Sample Balance Sheets

We will present examples of three balance sheet formats containing the same hypothetical amounts. (The notes to the financial statements are omitted as they will be identical regardless of the format used.)

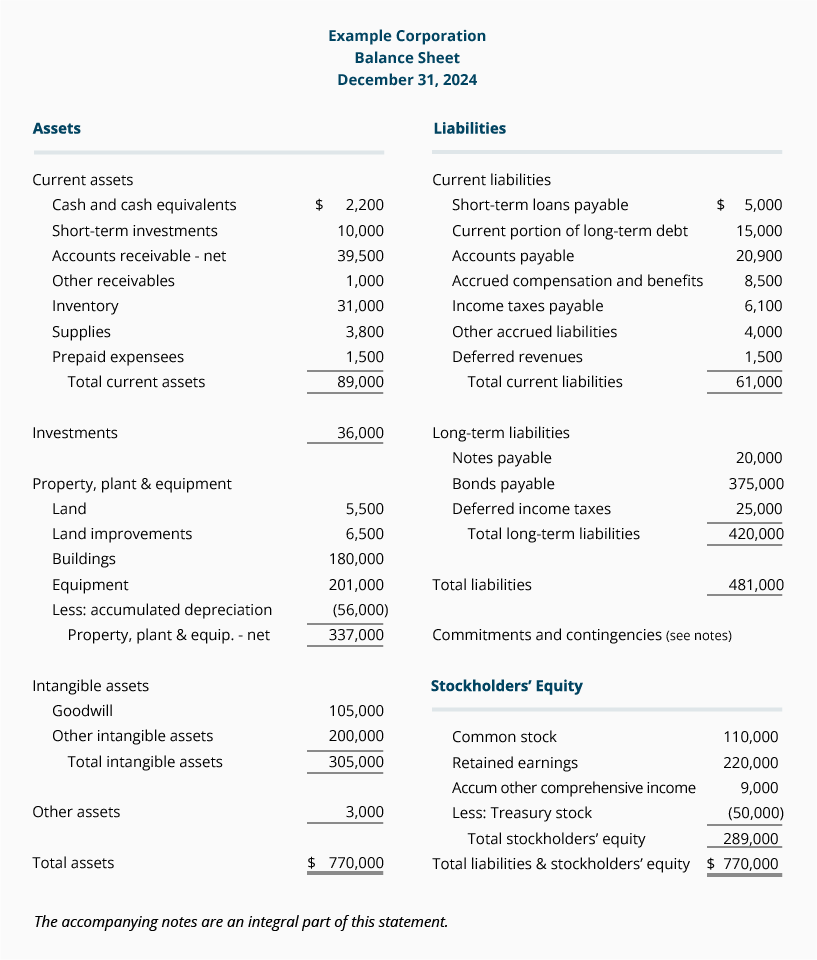

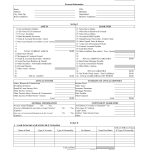

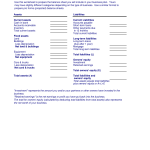

Example of a balance sheet using the account form

In the account form (shown above) its presentation mirrors the accounting equation. That is, assets are on the left; liabilities and stockholders’ equity are on the right.

With the account form it is easy to compare the totals. It is also convenient to compare the current assets with the current liabilities.

A drawback of the account form is the difficulty in presenting an additional column of amounts on an 8.5″ by 11″ page.

