000

- Medical Insurance Premium – Rs 25,000

- Total Tax Deduction = Rs 1,50,000 + 25,000 = Rs 1,75,000 (PPF & EPF both come under section 80C and have a tax deduction upper limit of Rs 1.5 lakh)

Step 3: Other Income

Amit also had Rs 20,000 from interest from fixed deposits with banks.

Step 4: Net Taxable Income

The table below shows the Net Taxable Income for Amit

| Nature | Old Tax Regime | New Tax Regime |

|---|---|---|

| Income from Salary | 670,000 | 1,000,000 |

| Income from Other Sources | 20,000 | 20,000 |

| Tax Deduction | -175,000 | 0 |

| Total Taxable Income | 515,000 | 1,020,000 |

Step 5: Calculating using Income Tax Formula

Old Regime:

| Tax Slab | Calculation | Tax |

|---|---|---|

| up to Rs 250,000 | Tax Exempt | 0 |

| Rs 250,000 to 500,000 | 5% || (5% * (500,000 – 250,000) | 12,500 |

| Rs 500,000 to 1,000,000 | 20% || (20% *(515,000 – 500,000) | 3,000 |

| Income Tax | – | 15,500 |

| Cess | 4% || (4% of 15,500) | 620 |

| Total Tax Payable | – | 16,120 |

New Regime:

| Tax Slab | Calculation | Tax |

|---|---|---|

| up to Rs 250,000 | Tax Exempt | 0 |

| Rs 250,000 to 500,000 | 5% || (5% * (500,000 – 250,000) | 12,500 |

| Rs 500,000 to 750,000 | 10% || (10% * (750,000 – 500,000) | 25,000 |

| Rs 750,000 to 1,000,000 | 15% || (15% * (1,000,000 – 750,000) | 37,500 |

| Rs 1,000,000 to 1,250,000 | 20% || (20% * (1,020,000 – 1,000,000) | 4,000 |

| Income Tax | – | 79,000 |

| Cess | 4% || (4% of 79,000) | 3,160 |

| Total Tax payable | – | 82,160 |

As you can see the tax liability changes hugely depending on what tax regime you choose. So you should plan carefully. You can also check the official Income Tax website for calculating your income tax.

How to Pay 0 Income Tax on Salary of Rs 20+ Lakh (FY 2021-22)?

As you can see with the above income tax calculation, salary components and salary structure plays a very important role in how much income tax you pay. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs.

Income Tax Calculator FY 2020-21 Excel

Budget 2020 had introduced the new Vs old tax slabs. Below are the tax slabs

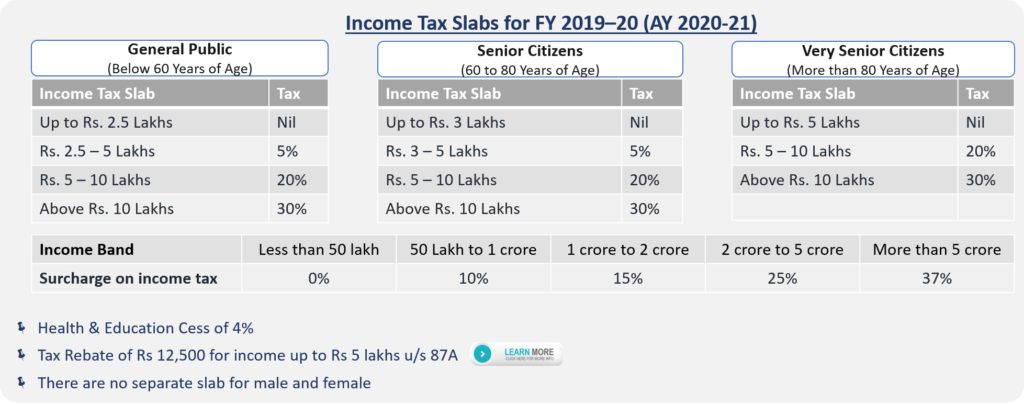

Income Tax Calculator FY 2019-20 Excel

Following changes were made in Budget 2019 applicable for FY 2019-20:

- Rebate under Section 87A changed from Rs 2,500 to Rs 12,500 or 100% of income tax (whichever is lower) for individuals with income below Rs 5 Lakhs (from Rs 3.5 Lakhs)

- Standard Deduction raised for Salaried & Pensioners from Rs 40,000 to Rs 50,000

- Increased Tax for super-rich: Surcharge increased to 25% for income between 2 to 5 crore & to 37% for income beyond Rs 5 crores

- Additional Tax Deduction of Rs 1.5 lakhs u/s 80EEA on home loans on purchase of affordable home

- Additional Tax Deduction of Rs 1.5 lakhs u/s 80EEB on Auto loans on purchase of Electric vehicles

- No Tax on Notional Rental Income from Second House

- Capital gains exemption on reinvestment in two house properties: Tax payers can now buy two houses on sale of 1 house if the capital gains are less than Rs 2 crore. This benefit can be availed only once in lifetime

- TDS threshold increased from Rs 10,000 to Rs 40,000 on Bank Interest Income

You can download the Income Tax Calculator in Excel for FY 2019-20 from the link below.

