Отчет о движении денежных средств

С помощью этого шаблона можно проанализировать или продемонстрировать движение денежных средств бизнеса за последние двенадцать месяцев. Спарклайны, условное форматирование и четкий дизайн делают его одновременно красочным и практичным.

Excel

Скачать

Поделиться

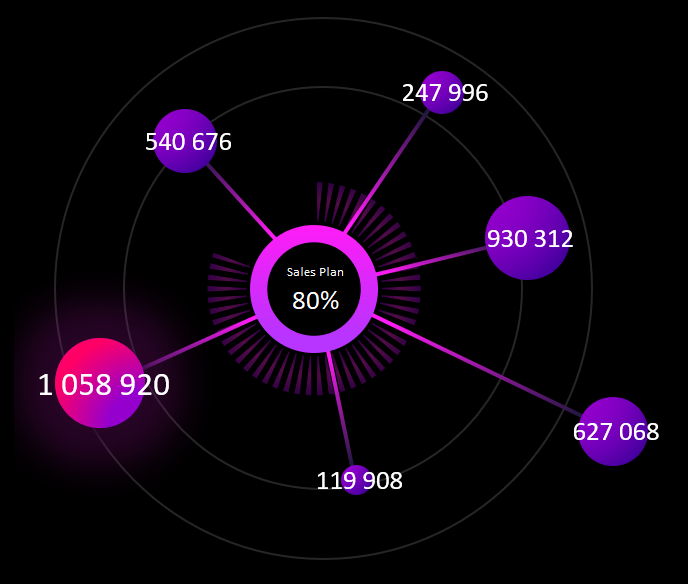

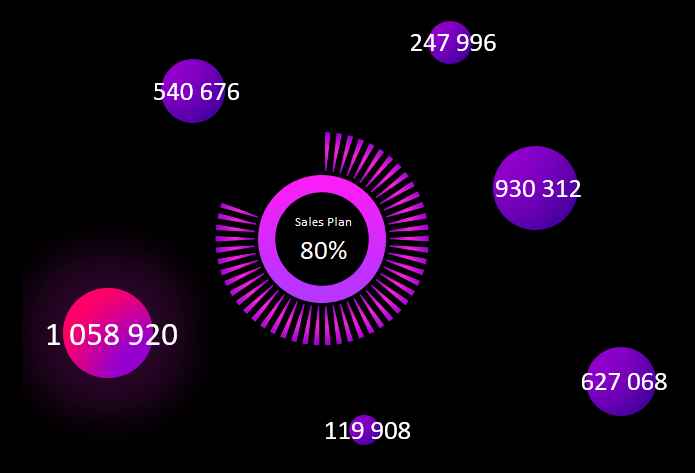

Отчет Cash Flow позволяет спрогнозировать финансовые показатели в будущем и предотвратить кассовые разрывы. Поэтому он очень важен и так популярен. Но среди стандартных диаграмм Excel нет подходящих инструментов для визуализации данных по отчету Cash Flow. Вашему вниманию предлагается необычный пример создания комбинированной диаграммы для визуального анализа циркуляции денежного потока на предприятии.

Комбинированная диаграмма для визуального анализа Cash Flow в Excel

Так как в арсенале стандартных диаграмм Excel нет подходящего инструмента для анализа отчета по Cash Flow, будем комбинировать свой график из уже имеющихся средств. В данном примере используется комбинация из трех отдельных диаграмм:

- Пузырьковой (Bubble).

- Круговой (Pie)

- Комбинированной из двух Кольцевых (Doughnut).

Подробное описание предназначения и стратегии использования по каждому пункту:

- Пузырьковая диаграмма – предназначена для визуального сравнения величины более двух значений.

- Круговая – отображает отношение нескольких частей к целому общему значению. В этике дизайнеров и разработчиков визуальных отчетов не рекомендуется использовать круговую диаграмму для сравнения более чем 2 значения. Но в нашей творческой комбинации ее мы будем использовать для отображения экспонированного значения перевыполнения финансового плана больше 100% на одной и той же диаграмме. Хотя по сути все сохраняется в рамках этики дизайна визуализации, так как используется 2 значения: 1– процент доли перевыполнения плана по отношению к 2 – общего целого значения 100%.

- Кольцевая – так же, как и круговая предназначена для отображения нескольких долей по отношению к целому общему значению. Но в отличии от круговой диаграммы может содержать несколько рядов данных. Это отличие нам сильно пригодится в разработке дизайна визуализации данных для интерактивной презентации.

Одно из важнейших предназначений отчета по Cash Flow – это предотвращение кассовых разрывов. Поэтому наш комбинированный график будет содержат в центре большую комбинированную диаграмму, информирующую о проценте выполнения плана продаж. Чем выше этот показатель, тем меньше вероятность кассового разрыва. Схема как будет выглядеть будущий дизайн визуализации:

Техническое задание для разработчика определено, показано и описано. Теперь можно переходить к процессу реализации задачи.

Сборка комбинированной диаграммы в Excel пошагово

Разберем данный пример в стиле пошаговой инструкции:

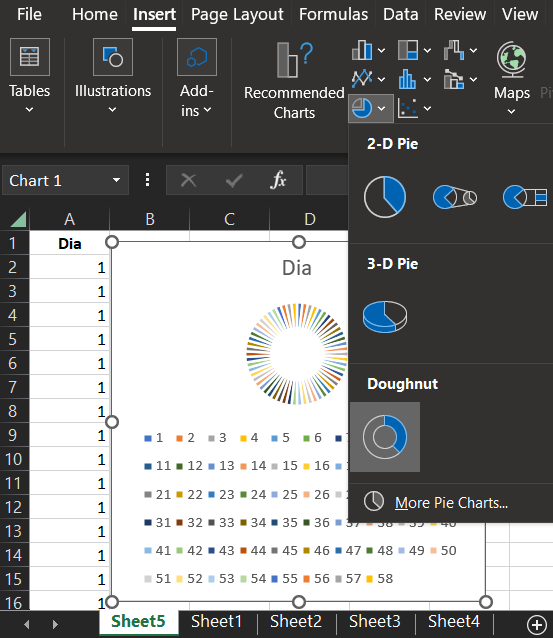

- Создадим кольцевую шкалу из 58-ми делений:

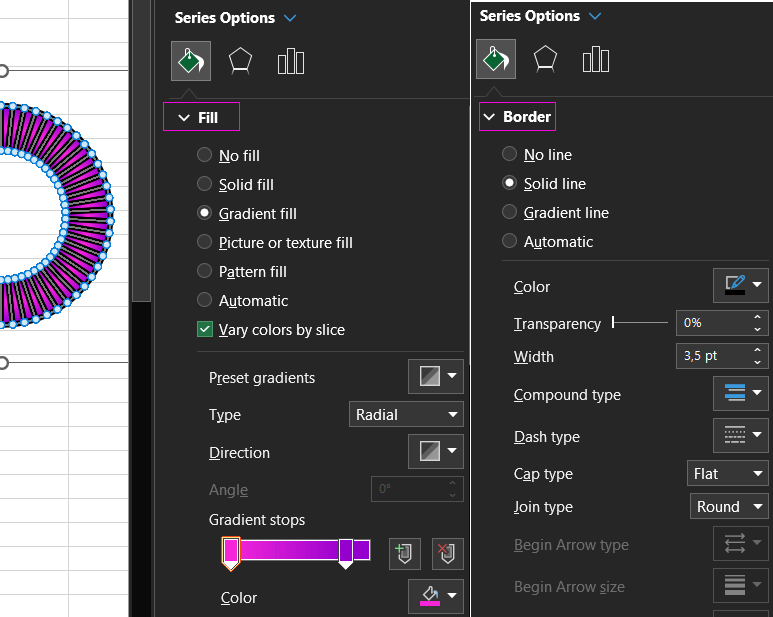

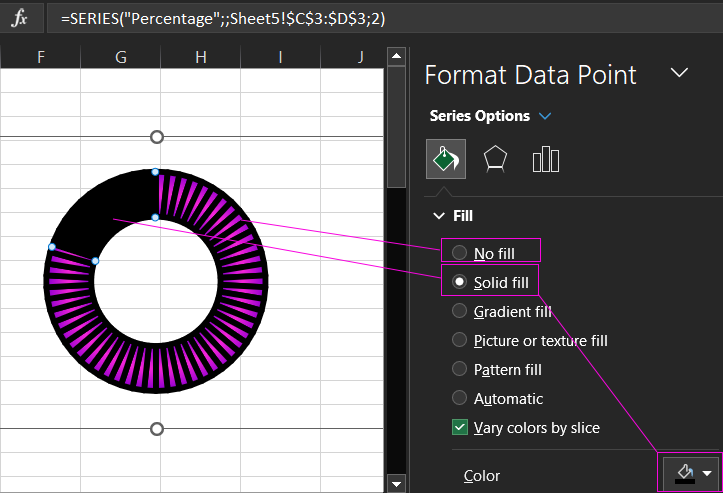

- Проектируем дизайн для делений на кольцевой шкале:

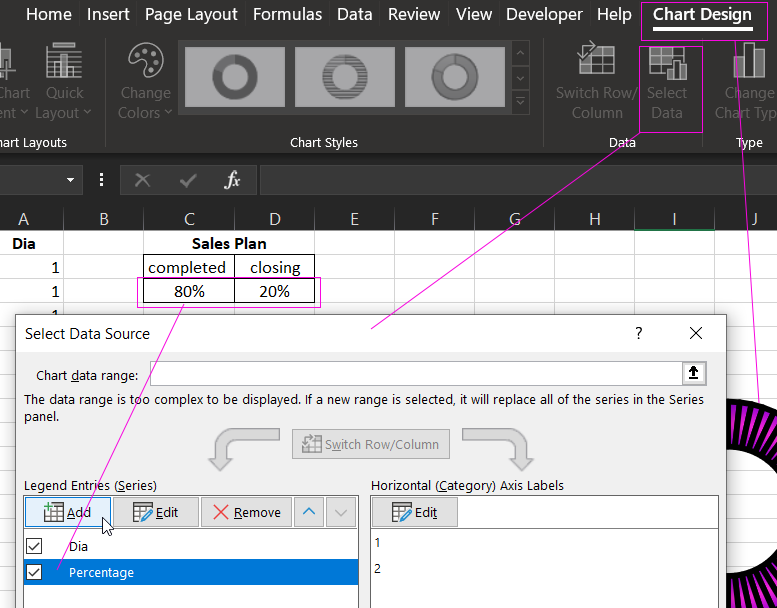

- Добавляем новую серию значений для комбинирования диаграммы:

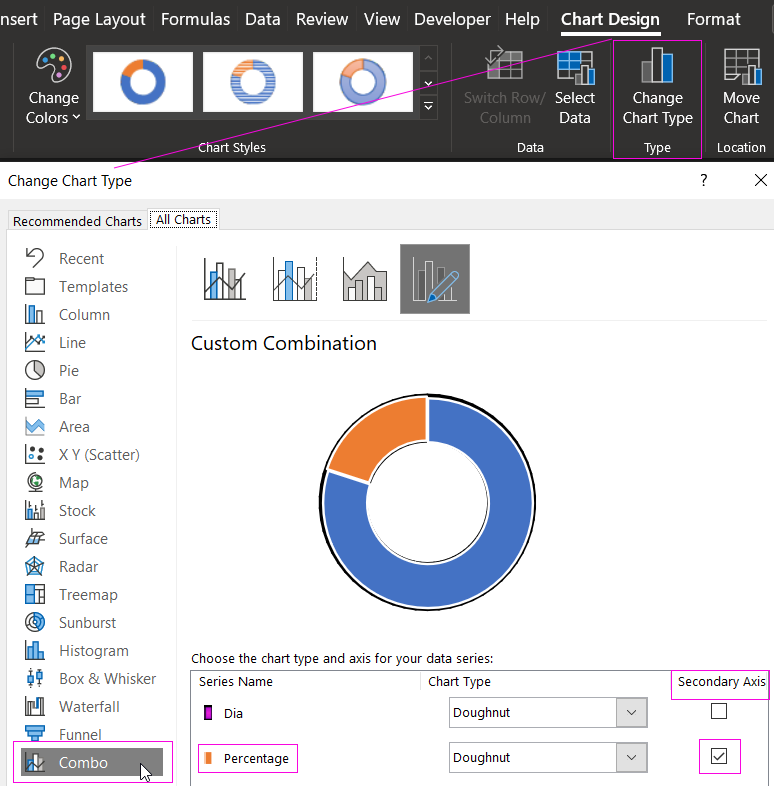

- Настраиваем комбинацию в окне изменения типа. Обратите внимание на то, что нужно указать для второй серии значений расположение по вспомогательной оси координат. Таким образом две кольцевые диаграммы будут наложены как на разных слоях:

