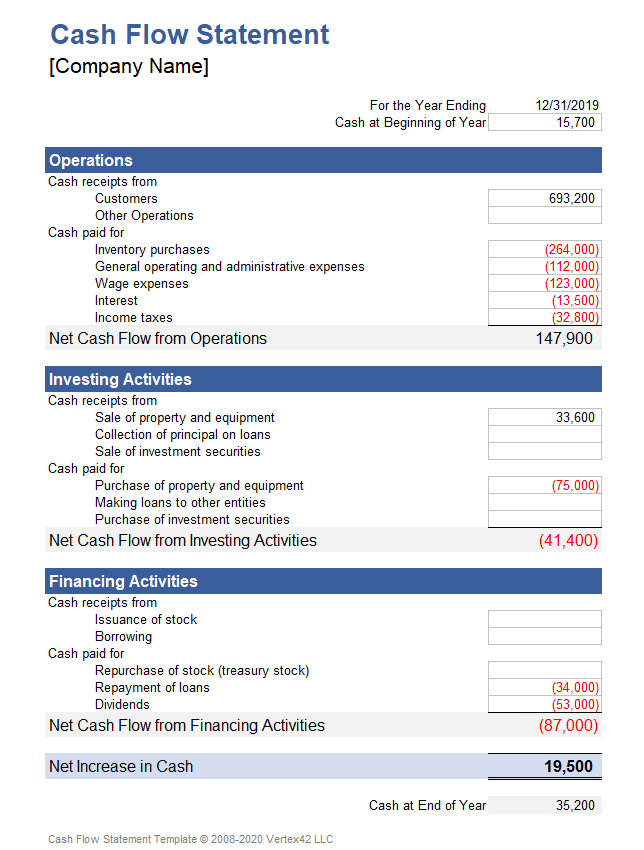

The Cash Flow Statement, or Statement of Cash Flows, summarizes a company’s inflow and outflow of cash, meaning where a business’s money came from (cash receipts) and where it went (cash paid). By «cash» we mean both physical currency and money in a checking account. The cash flow statement is a standard financial statement used along with the balance sheet and income statement. The statement usually breaks down the cash flow into three categories including Operating, Investing and Financing activities. A simplified and less formal statement might only show cash in and cash out along with the beginning and ending cash for each period.

Advertisement

To perform a cash flow analysis, you can compare the cash flow statement over multiple months or years. You can also use the cash flow analysis to prepare an estimate or plan for future cash flows (i.e. a cash flow budget). This is important because cash flow is about timing — making sure you have money on hand when you need it to pay expenses, buy inventory and other assets, and pay your employees.

A cash flow analysis is not the same as the business budget or profit and loss projection which are based on the Income Statement. However, for a small uncomplicated business operating mainly with cash instead of credit accounts, there may seem to be little difference.

for Excel, Google Sheets, and Spreadsheet.com

Description

This cash flow statement was designed for the small-business owner looking for an example of how to format a statement of cash flows. The categories can be customized to suit your company’s needs. If you don’t want to separate the «cash receipts from» and the «cash paid for» then you can just delete the rows containing those labels and reorder the cash flow item descriptions as needed.

The spreadsheet contains two worksheets for year-to-year and month-to-month cash flow analysis or cash flow projections.

Update 9/30/2021: You can now try the cash flow template in Spreadsheet.com which uses a set of categories based on common public stock financial statements.

Cash Flow Statement Essentials

Operating Activities

Operating activities make up the day-to-day business, like selling products, purchasing inventory, paying wages, and paying operating expenses. Perhaps the most important line of the cash flow statement is the Net Cash Flow from Operations. This section of the statement is associated with the Current Assets and Current Liabilities sections of the Balance Sheet, as well as the Revenue and Expenses section of the Income Statement.

Investing Activities

Investing activities include buying and selling assets like property and equipment, lending money to others and collecting the principal, and buying/selling investment securities. This section of the statement is associated with the Long-Term Assets section of the balance sheet.

Financing Activities

Financing activities include borrowing from creditors and repaying loans, issuing and repurchasing stock, and collecting money from owners/investors, and payment of cash dividends. This section of the statement is associated with the Long-Term Liabilities and Owners’/Stockholders’ Equity from the Balance Sheet.

I’m not going to try to explain how to prepare or analyze the cash flow statement other than to say that if you have the records of all the cash transactions, then the preparation can be done using the simple method of categorizing the receipts and payments into the three categories listed above. The indirect method can be used to create the statement of cash flows from the information in the balance sheet and income statement, but I’ll leave that explanation for the textbooks. For more information, see the references below.

References:

- Financial Accounting: Reporting and Analysis by M.A. Diamond, E. K. Slice, and J.D. Slice., 2000.

- Cash Flow Statement at wikipedia.org

Disclaimer: The information on this page is for illustrative and educational purposes only. The spreadsheet is provided as-is. We do not guarantee the results or the applicability to your financial situation. You should seek the advice of qualified professionals regarding financial decisions.

A cash flow statement, also referred to as a statement of cash flows, shows the flow of funds to and from a business, organization, or individual. It is often prepared using the indirect method of accounting to calculate net cash flows. The statement is useful for analyzing business performance, making projections about future cash flows, influencing business planning, and informing important decisions. The term “cash” refers to both income and expenditures and may include investments and assets that you can easily convert to cash. By conducting a cash flow analysis, a business can evaluate its liquidity and solvency, compare performance among accounting periods, identify cash flow drivers to support growth, and plan ahead to maintain a positive cash position.

Below you’ll find a collection of easy-to-use Excel templates for accounting and cash flow management, all of which are fully customizable and can be downloaded for free.

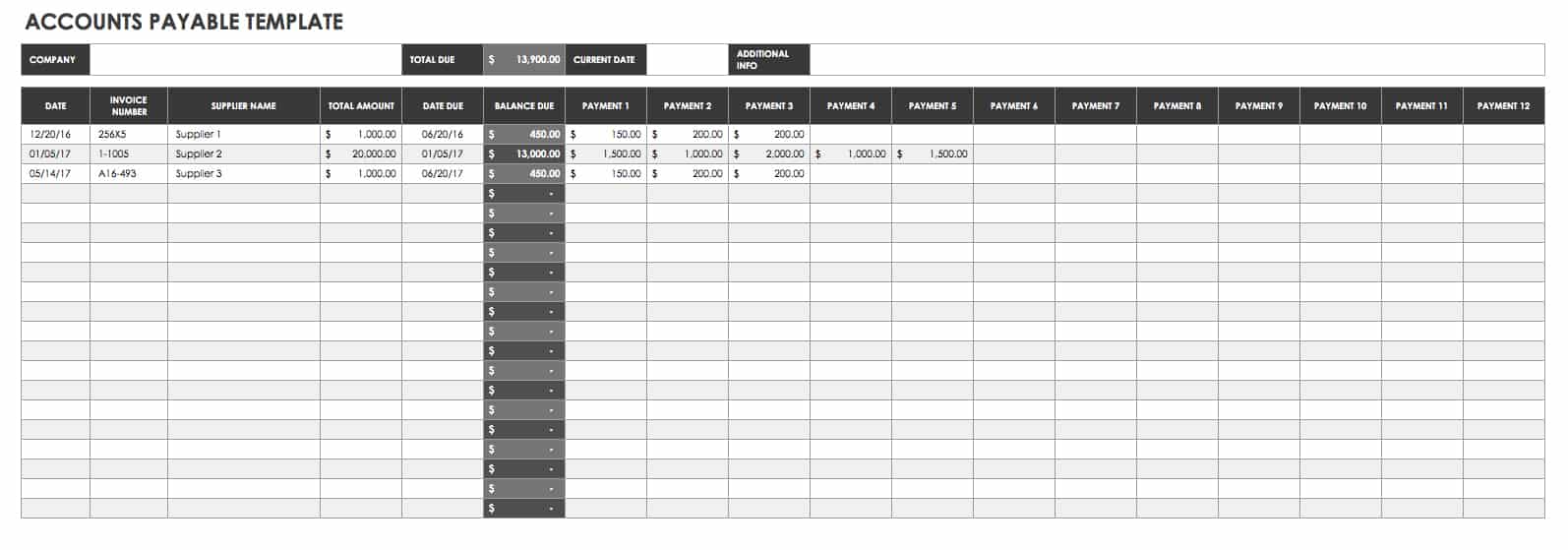

Accounts Payable Template

Download Accounts Payable Template

Excel | Smartsheet

This accounts payable template tracks suppliers, order numbers, and amounts due to help you manage payments and due dates. Easily organize ordering stock or supplies from multiple vendors with this template for greater efficiency and fewer errors.

Accounts Receivable Template

Download Accounts Receivable Template

Excel | Smartsheet

Don’t let balances owed to your business slip through the cracks. This template accounts receivable template lists customers, invoice tracking details, amounts due, and outstanding balances. Keeping track of these accounts can inform your collections process by helping you quickly identify which overdue payments have aged significantly.

Balance Sheet Template

Download Balance Sheet Template

Excel | Smartsheet

A balance sheet provides a summary of financial health in a single, brief report. With this balance sheet template, you can assess the financial standing of a business by examining assets, liabilities, and equity. Business owners can use it to evaluate performance and communicate with investors.

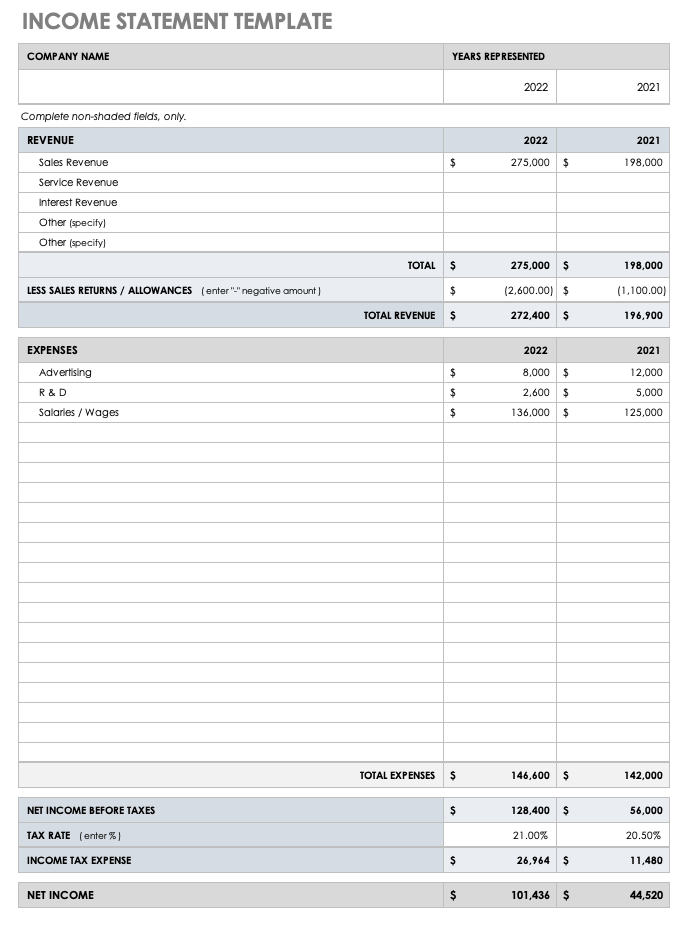

Income Statement Template

Download Income Statement Template

Excel | Smartsheet

Use this income statement template to assess profit and loss over a given time period. This template provides a clear outline of revenue and expenses along with net income figures. You can edit the template to match your needs by adding or removing detail, and create an income statement for a large or small business.