Income Tax Calculator FY 2018-19 Excel

Budget 2018 has made some changes to Income tax for individual. There has been no changes in the income tax slab, however there have been some changes related to salaried/pensioner tax payers and senior citizens.

- No Change in Income Tax Slabs

- 1% additional health cess taking total cess on income tax to 4% (2% education cess & 1% higher education cess continues). This will marginally increase income tax for every tax payer.

- Standard Deduction of Rs 40,000 to Salaried and Pensioners. However transport allowance (Rs 19,200 per annum) and medical reimbursement of Rs 15,000 has been abolished. So the net benefit for salaried would be Rs 5,800 only bringing marginal relief. However Pensioners would gain as they did not have transport & medical allowance.

- 10% Long Term Capital Gains Tax on Equity and Equity based Mutual Funds introduced.

- Medical Insurance premium exemption for senior citizen increased from Rs 30,000 to Rs 50,000 u/s 80D

- Medical expenses will see increased tax benefits for senior citizens. 100,000 on critical illness u/s 80DDB

- Rs 50,000 exemption for interest income from Bank or Post Office Fixed/Recurring Deposits for Senior Citizens

Income Tax Calculator FY 2017-18 Excel

In Budget 2017, the finance minister has made little changes to this. We highlight the changes and give you the new tax calculator for FY 2017-18 [AY 2018-19].

- Tax reduced from 10% to 5% for Income from Rs 2,50,000 – Rs 5,00,000 leading to tax saving of up to Rs 12,500.

- 10% surcharge on income tax if the total income exceeds Rs 50 Lakhs but less than Rs 1 crore

- For people with net taxable income below Rs 3.5 lakh, the tax rebate has been reduced to Rs 2,500 u/s 87A

- NO RGESS Tax exemption from FY 2017-18

- Interest deduction on rented property capped at Rs 2 Lakh

![Income Tax Calculator India in Excel★ (FY 2021-22) (AY 2022-23) 6 Income Tax Slab for FY 2017–18 [AY 2018-19]](https://www.apnaplan.com/wp-content/uploads/2017/02/Income-Tax-Slab-for-FY-2017%E2%80%9318-AY-2018-19-1024x441.png)

Income Tax Calculator FY 2016-17 Excel

In Budget 2016, the finance minister has made little changes.

- There has been no change in the income tax slabs.

- For people with net taxable income below Rs 5 lakh, the tax rebate has been increased from Rs 2,000 to Rs 5,000 u/s 87A. This would benefit people who have net taxable income between Rs 2.7 Lakhs to Rs 5 Lakhs.

- Additional exemption for first time home buyer up to Rs. 50,000 on interest paid on housing loans. This would be applicable where the property cost is below Rs 50 Lakhs and the home loan is below Rs 35 lakhs. The loan should be sanctioned on or after April 1, 2016.

- Tax Exemption u/s 80GG (for rent expenses who do NOT have HRA component in salary) has been increased from Rs 24,000 to Rs 60,000 per annum. This is a good move to align the exemption amount with today’s rent and keep the section relevant.

- For people with net taxable income above Rs 1 crore, the surcharge has been increased from 12% to 15%

- Dividend Income in excess of Rs. 10 lakh per annum to be taxed at 10%

- 40% of lump sum withdrawal on NPS at maturity would be exempted from Tax. This rule now also applies to EPF. So now in case of EPF income tax would be applicable on 60% of the corpus on maturity.

- Presumptive taxation scheme introduced for professionals with receipts up to Rs. 50 lakhs. The presumptive income would be 50% of the revenues.