- Изменяем дизайн для второй кольцевой диаграммы, дополнительно наложенной сверху с помощью комбинирования типов в Excel. Синею заливку изменяем на прозрачную, а оранжевую на черную. И не забудем убрать контуры. Комбинированная диаграмма из двух кольцевых – готова:

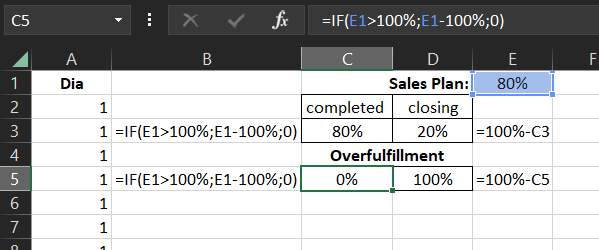

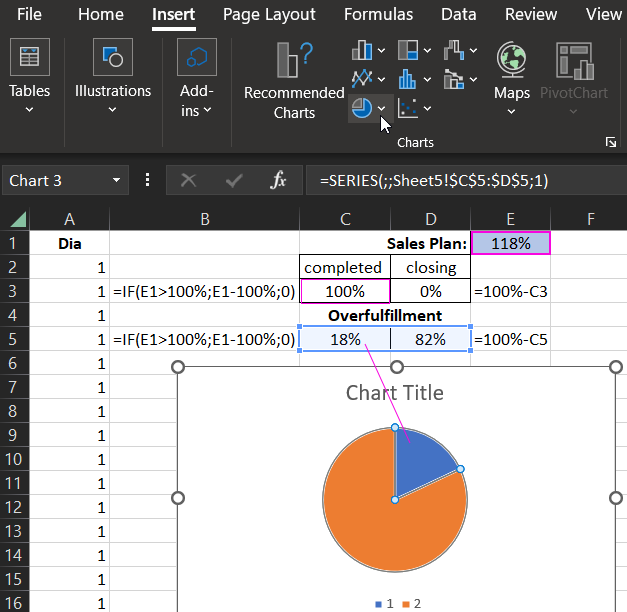

- Изменяем значения на формулы в таблице показателей выполнения плана продаж. А также создаем еще одну табличку с формулами для исходных значений круговой диаграммы:

- На основе второй таблички создаем круговую диаграмму, которая будет экспонировать на шкале долю соответственной значениям при превышении выполнения плана продаж:

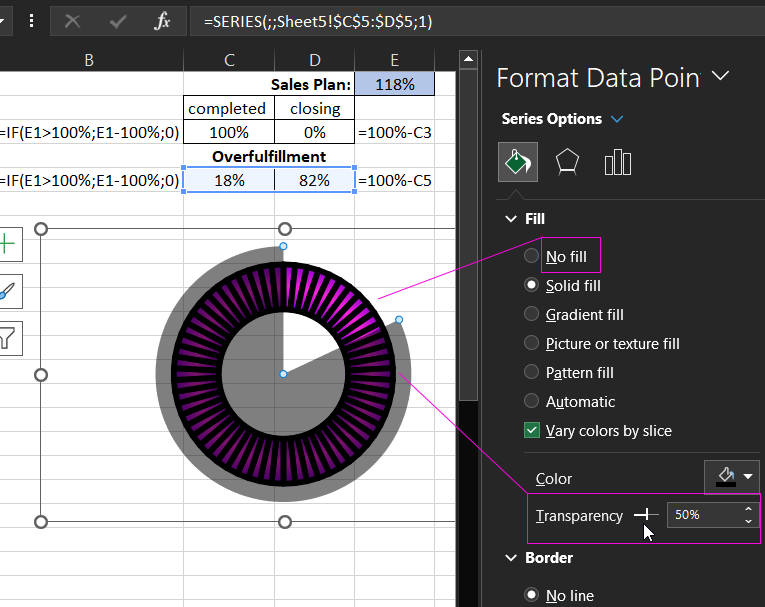

- Изменяем цвета заливок круговой диаграммы и накладываем ее на комбинированную состоящую из двух кольцевых. Незабываем подровнять размеры. Синий цвет меняем на прозрачный, а оранжевый делаем черной, но полупрозрачной заливкой и удаляем все контуры:

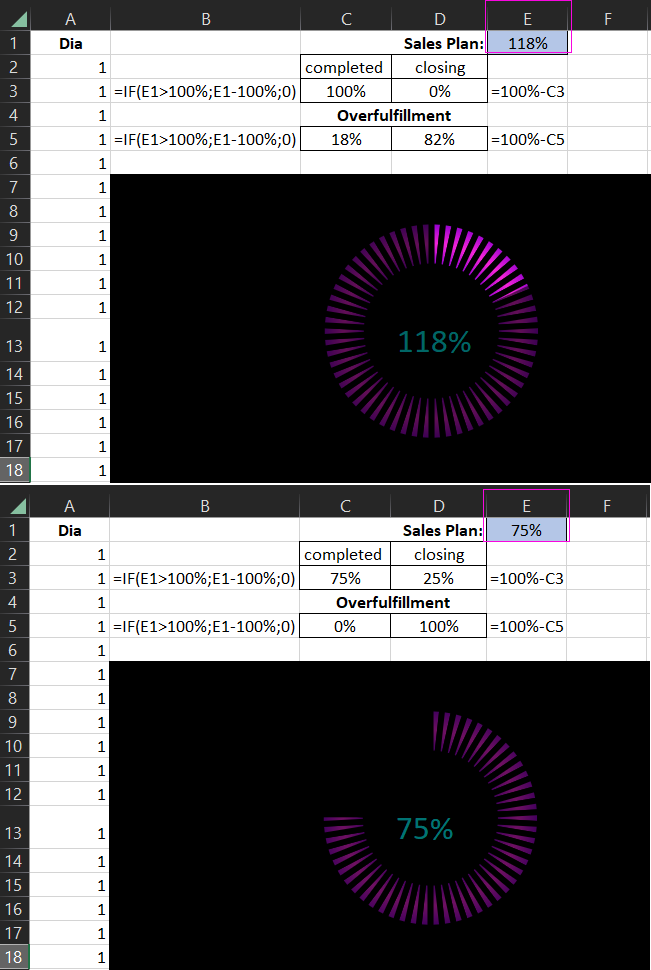

- Тестируем и наслаждаемся готовым результатом на черном фоне и проверяем как все работает при изменении исходного значения в ячейке E1:

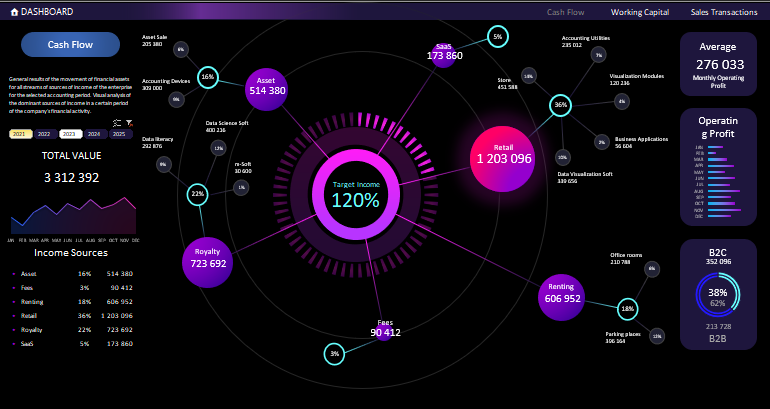

- Добавляем пузырьковый график как последнюю комбинацию в общей композиции презентации отчета по циркуляции движения денежных средств:

Дальше все красиво и талантливо оформляем для создания профессиональной инфографики с интерактивными возможностями. Все зависит от вашего воображение, а оно зависит от вдохновения:

В широком ассортименте инструментов для визуализации данных в Excel есть все и даже больше, чем кажется на первый взгляд. Необходимо лишь немного опыта, а воображение придет с творческим вдохновением. Смело скачивайте данный шаблон и вдохновляйтесь, изменяйте под свои потребности и улучшайте. Нет предела совершенству, не существует границ между душой и творчеством.

A cash flow statement, also referred to as a statement of cash flows, shows the flow of funds to and from a business, organization, or individual. It is often prepared using the indirect method of accounting to calculate net cash flows. The statement is useful for analyzing business performance, making projections about future cash flows, influencing business planning, and informing important decisions. The term “cash” refers to both income and expenditures and may include investments and assets that you can easily convert to cash. By conducting a cash flow analysis, a business can evaluate its liquidity and solvency, compare performance among accounting periods, identify cash flow drivers to support growth, and plan ahead to maintain a positive cash position.

Below you’ll find a collection of easy-to-use Excel templates for accounting and cash flow management, all of which are fully customizable and can be downloaded for free.

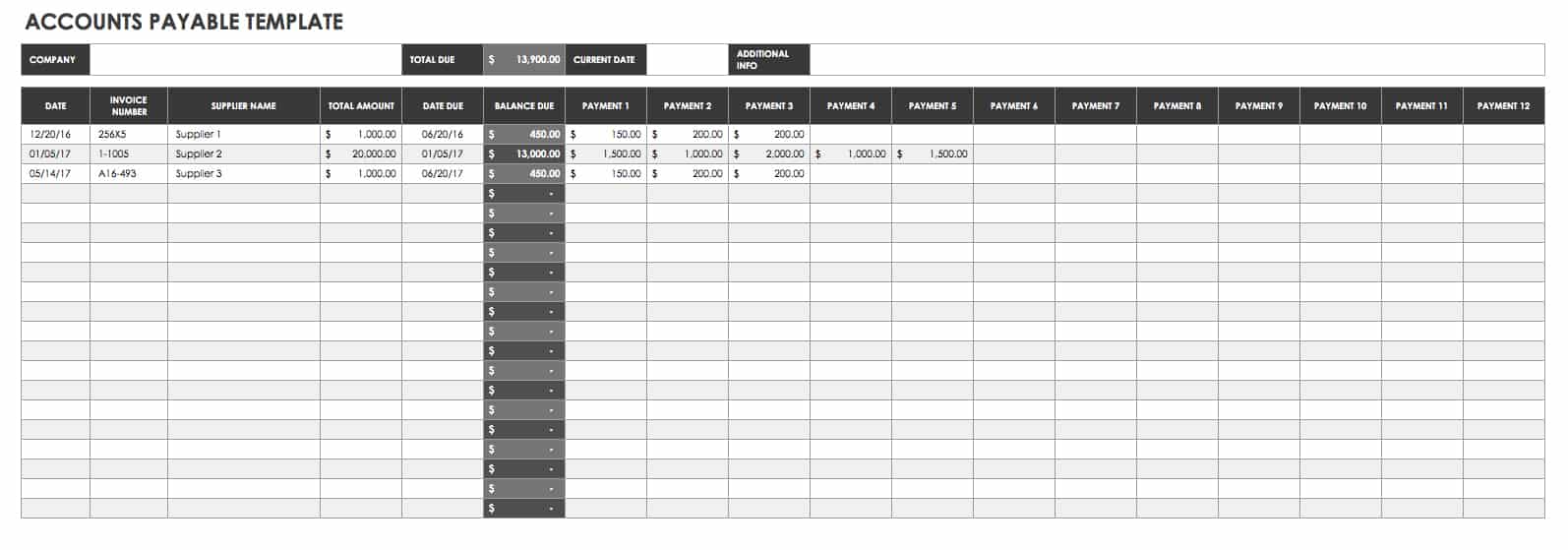

Accounts Payable Template

Download Accounts Payable Template

Excel | Smartsheet

This accounts payable template tracks suppliers, order numbers, and amounts due to help you manage payments and due dates. Easily organize ordering stock or supplies from multiple vendors with this template for greater efficiency and fewer errors.