Simple Cash Flow Template

Download Simple Cash Flow Template

Excel | Smartsheet

This template works for any length of time and allows you to compare different periods for a quick analysis of cash flows. It include sections for an itemized list of revenue and expenditures, automatic calculations of totals and net cash flows, and a simple layout for ease of use. You can modify the template by adding or removing sections to tailor it to your business.

3-Year Cash Flow Statement Template

Download 3-Year Cash Flow Statement Template

Excel | Smartsheet

Use this statement of cash flows template to track and assess cash flows over a three-year period. The template is divided into sections for operations, investing, and financing activities. Simply enter the financial data for your business, and the template completes the calculations.

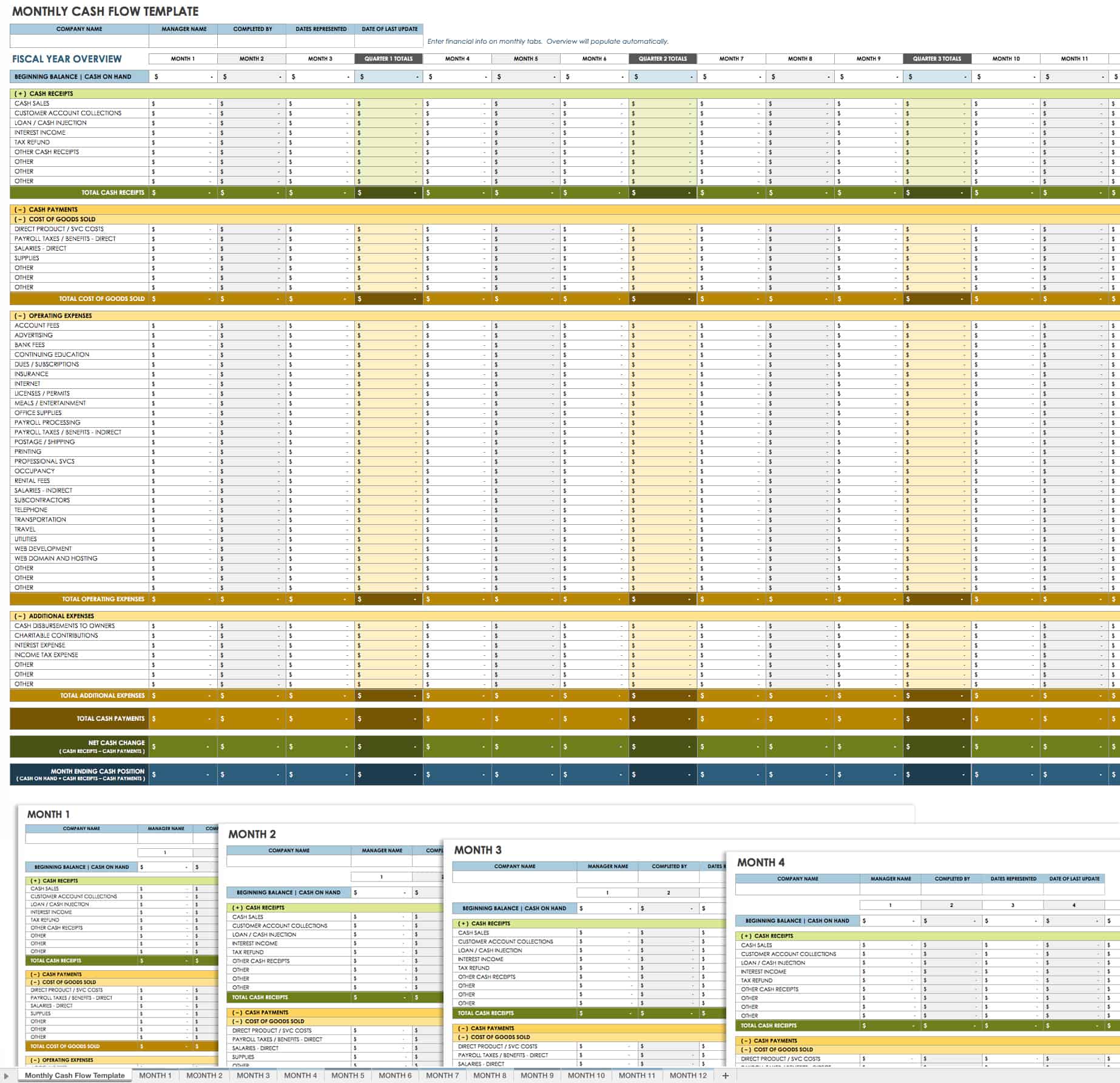

Monthly Cash Flow Template

Download Monthly Cash Flow Template

This comprehensive template offers an annual overview as well as monthly worksheets. Create a detailed monthly cash flow report to analyze performance or plan for the future. Each month has a separate sheet so that you can get a thorough picture of cash inflows and outflows for both short- and long-term periods.

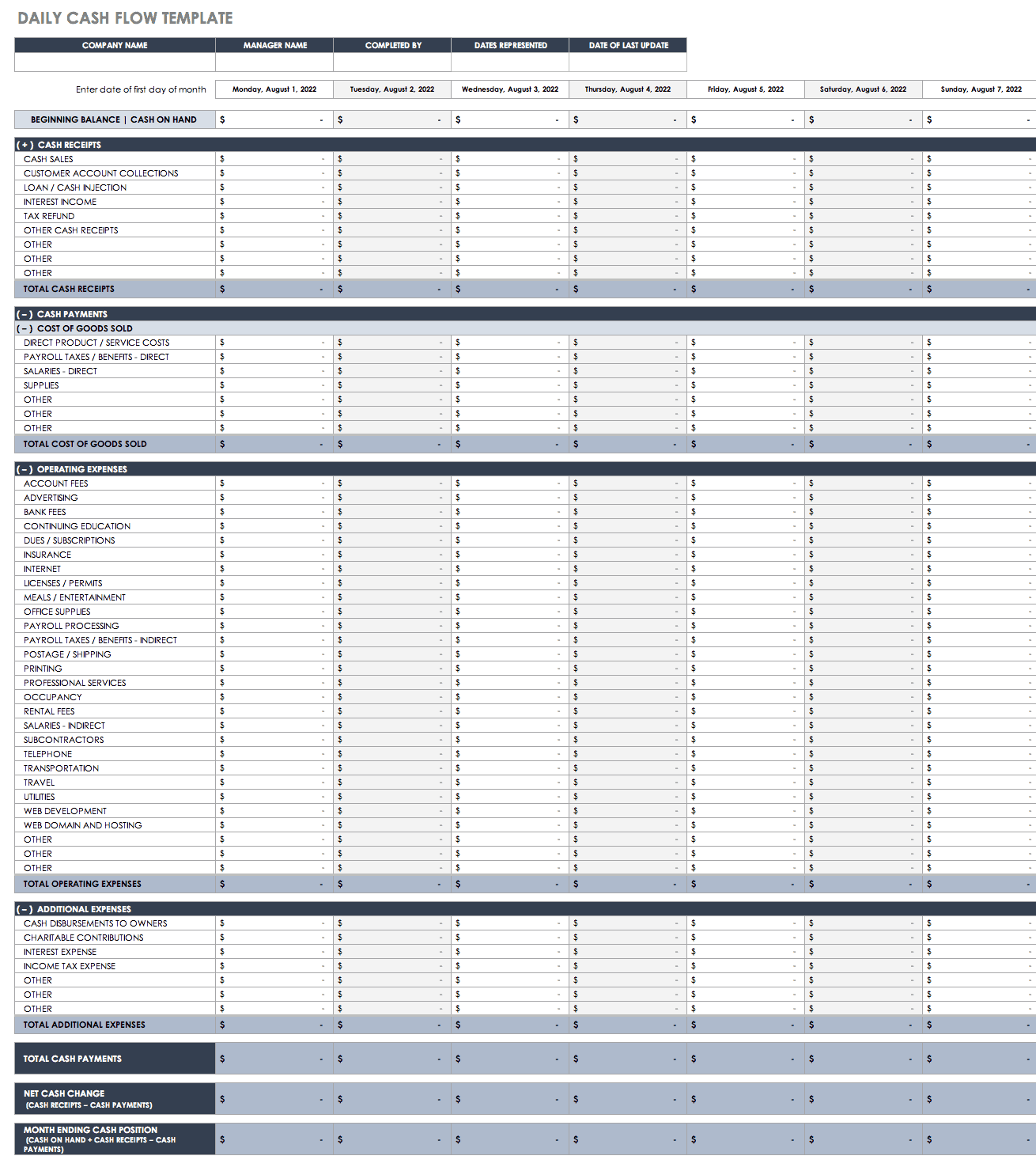

Daily Cash Flow Template

Download Daily Cash Flow Template

Add receipts and payments to this daily cash flow template to get a deep understanding of business performance. You can customize the list of cash inflows and outflows to match your company’s operations.

12-Month Cash Flow Forecast

Download 12-Month Cash Flow Forecast

Excel | Smartsheet

Use this template to create a cash flow forecast that allows you to compare projections with actual outcomes. This template is designed for easy planning, with a simple spreadsheet layout and alternating colors to highlight rows. You get a snapshot of cash flows over a 12-month period in a basic Excel template.