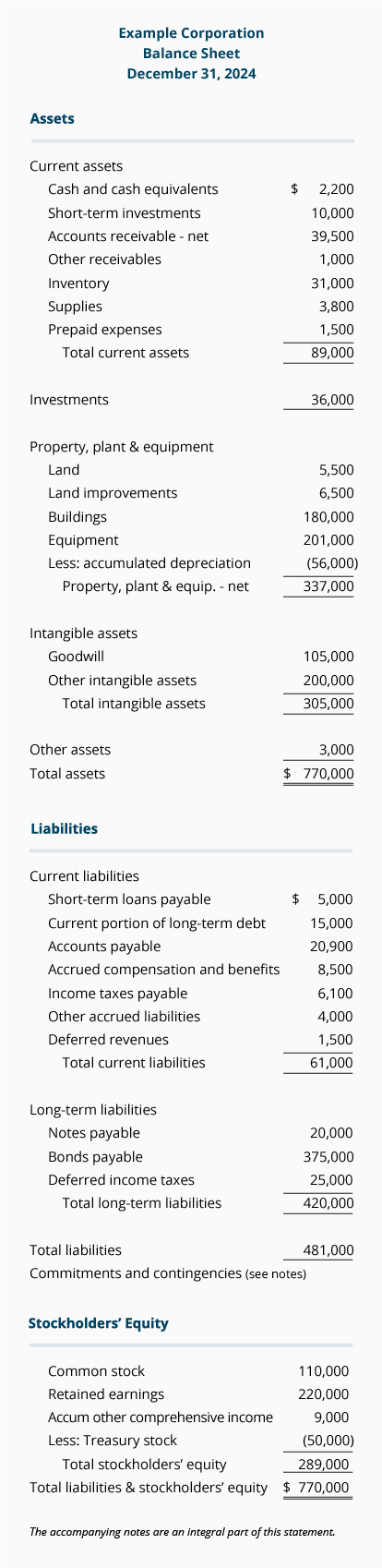

Example of a balance sheet using the report form

As you can see, the report form presents the assets at the top of the balance sheet. Beneath the assets are the liabilities followed by stockholders’ equity.

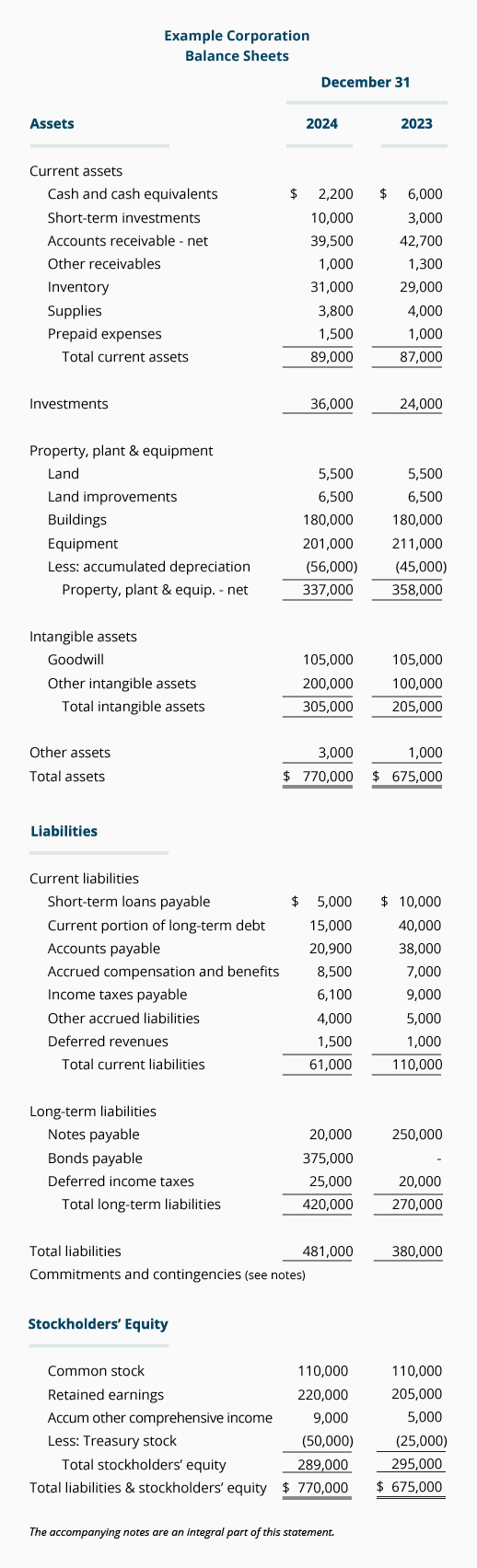

Example of a comparative balance sheet

The comparative balance sheet presents multiple columns of amounts, and as a result, the heading will be Balance Sheets. The additional column allows the reader to see how the most recent amounts have changed from an earlier date.