Accounts Receivable Template

Download Accounts Receivable Template

Excel | Smartsheet

Don’t let balances owed to your business slip through the cracks. This template accounts receivable template lists customers, invoice tracking details, amounts due, and outstanding balances. Keeping track of these accounts can inform your collections process by helping you quickly identify which overdue payments have aged significantly.

Balance Sheet Template

Download Balance Sheet Template

Excel | Smartsheet

A balance sheet provides a summary of financial health in a single, brief report. With this balance sheet template, you can assess the financial standing of a business by examining assets, liabilities, and equity. Business owners can use it to evaluate performance and communicate with investors.

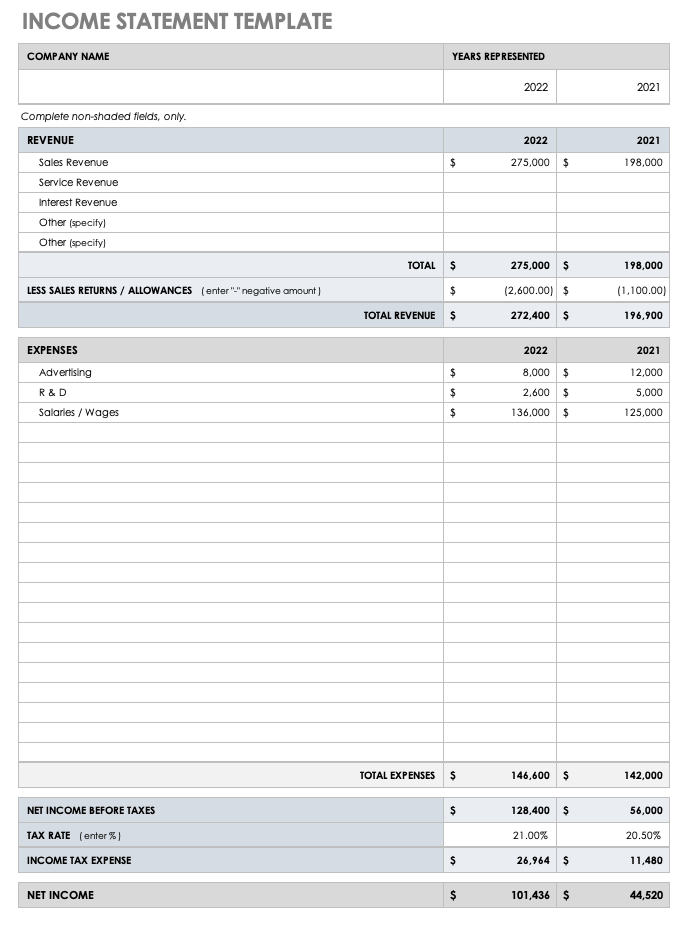

Income Statement Template

Download Income Statement Template

Excel | Smartsheet

Use this income statement template to assess profit and loss over a given time period. This template provides a clear outline of revenue and expenses along with net income figures. You can edit the template to match your needs by adding or removing detail, and create an income statement for a large or small business.

Simple Cash Flow Template

Download Simple Cash Flow Template

Excel | Smartsheet

This template works for any length of time and allows you to compare different periods for a quick analysis of cash flows. It include sections for an itemized list of revenue and expenditures, automatic calculations of totals and net cash flows, and a simple layout for ease of use. You can modify the template by adding or removing sections to tailor it to your business.

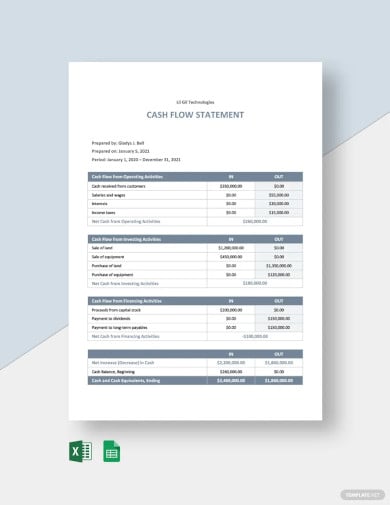

3-Year Cash Flow Statement Template

Download 3-Year Cash Flow Statement Template

Excel | Smartsheet

Use this statement of cash flows template to track and assess cash flows over a three-year period. The template is divided into sections for operations, investing, and financing activities. Simply enter the financial data for your business, and the template completes the calculations.

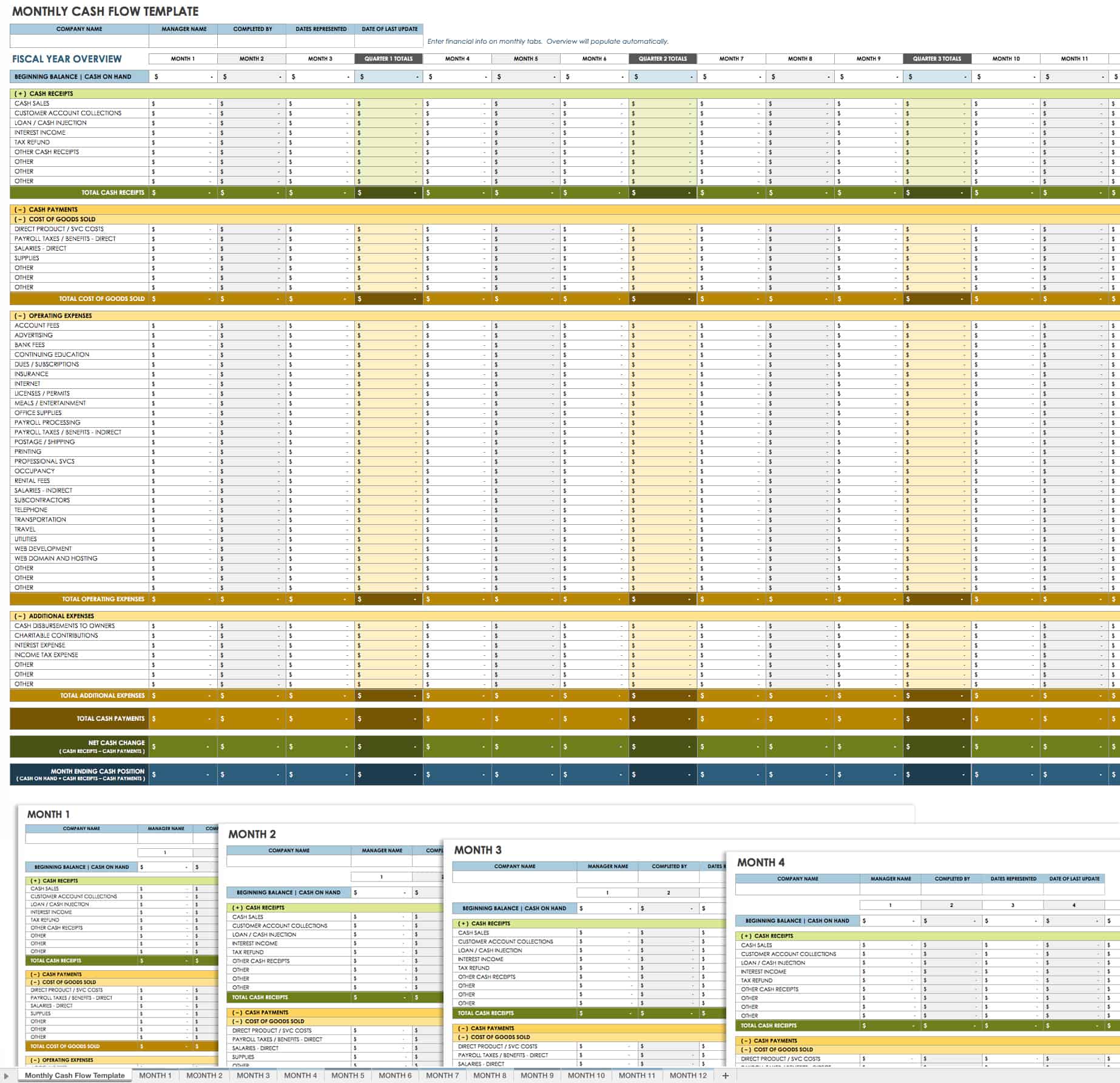

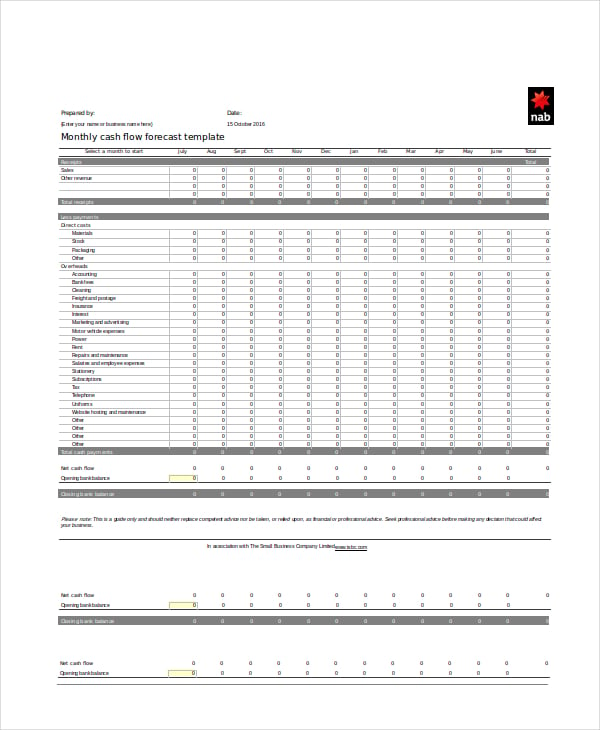

Monthly Cash Flow Template

Download Monthly Cash Flow Template

This comprehensive template offers an annual overview as well as monthly worksheets. Create a detailed monthly cash flow report to analyze performance or plan for the future. Each month has a separate sheet so that you can get a thorough picture of cash inflows and outflows for both short- and long-term periods.

