Excel for Microsoft 365 Excel for Microsoft 365 for Mac Excel for the web More…Less

Creating a budgeting plan for your household can feel overwhelming and hard, but Excel can help you get organized and on track with a variety of free and premium budgeting templates.

Get a lay of the land

The purpose of a household budget is to summarize what you earn against what you spend to help you plan for long and short-term goals. Using a budgeting spreadsheet can help make your financial health a priority by keeping spending in check and savings on the rise!

DIY with the Personal budget template

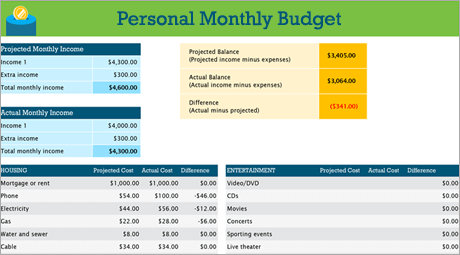

Prefer to do things yourself? This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any projected surpluses. Compare projected costs with actual costs to hone your budgeting skills over time.

> Get this personal budget template

Tip:

Track monthly expenses

Utilities, credit cards, and insurance are billed monthly, so the easiest way to keep an eye on expenses is to determine how much you spend on a monthly basis.

Don’t forget the «extras»

Beyond your electric bill, do you have a movie or game subscription? What about a gym membership? Be sure to keep track of those, too.

Tip:

Pay attention to variable expenses

While gas and phone bills generally don’t vary in amount month over month, other expenses, such as dining out or clothes shopping, can vary wildly.

Categorize expenses

Now that you have an overall idea of monthly expenses, it’s time to categorize them so you can review your fixed, variable, and discretionary expenses.

Fixed expenses

Fixed expenses stay the same amount month to month. Examples include a mortgage or rent, health insurance, a car payment, or house taxes. You can capture all of these in a «fixed expenses» category.

Tip:

Variable expenses

You can’t do without variable expenses, but they can fluctuate from month to month. Such expenses include groceries, car maintenance, electricity, and water usage.

Discretionary expenses

Discretionary expenses can vary wildly from one month to the next. Examples include dining out, streaming service subscriptions, a club membership, cable, and clothing.

Set your goals

Once you have a good idea of how much money is coming in versus what you’re spending, you can start prioritizing for your short and long term goals.

Budget a home remodel

Is your washing machine on the fritz? Are your cabinets getting shabby? Master bath need an upgrade? Remodeling your home can present many contingencies. Remember to include these expenses as you look at your financial goals.

> Home construction budget

Tip:

Keep your wedding options open

Consistent review of your finances helps you figure out if you’ve saved enough to purchase an item that’s essential or just «nice to have.» Do you need that rose archway for your wedding procession or just really want one? Either way, be sure to track this against your goals.

> Floral wedding budget

Plan for fun at college

If you stick to fixed expenses, you can get to your short and long term goals more quickly. But, you can also include a certain amount in your monthly budget for fun and entertainment — a variable expense you certainly might want to track while attending college.

> Monthly college budget

See Also

Other budget templates

LinkedIn Learning: Create a simple budget in Excel

Need more help?

Want more options?

Explore subscription benefits, browse training courses, learn how to secure your device, and more.

Communities help you ask and answer questions, give feedback, and hear from experts with rich knowledge.

All the Vertex42™ budget templates can be downloaded for personal use and no charge. We hope that they will be helpful to you! The templates featured below also work with OpenOffice and Google Spreadsheets, so if you don’t own a version of Microsoft Excel®, the only thing stopping you from making a budget is the time to download and the determination to get your finances under control.

Advertisement

1

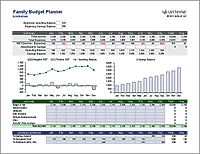

Family Budget Planner ▶

Family Budget Planner ▶

A yearly budget planner with more categories including child care and other family expenses.

3

Vertex42® Money Manager ▶

Vertex42® Money Manager ▶

Record daily transactions just like you would with Quicken or Microsoft Money. The budget report updates automatically based on your transaction history.

8

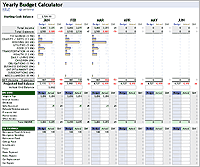

Budget Calculator ▶

Budget Calculator ▶

Combines a yearly budget planner with monthly calculations and graphs. Shows budget vs. actual for each of 12 months within a single worksheet.