It is common to present the recent amounts in the column closest to the descriptions, and the oldest amounts furthest from the descriptions. It is also common for the amounts to be rounded to the nearest dollar or nearest thousand dollars.

As you can see, the report form is more conducive to reporting an additional column(s) of amounts.

Balance Sheet Templates

Did you know? Our Business Forms Package offers 80+ different business forms including the following balance sheet templates in Excel and PDF format:

- Balance Sheet Template: Manufacturer – Corporation

- Balance Sheet Template: Retail/Wholesale – Corporation

- Balance Sheet Template: Retail/Wholesale – Sole Proprietor

- Balance Sheet Template: Services – Corporation

- Balance Sheet Template: Services – Sole Proprietor

In addition to our balance sheet templates, our business forms also offer templates for the income statement, statement of cash flows, and more.

Now that we have seen some sample balance sheets, we will describe each section of the balance sheet in detail.

July 26th, 2021

At FinancePal, we recognize that most small business owners started their companies because they were experts in providing a good or a service—not at balancing a book. Plus, accounting and bookkeeping for startups can be complex and multi-faceted. That said, sound accounting and bookkeeping are imperative to manage any company’s financial health, guide decisions for growth initiatives, and ultimately ensure your business is in good standing with its tax obligations throughout the year.

Industry jargon and complex language provides a significant obstacle for most people when trying to learn accounting concepts. That is why we provided this glossary of accounting industry terms from ecpi.edu to gain a solid baseline from which you can explore various accounting topics.

● Accounts Payable

Money a business owes to its suppliers, vendors, or creditors for goods or services bought on credit; considered a short-term debt. Accounts payable is a crucial concept for any business operating with credit—every time a business purchases from a supplier on credit, an accounting entry is made in accounts payable.

● Accounts Receivable

The opposite of accounts payable; money owed to a business by its customers, for goods or services delivered. Accounts receivable refers to money your customers owe for goods or services purchased from you in the past. This money is typically recorded as an asset on your balance sheet; they live under the ‘current assets’ portion on your balance sheet or chart of accounts.

● Accounting Period

An accounting period is a period during the fiscal or calendar year in which accountants perform functions such as gathering and aggregating data and creating financial statements. The financial statements made during these periods are important for attracting potential investors or procuring loans from banks.

● Accruals

A record-keeping adjustment that recognizes business expenses and revenues before exchanges of money take place.

● Accrual-Basis Accounting

An accounting method where revenue and expenses are recorded as they are earned, regardless of when the money is received or paid. Mutually exclusive with cash-basis accounting.

● Assets

Resources with economic value. Assets can reduce expenses, generate cash flow, or improve sales for businesses.

● Balance Sheet

A financial statement providing a picture of an organizations’ liabilities, assets, and shareholders’ equity at a specific moment in time. Compare the balance sheet vs. income statement.

● Capital

A person’s or organization’s financial assets. Capital may include funds in deposit accounts or money from financing sources.

● Cash-Basis Accounting

Under the cash method, income is considered constructively received the moment it is credited to a business’s account, made available without restriction, or received by an authorized agent acting on behalf of the company.

● Cash Flow

Cash flow is the total amount of money that comes into and goes out of a business.

● Certified Public Accountant

Certified public accountants (CPAs) are accounting professionals certified to practice public accounting by the American Institute of Certified Public Accountants.