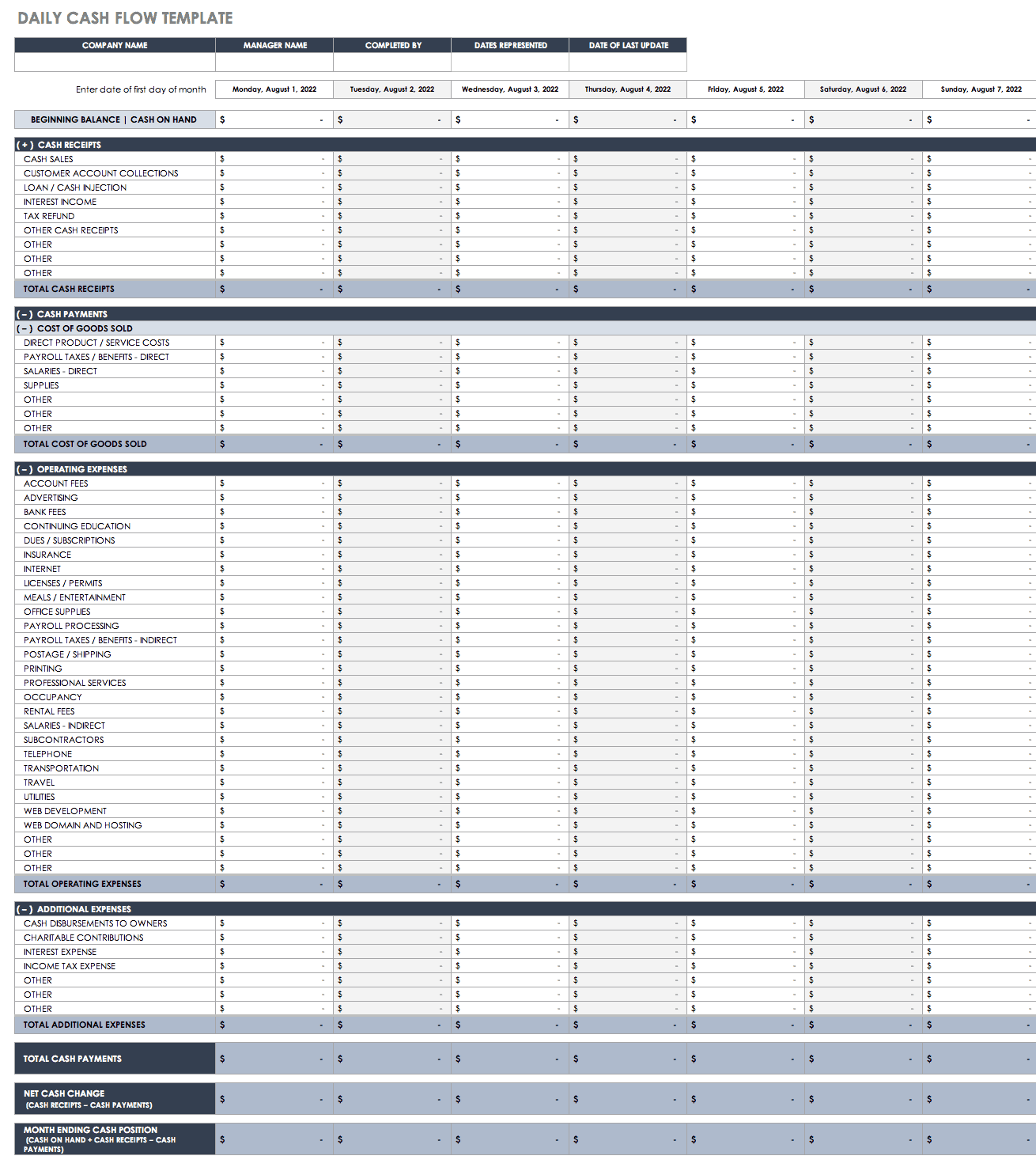

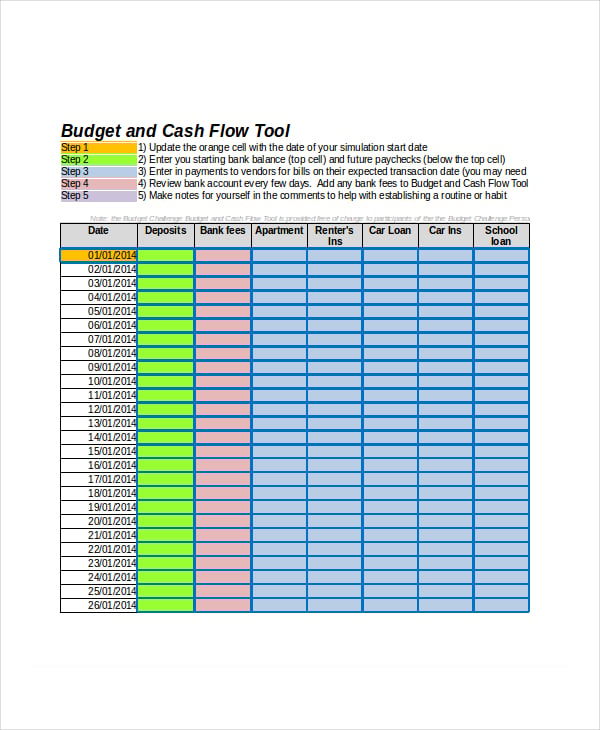

Daily Cash Flow Template

Download Daily Cash Flow Template

Add receipts and payments to this daily cash flow template to get a deep understanding of business performance. You can customize the list of cash inflows and outflows to match your company’s operations.

12-Month Cash Flow Forecast

Download 12-Month Cash Flow Forecast

Excel | Smartsheet

Use this template to create a cash flow forecast that allows you to compare projections with actual outcomes. This template is designed for easy planning, with a simple spreadsheet layout and alternating colors to highlight rows. You get a snapshot of cash flows over a 12-month period in a basic Excel template.

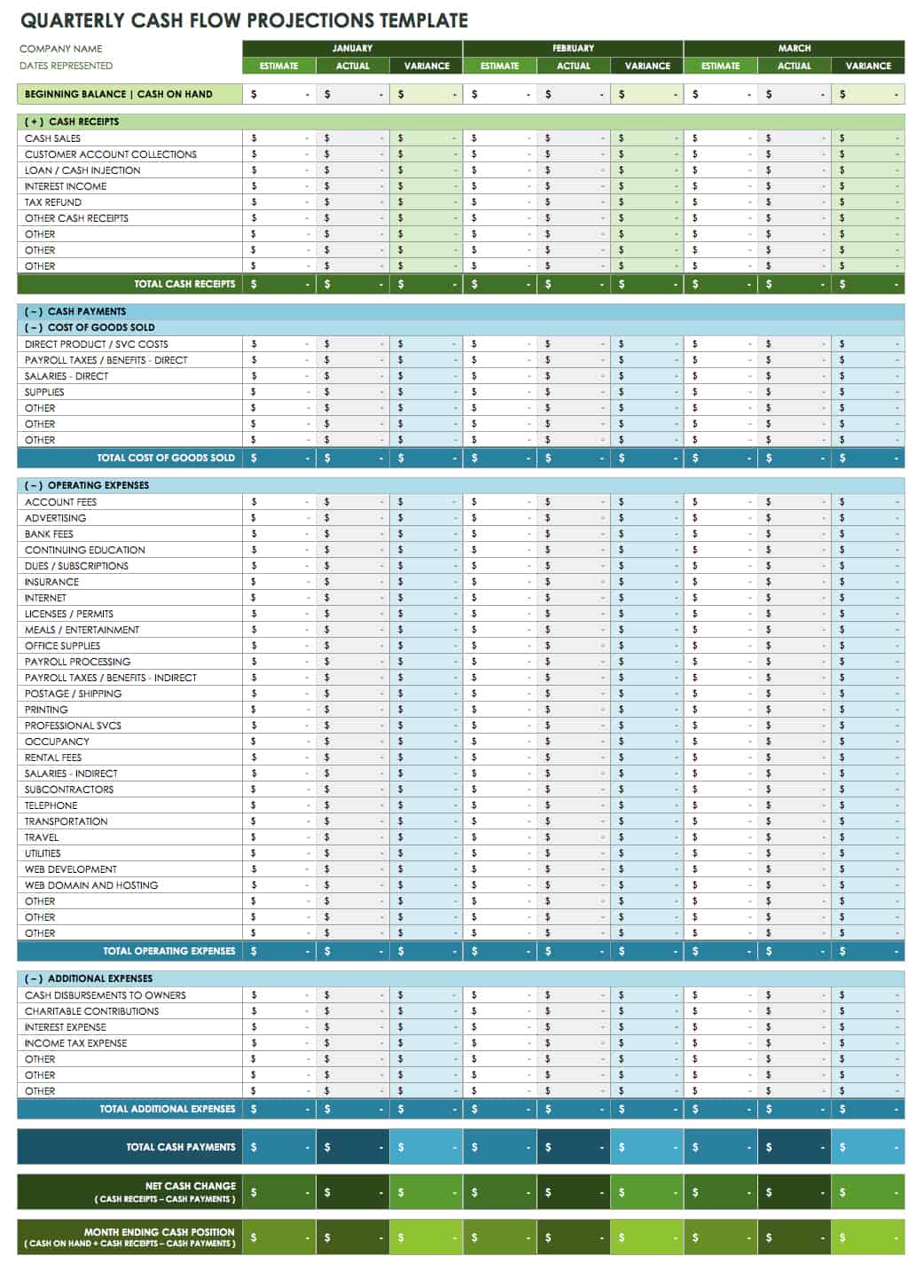

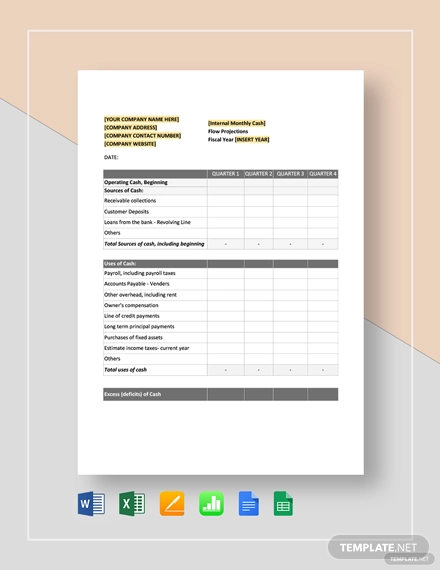

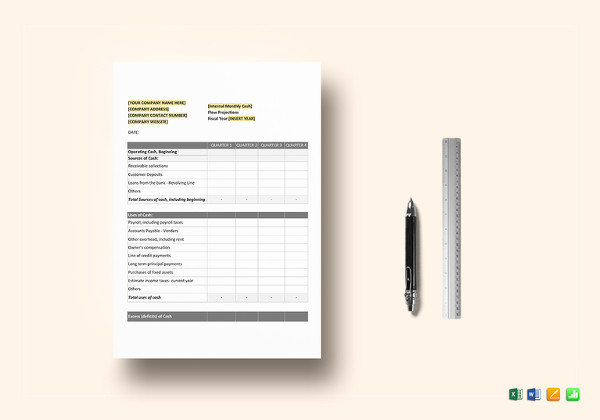

Quarterly Cash Flow Projections Template

Download Quarterly Cash Flow Projections Template

Cash flow projection templates can cover a variety of time frames, including the quarterly format offered here. Quarterly projections are useful for new businesses and those wanting to align cash flow projections with upcoming goals and business activities. Use the template to create projections and then compare the variance between estimated and actual cash flows.

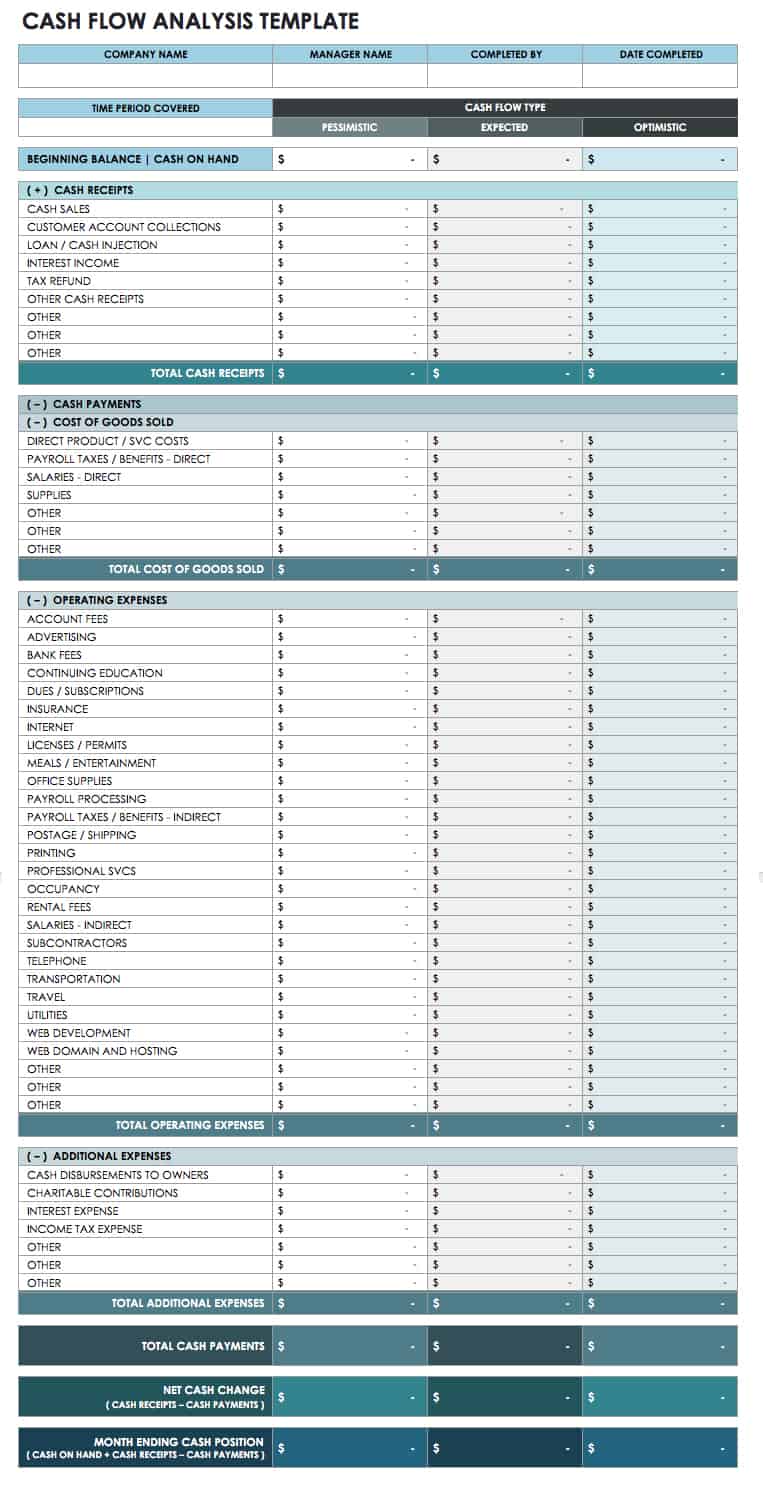

Cash Flow Analysis Template

Download Cash Flow Analysis Template

You can use this template to perform a cash flow sensitivity analysis in order to anticipate shortfalls and help your business maintain a positive cash position. This analysis can help you make more accurate cash flow predictions and inform your business decisions.