9

Business Budget ▶

Business Budget ▶

Contains two worksheets for creating a yearly business budget — for service providers or companies producing and selling goods.

10

Project Budget ▶

Project Budget ▶

Three different worksheets for simple to complex projects, including a version based on the project work breakdown structure (WBS). Calculate the budget amount for each task based on labor rates, material costs, and other fixed costs.

11

Bill Tracker Worksheet ▶

Bill Tracker Worksheet ▶

Keep track of your monthly bill payments using this printable worksheet. Record amounts for variable bills.

14

Home Budget Worksheet ▶

Home Budget Worksheet ▶

Create a simple yearly home budget, with expenses divided into deductible and non-deductible categories.

15

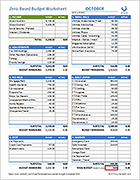

Zero Based Budget Worksheet ▶

Zero Based Budget Worksheet ▶

Use this spreadsheet to help you create a monthly budget where every dollar of income is planned to go to savings or expenses.

18

Account Register Template ▶

Account Register Template ▶

Track multiple accounts within a single account register. For example, divide a savings account into virtual sub-accounts for tracking specific goals.

19

Credit Account Register ▶

Credit Account Register ▶

Keep track of your credit card transactions, fees and payments with this free account register template.

20

Checkbook Register ▶

Checkbook Register ▶

A very simple method for recording transactions for a checkbook, savings account, or credit card account.

21

Savings Goal Tracker ▶

Savings Goal Tracker ▶

Keep track of how your savings is allocated. Track the progress of your goals. Ideal for people who budget.

22

Money Tracker ▶

Money Tracker ▶

Track your cash, checking, credit, and savings in Excel on your mobile phone.

Budget Templates For Special Occasions

23

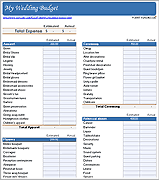

Wedding Budget ▶

Wedding Budget ▶

Includes a budget estimator worksheet as well as a detailed list of categories specifically for weddings.

24

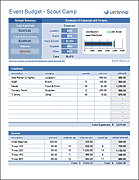

Event Budget ▶

Event Budget ▶

Create a budget for a camp, reunion, seminar, party, or other event. Record expenses and sources of income.

25

Expense Tracker ▶

Expense Tracker ▶

Provides a way to track expenses for projects like home improvements or for events such as parties or seminars.

27

Donation Tracker ▶

Donation Tracker ▶

Track a fundraising campaign using a simple donation log and pivot tables. Includes a thermometer chart for showing progress.

29

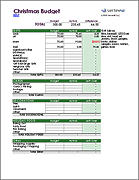

Christmas Budget ▶

Christmas Budget ▶

Keep track of your budget for Christmas gifts and other holiday spending.

Related Templates

30

Cash Envelope Register (Short) ▶

Cash Envelope Register (Short) ▶

Print simple registers to insert into your cash envelopes for tracking your budget. This version is roughly the size of US currency.

31

Price Comparison Template ▶

Price Comparison Template ▶

Compare prices for multiple items from different vendors or stores. Useful for both business and personal purposes.

Follow Us On …

Browse Template Categories

With thousands of free Excel budget templates available across the internet, it can be difficult to find the perfect spreadsheet for your needs.

- You have to evaluate the quality of the template. (Does it work?)

- Do you need a weekly budget, monthly budget, or a family budget? And what’s the difference?

- Is it compatible with your preferred version of Excel? (Google Sheets has far fewer templates than Excel, but since it’s always been cloud-based, compatibility isn’t such an issue.)

Readers often ask Tiller for recommendations for Excel spreadsheet templates. So we rounded up the best free personal and family Excel budget spreadsheets around the web.

Leave a comment if you’d like us to consider including a template you designed or enjoy using!

Spreadsheets bring all other financial tools together.

In the roundup below, you might be surprised to see sites sometimes considered competitors to Tiller (like Mint.)

However, while we believe spreadsheets remain the ultimate control center for total financial engagement, we also appreciate the utility of other apps and services to help out along the financial journey.

For example, you might use Mint to check your credit score. But you also use an Excel spreadsheet to manage your household spending with your spouse, track your total net worth, or run detailed reports about your cash flow.

We want to call out the free Automated Budget Spreadsheet in Excel from Young Adult Money. It was designed to work with Tiller, but even without a Tiller subscription, this budget is elegant and fun to use.