● Chart of Accounts

An index of the financial accounts in a company’s general ledger, a chart of accounts provides a picture of all the financial transactions a company has conducted in a specific accounting period.

● Closing the Books

An idiom refers to accounting for all financial transactions within a certain period.

● Cost of Goods Sold

Cost of goods sold, commonly shortened to COGS (or, if applicable, referred to as cost of sales or cost of service), is simply how much it costs to produce products or services, including direct material or labor expenses. Cost of goods only includes expenses directly related to products and services. For example, a chandler business would consist of wax, wicks, glass, and ingredients in its COGS. Overhead, such as marketing spend, real estate, utilities, asset depreciation, shipping fees, and other indirect expenses do not count towards COGS.

● Credit

Credits are accounting entries that either increase an equity or liability account, or decrease an expense or asset account.

● Debit

The opposite of a credit, debits either increase expense or asset accounts or decrease equity or liability accounts.

● Depreciation

The depreciation accounting method determines the decreasing value of a tangible asset over its lifetime.

● Diversification

Diversification mixes many different investments and assets in one portfolio, allowing individuals or businesses to spread out risk and protect themselves from financial ruin if any investments or assets fail. Finance Pal’s own CEO and Co-founder, Jacob Dayan, provides his expert investment advice on Finder’s “11 pieces of investment advice from experts for beginners” to provide individuals guidance to the best investment plan.

● Dividends

Company earnings, or profit, which a business pays to its shareholders as a reward for their investment in its equity.

● Double-Entry Bookkeeping

Put simply; double-entry accounting is a ubiquitous bookkeeping system that tracks where the money comes from and where it goes. The central tenet of double-entry accounting is after a financial transaction, each entry made into an account has a corresponding opposite entry made into a separate account. This produces two entries—thus, the name. When shown side-by-side in a ledger, the entry listed on the left side is referred to as a debit entry, while the entry displayed on the right side is called a credit entry.

● Enrolled Agent

Federally licensed tax professionals who can represent U.S. taxpayers. They must pass the three-part special enrollment examination from the IRS.

● Entity Formation

Entity formation is the process of classifying a business as an entity such as an LLC, sole proprietorship, partnership, S-Corp, or C-Corp.

● Expenses

The costs of conducting business. Companies can deduct some eligible expenses from their taxes.

● Equity

The amount of money left over and returned to shareholders after a business sells all assets and pays off all debt.

● Fixed Cost

A type of expense, fixed costs do not change from month to month. Fixed costs include things like payroll, rent, and insurance payments.

● General Ledger

General ledgers include debit and credit account records. Companies use the information in their general ledgers to prepare financial reports and understand their financial performance and health over time.

● Generally Accepted Accounting Principles

Generally accepted accounting principles (GAAP) refer to a group of significant accounting rules, standards, and ways of reporting financial information. The Financial Accounting Standards Board sets GAAP. All publicly traded companies must adhere to GAAP, per the Securities and Exchange Commission (SEC). While not required by law for non-publicly traded companies, GAAP compliance is critical for favorable views from creditors and lenders. Most banks and financial institutions require GAAP-compliant financial statements when issuing business loans.

● Gross Profit

The profit businesses make after subtracting the costs related to supplying their services or making and selling their products.

● Gross Margin

A business’s net sales revenue after subtracting the costs of goods sold. It represents the revenue companies keep as gross profit. An indicator of financial health, higher gross margins typically mean that a company can make more profit on its sales. Lower gross margins may mean a business needs to reduce production costs. The formula for gross margin is “Gross Margin = Net Sales – Cost of Goods Sold.”

● Inventory

A company’s goods and raw materials used for making the products it sells. It appears on a balance sheet as an asset. The IRS permits several inventory cost methods depending on the type of inventory (for example, FIFO or LIFO). A small business accountant will know which method the IRS requires for each specific business. Using the appropriate method, the accountant will calculate your inventory cost and set the cost of goods sold formula into motion.