- Exemption to employer’s contribution to recognized provident funds limited to 1.5 lakh. Earlier, the cap was up to 12% of salary

![Income Tax Calculator India in Excel★ (FY 2021-22) (AY 2022-23) 7 Income Tax Slabs for FY 2016–17 [AY 2017-18]](https://www.apnaplan.com/wp-content/uploads/2016/02/Income-Tax-Slabs-for-FY-2016%E2%80%9317-1024x426.png)

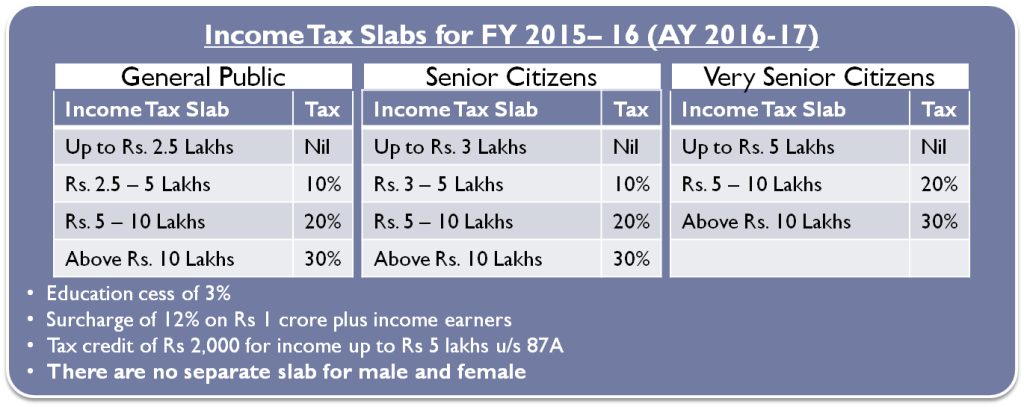

Income Tax Calculator FY 2015-16 Excel

The tax slabs have remain unchanged but there have been some changes in terms of Transport Allowance, Medical Insurance benefits and exemption for Physically challenged tax payers.

- Transport Allowance increased to Rs 1,600 from Rs 800

- Increase in Medical Insurance Premium exemption limit from Rs 15,000 to Rs 25,000 u/s 80D (up to 30K for Senior Citizens)

- Sukanya Samriddhi Account a new investment option u/s 80C

- Very Senior Citizens (above 80 Years of age) to be allowed deduction of Rs 30,000 for medical expenditure in case they do not have health insurance

- Additional exemption of Rs 50,000 under sec 80CCD for investing in NPS (New Pension Scheme)

- Increase in the limit of deduction available for treatment of chronic diseases u/s 80DDB from Rs 60,000 to Rs 80,000

- Rs 25,000 increase in deduction available to persons with disability and severe disability u/s 80DD and 80U

- 2% surcharge on Super rich (i.e. individuals with income > 1 crore)

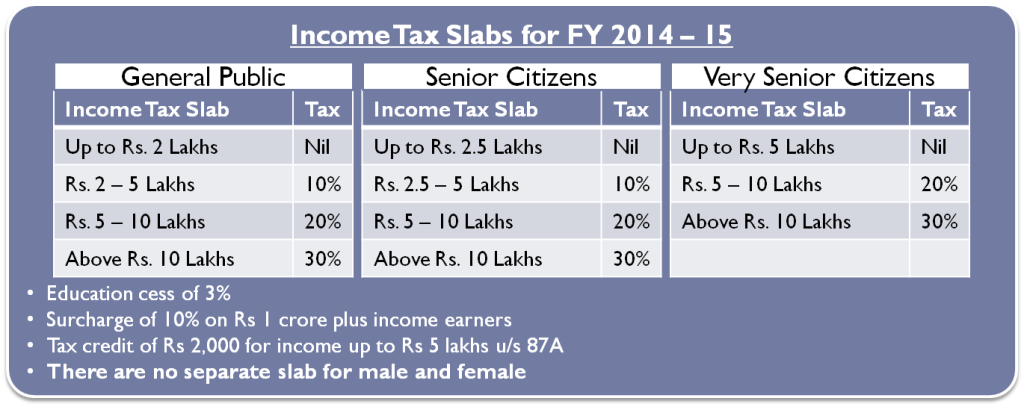

Income Tax Calculator FY 2014-15 Excel

We have incorporated the 3 changes that happened in Budget 2014 (presented on July 10, 2014)

- Income up to Rs 2.5 lakhs for General Public and up to Rs. 3 lakhs for Senior citizens are now exempted from paying Income tax. Earlier this limit was Rs 2 Lakhs for General Public and rs 2.5 Lakhs for Senior Citizens.

- The exemption limit for investments under section 80C has been raised from Rs 1 Lakh to Rs 1.5 Lakhs.

- The exemption on paying interest on Home Loan has been raised from Rs 1.5 Lakhs to Rs 2 Lakh.