Free Weekly Excel Budget Templates

- Weekly Budget Planner from Vertex42 – Contrary to the name, you can use this template to create a weekly, bi-weekly, or monthly budget. With only one page, the template is simple while still managing to display all the information you need to remain informed about your money.

- Weekly/Bi-weekly Budget from Spreadsheet123 – This template allows you to budget either weekly or bi-weekly, making it easy for you to budget according to your pay schedule. With minimal cell reference and an intuitive design, it’s difficult to accidentally break, which is especially helpful if you’re new to spreadsheets.

- Weekly Budget Template by Smartsheet – As the name suggests, this budget tracks income and expenses by week; however, you can keep adding week columns in order to create a monthly or yearly budget.

Free Monthly Budget Template

- Monthly Budgeting Sheet by My Stay at Home Adventures – This template for monthly budgeters is very simple, yet visually appealing. With one quick glance, you can see if your actual spending lines up with the amount you budgeted. It’s a great option for beginners who may be intimidated by spreadsheet budgeting.

- Monthly Budget Spreadsheet by Money Under 30 – This monthly budget has a page for each month which breaks down your daily spending by category. It also has a summary page with a snapshot of your debt and savings.

- Budget by Words of Williams – This budget for beginners comes with a video tutorial to help you get started. The template is color coordinated to indicate which categories are paid for with cash–if you’re using the envelope method–or with budgeted savings–if you’re saving up for an expense over time.

Yearly Excel Budget Template

- Yearly Budget Calculator by Vertex42 – If you’re looking for a comprehensive yearly budget, this is the one for you. It breaks down your income by source and your expenses by category and tracks budgeted vs. actual amounts. It also features a robust section for savings goals.

- Personal Budget Planner Template by Budget Templates – This yearly budget template is as simple as it gets, but it contains all the information you need for a yearly financial check-up. Spreadsheet nerd bonus: it has sparklines to show you yearly spending trends by category.

Multi-period Budget Excel Budget Template

- Money Management Template from Vertex42 – This template has everything. You can create a user-friendly budget by category and subcategory and utilize summaries of both your monthly and your yearly budget progress.

- Family Budget Planner by Spreadsheet123 – Whether you’re single or have a bunch of littles running around, this template is comprehensive. You’ll log your income and expenses on a monthly basis. As you go through the year, the template autogenerates big-picture views of your personal finances by quarter and for the entire year, complete with charts and graphs.

- Personal Budget Template by Smartsheet – This simple budget shows income and expenses by month and for the entire year.

Free Family Excel Budget Template

- Family Budget Planner from Vertex42 – This template gives you a broad view of your finances over an entire year. As the name suggests, it utilizes categories that will resonate with families, such as child and education expenses. It also has a section for tracking long-term savings goals, such as college savings and retirement.

- Household Budget Worksheet by Budget Templates – This simple family budget has a comprehensive list of prefilled income and expense categories. It also has a section for unbudgeted expenses, such as automotive emergencies or appliance repairs.

- CFO Worksheet from Black Family Finances – Run a family and a business? This cash-flow optimizer is a great spreadsheet to keep track of your big-picture finances. You’ll log your income and expenses as normal, and the template will use those numbers to calculate things like your DTI ratio, housing expense ratio, and credit repayment ratio, presenting the important metrics to you on the very first page.

- Home Budget Worksheet by Vertex42 – This versatile budget template is the only one on the list that breaks down expenses into deductible and non-deductible. If you’re a freelancer or a have a side hustle, this is a great budget to track both your income and expenses from regular employment and self-employment.

- Household Shopping List – An editable and printable household shopping list from SavvySpreadsheets.com

Student Excel Budget Template

- Student Budget Template by Mint – This template was designed for college students to track both their monthly income and expenses and their semester income and expenses to ensure they have funds to cover both personal and educational expenses.

- Money Tracker from Vertex42 – The money tracker template was designed specifically to be used on your phone with the Microsoft Excel mobile app. The creator intended it for older children learning to manage their money, so it tracks cash, bank accounts, credit cards, and savings accounts in an easy-to-use interface.

Special Occasion Excel Budget Template

- Travel Budget Worksheet by Vertex42 – Travel can derail a budget, so it’s important to track all your anticipated expenses. With this travel budget, you can plan for everything from your flight to entertainment at your destination and see a handy breakdown of your expenses by category.