● Journal Entry

A business transaction recorded in a business’s general ledger.

● Liabilities

A liability is when someone owes someone else money. Types of liabilities can include loans, mortgages, accounts payable, and accrued expenses.

● Liquidity

How easily an individual or business can convert an asset to cash for its full market value. The most liquid asset, cash, can easily and quickly convert to other assets.

● Net Income

The amount an individual or business earns after subtracting deductions and taxes from gross income. To calculate the net income of a business, subtract all expenses and costs from revenue.

● On Credit

An agreement for an individual or company to pay for a good or service later. Usually an invoice will be sent with payment due at a later date.

● Overhead

The ongoing costs of doing business other than those related to directly creating a good or service.

● Payroll

HR and accounting departments typically handle payroll, the total compensation a company pays its employees for a specific time period.

● Present Value

The notion that money is worth more today than it will be in the future. This may seem confusing at first, so let’s look at an example: if you have ten thousand today, you can invest the money, earn interest, and have more than ten thousand dollars in five years. The discounted cash flow model accounts for this, so it can also help compare different investment opportunities.

● Profit and Loss Statement

The profit and loss statement (also called the income statement or shortened to “the P&L statement”) includes vital cash flow information such as revenue, costs of goods sold, and operating expenses during a particular period. It also shows the resulting net income or loss for that specific period.

● Receipts

Written notices acknowledging that one party received something of value from another. An acknowledgment of ownership, receipts are proof of a financial transaction.

● Retained Earnings

The amount of net income left for a business to use after paying dividends to its shareholders. A company’s management typically decides whether to keep the earnings or give them to shareholders.

● Return on Investment (ROI)

The efficiency of an investment, including the amount of return on an investment relative to its cost. Accountants can also use ROI to compare the efficiency of more than one investment. To calculate ROI, subtract the cost of investment from the current value of investment, and divide that by the cost of the investment.

● Revenue

Gross income a business makes through normal business operations. To calculate sales revenue, multiply sales price by number of units sold.

● Sales Tax

Small business sales tax is an indirect tax that is assessed on a product at the point of sale. Included within the price of the product.

● Single-Entry Bookkeeping

A type of accounting system that records the financial transactions of a business. The system uses one entry per transaction to record cash, taxable income, and tax-deductible expenses going in or out of the business. Businesses can use accounting software or even simple tables to perform single-entry bookkeeping.

● Trial Balance

A periodical bookkeeping worksheet, a trial balance compiles the balance of ledgers into credit and debit columns that equal each other. Companies create trial balances to ensure the mathematical accuracy of their bookkeeping systems entries.

● Variable Cost

Expenses that change depending on the level of a business’s production. Variable costs go up when production increases and down when production decreases. In contrast to variable cost, fixed cost refers to expenses for a company that stays the same, regardless of production. Fixed costs may include insurance, rent, and interest payments.

About the Author

Jacob Dayan, Esq.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Read More

About the Author

Nick Charveron, EA

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

About the Author

Jason Gabbard, Founder and CEO of JUSTLAW

Jason Gabbard is a lawyer and the founder of JUSTLAW.

About the Author

Andrew Jordan, Chief Operations Officer at FinancePal

Andrew is an experienced CPA and has extensive executive leadership experience.

A balance can refer to the money in a bank account or due on an account. And balance can also describe the act of balancing an account.

Balance Extended Definition

When used as a noun, balance may refer to the amount of money in an account, like a bank or credit card account. It can also describe the remainder due on an account, such as the balance due on a bill.

When using balance as a verb, the word can describe the act of comparing debits to credits to make sure they are equal, like balancing a checking account against an account statement.

Related Articles

What is a Balance Sheet? | Patriot Software

What is a Chart of Accounts? | Patriot Software

Last Updated By

Andrew Freiman | Feb 28, 2023

Balance sheets along with income statements are statements that are not only used to evaluate the health and financial position of a business but are the primary statements that lenders and investors will look at. In our previous article, we talked about creating an internal income statement to analyze our financial data.