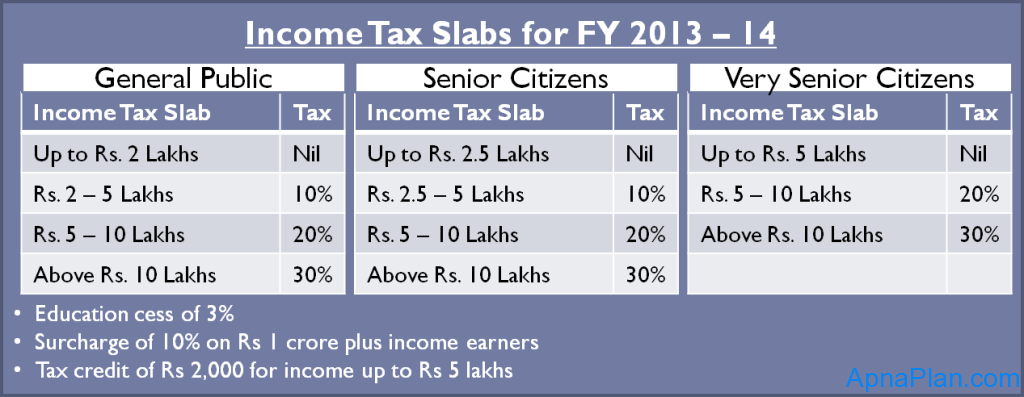

Income Tax Calculator FY 2013-14 Excel

The finance minister, P Chidambaram in his Budget 2013-14 kept the income tax rates unchanged. The table below shows the summary of tax slabs for FY 2013-14.

There are two minor changes:

- Super rich have to pay more taxes. A surcharge of 10% on Rs 1 crore plus income earners have been imposed. This is for one year only and would impact about 42,800 people only

- The middle class with income of up to Rs 5 lakhs would receive tax credit of Rs 2,000 for FY 2013-14. This essentially means people with income up to Rs 5 lakhs have reduced tax burden of Rs. 2,060 for FY 2013-14.

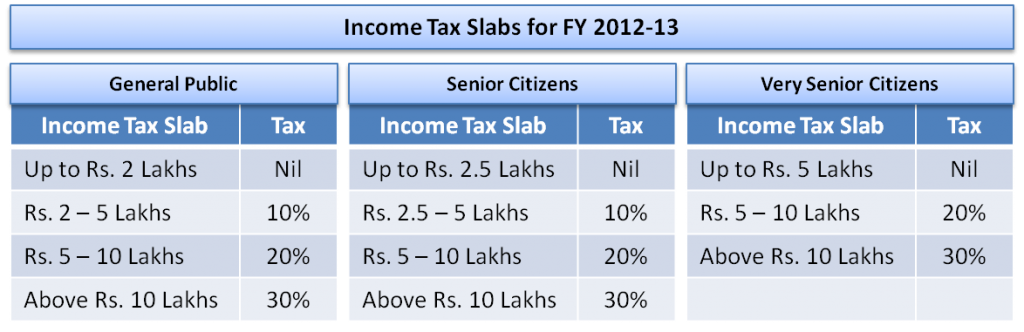

Income Tax Calculator FY 2012-13 Excel

Below is the Income Tax Slab for FY 2012-13. A significant difference is there is no more distinction between men and women as far as taxes are concerned.

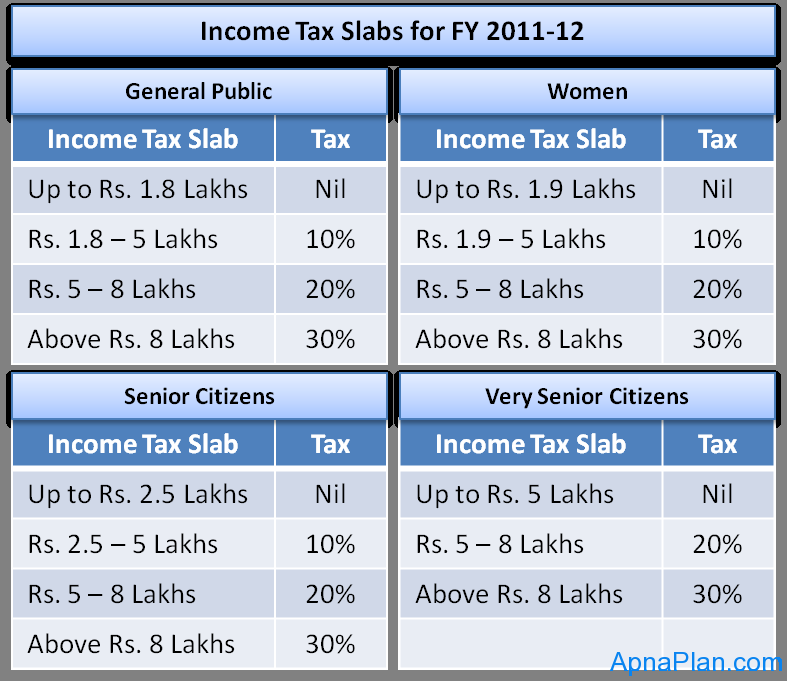

Income Tax Calculator FY 2011-12 Excel

Below is the Income Tax Slab for FY 2011-12.

