Содержание

- How to Use Microsoft Excel for Accounting

- Related

- Budgeting and Statements

- Spreadsheets

- External Data

- Integration

- The ultimate Excel accounting template for bookkeeping

- What is an Excel accounting template?

- Why use the Excel accounting template?

- What are some examples of Excel accounting templates?

- Income statement templates

- Balance sheet templates

- Cash flow statement templates

- Managerial accounting templates

- Cost accounting templates

- Excel accounting template by monday.com

- Why monday.com’s built-in Accounting Template is the only template you’ll ever need

- Even more accounting templates from monday.com

- Financial Statements Template

- Expense Tracking Template

- FAQs about Excel accounting templates

- How do I create an accounting template in Excel?

- Does Excel have accounting templates?

- How do you do accounting in Excel?

How to Use Microsoft Excel for Accounting

Microsoft Office Excel was designed to support accounting functions such as budgeting, preparing financial statements and creating balance sheets. It comes with basic spreadsheet functionality and many functions for performing complex mathematical calculations. It also supports many add-ons for activities such as modeling and financial forecasting, and seamlessly integrates with external data to allow you to import and export banking information and financial data to and from other accounting software platforms.

Microsoft Office Excel was designed to support accounting functions such as budgeting, preparing financial statements and creating balance sheets. It integrates with external data to allow you to import and export banking information and financial data to and from other accounting software platforms.

Budgeting and Statements

Microsoft Office Excel ships with templates for creating budgets, cash-flow statements and profit-and-loss statements, which are some of the most basic documents used in accounting. In addition, you can download more complex budgeting and statement templates from the Office website, or purchase specialized templates from third-party vendors and install these in the application. If you need to create complex or custom budgets or financial statements, you can either customize an existing template and re-use its elements, or create one from scratch using the functionality built into Excel.

Spreadsheets

Performing line calculations is a basic accounting task, and Excel spreadsheets are designed to contain data in a tabular format that supports both in-line and summation calculations, replacing the need for ticker tape and special accounting calculators. The data in the spreadsheet is reusable and storable, making Excel more flexible than an accounting calculator for performing simple calculations and summations. Additionally, you can create charts and graphs from the spreadsheet data, creating a media-rich user experience and different views of the same data. You can also use add-ons to mine the data and create models and financial forecasts.

External Data

You can import data from many different data sources into Excel. This is especially useful for accounting as you can pull sales data, banking data and invoices from many sources into one central workbook to support your accounting activities. The data can be stored in different databases and file formats prior to importing, allowing you to access data from many different areas of your business without having to do additional data entry.

Integration

Excel integrates with many popular accounting software applications. For example, you can use the wizards that ship with your preferred accounting software package to map Excel spreadsheets to your accounting data so you can perform push and pull data operations from both Excel and your accounting package on demand.

Источник

The ultimate Excel accounting template for bookkeeping

Your business can’t survive without accounting, which is why you’re probably on the hunt for an Excel accounting template that can help you stay on top of your organization’s finances.

But before you dive in head-first, there are a few important things you should know about accounting templates and other accounting software.

In this article, we will explain what accounting is, how Excel accounting templates work, and how monday.com’s Accounting Template can take your organization’s accounting to the next level.

What is an Excel accounting template?

Accounting is all about making sure you always have a clear view of your income, petty cash, cost management, cash book, tax obligations, debts, paychecks, and everything else money-related you could possibly think of.

But that can be pretty hard to keep track of — especially if you’re leading a small team and wearing many different hats at any given time. This is where an Excel accounting template really comes to the rescue.

An accounting template is a pre-built accounting statement that you can download and customize to suit your business needs. These templates are typically pre-populated or have a range of labeled columns — and then you simply fill in the blanks with your own financial information.

There are a number of free accounting templates for Excel and Google Sheets you can download and import onto your desktop or web app.

Why use the Excel accounting template?

Excel accounting templates are all about making life easier. If you’re new at this, having a clearly labeled template that can show which values to place and where is a total lifesaver.

For example, let’s say you’re a software engineer managing a new start-up. You might know a whole lot about building apps, but next to nothing about how to fill out an income statement. Don’t worry: most of us aren’t accountants.

Having an Excel accounting template to fall back on gives you some peace of mind in knowing you’re on the right track. A template will guide you in terms of all the fields and columns you have to include and what financial data you’ve got to keep tabs on.

If you’re looking for a more flexible and dynamic accounting template with less manual labor involved, we’ve got you covered. But more on that in a minute. First, let’s talk about the different types of accounting templates.

What are some examples of Excel accounting templates?

Because it’s the bread and butter of most trained accountants, you can find a lot of Excel accounting templates and just about every Excel bookkeeping template you could ever want, depending on your needs.

For example, there’s a General Ledger Template for you to track any business expense, a Statement of Account Template, Credit Card Tracker Template, invoice templates, and more.

Let’s talk about the different types of accounting templates.

Income statement templates

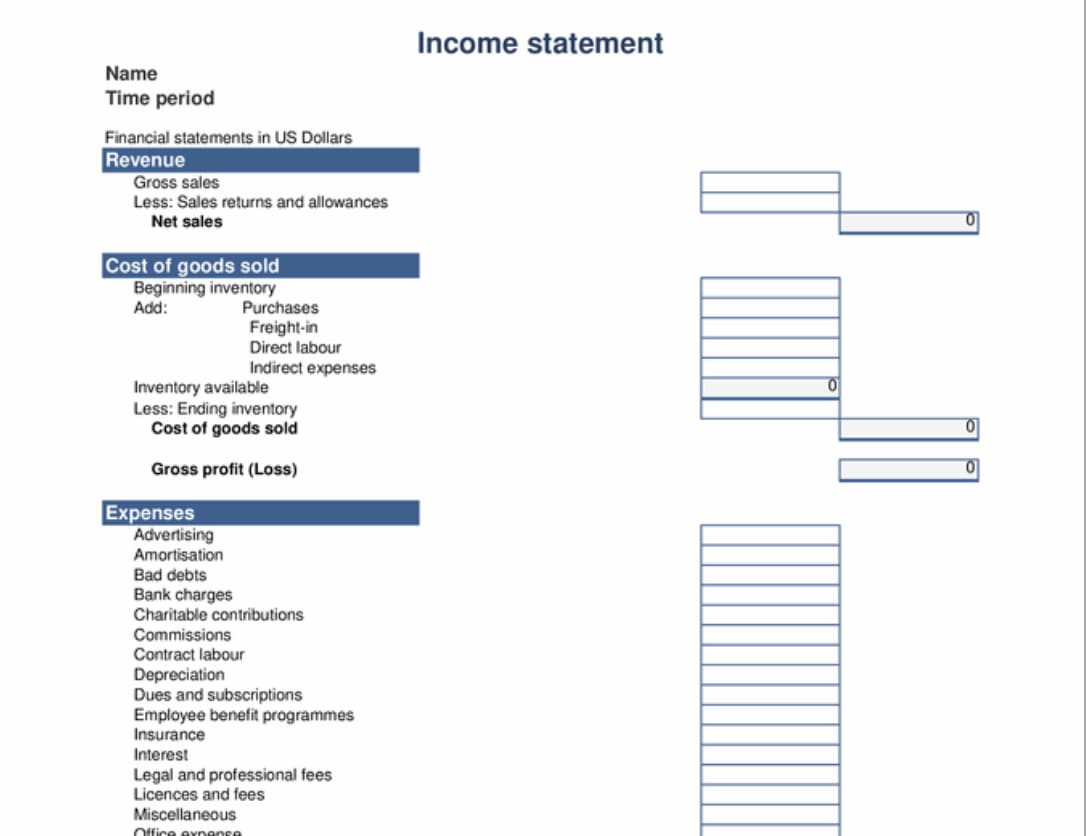

An income statement template is a pre-designed template to help you record and summarize all of your team’s net income, net sales, and expenses during a given period of time.

An income statement is also often referred to as a “profit and loss statement” or “statement of revenue and expense.” That means you might occasionally see an income statement template labeled as a profit and loss statement template or a statement of revenue and expense template — but it all amounts to the same thing.

There are a number of downloadable income statement templates you can use to record your income information in Excel spreadsheets. They’re normally pretty basic and include a number of pre-labeled rows and columns identifying common expenses and revenue sources that apply to a lot of different business types.

The key benefit here is that these templates will serve as a great prompt in terms of all the expenses or income sources you might not have otherwise considered including in your statement.