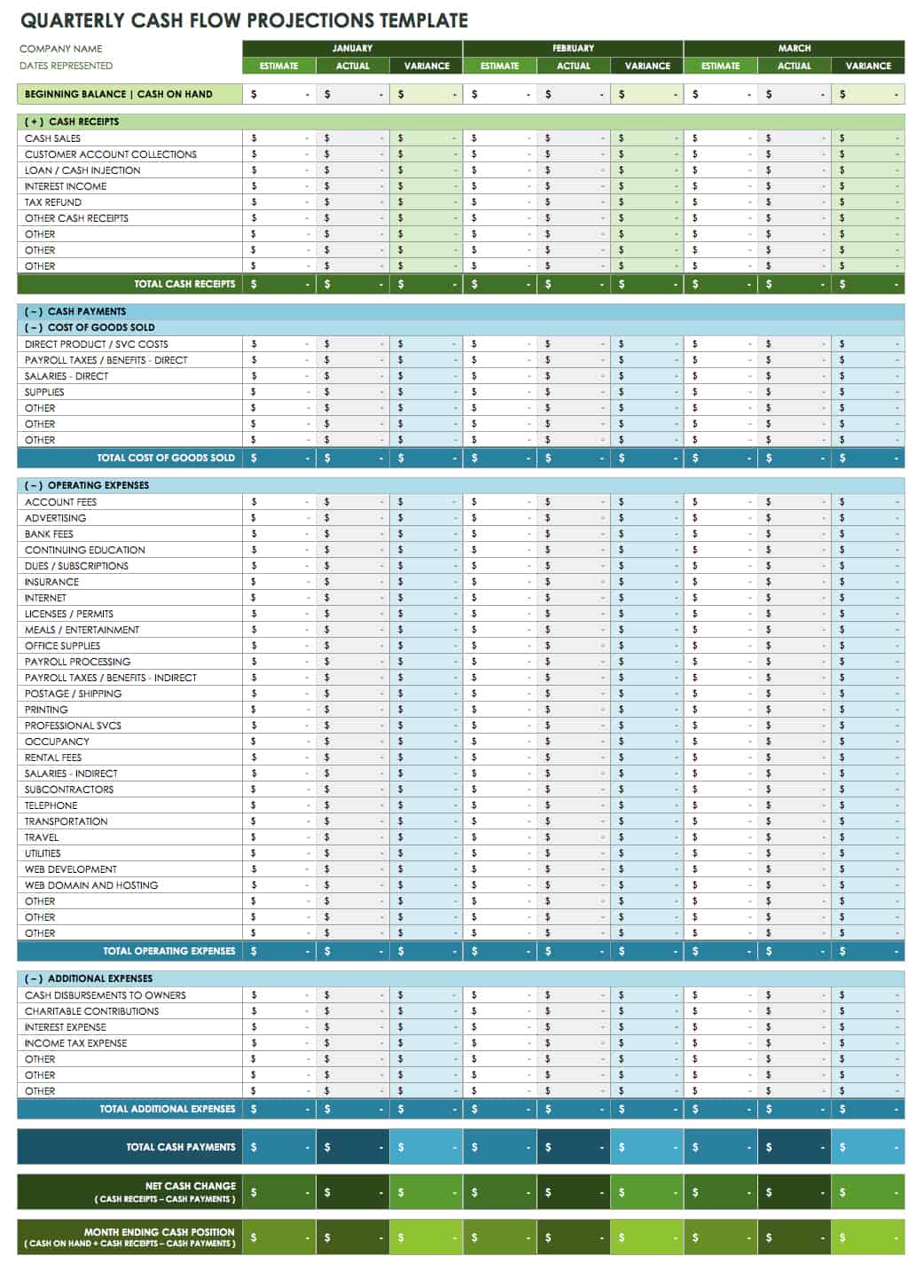

Quarterly Cash Flow Projections Template

Download Quarterly Cash Flow Projections Template

Cash flow projection templates can cover a variety of time frames, including the quarterly format offered here. Quarterly projections are useful for new businesses and those wanting to align cash flow projections with upcoming goals and business activities. Use the template to create projections and then compare the variance between estimated and actual cash flows.

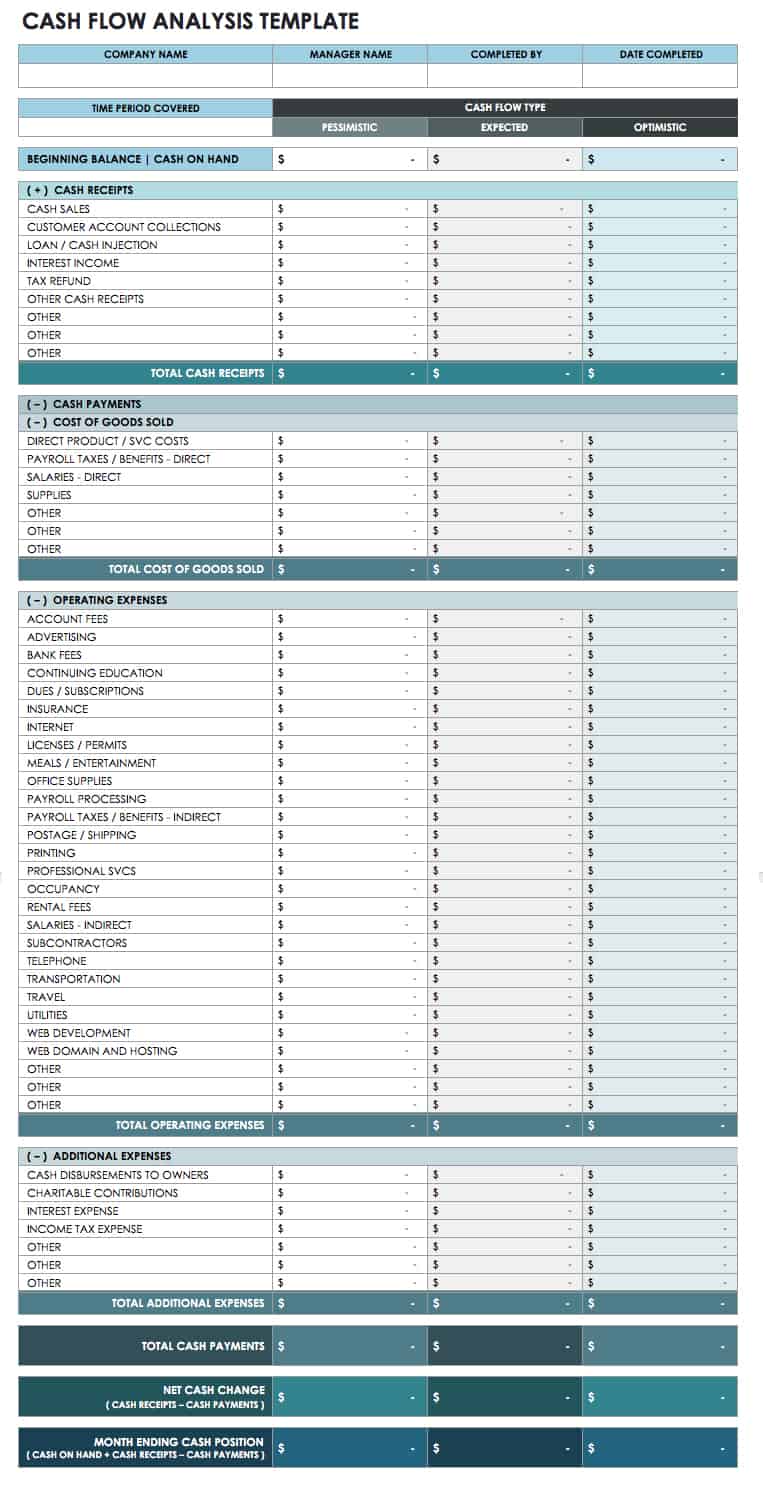

Cash Flow Analysis Template

Download Cash Flow Analysis Template

You can use this template to perform a cash flow sensitivity analysis in order to anticipate shortfalls and help your business maintain a positive cash position. This analysis can help you make more accurate cash flow predictions and inform your business decisions.

Discounted Cash Flow Template

Download Discounted Cash Flow Template

This template allows you to conduct a discounted cash flow analysis to help determine the value of a business or investment. Enter cash flow projections, select your discount rate, and the template calculates the present value estimates. This template is a useful tool for both investors and business owners.

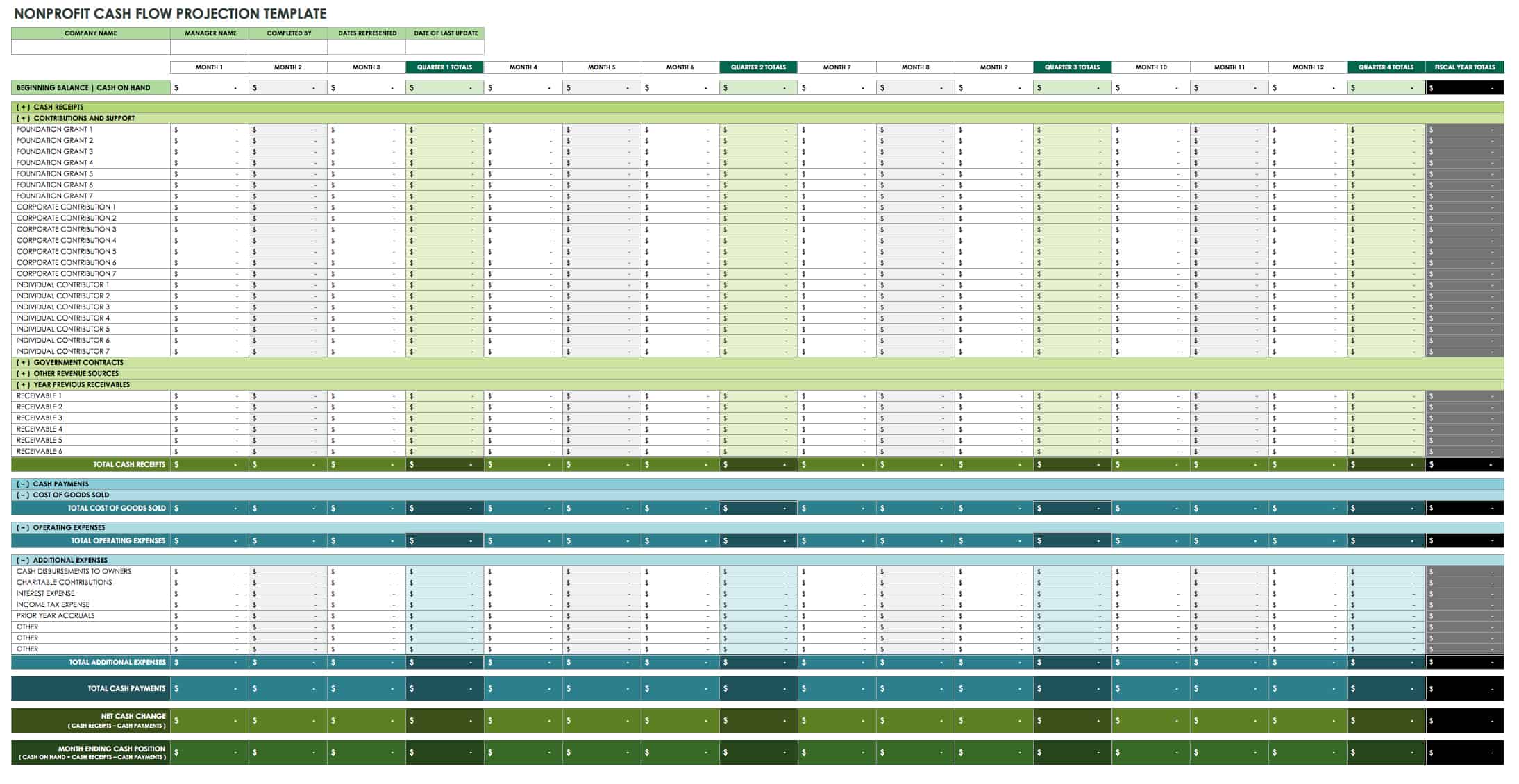

Nonprofit Cash Flow Projection Template

Download Nonprofit Cash Flow Projection Template

This template is designed with nonprofit organizations in mind and includes some common income sources, such as donations and grants, as well as expenditures. The template covers a 12-month period and makes it easy to see annual and monthly carryover so that you can track a rolling cash balance. Create a detailed list of all receipts and disbursements that are relevant to your organization.