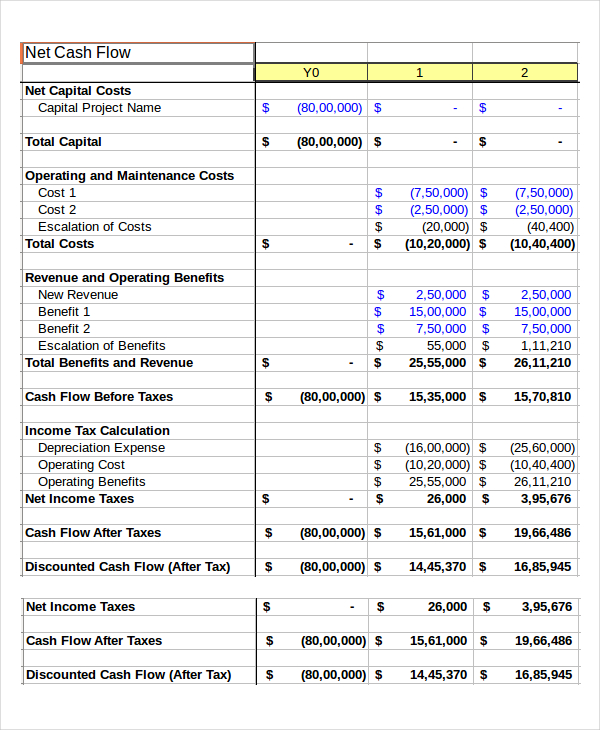

Discounted Cash Flow Template

Download Discounted Cash Flow Template

This template allows you to conduct a discounted cash flow analysis to help determine the value of a business or investment. Enter cash flow projections, select your discount rate, and the template calculates the present value estimates. This template is a useful tool for both investors and business owners.

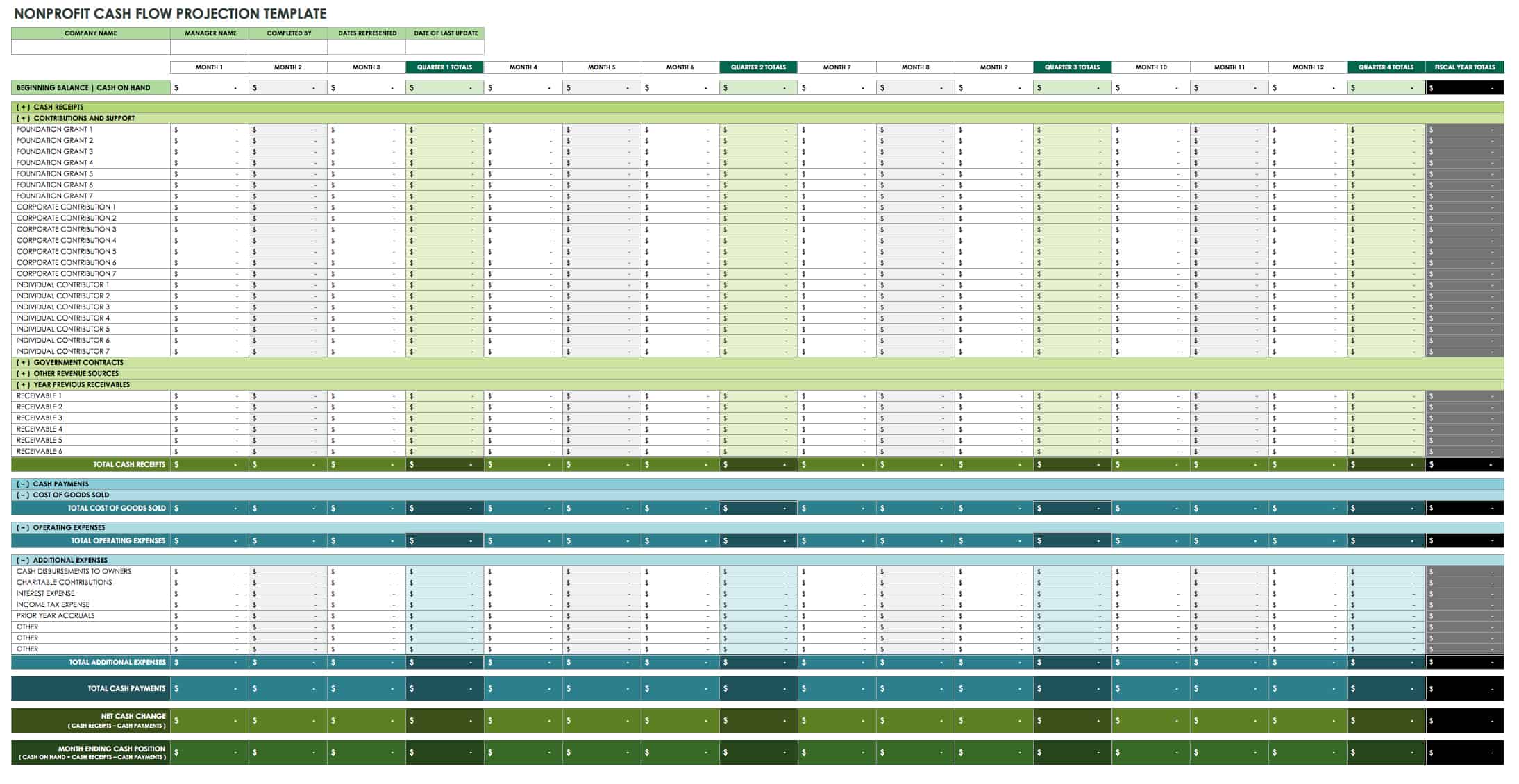

Nonprofit Cash Flow Projection Template

Download Nonprofit Cash Flow Projection Template

This template is designed with nonprofit organizations in mind and includes some common income sources, such as donations and grants, as well as expenditures. The template covers a 12-month period and makes it easy to see annual and monthly carryover so that you can track a rolling cash balance. Create a detailed list of all receipts and disbursements that are relevant to your organization.

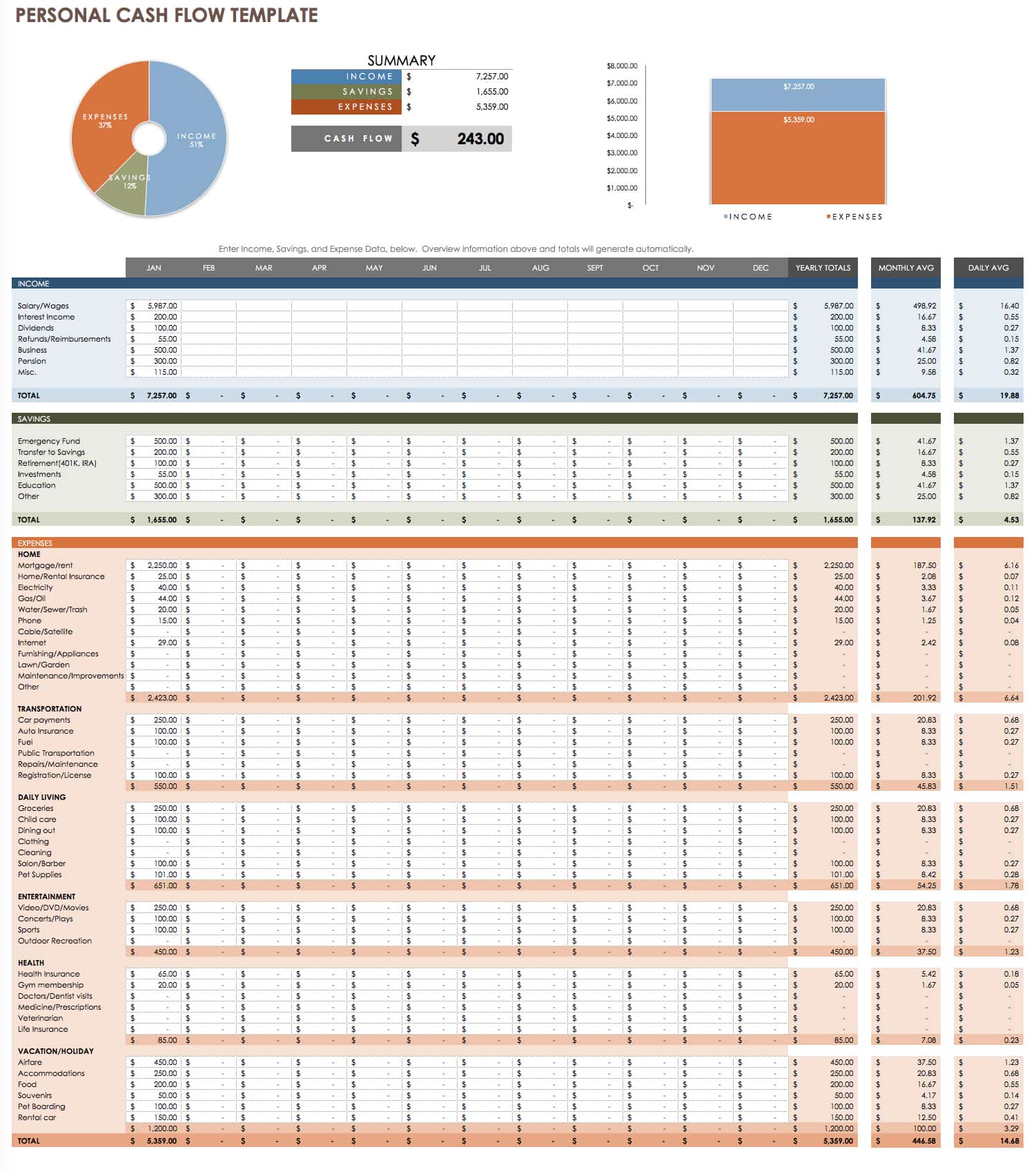

Personal Cash Flow Template

Download Personal Cash Flow Template

Individuals can manage their personal cash flow with this free template. The simple layout makes it easy to use and provides a financial overview at a glance. Keep track of how you are spending money to gain more control over your financial habits and outlook.

Trial Balance Worksheet

Download Trial Balance Worksheet

Excel | Smartsheet

Use this trial balance template to check your credit and debit balances at the end of a given accounting period, and to support your financial statements. The template shows ending balances for specific accounts, as well as total amounts for the activity period and the overall difference. This is a simple worksheet that you can customize to reflect your business type and the products or services it offers.