Balance sheet templates

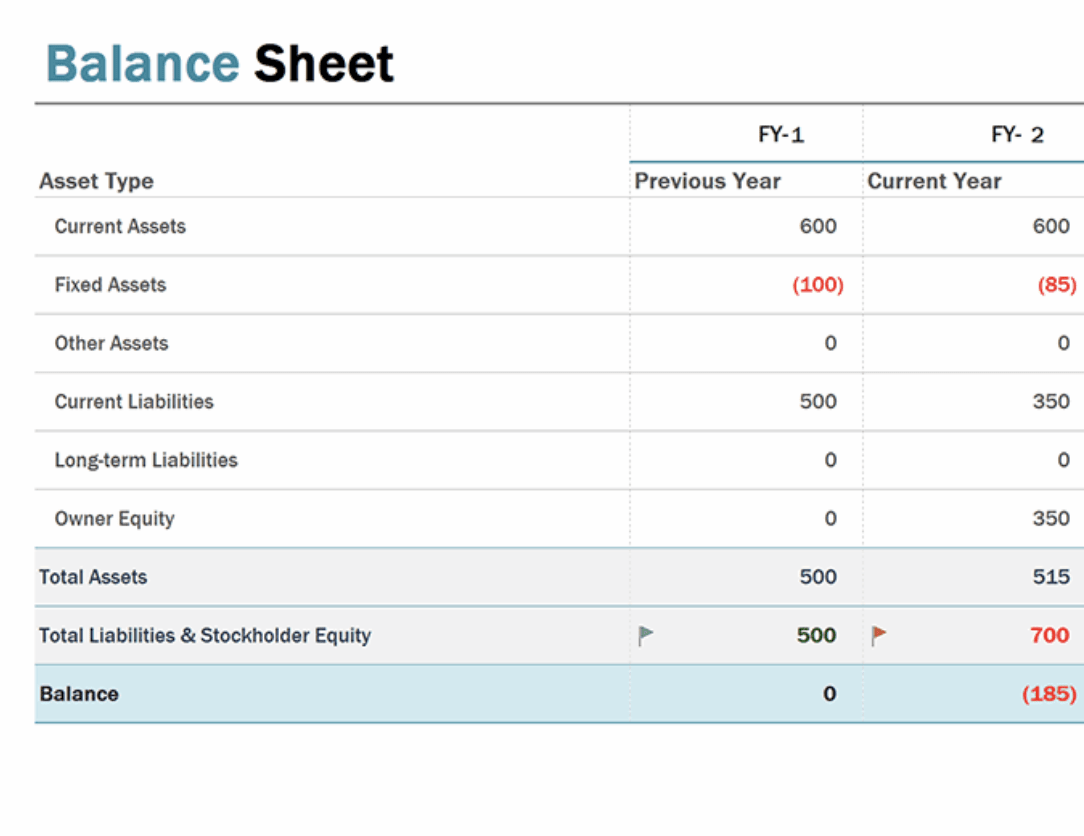

A balance sheet template is a pre-made accounting statement that looks at all of your company’s total assets and liabilities — as well as shareholder equity. Balance sheets are all about demonstrating the “book value” of your company. To figure out your book value, you need to list all your company’s assets, liabilities, and equity for a given reporting date. Balance sheet templates are useful because they include pre-loaded rows that spell out all the basic information you’ll need to include in your accounting statement.

There are a number of pre-built balance sheet templates on Microsoft Office and other apps that include pre-configured formulas to find all your balance totals. This can save you valuable time because all you’ve got to do is drag and drop your financial data — the template does all the hard work.

Cash flow statement templates

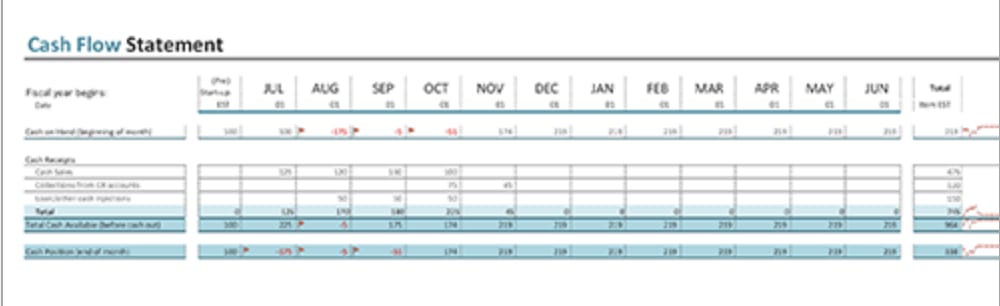

Next, you’ve got cash flow statement templates. A cash flow statement gives you a breakdown of what your company’s cash balances look like for a given period. There are loads of cash flow templates available on Excel and a number of external sites that you can download for free.

Cash flow statement templates are particularly useful for companies that are scaling up and need to show how sustainable their cash inflows are. For example, a clothing startup might use a cash flow statement template to quickly work out their cash balances over a 12-month period to show a lender that the startup can afford to take on a new business loan.

Managerial accounting templates

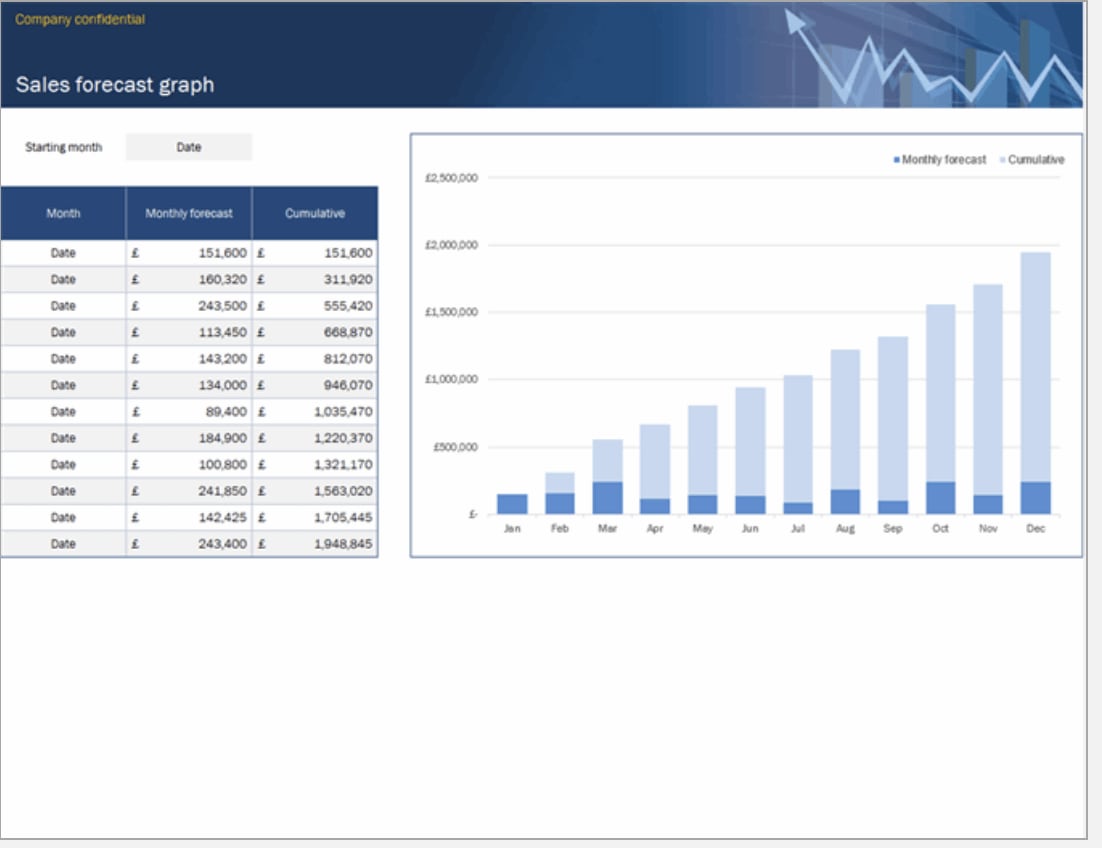

Managerial accounting is similar to financial accounting. But instead of looking at various accounting dates, it focuses on monthly or quarterly reports.

Managerial accounting statements enable you to analyze a company’s income and overheads to make important decisions about how your operations are funded and run. There are a number of managerial accounting templates on Excel — including budget templates and forecast templates.

This makes it easy to share with stakeholders and externals to let them know how your business is doing — without losing hours of precious time building tables yourself.

Cost accounting templates

Cost accounting templates are used to analyze spending and choose how your business prices its products or services. Translation: cost accounting is all about helping you develop price points to promote sales. You’ll encounter quite a few cost accounting templates on Excel and other third-party sites, although these will often be labeled as “cost sheets” or “costing templates.”

A huge benefit of using cost accounting templates is that the cost data you’re inputting is often dependent on other variables. That means your data in one cell may go up or down based on the number you place into a different column — which can get complicated fast. Costing templates come with all those formulas pre-loaded so that you can create an accounting statement without creating a headache.

Excel accounting template by monday.com

If you’re on the hunt for the perfect Excel accounting template but can’t find any Microsoft templates that fit the bill, you should check out monday.com’s free Excel accounting template.

Our dynamic downloadable template comes with a range of pre-built financial reports — including all the basic accounting statements we’ve already talked about. That means rather than worrying about creating loads of new spreadsheets and organizing them all, you can make life simpler with one master template that has everything you need in one place.

Each column is fully customizable, and all you’ve got to do is drag and drop your company’s financials to create fast and reliable financial statements to support your accounting function. All of the formulas you’ll ever need are already integrated into the template, which means you can knock out all your accounting statements in record time without breaking a sweat.

You can download our free Excel accounting template here. But if you want to remove all of the manual processes involved in accounting with Excel, we’ve got an even better solution available in the form of our fully-loaded Work OS Accounting Template.

It’s totally possible to run a company’s accounting function offline using Excel. Many companies do it. But if you want to be able to handle all the core accounting functions we’ve covered without working overtime, you may want to rethink Excel and check out monday.com’s Accounting Template.