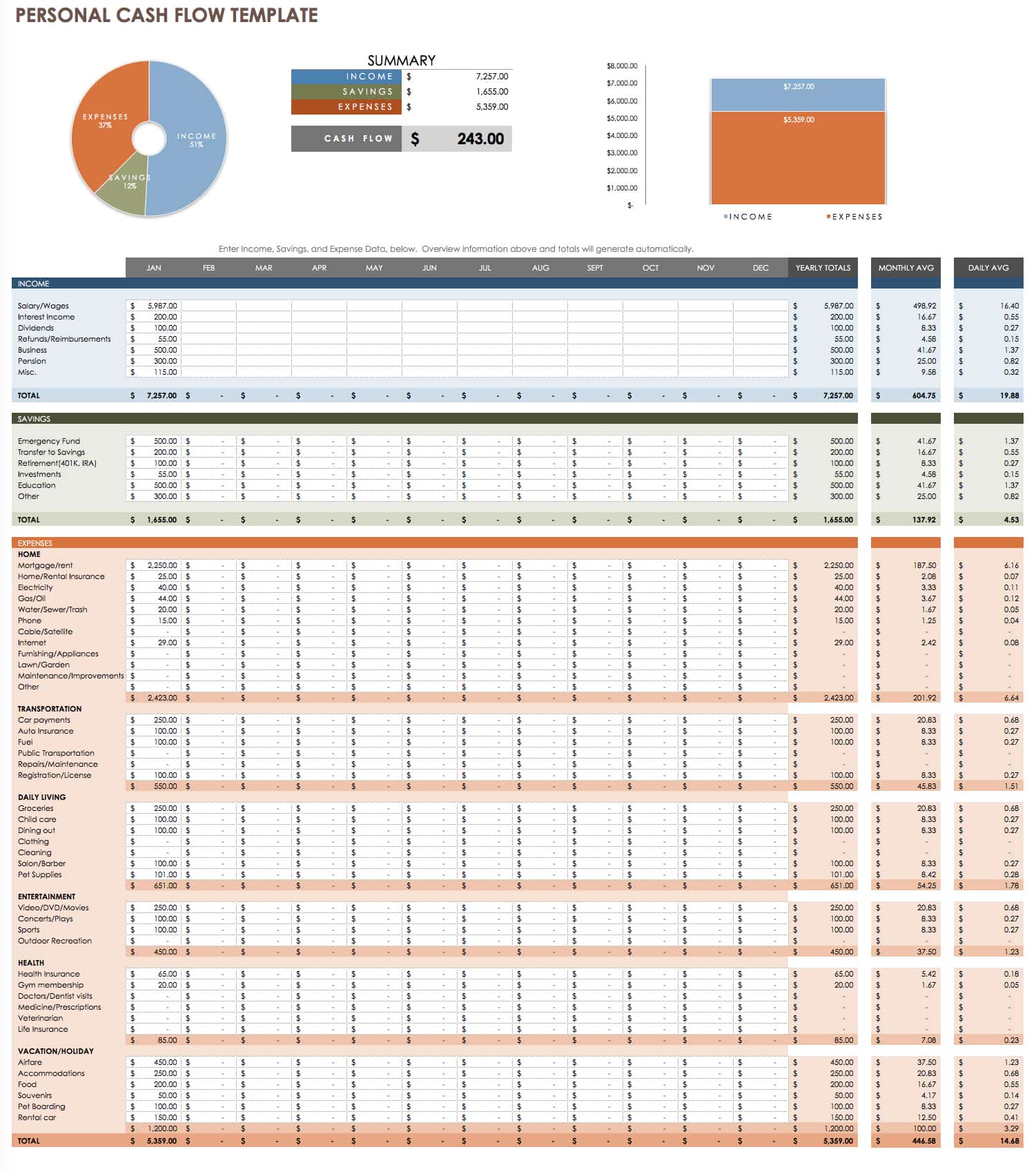

Personal Cash Flow Template

Download Personal Cash Flow Template

Individuals can manage their personal cash flow with this free template. The simple layout makes it easy to use and provides a financial overview at a glance. Keep track of how you are spending money to gain more control over your financial habits and outlook.

Trial Balance Worksheet

Download Trial Balance Worksheet

Excel | Smartsheet

Use this trial balance template to check your credit and debit balances at the end of a given accounting period, and to support your financial statements. The template shows ending balances for specific accounts, as well as total amounts for the activity period and the overall difference. This is a simple worksheet that you can customize to reflect your business type and the products or services it offers.

Excel Bookkeeping and Cash Flow Templates

To help you get started creating a cash flow statement or forecast, we’ve included a variety of customizable templates that you can download for free. Simply adjust your chosen template to fit your specific goals and the intended audience. Each template offers a clean, professional design and is intended to save you time, boost efficiency, and improve accuracy. Just enter your financial data, and the templates will perform automatic calculations for you to analyze. By combining your cash flow statement with a balance sheet, income statement, and other forms, you can manage cash flow and get a comprehensive understanding of business performance. Smartsheet offers additional Excel templates for financial management, including business budget templates.

Elements of a Cash Flow Statement

A cash flow statement is typically divided into the following sections to distinguish among different categories of cash flow:

- Operating Activities: Cash flows in this section will follow a company’s operating cycle for an accounting period and include things like sales receipts, merchandise purchases, salaries paid, and various operating expenses.

- Investing Activities: Some examples of investing activities include buying or selling assets, making loans and collecting payments, and generating cash inflows or outflows from other investments.

- Financing Activities: This section may include activities such as receiving money from creditors or shareholders, repaying loans and paying dividends, and selling company stock, as well as other activities that impact equity and long-term liabilities.

A statement of cash flows can summarize information for any accounting period, but if you’re starting a new business or planning for the months ahead, creating a cash flow projection can help you anticipate how much money your business will have coming in and going out during a future time frame.

Creating a Cash Flow Forecast

Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company’s performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. New businesses trying to secure a loan may also require a cash flow forecast.

In order to set yourself up for success, it’s imperative to be realistic when forecasting cash flows. You can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. For instance, knowing when your business will receive payments and when payments are due to outside vendors allows you to make more accurate assumptions about your final funds during an operating cycle. Estimated cash flows will always vary somewhat from actual performance, which is why it’s important to compare actual numbers to your projections on a monthly basis and update your cash flow forecast as necessary. It’s also wise to limit your forecast to a 12-month period for greater accuracy (and to save time). On a monthly basis, you can add another month to create a rolling, long-term projection.

A cash flow forecast may include the following sections:

- Operating Cash: The cash on hand that you have to work with at the start of a given period. For a monthly projection, this is the cash balance available at the start of a month.

- Revenue: Depending on the type of business, revenue may include estimated sales figures, tax refunds or grants, loan payments received or incoming fees. The revenue section covers the total sources of cash for each month.

- Expenses: Cash outflows may include your salary and other payroll costs, business loan payments, rent, asset purchases, and other expenditures.

- Net Cash Flow: The closing cash balance, which reveals whether you have excess funds or a deficit.

Keep in mind that while many costs are recurring, you also need to consider one-time costs. Additionally, you should plan for seasonal changes that could impact business performance, and upcoming promotional events that may boost sales. Depending on the size and complexity of your business, you may want to delegate the responsibility of creating a cash flow forecast to an accountant. However, small businesses can save time and money with a simple cash flow projections template.