Excel Bookkeeping and Cash Flow Templates

To help you get started creating a cash flow statement or forecast, we’ve included a variety of customizable templates that you can download for free. Simply adjust your chosen template to fit your specific goals and the intended audience. Each template offers a clean, professional design and is intended to save you time, boost efficiency, and improve accuracy. Just enter your financial data, and the templates will perform automatic calculations for you to analyze. By combining your cash flow statement with a balance sheet, income statement, and other forms, you can manage cash flow and get a comprehensive understanding of business performance. Smartsheet offers additional Excel templates for financial management, including business budget templates.

Elements of a Cash Flow Statement

A cash flow statement is typically divided into the following sections to distinguish among different categories of cash flow:

- Operating Activities: Cash flows in this section will follow a company’s operating cycle for an accounting period and include things like sales receipts, merchandise purchases, salaries paid, and various operating expenses.

- Investing Activities: Some examples of investing activities include buying or selling assets, making loans and collecting payments, and generating cash inflows or outflows from other investments.

- Financing Activities: This section may include activities such as receiving money from creditors or shareholders, repaying loans and paying dividends, and selling company stock, as well as other activities that impact equity and long-term liabilities.

A statement of cash flows can summarize information for any accounting period, but if you’re starting a new business or planning for the months ahead, creating a cash flow projection can help you anticipate how much money your business will have coming in and going out during a future time frame.

Creating a Cash Flow Forecast

Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company’s performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. New businesses trying to secure a loan may also require a cash flow forecast.

In order to set yourself up for success, it’s imperative to be realistic when forecasting cash flows. You can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. For instance, knowing when your business will receive payments and when payments are due to outside vendors allows you to make more accurate assumptions about your final funds during an operating cycle. Estimated cash flows will always vary somewhat from actual performance, which is why it’s important to compare actual numbers to your projections on a monthly basis and update your cash flow forecast as necessary. It’s also wise to limit your forecast to a 12-month period for greater accuracy (and to save time). On a monthly basis, you can add another month to create a rolling, long-term projection.

A cash flow forecast may include the following sections:

- Operating Cash: The cash on hand that you have to work with at the start of a given period. For a monthly projection, this is the cash balance available at the start of a month.

- Revenue: Depending on the type of business, revenue may include estimated sales figures, tax refunds or grants, loan payments received or incoming fees. The revenue section covers the total sources of cash for each month.

- Expenses: Cash outflows may include your salary and other payroll costs, business loan payments, rent, asset purchases, and other expenditures.

- Net Cash Flow: The closing cash balance, which reveals whether you have excess funds or a deficit.

Keep in mind that while many costs are recurring, you also need to consider one-time costs. Additionally, you should plan for seasonal changes that could impact business performance, and upcoming promotional events that may boost sales. Depending on the size and complexity of your business, you may want to delegate the responsibility of creating a cash flow forecast to an accountant. However, small businesses can save time and money with a simple cash flow projections template.

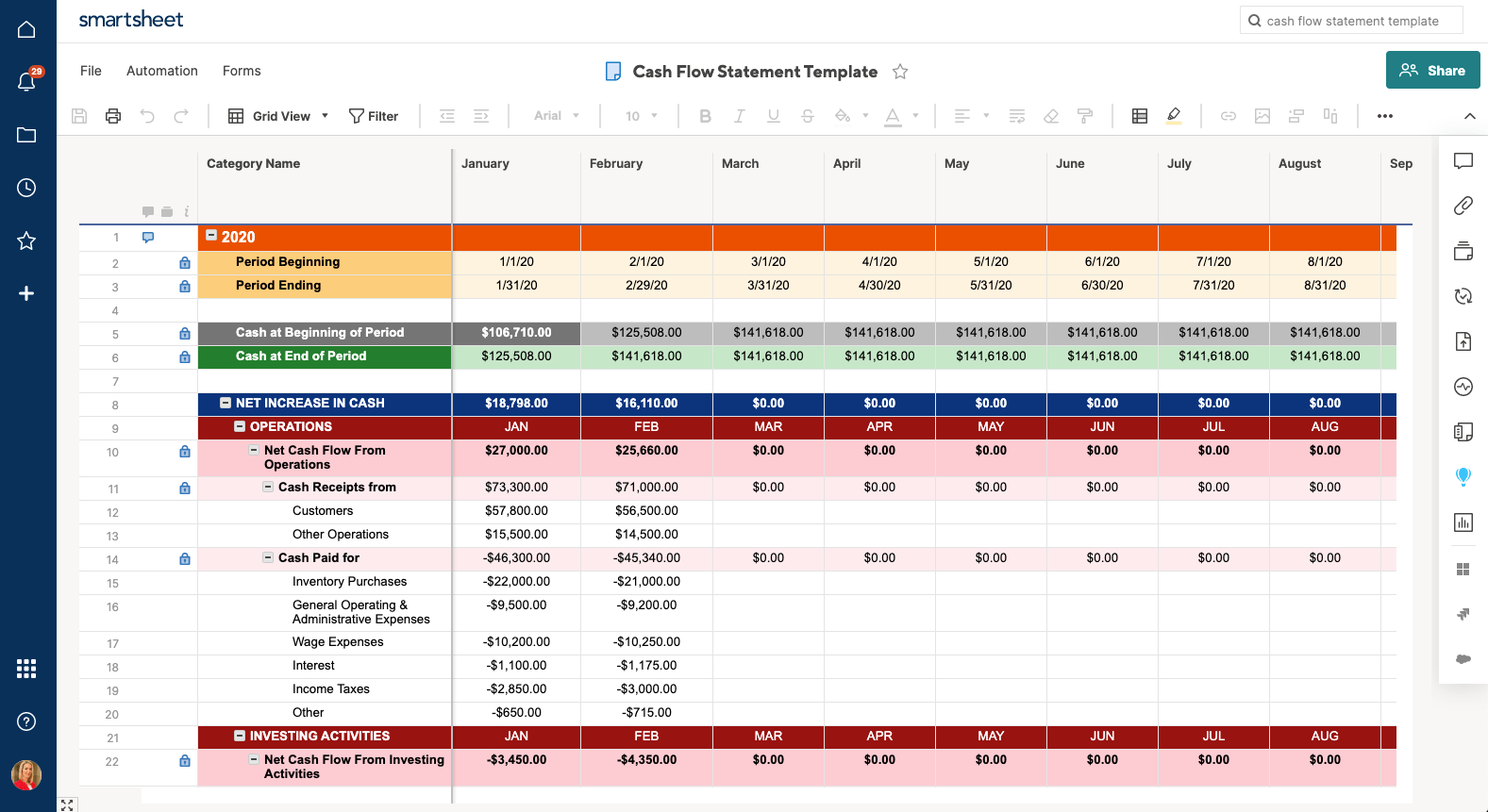

A More Collaborative Cash Flow Statement Template in Smartsheet

Using a template is essential to helping you get started managing your organization’s financials quickly. But, creating and managing your cash flow statement may require multiple stakeholders to weigh in and make updates. That’s why it’s important to find a template with more advanced functionality like notifications and reminders and enhanced collaboration features to ensure everyone is kept in the loop. One such template is the cash flow statement template in Smartsheet.

A Smartsheet template can improve how your team tracks and reports on cash flow — use row hierarchy to sum line items automatically, checkboxes to track stakeholder approval, and attachments to store item details directly to the rows in your sheet. Easily create reports to roll up annual, quarterly, or monthly cash flow details so you’ll always have a real-time view of the financial health of your business.

See how easy it is to track and manage your cash flow statement with a template in Smartsheet.

Create a Cash Flow Statement in Smartsheet

A Better Way to Manage Accounting and Finance Processes for Companies of All Sizes

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Free Excel Cash Flow Template from Xlteq

Download Xlteq’s free Cash Flow Template to assist with managing and reporting for your business. This free cash flow template shows you how to calculate cash flow using a simple cash flow statement. Our cash flow template helps measure your company’s financial performance. It displays the cash that your company has on hand after deducting elements such as salaries, rent, purchase of assets (e.g. equipment), and costs from the company income. In other words, it measures your company’s ability to manage the cash that’s available at any given time.

Free Cash Flow = Operating Cash Flow – Capital Expenditures

After downloading the Excel file, simply enter your own information in all the white cells which will automatically produce an annual output.

The downloadable Excel file includes five tabs.

- Company Information : Name and start date

- Forecast : Expenditure and income

- Actuals : Real data accross the year

- Summary : Compare Forecast verses Actual

- Help : Assistance

Download the Free Cash Flow Template

Download

Additional Resources

Thank you for checking out Xlteq’s free Cash Flow template, in addition to this we offer a range of sevices that might be helpful to your buiness:

- Excel Development

- Access Database Development

- Ongoing Support

We would be delighted to hear from you to discuss your Excel spreadsheet or Access database project.

Contact Us

You can call us now on 020 3817 6945 or fill out the form below.

Excel

26+ Cash Flow Excel Templates

Keeping a record sheet of cash flow is a very important job. It is important to make a proper budget. Another use of keeping a record of cash flow is to determine various taxes that have to be paid. The cash flow must be in a very systematic fashion. Cash flow analysis come in handy to help you keep a record of the cash that comes in and goes out of your organization, for every possible purpose.

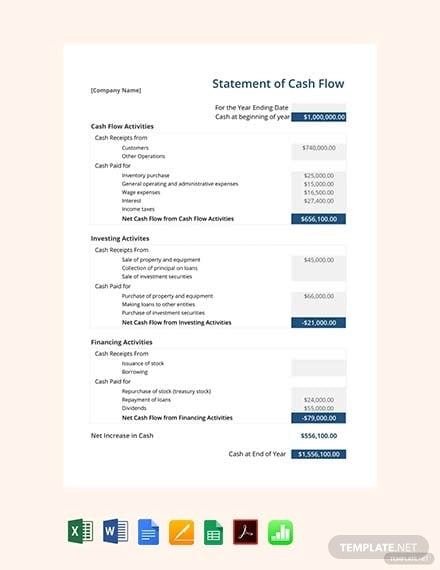

Free Cash Flow Statement Template

Details

File Format

- Google Docs

- Word

- Pages

- Excel

- Google Sheets

- Numbers

- Editable PDF

Size: A4 & US

Download

A cash flow statement can be defined as a statement that has in it the details of the flow of money into and out of the organization as income and expenses. Get the above template to craft a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company. It helps you keep a check on your income and expenses, making it easier to know where to cut down on expenses and where you can increase the incomes for the growth of your business.

Freelance Cash Flow Sheet Template

Details

File Format

- Google Sheets

- MS Excel

Download

Simple Cash Flow Statement Template

Details

File Format

- MS Word

- Google Docs

- Apple Pages

Download

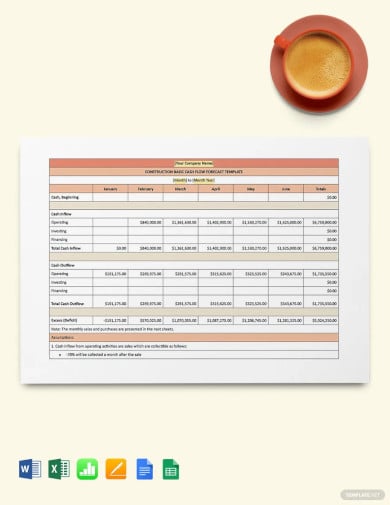

Construction Basic Cash Flow Forecast Template

Details

File Format

- MS Word

- Google Docs

- Google Sheets

- MS Excel

- Apple Numbers

- Apple Pages

Download

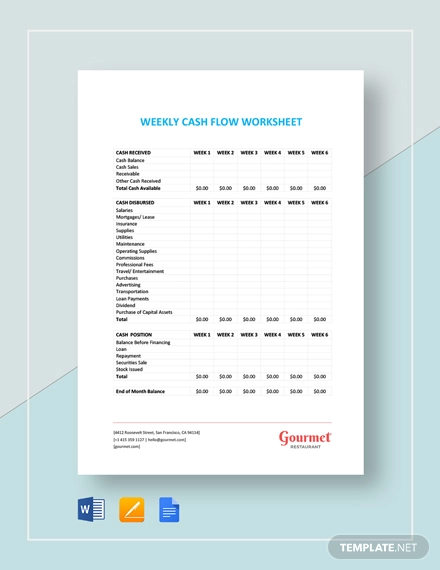

Weekly Cash Flow Worksheet Template

Details

File Format

- Google Docs

- Word

- Pages

- Excel

- Google Sheets

- Numbers

Size: A4 & US

Download

Get to produce a document that would help you show the flow of funds to and from your business weekly with the help of this above-mentioned ready-made weekly cash flow worksheet template. This is perfect for analyzing business performance, making projections about future cash flows, influencing business planning, and informing important decisions. The file is easy to use, simply make the necessary customization and add the necessary data to the worksheet to proceed with your calculations.