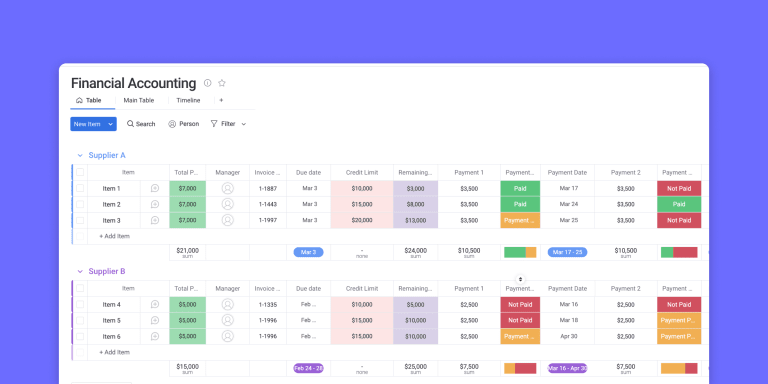

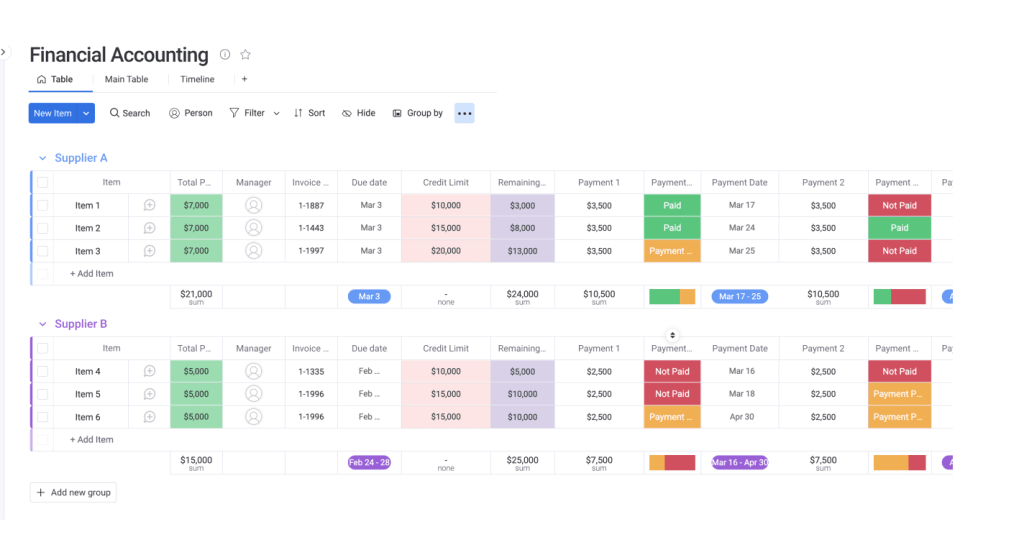

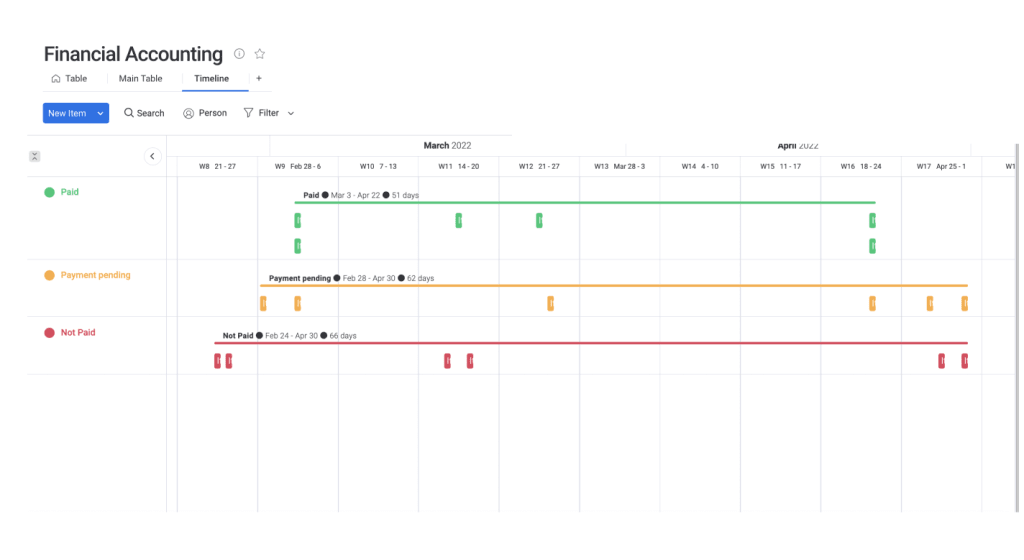

With our easy-to-use Accounting Template, you can consolidate all the accounting information and workflows in your business to manage everything on a single dashboard. This empowers you with a bird’s-eye view of all your finances. You’ll be able to automate financial reports, keep track of spending, set up spending alerts, and you’ll always know where you are in relation to your budget and income streams. This makes performing financial audits a breeze.

And if you really love a particular Excel accounting template — like ours — you can even use it alongside monday.com’s more dynamic template. With the help of our set of handy integrations, you can easily import Excel workbooks onto your monday.com dashboard and use that data to contribute to your wider works on monday.com.

Not only will that save you valuable time, but it also keeps you organized. We’re pretty good at knowing which columns go where — which means that we’ll automatically turn your imported Excel workbooks into a clearly labeled and fully customizable monday.com board in just a few clicks.

You can then tag and move items, assign tasks to team members based on your imported accounting statements, and change your dashboard view to give you different perspectives on the financial data you’ve imported.

End result: your accounting management will go from slow and reactive to super proactive in a matter of minutes.

Even more accounting templates from monday.com

Financial Statements Template

If you’re focusing less on overall accounting and more on your financial statements, our Financial Statements Template will fit the bill.

You can use this template to manage capital investments, track debts and repayment schedules, and manage corporate audits — all while setting up rules and automations that will keep a running score of your core financial statements like your balance, income, and cash flow.

For example, you could set up an automation that automatically alerts a certain member of your team every time a capital investment posts a loss — or create an automated recurring task for your finance team to perform a monthly expenses audit.

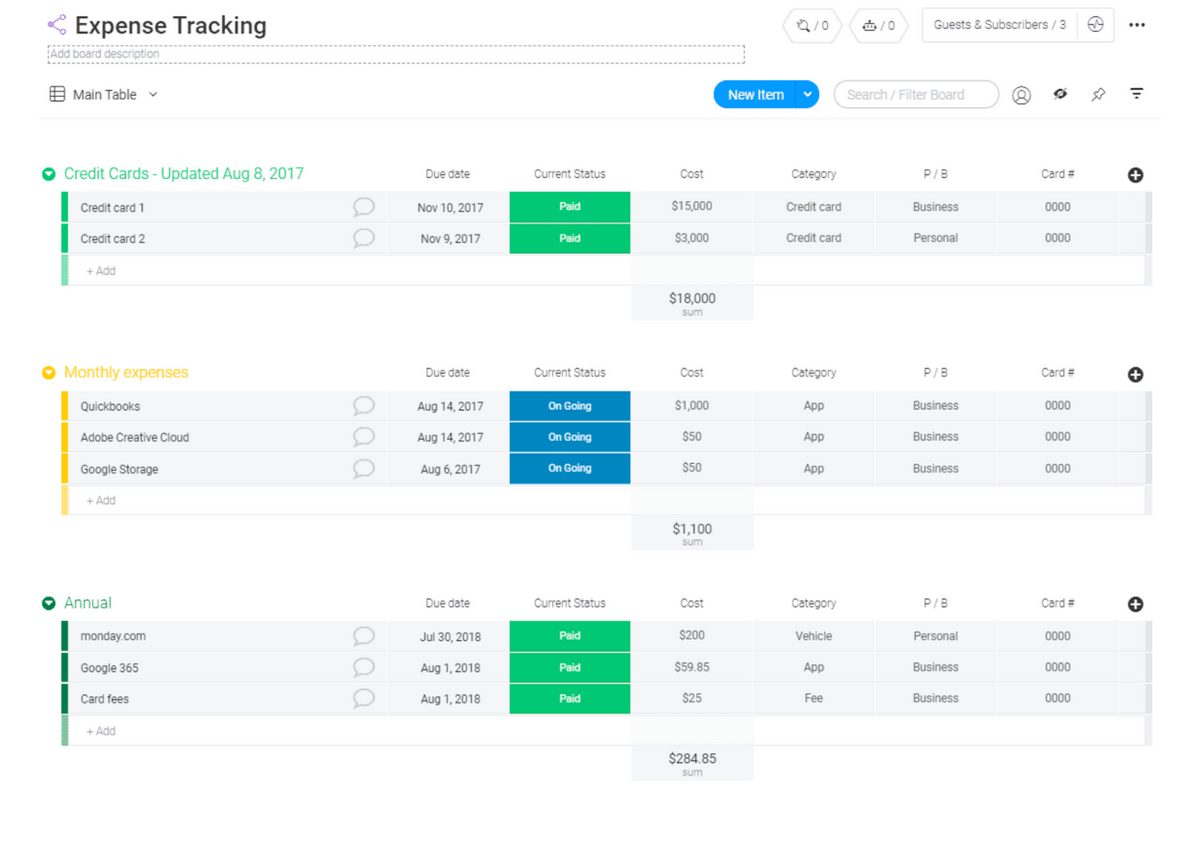

Expense Tracking Template

Our Expense Tracking Template is designed to help you regain control of your finances with a fast and simple proactive approach.

This template offers live updates on all of your project or organization’s financials for any given period.

But it also gives you the chance to skip ahead and forecast where your existing financials will be in the days, weeks, and months ahead.

FAQs about Excel accounting templates

How do I create an accounting template in Excel?

Creating your own accounting template in Excel is pretty straightforward — although it can be a little time-consuming.

First, you’ve got to decide what sort of accounting template you’d like to create. After all, each template includes a range of different fields, so you’ll need to hone in on the reason you’re creating a template.

After opening up Excel, start a blank workbook and label your columns and rows. You may need to add formulas for certain columns depending on the type of statement template you’re creating.

Once you’re happy with the design and layout of your statement, all you’ve got to do is hit “File” and then “Save As Template.”

Does Excel have accounting templates?

The short answer is: yes, Excel has loads of accounting templates. If you open up Excel and then use the relevant keyword in the “Search All Templates” box, you should be able to find a basic template that will fit your needs.