Here we will discuss the importance of an accounting balance sheet, look at an example to get an understanding of the balance sheet format.

If you just came for the balance sheet template, scroll to the bottom of the page!

What is a Balance Sheet?

An accounting balance sheet is a portrait of the financial standing of a business at a point in time. It shows what your business owns and what it owes. This financial report is similar to a personal financial statement that someone may fill out when applying for a loan to show their assets and liabilities.

The balance sheet is an important financial statement as it will show a summary of a company’s assets, liabilities, and shareholders’ equity at a specific point in time.

It is usually prepared at the end of the month, quarter, or year.

Why Prepare a Balance Sheet?

The balance sheet is one of the three primary financial statements that a business uses to evaluate its financial health. This can be a very valuable tool in evaluating financial performance and making financial business decisions.

Balance Sheet Terms Explained

There are a lot of terms used when preparing a balance sheet. A few of the more common terms are explained below:

Assets – Assets are items owned by the business. In the assets section of the balance sheet, you will notice that there are current and long-term assets.

Current assets are the same as short-term assets and those are assets that are expected to be sold or turned into cash within one year. Cash is considered the most liquid of all assets, but other short-term assets include items like accounts receivable and prepaid rent or prepaid insurance..

Long-term assets or non-current assets are assets not expected to take more than one year to be consumed or converted into cash. Long-term assets often include items like real estate or machinery.

The reason for dividing current and long-term assets is that these categories can be used to measure the liquidity of a company by turning assets into cash.

Accounts Receivable – Money owed by customers who purchased goods or services on credit that was provided by the company.

Current Liabilities – A current liability is a loan due to creditors within the next 12 months from the beginning date of the reporting period.

Accounts Payable – Similar to accounts receivable, accounts payable are short-term loans, typically owed by the business from purchases made on credit from suppliers or vendors.

Taxes Payable – Taxes that have accrued but have not yet been paid. One example would be payroll taxes. The wages have been paid to the employee but payroll taxes haven’t been paid yet as they weren’t due at the specific time period.

Long-term Liabilities – Similar to current liabilities, but a long-term liability is a debt that is due more than one year out from the date being reviewed.

Retained earnings – Earnings that are reinvested in the business after the deduction of any dividends.

Current Portion of Long-Term Debt – Amount of principal that will be due within one year of the reporting date.

Owners’ Equity (or Shareholders’ Equity) – Owner’s equity is sometimes referred to as stockholder equity, net worth, or paid-in capital and is the amount owners have invested in the business minus any withdrawals (not including salaries) taken since the business began.

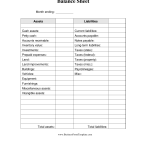

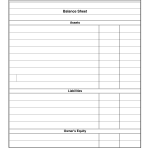

What is Included in a Balance Sheet?

At the core, the balance sheet includes the assets and liabilities of the business along with the owner’s equity. The typical balance sheet format is as follows:

Types of Assets on the Balance Sheet

The assets on the balance sheet can include current assets (sometimes called short-term assets) and then long-term assets. Some of the assets include:

Current Assets

- Cash

- Accounts Receivable

- Inventory

- Supplies

Long-Term Assets

- Land

- Buildings & Improvements

- Furniture & Fixtures

- General Equipment

- Goodwill

- Intangible assets

Types of Liabilities on the Balance Sheet

After the assets, the liabilities show up on the balance sheet. The company’s liabilities are debts for the business and will include short-term and long-term liabilities. Some examples of liabilities include:

- Accounts Payable

- Taxes Payable

- Salaries/Wages Payable

- Interest Payable

- Owner’s Equity – Shows the amount of money invested in the business along with retained earnings.

What is the Order of Items on the Balance Sheet?

Balance sheet accounts are listed in a specific order depending on if they are assets or liabilities.