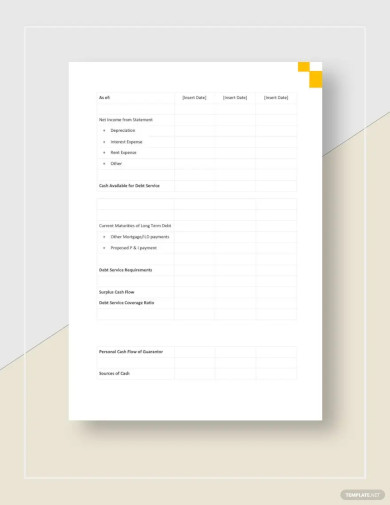

Free Global Cash Flow Analysis Template

Details

File Format

- MS Word

- Google Docs

- Apple Pages

Download

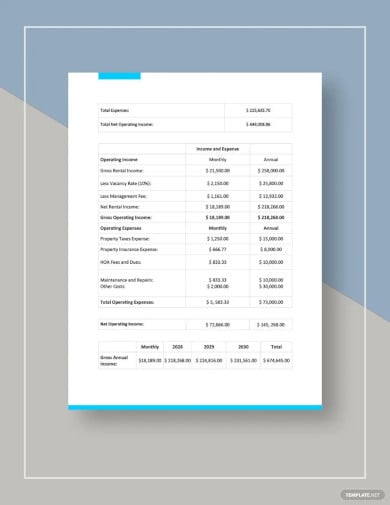

Free Real Estate Cash Flow Analysis Template

Details

File Format

- MS Word

- Google Docs

Download

Monthly Cash Flow Forecast Template

Details

File Format

- Google Docs

- Word

- Pages

- Excel

- Google Sheets

- Numbers

Size: A4 & US

Download

Create a excel document that indicates the amount of available cash in one month once expenditures are subtracted from income using the above template. We help turn your tedious tasks into time-saving ones as these templates help you reduce the stress of creating cash flow sample statements from scratch. Improve your business and make sure your finances are well taken care of. It is professionally designed and helps you with number crunching for your convenience.

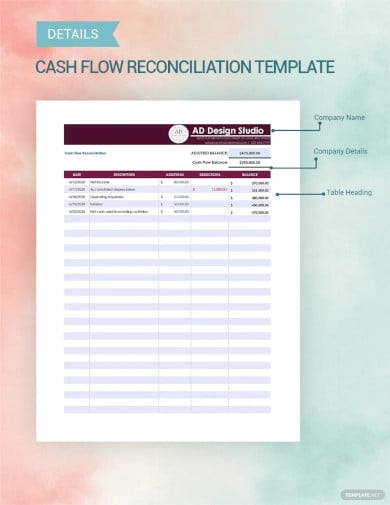

Cash Flow Reconciliation Template

Details

File Format

- Google Sheets

- MS Excel

Download

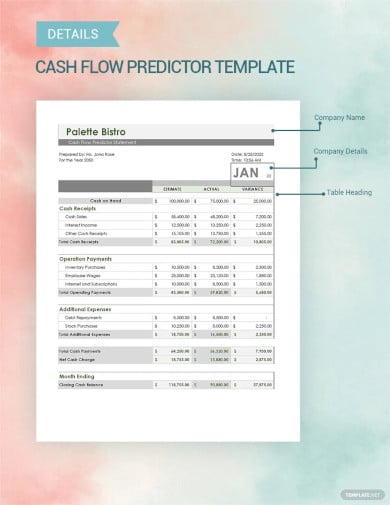

Cash Flow Predictor Template

Details

File Format

- Google Sheets

- MS Excel

Download

Cash Flow Tracker Template

Details

File Format

- Google Sheets

- MS Excel

Download

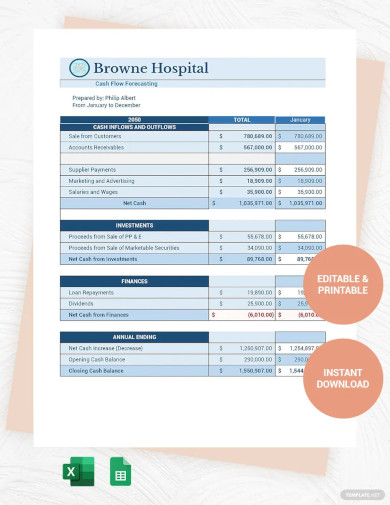

Cash Flow Forecasting template

Details

File Format

- Google Sheets

- MS Excel

Download

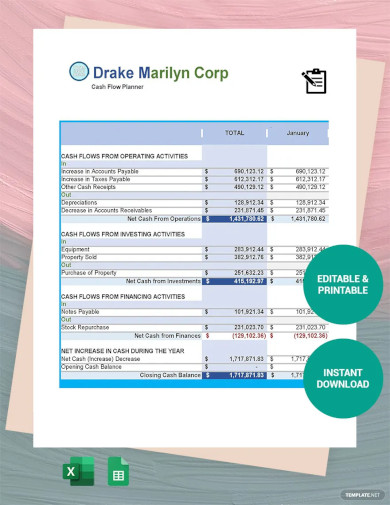

Cash Flow Planner Template

Details

File Format

- Google Sheets

- MS Excel

Download

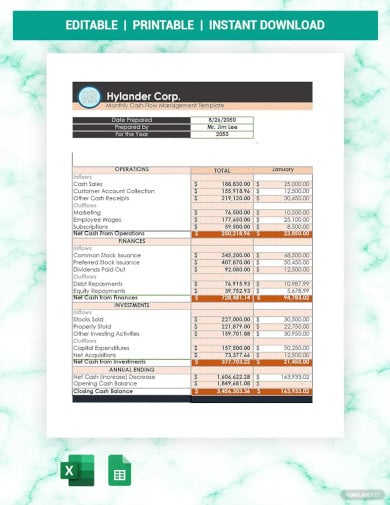

Monthly Cash Flow Management Template

Details

File Format

- Google Sheets

- MS Excel

Download

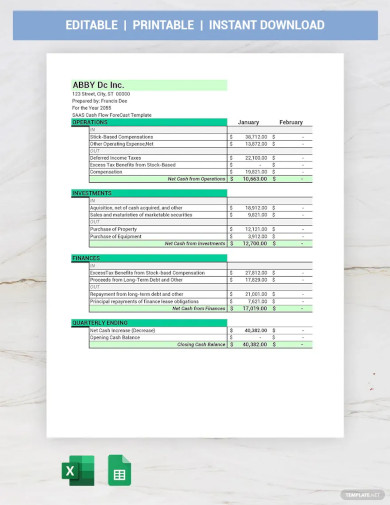

SaaS Cash Flow Forecast Template

Details

File Format

- Google Sheets

- MS Excel

Download

Monthly Cash Flow Forecast Template

Details

File Format

- MS Excel

- MS Word

- Numbers

- Pages

Size: US & A4

Download

This monthly cash flow forecast template stated above not only sees how the money is being spent, but it also shows if you have enough to keep the business afloat or not. It is easily editable and can be customized to suit your needs perfectly. All you have to do is download the template, edit it and customize it as you wish to do so. Edit the highlighted parts with your information and you’re good to go! You can also see more on Cash Analysis.

Simple Operating Daily Cash Report Template

Details

File Format

- MS Excel

- MS Word

- Numbers

- Pages

Size: A4 & US

Download

Be on top of your operations with the help of the above outline template, which is a daily cash report template. Download this straight forward and effective template that you can use for tracking cash for your business daily. Open and edit with your favorite chosen app or sample program. Be at the helm of your business by always being updated on the state of your finances by using this template now!

Printable Daily Cash Sheet Template

Details

File Format

- MS Word

- Pages

Size: A4 & US

Download

The above simple outline template is a daily cash sheet template, which proves to be a good record-keeping device for the daily cash balance of your business, regardless of which industry you work in. This daily cash sample sheet template is the perfect record keeper for the daily cash balance for your business. It is compatible with Google Docs, so you can edit and share online with your business partners if and when necessary.

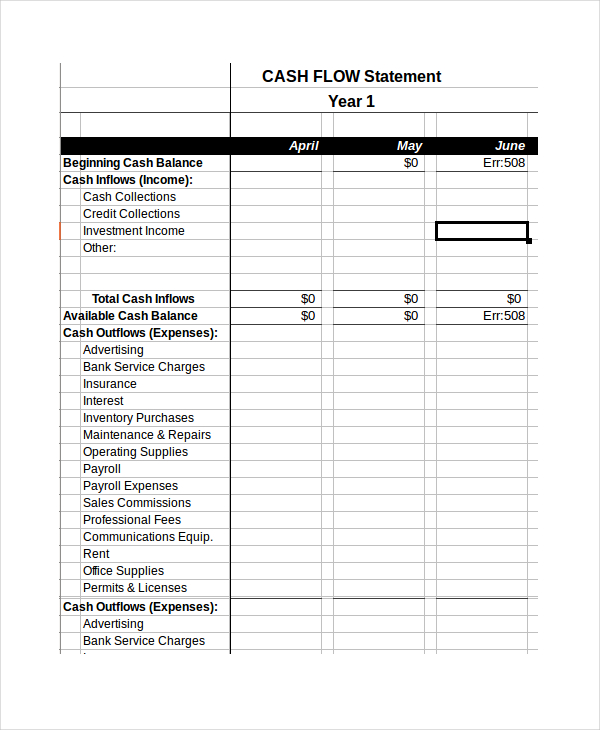

Cash Flow Statement Balance Sheet Excel Template

s.hswstatic.com

Details

File Format

- Xls

- Xlsx

Size: 49.2KB

Download

This is a very useful cash flow Excel template which can be used to calculate the inflow and outflow of cash for a company to calculate its net cash balance.

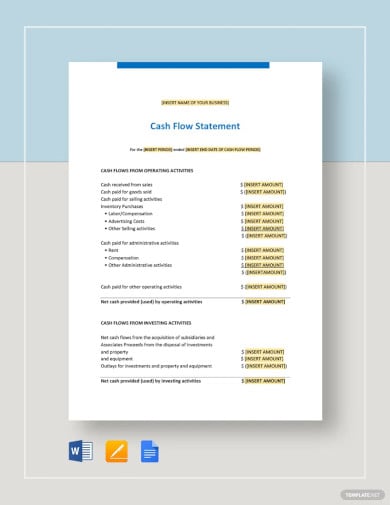

Creating a Cash Flow Statement:

Creating a cash flow can be a tough job since there are two methods you can follow- the direct and the indirect methods. You can follow the steps mentioned below to make it easier for you to create the right kind of a cash flow statement for your organization:

1. Calculate the Beginning Cash Equivalent

The first thing you need to do is to know what your ending cash balance or the previous year was. This way, you will know if there is any left from the previous year which you can use this year for any extra expenses that might take place. Free cash flow analysis templates will help you get a better idea of how to make the most of the templates that are available online. Then, you would have to establish the cash balance of the present year. Add the value, so you get the right value for your cash flow statement format.

2. Income Generated from Operations

Net income plays an important role in the cash flow statement. Gather basic documents and data that are required to make the perfect cash flow statement for your business. Make adjustments for the accounts you have to pay and receive cash from. Make a list of the cash net income you get from basic operations and deals done in your organization. This way you will know the depreciation (reduction of value of an asset over time) and you can adjust it accordingly.