For example, Excel has an inbuilt profit and loss statement template, business expenses budget template, budget planner template, and more.

How do you do accounting in Excel?

If you know what you’re doing, it’s possible to perform all of the core accounting functions for a business on Excel. But there’s a lot to do.

You’ll need to create an excel sheet as an invoice tracker, create a financial transaction tracker, set up multiple managerial accounting spreadsheets to keep tabs on operational expenditure — not to mention prepare income statements and cash flow statements.

These financial records will need to be constantly added into an up-to-date company ledger, which is essentially your master accounting template. Excel does offer a basic, pre-built company ledger template.

Источник

Table of Contents

- How do you create an accounting system in Excel?

- How do you do single entry accounting?

- How do you make a simple Ledger in Excel?

- What Excel functions do accountants use?

- Can I use Excel instead of Quickbooks?

- How is single entry system calculated?

- What are types of single entry system?

- How do you do double entry bookkeeping in Excel?

- How do I create a purchase sheet in Excel?

- What is the single entry system in accounting?

- How does single entry bookkeeping work in Excel?

- Can you create a double entry accounting system in Excel?

- Are there any free accounting templates for Excel?

Microsoft Office Excel was designed to support accounting functions such as budgeting, preparing financial statements and creating balance sheets. It integrates with external data to allow you to import and export banking information and financial data to and from other accounting software platforms.

How do you create an accounting system in Excel?

How to Create a Bookkeeping System in Excel

- Step 1: Start with a bookkeeping Excel sheet template.

- 3 Necessary Parts of an Excel Bookkeeping System.

- Step 2: Customize the chart of accounts within your template.

- Step 3: Customize the income statement sheet.

- Add a sheet for tracking invoices.

How do you do single entry accounting?

In the above example of the cash book, a single entry is made for all the income and expenses of a business for a month. The balances of the income and expenses are carried forward to the next month, and the next month starts with the previous months’ total income and expenses balances.

How do you make a simple Ledger in Excel?

Open Microsoft Excel, click the “File” tab, and then choose the “New” link. When the Available Templates window appears, type “ledger” into the search box, and then click the arrow button. Excel does not have a button on the Available Templates window for its collection of ledger templates, but it does offer them.

What Excel functions do accountants use?

VLOOKUP and HLOOKUP are two of the most useful Excel functions for accountants. These functions let you search a table of data and give all the appropriate information for an individual set of data based on only one part of it.

Can I use Excel instead of Quickbooks?

If you like the freedom to do whatever you want with your financial data, choose Excel. If all you want to do is to simply (or quickly) input your financial records, Quickbooks is for you. If you need to come up with sophisticated graphs and charts, use Excel. Quickbooks only has graphs specific to accounting.

How is single entry system calculated?

Under Single Entry System Opening Capital = Opening Assets Less Opening Liabilities. Explanation: Opening Capital is calculated by deducting the total opening liabilities from the total opening assets.

What are types of single entry system?

Types of Single Entry Accounting System

- #1 – Pure Single Entry.

- #2 – Simple Single Entry.

- #3 – Quasi Single Entry.

- #1 – Assets.

- #2 – Audited Statements.

- #3 – Increased Risk of Errors.

- #4 – Performance Analysis.

- #5 – Incomplete Records.

How do you do double entry bookkeeping in Excel?

How to Do Double-Entry Bookkeeping in Excel

- Step One: Choose Your Accounts.

- Step Two: Row 1 on Your Excel Document.

- Step Three: Formatting.

- Step Four: If-then Formulas (Columns G onward)

- Step Five: Record Your Opening Balances.

- Step Six: Record Your Expenses.

- Step Seven: Using Your Data.

How do I create a purchase sheet in Excel?

If you’d rather work with a spreadsheet, you can use the same technique to create a purchase order in Microsoft Excel. Open a new document in Excel then click the icon at the top left of the screen. Choose “new” and “Purchase Orders” from the list.

What is the single entry system in accounting?

Single Entry System in Accounting. Single Entry System in Accounting is an accounting approach under which each and every accounting transaction is recorded with only a single entry in the accounting records which is centered towards results of the business enterprise which are shown in the statement of income of the company.

How does single entry bookkeeping work in Excel?

Single Entry Bookkeeping in Excel In a Single entry system, only one side of the transaction will be recorded, and the effect of these transactions will go to only one place. Whereas in the double-entry accounting system, every transaction will be recorded by debit and credit, and these will affect two accounts.

Can you create a double entry accounting system in Excel?

This system of accounting is different from the double-entry method, in which you enter every transaction twice, once as a debit, and once as a credit. Although it is technically possible to create a double-entry accounting system in Excel, we wouldn’t advise doing so.

Are there any free accounting templates for Excel?

All excel templates are free to download and use. Click the link to visit the page to find the detail description about each template and understand how each template has been prepared. If you didn’t find any accounting template here, please use of our suggestion form.

Contents

- 1 How do accountants use Excel?

- 2 What you need to know on Excel for accounting?

- 3 How do accountants use spreadsheets?

- 4 Can I use Excel for bookkeeping?

- 5 What jobs use Excel?

- 6 What are the basic formulas in Excel?

- 7 What are the common mistakes in accounting?

- 8 How do I write an if statement in Excel?

- 9 Can I use Excel instead of QuickBooks?

- 10 Do accountants use Excel a lot?

- 11 Is Excel important for accountants?

- 12 Is Excel hard to learn?

- 13 How can I improve my Excel skills?

- 14 What are the 3 common uses for Excel?

- 15 Where do I start with Excel?

- 16 What are the 10 most used Excel functions?

- 17 What are the 5 functions in Excel?

- 18 What are the golden rules of accounting?

- 19 What is the rule of 9 in accounting?

- 20 What is journal in accounts?

How do accountants use Excel?

Excel offers users the ability to undertake intense qualitative analysis, which is part of the reason it’s so invaluable in the accounting and finance industry. The program lets you input and interpret masses upon masses of data, and can intuit the direction of numbers and statistics as you manipulate them.

What you need to know on Excel for accounting?

Let’s look at 7 essential Excel skills for accountants.

- Keyboard Shortcuts.

- Repeat the Last Action.

- Perform Calculations Without Formulas.

- Easy Charting with Sparklines.

- Using Data Validation to Limit Users’ Options.

- Using Proper Cell Referencing.

- Summarize Data with Pivot Tables.

How do accountants use spreadsheets?

Spreadsheets are commonly used to analyse money that has been spent and income that has been received. They allow you to split the amount of money you have spent and received by time period and source.

Can I use Excel for bookkeeping?

As a spreadsheet-based program, Excel can be used for many purposes, including basic bookkeeping and keeping accounts—however, it does have limits, especially in comparison to a platform like QuickBooks Online or Wave.

What jobs use Excel?

We scrounged up a list of jobs (in no particular order) that make use of Excel to give you a head start.

- Financial Analysts. Financial Analysts are expected to know MS Excel inside out.

- Retail Store Managers.

- Project Managers.

- Business Analysts.

- Data Journalists.

- Accountants.

What are the basic formulas in Excel?

Seven Basic Excel Formulas For Your Workflow

- =SUM(number1, [number2], …)

- =SUM(A2:A8) – A simple selection that sums the values of a column.

- =SUM(A2:A8)/20 – Shows you can also turn your function into a formula.

- =AVERAGE(number1, [number2], …)

- =AVERAGE(B2:B11) – Shows a simple average, also similar to (SUM(B2:B11)/10)

What are the common mistakes in accounting?

Some common data entry blunders include: Entering items in the wrong account. Transposing numbers. Leaving out or adding a digit or a decimal place.

How do I write an if statement in Excel?

Use the IF function, one of the logical functions, to return one value if a condition is true and another value if it’s false. For example: =IF(A2>B2,”Over Budget”,”OK”) =IF(A2=B2,B4-A4,””)

Can I use Excel instead of QuickBooks?

If you like the freedom to do whatever you want with your financial data, choose Excel. If all you want to do is to simply (or quickly) input your financial records, Quickbooks is for you.If you need to come up with sophisticated graphs and charts, use Excel. Quickbooks only has graphs specific to accounting.

Do accountants use Excel a lot?

Accountants use Excel as most users who use Excel daily would. Any professional that understands the power of Excel knows that you have to maximize it if you want the most benefit out of it. Short answer: It really depends on what type of accountant they are, what they do, and how much data they have to work with.

Is Excel important for accountants?

Excel is an important tool that can help finance and accounting professionals create reports, analyze data, and prepare financial strategies. Although you may have a basic knowledge of Excel, you might not know about specialized functions that can make your job easier.

Is Excel hard to learn?

Excel is a sophisticated software with loads of functionality beneath its surface, and it can seem intimidating to learn. However, Excel is not as challenging to learn as many people believe. With the right training and practice, you can improve your Excel skills and open yourself up to more job opportunities.

How can I improve my Excel skills?

5 Ways to Improve Your Excel Skills

- Master the Shortcuts. Using the mouse and keyboard to explore all the menus and different options seems convenient, but it’s often time-consuming.

- Import Data from a Website.

- Result Filtering.

- Autocorrect and Autofill.

- Excel 2016 Intermediate Training.

What are the 3 common uses for Excel?

The three most common general uses for spreadsheet software are to create budgets, produce graphs and charts, and for storing and sorting data. Within business spreadsheet software is used to forecast future performance, calculate tax, completing basic payroll, producing charts and calculating revenues.

Where do I start with Excel?

Open Excel Starter with the Windows Start button.

- Click the Start button. . If Excel Starter is not included among the list of programs you see, click All Programs, and then click Microsoft Office Starter.