- Wedding Budget by Vertex42 – Weddings can be incredibly expensive. Newlyweds don’t want to enter a marriage in massive debt from their wedding, so creating a budget is essential. This template features a wedding budget estimator to help you plan your total available budget as well as your budget by category. Then you can track your budgeted vs. actual expenses to make sure you stay on track.

- Check out our favorite wedding budget templates. Some of them are for Excel, while others are Google Sheets.

Other Free Excel Budgets

- Zero-Based Budgeting Template by Enemy of Debt – This is a complex template based on Dave Ramsey’s budgeting and Baby Steps system. The creator also designed it to work well with the envelope system.

- Cash-Flow Budget from It’s Your Money – This is another budget inspired by Dave Ramsey, but with a simple, easy-to-use layout.

- Money Manager Template by Smartsheet – If you enjoy balancing your checkbook or closely monitoring your cashflow, you will love this template which is a combination budget and ledger.

- Retirement Budget Template by Smartsheet – This template helps you plan the income you’ll need during retirement based on your anticipated expenses. It works best in conjunction with your current monthly or yearly budget since you’ll want to use your actual expenses to plan your future expenses.

There are many reasons you would want to keep a household budget. Setting a budget allows you to control spending and save more money. A budget should give you an accurate picture of what you are earning and what you are spending. Knowing what you can afford is critical if you want to stay out of debt. Keeping a household budget will really help you with that.

Microsoft Excel is an amazing tool often used to keep track of budgets both in the workplace and at home. With the built-in templates provided by Microsoft, creating a household budget in Excel can be done with ease. Before you take this on, some basic knowledge of Excel would be preferable, but it is not a necessity.

The household budget template in Excel is easy to set up and it helps you to quickly create and track your budget plan. By using a template, it saves you time trying to work out what is included in a household budget.

In this article you are going to learn, step by step how to set up, manage and edit the monthly household budget template in Excel.

What we will cover in this article:

How to Open Household monthly budget Excel template

Budget Overview

Projected Income

Actual Income

Monthly Expenses

Projected Costs

Actual Costs

Reports

Budget Overview

Budget Summary

Monthly Expenses

Additional Data.

Adding Expenses and Categories

Saving your file.

Tips for keeping this household budget

How to Open Household monthly budget Excel template

Open a new instance of Excel and select New

In the search bar search for Household budget. You will find a template named Household Monthly Budget

Select the Household monthly budget template and select create.

The household monthly budget in Excel template will download and open. The template contains 4 worksheets and we will look at each one of these in detail as we move though the article.

Budget Overview

Budget Overview sheet allows you compare your actual spend and savings against your budget. Don’t panic just yet! I know it looks a lot. We only have a few small details to complete on this page as most of the work is automatic. All we must do is complete the Income section, both Projected and Actual.

Projected Income

Projected income is all the cash you expect to take home during the month. For example, a household has two earners. The higher earner expects to take home $6000 during the month and the lower earner expects to take home $1000. You can see in the projected field for income 1 we have $6000 and for income 2 we have $1000 representing this.

We complete these values at the start of the month.

If your household only has one income, you can leave the content of income 2 blank. If you are expecting other income, such as child support, rental income or any other cash income, this goes into the Extra income projection cell.

Once you have entered these 3 values, the Total income will automatically calculate.

Actual Income

Only when the actual amounts have been paid to you, can you then enter them into the actual fields. Very often the actual will not be the same as the projected. Working hours might change, or sick days can happen. There are many reasons why the projected will not be the same as the actual.

Monthly Expenses

We are going to skip to the third worksheet in the Household budget template now. Monthly Expenses. On this sheet we need to enter all our outgoings. Our household expenses. Everything from loans to Food. You need to enter every cent you plan on spending during the month to this sheet. Leaving out any expected expenditure will give you an inaccurate budget.

The monthly expenses sheet has been prefilled with many different expense types within different categories. For example, we have a Description of Extracurricular Activities, and this is in the category Children. We will look at adding and amending some of these Descriptions and Categories in a few minutes but for the moment lets work on completing this sheet.

Projected Costs

For each item on the expenses sheet you need to complete the Projected cost. This is the amount you expect to spend in the month. This will be your spending budget that you want to try and stick to. For some expenses you will know the exact amount as there is a fixed charge. When you don’t know the amount, you can use the average that you have spent over the last few months.

Scroll down the page and make sure you fill in all the Projected costs that you have. You might find there are some expenses on the template that do not apply to you. You can ignore these. If there are expenses you want to include that are not on the template, we will cover that later.