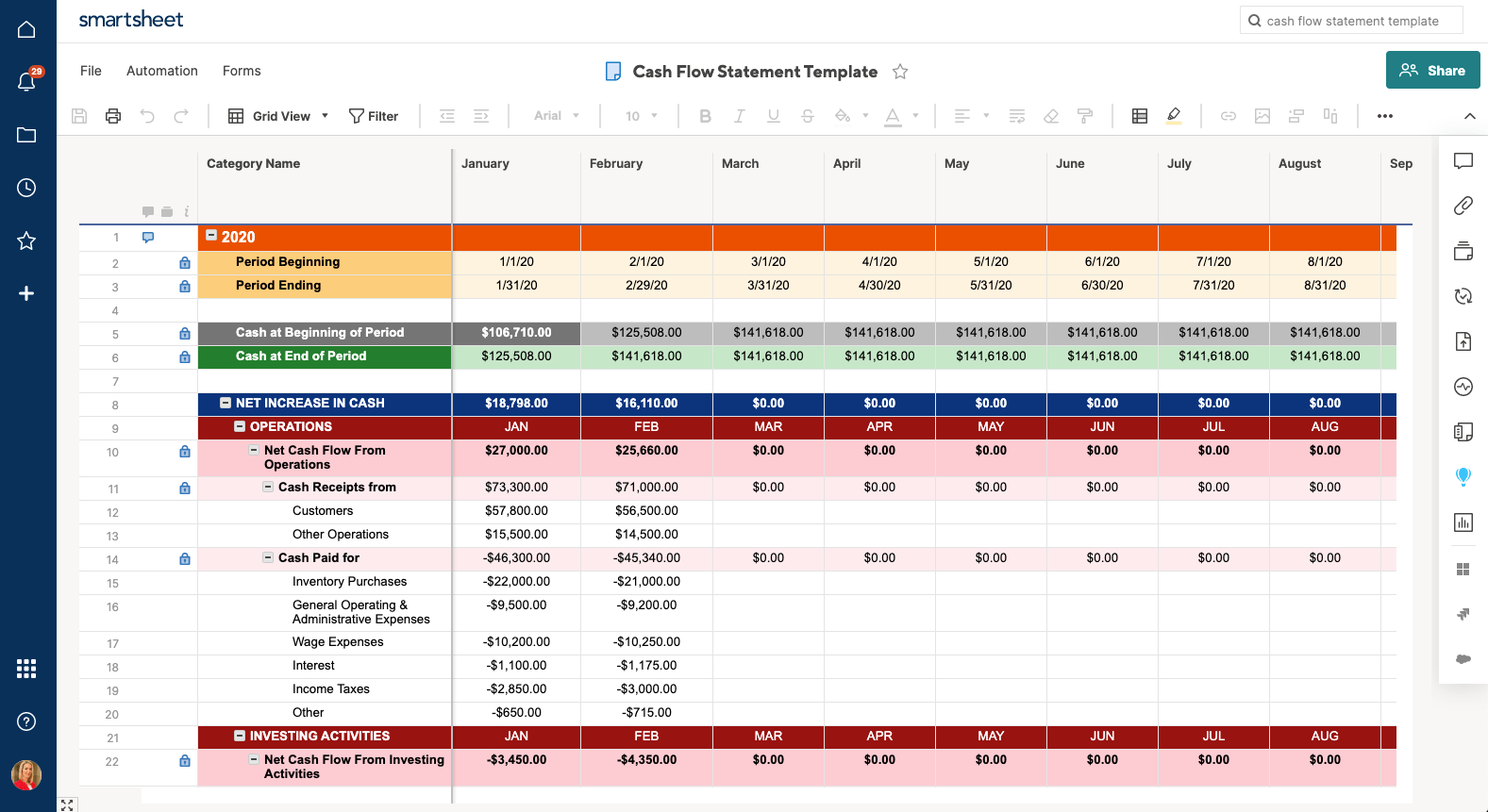

A More Collaborative Cash Flow Statement Template in Smartsheet

Using a template is essential to helping you get started managing your organization’s financials quickly. But, creating and managing your cash flow statement may require multiple stakeholders to weigh in and make updates. That’s why it’s important to find a template with more advanced functionality like notifications and reminders and enhanced collaboration features to ensure everyone is kept in the loop. One such template is the cash flow statement template in Smartsheet.

A Smartsheet template can improve how your team tracks and reports on cash flow — use row hierarchy to sum line items automatically, checkboxes to track stakeholder approval, and attachments to store item details directly to the rows in your sheet. Easily create reports to roll up annual, quarterly, or monthly cash flow details so you’ll always have a real-time view of the financial health of your business.

See how easy it is to track and manage your cash flow statement with a template in Smartsheet.

Create a Cash Flow Statement in Smartsheet

A Better Way to Manage Accounting and Finance Processes for Companies of All Sizes

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Cash Flow Statement is a ready-to-use template in Excel, Google Sheet, and OpenOffice to prepare a detailed cash flow of the company for a specific period.

Moreover, this template provides the cash flow from operating, investing, and financing activities.

What Is A Cash Flow Statement?

Cash Flow Statement is a financial statement that reports the cash generated and spent during a period. It is one of the main financial statements.

In other words, this statement allows you to understand how your company operations run. It gives you an overview of where the money is coming from, and how it is spent.

You can decide the period for this statement. It can be either monthly, quarterly, half-yearly, or yearly. It can be more in some cases as per the requirement.

Reviewing this helps companies in taking crucial and big economic decisions.

Components Of A Cash Flow Statement

A Cash flow statement consists of the company’s inflow and outflow of cash. It covers 3 categories of activities: Operations, Investing, and Financial.

Operating Activities

Operating activities are the main sources of cash inflow and outflow. It depicts the cash earned and spent on regular business activities. It includes activities such as sales receipts, merchandise purchases, salaries, and other operating expenses.

Investing Activities

Cash flow from investing activities includes inflow and outflow of cash in investing activities. It can include assets, equipment, acquisitions, and equity. Usually, they are the long-term assets of the company’s balance sheet.

Financial Activities

The Financial activities of the cash flow statement display the inflow and outflow of cash from financing activities. These involve repayment of loans, stock issuance and dividends, equity buy-back programs. Usually, these items are the long term liabilities on a company’s Balance Sheet.

Methods Of Cash Flows

There are two types of cash flows: Direct and Indirect.

Direct Cash Flow Method

The direct cash flow method involves adding up all the cash receipts and payments of a business. These include payments to suppliers, receipts from customers, and salaries paid to employees. In this method, the opening and closing balance of various accounting heads.

Indirect Cash Flow Method

In the Indirect cash flow method, cash flow from operating activities is derived. You can find this as Net income on your income statement.

Usually, the net income on the income statement is prepared on an accrual basis. Hence, one needs to make adjustments to find the EBIT (earnings before interest and taxes).

Moreover, you need to make adjustments entries. This involves adding back the non-operating expenses that do not affect the cash flow.

We have created a simple and easy to use Cash Flow Statement with predefined formulas. Just enter the required data and get an overview of your company’s cash flows.

Excel Google Sheets Open Office Calc

Click here to Download All Financial Statement Excel Templates for ₹299.

Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Additionally, you can also download other Financial templates from our websites like Bank Reconciliation Statement and Trial Balance, Balance Sheet, etc.

Let’s discuss the Cash Flow Statement in detail.

Contents of Cash Flow Statement

This statement consists of two sections: Heading Section and Data Input Section.

Header Section

The header section contains the details like Name of the Company, Heading “Cash Flow Statement”.

The second row contains the preparation date along with the Opening Balance of cash.

Data Input Section

This section includes cash flow from mainly 3 type activities which are as follows: Operating activities, investing activities, and financial activities.

Operating activities are the principal revenue-producing activities of our company.

You can calculate Net Cash Flow from Operating deducting Operating expenses from operating incomes.

Operating expenses are salaries, income tax, etc. Incomes include cash received from customers and other sources.

Investing activities are the acquisition and disposal of long-term assets. It also includes other investments that are not cash equivalents.

Similar to Operating activities, you can calculate Net Cash Flow from Investment by deducting Investment expenses from incomes.

Investment expenses like the purchase of property, Loans, etc. Incomes like cash received from property sold, principal amounts of loan, etc are considered.

Financing activities are activities that result in changes in the size and composition of the owner’s capital. The owner’s capital includes preference share capital and borrowings.

Net Cash Flow from Financial is calculated by deducting financial expenses from financial Income.

These expenses include the repurchase of treasury stock, repayments, etc. Incomes include cash received against share issuance and borrowings done by the company.

In the end, the Closing Balance of Cash is given.

Benefits of Cash Flow Forecasts

- Cash Flow Statements can bee used to predict the future cash flow of companies. This statement reflects the financial health of a company.

- A cash flow statement tells you if you’re running out of money even when you’re profitable. You can also see how your bank loan payments are affecting your cash. Thus, it very important for a company to prepare and review Cash Flow Statements.

- Cash Flow Statements help to the actual cash position which cannot be derived from the P&L statement. Thus, being aware of the cash liquidity, you can arrange for any cash shortfalls. Or you can use the excess cash for growth purposes.

- Furthermore, it enables the management to plan and control the financial operations properly. You can measure the profitability and financial position by doing cash flow analysis along with ratio analysis. Moreover, it is a great tool for internal financial management.

Limitations of Cash Flow Forecasts

- The cash flow cannot project the profits as it shows only the cash position of a company.

- Moreover, for any cash flow projections, we need to use the Balance Sheet as well as the P&L statement.

- The cash flow statement displays actual cash activities. Hence, it cannot be used as a substitute for the P&L account.

- By making some adjustments in purchases and other payments, the cash position can be manipulated. Thus, sometimes the cash flow statement doesn’t display the real liquidity position.

How To Analyze A Cash Flow Statement?

Operating cash flows are the heart of the cash flow statement. Thus, companies having high Operating cash flows consistently are healthy and self-sustaining.

Usually, negative investing cash flows indicate the expansion of business or replacement of old assets. Thus, it is necessary to find out whether investments can generate revenue growth in the future or not.

Often, companies having negative cash from Investing activities will have positive Financing cash flows.

Generally, it is because companies raise additional debt or equity capital to support their investments.

However, a company’s cash inflows from core operations must be enough to fund its investments. It should also cover lenders and shareholder’s obligations. Therefore, in the long run, investing and financing outflows must be almost equal to Operating cash flows.

Often we can see that some companies having low or negative cash flows from operating and a positive from Investing. In such a scenario, it means that a company funds its operations by liquidating its assets.

Such cash flows can be a wake-up call for a company. From an investor’s point of view, such a company can even be on the verge of bankruptcy.

There can be scenarios where companies need to sell their assets to maintain dividend levels. It is done to handle its investor. Because dividend cuts are a sign of poor financial health.

Thus, while selling the assets, it should be kept in mind that they aren’t core business. Moreover, they must also not be an unnecessary financial burden to the company. As an investor, you must look deep into the company if they are selling key assets.

Positive cash flows from Financing activities and a low or negative cash flows from operating activities indicates improper usage of its capital. Hence, it shows operational inefficiency and improper management of a company.

Tips To Improve Cash Flow

- To improve your cash flows, you can make adjustments to your staffing to decrease payroll expenses.

- In addition to the above, avoid unnecessary purchase of inventory.

- Furthermore, manage Accounts Payable efficiently. Make payments neither too early nor not too late.

- Create some offers to acquire more new customers and to increase sales fro the existing customers.

- Additionally, keep your accounts receivable stringent. Reach out to late-payers for speedy payments.

- Moreover, depending on market demand decreasing or increases prices can help you increase cash flows.

- Finally, if business operations suffice for managing proper cash flow, find a source of short-term working capital.

We thank our readers for following us on different social media accounts.

If you have any queries or questions, share them in the comments below. We will be more than happy to help you.

Frequently Asked Questions

Is cash flow the same as profit?

The key difference between cash flow and profit is that profit means the money left over after paying all the expenses have been paid. Whereas, the cash flow means the inflow and outflow of a business.

How do you know if a cash flow statement is correct?

To verify the accuracy of your Cash Flow Statement:

Matching the change in cash on your Cash Flow Statement with the change in cash on your balance sheets. Find the Net Increase or Net Decrease in Cash at the bottom of your Cash flow statements.

What is the formula for net cash flow?

Net Cash Flow = Total Cash Inflows – Total Cash Outflows.

What is the difference between cash flow and fund flow?

The cash flow records the inflow and outflow of actual cash and cash equivalents. Whereas, the fund flow records the categorized movement of cash in and out of the business.

The cash flow statement shows how a company generated and spent cash throughout a given timeframe. An important truth that is frequently neglected by inexperienced business owners is that profit does not equal cash. Every business owner and manager needs to have a clear idea of the cash flows their company produces and how this impacts near and long-term performance.

We can distinguish between direct and indirect cash flow statements. A direct cash flow statement is based on data about the actual inflows and outflows the company had during a given period. This type of cash flow statement can be prepared by company insiders only. On the other hand, the indirect method uses the P&L and the Balance sheet items to obtain cash flows and give an idea how the money was generated and spent during the period under consideration.

Some other related topics you might be interested to explore are Profit & Loss, Balance Sheet, and 3-Statement Model.

This is an open-access Excel template in XLSX format that will be useful for anyone who wants to work as a Financial Analyst, Business Analyst, Consultant, Corporate Executive, or everyone preparing a corporate presentation.