- Click Microsoft Excel Starter 2010. The Excel Starter startup screen appears, and a blank spreadsheet is displayed.

What are the 10 most used Excel functions?

Top 10 Most Useful Excel Formulas

- SUM, COUNT, AVERAGE. SUM allows you to sum any number of columns or rows by selecting them or typing them in, for example, =SUM(A1:A8) would sum all values in between A1 and A8 and so on.

- IF STATEMENTS.

- SUMIF, COUNTIF, AVERAGEIF.

- VLOOKUP.

- CONCATENATE.

- MAX & MIN.

- AND.

- PROPER.

What are the 5 functions in Excel?

5 Functions of Excel/Sheets That Every Professional Should Know

- VLookup Formula.

- Concatenate Formula.

- Text to Columns.

- Remove Duplicates.

- Pivot Tables.

What are the golden rules of accounting?

Golden Rules of Accounting

- Debit the receiver, credit the giver.

- Debit what comes in, credit what goes out.

- Debit all expenses and losses and credit all incomes and gains.

What is the rule of 9 in accounting?

If a business’ accounting records show a discrepancy, the difference between the correct amount and the incorrectly-entered amount will be evenly divisible by 9.

What is journal in accounts?

A journal is a detailed account that records all the financial transactions of a business, to be used for the future reconciling of accounts and the transfer of information to other official accounting records, such as the general ledger.

“I am not going to fiddle taxes. I pay my accountant a fortune to look after me.” — Harry Redknapp

If you’re a small business owner or a sole trader, you’re probably wondering how you can do your accounting without needing to hire an accountant. Fortunately for you, it’s never been easier to do your accounting. That said, there are still legal obligations and requirements that you have to get right before you can start doing your accounts. However, once you get these right, you can do a lot of everyday accounting tasks quite simply with the help of Excel. Here’s Superprof’s guide to using Excel for your accounting.

The best Accounting tutors available

5 (22 reviews)

1st lesson free!

5 (19 reviews)

1st lesson free!

5 (13 reviews)

1st lesson free!

5 (15 reviews)

1st lesson free!

5 (27 reviews)

1st lesson free!

5 (16 reviews)

1st lesson free!

5 (13 reviews)

1st lesson free!

5 (11 reviews)

1st lesson free!

5 (22 reviews)

1st lesson free!

5 (19 reviews)

1st lesson free!

5 (13 reviews)

1st lesson free!

5 (15 reviews)

1st lesson free!

5 (27 reviews)

1st lesson free!

5 (16 reviews)

1st lesson free!

5 (13 reviews)

1st lesson free!

5 (11 reviews)

1st lesson free!

Let’s go

Learn About Your Legal Obligations

The first thing you need to know when doing your accounts is what you need to legally keep a record of.

Don’t panic, this information is readily available and there are checklists and guides online to help you. When it comes to accounting, everything needs to be accurate, especially when you’re sending your stuff to the government for taxes. Good record-keeping will also help you to better manage your business’ finances and make better financial decisions. SMEs and sole traders will want to keep a record of everything they earn, are spending, and their tax contributions.

Sole-Traders

If you’re working for yourself, there are a few records that you’ll need to keep. You’ll need to keep a record of all sales and income, all business expenses, VAT records if you’re registered for VAT, PAYE records if you employ people, and records about your personal income.

Limited Companies

If you’re running a limited company, you’ll have far more records to keep and it’s generally recommended that you hire a professional accountant to help. These records can include records about the company itself, financial and accounting records. Generally, all of these records must be kept for at least 6 years with certain records to be kept longer if they still apply. Find out more about using Excel for accounting

Making a Cash Flow Plans and Statements

It’s always a good idea to keep a close eye on your business’ finances. With Excel, you can easily find cash flow statement templates that you can use.

This means you just need to fill in the relevant field and all the calculations will be done for you. Let’s see what kind of things you can do with this kind of spreadsheet. Start by working out income and expenses. You’ll want to make a list of things like:

- Revenue

- Equity

- Transactions

- Credits

- Debits

- VAT (where applicable)

- Etc.

Essentially, you need to be meticulous when it comes to bookkeeping and ensure you have a record of what happens to every single penny in your business. Thus, you can work out your cash flow, how much money you have, how much you’re earning, and how much your business costs to run. With all this information, you should also be able to make projections on earnings and predict how much money you can expect to have and make more informed business decisions. If you’re regularly losing money, you might want to look to professional accountants and financial advisors. You can also use Excel for your invoices. Similarly, the totals, VAT, etc. can be calculated automatically using Excel. There are plenty of templates available online where you can just add your details and the spreadsheet will do the rest. Automating your invoices can save business owners and sole traders a lot of time. You don’t need costly accounting software to do certain calculations. With a bit of patience and know-how, you and Excel can take care of everything. While all this may seem a bit overwhelming at first, just take your time, study how to do it correctly, and use templates to help you. Just make sure any templates you do use include all the relevant information required for businesses or sole traders in the UK. After all, not every template is made with the practices and laws of the UK in mind. Learn about the advantages of using Excel for accounting

There are two main parts to accounting with Excel.

The first part is creating a spreadsheet. Depending on the information you’re going to need, you need to choose how to layout and set up the spreadsheet. Again, there are templates to help you with this. This is where you’ll insert the formulae and calculations. Once you’ve created and set up your spreadsheet, you can start filling in your information. This is when you’ll take the information from the real world and put it into your spreadsheet. Business owners and those with more complicated accounting requirements might want to ask a professional accountant to help them with setting up these kinds of systems, protocols, and spreadsheets. With a good spreadsheet, you just have to type in the numbers or import data from reports and statements and let Excel take care of the rest. With the right protocols, you should be able to:

- Set up financial business plans

- Manage a bank account

- File taxes

- Set up payments and direct debits

- Manage expenses

- Manage the treasury

- Maintain financial records

Planning and organisation are key when it comes to accounting and the right type of spreadsheet can help you with this. Check out the best Excel accounting templates

Learning About Accounting

Not good with numbers? Have you started a business without the faintest idea about how accounting works?

Don’t panic! Even absolute beginners can learn about Excel and how to use it for their business. Would you like to do your accounts? It’s recommended that you get some training or learn how to use Excel to do your accounts. Fortunately, there are a few ways to do this:

- Night classes

- Professional training

- Online courses

- Online tutorials

- Private tutorials

- Private tutoring websites

- Etc.

With the right training, you should be able to do your bookkeeping. You’ll quickly learn how effective Excel can be for this. Of course, your level will need to match the type of accounting that you need to do. You won’t want to be running the accounts of a multinational corporation with absolutely no training but a small business owner should be able to get by after a few lessons. Hopefully, you now have a better idea of how accounting can be done with Excel. Just remember that you need to be meticulous and ensure that you meet your legal requirements as a sole trader or business. Discover Excel’s best features and functions If you’re interested in learning more about Excel, accounting, or finance, consider getting in touch with some of the talented and experienced private tutors on the Superprof website. There are plenty of private tutors all over the country and around the world offering tutoring either face-to-face, online, or in groups. Since each type of tutoring comes with its advantages and disadvantages in terms of learning approach and cost, think carefully about which will be best for you and your goals. Face-to-face tutoring allows the tutor to focus fully on their student and also allows them to tailor their lessons to the student. Of course, this bespoke service comes at a cost and one-on-one tutoring tends to be more expensive than the other types available. However, it’s usually the most cost-effective since the tutor will spend every minute of every session working with their student. Group tutorials are great for those on a budget as you can share the cost of the tutoring with the other students in attendance. While group tutoring isn’t as tailored as one-on-one tutoring, it can be useful for those who learn well from their peers or prefer a more social atmosphere while they learn. If you can’t find any suitable or available tutors in your local area, you can always broaden your search to include online tutors. As long as you have a webcam and a decent internet connection, you can learn almost anything from private tutors all over the world. With academic subjects like economics and finance or computer-based subjects like IT and using Excel, online tutorials can be just as effective as face-to-face tutoring. Don’t forget that a lot of the tutors on Superprof also offer the first lesson or session for free. You can use these sessions to try out various tutors before deciding on the one that’s right for you. Of course, rather than just contacting every single tutor and arranging a free lesson, we recommend thinking about what you’re looking for in a tutor and only contacting those that meet your criteria.

“Accounting does not make corporate earnings or balance sheets more volatile. Accounting just increases the transparency of volatility in earnings.” — Diane Garnick

Having a clear idea of your accounts and finances is very important, especially if you’re running a business or working for yourself. There are plenty of accounting programs on the market like QuickBooks, EBP, etc. However, there is a solution that’s much cheaper and more readily available. If you’re looking for a way to track your finances and do your accounting, Excel from Microsoft is an excellent option.

So how can you use this software for accounting? Can you do your bookkeeping with this software?

In this article, we’ll be looking at why you should choose Excel, how Excel templates can save you a lot of time, what Excel can do, and how to get started with Excel.

The best Accounting tutors available

5 (16 reviews)

1st lesson is free!

5 (21 reviews)

1st lesson is free!

5 (34 reviews)

1st lesson is free!

5 (31 reviews)

1st lesson is free!

5 (5 reviews)

1st lesson is free!

5 (19 reviews)

1st lesson is free!

4.9 (16 reviews)

1st lesson is free!

5 (11 reviews)

1st lesson is free!

5 (16 reviews)

1st lesson is free!

5 (21 reviews)

1st lesson is free!

5 (34 reviews)

1st lesson is free!

5 (31 reviews)

1st lesson is free!

5 (5 reviews)

1st lesson is free!

5 (19 reviews)

1st lesson is free!