Assets are ordered in terms of liquidity or how long it would take to change into cash. The most liquid assets start at the top. Cash would obviously be first then followed by accounts receivable, inventory, fixed assets like land, equipment, and buildings, with goodwill at the end because that typically represents the sale of the business.

Total liability is typically ordered with total current liabilities first and then non-current liabilities. The order varies with the other liability items by the business.

Why Does a Balance Sheet Balance?

The balance sheet should always balance because of the accounting equation Assets = Liability + Equity.

The reason for this equation is that if you take the total assets of the business and then subtract the total liabilities, you are left with the amount that belongs to the business owners.

Take a non-business example to maybe better this easier to understand. Let’s say you own a home and it has a value of $200,000 with a mortgage of $75,000.

Assets = Liability + Equity

$200,000 = $75,000 + $125,000

Simple Balance Sheet Template & Example:

If you are using double-entry accounting software, a company balance sheet is very easy to create. You can also run a comparison between two dates to compare your current accounting balance sheet with a previous accounting period.

Single-entry bookkeeping systems such as my free balance sheet template spreadsheet do not include the ability to track assets and liabilities, so generating one can be a little more tedious.

When the balance sheet is completed and the starting and ending cash balances that are calculated, the Cash Flow Statement is the next financial statement to tackle.

Some of the common questions that get we are asked about balance sheets are answered below:

What are balance sheet accounts?

In general ledger accounts, there are two primary types which include the balance sheet and income statement. Balance sheet accounts are permanent or real accounts and are used to organize, record, and sort transactions.

What is a horizontal balance sheet?

A horizontal balance sheet is a financial statement with additional columns to show changes in the amounts of assets, liabilities, and equity of a business over multiple years. This makes it easier to see the financial performance of a business as multiple years are on one page.

How do I check for mistakes?

The easiest way to check a balance sheet for mistakes is to see if the right side (total assets) are equal to the right side (liabilities plus owner’s equity).

What notes are typically prepared?

The notes (or footnotes) on the balance sheet contain information that is critical to properly understanding and analyzing a company’s financial statements and are used to inform a reader about significant accounting activities like commitments made by the company, potential liabilities & losses and procedural changes. The notes contain information that is critical to properly understanding and analyzing a company’s financial statements.

A few examples of footnotes in the balance sheet could include claims against the company, methods of depreciation, or the method of valuing inventory.

Where does accumulated depreciation go?

The accumulated depreciation account should go on the asset side of the balance sheet. Accumulated depreciation is the cumulative total amount of depreciation that has been reported as an expense on the income statement and is increased with a credit and decreased with a debit because its function is to decrease the cost of a company asset as it loses value over time.

What is a pro forma balance sheet?

A pro forma balance sheet makes estimates on the future effects on assets, liabilities, and net worth after applying assumptions and projections to the current performance of the company.

What accounts appear on a balance sheet?

The accounts that commonly show up on a typical small business balance sheet may include

Current Assets – cash, accounts receivable (A/R), inventory and pre-paid expenses

Fixed Assets – land, buildings, and equipment

Liabilities – accounts payable (A/P), accrued expenses, short-term debt, and long-term debt

What is the balance sheet equation?

The balance sheet equation is assets = liabilities + owner’s equity.

What is the statement of financial position?

The statement of financial position or (SOFP) is just another name for the balance sheet.

Balance sheet template download

Accounting Balance Sheet Template

Download this Accounting Balance Sheet Template that is a very simple blank sheet for the user to customize according to their own income and expenditures. If the form is used for…

Adobe PDF

MS Excel

MS Word

Rich Text

12,942 Downloads

Bank Balance Sheet Template

Download the Bank Balance Sheet Template that is designed to work well for an individual or a firm. It is a complete, combined balance sheet that would include anything any institution would…

Adobe PDF

MS Excel

MS Word

Rich Text

PowerPoint

15,134 Downloads

Business Balance Sheet Template

Download this Business Balance Sheet that is designed to allow a business owner or book keeper the ability to keep a simple balance sheet on a monthly basis. This provides records at…