You can now download the Excel template for free.

Cash Flow is among the topics included in the Corporate Finance module of the CFA Level 1 Curriculum.

Содержание

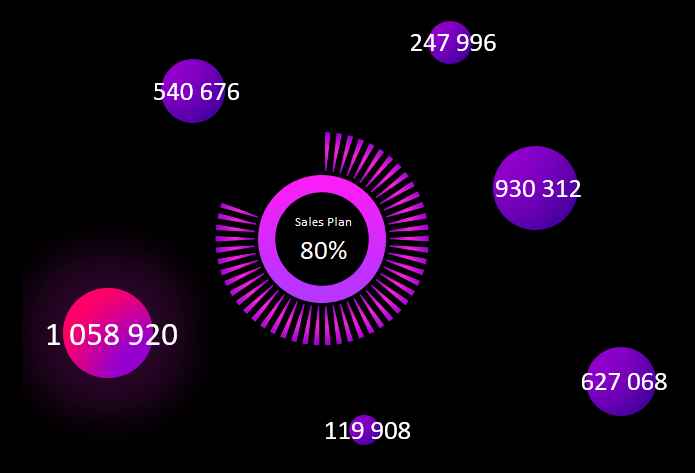

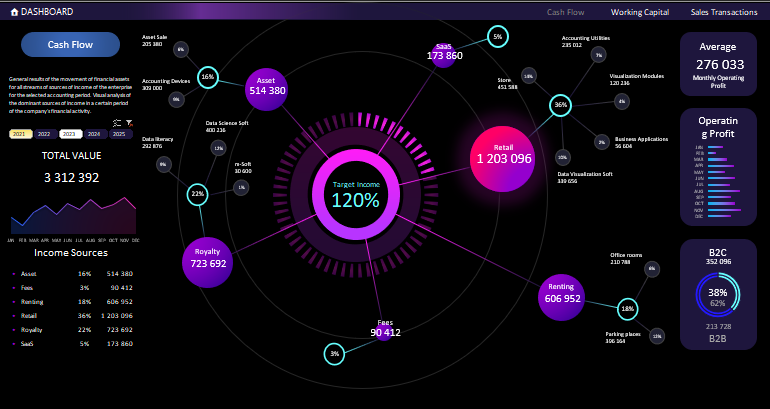

- Пример анализа Cash Flow в комбинированной диаграмме Excel

- Комбинированная диаграмма для визуального анализа Cash Flow в Excel

- Сборка комбинированной диаграммы в Excel пошагово

- Работа с денежными потоками: вычисление показателей ЧПС и ВСД в Excel

- Вопросы о проектов по capital investment

- Ответы на вопросы с помощью ЧПС и IRR

- Сравнение проектов

- Выбор соответствующей Excel функции

- Дополнительные сведения

Пример анализа Cash Flow в комбинированной диаграмме Excel

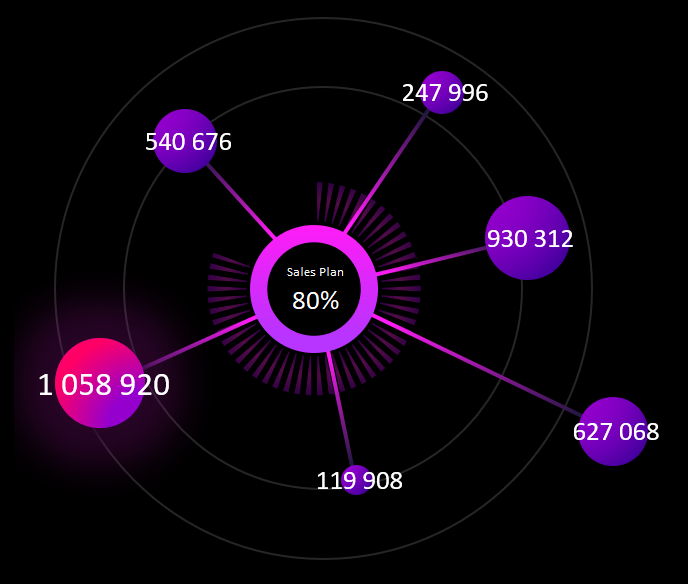

Отчет Cash Flow позволяет спрогнозировать финансовые показатели в будущем и предотвратить кассовые разрывы. Поэтому он очень важен и так популярен. Но среди стандартных диаграмм Excel нет подходящих инструментов для визуализации данных по отчету Cash Flow. Вашему вниманию предлагается необычный пример создания комбинированной диаграммы для визуального анализа циркуляции денежного потока на предприятии.

Комбинированная диаграмма для визуального анализа Cash Flow в Excel

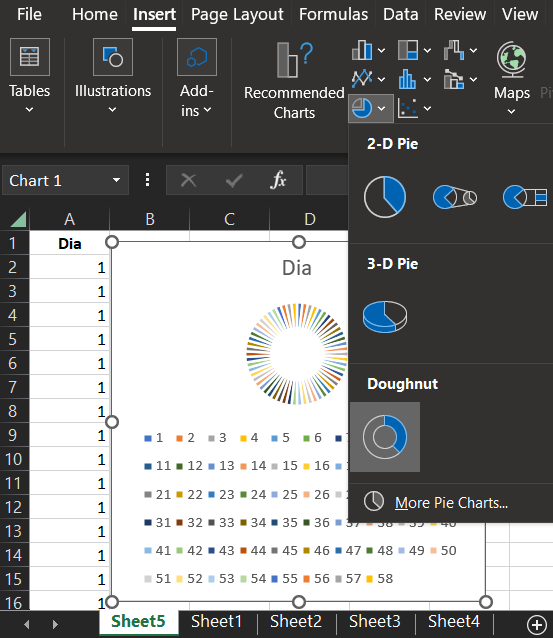

Так как в арсенале стандартных диаграмм Excel нет подходящего инструмента для анализа отчета по Cash Flow, будем комбинировать свой график из уже имеющихся средств. В данном примере используется комбинация из трех отдельных диаграмм:

- Пузырьковой (Bubble).

- Круговой (Pie)

- Комбинированной из двух Кольцевых (Doughnut).

Подробное описание предназначения и стратегии использования по каждому пункту:

- Пузырьковая диаграмма – предназначена для визуального сравнения величины более двух значений.

- Круговая – отображает отношение нескольких частей к целому общему значению. В этике дизайнеров и разработчиков визуальных отчетов не рекомендуется использовать круговую диаграмму для сравнения более чем 2 значения. Но в нашей творческой комбинации ее мы будем использовать для отображения экспонированного значения перевыполнения финансового плана больше 100% на одной и той же диаграмме. Хотя по сути все сохраняется в рамках этики дизайна визуализации, так как используется 2 значения: 1– процент доли перевыполнения плана по отношению к 2 – общего целого значения 100%.

- Кольцевая – так же, как и круговая предназначена для отображения нескольких долей по отношению к целому общему значению. Но в отличии от круговой диаграммы может содержать несколько рядов данных. Это отличие нам сильно пригодится в разработке дизайна визуализации данных для интерактивной презентации.

Одно из важнейших предназначений отчета по Cash Flow – это предотвращение кассовых разрывов. Поэтому наш комбинированный график будет содержат в центре большую комбинированную диаграмму, информирующую о проценте выполнения плана продаж. Чем выше этот показатель, тем меньше вероятность кассового разрыва. Схема как будет выглядеть будущий дизайн визуализации:

Техническое задание для разработчика определено, показано и описано. Теперь можно переходить к процессу реализации задачи.

Сборка комбинированной диаграммы в Excel пошагово

Разберем данный пример в стиле пошаговой инструкции:

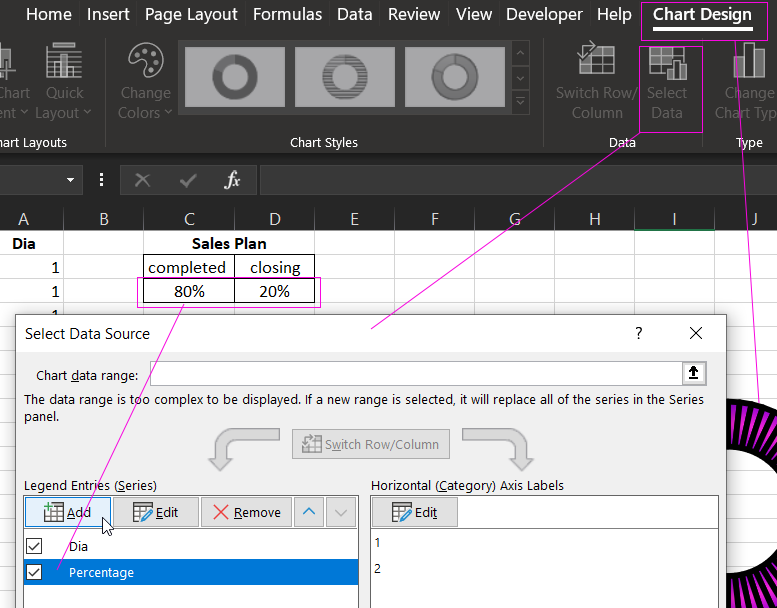

- Создадим кольцевую шкалу из 58-ми делений:

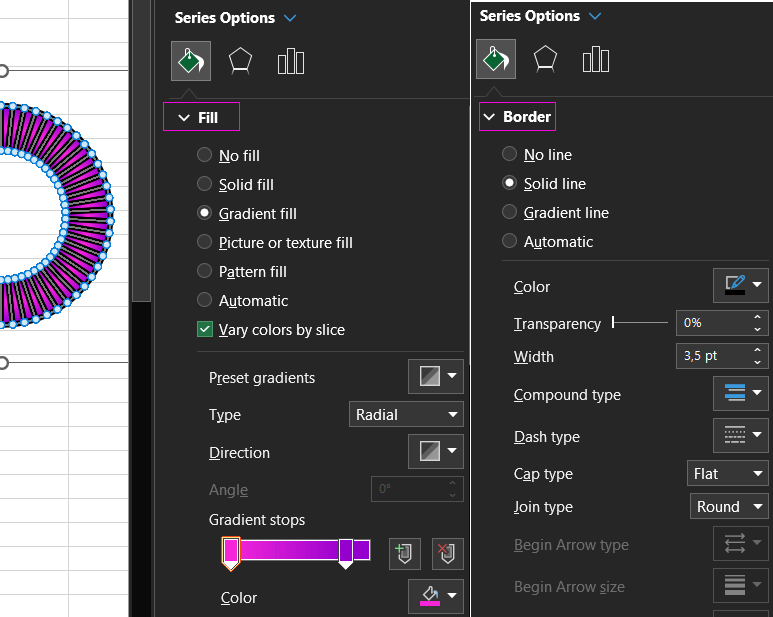

- Проектируем дизайн для делений на кольцевой шкале:

- Добавляем новую серию значений для комбинирования диаграммы:

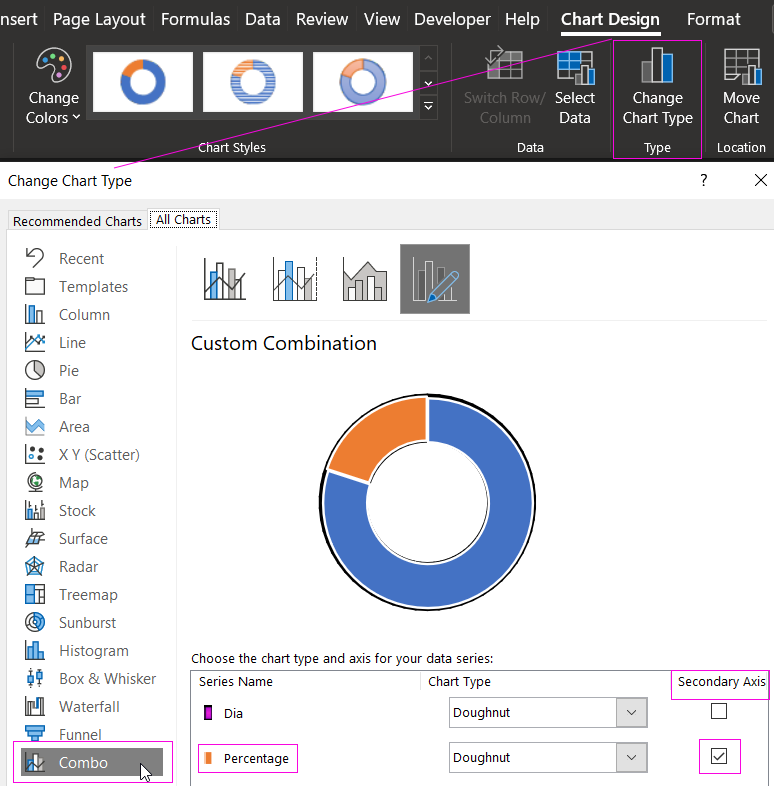

- Настраиваем комбинацию в окне изменения типа. Обратите внимание на то, что нужно указать для второй серии значений расположение по вспомогательной оси координат. Таким образом две кольцевые диаграммы будут наложены как на разных слоях:

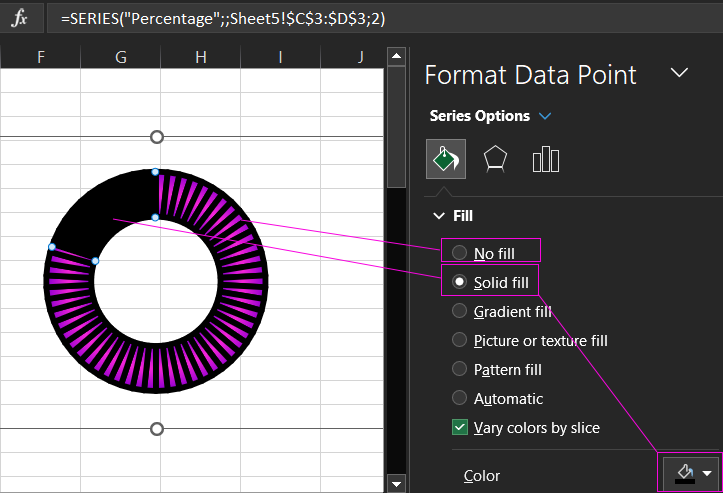

- Изменяем дизайн для второй кольцевой диаграммы, дополнительно наложенной сверху с помощью комбинирования типов в Excel. Синею заливку изменяем на прозрачную, а оранжевую на черную. И не забудем убрать контуры. Комбинированная диаграмма из двух кольцевых – готова:

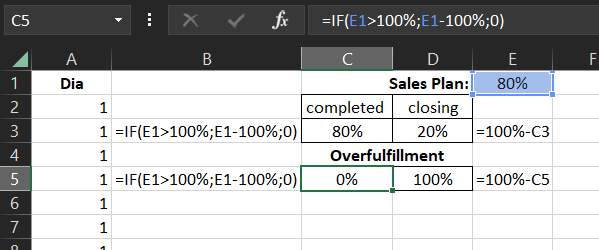

- Изменяем значения на формулы в таблице показателей выполнения плана продаж. А также создаем еще одну табличку с формулами для исходных значений круговой диаграммы:

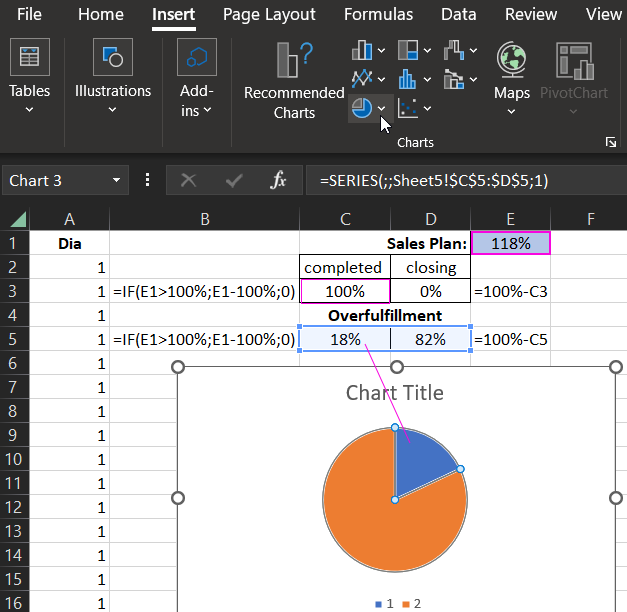

- На основе второй таблички создаем круговую диаграмму, которая будет экспонировать на шкале долю соответственной значениям при превышении выполнения плана продаж:

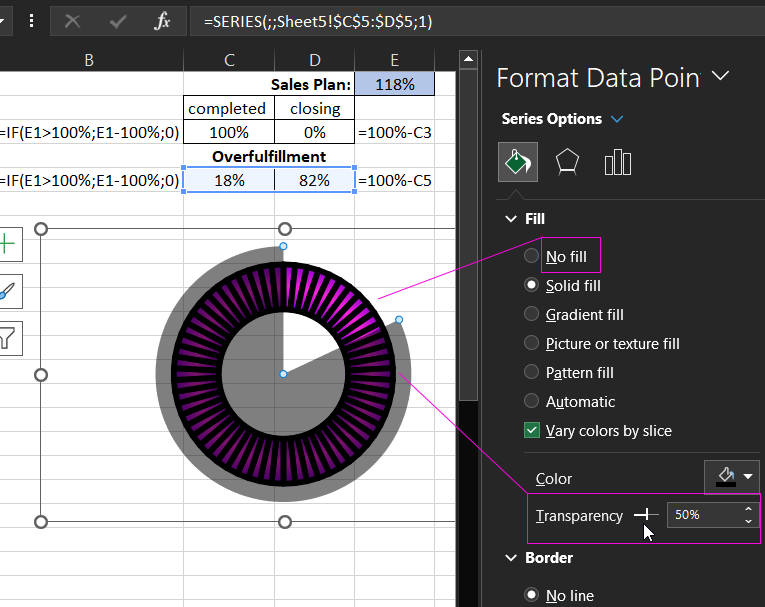

- Изменяем цвета заливок круговой диаграммы и накладываем ее на комбинированную состоящую из двух кольцевых. Незабываем подровнять размеры. Синий цвет меняем на прозрачный, а оранжевый делаем черной, но полупрозрачной заливкой и удаляем все контуры:

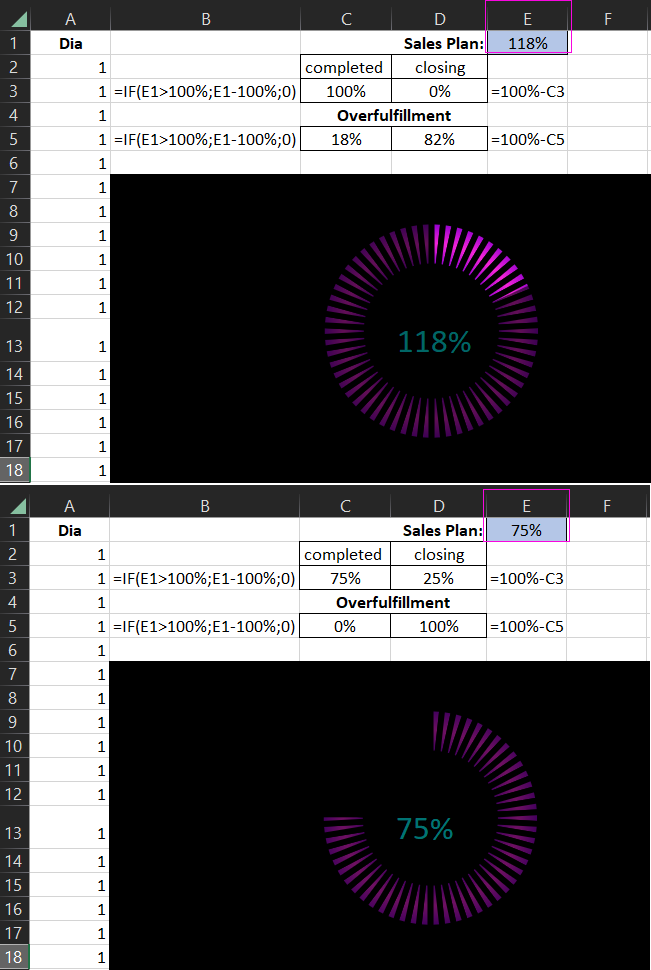

- Тестируем и наслаждаемся готовым результатом на черном фоне и проверяем как все работает при изменении исходного значения в ячейке E1:

- Добавляем пузырьковый график как последнюю комбинацию в общей композиции презентации отчета по циркуляции движения денежных средств:

Дальше все красиво и талантливо оформляем для создания профессиональной инфографики с интерактивными возможностями. Все зависит от вашего воображение, а оно зависит от вдохновения:

В широком ассортименте инструментов для визуализации данных в Excel есть все и даже больше, чем кажется на первый взгляд. Необходимо лишь немного опыта, а воображение придет с творческим вдохновением. Смело скачивайте данный шаблон и вдохновляйтесь, изменяйте под свои потребности и улучшайте. Нет предела совершенству, не существует границ между душой и творчеством.

Источник

Работа с денежными потоками: вычисление показателей ЧПС и ВСД в Excel

Вы теряете спящий режим и знаете, как максимально повысить прибыльность и свести к минимуму риски, связанные с бизнес-инвестициями? Остановить переключение и поворот. Расслабьтесь и перейти к потоку.