4.9 (16 reviews)

1st lesson is free!

5 (11 reviews)

1st lesson is free!

Let’s go

Why Choose Excel?

Would you like to start managing your accounts digitally?

Here are a few things you should know about Excel.

Excel can be a powerful tool when it comes to accounting. It comes as part of the Microsoft Office Suite and can be used by sole traders and business owners alike and can make accounting more simplified through the use of accounting templates, calculations, and automated tasks.

You can fully customise your spreadsheets and use calculations to save yourself a lot of time, which is one of the many reasons Excel is a powerful tool that a lot of professionals use.

There are also SaaS versions of Excel which allow you to collaborate with other users across several devices.

Most of the time, Excel is used for accounting. You can use it for:

- Expenses

- Balance sheets

- Losses

- Quotes

- Bookkeeping

- Invoices

- Financial management

- Sales reports

- Financial reporting

- Etc.

Microsoft Excel makes life easier for both sole traders and business owners.

Some already have a good idea of Excel works while others could do with learning more about it. Don’t hesitate to look for tips and advice to help you. From keyboard shortcuts to useful functions, you need to know how to use Excel effectively and once you know how it works, you’ll be able to do an awful lot with it.

Learn about the advantages of using Excel for accounting

How to Save Time with Excel Templates

When it comes to tips for using Excel, we can’t recommend using templates enough. Accounting with Excel is so much easier when you use templates as most of the work is already done for you.

Discover many a accounting course here.

There are tonnes available online and many available directly from Microsoft. Check out the template library for Excel and just search what you’re looking for.

You can also find templates on other sites. There are templates for things like:

- Expenses

- Balance sheets

- Budgeting

- Bookkeeping

- And much more!

Popular templates allow you to just fill in cells with your information. The spreadsheet will do the rest since all the calculations will be done in the spreadsheet, allowing business owners or sole traders to quickly see the state of their finances. Just make sure that you keep them up to date and they’ll become a powerful tool for your business since budgeting, quotes, payments, and projections can all be done through templates.

Financial reporting is essential, especially if you own your own business and the right templates can make it less of a worry. They can also be incredibly useful when submitting tax returns as they can be used for all the calculations you need to do. Type in the numbers and the template will do the rest.

There are plenty of websites where you can get Excel templates. There are hundreds available for every situation.

Ready to download Excel templates for your business?

Check out the best Excel accounting templates

What Can Excel Do?

You’re probably wondering exactly how Excel can be useful. Here are some of the best things it can do.

Functions are what makes Excel so powerful as they allow you to do automate calculations. Here are the different types of things Excel’s functions can be used for:

- Maths and trigonometry

- Lookup and reference

- Finance

- Date and time

- Text

- Statistics

- Database management

- Engineering

- Presenting information

- Accounting

Of course, you don’t need to use all of these for your accounting or tax returns. The most common will probably be logic, lookup, date and time, and text functions. Most Excel users use logic in their calculations to compare data.

You can use functions like IF, AND, OR, and IFERROR to define conditions to be met and these functions can help you quickly find information across several spreadsheets.

Date and time functions like YEAR, MONTH, DAY, and WEEKNUM are also useful for navigating your financial records.

Finally, text functions can help you manage the text in your spreadsheets, which often accompany the numerical data.

Here are some other useful functions you can use:

- SUM

- SUMPRODUCT

- SUBTOTAL

- ROUND

- ROUNDUP

- PRODUCT

- TRUNC

- ABS

- POWER

- SQRT

Discover Excel’s best features and functions

Start Accounting with Excel

When it comes to accounting with Excel, there are a few things you need to do to get started.

Firstly, learn about your legal obligations for your accounting. These may vary depending on your status and you need to make sure your bookkeeping is above board. Even if you feel like you have all the information you need, there may be other information you need to include from a legal standpoint. If you’re worried about it, you might want to get help from a professional accountant. However, that doesn’t mean you can’t manage your finances internally.

Let’s not forget that accounting can involve:

- Analysing transactions

- Keeping accounting records

- Preparing balance sheets

- Recording expenses

- Preparing financial reports

- Creating financial projections

Entrepreneurs and sole traders can always take courses to learn how to use Excel for accounting or learn from private tutors and most courses or training will also be counted as a business expense.

Learn how to start accounting with Excel

Hopefully, you found this article on using Excel for accounting useful and you can find out more about Excel in our other articles.

If you’re interested in learning more about Excel, accounting, or finance, consider getting in touch with some of the talented and experienced private tutors on the Superprof website.

There are plenty of private tutors all over the country and around the world offering tutoring either face-to-face, online, or in groups. Since each type of tutoring comes with its advantages and disadvantages in terms of learning approach and cost, think carefully about which will be best for you and your goals.

Face-to-face tutoring allows the tutor to focus fully on their student and also allows them to tailor their lessons to the student. Of course, this bespoke service comes at a cost and one-on-one tutoring tends to be more expensive than the other types available. However, it’s usually the most cost-effective since the tutor will spend every minute of every session working with their student.

Group tutorials are great for those on a budget as you can share the cost of the tutoring with the other students in attendance. While group tutoring isn’t as tailored as one-on-one tutoring, it can be useful for those who learn well from their peers or prefer a more social atmosphere while they learn.

If you can’t find any suitable or available tutors in your local area, you can always broaden your search to include online tutors. As long as you have a webcam and a decent internet connection, you can learn almost anything from private tutors all over the world. With academic subjects like economics and finance or computer-based subjects like IT and using Excel, online tutorials can be just as effective as face-to-face tutoring.

Don’t forget that a lot of the tutors on Superprof also offer the first lesson or session for free. You can use these sessions to try out various tutors before deciding on the one that’s right for you. Don’t just contact every single tutor and arranging a free lesson, though.

We recommend thinking about what you’re looking for in a tutor and only contacting those that meet your criteria. After all, you might be working with your tutor for a while so you must make the right choice when you pick them. They should specialise in exactly what you want to learn and be within your budget.

If you’re not sure, remember that you can always check their qualifications and read reviews left by their other students on their profiles before you reach out to them to discuss tutoring.

Excel is a powerful tool and with the right tutor, you too can learn how to get the most out of it for your accounting.

Find online accounting courses here on Superprof.

You can use Excel’s built-in formats and formulas to help you with your accounting. If you highlight the cells you are working with, then left-click on them you can bring up a menu. Choose the Format option, and choose Accounting under the Number tab.

Can you use Excel for bookkeeping?

Some pros of using Excel for bookkeeping include: You can generate financial reports and statements. You can tabulate and compare financial data between different periods to evaluate your business’s operations. You can also record other data, such as a list of suppliers and customers and update it regularly.

What Excel functions do accountants use?

VLOOKUP and HLOOKUP are two of the most useful Excel functions for accountants. These functions let you search a table of data and give all the appropriate information for an individual set of data based on only one part of it.

Is Excel important for accountants?

Excel is an important tool that can help finance and accounting professionals create reports, analyze data, and prepare financial strategies. Although you may have a basic knowledge of Excel, you might not know about specialized functions that can make your job easier.

Is QuickBooks better than Excel?

If you like the freedom to do whatever you want with your financial data, choose Excel. If all you want to do is to simply (or quickly) input your financial records, Quickbooks is for you. If you need to come up with sophisticated graphs and charts, use Excel. Quickbooks only has graphs specific to accounting.

What is an Hlookup vs VLOOKUP?

VLOOKUP allows you to search a data range that is set up vertically. HLOOKUP is the exact same function, but looks up data that has been formatted by rows instead of columns. LOOKUP and related functions are commonly used for business analytics in Excel as a way of slicing and dicing data for analysis.

Do you need Excel to use QuickBooks?

You can’t send or receive invoices directly from Excel. Often, they need to input Excel data into bookkeeping software like QuickBooks. It’s not a tool for longterm accounting. While an Excel sheet can be incredibly useful for analyzing data, it’s not a practical tool for ongoing use.

Does Excel work like QuickBooks?

Quickbooks is an accounting software made by the company Intuit. If Excel is a spreadsheet program you can use for different reasons like database, accounting, project management, etc., Quickbooks is dedicated only to accounting.

Microsoft Office Excel was designed to support accounting functions such as budgeting, preparing financial statements and creating balance sheets. It comes with basic spreadsheet functionality and many functions for performing complex mathematical calculations. It also supports many add-ons for activities such as modeling and financial forecasting, and seamlessly integrates with external data to allow you to import and export banking information and financial data to and from other accounting software platforms.

Tip

Microsoft Office Excel was designed to support accounting functions such as budgeting, preparing financial statements and creating balance sheets. It integrates with external data to allow you to import and export banking information and financial data to and from other accounting software platforms.

Budgeting and Statements

Microsoft Office Excel ships with templates for creating budgets, cash-flow statements and profit-and-loss statements, which are some of the most basic documents used in accounting. In addition, you can download more complex budgeting and statement templates from the Office website, or purchase specialized templates from third-party vendors and install these in the application. If you need to create complex or custom budgets or financial statements, you can either customize an existing template and re-use its elements, or create one from scratch using the functionality built into Excel.

Spreadsheets

Performing line calculations is a basic accounting task, and Excel spreadsheets are designed to contain data in a tabular format that supports both in-line and summation calculations, replacing the need for ticker tape and special accounting calculators. The data in the spreadsheet is reusable and storable, making Excel more flexible than an accounting calculator for performing simple calculations and summations. Additionally, you can create charts and graphs from the spreadsheet data, creating a media-rich user experience and different views of the same data. You can also use add-ons to mine the data and create models and financial forecasts.