Income Tax Calculator India FAQs

✅ Should I go with New or Old Tax Slab?

You should do the calculation using our income tax calculator and check yourself. In most cases if you do tax saving investments and get salary components tax deduction, you should follow the old tax slab.

✅ Is Tax Deduction different than Tax Exemption?

You may find both Tax Deduction and Tax exemption terms used interchangeably. But technically both terms have different meaning.

Tax Deduction means you can deduct those from your income. This could be investments like PPF, etc that you do under section 80C. This is tax deducted up to Rs 1.5 lakhs.

Tax Exemption means the income is not taxable like interest earned on PPF.

✅ Do NRIs need to pay Income Tax in India?

NRIs (Non-resident Indians) and foreigners have to pay income tax in India on income accrued in India.

✅ What is surcharge on Income Tax?

For certain high-income tax payers, the government of India has introduced surcharge. As of FY 2021-22 the surcharge is as follows:

Less than Rs 50 Lakh – No Surcharge

Rs 50 lakh to 1 crore – 10%

Rs 1 crore to 2 crores – 15%

Rs 2 crores to 5 crores – 25%

More than Rs 5 crores – 37%

✅ What is Cess on Income Tax?

All tax payers have to pay 4% of Income Tax as health and Education cess. This cess is said to be used for the above purpose.

Income tax computation software download in excel

Income tax software is a package of Income tax computation software, ITR software and income tax e-filing software. Income tax software is enabled for different types of Assessee Status. The data entry in CA-ERP is very simple and user-friendly due to minimum key operations and single window computation. As the calculation of tax and entry of data are in the same table, there is no navigation through multiple windows and thereby avoids confusion in data entry.

Income tax Calculator 2023-24

6

Comments

इस पेज / वेबसाइट की त्रुटियों / गलतियों को यहाँ दर्ज कीजिये

(Errors/mistakes on this page/website enter here)

- | Income Tax

— Downloads

- 21 Nov 2021

- 34,440 Views

|

Income Tax Calculation F.Y. 2021 -22 in Excel

आयकर गणना प्रपत्र वित्तीय वर्ष 2021 – 22

Fully Automatic Excel Program

इसमें आपको दो प्रोग्राम मिलेंगे जिसमे एक प्रोग्राम fully automatics है और दूसरा जिसमे आपको केवल GA55 भरकर अपने टैक्स की कैलकुलेशन कर सकते है |

इस एक्सेल प्रोग्राम की सहायता से आप अपने आयकर वित्तीय वर्ष 2021 – 22 की गणना के सकते है इसके लिए आपको इस प्रोग्राम की फर्स्ट शीट मास्टर में अपनी बेसिक डिटेल भरनी है फिर आपको other deductions वाली शीट में सैलरी के अलावा जो आपकी कटौतियां है वो लिखनी है | बस ये डिटेल भरते ही आपकी टैक्स कैलकुलेशन तैयार है | दोनों तरह की टैक्स कैलकुलेशन ओल्ड एंड न्यू दोनों की गणना एक साथ हो जाएगी |

Access Denied! Only Regstered Users Can Download The File «Income Tax Calculation Excel Software«. Register Here or Login

Author Bio

Qualification: Graduate

Company: N/A

Location: Kuchaman City, Rajasthan, India

Member Since: 18 Nov 2021 | Total Posts: 1

Join Taxguru’s Network for Latest updates on Income Tax, GST, Company Law, Corporate Laws and other related subjects.

Review us on Google

More Under Income Tax

Home »

DSTF CALCULATORS

» INCOME TAX CALCULATOR with Calculation Sheet in Excel Format FY 2019-20 AY 2020-21

———————————————————————

DELHI SCHOOL TEACHERS FORUM is publishing INCOME TAX CALCULATOR with Calculation Sheet in Excel Format. Now you can Estimate Your Income Tax for assessment Year 2020-21 and Financial Year 2019-20 accurately. This Calculator is based on the Income Tax Slab announced in Budget-2019. Disclaimer apply.

How to Use this Calculator :-

NOTE : Enter the value only in the PINK colour Cells and not in other column as it will delete the formula i. e. edit only PINK COLOUR Cells.