Наличные, то есть. Взгляните на движение денежных средств, а также на то, что выходит за рамки вашей компании. Положительный денежный поток — это показатель получения денежных средств (продажи, проценты, проблемы с акциями и так далее), тогда как отрицательный денежный поток — это показатель выходных денежных средств (покупки, выплаты, налоги и так далее). Чистое движение денежных средств — это разница между положительным и отрицательным денежными потоками и ответы на наиболее фундаментальные деловые вопросы о том, сколько денег осталось в хлеве?

Для развития бизнеса необходимо принимать ключевые решения о том, куда вкладывать деньги в долгосрочной перспективе. Microsoft Excel сравните параметры и сделайте правильный выбор, чтобы можно было отдохнуть как днем, так и ночью.

Вопросы о проектов по capital investment

Если вы хотите взять деньги с себя, сделать его рабочим и вкладывать их в проекты, которые составляют вашу бизнес, вам нужно задать несколько вопросов об этих проектах:

Будет ли новый долгосрочный проект прибыльным? Когда?

Лучше ли вкладывать деньги в другой проект?

Следует ли вкладывать средства в текущий проект еще больше или стоит ли сократить потери?

Теперь рассмотрим каждый из этих проектов подробнее и спросите:

Каковы отрицательные и положительные денежные потоки для этого проекта?

Какое влияние оказывают крупные первоначальные инвестиции и какой объем будет слишком велик?

В итоге вам действительно нужны номера нижней строки, которые можно использовать для сравнения вариантов проектов. Но для этого необходимо включить в анализ значения времени денежных средств.

Мой гогол как-то сказал мне: «»Юный, лучше получить деньги как можно скорее и удерживать на нем как можно больше времени». Позже я узнал, почему. Вы можете вкладывать эти деньги по сложным процентным ставкам, что означает, что ваши деньги могут заработать вам больше денег , а затем некоторые из них. Другими словами, при выходе или выходе денежных средств так же важно, как и то, сколько денег выходит или поступает.

Ответы на вопросы с помощью ЧПС и IRR

Существует два финансовых способа, которые помогут вам ответить на все эти вопросы: чистая стоимость (ЧПС) и внутренняя ставка прибыли (IRR). Как ЧПС, так и IRR называются дисконтируемыми методами движения денежных средств, так как они применяют значение времени к оценке проектов по capital investment. Как ЧПС, так и IRR основаны на рядах будущих платежей (отрицательный денежный поток), доходов (положительный денежный поток), потерь (отрицательный денежный поток) или «нулевых денежных потоков».

ЧПС возвращает чистую стоимость денежных потоков, представленных в современных рублях. Из-за денежной стоимости каждый доллар сегодня стоит больше, чем завтра. ЧПС вычисляет обтекаемую стоимость для каждого ряда денежных потоков и объединяет их, чтобы получить чистую стоимость.

Где n — количество денежных потоков, а i — процентная или скидка.

IRR основан на ЧПС. Это можно представить в особом случае ЧПС, где вычисляемая ставка прибыли представляет процентную ставку, соответствующую нулевой (нулевой) чистой стоимости.

Если все отрицательные денежные потоки происходят раньше всех положительных или когда последовательность денежных потоков проекта содержит только один отрицательный денежный поток, IRR возвращает уникальное значение. Большинство проектов по инвестиции в основном начинаются с больших отрицательных денежных потоков (в начале инвестиции), за которыми следуют положительные денежные потоки, и, следовательно, имеют уникальный IRR. Однако иногда может быть несколько допустимых IRR или вообще ничего.

Сравнение проектов

ЧПС определяет, должен ли проект получить больше или меньше желаемой ставки прибыли (уровень сложности), и хорошо определяет, будет ли проект прибыльным. IRR на один шаг дальше, чем ЧПС, чтобы определить определенную ставку прибыли для проекта. Как ЧПС, так и IRR — это числа, которые можно использовать для сравнения проектов и выбора оптимальных вариантов для вашей компании.

Выбор соответствующей Excel функции

hich Office Excel функции, которые можно использовать для вычисления ЧПС и IRR? Существует пять: функция ЧПС,функция ЧПС,функция IRR,ФУНКЦИЯ XIRRи МВСД. Выбор зависит от предпочитаемого финансового метода, от того, происходят ли денежные потоки через определенные интервалы времени и являются ли они периодическими.

Примечание: Денежные потоки заданы как отрицательные, положительные или нулевые значения. При использовании этих функций обратите особое внимание на то, как вы обрабатываете мгновенные денежные потоки, которые происходят в начале первого периода, и все остальные денежные потоки, которые происходят в конце периодов.

Используйте, когда нужно

Определите чистую стоимость на основе денежных потоков, которые происходят регулярно, например ежемесячно или ежегодно.

Каждый денежный поток, заданный как значение,происходит в конце периода.

Если в начале первого периода имеется дополнительный денежный поток, он должен быть добавлен к значению, возвращаемом функцией ЧПС. См. пример 2 в разделе справки по функции ЧПС.

Определите чистую стоимость на основе денежных потоков, которые возникают через нерегулярные интервалы.

Каждый денежный поток, указанный как значение, происходит в запланированную дату платежа.

Определите внутреннюю ставку прибыли с использованием денежных потоков, которые происходят регулярно, например ежемесячно или ежегодно.

Каждый денежный поток, заданный как значение,происходит в конце периода.

IRR вычисляется с помощью итеративной процедуры поиска, которая начинается с оценки для IRR , указанной в качестве прогноза, и затем несколько раз изменяет это значение до тех пор, пока не будет достигнут правильный IRR. Указать аргумент «предположение» необязательно. Excel в качестве значения по умолчанию используется значение 10%.

Если имеется несколько допустимых ответов, функция IRR возвращает только первый из них. Если IRR не находит ответ, возвращается #NUM! значение ошибки #ЗНАЧ!. Используйте другое значение для предположения, если вы получаете ошибку или результат отличается от ожидаемого.

Примечание. Другой вариант может возвращать другой результат, если имеется более одной внутренней ставки прибыли.

ФУНКЦИЯ XIRR (значения, даты, [предположение])

Определите внутреннюю ставку прибыли с помощью денежных потоков, которые возникают через нерегулярные интервалы.

Каждый денежный поток, указанный как значение, происходит в запланированную дату платежа.

XIRR вычисляется с помощью итеративной процедуры поиска, которая начинается с оценки IRR , указанной в качестве прогноза, и затем несколько раз изменяет это значение до тех пор, пока не будет достигнут правильный XIRR. Указать аргумент «предположение» необязательно. Excel в качестве значения по умолчанию используется значение 10%.

Если имеется несколько допустимых ответов, функция XIRR возвращает только первый из них. Если xiRR не находит ответ, возвращается #NUM! значение ошибки #ЗНАЧ!. Используйте другое значение для предположения, если вы получаете ошибку или результат отличается от ожидаемого.

Примечание. Другой вариант может возвращать другой результат, если имеется более одной внутренней ставки прибыли.

Функция MIRR (значения, finance_rate, reinvest_rate)

Определите модифицированную внутреннюю ставку прибыли с использованием денежных потоков, которые происходят регулярно, например ежемесячно или ежегодно, и учитывайте как стоимость инвестиций, так и проценты, полученные от реинвестирования денежных средств.

Каждый денежный поток, заданный как значение,происходит в конце периода, за исключением первого денежного потока, который определяет значение в начале периода.

Процентная ставка, которую вы платите с денежных средств, используемых в денежных потоках, указана в finance_rate. Процентная ставка, получаемая для денежных потоков при реинвестирования, указывается в reinvest_rate.

Дополнительные сведения

Дополнительные сведения об использовании ЧПС и IRR см. в разделах Главы 8 «Оценка инвестиций с использованием критериев чистой стоимости» и Глава 9 ,»Внутренняя ставка прибыли» в Microsoft Excel Анализ данных и бизнес-моделирование Уин Л. Уинстон. чтобы узнать больше об этой книге.

Источник

This is our small assortment of professional cash flow spreadsheets. Created by professionals with years of experience in handling private and professional finances, these free excel templates have been downloaded 55189 times since 2006.

We only have 9 templates as of today. Cash flow planning and cash flow report are the templates you can download below, but we are working on adding more.

You can use these templates in Microsoft Excel, Mac Numbers, OpenOffice, or Google Spreadsheets.

table of content

- Cash Flow Statement

- Cash Flow Planner

- Discounted Cash Flow Valuation Excel

- Simple Cash Flow Statement for Small Business

- Uneven Cash Flow Calculator

- Annual Cash Flow Calculator

- Cash Flow Diagram Generator

- Cash Flow Projection Example

- Operating Cash Flow Calculator

Cash Flow Statement

Cash Flow Statement is a financial report to provide relevant information about the cash receipts and disbursements the company has in particular accounting period. Information from cash flow is important…

File Size: 3.4 Mb Downloads: 11810 Rating: 4.6

Cash Flow Planner

Company Cash Flow Planner spreadsheet is a spreadsheet to plan more detail about your company cash flow. It fits small business companies who manage their tight cash flow where their expenses rely upon…

File Size: 5.8 Mb Downloads: 9008 Rating: 4.9

Discounted Cash Flow Valuation Excel

As an investor, it is important to be able to evaluate the worth of current investments and future investment opportunities.

The profit that can be materialized as an investor/business owner is not restricted…

File Size: 300KB Downloads: 7673 Rating: 4.9

Simple Cash Flow Statement for Small Business

Traditional financial statements – with categories of assets, liabilities, and profits and losses – are essential sources of information for small business owners. However, understanding the business’s…

File Size: 240 KB Downloads: 4059 Rating: 4.3

Uneven Cash Flow Calculator

Calculating the present or future value of an investment is easy, as long as that investment generates even cash flows over the period of investment. But uneven or irregular cash flows present a challenge.

Cash…

File Size: 290 KB Downloads: 3085 Rating: 4.4

Annual Cash Flow Calculator

All businesses want to operate in the black. As a business owner, however, you know you can’t just hope that you’re doing well financially. Doing well financially, rather, takes planning and strategy…

File Size: 235 KB Downloads: 4163 Rating: 5

Cash Flow Diagram Generator

Every business owner understands the importance of tracking business expenses, income, and net cash flow. But many may not realize the value of seeing those financial results in graphical form. Our Cash…

File Size: 250 KB Downloads: 5517 Rating: 4.3

Cash Flow Projection Example

A cash flow statement is a critical tool for analyzing the current liquidity of any business venture. Cash Flow Projections are even more important as they help you understand not only your current liquidity,…

File Size: 90 KB Downloads: 6022 Rating: 4.6

Operating Cash Flow Calculator

As a business owner, you need to understand every aspect of your business’s operation, and the effect its activities have on the health of the business.

Tools that provide such information are invaluable,…

File Size: 240 KB Downloads: 3852 Rating: 4.7