External Data

You can import data from many different data sources into Excel. This is especially useful for accounting as you can pull sales data, banking data and invoices from many sources into one central workbook to support your accounting activities. The data can be stored in different databases and file formats prior to importing, allowing you to access data from many different areas of your business without having to do additional data entry.

Integration

Excel integrates with many popular accounting software applications. For example, you can use the wizards that ship with your preferred accounting software package to map Excel spreadsheets to your accounting data so you can perform push and pull data operations from both Excel and your accounting package on demand.

Your business can’t survive without accounting, which is why you’re probably on the hunt for an Excel accounting template that can help you stay on top of your organization’s finances.

But before you dive in head-first, there are a few important things you should know about accounting templates and other accounting software.

In this article, we will explain what accounting is, how Excel accounting templates work, and how monday.com’s Accounting Template can take your organization’s accounting to the next level.

Get the template

What is an Excel accounting template?

Accounting is all about making sure you always have a clear view of your income, petty cash, cost management, cash book, tax obligations, debts, paychecks, and everything else money-related you could possibly think of.

Download Excel template

But that can be pretty hard to keep track of — especially if you’re leading a small team and wearing many different hats at any given time. This is where an Excel accounting template really comes to the rescue.

An accounting template is a pre-built accounting statement that you can download and customize to suit your business needs. These templates are typically pre-populated or have a range of labeled columns — and then you simply fill in the blanks with your own financial information.

There are a number of free accounting templates for Excel and Google Sheets you can download and import onto your desktop or web app.

(Image source)

Why use the Excel accounting template?

Excel accounting templates are all about making life easier. If you’re new at this, having a clearly labeled template that can show which values to place and where is a total lifesaver.

For example, let’s say you’re a software engineer managing a new start-up. You might know a whole lot about building apps, but next to nothing about how to fill out an income statement. Don’t worry: most of us aren’t accountants.

Having an Excel accounting template to fall back on gives you some peace of mind in knowing you’re on the right track. A template will guide you in terms of all the fields and columns you have to include and what financial data you’ve got to keep tabs on.

If you’re looking for a more flexible and dynamic accounting template with less manual labor involved, we’ve got you covered. But more on that in a minute. First, let’s talk about the different types of accounting templates.

What are some examples of Excel accounting templates?

Because it’s the bread and butter of most trained accountants, you can find a lot of Excel accounting templates and just about every Excel bookkeeping template you could ever want, depending on your needs.

For example, there’s a General Ledger Template for you to track any business expense, a Statement of Account Template, Credit Card Tracker Template, invoice templates, and more.

Let’s talk about the different types of accounting templates.

Income statement templates

An income statement template is a pre-designed template to help you record and summarize all of your team’s net income, net sales, and expenses during a given period of time.

An income statement is also often referred to as a “profit and loss statement” or “statement of revenue and expense.” That means you might occasionally see an income statement template labeled as a profit and loss statement template or a statement of revenue and expense template — but it all amounts to the same thing.

(Image source)

There are a number of downloadable income statement templates you can use to record your income information in Excel spreadsheets. They’re normally pretty basic and include a number of pre-labeled rows and columns identifying common expenses and revenue sources that apply to a lot of different business types.

The key benefit here is that these templates will serve as a great prompt in terms of all the expenses or income sources you might not have otherwise considered including in your statement.

Balance sheet templates

A balance sheet template is a pre-made accounting statement that looks at all of your company’s total assets and liabilities — as well as shareholder equity. Balance sheets are all about demonstrating the “book value” of your company. To figure out your book value, you need to list all your company’s assets, liabilities, and equity for a given reporting date. Balance sheet templates are useful because they include pre-loaded rows that spell out all the basic information you’ll need to include in your accounting statement.

(Image source)

There are a number of pre-built balance sheet templates on Microsoft Office and other apps that include pre-configured formulas to find all your balance totals. This can save you valuable time because all you’ve got to do is drag and drop your financial data — the template does all the hard work.

Cash flow statement templates

Next, you’ve got cash flow statement templates. A cash flow statement gives you a breakdown of what your company’s cash balances look like for a given period. There are loads of cash flow templates available on Excel and a number of external sites that you can download for free.

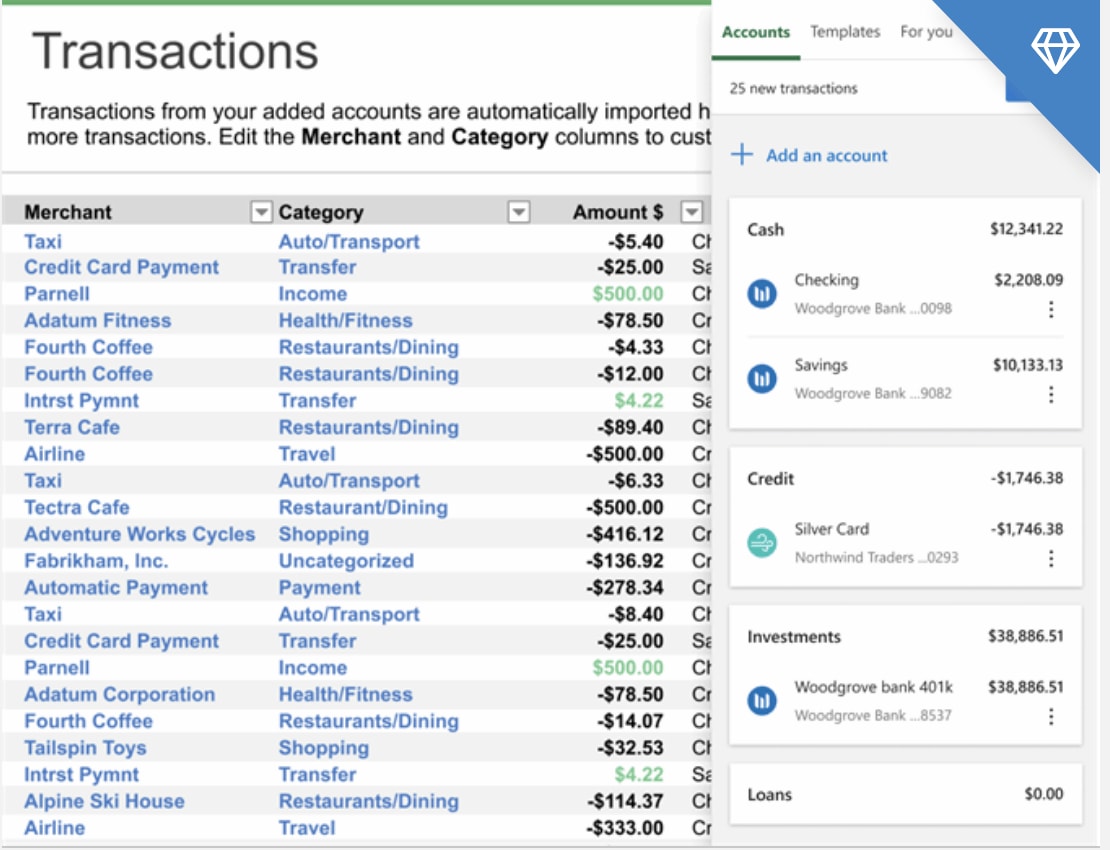

(Image source)

Cash flow statement templates are particularly useful for companies that are scaling up and need to show how sustainable their cash inflows are. For example, a clothing startup might use a cash flow statement template to quickly work out their cash balances over a 12-month period to show a lender that the startup can afford to take on a new business loan.

Managerial accounting templates

Managerial accounting is similar to financial accounting. But instead of looking at various accounting dates, it focuses on monthly or quarterly reports.

Managerial accounting statements enable you to analyze a company’s income and overheads to make important decisions about how your operations are funded and run. There are a number of managerial accounting templates on Excel — including budget templates and forecast templates.

(Image source)

Why would you use a managerial accounting template? One of the key benefits is that these accounting templates tend to come with visualizations like graphs and tables that automatically change and update as you drop in your financial data.

This makes it easy to share with stakeholders and externals to let them know how your business is doing — without losing hours of precious time building tables yourself.

Cost accounting templates

Cost accounting templates are used to analyze spending and choose how your business prices its products or services. Translation: cost accounting is all about helping you develop price points to promote sales. You’ll encounter quite a few cost accounting templates on Excel and other third-party sites, although these will often be labeled as “cost sheets” or “costing templates.”

A huge benefit of using cost accounting templates is that the cost data you’re inputting is often dependent on other variables. That means your data in one cell may go up or down based on the number you place into a different column — which can get complicated fast. Costing templates come with all those formulas pre-loaded so that you can create an accounting statement without creating a headache.

Excel accounting template by monday.com

If you’re on the hunt for the perfect Excel accounting template but can’t find any Microsoft templates that fit the bill, you should check out monday.com’s free Excel accounting template.

Our dynamic downloadable template comes with a range of pre-built financial reports — including all the basic accounting statements we’ve already talked about. That means rather than worrying about creating loads of new spreadsheets and organizing them all, you can make life simpler with one master template that has everything you need in one place.

Each column is fully customizable, and all you’ve got to do is drag and drop your company’s financials to create fast and reliable financial statements to support your accounting function. All of the formulas you’ll ever need are already integrated into the template, which means you can knock out all your accounting statements in record time without breaking a sweat.

You can download our free Excel accounting template here. But if you want to remove all of the manual processes involved in accounting with Excel, we’ve got an even better solution available in the form of our fully-loaded Work OS Accounting Template.

Why monday.com’s built-in Accounting Template is the only template you’ll ever need

It’s totally possible to run a company’s accounting function offline using Excel. Many companies do it. But if you want to be able to handle all the core accounting functions we’ve covered without working overtime, you may want to rethink Excel and check out monday.com’s Accounting Template.