When you have completed the projected costs, you need to ensure that you are not overspending. It would be nice to put in an entertainment budget of $1000 but just because you enter it, does not mean you can actually afford it.

Return to the first worksheet, Budget Overview. By keeping an eye on the Balances, we can ensure we are not overspending on our household budget.

We need to ensure the projected balance value is a positive value. If there is a minus value here, you are overspending. You must revisit the Monthly Expenses sheet. Review all your expenses and where you can, make some reductions. First start with expenses that are not a necessity. Continue to reduce expenses until the project balance is a positive figure.

Actual Costs

To complete the household budget, we need to also complete the actual expenses. This can only be done when the expense happens. When you make the payment. Bills may vary month to month. You might decide not to get your nails done, or you could get a voucher for your birthday and use that to pay for those jeans you want! There are many reasons the actual expense won’t be the same as the budget or projected expense.

Reports

As we enter our actual income and expenses, we can keep an eye on the reports to make sure we are staying within budget. This household budget template provides a lot of useful information that you can take action on.

Budget Overview

The key values to keep an eye on here are the Balances.

The Projected Balance we looked at earlier. This takes the projected income, and the budget expenses and lets you know how much is left at the end.

The Actual Balance shows us the Actual income less the actual expenses.

The difference shows us how much more, or less we ended up with against our projections. A great household budget will keep this difference to a minimum.

At the bottom of this page you will see a chart. This shows the actual money you spent by category. The chart makes it really easy for you to see what categories you are spending the most on.

Budget Summary

The Budget Summary worksheet is an interactive report that allows you view details of your expenses. It compares budget against actual and is easy to use. It allows you quickly see where you have overspent as the difference column will appear red to let you know you have gone over budget.

If you keep the expenses sheet up to date during the month by added expenses as they happen, on the budget summary sheet, you can use the difference column to foresee any possible problems. If something has gone red before the month is over, you might have time to save costs elsewhere. That way you can keep your overall budget on track.

Monthly Expenses

The monthly expense sheet allows you see if you are within budget as you enter the actual costs. The difference column will show up red if you are going over budget. If this happens you can try and stay under budget on other items such as luxury goods.

The Actual cost overview bar gives you an idea how much of the overall spend each item contributes.

Additional Data

The additional data sheet contains two tables. The Pivottable for Budget Chart shows the total of the actual costs by category.

The second table is a category list. If you need to add new categories for your expenses, the category would be added to this table, but we will cover that next.

Adding Expenses and Categories

Although this template is rather detailed, and it contains a lot of expenses and categories. There may be a case where you need to add expense that have not be included in the template.

Both the Category’s and the Expenses are included in Excel Tables. Excel tables are a special format that allows for other parts of the spreadsheet to automatically update. To add a new row to either the Category table or the Expenses table, you must to the last row in the table and the right most column. From there you press tab. This will create a new row in the table, and you can then enter your details.

Saving your file

It is a good idea to save your file with the month name. To save the file, in Excel go to File, and then Save as. Navigate to the folder you wish to save your file in and press ok.

Tips for keeping this household budget.

Before you start a budget, it is a good idea to get an idea of your income and expenses. Go back over the last few months and work out how much you spend and how much you earn. You can use the same template for this by entering the actual income and expenses into the template.

By looking back over a few previous months, you can then see where you are spending your money, what are necessary spends and what are not. This will make an awesome foundation for getting your home budget right.

The final tip is to keep your budget up to date. Add in the actual expenses as they happen. That way you can see if you are reaching your budget spend and need to slow down, or if you have surplus cash for that fun family activity

Simplify your budget with a template

Reaching your financial goals takes careful planning and saving—using the right tools is the first step to budgeting effectively. Simplify your monthly or weekly budgeting by using a free, customizable budget template. Monitor all of your home or business expenses accurately and decide what areas of your budget can be better managed. Whether you’re managing the office budget of a small business or need to track your personal expenses, using a template makes it easier to stay organized. By visualizing your expenses and financial goals, you’ll be able to see exactly where your money goes. Browse budget templates made for a range of uses, from regular monthly budgets to budgets focused on weddings, college, or saving for a home. You won’t need to worry about your calculating skills when you use a budget template—focus your energy on saving and let a template do the rest.With easy-to-use templates, you’ll save time and money year-round by creating beautiful custom cards. Focus on celebrating with your loved ones and let the template do the rest!