- Click on the Click Here to Use Income Tax Calculator online or Click on download Calculator on your Computer.Then use Calculator as follow

- This Calculator has one ‘Input Sheet’ and other ‘Calculation Sheet’.

- You have to select/fill your Pay as on 1-3-19 and all other pay with increment will be calculated automatically.

- In input Sheet fill/select all the required data in PINK Cells only. Do not edit other cells as it may delete formulae.

- Your Income Tax due will automatically calculated

- Download the this Sheet on your computer.

Click below download link to download.

Click Here to download Income Tax Calculator without NPS.

———————————————————————

Click Here to CALCULATE MAXIMUM RENT RECIEPT FOR MAX. HRA TAX REBATE

Please fill below form to download Income Tax Calculator for FY 2022-23 in Excel. Once you provide details, you will be provided with link to download excel via Email. Also, read the instructions to use this Income Tax Excel Calculator. This excel calculator helps you to calculate income tax if you are salaried employee or business man.

Check out More online Calculators here including Income Tax, PPF, SIP, Home Loan Calculator and many more..

Note: In the above google drive path, choose the option to Download the excel calculator on your computer or mobile phone, so that you can edit the file as a local copy. This calculator is applicable for AY 2023-24. There were no changes made in Budget 2022, so the income tax slab rates remain same for Old and New Tax Regime.

Instructions to use Income Tax Excel Calculator FY 2022-23:

- Download the Income Tax Calculator FY 2022-23 Excel on your device

- Provide Income as Gross Income for FY 2022-23

- Provide Investments including Standard Deduction, Section 80C investments, Section 80CCD(1B) investments and other tax saving options you are eligible for. Total amount of investments need to be entered. Standard Deduction of Rs. 50,000 is applicable for Employees.

- Enter TDS amount that is already deducted from your salary in financial year

- After providing all these parameters, income tax will be calculated based on Old and New Tax Regime

You can find more income tax calculation examples here

Now since you got the idea about how this excel calculator works, let’s see How to calculate Income Tax FY 2022-23 with the help of a video.

Income Tax Calculation FY 2022-23 Excel Video

Watch more Excel Videos Here

Also in case you want to use Online income tax calculator use below link instead of using excel calculator:

How this Income Tax Calculator in Excel helps you?

- This income tax calculator helps you to understand your income tax based on Old and New Tax Regime.

- Based on the calculations, you can choose which Tax regime you should choose. You should select tax regime based on which you’ll be paying less income tax.

- It is important to note that investment deductions are available only in Old Tax Regime.

- New Tax Regime does not allow you to claim any investment deductions to save income tax. This is because new tax regime are reduced tax slab rates.

- This means that Standard Deductions of Rs. 50,000 is only available in Old Tax Regime, and not in New Tax Regime

- In this way, the calculator can help you to compare your tax outgo and by iteratively entering the investment amount, you can decide how much you can invest more to pay less income tax if selecting Old Tax Regime.

Old Tax Regime vs New Tax Regime Slab Rates

Below is the table showing Old and New Tax Slab Rates for FY 2022-23:

| Income | Old Tax Regime | New Tax Regime |

|---|---|---|

| Rs. 0 to Rs. 2.5 Lacs | 0% | 0% |

| Rs. 2.5 Lacs to Rs. 5 Lacs | 5% | 5% |

| Rs. 5 Lacs to Rs. 7.5 Lacs | 20% | 10% |

| Rs. 7.5 Lacs to Rs. 10 Lacs | 20% | 15% |

| Rs. 10 Lacs to Rs. 12.5 Lacs | 30% | 20% |

| Rs. 12.5 Lacs to Rs. 15 Lacs | 30% | 25% |

| more than Rs. 15 Lacs | 30% | 30% |

As seen above, New Tax regime has reduced tax slab rates which means you will be paying less income tax, if you are not opting for any investment deductions.

In case you want to claim various deductions to save income tax, you might have to check how much income tax can be saved using Old Tax Regime.

Which Tax Regime you should choose?

To answer this question, it depends on person to person. Every individual is having different incomes in a Financial Year.

If your income is in the range of Rs. 5 Lacs to Rs. 12 Lacs, you can opt for Old Tax Regime, and make some Tax saving investments and Save Income Tax.

But if your income is above Rs. 12 Lacs, there is not much option to save maximum income tax. Even after making investments with maximum limits in different sections, you’ll still be paying more taxes with old tax regime compared to new tax regime.