3. Cash Flow from Investing and Financing

You must mention the investments in capital. Mention the impact of financing and investing activities. Make adjustments wherever required in the two departments, so you can know where to cut down costs. Tax plays a major role in the cash flow statement, so make sure you mention it without fail. Balance sheets, income statements, and other information should be mentioned in the cash flow statement that needs to be mentioned.

4. Calculate Ending Cash Equivalent

In the ending cash flow balance, you would have to mention whether there was an increase or decrease in the net cash. Calculate the ending cash equals and compare them to the previous year. This way, you will know whether there was an increase or decrease in the expenses. Mention if there are any effects of changes in working capital and what would those be. Simple List all the current assets and liabilities without fail.

5. Evaluation

The last and final step would be to evaluate where your company stands now. This way, you will know the operating, investing and financing activities of your company. Evaluate your company’s financial place and health with the help of cash flow sample budget statements that are available online for you to use. Add up all of the incomes and expenditures to perform a final check.

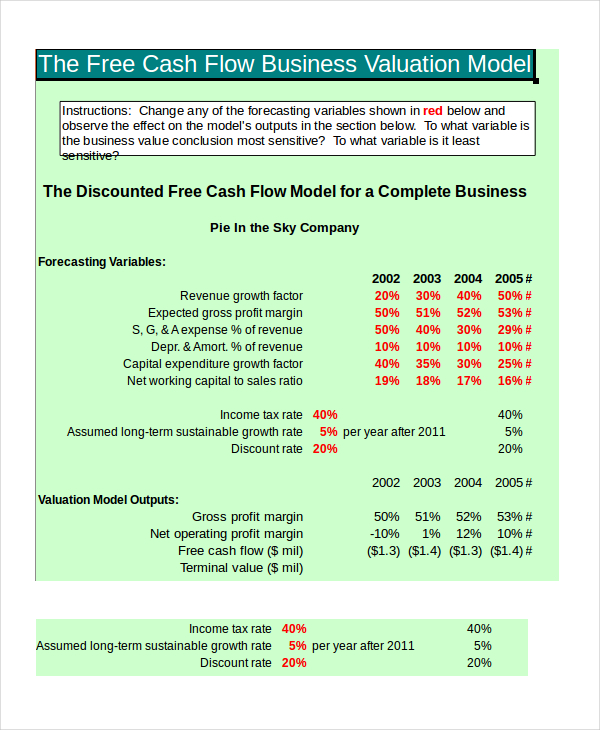

Accounting Cash Flow Business Valuation Template

exinfm.com

Details

File Format

- Xls

- Xlsx

Size: 30.2KB

Download

This is a very useful cash flow Excel template that can be used for keeping a record of various transactions of the company to calculate its total revenue, profit, and percentage increase. You can also see more on Small Business Budgets.

Positive Cash Flow Forecast Excel Template

nab.com.au

Details

File Format

- Xls

- Xlsx

Size: 55.8KB

Download

This cash flow template Excel can be of great help as it helps in calculating the expected cash balance you will have by noting the regular expenses and expected income. You can also see more on Small Business Budgets.

How to Use a Cash Flow Excel Template?

Cash flow templates are pretty similar to excel balance sheets and using them right is very easy. It makes your job way easier. To use the sign-in sheet templates to calculate your net cash flow, you have to make a record of two things, all the assets, and liabilities of your organization. Assets include all the sources from where there are income and gain like investments, collections, sales, funds, etc. These calculate the total amount of money your organization will receive.

Then you have to make a note of liabilities, all sources where you will have to spend money. This includes the salaries of employees, loan payments, advertising, etc. After entering these values, the template automatically gives you the balance and percentage increase. You can also see more on Cash Flow Analysis in Pdf.

Who Can Use the Cash Flow Excel Templates?

Cash flow Excel templates can be used for any type of business. Small businesses ranging from shops and restaurants to large scale industries can make use of these templates to keep a record of their financial status and also project the status of the coming quarters. There are many global cash flow analysis templates available online for you to check and choose the best one that suits your business perfectly.

Accountants are the ones who will benefit the most from the use of these templates as they are the ones who have to keep a record of cash flow and do these complex calculations and make projections regarding the company’s finances. Individuals can also make use of these templates to take care of their finances. You can also see more on Business Expense Budgets in Excel.

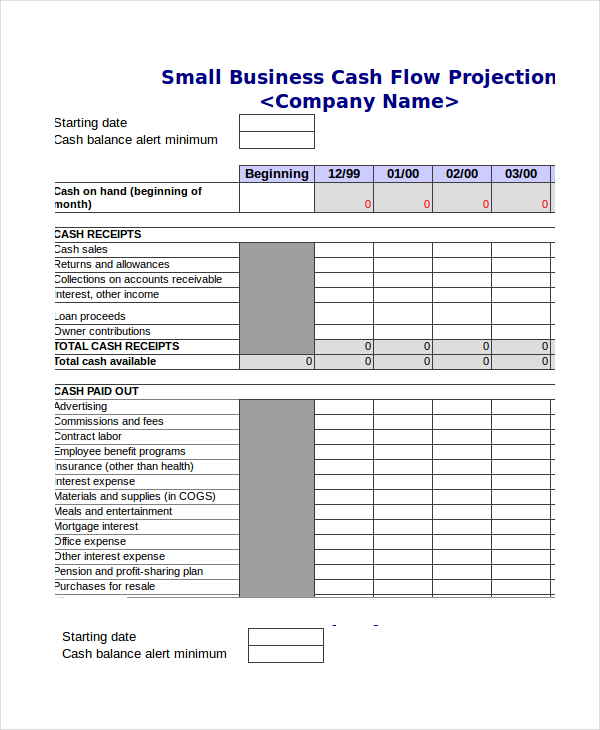

Small Business Cash Flow Projection in Excel Format

nbcc.nu.ca

Details

File Format

- Xls

- Xlsx

Size: 43KB

Download

This cash flow template Excel will be extremely useful for small businesses as it helps in projecting the total cash flow for an interval by taking into account all the transactions that are expected. You can also see more on Company in excel templates.

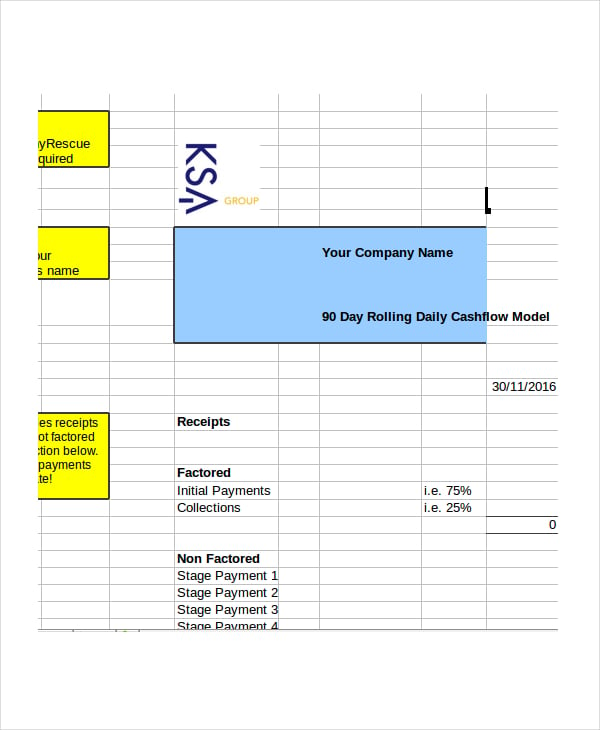

companyrescue.co.uk

Details

File Format

- Xls

- Xlsx

Size: 167.9KB

Download

If you want to keep a record of the cash flow in and out of your organization that is done on a day to day basis then you can highly benefit by using this cash flow Excel template. You can also see more on Daily Sheets in Excel.

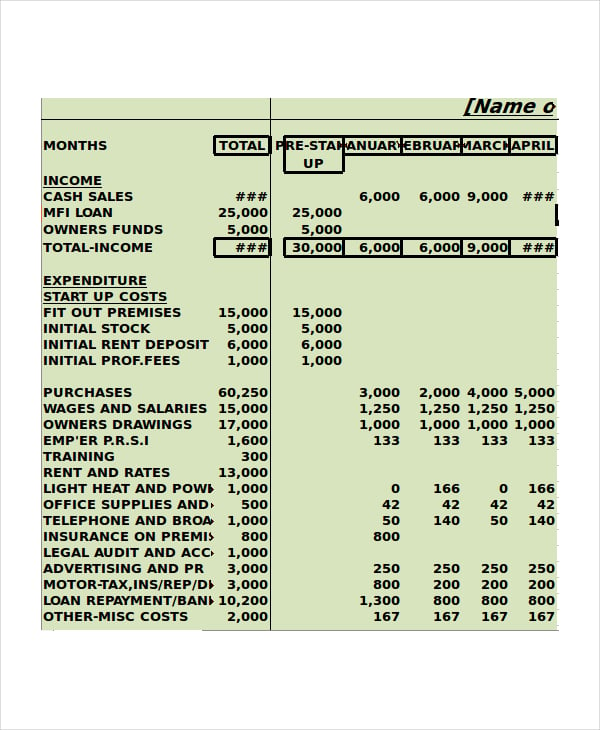

Free Monthly Cash Flow Excel Template

microfinanceireland.ie

Details

File Format

- Xls

- Xlsx

Size: 40.3KB

Download

Free Cash Flow & Budget Template

readingschools.org

Details

File Format

- Xls

- Xlsx

Size: 31.2KB

Download

Money / Cash Flow Excel Spreadsheet Template

money-zine.com

Details

File Format

- Xls

- Xlsx

Size: 39.4KB

Download

Final Thoughts:

Cash flow templates have a huge number of benefits. The biggest benefit is that cash flow templates help you in doing complex calculations with ease by making use of the inbuilt functions in Excel. These signup sheet templates also decrease any chances of mistake you might commit while making these calculations as you can easily double-check your entries, which will be difficult to accomplish if you choose to do these calculations manually.

Cash flow templates also help you in listing your finances in order manner, which can be extremely useful for future references. You save a huge amount of time by using these templates. If you are looking to make a budget then you can make use of Excel budget templates.

Cash flow templates can find use in all kinds of businesses. Check out all the templates that we have listed above. You are sure to find a template that will help you with your needs. Best cash flow statements will help you get a better idea of how to make the most perfect and the easiest to understand cash flow personal statements for your business.

General FAQs

1. What is Cash Flow?

Cash flow can be defined as the net amount of cash-to-cash equivalents that are carried in and out of business. It is the company’s ability to create profit for shareholders by creating positive cash flows. Cash flow is the current money that is coming into your business, rather than the expenses going out.

2. Why is Cash Flow important?

Cash flow is important because it is the payment for things that make your business run. This could be for expenses like stock or raw materials, employee salaries, rent, etc. Positive cash flow is preferred in any business, but many companies also have negative cash flow, where there is more expense than income.

3. What is a good Cash Flow?

The best things in life are free and that is true for cash flow. Investors prefer companies that produce plenty of cash flow, as that is a huge benefit for them. Good cash flow shows a company’s ability to clear debts, pay dividends and on the whole, promote the growth of the business.

4. How is Cash Flow calculated?

Cash flow is calculated with the help of proper balance simple sheets for each financial year. Using cash flow statements and balance sheets can give you the net income and expenses you have had in that particular year. It helps you understand your income, assets and liabilities, depreciation costs, working capital, etc.

5. What affects Cash Flow?

Many factors affect the cash flow of a business organization. Some of them are:

- Accounts receivable and the average collection period

- Sales and management ratio

- Improper cash flow management

- Allowing too much customer credit

- Loss of business

- Increase of balance of an asset, etc.

6. What is the difference between Cash Flow and Profit?

Profit is the overall revenue that remains after subtracting the business costs, while cash flow is the amount of money that flows in and out of business regularly. Profit is more symbolic of the success of your business, whereas cash flow is more important to keep your business running on a daily basis.