Adobe PDF

MS Excel

MS Word

Rich Text

14,471 Downloads

Church Balance Sheet Template

Download the Church Balance Sheet Temple that has been created especially to assist churches remain financially balance. Obviously churches need a specific kind of balance and record keeping instrument. This balance sheet…

Adobe PDF

MS Excel

MS Word

Rich Text

PowerPoint

11,873 Downloads

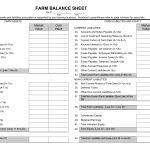

Farm Balance Sheet Template

Download the Farm Balance Sheet Template that is designed to assist farming businesses and bookkeepers in keeping assets, liabilities etc, up to date. As well, by keeping these records, if farming…

Adobe PDF

MS Excel

MS Word

Rich Text

PowerPoint

17,382 Downloads

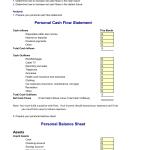

Income Statement and Balance Sheet Template

Download this Income Statement and Balance Sheet Template that is designed to assist anyone in creating their own financial plan. In completing this form, one would be able to set financial goals…

Adobe PDF

MS Excel

MS Word

Rich Text

12,486 Downloads

Personal Financial Balance Sheet Template

Download this Personal Financial Balance Sheet Template that has been created for the purpose of listing and calculating personal finances and assets. The user generally utilizes this form when they are working…

Adobe PDF

MS Excel

MS Word

Rich Text

6,375 Downloads

Pro Forma Balance Sheet Template

Download the Pro Forma Balance Sheet Template that has been created to provide a three year balance observation for the purpose of acquiring a business loan. In year 1, provide current year…

Adobe PDF

MS Excel

MS Word

Rich Text

PowerPoint

15,057 Downloads

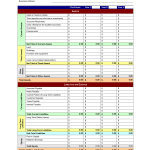

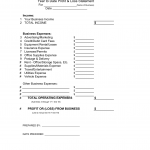

Profit and Loss Balance Sheet Template

Download the Profit and Loss Balance Sheet Template that once completed and calculated, will determine profit or loss in any business. The document will address business income and business expenses. Finally it…

Adobe PDF

MS Excel

MS Word

Rich Text

PowerPoint

24,448 Downloads

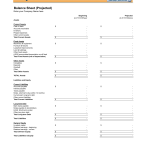

Projected Balance Sheet Template

Download the Projected Balance Sheet Template that has been created to provide potential financial projections for a business proposal. These projections would be based on current financial conditions with an individual wishing…

Adobe PDF

MS Excel

MS Word

Rich Text

27,568 Downloads

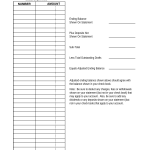

Reconciliation Balance Sheet Template

Download this Reconciliation Balance Sheet Template that is designed to track and monitor financial account information. One of the most used reconciliation sheets are for checking accounts. Today, many use ATM debit…

Adobe PDF

MS Excel

MS Word

Rich Text

3,130 Downloads

Restaurant Balance Sheet Template

Download the Restaurant Balance Sheet Template that is designed as a simple balance sheet for any kind of restaurant. Enter all information that applies to your specific type of establishment whether it…

Adobe PDF

MS Excel

MS Word

Rich Text

PowerPoint

6,667 Downloads

Simple Balance Sheet Template

Download this Simple Balance Sheet Template that could be used for personal or business. It is a very simple format to help keep understanding balances simple and fast to fill in. It…

Adobe PDF

MS Excel

MS Word

Rich Text

5,341 Downloads

Small Business Balance Sheet Template

Download this Small Business Balance Sheet Template that has been created to prepare and to include in your business plan and proposal. This sheet will include basic categorical information needed to present…

Adobe PDF

MS Excel

MS Word

Rich Text

9,868 Downloads