Below is the graph showing the comparison of income vs income tax:

As seen above, green line depicts income tax with new tax regime, which is low when your income moves greater than 12 Lacs. Blue line (old regime with investments) is still above green line which shows that even after investments you’ll more more income tax with old slab rates compared to new slab rates.

So you should make your investments according to your total income and based on the calculations of income tax in both regimes. Choose the one that helps you pay less income tax.

ALSO READ: Income Tax Calculation FY 2022-23 in Excel

Are you eligible for Tax Rebate u/s 87A?

You will be eligible for Tax Rebate u/s 87A when your taxable income is below Rs. 5 lacs in FY 2022-23. This is achievable by making investments under various sections.

Tax Rebate u/s 87A will be allowed in both Old and New Tax Regime.

Example

Let’s say your Net Taxable Income equals Rs. 5 Lacs in FY 2022-23

Based on Old and New Tax Slab Rates, you are liable to pay Rs. 12,500 as Income Tax based on your Net Taxable Income.

But we also have Tax Rebate u/s 87A which provides us a maximum rebate of Rs. 12,500, thus making our Income Tax = Rs. 0.

Find more Income Tax Calculation examples here.

How to pay ZERO Income Tax?

Using above trick of getting your Taxable income to below Rs. 5 lacs in FY, you need not have to pay any income tax, and by making investments, you save for your future as well. So it’s a win-win situation.

This is possible only when your total income is up to 10-12 lacs in a financial year and you are able to use all available investment options present. If your income goes above this figure in FY, it becomes difficult to save maximum income tax. Again, you can check by yourself using the Income Tax Calculator in Excel I have provided.

Watch below video to know various tax saving options:

Watch more Excel Videos Here

That’s it in this article about income tax calculator FY 2022-23 in excel. Comment your queries in case you have any. Make sure that you Subscribe to YouTube Channel for more Personal Finance Videos and Download Income Tax Calculator App “FinCalC” on your mobile.

You can Donate Too!

Found this Helpful? DONATE any amount to see more useful Content. Scan below QR code using any UPI App!

UPI ID: abhilashgupta8149-1@okhdfcbank

Verify that you are “Paying Abhilash Gupta” before making the transaction so that it reaches me. It makes my Day 🙂

Thank you for Donating. Stay Tuned!

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2023-24 and previous FY 2022-23

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Some more Reading:

How to Claim HRA when living with Parents

SIP Returns Calculation in Excel

How to Calculate Income Tax on Salary [Examples]

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.

Tax calculator will make your income tax calculation very easy. Calculate Indian income tax with our free income tax calculator in Excel, according to latest assessment year FY 2013-14.

Top File Download:

- income tax calculator 2013-14 excel free download

- income tax calculator excel

- income tax calculator india 2013-14 excel free download

Incometax program by cp kurmi, income tax calculation by cp kurmi, incometax 2021-22 excel program by cp kurmi, incometax calculation excel progrom

Income Tax Calculation F.Y. 2021 -22 in Excel

आयकर गणना प्रपत्र वित्तीय वर्ष 2021 — 22

Fully Automatic Excel Program

- इसमें आपको दो प्रोग्राम मिलेंगे जिसमे एक प्रोग्राम fully automatics है और

- दूसरा जिसमे आपको केवल GA55 भरकर अपने टैक्स की कैलकुलेशन कर सकते है |

इस एक्सेल प्रोग्राम की सहायता से आप अपने आयकर वित्तीय वर्ष 2021 — 22 की गणना के सकते है इसके लिए आपको इस प्रोग्राम की फर्स्ट शीट मास्टर में अपनी बेसिक डिटेल भरनी है फिर आपको other deductioस वाली शीट में सैलरी के अलावा जो आपकी कटौतियां है वो लिखनी है | बस ये डिटेल भरते ही आपकी टैक्स कैलकुलेशन तैयार है | दोनों तरह की टैक्स कैलकुलेशन ओल्ड एंड न्यू दोनों की गणना एक साथ हो जाएगी |

Excel Program Download Link Fully Automatic::🙈🙈

Excel Program Download Link Only By GA55::🙈🙈

Other Ded. Sheet Instruction (जो आप पर लागु है उसका अमाउंट भरिये)

- 01. मकान किराया भत्ता ( छूट जो लेनी है)

- 02. गृह सम्पति से प्राप्त किराया — आय

- 03. गृहकर

- 04. सरकारी पेंशन योजना में कर्मचारी का अंशदान अधिकतम वेतन का 10% धारा 80 CCD(1)

- 05. Covid — 19 (धारा 80G)

- 06. गृह ऋण किस्त मूल (जो वेतन से नहीं काटा गया)

- 07. गृह ऋण किस्त ब्याज (जो वेतन से नहीं काटा गया)

- 08. LIC जीवन बीमा प्रीमियम (जो वेतन से नही काटा गया)

- 09. PLI (पी.एल.आई.)