With our easy-to-use Accounting Template, you can consolidate all the accounting information and workflows in your business to manage everything on a single dashboard. This empowers you with a bird’s-eye view of all your finances. You’ll be able to automate financial reports, keep track of spending, set up spending alerts, and you’ll always know where you are in relation to your budget and income streams. This makes performing financial audits a breeze.

And if you really love a particular Excel accounting template — like ours — you can even use it alongside monday.com’s more dynamic template. With the help of our set of handy integrations, you can easily import Excel workbooks onto your monday.com dashboard and use that data to contribute to your wider works on monday.com.

Not only will that save you valuable time, but it also keeps you organized. We’re pretty good at knowing which columns go where — which means that we’ll automatically turn your imported Excel workbooks into a clearly labeled and fully customizable monday.com board in just a few clicks.

You can then tag and move items, assign tasks to team members based on your imported accounting statements, and change your dashboard view to give you different perspectives on the financial data you’ve imported.

End result: your accounting management will go from slow and reactive to super proactive in a matter of minutes.

Get the template

Even more accounting templates from monday.com

Financial Statements Template

If you’re focusing less on overall accounting and more on your financial statements, our Financial Statements Template will fit the bill.

You can use this template to manage capital investments, track debts and repayment schedules, and manage corporate audits — all while setting up rules and automations that will keep a running score of your core financial statements like your balance, income, and cash flow.

For example, you could set up an automation that automatically alerts a certain member of your team every time a capital investment posts a loss — or create an automated recurring task for your finance team to perform a monthly expenses audit.

Expense Tracking Template

Our Expense Tracking Template is designed to help you regain control of your finances with a fast and simple proactive approach.

This template offers live updates on all of your project or organization’s financials for any given period.

But it also gives you the chance to skip ahead and forecast where your existing financials will be in the days, weeks, and months ahead.

Get started

FAQs about Excel accounting templates

How do I create an accounting template in Excel?

Creating your own accounting template in Excel is pretty straightforward — although it can be a little time-consuming.

First, you’ve got to decide what sort of accounting template you’d like to create. After all, each template includes a range of different fields, so you’ll need to hone in on the reason you’re creating a template.

After opening up Excel, start a blank workbook and label your columns and rows. You may need to add formulas for certain columns depending on the type of statement template you’re creating.

Once you’re happy with the design and layout of your statement, all you’ve got to do is hit “File” and then “Save As Template.”

Does Excel have accounting templates?

The short answer is: yes, Excel has loads of accounting templates. If you open up Excel and then use the relevant keyword in the “Search All Templates” box, you should be able to find a basic template that will fit your needs.

For example, Excel has an inbuilt profit and loss statement template, business expenses budget template, budget planner template, and more.

How do you do accounting in Excel?

If you know what you’re doing, it’s possible to perform all of the core accounting functions for a business on Excel. But there’s a lot to do.

You’ll need to create an excel sheet as an invoice tracker, create a financial transaction tracker, set up multiple managerial accounting spreadsheets to keep tabs on operational expenditure — not to mention prepare income statements and cash flow statements.

These financial records will need to be constantly added into an up-to-date company ledger, which is essentially your master accounting template. Excel does offer a basic, pre-built company ledger template.

Get the template

Excel is a Microsoft Office program that’s designed to help calculate, tabulate, store, chart, and compare data for current and future reference. Its features are robust. Using Excel for accounting can provide an excellent tool for performing these tasks for small businesses.

Excel can be used with as little or as much complexity as you prefer. Small business owners can do all their bookkeeping in Excel.

Key Takeaways

- Excel offers formula tools and formats that can help you with your accounting needs if you’re not quite an accounting expert.

- Preparation of your accounts will differ if you’re using the accrual basis accounting method or double-entry accounting.

- Start by making a chart of accounts, such as asset accounts, revenue, or liability, then enter details for each.

Cash Basis Accounting in Excel

Most small businesses use cash basis accounting. Start a new worksheet if this is your method of accounting and enter column headers for the date, transaction description, and a transaction number. Include column headers for income, expense, and account balance.

| Cash Basis Entries | |||||

|---|---|---|---|---|---|

| Number | Date | Description | Income | Expense | Account Balance |

| 001 | 8/10/2022 | 2Flo’s Plastics | $300.00 | $1500.00 | |

| 002 | 8/10/2022 | Joe’s Parts | $50.00 | $1550.00 |

This is very similar to entering your transactions in a checkbook register. Enter an expense for that amount if you purchase something. You’ll enter income if a customer pays for a product. Either add or subtract the amount from the account balance for each type of transaction.

Note

You can make different sheets for each month or continue to use one sheet to track all your transactions.

Accrual Basis Accounting in Excel

You’ll have to prepare different accounts if you’re using the accrual basis accounting method or double-entry accounting. The accounting equation is the guideline for all transactions:

Assets = Liabilities + Shareholders’ Equity

The total of your asset accounts must equal the total of your liability and equity accounts. Your liabilities and equity should increase if your assets increase.

You’ll first have to make a chart of accounts. The different categories of accounts are asset, liability, equity, revenue, and expense.

Note

Small businesses might have equity accounts if they have investors or use a type of equity financing.

Each category of account has different accounts within it. Assets accounts can contain accounts such as cash, accounts receivable, inventory, fixed assets, or other assets. Accounts receivable are payments owed to you for purchases from you using credit.

Liability accounts for small businesses usually have accounts payable, wages payable, or any other payable expenses. An account payable is money you owe for purchases on credit.

Create your chart of accounts in the first worksheet of the workbook. You can list them by account type such as asset or liability to make it easier to understand. Assign a number to each account in the next column.

| Chart of Accounts | |||

|---|---|---|---|

| No. | Account Title | How to Increase | Type |

| 101 | Cash | Debit | Asset |

| 102 | Accounts Receivable | Debit | Asset |

| 103 | Accounts Payable | Credit | Liability |

| 104 | Advertising Expense | Debit | Expense |

Create an account labeled «Cash» in a new worksheet. Now make a column for debit, and a column for credit. Another account is credited, and vice versa, every time you record a debit. You might have to reference the account type chart you made to help you discern when to debit or credit an account and what each action does to an account.

If you sold $100 of your inventory and received cash, since both cash and inventory are assets, your entries would look like this:

| Cash | ||

|---|---|---|

| Debit | Credit | Balance |

| $1000 | ||

| $100 | $1100 |

You would debit cash, since you debit an asset to record an increase. Similarly, you would credit inventory, since you credit an asset while recording a decrease.

| Inventory | ||

|---|---|---|

| Debit | Credit | Balance |

| $10,000 | ||

| $100 | $9,900 |

The key concept to remember is that you’re transferring value from one account to another with this method. If you make one entry, you must make another entry in a corresponding account.

One concept that confuses many people is that it’s possible to increase two different accounts. You would increase your asset account (equipment) with the value of the item if you purchase a piece of equipment on credit, and you would increase your liability account (account payable for that supplier).

A debit in accounts payable decreases the account value, while a debit increases the account value in an account receivable. You would therefore debit that account (a liability account) and debit your cash account (an asset account) if you paid one of your credit accounts.

You’d create an account named after that business in your accounts receivable under your asset accounts if you allowed a business to purchase 100 items on credit. It’s an asset account because it is owed to you. You’d enter a $100 debit in the accounts receivable for that business if you charged one dollar per item and enter a $100 credit in inventory. Remember to use the account type chart to help you increase and decrease different accounts.

| Inventory | ||

|---|---|---|

| Debit | Credit | Balance |

| $100 | $9,800 |

| Joe’s Parts (Accounts Receivable) | ||

|---|---|---|

| Debit | Credit | Balance |

| $100 | $100 |

The liability account is named after that business if you’d purchased on credit 100 in raw materials needed to make your products from another business. It’s a liability account because you owe them money. Assuming the price was the same as in the previous example, you would enter a $100 debit in the account payable for the company you purchase from and a $100 debit in your raw materials inventory account. You debit both accounts because you’re increasing an asset and a liability.

| Joe’s Parts (Liability Account) | ||

|---|---|---|

| Debit | Credit | Balance |

| $100 | $100 |

| Raw Materials Inventory (Asset Account) | ||

|---|---|---|

| Debit | Credit | Balance |

| $100 | $100 |

Formulas and Formats for Accounting

You can use Excel’s built-in formats and formulas to help you with your accounting. Highlight the cells you’re working with then left-click on them so you can bring up a menu. Choose the «Format» option and choose «Accounting» under the «Number» tab. This places the cells you highlighted in an accounting format, automatically placing a dollar sign in them.

It also places parentheses around negative numbers, which you could enter when you’re decreasing any accounts. Enter the following formula (assuming the cells are A15 through B15) to have Excel automatically calculate balances for you:

=Sum(A15:B15)

This will add the values of cells A15 through B15 and display the result.

You can use the sum function to add your total assets, total liabilities, and total equity. This will help ensure that your assets equal the sum of your liabilities and equity, balancing your finances using double-entry, accrual-based accounting.

Expand Your Microsoft Excel Knowledge

These are very basic accounting concepts and uses of Excel that should provide you with enough information to get your accounting procedures started for your small business. But there are many other functions for accounting purposes in Excel. You’ll be able to use it to generate reports, forecast expenses, and design your own financial sheets for reporting and analysis as you become more familiar with the program and with accounting.

Frequently Asked Questions (FAQs)

How do I treat retained earnings?

Equity accounts are usually owners’ or stockholders’ equity accounts, but small businesses may not have any shareholders. It’s generally referred to as owners’ equity in this case. Retained earnings are included in the equity accounts because they’re the profit a company has earned over its lifetime after paying any dividends (if there are stockholders).