- 10. टयूशन फीस

- 11. PPF (लोक भविष्य निधि)

- 12. सुकन्या समृद्धि योजना

- 13. यू. एल. आई. पी./वार्षिक प्लान

- 14. NSS (राष्ट्रीय बचत स्कीम)

- 15. NSC (राष्ट्रीय बचत पत्र)

- 16. राष्ट्रीय बचत पत्र पर ब्याज

- 17. बचत खाते की जमा राशि पर प्राप्त ब्याज

- 18. इक्विटी लिंक सेविंग स्कीम

- 19. Defferred Annuty (स्थगित वार्षिकी)

- 20. मनोरंजन भता धारा 16 (II) के अन्तर्गत

- 21. व्यवयाय कर धारा 16 (III) के अन्तगर्त

- 22. एफडी आदि अन्य जमा राशि पर प्राप्त कुल ब्याज (पीपीएफ को छोड़कर)

- 23. अन्य विभिन्न स्त्रो़त्र (ब्याज के अलावा) से कुल आय

- 24. धारा 80 सी के अन्तर्गत अन्य मद में जमा करायी गयी राशि

- 25. धारा 80 CCC पेंशन प्लान हेतु अंशदान (एन.पी.एस. के अलावा)

- 26. धारा 80CCD (1B) नवीन पेंशन योजना में अतिरिक्त अंशदान (अधिकतम रू. 50,000)

- 27. धारा 80D चिकित्सा बीमा प्रीमियम (सामान्य 25000, वरिष्ठ नागरिक 50000)

- 28. धारा 80DD विकलांग आश्रितों के चिकित्सा उपचार(अधिकतम 75000, 80% विकलांगता 125000)

- 29. धारा 80DDB विशिष्ट रोगों के उपचार हेतु कटौती (सामान्य 40000, वरिष्ठ नागरिक 1 लाख)

- 30. धारा 80E उच्च शिक्षा हेतु लिए ऋण का ब्याज

- 31. धारा 80U स्थाई शारीरिक विकलांगता (अधिकतम 75000ए 80% विकलांगता 125000)

- 32. धारा 80GGA अनुमोदित वैज्ञानिक,सामाजिक,ग्रामीण विकास हेतु दिया गया दान

- 33. राहत धारा 89 के अन्तर्गत

- 34. वेतन बिल के अलावा जमा कराया गया आयकर (TDS)

- 35. धारा 10(14) के अन्तर्गत भत्ते जो करमुक्त है

- 36. धारा 80G धर्मार्थ संस्थाओं आदि को दिये दान (क श्रेणी 100% एवं ख श्रेणी 50%)

NEW TAX SLAB RATES INTRODUCED IN BUDGET 2020:

- — No Income Tax on Income between Rs. 0 to Rs. 2.5 lacs

- — 5% Tax on Income between Rs. 2.5 lacs to Rs. 5 lacs

- — 10% Tax on Income between Rs. 5 lacs to Rs. 7.5 lacs

- — 15% Tax on Income between Rs. 7.5 lacs to Rs. 10 lacs

- — 20% Tax on Income between Rs. 10 lacs to Rs. 12.5 lacs

- — 25% Tax on Income between Rs. 12.5 lacs to Rs. 15 lacs

- — 30% Tax on Income above Rs. 15 lacs

OLD TAX SLAB RATES (STILL APPLICABLE:

- — No Income Tax on Income between Rs. 0 to Rs. 2.5 lacs

- — 5% Tax on Income between Rs. 2.5 lacs to Rs. 5 lacs

- — 20% Tax on Income between Rs. 5 lacs to Rs. 10 lacs

- — 30% Tax on Income above Rs. 10 lacs

How To Calculate Income Tax FY 2021-22 EXAMPLES, New Income Tax Calculation FY 2021-22, आयकर गणना प्रपत्र कैसे भरे, आयकर गणना प्रपत्र FY 2021-22, आयकर गणना प्रपत्र वित्तिय वर्ष 2021-22, Income Tax Calculation FY 2021-22, Old Tax Regime, New Tax Regime, Income Tax Calculation 2021-22, How to fill income tax calculate form in aaykar, Aaykar ganana praptra kaise bhare, Vetan draw form 2021-22, Income tax calculation 2021, Vetan draw kaise bhare, How To Calculate Income Tax FY 2021-22, New Tax Slabs & Rebate, Income Tax Calculation 2021-22

For any Problem You can contact-